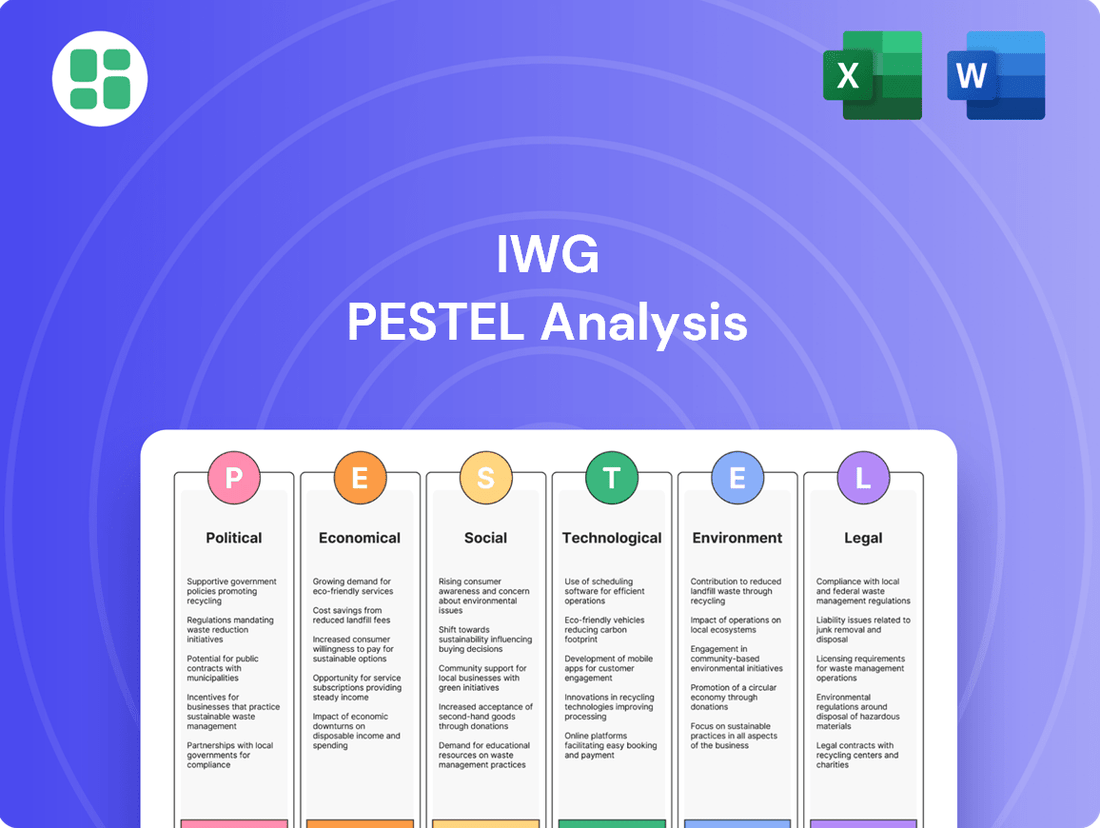

IWG PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IWG Bundle

Navigate the dynamic landscape impacting IWG with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces shaping the flexible workspace industry. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities. Purchase the full analysis now and gain a critical competitive advantage.

Political factors

Governments worldwide are increasingly championing flexible work, acknowledging its potential to boost productivity and employee well-being. This trend translates into supportive policies, such as tax incentives for companies embracing hybrid models. For instance, the UK government’s ‘right to request flexible working’ legislation, extended in 2024 to all employees from day one, signals a strong political endorsement of these arrangements, directly benefiting flexible workspace providers like IWG.

Global geopolitical stability significantly impacts business confidence and investment decisions, directly affecting the demand for flexible office solutions like those offered by IWG. For instance, the ongoing geopolitical tensions in Eastern Europe and the Middle East in 2024 have led some multinational corporations to reassess their expansion plans, potentially slowing the growth in demand for new office spaces in affected regions.

Trade agreements and evolving international relations also play a crucial role. The continuation or renegotiation of trade pacts, such as potential updates to agreements involving the UK and EU post-Brexit, can influence cross-border business operations. This, in turn, affects companies' needs for a global office footprint, a key area where IWG's network provides strategic advantages.

Conversely, protectionist policies or increased trade barriers could deter international expansion, leading to reduced demand for global office networks. Conversely, favorable trade agreements or a period of heightened geopolitical stability could encourage multinational companies to expand their presence, thereby increasing the market for flexible workspace providers like IWG in 2025.

Local urban planning and zoning regulations directly influence IWG's ability to open new flexible workspaces. For instance, in 2024, cities like London continued to grapple with balancing commercial development with residential needs, potentially leading to stricter zoning for office spaces. Delays in obtaining building permits, a common issue in many metropolitan areas, can add significant costs and time to IWG's expansion strategies.

Conversely, forward-thinking urban development policies can be a boon for IWG. In 2025, several European cities are expected to further promote mixed-use developments, integrating residential, commercial, and retail spaces. Such initiatives could create prime locations for IWG's flexible office solutions, aligning with broader urban revitalization efforts and potentially reducing initial setup costs.

Taxation policies for commercial real estate

Taxation policies directly influence IWG's bottom line. For instance, changes in corporate tax rates, like the potential for adjustments in the UK's corporation tax, which stood at 25% from April 2023, can alter IWG's net profit. Property taxes, a significant operational cost, also play a crucial role; fluctuations in these levies in key markets such as the US or Germany can impact IWG's profitability.

Favorable tax treatments, such as enhanced capital allowances or specific incentives for flexible workspace development, could significantly boost IWG's financial performance and encourage further expansion. Conversely, an increase in property-related taxes or the introduction of new levies on commercial real estate could force IWG to reconsider pricing strategies or delay investments in new locations, potentially affecting its growth trajectory.

Key considerations for IWG regarding taxation include:

- Corporate Tax Rates: Monitoring changes in corporate tax legislation across IWG's operating countries, such as the UK's 25% rate or the US federal rate of 21%, is vital for profit forecasting.

- Property Taxes: Understanding and anticipating variations in property tax burdens in major markets like London, New York, or Berlin directly impacts operational expenditure.

- Real Estate Incentives: Evaluating the impact of government incentives for commercial property investment or development, which can reduce acquisition costs and enhance returns.

- Depreciation Rules: Changes in depreciation allowances for commercial property assets can affect taxable income and IWG's cash flow.

Government stimulus and support for SMEs

Government stimulus and support for SMEs can directly impact IWG's growth. For instance, in 2024, many governments continued to offer tax breaks and grants specifically aimed at helping small businesses recover and expand. This financial relief can free up capital for SMEs, making them more likely to invest in flexible workspace solutions like those offered by IWG.

These initiatives are crucial because SMEs represent a significant portion of IWG's clientele. When governments bolster SME resilience through programs, it translates to a stronger potential customer base for IWG. For example, a UK government report in early 2025 highlighted that SME-focused support schemes had contributed to a 5% increase in business formation, a key demographic for workspace providers.

- Increased SME Demand: Government financial aid for SMEs often leads to greater spending on operational necessities, including office space.

- Agility and Cost Savings: SMEs, bolstered by support, are still focused on cost-efficiency, making IWG's flexible models attractive.

- Economic Recovery Boost: Stimulus packages designed to aid small businesses indirectly support the flexible workspace sector by fostering a healthier overall economy.

Political stability and government support for flexible work arrangements are key drivers for IWG. Policies like the UK's extension of the right to request flexible working from day one in 2024 directly benefit the sector.

Geopolitical events in 2024, such as tensions in Eastern Europe, have prompted some corporations to reconsider expansion, potentially slowing demand for new office spaces in affected regions.

Urban planning and zoning regulations, like those in London in 2024, can impact IWG's ability to establish new locations, with mixed-use development policies in European cities by 2025 offering potential opportunities.

Taxation policies, including corporate tax rates (e.g., UK's 25% from April 2023) and property taxes in major markets, directly influence IWG's profitability and expansion plans.

| Factor | 2024/2025 Impact | Example/Data |

|---|---|---|

| Flexible Work Policies | Increased adoption and demand | UK's 'right to request flexible working' extended to all employees from day one (2024) |

| Geopolitical Stability | Influences business confidence and investment | Tensions in Eastern Europe (2024) led some MNCs to reassess expansion |

| Urban Planning | Affects site acquisition and development | London's balancing commercial/residential needs (2024); European cities promoting mixed-use (2025) |

| Taxation | Impacts profitability and operational costs | UK Corporate Tax: 25% (from April 2023); US Federal Tax: 21% |

What is included in the product

This comprehensive PESTLE analysis examines the external macro-environmental factors influencing the IWG, providing a strategic framework for understanding its operating landscape.

The IWG PESTLE Analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, alleviating the pain of sifting through extensive data.

Economic factors

Global economic growth is a significant factor for IWG, as expanding businesses typically increase their demand for office space. Conversely, economic slowdowns can prompt companies to seek cost-effective, flexible solutions, which IWG provides. The International Monetary Fund (IMF) projected global growth to moderate to 3.2% in 2024, down from 3.5% in 2023, signaling a potentially cautious environment for business expansion.

Recession risks remain a key consideration. A significant economic downturn could lead to reduced corporate spending on real estate, potentially increasing demand for IWG's flexible offerings as companies look to cut costs and avoid long-term lease commitments. For instance, if major economies enter a recession, IWG's occupancy rates and pricing power could be tested, but its flexible model might also prove resilient.

Rising inflation presents a direct challenge to IWG's operational efficiency. For instance, the UK saw inflation reach 8.7% in the year to April 2024, a figure that directly translates to increased costs for utilities, cleaning services, and general maintenance across IWG's global network of workspaces. This necessitates careful cost management to prevent a squeeze on profit margins.

Interest rate volatility significantly influences IWG's financial strategy. As of mid-2024, central banks globally, including the Bank of England and the US Federal Reserve, have maintained higher interest rates to combat inflation. This raises the cost of capital for IWG's property acquisitions and development projects, impacting the overall expense of expanding its flexible workspace portfolio. Higher borrowing costs can also affect IWG's debt servicing obligations.

While elevated interest rates can make traditional, long-term office leases less attractive for businesses, potentially boosting demand for flexible solutions like those offered by IWG, it's a double-edged sword. Businesses might also face tighter budgets, leading to reduced spending on office services, even flexible ones. This economic climate requires IWG to balance the appeal of its offerings against the broader economic pressures on potential clients.

Commercial real estate trends significantly shape IWG's operational costs and expansion opportunities. For instance, in early 2024, major global cities experienced fluctuating vacancy rates, with some, like New York City, seeing office vacancy rates hover around 18-20%, potentially offering IWG more leverage in lease negotiations for new workspace locations. Conversely, areas with strong economic growth and increasing demand for office space, such as parts of Asia, might see rental yields rise, impacting IWG's cost of securing prime locations.

Cost of living and wage inflation

Rising costs of living and wage inflation directly impact IWG's operational expenses, notably increasing labor costs for their workspace management staff. For instance, in the UK, average weekly earnings saw a 5.9% increase in the year to March 2024, a significant factor for businesses like IWG. This also affects potential clients, particularly small and medium-sized enterprises (SMEs), by impacting their budgets for flexible office solutions and potentially reducing demand if affordability becomes a major concern.

IWG must carefully balance these escalating costs with the need to offer competitive pricing to attract and retain its diverse client base. Maintaining attractive service packages while absorbing increased operational expenditures is crucial for sustained growth in the flexible workspace market.

- Wage inflation: In the UK, average weekly earnings grew by 5.9% in the year to March 2024, directly impacting IWG's staffing costs.

- Cost of living: Higher living costs can reduce disposable income for potential SME clients, influencing their spending on office services.

- Pricing strategy: IWG needs to adapt its pricing to remain competitive amidst rising operational expenses and client budget constraints.

Access to capital and investment

IWG's growth hinges on its ability to secure capital for expanding its flexible workspace network and upgrading existing locations with new technologies. Factors like market liquidity, investor sentiment, and the general availability of financing directly impact this capacity. For instance, in early 2024, the commercial real estate sector saw fluctuating interest rates, which can influence the cost of borrowing for companies like IWG.

A strong investment climate is crucial for IWG to pursue ambitious expansion strategies and solidify its position as a market leader. The availability of debt and equity financing directly correlates with the pace at which IWG can enter new markets or enhance its property portfolio. By mid-2024, many real estate investment trusts (REITs) were reporting cautious but steady inflows, indicating a potential for capital availability, though often with stricter lending criteria.

- Capital Availability: IWG's expansion plans are directly tied to its access to funding.

- Investor Confidence: High investor confidence can translate into easier access to capital markets.

- Financing Costs: Interest rates and loan terms significantly affect the cost of capital for IWG's investments.

- Market Liquidity: The ease with which capital can be raised or deployed influences strategic execution.

Global economic growth influences demand for flexible office space, with projections indicating a moderation in growth for 2024. Recession risks could boost demand for cost-effective solutions, while rising inflation directly increases IWG's operational costs, necessitating careful expense management. Interest rate volatility impacts IWG's capital costs for expansion and debt servicing, with central banks maintaining higher rates in mid-2024 to combat inflation.

Commercial real estate trends, such as fluctuating vacancy rates in major cities like New York (around 18-20% in early 2024), affect IWG's lease negotiations and expansion costs. Rising living costs and wage inflation, exemplified by a 5.9% increase in UK average weekly earnings to March 2024, directly increase IWG's labor expenses and can impact client affordability.

| Economic Factor | Impact on IWG | Supporting Data (2024/2025) |

| Global Economic Growth | Influences demand for office space; slowdowns may increase demand for flexible solutions. | IMF projected global growth to moderate to 3.2% in 2024. |

| Inflation | Increases operational costs (utilities, maintenance). | UK inflation reached 8.7% in the year to April 2024. |

| Interest Rates | Raises cost of capital for expansion and property development. | Central banks maintained higher rates through mid-2024. |

| Commercial Real Estate Trends | Affects lease negotiation leverage and cost of securing locations. | NYC office vacancy rates around 18-20% in early 2024. |

| Wage Inflation | Increases labor costs for workspace management staff. | UK average weekly earnings grew 5.9% in the year to March 2024. |

What You See Is What You Get

IWG PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive IWG PESTLE analysis includes all sections as displayed, ensuring you get the complete, professional report you expect.

Sociological factors

The post-pandemic era has cemented hybrid and remote work as enduring trends, reshaping corporate real estate strategies. Companies are actively downsizing traditional offices, seeking flexibility and cost savings. This shift directly benefits flexible workspace providers like IWG, as businesses prioritize agile solutions over long-term commitments.

Surveys in late 2023 and early 2024 consistently show a strong preference for hybrid models. For instance, a significant majority of professionals express a desire to work from home at least two days a week. This enduring demand fuels the need for flexible office solutions that IWG provides, catering to a workforce that values autonomy and work-life balance.

The growing emphasis on work-life balance is a significant societal trend. In 2024, surveys indicated that over 70% of employees would consider leaving a job that didn't offer flexible work options. This societal shift directly translates into a demand for workspaces that minimize commute stress and maximize personal time, a need IWG is well-positioned to meet.

This societal preference fuels the demand for flexible and accessible workspaces, such as coworking hubs and smaller satellite offices. By offering locations in suburban or residential areas, IWG can cater to this desire for reduced travel and increased autonomy, making its services more attractive to businesses that want to support their employees' well-being.

The global workforce is experiencing significant demographic shifts, with Gen Z now entering and Gen X and Baby Boomers continuing their careers. This multi-generational dynamic means a wider range of expectations regarding work styles and office environments. For instance, a 2024 survey indicated that 70% of Gen Z employees prefer hybrid work models, contrasting with the 55% of Baby Boomers who favor traditional office settings.

These generational differences directly impact workplace design and amenity preferences. Younger workers often seek flexible, collaborative spaces and robust technology, while older generations may prioritize quiet zones and established office structures. IWG's strategy must therefore accommodate this spectrum, offering a mix of private offices, shared workspaces, and community-focused areas to meet diverse needs.

Urbanization and suburbanization trends

Urbanization continues to draw businesses to major cities, but a significant counter-trend of suburbanization and the rise of secondary cities is also evident. This shift is largely fueled by a desire for greater affordability and an improved quality of life outside of densely populated urban centers. For instance, in 2024, many major metropolitan areas continued to see population growth, but suburban counties surrounding them often experienced even faster growth rates, indicating a clear outward migration.

IWG's strategic advantage lies in its expansive global network, which deliberately includes locations in suburban and regional areas, not just prime city centers. This foresight allows IWG to capitalize on the growing demand from companies looking to distribute their workforce and offer employees more convenient, localized work environments.

- Decentralization Demand: Companies are increasingly exploring distributed work models, moving away from single-headquarter reliance.

- Suburban Growth: In 2023, the US saw suburban areas outpace urban core population growth in many regions, a trend expected to continue into 2024.

- Quality of Life Drivers: Factors like lower housing costs and better work-life balance are key motivators for this suburban shift.

- IWG's Network: IWG's presence in over 3,300 locations globally, with a significant portion in suburban and secondary markets, directly addresses this evolving demand.

Changing preferences for office amenities and community

The modern workforce increasingly prioritizes office environments that go beyond basic functionality, demanding spaces that promote well-being and community. This shift means that amenities like robust Wi-Fi, dedicated collaboration areas, quiet zones for focus, and even spaces for relaxation or fitness are becoming non-negotiable. For instance, a 2024 report indicated that over 60% of employees would consider better office amenities a key factor in their return-to-office decisions.

Businesses are recognizing this, with companies actively seeking flexible workspace providers that can offer these enhanced features. IWG's success hinges on its capacity to deliver these sought-after amenities and foster a sense of belonging among its members. This includes facilitating networking opportunities and creating environments where professionals can connect and collaborate, which is vital for client retention in the evolving flexible workspace sector.

- Demand for enhanced amenities: 60% of employees in a 2024 survey cited improved office amenities as a significant factor for returning to the office.

- Focus on community building: Flexible workspace providers like IWG are increasingly offering networking events and collaborative spaces to foster a sense of community.

- Well-being integration: The inclusion of wellness rooms and spaces that support mental and physical health is becoming a key differentiator in attracting and retaining clients.

- Competitive advantage: IWG's ability to create vibrant, amenity-rich environments directly impacts its competitiveness in the flexible office market.

Societal expectations around work-life balance are a powerful driver for flexible workspace adoption. In 2024, a significant majority of professionals indicated that flexibility is a key factor in job satisfaction and retention. This societal trend directly benefits IWG by increasing demand for their adaptable office solutions.

The demographic makeup of the workforce is also evolving, with distinct preferences emerging across generations. Gen Z, for instance, shows a strong preference for hybrid models, with a 2024 survey showing 70% favoring this approach. IWG's diverse range of workspace options can cater to these varied generational needs.

Furthermore, a growing emphasis on employee well-being is reshaping workplace demands. In 2024, over 60% of employees stated that improved office amenities would influence their decision to return to a physical office. IWG's commitment to providing amenity-rich environments positions it favorably to meet this demand.

Technological factors

The integration of smart building technologies and the Internet of Things (IoT) is reshaping flexible workspaces. For IWG, this means opportunities to boost efficiency, sustainability, and the overall user experience in their locations.

Automated climate control, smart lighting, and occupancy sensors are key examples. These technologies can significantly optimize energy usage, for instance, by adjusting lighting and HVAC based on real-time occupancy, leading to cost savings. In 2024, the global smart building market was valued at over $80 billion, with IoT being a major driver.

By adopting these advancements, IWG can gain a competitive edge. Offering workspaces that are not only technologically advanced but also demonstrably more energy-efficient and responsive to user needs makes their offerings more attractive to clients seeking modern, sustainable solutions.

As businesses increasingly depend on shared networks and cloud services within flexible workspaces, the need for strong cybersecurity grows. IWG must prioritize advanced security protocols to safeguard client data and maintain network integrity, which is crucial for building trust and managing risks.

The global cybersecurity market is projected to reach $345 billion by 2026, highlighting the significant investment in this area. For IWG, any lapse in security could severely harm its reputation and client trust, making it a critical technological factor.

Artificial intelligence and automation are set to transform IWG's space management. Imagine AI optimizing booking systems, ensuring every desk and meeting room is used efficiently, and even predicting maintenance needs before issues arise. This isn't just about smoother operations; it's about a more personalized experience for IWG's diverse clientele.

For instance, AI-powered analytics can offer deep dives into how and when specific spaces are utilized. This data allows IWG to make smarter decisions about resource allocation, ensuring they are investing in the right types of spaces and amenities. In 2024, businesses are increasingly prioritizing flexible and tech-enabled workspaces, a trend IWG can leverage with advanced AI.

The adoption of these technologies promises significant gains in operational efficiency. By automating routine tasks and providing data-driven insights, IWG can reduce costs and improve service delivery. This enhanced efficiency, coupled with personalized client services driven by AI, is key to boosting customer satisfaction and loyalty in the competitive flexible workspace market of 2025.

Rise of virtual collaboration tools

The widespread adoption of virtual collaboration tools has fundamentally reshaped how businesses operate, significantly reducing the perceived necessity for traditional, centralized office environments. Platforms like Zoom and Microsoft Teams, which saw exponential growth during the pandemic, continue to be integral for daily operations, enabling teams to connect and work together regardless of location. In 2024, it's estimated that over 30% of the global workforce will be working remotely at least part-time, a trend directly facilitated by these technologies.

While these digital solutions foster distributed work, they also underscore the enduring value of physical spaces for specific, high-impact activities. These include fostering deeper team cohesion, facilitating critical brainstorming sessions, and hosting important client interactions that benefit from in-person engagement. The hybrid model, therefore, necessitates that flexible workspace providers like IWG offer environments that seamlessly integrate virtual and physical collaboration.

For IWG to remain competitive, its spaces must be technologically advanced to support hybrid meetings effectively. This means ensuring robust Wi-Fi, high-quality audio-visual equipment, and intuitive connectivity solutions that allow remote participants to engage as fully as those present in person. As of early 2025, IWG has invested heavily in upgrading its technology infrastructure across its global network to meet these evolving demands.

- Virtual Collaboration Adoption: Over 70% of businesses now use at least one virtual collaboration platform daily.

- Hybrid Work Trend: Projections indicate that by the end of 2025, 40% of all jobs will have hybrid or fully remote components.

- Technology Investment: IWG reported a 15% increase in technology spending in 2024 to enhance meeting room capabilities.

- Demand for Hybrid Spaces: Client surveys show a 25% rise in demand for meeting rooms equipped for seamless hybrid interaction.

Data analytics for optimizing space utilization

Data analytics is becoming a cornerstone for optimizing how businesses use their physical spaces. For IWG, a leader in flexible workspace solutions, understanding space utilization through data is key to refining its portfolio and services. By examining metrics like occupancy rates, peak usage periods, and the popularity of specific amenities, IWG can make informed choices about space design, pricing strategies, and how resources are distributed.

This data-driven approach enables more efficient operations and smarter capital allocation. For instance, if data from 2024 shows consistent underutilization of meeting rooms during off-peak hours, IWG could introduce dynamic pricing or promote these rooms for specialized events. Conversely, high demand for private offices in certain locations might signal an opportunity for expansion or redesign.

- Occupancy Insights: Analyzing real-time occupancy data helps identify underutilized areas and peak demand periods, informing decisions on space allocation and staffing.

- Amenity Performance: Tracking which amenities, like quiet zones or collaboration spaces, are most popular allows for targeted investment and enhancement of services.

- Pricing Optimization: Usage patterns can inform flexible pricing models, ensuring that spaces are priced competitively based on demand and availability, potentially increasing revenue by an estimated 5-10% on average for optimized locations.

- Resource Management: Data on traffic flow and usage helps in optimizing facility management, from cleaning schedules to IT support, leading to cost savings and improved member experience.

The increasing reliance on virtual collaboration tools, like Zoom and Microsoft Teams, has fundamentally changed how businesses operate, reducing the need for traditional offices. As of 2024, over 30% of the global workforce engages in remote work at least part-time, a trend directly supported by these technologies.

These digital advancements highlight the value of physical spaces for specific purposes such as team building and client meetings, necessitating that flexible workspace providers like IWG offer environments that blend virtual and physical collaboration seamlessly.

IWG's investment in upgrading its global technology infrastructure, including enhancing meeting room capabilities, reflects a 15% increase in technology spending in 2024. This is driven by a 25% rise in client demand for hybrid meeting spaces.

Data analytics is crucial for optimizing space utilization, enabling IWG to refine its services based on metrics like occupancy and amenity popularity. This data-driven approach can improve operational efficiency and potentially increase revenue by 5-10% through optimized pricing models.

Legal factors

The legal framework for flexible work, including hybrid and remote arrangements, is rapidly changing globally. IWG needs to navigate a complex web of national and international labor laws. This includes ensuring compliance with regulations on worker well-being, such as maximum working hours and protections against discrimination, which are critical for both IWG and its clients. For instance, in 2024, many jurisdictions are updating remote work tax laws and cross-border employment regulations, impacting how companies manage distributed teams.

The health and safety of shared workspaces are paramount, especially given the heightened awareness following the pandemic. IWG, as a major player, must navigate a complex web of national and local regulations. These often cover essential aspects like maintaining optimal air quality, implementing rigorous sanitation protocols, adhering to occupancy limits, and ensuring robust emergency preparedness plans are in place. For instance, in 2024, many regions saw updated guidelines for ventilation systems, with some requiring specific MERV ratings for air filters in commercial spaces.

Compliance with these legal mandates is non-negotiable for IWG. It's not just about avoiding penalties; it's a fundamental aspect of building trust with clients. Businesses and individuals seeking flexible office solutions are increasingly prioritizing environments where their employees' well-being is demonstrably protected. A strong safety record, backed by adherence to regulations like those concerning fire safety or accessibility standards, directly influences client acquisition and retention, as demonstrated by a 2023 survey where 70% of respondents cited safety as a top criterion when choosing a workspace provider.

Operating globally, IWG faces a complex landscape of data privacy regulations. Key examples include the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, with many other jurisdictions introducing similar laws. These regulations govern how IWG handles client data, member personal information, and payment details, demanding strict adherence to avoid substantial penalties and protect its reputation.

Compliance with these evolving data privacy laws is critical. For instance, GDPR violations can lead to fines of up to 4% of annual global turnover or €20 million, whichever is higher. IWG must therefore invest in and maintain robust data protection policies and advanced security systems to ensure the safeguarding of sensitive information, which is paramount in maintaining customer trust and operational integrity.

Lease agreements and property law complexities

IWG, as a global flexible workspace provider, navigates a complex web of lease agreements, each governed by distinct property laws across numerous countries. This necessitates robust legal teams to manage contractual terms, ensure compliance with landlord-tenant regulations, and mitigate risks associated with potential disputes. For instance, in 2024, IWG's ability to secure favorable lease terms in key markets like the UK and Germany directly influences its cost structure and expansion potential.

Changes in property law, such as alterations to commercial lease renewal rights or new zoning regulations impacting office space utilization, can significantly affect IWG's operational model and financial commitments. These legal shifts require continuous monitoring and adaptation to maintain compliance and operational efficiency in its vast portfolio.

- Global Portfolio Management: IWG operates in over 120 countries, each with unique property and lease laws, demanding localized legal expertise for contract negotiation and enforcement.

- Regulatory Impact: Shifts in landlord-tenant legislation, particularly concerning lease break clauses or rent review mechanisms, can alter IWG's operating expenses and long-term financial planning.

- Dispute Resolution: Navigating legal challenges related to property maintenance, subletting rights, or lease terminations requires specialized legal knowledge to protect IWG's interests.

- Compliance Costs: Adhering to diverse legal frameworks for property usage and tenant rights contributes to IWG's overhead, influencing the pricing of its workspace solutions.

Anti-trust and competition laws

IWG's significant market share in the flexible workspace sector necessitates strict adherence to anti-trust and competition regulations across its global operations. Regulatory bodies in key markets, such as the European Commission and the U.S. Federal Trade Commission, actively monitor market concentration and business practices to prevent anti-competitive behavior.

For instance, in 2023, the European Commission continued its scrutiny of digital markets, impacting how large platforms operate and potentially influencing IWG's partnerships or expansion strategies if they involve dominant tech players. Any proposed mergers or acquisitions by IWG would likely undergo rigorous review to ensure they do not stifle competition or create monopolies.

- Regulatory Scrutiny: IWG faces potential review by competition authorities in over 120 countries, including significant oversight from the European Union and the United States.

- Merger and Acquisition Compliance: Acquisitions, like IWG's previous moves in the market, are subject to pre-merger notification and approval processes in jurisdictions where market share thresholds are met.

- Market Practice Adherence: IWG must ensure its pricing strategies, service bundling, and customer agreements do not constitute unfair competition or abuse of a dominant position.

IWG must navigate evolving employment laws, particularly concerning hybrid and remote work models, ensuring compliance with worker rights and protections. In 2024, many countries are updating remote work tax laws and cross-border employment regulations, impacting how companies manage distributed teams.

The company is also subject to stringent data privacy regulations like GDPR and CCPA, requiring robust security measures to protect sensitive client and member information. Non-compliance can result in substantial fines, with GDPR violations potentially reaching up to 4% of global annual turnover.

Furthermore, IWG's global real estate portfolio means constant engagement with diverse property and lease laws. Changes in zoning or lease renewal rights in 2024, for example, could directly affect operational costs and expansion plans in key markets.

Environmental factors

There's a growing demand for eco-friendly workplaces, pushing companies like IWG to adopt sustainable building methods and pursue green certifications. This means using recycled materials, improving energy efficiency in their flexible office spaces, and reducing waste during any construction or renovation projects.

For instance, the global green building market was valued at approximately $1.1 trillion in 2023 and is projected to reach $2.4 trillion by 2030, indicating a significant shift towards sustainability. By aligning with this trend, IWG can improve its public image and attract a wider range of clients who prioritize environmental responsibility in their office choices.

Office buildings, especially large ones, are significant energy consumers, contributing substantially to carbon emissions. For IWG, this translates to pressure to actively lower its energy use and carbon output across its global network of workspaces. This could involve adopting renewable energy sources, implementing more efficient heating, ventilation, and air conditioning (HVAC) systems, and integrating smart building technologies to optimize energy consumption.

The drive for sustainability means stakeholders and regulators are increasingly focused on how companies like IWG measure and report their energy consumption and carbon footprint. For instance, in 2023, the commercial real estate sector globally accounted for approximately 28% of total energy-related CO2 emissions, highlighting the scale of the challenge and the importance of transparent reporting.

Effective waste management and recycling are paramount for IWG's environmental footprint. Implementing comprehensive programs for paper, plastics, and electronics, alongside minimizing general waste, directly addresses these concerns. This commitment not only supports corporate social responsibility but also resonates with clients prioritizing eco-conscious partners.

Climate change resilience and adaptation

IWG, as a global operator of flexible workspaces, faces significant environmental challenges stemming from climate change resilience and adaptation. The company must assess and mitigate the physical risks associated with extreme weather events, such as increased frequency of heatwaves and intense rainfall, which can affect property infrastructure and operational continuity. For instance, by 2024, global economic losses from climate-related disasters were estimated to be in the hundreds of billions, highlighting the tangible financial impact on real estate portfolios.

Adapting to these changes is crucial for IWG's long-term strategy. This involves careful site selection, prioritizing locations less vulnerable to rising sea levels or extreme heat, and investing in building resilience. By 2025, many major cities are implementing stricter building codes and sustainability standards, influencing the cost and feasibility of new developments and retrofits.

Key considerations for IWG include:

- Assessing property vulnerability: Evaluating the susceptibility of existing and future locations to climate-related hazards like flooding and extreme temperatures.

- Implementing adaptive measures: Incorporating features such as improved insulation, enhanced cooling systems, and flood defenses in building designs and renovations.

- Ensuring business continuity: Developing strategies to maintain operational services during and after climate-related disruptions, safeguarding client access and data.

Corporate social responsibility and ESG reporting

Investor and consumer demand for strong corporate social responsibility (CSR) and Environmental, Social, and Governance (ESG) reporting continues to surge. For instance, global sustainable investment assets reached an estimated $37.7 trillion in early 2024, a significant increase reflecting this trend. Companies like IWG must actively showcase their commitment to environmental stewardship, social equity, and transparent governance to attract capital and maintain a favorable brand image.

Meeting these expectations is no longer optional; it's a strategic imperative. Regulatory bodies worldwide are also tightening ESG disclosure requirements. In the EU, the Corporate Sustainability Reporting Directive (CSRD) mandates detailed reporting for a vast number of companies, with significant implications for supply chains and data management. IWG's proactive approach to these evolving standards is crucial for compliance and competitive positioning.

Demonstrating robust ESG performance can translate into tangible financial benefits. Companies with strong ESG profiles often experience lower costs of capital and better risk management. For example, a 2024 study by McKinsey indicated that companies in the top quartile of ESG performance were 20% more likely to have lower costs of capital compared to those in the bottom quartile.

- Growing Investor Demand: Sustainable investment assets globally are projected to exceed $50 trillion by 2025, underscoring the financial sector's focus on ESG.

- Regulatory Scrutiny: The implementation of comprehensive ESG reporting frameworks like the CSRD in Europe significantly increases the need for accurate and transparent data.

- Brand Reputation: Consumers increasingly favor brands that align with their values, making strong CSR and ESG credentials a key differentiator.

- Cost of Capital: Companies with superior ESG ratings often benefit from lower borrowing costs and improved access to funding.

Environmental factors significantly influence IWG's operational landscape, from client expectations to regulatory pressures. The increasing demand for green buildings, with the global market valued at over $1.1 trillion in 2023, pushes IWG towards sustainable materials and energy efficiency in its flexible workspaces.

IWG must address its carbon footprint, as the commercial real estate sector contributed around 28% of global energy-related CO2 emissions in 2023. This necessitates a focus on renewable energy and efficient HVAC systems across its network.

Climate change resilience is also a critical concern, with global economic losses from climate-related disasters estimated in the hundreds of billions by 2024. IWG needs to assess property vulnerability and implement adaptive measures to ensure business continuity.

The surge in sustainable investment assets, projected to exceed $50 trillion by 2025, highlights the financial imperative for IWG to demonstrate strong ESG performance and transparent reporting to attract capital and maintain a competitive edge.

PESTLE Analysis Data Sources

Our IWG PESTLE Analysis is built on a robust data foundation, drawing from official government publications, international economic reports, and leading industry research firms. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is current and credible.