iRobot Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

iRobot Bundle

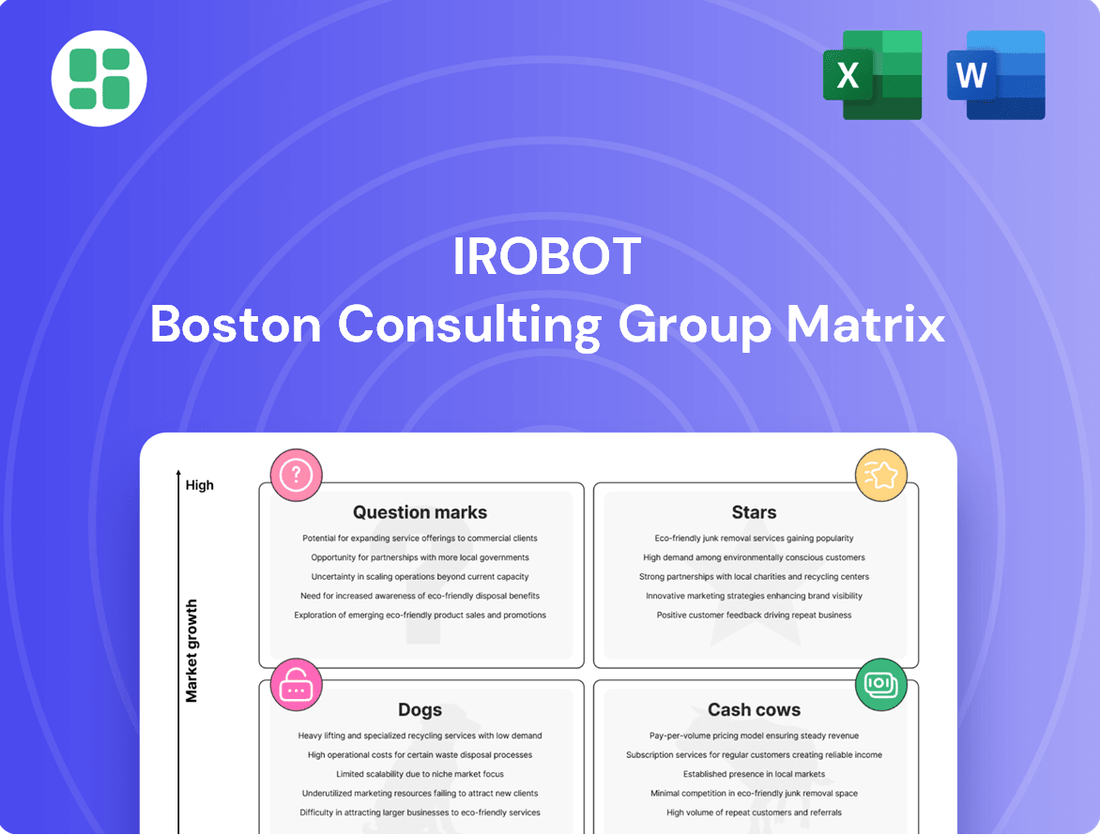

Curious about iRobot's strategic product positioning? Our BCG Matrix analysis reveals their current market standing, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full picture; purchase the complete report for a comprehensive breakdown and actionable insights to guide your investment decisions.

Stars

The Roomba Max 705 Combo Robot + AutoWash™ Dock, launched in July 2025, is iRobot's cutting-edge 2-in-1 cleaning solution, boasting heated mopping and superior suction power. This product is aimed squarely at the high-end of the robot vacuum-mop market, a sector that has seen substantial expansion.

With the global robot vacuum market projected to reach over $12 billion by 2027, this premium offering from iRobot is strategically positioned to capture a significant share. Its performance is critical for iRobot's objective of regaining its leading market position and fueling its future revenue streams, identifying it as a strong contender for the Star category within the BCG Matrix.

The Roomba Plus 505 Combo Robot + AutoWash™ Dock, launched in March 2025, represents iRobot's strategic push into the premium 2-in-1 robotic cleaning segment. This model, featuring PerfectEdge® Technology and a self-emptying dock, is designed to capitalize on the growing consumer demand for integrated, high-performance cleaning solutions. Its success is pivotal for iRobot to solidify its position in this high-growth market.

The Roomba Max 705 Vac Robot + AutoEmpty™ Dock, launched in April 2025, represents iRobot's push into the premium vacuum-only robot segment. With a marketing claim of 180x more suction power, it targets consumers seeking enhanced cleaning performance and extended automated operation. This product is positioned to capture a significant share of the growing high-end robotic vacuum market.

Advanced AI and Navigation Systems (e.g., ClearView™ Lidar, PrecisionVision™ AI)

The integration of advanced AI and navigation systems, such as ClearView™ Lidar and PrecisionVision™ AI, is a key differentiator for iRobot's premium products. These technologies significantly improve the robots' ability to map homes accurately and navigate complex environments, leading to more efficient cleaning. For instance, iRobot's 2024 models continue to leverage these sophisticated systems to offer superior obstacle avoidance and room recognition, directly addressing consumer demand for intelligent home automation.

These technological investments are crucial for iRobot's "Stars" in the BCG Matrix, as they support high market share and strong growth potential. The enhanced performance driven by AI and lidar systems allows these products to command premium pricing and attract a segment of consumers willing to pay for superior functionality. This focus on innovation in navigation and AI ensures these offerings remain at the forefront of the smart home cleaning market.

- Enhanced Mapping and Navigation: ClearView™ Lidar and PrecisionVision™ AI enable precise home mapping and intelligent path planning, improving cleaning coverage and efficiency.

- Superior Obstacle Avoidance: These AI-powered systems allow robots to better identify and avoid common household obstacles, reducing the likelihood of getting stuck or damaging furniture.

- Premium Consumer Appeal: The advanced capabilities directly translate to a better user experience, justifying premium pricing and reinforcing market leadership in the high-end segment.

- Competitive Advantage: Continued investment in these core technologies is vital for iRobot to maintain its leading position against competitors increasingly adopting similar smart features.

Strategic Focus on Margin-Accretive New Products

iRobot's strategic pivot, termed 'iRobot Elevate,' is centered on launching new products anticipated to boost profit margins and achieve consistent year-over-year revenue increases through 2025. This deliberate investment in a robust product pipeline, with a particular focus on the latter half of 2025, is engineered to unlock substantial future earnings. This approach mirrors a Star in the BCG Matrix, where current resource allocation is strategically directed to capture future market dominance and ensure sustained cash flow.

This focus on margin-accretive products is crucial for iRobot as it navigates a competitive landscape. For instance, in 2024, the company has been working to streamline its product offerings and invest in innovation. The success of these new launches will be key to demonstrating the effectiveness of this strategy.

- Margin-Accretive Products: The core of the 'iRobot Elevate' strategy is the introduction of new products designed to enhance profit margins.

- 2025 Revenue Growth: These new products are projected to be the primary drivers of year-over-year revenue growth in 2025.

- Future Profitability: Significant investment in the product pipeline, especially in the latter half of 2025, aims to secure considerable future profitability.

- Star BCG Matrix Alignment: This investment strategy aligns with a Star, focusing on current growth potential to achieve future market leadership and cash generation.

The Roomba Max 705 Combo and Roomba Plus 505 Combo, alongside the Roomba Max 705 Vac, represent iRobot's strategic push into premium, high-performance segments. These products, leveraging advanced AI and navigation, are designed to capture significant market share in a growing industry. Their success is crucial for iRobot's objective of regaining market leadership and driving future revenue.

The 'iRobot Elevate' strategy, focusing on margin-accretive products and innovation, positions these offerings as Stars in the BCG Matrix. By investing in advanced technologies like ClearView™ Lidar and PrecisionVision™ AI, iRobot aims to command premium pricing and deliver superior user experiences, ensuring a competitive edge.

The global robot vacuum market is projected to exceed $12 billion by 2027, with premium segments showing robust growth. iRobot's 2024 focus on streamlining offerings and investing in these innovative products is designed to capitalize on this expansion, aiming for consistent year-over-year revenue increases through 2025.

| Product | Launch Date | Key Features | BCG Category |

|---|---|---|---|

| Roomba Max 705 Combo + AutoWash™ Dock | July 2025 | Heated mopping, superior suction, 2-in-1 | Star |

| Roomba Plus 505 Combo + AutoWash™ Dock | March 2025 | PerfectEdge®, self-emptying dock, 2-in-1 | Star |

| Roomba Max 705 Vac + AutoEmpty™ Dock | April 2025 | 180x suction power, automated operation | Star |

What is included in the product

The iRobot BCG Matrix offers a strategic overview of its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides investment decisions, highlighting which product lines to nurture, maintain, or divest for optimal resource allocation.

The iRobot BCG Matrix provides a clear, visual pain point reliever by instantly categorizing each business unit, simplifying strategic decision-making.

Cash Cows

Established Roomba vacuum-only models, such as certain i and j series, are considered iRobot's cash cows. These products leverage iRobot's strong brand loyalty and a significant existing customer base, ensuring steady sales. In 2024, iRobot continued to see robust demand for these core models, which require less marketing and research expenditure than emerging technologies, contributing to their profitability.

Roomba's brand recognition is a significant asset, making it a household name in robotic vacuums. Having sold over 50 million robots worldwide, this deep market penetration provides iRobot with a stable revenue stream from the established robot vacuum market. This strong brand equity translates directly into consistent sales, bolstering the company's cash flow.

iRobot's Roomba vacuum owners represent a significant installed base, consistently driving revenue through the purchase of replacement parts like filters, brushes, and cleaning solutions. This predictable, recurring revenue is a hallmark of a cash cow, typically boasting high profit margins with relatively low incremental marketing spend. For example, in 2023, iRobot reported that its consumables and accessories business continued to be a stable contributor to its overall financial performance, underscoring the ongoing demand from its loyal customer base.

Loyal Customer Base

iRobot benefits significantly from a loyal customer base, particularly with its Roomba line. Many consumers stick with the Roomba brand, often upgrading to newer models or recommending them to friends and family. This strong brand affinity ensures a steady demand for their established products.

This loyalty translates into predictable sales volumes for existing Roomba models, which is a key characteristic of a Cash Cow. This consistent revenue stream from reliable, well-loved products helps iRobot maintain its financial stability. For example, in 2023, iRobot reported that its Roomba brand continued to be a dominant force in the robot vacuum market, underscoring the enduring customer preference.

- Brand Loyalty: Consumers frequently repurchase or upgrade within the Roomba ecosystem.

- Predictable Demand: Established models benefit from consistent sales volumes due to customer trust.

- Stable Revenue: The loyal customer base provides a reliable income stream for mature product lines.

Optimized Production and Supply Chain for Core Products

iRobot's long-standing production of its core Roomba vacuum models has undoubtedly led to substantial efficiencies in manufacturing and supply chain operations. This optimization translates directly into reduced production costs and healthier gross margins for these established product lines.

These cost efficiencies are a key driver of the consistent cash flow generated by iRobot's mature Roomba offerings. For instance, in 2023, iRobot reported a gross margin of 35.3% on its robotic vacuum cleaners, a testament to years of refining its production processes.

- Optimized Manufacturing: iRobot has honed its assembly processes for Roomba vacuums over many years, leading to lower per-unit manufacturing expenses.

- Supply Chain Efficiencies: Established relationships with suppliers and streamlined logistics for core components contribute to reduced input costs.

- Gross Margin Improvement: The cumulative effect of these optimizations directly boosts the profitability of each Roomba unit sold.

iRobot's established Roomba vacuum models, particularly those in the i and j series, function as its cash cows. These products benefit from iRobot's strong brand recognition and a substantial installed base, ensuring consistent sales. In 2024, these core models continued to experience robust demand, requiring less investment in research and development compared to newer technologies, which directly bolsters their profitability.

The deep market penetration of Roomba, with over 50 million robots sold globally, provides a stable revenue stream from the mature robot vacuum market. This strong brand equity, coupled with a loyal customer base that frequently purchases replacement parts, contributes significantly to iRobot's predictable and high-margin cash flow.

| Product Category | BCG Matrix Status | Key Characteristics | 2023 Financial Insight |

|---|---|---|---|

| Established Roomba Vacuums (i, j series) | Cash Cow | High brand loyalty, mature market, optimized manufacturing, predictable demand for consumables. | Gross margin of 35.3% on robotic vacuum cleaners, indicating strong profitability from established lines. |

Full Transparency, Always

iRobot BCG Matrix

The iRobot BCG Matrix preview you are currently viewing is the exact, unwatermarked, and fully formatted document you will receive upon purchase. This comprehensive analysis, crafted by industry experts, provides a clear strategic overview of iRobot's product portfolio, enabling informed decision-making. You can confidently expect the same level of detail and professional presentation in the downloadable file, ready for immediate integration into your business planning and competitive analysis.

Dogs

Older, non-connected Roomba models, often referred to as basic units, are finding it harder to keep up in today's market. These vacuums, which lack smart mapping and Wi-Fi, are being overshadowed by newer, more advanced models.

The market is shifting, and these older Roombas are losing ground. Competitors are offering more features, often at lower prices, making it tough for these basic models to stand out. This makes them less attractive to consumers looking for the latest technology in home cleaning.

For iRobot, these older models represent a challenge. They might require significant marketing spend to move, with less and less return on investment. There's also a risk of these units becoming obsolete, potentially leading to inventory write-offs, which can impact financial performance.

Following the failed Amazon acquisition, iRobot has strategically halted development and investment in its non-floorcare product lines, such as robotic lawnmowers and air purifiers. This decision signals a clear pivot, acknowledging these ventures as past investments no longer contributing to revenue or market share.

These discontinued lines are now effectively divested assets, tying up valuable capital without any future revenue-generating prospects. They represent cash traps, diverting resources that could be better allocated to core floorcare innovations and profitable growth areas.

Older Braava Jet models, those lacking the advanced combo features like integrated vacuuming, are finding themselves in a challenging market position. While Braava mops remain a significant part of iRobot's floorcare lineup, these specific, less sophisticated models are experiencing a noticeable dip in consumer interest.

The reason for this decline is clear: the market is overwhelmingly shifting towards hybrid 2-in-1 solutions that combine mopping and vacuuming capabilities. This trend makes standalone, less advanced mops like these legacy Braava Jet units less appealing and competitive against newer, more versatile offerings. For instance, in 2024, the market share for dedicated mopping robots saw a slight decrease as combo units gained traction.

Consequently, these older Braava Jet models likely contribute very little to iRobot's overall growth and profitability. Their position in the portfolio is akin to a declining product line, where innovation has moved past them, and consumer demand is waning in favor of more integrated and advanced technologies.

Products Subject to Heavy Promotional Spending for Clearance

In late 2024, iRobot experienced a situation where certain products required significantly more promotional spending than expected to clear out inventory. This suggests these items weren't performing well at their original prices, leading to reduced profit margins and acting as financial burdens. These are often older or less popular models that necessitate substantial price reductions to be sold.

This heavy promotional activity for clearance is characteristic of products that fall into the Dogs category of the BCG Matrix. These are offerings with low market share and low market growth, often requiring cash infusions to maintain rather than generating them. For instance, iRobot’s Q4 2024 earnings report highlighted increased marketing expenses aimed at clearing out older Roomba models, impacting overall profitability.

- Dogs represent products with low market share and low market growth.

- In late 2024, iRobot utilized significant promotional spending to clear excess inventory for certain products.

- This indicates these products were underperforming and selling below their intended price points, becoming cash traps.

- These are typically older or less desirable models that require heavy discounts to move.

Underperforming Products in Competitive International Markets

iRobot's underperforming products in competitive international markets are a significant concern. In Q4 2024, the company saw considerable revenue drops in key areas like the U.S. (-47%), Japan (-34%), and EMEA (-44%).

These broad regional declines are exacerbated by specific product lines that are struggling to gain traction against both established local competitors and aggressive pricing from Chinese manufacturers. These particular products are characterized by shrinking market share and negative growth trends.

- Struggling market share in key international regions.

- Negative growth trends for specific product models.

- Intensified competition from local and Chinese manufacturers.

- Significant revenue decreases reported in Q4 2024 across major markets.

Dogs in iRobot's portfolio are products with low market share and low growth potential. These items often require significant investment to maintain or clear out, draining resources without generating substantial returns. For example, older Roomba models lacking smart features are prime candidates for this category, as evidenced by iRobot's Q4 2024 need for heavy promotions to sell off excess inventory.

These underperforming products, such as older Braava Jet models or non-floorcare ventures like robotic lawnmowers, are often found in competitive international markets where they struggle against local and Chinese competitors. The significant revenue drops reported in Q4 2024 across regions like the U.S., Japan, and EMEA highlight the challenges these "dog" products face, contributing to the company's overall financial strain.

The strategic decision to halt development on non-floorcare lines and the ongoing challenges with older, less advanced floorcare units underscore iRobot's efforts to divest or manage these low-performing assets. These products represent cash traps, tying up capital that could be better utilized in innovative core floorcare solutions, ultimately impacting the company's ability to maximize returns in more promising market segments.

| Product Category | BCG Matrix Classification | Market Share | Market Growth | Key Challenges |

| Older Roomba Models (non-connected) | Dog | Low | Low | Lack of smart features, intense competition, need for heavy promotions (Q4 2024) |

| Older Braava Jet Models (standalone mops) | Dog | Low | Low | Shift to hybrid 2-in-1 units, waning consumer interest |

| Non-Floorcare Ventures (e.g., lawnmowers) | Dog | Low | Low | Halted development, divested assets, capital drain |

| Underperforming products in international markets | Dog | Shrinking | Negative | Intense competition (local & Chinese), significant revenue drops (Q4 2024: US -47%, JP -34%, EMEA -44%) |

Question Marks

iRobot's new 2-in-1 vacuum-mop combo models, launched in March 2025, are positioned as Question Marks in the BCG Matrix. These products target a rapidly expanding market segment, with the global robotic vacuum cleaner market projected to reach $14.9 billion by 2027, growing at a CAGR of 16.4%.

However, this high-growth area is also characterized by fierce competition from established brands and new entrants, making market share acquisition a significant challenge. iRobot's ability to convert these new offerings into Stars hinges on aggressive marketing, product innovation, and securing substantial market penetration against well-entrenched competitors.

The new Roomba 105 series, launched in March 2025, is iRobot's strategic play to gain traction in the budget-conscious segment of the robotic vacuum market. These models, available in Combo (vacuum and mop) and Vac-only versions, boast enhanced suction power compared to previous entry-level offerings, aiming to appeal to a broader consumer base.

However, the 105 series enters a highly competitive landscape, with numerous brands offering similarly priced or even cheaper alternatives that have already established a foothold. The key challenge for iRobot lies in differentiating the 105 series and convincing consumers of its value proposition in a market where price is often the primary driver.

The success of the Roomba 105 series as a Question Mark hinges on its ability to carve out a significant market presence and drive widespread adoption. If these budget-friendly models fail to gain substantial market share against established low-cost competitors, it could pose a strategic concern for iRobot's overall market positioning and growth trajectory.

While iRobot is widely recognized for its Roomba vacuum cleaners, the company's past innovation extends beyond floorcare, hinting at future possibilities. The 'iRobot Elevate' strategy underscores a commitment to transforming their research and development efforts, suggesting a move into more advanced domestic robotics.

Venturing into new robot categories, such as those capable of more complex household tasks or integrated next-generation smart home functionalities, represents a significant opportunity for high growth. These areas currently have minimal to no market share, offering iRobot a chance to establish a dominant position.

However, these ambitious projects would necessitate substantial investment in R&D, with the market's acceptance and adoption remaining a key uncertainty. For instance, the development of a truly multi-functional domestic robot would require breakthroughs in AI, manipulation, and navigation, demanding significant capital expenditure and a long development cycle.

Premium Features at More Accessible Price Points (e.g., AutoWash Dock under $1,000)

iRobot is strategically aiming to make high-end features, like the AutoWash Dock, available to a broader consumer base by targeting price points below $1,000. This move is designed to expand the market for robotic cleaning technology. The company's success hinges on whether consumers embrace these more affordable premium options.

The market's response to iRobot's strategy of combining advanced functionalities with competitive pricing will be crucial. If these products resonate with a wider audience, they could capture a more substantial market share. The accessibility of premium features remains a key question for iRobot's product portfolio.

- Democratizing Premium Features: iRobot's initiative to offer the AutoWash Dock for under $1,000 signifies a push to make advanced cleaning solutions more attainable.

- Market Reception is Key: The ultimate success of this strategy depends on consumer adoption of these feature-rich, yet competitively priced, robotic vacuums.

- Expanding Accessibility: iRobot's ability to successfully broaden the appeal of its premium segment through pricing will determine its position in the growing smart home market.

Expansion and Re-establishment of Market Share in Challenged International Markets

In 2024, iRobot experienced a notable dip in its global market share, a trend particularly pronounced in challenging international arenas such as the EMEA region and Japan. This decline is largely attributable to intensified competition, especially from aggressive Chinese manufacturers who have been rapidly gaining ground. For instance, reports indicated a significant increase in market penetration by these competitors in key European countries, impacting iRobot's sales volume.

The company's strategy for re-establishing its market presence involves a multi-pronged approach focused on innovation and targeted market penetration. The success of its recent product launches, such as the Roomba j9+ robot vacuum, is a critical component of this plan. These new offerings are designed to address consumer demands for enhanced cleaning performance and smart home integration, aiming to differentiate iRobot from its rivals.

- Market Share Decline: iRobot's global market share saw a reduction in 2024, with significant contractions noted in EMEA and Japan due to heightened competition.

- Competitive Landscape: Chinese manufacturers have emerged as formidable competitors, particularly impacting iRobot's market position in key international territories.

- Strategic Response: The company is focusing on its new product launches, including the Roomba j9+, as a cornerstone of its strategy to regain lost market share and appeal to evolving consumer preferences.

iRobot's new budget-friendly Roomba 105 series, launched in March 2025, represents a classic Question Mark in the BCG Matrix. These models aim for high growth by targeting a price-sensitive market, but face intense competition from established low-cost brands.

The company's success with the 105 series depends on its ability to carve out significant market share against these rivals. Failure to gain traction could impact iRobot's overall market standing.

The challenge lies in differentiating these models and proving their value proposition to consumers who prioritize price in this segment.

iRobot's future growth may also lie in entirely new robotic categories, currently nascent markets with minimal competition. These ventures, however, demand substantial R&D investment and face market acceptance uncertainties.

| Product/Strategy | BCG Category | Market Growth | Market Share | Key Challenge/Opportunity |

|---|---|---|---|---|

| Roomba 105 Series (March 2025) | Question Mark | High | Low (Targeted) | Gaining share against low-cost competitors. |

| 2-in-1 Vacuum-Mop Combos (March 2025) | Question Mark | High (Projected $14.9B by 2027) | Low (Targeted) | Securing penetration in a competitive, high-growth segment. |

| Democratizing Premium Features (e.g., AutoWash Dock < $1000) | Question Mark | High | Low (Targeted) | Consumer adoption of competitively priced premium features. |

| New Robot Categories (e.g., multi-functional domestic robots) | Question Mark | High | Very Low/None | Significant R&D investment, market acceptance uncertainty. |

BCG Matrix Data Sources

Our iRobot BCG Matrix leverages comprehensive data, including iRobot's financial reports, market share data, and industry growth projections, to accurately position each product line.