IWG Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IWG Bundle

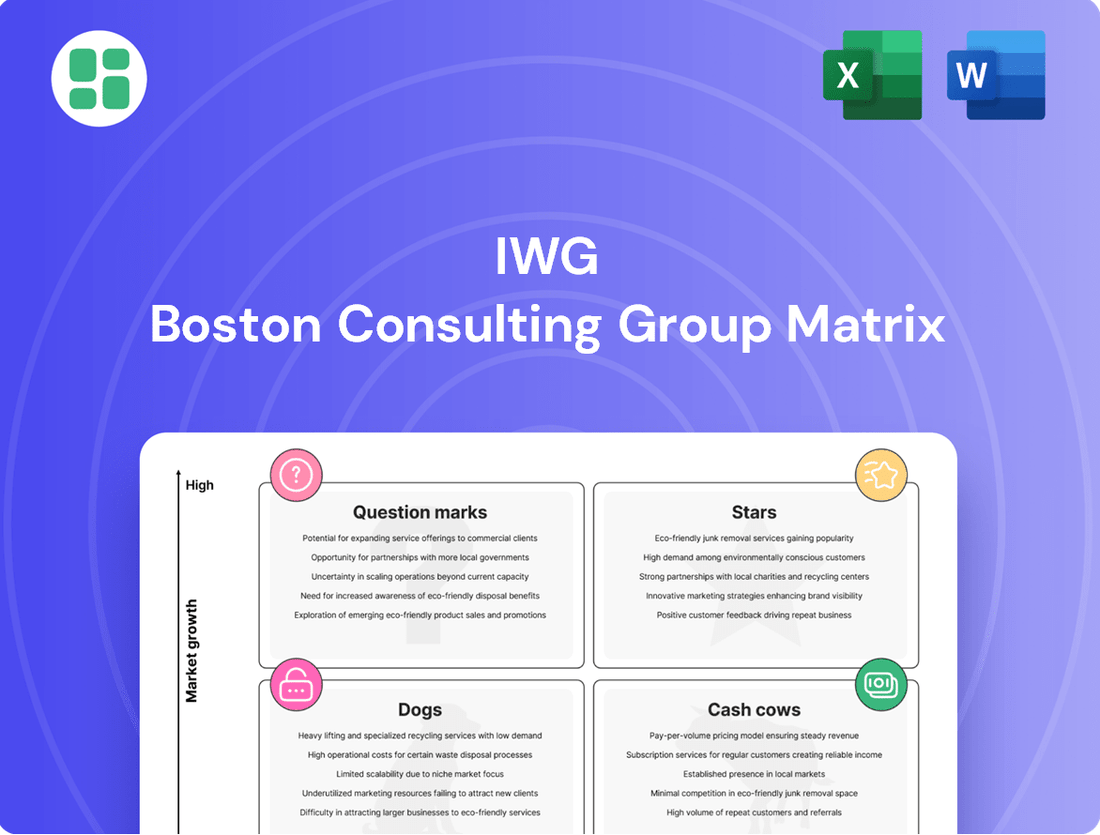

The BCG Matrix is a powerful tool for understanding a company's product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks based on market growth and share. This initial glimpse highlights the strategic importance of this framework for optimizing resource allocation and driving future growth.

To truly leverage this insight and make informed decisions, dive deeper with the full BCG Matrix report. It provides detailed quadrant placements, data-backed recommendations, and a clear roadmap to smart investment and product decisions, empowering you to navigate your market with confidence.

Stars

IWG's capital-light expansion model, a cornerstone of its Star status in the BCG Matrix, hinges on strategic partnerships with property investors. This approach significantly reduces the capital IWG needs to deploy, enabling faster network growth and boosting free cash flow and overall returns.

This strategy proved exceptionally effective in 2024, with IWG achieving a record 899 new center signings worldwide. The vast majority of these new locations were established through these capital-light partnership agreements, underscoring the model's ability to scale operations efficiently and rapidly expand IWG's global footprint.

Spaces, with its emphasis on modern, design-forward coworking spaces, is a significant growth driver for IWG. This brand is well-positioned to capture demand in the expanding flexible workspace market, reflecting a strategic focus on community and innovative office environments. IWG's investment in Spaces, particularly in 2024, saw continued expansion, aiming to solidify its presence in key urban centers and capitalize on the evolving needs of businesses and remote workers.

IWG's expansive global network, spanning over 120 countries and featuring more than 4,500 flex spaces, firmly establishes it as the world's largest hybrid workspace platform. This vast presence translates to a significant market share, capitalizing on the escalating global demand for flexible work arrangements.

The company's extensive reach provides a substantial competitive advantage, enabling it to serve a broad clientele seeking professional workspaces across numerous international locations. This widespread accessibility is a key driver of IWG's market leadership in the evolving landscape of work.

Growth in Emerging Markets and Secondary Cities

The flexible workspace market is seeing significant expansion beyond major metropolitan hubs. Workers increasingly seek convenient locations closer to their homes, fueling demand in secondary and tertiary cities, as well as suburban areas. This trend presents a prime opportunity for growth, aligning with the characteristics of a 'Star' in the BCG matrix.

IWG, a major player in this sector, is strategically capitalizing on this shift. In 2024 alone, the company launched operations in 13 new cities. Their future plans include a concentrated push into Tier-II and Tier-III cities, with a particular focus on high-potential markets like India. This expansion into previously underserved, yet rapidly growing, geographical areas positions IWG for future success.

- Expansion into 13 new cities in 2024 highlights IWG's commitment to geographical diversification.

- Focus on Tier-II and Tier-III cities, especially in India, targets high-growth, underserved markets.

- Worker preference for proximity to home drives demand in secondary and suburban locations.

- This strategic move into new territories is key to IWG's 'Star' potential within the flexible workspace industry.

Enterprise Solutions and Large Corporate Clients

Enterprise solutions and large corporate clients are a significant growth area for flexible workspace providers like IWG. Many businesses are actively seeking ways to offer more adaptable work environments for their employees, especially for larger teams and headquarters. This trend is driven by the ongoing adoption of hybrid work models and the desire to reduce overhead associated with traditional office leases.

IWG is well-positioned to capture this demand. They specialize in creating customized workspace arrangements that cater to the specific needs of large corporations, whether it's relocating entire departments or providing flexible hubs for distributed teams. This capability is crucial as companies navigate the complexities of post-pandemic workplace strategies.

Securing enterprise-level agreements provides IWG with a strong foundation of predictable, recurring revenue. This segment of the market is expanding rapidly, and IWG's established presence and service offerings make them a preferred partner for many major organizations. For instance, in 2024, IWG reported continued growth in its enterprise partnerships, reflecting the sustained demand for flexible office solutions among large businesses.

- Growing Enterprise Demand: Corporate clients are increasingly seeking flexible workspace solutions for larger teams and hybrid work arrangements.

- Tailored Solutions: IWG excels at providing customized office spaces that meet the unique requirements of large corporations.

- Recurring Revenue: Enterprise agreements offer stable, long-term revenue streams, bolstering financial predictability.

- Market Leadership: IWG's established expertise positions it as a leader in serving the large corporate flexible workspace sector.

IWG's classification as a 'Star' in the BCG matrix is strongly supported by its aggressive expansion into underserved markets and its successful capture of the growing enterprise solutions segment. The company's capital-light model, leveraging partnerships, fuels this rapid growth, as evidenced by a record 899 new center signings in 2024, with a significant portion stemming from these collaborations.

The demand for flexible workspaces is expanding beyond major cities, with workers preferring locations closer to home. IWG is strategically capitalizing on this trend, launching operations in 13 new cities in 2024 and focusing on Tier-II and Tier-III markets, particularly in India, to tap into high-growth potential.

Furthermore, IWG's ability to secure large enterprise-level agreements provides predictable, recurring revenue. This segment is experiencing robust growth, with IWG continuing to strengthen its corporate partnerships throughout 2024, demonstrating its leadership in offering tailored flexible office solutions to major organizations.

| Metric | 2024 Performance | Implication for 'Star' Status |

| New Center Signings | 899 | Accelerated market penetration and share capture. |

| New Cities Launched | 13 | Geographical diversification and access to new demand pools. |

| Enterprise Partnerships | Continued Growth | Stable, recurring revenue and strong corporate adoption. |

| Capital-Light Model | Dominant Expansion Strategy | Enables rapid scaling and high return on invested capital. |

What is included in the product

The IWG BCG Matrix analyzes business units based on market share and growth, guiding investment decisions.

A clear visual representation of your portfolio, simplifying complex strategic decisions.

Cash Cows

Regus, the cornerstone of IWG's portfolio, leverages its extensive global network of serviced offices as a significant cash generator. These mature, strategically located sites, often secured by long-term agreements, consistently deliver stable revenue streams.

In 2024, IWG reported a substantial portion of its revenue stemming from its established brands like Regus, highlighting its continued role as a reliable provider of flexible workspace solutions and a key contributor to the company's profitability.

IWG's company-owned and leased centers are the bedrock of its business, acting as its cash cows. While overall revenue growth for this segment remained flat, a crucial detail emerges: revenue from existing, operational centers actually climbed by 5% in 2024. This signals a healthy core business with consistent demand.

These established locations are a reliable source of cash flow for IWG. Their profitability is a testament to efficient operations, with margins improving from 22% in 2023 to a solid 25% in 2024. This steady increase in profitability underscores their status as a mature and dependable revenue generator within the company's portfolio.

Virtual office services for IWG are a prime example of a Cash Cow within the BCG Matrix. These offerings, while perhaps not experiencing explosive growth, are characterized by their consistent and reliable revenue generation, requiring minimal additional investment to maintain their market position.

These services benefit from IWG's established infrastructure and brand, allowing them to attract clients seeking professional business addresses and administrative support without the need for dedicated physical office space. This mature market segment provides a steady, low-maintenance income stream.

In 2024, the demand for flexible workspace solutions, including virtual offices, continued to be robust. IWG reported that its virtual office solutions served a significant portion of its customer base, contributing to the overall stability of its revenue portfolio amidst evolving work trends.

Consistent High Occupancy Rates

Consistent high occupancy rates are a hallmark of IWG's cash cow business units. In 2024, IWG reported an impressive average network occupancy of 85%. This high utilization signifies robust demand for their well-established flexible workspace solutions in mature markets.

These elevated occupancy levels directly translate into a stable and predictable revenue stream. By minimizing vacant space, IWG maximizes the revenue generated from each of its locations, reinforcing their position as reliable cash generators.

- 85% Average network occupancy in 2024.

- Steady Cash Flow: High occupancy ensures predictable income from existing operations.

- Maximized Revenue: Minimizes vacant space, boosting earnings per location.

- Demand Validation: Reflects strong market acceptance of IWG's core offerings.

Digital & Professional Services

IWG's Digital & Professional Services division demonstrated robust underlying performance throughout 2024. The segment achieved an 8% uplift in underlying revenue and a significant 18% growth in underlying EBITDA, showcasing its strong operational efficiency and market responsiveness.

This division capitalizes on IWG's extensive existing client base and established network. By offering a suite of additional value-added services, it generates consistent fee income while maintaining controlled overheads, a key characteristic of a cash cow.

- Revenue Growth: 8% underlying revenue increase in 2024.

- Profitability: 18% underlying EBITDA growth in 2024.

- Strategy: Leverages existing network for value-added services.

- Cash Generation: Stable cash flow due to efficient service delivery and controlled costs.

IWG's established serviced office locations, particularly under the Regus brand, function as its primary cash cows. These mature assets benefit from high occupancy rates and consistent demand, generating stable revenue streams with improving profitability.

In 2024, IWG saw revenue from existing, operational centers climb by 5%, with overall network occupancy reaching an impressive 85%. This demonstrates the reliable cash-generating capability of these mature business units.

The company's virtual office services also represent a cash cow. These offerings leverage IWG's existing infrastructure to provide steady, low-maintenance income with minimal additional investment, contributing to the overall stability of revenue.

Furthermore, IWG's Digital & Professional Services division, with its 8% underlying revenue growth and 18% EBITDA growth in 2024, acts as a cash cow by monetizing its extensive network and client base through value-added services.

| Business Unit | 2024 Revenue Contribution | 2024 Profitability Indicator | BCG Matrix Role |

|---|---|---|---|

| Serviced Offices (Regus) | Significant Revenue Driver | 25% Profit Margins | Cash Cow |

| Virtual Offices | Stable, Reliable Income | Low Maintenance Costs | Cash Cow |

| Digital & Professional Services | Growing Fee Income | 18% EBITDA Growth | Cash Cow |

Full Transparency, Always

IWG BCG Matrix

The BCG Matrix document you are previewing is the identical, final version you will receive upon purchase. This means you'll get a fully formatted, professionally designed strategic tool ready for immediate application without any watermarks or demo content. It's a complete, analysis-ready file that's yours to edit, present, or integrate into your business planning from the moment of purchase.

Dogs

Underperforming legacy centers, especially those in markets with shrinking demand or featuring aging facilities, can be viewed as the 'Dogs' within IWG's portfolio. These locations often struggle with consistently low occupancy rates, sometimes falling below 50% in less favorable economic periods. Furthermore, they might necessitate substantial capital investment for renovations and upgrades to keep pace with modern workspace expectations, impacting overall profitability.

Traditional office models are facing significant headwinds. Many companies are seeing resistance to strict return-to-office mandates, indicating a preference for more flexible work arrangements. For instance, a 2024 survey by Gartner found that 70% of employees want to continue working remotely at least part of the time.

This shift away from large, centralized offices means that IWG's older, less adaptable spaces might be losing appeal. If these legacy locations aren't being updated to support hybrid work, they risk becoming underutilized. This inflexibility can lead to higher operational costs without the expected revenue streams, impacting their position within a portfolio.

Locations that consistently demonstrate low market share in low-growth markets, coupled with high operational costs and minimal cash generation, are classified as Dogs within the IWG BCG Matrix. These underperforming areas often struggle with intense competition or a lack of demand for flexible workspace, as seen in some secondary cities where IWG's expansion might have outpaced organic growth.

For instance, a location with a 2% market share in a market growing at only 1% annually, while incurring 15% higher operating expenses than the company average, would exemplify a Dog. Such sites are resource drains, contributing little to overall profitability and requiring strategic review for potential divestment or restructuring.

Niche Offerings with Limited Adoption

Niche offerings with limited adoption, often seen in the Dogs quadrant of the BCG Matrix, represent services or products that haven't captured significant market share. These could be experimental solutions or highly specialized services that, despite investment, haven't resonated broadly with customers or achieved the scale needed for profitability.

For instance, a coworking company might have launched a highly specialized, AI-powered meeting room booking system that required substantial development costs but saw very low uptake. If the revenue generated by such an offering is less than the ongoing investment in its maintenance and promotion, it becomes a cash trap, draining resources without providing a return.

Careful evaluation is crucial. Companies must assess if these niche offerings can be strategically revamped to appeal to a wider audience or if they should be discontinued to reallocate capital to more promising ventures. For example, a company might find that a niche offering, like on-demand private office pods in underutilized urban areas, failed to gain traction in 2024, with only a 2% adoption rate across its network, despite significant marketing spend.

- Low Market Share: These offerings typically hold a small percentage of their respective markets.

- Low Growth: The market for these niche services is often stagnant or growing very slowly.

- Cash Trap Potential: Continued investment without sufficient revenue can drain company resources.

- Strategic Review Needed: Decisions regarding overhaul or discontinuation are paramount for resource optimization.

Centres Not Transitioning to Capital-Light Model

Centres that haven't transitioned to IWG's capital-light partnership model may face efficiency challenges. These legacy locations, often tied to older, capital-intensive lease agreements, can restrict financial flexibility and growth potential.

For instance, if a significant portion of IWG's portfolio remains under these older lease structures, it could represent a drag on overall profitability. In 2024, IWG has been actively working to convert its leasehold portfolio to a managed or partnership model, aiming to reduce its exposure to fixed lease costs and improve returns on capital. Those locations that resist this transition might struggle to compete with the more agile, capital-light operations.

- Capital Intensity: Older lease models require substantial upfront capital, limiting investment in new growth areas.

- Lease Obligations: Long-term, fixed lease payments can become a financial burden if occupancy rates decline.

- Reduced Agility: Inability to adapt these sites to new service offerings or operational efficiencies hampers competitiveness.

- Profitability Gap: Underperforming centres not aligned with the capital-light strategy can lower overall company margins.

Dogs in IWG's portfolio are centers with low market share in slow-growing markets, often burdened by high operational costs and minimal cash generation. These locations, such as older, underutilized legacy centers, may require significant investment for modernization to meet evolving workspace demands. For example, a center in a secondary city with only a 2% market share in a 1% growth market, incurring 15% above-average operating costs, exemplifies a Dog.

The shift towards flexible work arrangements, with a 2024 Gartner survey showing 70% of employees preferring remote work at least part-time, further challenges traditional office models. IWG's legacy spaces that haven't adapted to hybrid work risk becoming obsolete and draining resources. Locations still under capital-intensive lease agreements, rather than IWG's capital-light partnership model, also fall into this category, limiting financial flexibility.

These underperforming assets, including niche services with low adoption rates, represent a cash trap if investment continues to outweigh revenue. A 2024 example could be a specialized booking system with a mere 2% adoption rate despite marketing spend. Strategic decisions to revamp or divest these Dogs are crucial for optimizing resource allocation and improving overall portfolio profitability.

| BCG Category | Characteristics | IWG Portfolio Example | 2024 Data/Trend | Strategic Implication |

|---|---|---|---|---|

| Dogs | Low market share, low market growth, high costs, low cash generation | Legacy centers in declining markets, underutilized spaces, older lease models | 70% employee preference for remote work (Gartner 2024) impacting traditional office demand | Divestment, restructuring, or significant investment for modernization |

| Dogs | Niche offerings with limited customer adoption | Experimental services with low uptake, specialized solutions not resonating | Low adoption rates (e.g., 2%) for new tech services despite marketing spend | Revamp for wider appeal or discontinuation to reallocate capital |

| Dogs | Capital-intensive legacy lease agreements | Centers tied to older, fixed lease structures limiting flexibility | IWG's ongoing conversion to capital-light models highlights the drag of older leases | Reduced agility and profitability compared to capital-light operations |

Question Marks

IWG's significant investment in technology, aiming for AI integration in 75% of its locations by the close of 2024, positions its advanced solutions as a 'Question Mark' within the BCG matrix. This aggressive digital push, while forward-thinking, faces uncertainties regarding market acceptance and the direct impact on revenue streams.

IWG's strategic push into India's Tier-III and Tier-IV cities is a calculated move targeting substantial volume growth. This expansion is characteristic of a Question Mark in the BCG matrix, signifying high market growth potential but with an uncertain competitive standing for IWG.

These nascent markets, while promising for future demand, require significant upfront investment in infrastructure and brand building. For instance, India's Tier-III cities are projected to contribute substantially to the nation's GDP growth in the coming years, creating a fertile ground for service-based businesses like flexible workspaces.

The challenge lies in capturing market share amidst evolving local competition and consumer adoption rates. IWG must invest heavily to establish a strong presence, anticipating that these efforts will eventually transform these markets into Stars, but the immediate profitability and market dominance remain an open question.

The emergence of innovative hybrid work models, integrating office solutions into non-traditional locations like shopping malls and transport hubs, represents a significant growth opportunity. These flexible spaces cater to evolving workforce needs, offering convenience and accessibility.

While these segments are expanding rapidly, IWG's current market penetration remains relatively low, indicating substantial room for expansion. For instance, in 2024, the flexible workspace market saw a notable increase in demand for these distributed models, with reports suggesting a 15% year-over-year growth in non-central business district locations.

Capturing a dominant market share in these nascent areas necessitates considerable investment in marketing to build brand awareness and operational infrastructure to ensure seamless service delivery. This strategic push is crucial for IWG to capitalize on the growing trend and establish a strong foothold.

Tailored Solutions for Specific Industries

Developing highly tailored flexible workspace solutions for specific industries, like biotech labs or media production studios, presents a potential Question Mark for IWG. While these niche markets show promise, IWG's current penetration might be limited, requiring significant investment to understand and cater to unique operational needs. The success hinges on IWG’s ability to adapt its offerings and marketing to these specialized segments.

The growth in demand for industry-specific flexible workspaces is evident, with reports indicating a rise in companies seeking customized environments that support their unique workflows. For instance, a 2024 market analysis highlighted that sectors like technology and creative industries are increasingly prioritizing flexible spaces that offer specialized amenities, driving a potential shift in demand away from generic co-working models.

- Industry Specialization: IWG could explore developing dedicated flexible workspace hubs for sectors like healthcare, finance, or creative arts, offering industry-specific infrastructure and services.

- Market Fragmentation: These niche markets are often fragmented, meaning IWG would need to strategically target and acquire or partner with existing players to gain traction.

- Investment and Scaling: Success requires substantial investment in understanding specific industry requirements and the ability to scale these tailored solutions rapidly to achieve market leadership.

- Competitive Differentiation: IWG must clearly differentiate its specialized offerings from competitors by providing unique value propositions that directly address the operational challenges and opportunities within each target industry.

Residential Developer Partnerships for Localized Workspaces

Partnering with residential developers to create localized workspaces, like micro-offices or 'work-from-home' adjacent solutions, is a significant growth area. This trend taps into the increasing demand for flexible work arrangements closer to residential areas.

While this segment presents a high-growth opportunity, IWG's current market share and penetration within this specific niche are likely nascent. Successfully capitalizing on this trend requires significant upfront investment and a well-executed strategy to establish a strong presence and leadership in neighborhood-based workspaces.

- Market Trend: Increasing demand for flexible, local workspaces near residential areas.

- IWG's Position: Likely low current penetration and market share in this specific segment.

- Investment & Strategy: Requires substantial capital and strategic execution for significant traction.

- Growth Potential: High potential for IWG to become a leader in neighborhood workspaces if successful.

IWG's ventures into specialized industry workspaces and partnerships with residential developers represent classic Question Marks. These initiatives target high-growth niches, but IWG's current market penetration is likely limited, demanding substantial investment and strategic execution. Success hinges on their ability to adapt offerings and build brand awareness in these emerging segments, with the potential to evolve into Stars.

| Initiative | Market Potential | IWG's Current Position | Key Challenge | Growth Outlook |

|---|---|---|---|---|

| Industry-Specific Workspaces | High (e.g., tech, creative) | Nascent | Understanding unique operational needs, scaling tailored solutions | Potential Star if successful |

| Residential Partnerships (Micro-offices) | High (demand for local work) | Nascent | Establishing presence, market penetration | Potential Star if successful |

| AI Integration in Locations | High (efficiency, user experience) | Developing | Market acceptance, direct revenue impact | Potential Star if adoption is strong |

| Expansion into Tier-III/IV Cities (India) | High (untapped markets) | Developing | Capturing market share, local competition | Potential Star if market leadership is achieved |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial statements, market research reports, and industry performance metrics to provide a clear strategic overview.