iRobot SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

iRobot Bundle

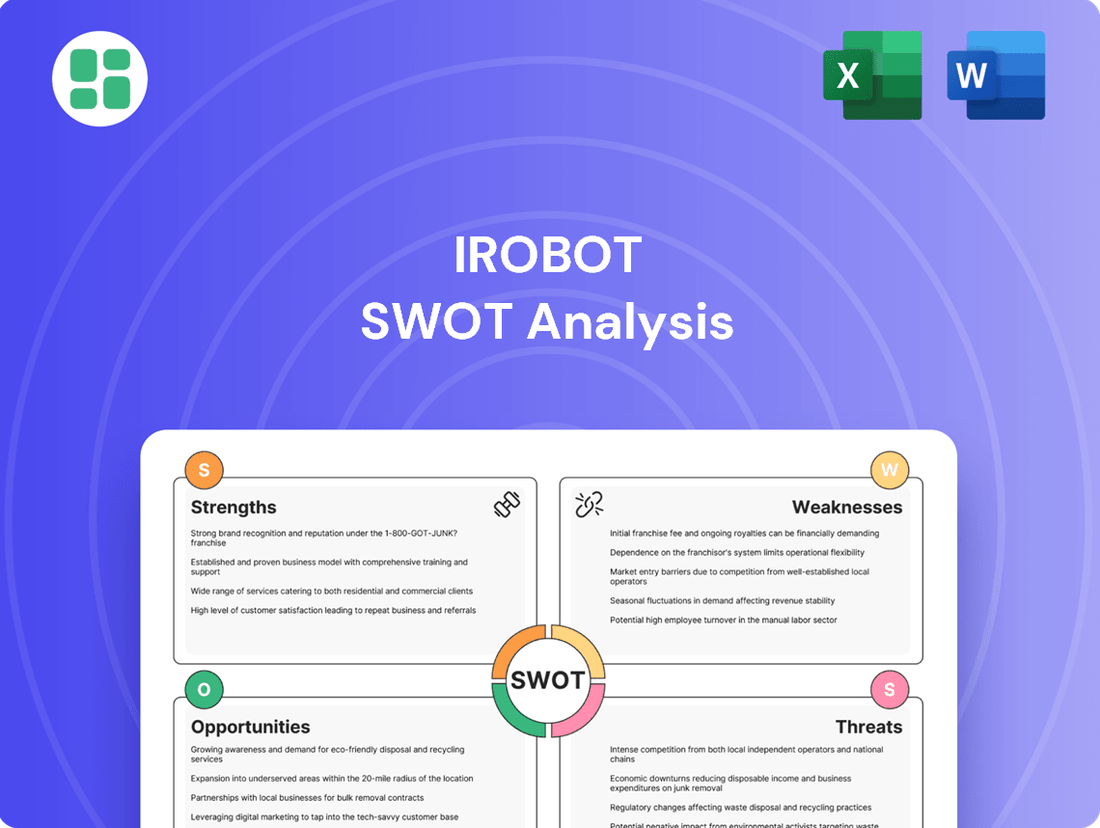

iRobot, a pioneer in robotic vacuum cleaners, boasts strong brand recognition and a loyal customer base, but faces intense competition and evolving consumer expectations. Understanding these dynamics is crucial for any investor or strategist.

Discover the complete picture behind iRobot’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

iRobot's Roomba brand is a household name, synonymous with robotic vacuum cleaners and holding a dominant position in the market for over twenty years. This deep-rooted brand recognition translates directly into significant consumer trust and a powerful competitive edge.

The company's legacy as a pioneer in robotic floorcare, launching its first Roomba in 2002, has cemented its reputation for innovation and quality. This long history of technological advancement continues to resonate with consumers seeking reliable and cutting-edge home automation solutions.

iRobot boasts an impressive patent portfolio, especially in artificial intelligence, home understanding, and machine vision, forming the backbone of its iRobot OS. This strong intellectual property directly translates to faster product launches and lower development expenses.

Despite facing financial headwinds, iRobot remains committed to research and development, consistently investing to improve its product offerings and maintain a competitive edge in the smart home robotics market.

iRobot's strategic restructuring, initiated in January 2024, has been a significant strength. The company has reduced its workforce by more than half, a move designed to drastically cut operational costs and better match expenses with anticipated revenue streams. This aggressive cost optimization is a key factor in their pursuit of improved profitability.

Furthermore, iRobot has fundamentally reshaped its research and development and supply chain operations. By embracing contract manufacturing, they've unlocked greater efficiency and flexibility, allowing them to scale production more effectively and reduce overhead associated with in-house manufacturing. This strategic shift is crucial for navigating a competitive market.

Focus on Core Robotic Floorcare Market

iRobot has strategically honed its efforts on its core robotic floorcare business, specifically targeting the mid-tier and premium segments for its vacuum and mopping robots. This laser focus allows the company to channel its development and marketing resources into its most impactful product categories, thereby better navigating the competitive landscape.

This strategic realignment ensures a more defined product development path and optimizes resource allocation. For instance, in early 2024, iRobot announced a renewed commitment to its Roomba line, aiming to innovate within this established core. This concentration is crucial for maintaining market share against a growing number of competitors.

- Refocus on Core Competencies: iRobot is concentrating its innovation and investment on robotic vacuums and mops.

- Targeted Market Segments: The company is prioritizing the mid-tier and premium segments for its floorcare products.

- Resource Optimization: This focused strategy allows for more efficient allocation of capital and research and development efforts.

- Competitive Advantage: By doubling down on its core, iRobot aims to strengthen its position against emerging and established rivals in the smart home appliance market.

New Product Pipeline with Margin-Accretive Potential

iRobot's strength lies in its robust new product pipeline, featuring its largest lineup ever launched in March 2025. This includes advanced Roomba vacuums and innovative 2-in-1 vacuum and mop combinations.

These new offerings are strategically designed to be margin-accretive, meaning they are expected to generate higher profit margins than iRobot's older products. This pipeline is a key driver for anticipated year-over-year revenue growth, especially projected for the latter half of 2025.

Early feedback from both consumers and distributors regarding these recent product introductions has been overwhelmingly positive, indicating strong market reception and potential for sales success.

- Largest Product Lineup: Introduced in March 2025, marking a significant expansion of iRobot's offerings.

- Margin Enhancement: New models are designed to be margin-accretive, boosting profitability.

- Revenue Growth Driver: Expected to fuel year-over-year revenue increases, particularly in H2 2025.

- Positive Market Reception: Early consumer and distributor reactions have been favorable.

iRobot's Roomba brand is a powerhouse, holding a commanding market share and deep consumer loyalty built over two decades of innovation. This strong brand equity is a significant asset, enabling premium pricing and robust demand for its products.

The company's extensive patent portfolio, particularly in AI and machine vision, provides a technological moat, facilitating quicker product development cycles and reducing reliance on external technologies. This intellectual property underpins the advanced capabilities of their iRobot OS.

iRobot's strategic pivot in early 2024, which included a substantial workforce reduction and a focus on contract manufacturing, has streamlined operations and significantly lowered its cost structure. This efficiency drive is crucial for improving profitability in a competitive market.

The company launched its most extensive product lineup in March 2025, featuring advanced Roomba vacuums and innovative 2-in-1 mopping units. These new, margin-accretive products are expected to drive revenue growth, with positive early market reception reported by distributors and consumers.

| Strength | Description | Impact |

|---|---|---|

| Brand Recognition | Household name, synonymous with robotic vacuums, over 20 years of market presence. | High consumer trust, strong competitive advantage. |

| Intellectual Property | Extensive patents in AI, home understanding, and machine vision (iRobot OS). | Faster product launches, lower development costs, technological differentiation. |

| Strategic Restructuring | Workforce reduction (over 50%), shift to contract manufacturing. | Reduced operational costs, improved efficiency, enhanced flexibility. |

| New Product Pipeline | Largest lineup launched March 2025, margin-accretive products. | Expected revenue growth (H2 2025), positive market reception. |

What is included in the product

Delivers a strategic overview of iRobot’s internal and external business factors, highlighting its market strengths, operational gaps, and risks.

Offers a clear SWOT analysis that highlights iRobot's competitive advantages and potential threats, enabling targeted strategies to overcome market challenges.

Weaknesses

iRobot has faced a significant downturn in its financial performance. For the fourth quarter of 2024, the company reported a substantial revenue drop in key markets like the U.S., Japan, and EMEA. This challenging trend unfortunately continued into the first and second quarters of 2025, indicating persistent headwinds.

The financial strain is further evidenced by considerable net losses reported for the entirety of 2024. This pattern of negative profitability extended into the first half of 2025, with the company posting significant net losses for both Q1 and Q2. These ongoing financial deficits underscore the severe market pressures and operational hurdles iRobot is currently navigating.

iRobot faces severe liquidity concerns, with its cash and cash equivalents significantly decreasing and continuing to decline through the second quarter of 2025. This dwindling financial resource is a major weakness, impacting its ability to operate smoothly.

The company has publicly acknowledged substantial doubt regarding its ability to continue as a going concern for the next twelve months. This statement underscores the critical nature of its cash burn and the urgent need for financial stabilization.

This precarious financial position severely curtails iRobot's operational flexibility, making it difficult to fund essential activities, research and development, or respond effectively to market challenges.

The failure of the Amazon acquisition, terminated in January 2024 due to regulatory concerns, dealt a significant blow to iRobot. This setback resulted in substantial workforce reductions, impacting employee morale and operational capacity.

iRobot received a $94 million termination fee from Amazon, a financial cushion but not a solution to the underlying strategic challenges. This fee was a direct consequence of the deal's collapse, highlighting the costs associated with failed mergers.

The termination necessitated an urgent and comprehensive restructuring of iRobot's operations and strategy. This restructuring is crucial for the company to regain financial stability and redefine its path forward in a competitive market.

Inability to Diversify Beyond Floor Care

Despite a history in broader robotics, iRobot has found it challenging to expand its consumer robotics offerings beyond floor care. For instance, the company decided to discontinue its venture into robot lawn mowers, a move that underscores its continued concentration on the robotic vacuum and mop segments. This strategic focus, while potentially allowing for deeper expertise, also heightens the company's exposure to fluctuations within this specific market. In 2023, iRobot's revenue was $974 million, with the vast majority stemming from its Roomba and Braava product lines, highlighting this dependence.

This limited diversification makes iRobot particularly susceptible to shifts in consumer preferences or increased competition within the floor cleaning robotics niche. The market for robotic vacuums is increasingly crowded with both established brands and new entrants, many offering products at lower price points. iRobot's reliance on this single product category means that a downturn in demand or a failure to innovate effectively in floor care could have a significant impact on its overall financial performance.

- Over-reliance on Floor Care: iRobot's product portfolio remains heavily weighted towards robotic vacuums and mops, limiting its ability to offset potential declines in this core market.

- Shelved Diversification Efforts: Past attempts to branch out, such as the robot lawn mower initiative, have not materialized, reinforcing the company's concentration on floor cleaning.

- Competitive Pressure: The floor care robotics market is intensely competitive, with numerous players vying for market share, potentially eroding iRobot's dominance.

Price and Product-Mix Pressures

iRobot is experiencing significant pressure on its pricing and product mix. The average selling price of its robots saw a decline in the second quarter of 2025, indicating a potential shift towards more budget-conscious consumers or increased competition at lower price points.

Furthermore, the company's sales mix has shifted, with a notable decrease in the proportion of mid-range and premium robots sold. This trend suggests iRobot may be compelled to compete more aggressively on price, potentially impacting its profitability as it faces a growing number of lower-cost competitors in the market.

- Declining Average Selling Price: iRobot's average selling price for robots decreased in Q2 2025.

- Shift in Product Mix: The share of mid-range and premium robots in total sales has fallen.

- Competitive Pricing Pressure: The company may need to compete on price, potentially hurting margins.

- Market Saturation: The market is increasingly populated by cheaper alternatives.

iRobot's inability to successfully diversify beyond floor care is a significant weakness. The discontinuation of its robot lawn mower venture in 2024 highlights this, leaving the company heavily reliant on its Roomba and Braava lines, which accounted for the vast majority of its $974 million revenue in 2023. This narrow focus makes iRobot vulnerable to market shifts and intense competition in the robotic vacuum segment.

Full Version Awaits

iRobot SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing the actual iRobot SWOT analysis, giving you a clear understanding of its strengths, weaknesses, opportunities, and threats.

Opportunities

The global household robots market is experiencing significant expansion, with projections indicating continued strong growth. This upward trend is fueled by the increasing integration of smart home technologies, rising consumer disposable incomes, and a persistent demand for greater convenience in daily life.

Within this burgeoning market, robotic vacuum cleaners and mops are leading the charge, representing the fastest-growing segments. This presents a particularly opportune environment for iRobot, provided the company can effectively navigate its current challenges and solidify its market standing.

Market research from Statista in early 2024 estimated the global market for domestic robots to reach approximately $12.6 billion in 2024, with forecasts suggesting it could surpass $20 billion by 2029, demonstrating a compound annual growth rate (CAGR) of over 10%.

iRobot is banking on a significant turnaround, projecting a return to year-over-year top-line growth in 2025, with the second half expected to be particularly strong. This optimism is largely fueled by a pipeline of new product introductions, both recently launched and those slated for release.

These new offerings are strategically developed to be margin-accretive, meaning they are expected to contribute positively to iRobot's profitability. They represent a core component of the company's comprehensive 'iRobot Elevate' strategy, designed to revitalize its financial performance.

The successful scaling and market adoption of these new product lines are critical. If iRobot can effectively ramp up production and sales for these innovative devices, it could lead to a substantial improvement in its overall financial results, demonstrating a clear path to recovery.

iRobot's Board of Directors has launched a formal strategic review, examining options like debt refinancing or a potential sale. This move signals a proactive approach to addressing financial pressures and seeking avenues for enhanced operational stability.

This exploration presents a significant opportunity to secure vital capital, lighten the company's debt load, or identify a strategic partner. Such a collaboration could inject the necessary resources to ensure iRobot's long-term growth and market competitiveness.

As of late 2023, iRobot faced financial headwinds, including a significant debt burden and challenges in its consumer electronics market. The strategic review aims to navigate these complexities, potentially leading to a more robust financial structure or a new ownership that can accelerate innovation and market penetration.

Leveraging Enhanced Operational Efficiency

iRobot's strategic restructuring, including its move to leverage contract manufacturers like Picea Robotics, is a key opportunity to significantly improve its operational efficiency. This streamlining of the supply chain is designed to reduce both product costs and the time it takes to bring new products to market. The company anticipates these changes will positively impact its margins and overall profitability, with expectations for these benefits to materialize in 2025.

The pursuit of enhanced operational efficiency directly translates into a stronger competitive position. By reducing costs and speeding up development cycles, iRobot can respond more nimbly to market demands and potentially offer more competitive pricing. This improved agility is crucial in the dynamic consumer electronics sector.

- Reduced Cost of Goods Sold: Transitioning to contract manufacturing is projected to lower production expenses.

- Faster Time-to-Market: Streamlined development and manufacturing processes aim to accelerate product launches.

- Improved Profitability: Enhanced efficiency is expected to contribute to better financial performance, with specific margin improvements anticipated in 2025.

- Increased Competitiveness: Operational agility allows for more responsive pricing and product innovation.

Advancements in AI and Smart Home Integration

The rapid advancement of artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) creates a significant opportunity for iRobot to innovate. By integrating these technologies, iRobot can develop more intelligent, autonomous, and interconnected robotic cleaning solutions that seamlessly fit into the modern smart home ecosystem. This aligns with the increasing consumer expectation for sophisticated home automation. For instance, the global smart home market was valued at approximately $84.5 billion in 2023 and is projected to reach $208.4 billion by 2028, indicating substantial growth potential for integrated robotic devices.

Enhancing its proprietary iRobot OS with cutting-edge AI and ML capabilities allows the company to offer advanced features. These could include predictive maintenance, personalized cleaning routines based on user behavior, and improved navigation in complex home environments. Such enhancements are crucial as consumers increasingly seek devices that offer convenience and proactive assistance, moving beyond basic functionality. iRobot's ability to leverage AI for smarter object recognition and obstacle avoidance, for example, directly addresses this demand.

- AI-driven cleaning: Develop robots that learn and adapt to specific home layouts and cleaning needs, optimizing performance over time.

- IoT integration: Enable seamless connectivity with other smart home devices, allowing for voice commands and automated routines through platforms like Alexa or Google Assistant.

- Enhanced user experience: Offer more intuitive controls and personalized insights through the iRobot OS, making robotic cleaning more user-friendly and efficient.

The expanding global market for domestic robots, projected to exceed $20 billion by 2029, offers a significant growth avenue for iRobot. The company's strategic review may unlock capital or a partnership, bolstering its financial health and competitive edge. Furthermore, advancements in AI, machine learning, and IoT present opportunities to develop more intelligent and integrated home cleaning solutions, enhancing user experience and market appeal.

Threats

iRobot is facing a significant challenge from intense and growing competition. Established players and emerging companies, especially from China like Ecovacs, Roborock, and Anker, are offering products that are often comparable or even better than iRobot's, but at more attractive prices. This aggressive pricing strategy, coupled with rapid innovation from these competitors, is directly impacting iRobot's market share and profitability.

iRobot has faced significant revenue challenges, with reported net sales declining by approximately 31% in 2023 compared to 2022, a trend that continued into early 2024. This downturn is largely driven by softening consumer demand for discretionary purchases like robotic vacuums. For instance, the company's first quarter 2024 results showed a net loss and a substantial drop in revenue, underscoring this threat.

Persistent macroeconomic headwinds, including elevated inflation and a general erosion of consumer spending power, continue to dampen demand for iRobot's products. These conditions create a challenging sales environment, impacting both unit volumes and the company's ability to maintain pricing power across its key geographical markets, directly affecting profitability.

iRobot has explicitly stated there is substantial doubt about its ability to continue as a going concern for the next year. This stems directly from ongoing operating losses and negative cash flow, painting a stark picture of its financial health.

The company faces persistent liquidity risk, a critical concern that could significantly impact its operations and future. This situation is amplified by the necessity to renegotiate existing debt covenants, adding a layer of considerable uncertainty for potential investors and business partners alike.

Regulatory Scrutiny and Antitrust Challenges

iRobot faces significant headwinds from regulatory bodies, as evidenced by the European Commission blocking its proposed acquisition by Amazon in January 2024. This decision, citing antitrust concerns, underscores a heightened level of scrutiny that could impact iRobot's ability to pursue future strategic alliances or mergers. Such regulatory hurdles can limit options for financial restructuring or market expansion, potentially hindering the company's growth trajectory.

The antitrust challenges extend beyond the Amazon deal, signaling a broader trend of increased oversight from competition authorities in key markets like the US and EU. This environment makes it more difficult for iRobot to engage in M&A activities, which are often crucial for companies seeking to consolidate market share or access new technologies. The potential for ongoing investigations or new regulatory demands could divert management attention and resources, impacting operational focus.

- January 2024: European Commission blocks Amazon's acquisition of iRobot due to antitrust concerns.

- Regulatory Environment: Heightened scrutiny from EU and US regulators on market concentration and competitive practices.

- Impact on Strategy: Potential impediment to future mergers, acquisitions, or strategic partnerships for iRobot.

- Financial Implications: Limited avenues for growth or financial improvement through external consolidation.

Supply Chain Challenges and Geopolitical Risks

iRobot has consistently grappled with supply chain disruptions. For instance, in 2023, the company cited component shortages, particularly semiconductors, as a factor impacting production volumes. This vulnerability persists, exposing iRobot to potential delays and increased costs for essential parts needed for its robotic vacuum cleaners and other products.

Geopolitical tensions and shifting trade policies represent a significant external threat. Tariffs on goods imported or exported can directly inflate iRobot's cost of goods sold and affect the competitiveness of its pricing in key international markets. The ongoing global trade environment creates uncertainty for manufacturing and distribution strategies.

- Component Shortages: Continued reliance on global supply chains for critical components like semiconductors remains a vulnerability, as seen in past production impacts.

- Logistical Hurdles: Delays in shipping and transportation can disrupt inventory management and product delivery timelines, affecting customer satisfaction and sales.

- Trade Policy Uncertainty: Evolving tariff structures and international trade disputes pose a risk to iRobot's cost structure and market access, potentially impacting profitability.

Intense competition, particularly from lower-priced Chinese manufacturers like Ecovacs and Roborock, is a major threat, eroding iRobot's market share and profitability. The company's revenue has seen a significant decline, with net sales down approximately 31% in 2023, and this trend continued into early 2024, marked by substantial revenue drops and net losses in Q1 2024. Macroeconomic pressures, including inflation and reduced consumer spending, further dampen demand for discretionary items like robotic vacuums, impacting sales volumes and pricing power.

iRobot faces existential financial threats, including substantial doubt about its ability to continue as a going concern for the next year, stemming from persistent operating losses and negative cash flow. This is compounded by liquidity risks and the necessity to renegotiate debt covenants, creating significant uncertainty for stakeholders. Furthermore, regulatory hurdles, such as the European Commission's January 2024 block of the Amazon acquisition due to antitrust concerns, limit strategic options and highlight increased scrutiny from authorities in key markets.

| Threat Category | Specific Threat | Impact on iRobot | 2023/2024 Data/Context |

|---|---|---|---|

| Competition | Aggressive pricing from Chinese competitors | Market share erosion, reduced profitability | Ecovacs, Roborock, Anker offer comparable or superior products at lower prices. |

| Financial Health | Declining Revenue & Operating Losses | Risk of going concern, liquidity issues | Net sales down ~31% in 2023; Q1 2024 showed significant revenue drop and net loss. |

| Macroeconomic Factors | Softening Consumer Demand & Inflation | Reduced sales volumes, limited pricing power | Consumers cutting back on discretionary purchases; inflation impacts spending power. |

| Regulatory Environment | Antitrust Scrutiny & Deal Blocks | Limited M&A opportunities, strategic constraints | Amazon acquisition blocked Jan 2024 by EU Commission; increased oversight in US/EU. |

| Supply Chain & Geopolitics | Component shortages & Trade policy uncertainty | Production delays, increased costs, market access issues | Past reliance on semiconductors cited; tariffs can inflate costs and affect competitiveness. |

SWOT Analysis Data Sources

This iRobot SWOT analysis is constructed from a blend of reliable data, including the company's financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a robust foundation for understanding iRobot's current position and future potential.