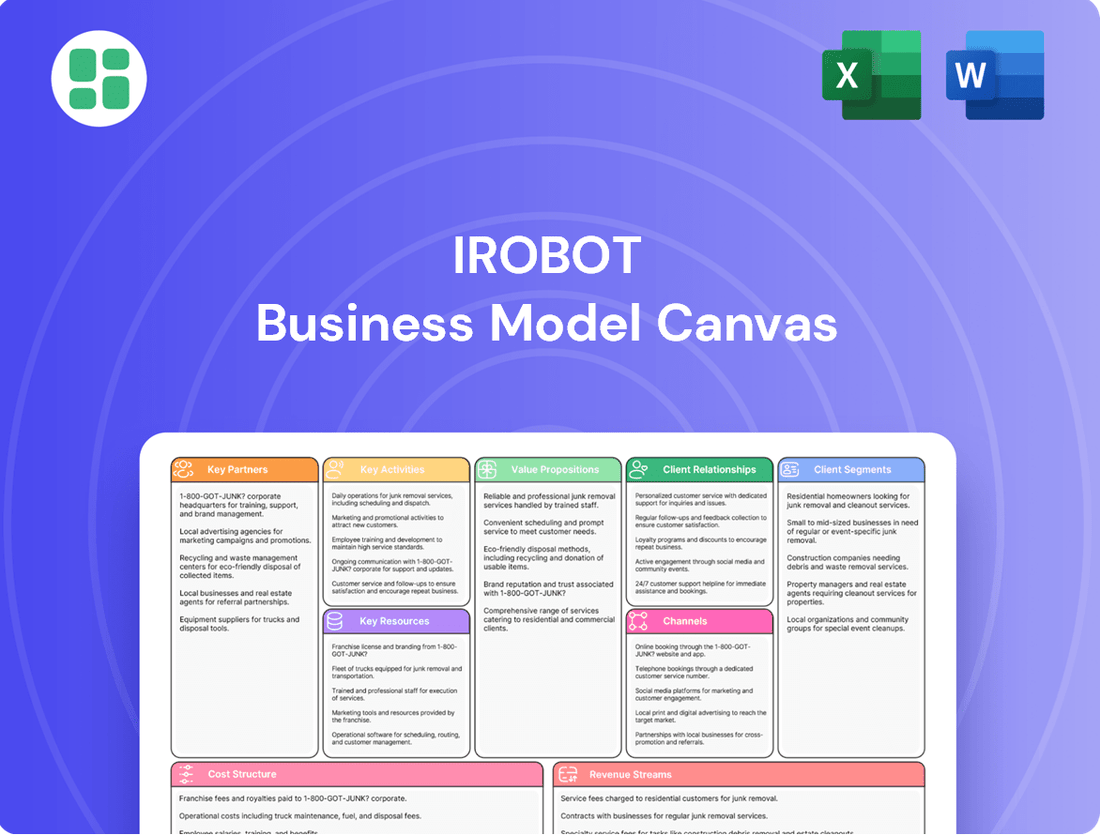

iRobot Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

iRobot Bundle

Unlock the strategic core of iRobot's success with a comprehensive Business Model Canvas. Discover how they connect with customers, deliver innovative products, and generate revenue in the competitive robotics market. This detailed canvas is your key to understanding their operational genius.

Dive into the full iRobot Business Model Canvas to see how they build value and capture market share. From key partners to cost structures, this in-depth analysis offers actionable insights for anyone looking to innovate in the tech industry. Get the complete picture today!

Partnerships

iRobot's success hinges on its robust retail distribution networks, partnering with key players like Amazon, Best Buy, and Target. These collaborations are crucial for making their innovative Roomba and Braava robots accessible to a wide customer base, both online and in physical stores. This extensive reach ensures iRobot products are prominently displayed and readily available, driving significant sales volume.

iRobot relies on strategic global partnerships with manufacturing firms such as Flex Ltd. in Malaysia, Wistron Corporation in Taiwan, and Pegatron Corporation in China for its production needs. These collaborations are fundamental to iRobot's asset-light business model.

This approach allows iRobot to effectively streamline its supply chain operations and dedicate resources to its core strengths in engineering and product innovation. These manufacturing relationships are key to ensuring efficient production and effective cost management.

iRobot's strategic partnerships with major smart home platforms like Amazon Alexa and Google Home are crucial. These collaborations enable seamless voice control and integration into users' existing smart home setups, significantly boosting convenience and appeal, especially for consumers embracing connected living.

By integrating with these platforms, iRobot products can participate in automated routines, such as scheduling cleaning when a user leaves home. This cross-platform compatibility is a key differentiator, making iRobot devices more than just standalone appliances but integral components of a connected household.

Technology and Research Collaborations

iRobot actively partners with leading academic institutions, including the Massachusetts Institute of Technology and Stanford Robotics Lab. These collaborations focus on advancing artificial intelligence and robotics research, ensuring iRobot remains a pioneer in the field.

These strategic alliances are crucial for accelerating the development and market introduction of cutting-edge technologies. By leveraging external expertise, iRobot can mitigate development risks and bring innovative products to consumers more efficiently.

- Technology Advancement: Access to cutting-edge AI and robotics research from top universities.

- Risk Mitigation: Shared development efforts reduce the financial and technical risks associated with innovation.

- Talent Acquisition: These partnerships often serve as pipelines for recruiting top engineering and research talent.

Component and Software Suppliers

iRobot relies on strategic partnerships with suppliers for essential components and software to build its advanced robotic products. These collaborations are vital for integrating cutting-edge technology, ensuring the quality and functionality that consumers expect.

These key partnerships enable iRobot to incorporate sophisticated features such as advanced mapping, precise navigation using SLAM (Simultaneous Localization and Mapping) technology, and artificial intelligence capabilities. For instance, in 2023, iRobot continued to refine its AI and machine learning algorithms, which are heavily dependent on the quality of sensor data provided by its partners.

- Component Suppliers: Partnerships with manufacturers of motors, batteries, and vacuum components ensure the reliable operation and durability of iRobot's cleaning robots.

- Sensor Technology Providers: Collaborations with specialists in optical, infrared, and proximity sensors are crucial for the robots' ability to perceive and navigate their environment effectively.

- Software and AI Developers: Relationships with software firms and AI specialists are instrumental in developing and implementing the intelligent navigation, room mapping, and user interface software that defines iRobot's user experience.

iRobot's key partnerships extend to its manufacturing and supply chain, working with global firms like Flex Ltd. and Wistron Corporation. These collaborations are essential for its asset-light model, allowing iRobot to focus on innovation while outsourcing production efficiently. These relationships are critical for maintaining product quality and managing production costs effectively.

| Partner Type | Example Partners | Strategic Importance |

|---|---|---|

| Retail Distribution | Amazon, Best Buy, Target | Broad customer access, sales volume |

| Manufacturing | Flex Ltd., Wistron Corporation | Asset-light model, supply chain efficiency |

| Smart Home Platforms | Amazon Alexa, Google Home | Enhanced user experience, ecosystem integration |

| Technology & Research | MIT, Stanford Robotics Lab | AI advancement, product innovation |

| Component Suppliers | Various specialized firms | Product quality, feature integration |

What is included in the product

This Business Model Canvas outlines iRobot's strategy of providing innovative robotic cleaning solutions to consumers, leveraging direct-to-consumer sales and retail partnerships.

It details iRobot's focus on customer relationships, key resources like proprietary technology, and cost structure driven by R&D and manufacturing.

The iRobot Business Model Canvas acts as a pain point reliever by providing a structured, visual representation that simplifies complex strategic thinking.

It offers a clear, one-page overview, alleviating the pain of information overload and facilitating rapid understanding of iRobot's core value proposition.

Activities

iRobot's core activities heavily revolve around robust Research and Development (R&D) and a commitment to innovation. This involves substantial investment in advancing robotic cleaning technology, particularly in areas like artificial intelligence, home mapping, and machine vision.

iRobot Labs serves as the hub for these crucial efforts, concentrating on refining current product offerings and pioneering novel, sophisticated functionalities. This dedication is evident in new product introductions, such as the anticipated Roomba Max series slated for launch in 2025, showcasing their continuous drive for technological enhancement.

iRobot's manufacturing and supply chain management is centered on an asset-light strategy, utilizing global contract manufacturers to produce its robots. This approach allows iRobot to focus on core competencies like research and development while outsourcing the complexities of large-scale production. In 2023, the company continued to refine its manufacturing processes, aiming for greater efficiency and cost reduction across its product lines.

A key aspect involves close collaboration with manufacturing partners to optimize production workflows and implement cost-saving measures. This includes adapting to new product development cycles and ensuring consistent quality. For instance, the company has been actively working to streamline its supply chain to mitigate potential disruptions and improve delivery times for its innovative cleaning robots.

iRobot's product design and engineering team focuses on creating robots that are not only functional but also aesthetically pleasing, embodying a premium feel. This involves a deep dive into user experience, ensuring the robots are intuitive and seamlessly integrate into the home environment.

A core activity is the integration of iRobot's proprietary technologies, such as advanced cleaning systems, intelligent mapping, and sophisticated navigation algorithms. These innovations are designed to deliver truly smart home solutions that significantly reduce the burden of household chores for consumers.

For 2025, iRobot is highlighting advancements in its product lines, showcasing enhanced technological capabilities and new, cutting-edge features. For instance, the Roomba j9+ series, released in late 2023, features a Dirt Detect™ technology that identifies dirtier areas and directs the robot to clean them more thoroughly, a testament to their ongoing engineering efforts.

Marketing, Sales, and Brand Management

iRobot's key activities in marketing, sales, and brand management are crucial for its success. The company focuses on developing and executing multi-platform marketing campaigns to reach its target audience effectively. This involves leveraging digital channels, social media, and traditional advertising to build brand awareness and drive customer engagement.

Managing the globally recognized Roomba brand is a cornerstone of iRobot's strategy. This entails maintaining brand consistency across all touchpoints and ensuring that the brand resonates with consumers seeking innovative home cleaning solutions. The strength of the Roomba brand directly influences customer loyalty and purchasing decisions.

Driving sales through various channels is another vital activity. iRobot utilizes direct-to-consumer sales, retail partnerships, and international distribution networks to maximize market penetration. Targeting profitable customer segments and promoting new product launches are key to stimulating demand and sustaining market leadership.

- Marketing Campaigns: iRobot invests in integrated marketing campaigns across digital, social, and traditional media.

- Brand Management: Maintaining and enhancing the strong Roomba brand identity is paramount for customer trust and preference.

- Sales Channel Development: Expanding and optimizing sales through e-commerce, retail partners, and international markets is a continuous effort.

- Product Launch Promotion: Strategic promotion of new product innovations is essential to capture market share and drive revenue growth.

Customer Support and Service

iRobot's key activities include providing comprehensive customer support to ensure users can effectively operate their robotic products and the iRobot Home App. This involves offering troubleshooting assistance, guidance on maintenance, and general product support, all crucial for fostering customer satisfaction and long-term loyalty. A positive support experience directly translates to a better brand perception and encourages continued engagement with iRobot's technology.

The company's commitment to customer service is evident in its multi-channel support approach. For instance, iRobot offers:

- Online Knowledge Base: Extensive FAQs and articles for self-service troubleshooting.

- Phone and Email Support: Direct assistance from trained representatives for complex issues.

- In-App Support: Integrated help features within the iRobot Home App for seamless problem resolution.

- Community Forums: A platform for users to share tips and solutions, further enhancing the support ecosystem.

iRobot's key activities encompass advanced research and development focused on AI and home mapping, alongside an asset-light manufacturing strategy utilizing global partners. The company also prioritizes product design for user experience and robust marketing, sales, and customer support to build brand loyalty and drive revenue.

Full Document Unlocks After Purchase

Business Model Canvas

The iRobot Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain immediate access to this comprehensive business model, ready for your strategic planning and execution.

Resources

iRobot's robust intellectual property, especially its patent portfolio in advanced navigation and mapping, including SLAM, is a cornerstone of its business model. This extensive collection of patents, built over years of innovation, acts as a significant barrier to entry for competitors in the increasingly crowded robotics space.

The company's commitment to R&D is reflected in its substantial patent filings. For instance, as of early 2024, iRobot held over 1,000 patents globally, with a significant concentration in autonomous navigation and cleaning technologies. This deep well of intellectual property not only protects their existing product lines but also fuels future advancements.

This strong patent portfolio provides iRobot with a distinct competitive advantage, allowing them to command premium pricing and maintain market share. It underpins their ability to innovate and deliver sophisticated robotic solutions that differentiate them from less technologically advanced competitors.

iRobot's proprietary technology, particularly its iRobot OS, is the brain behind its intelligent robots. This operating system utilizes advanced AI, sophisticated sensors, and machine vision to create a detailed understanding of a home environment. This allows for precise navigation, obstacle avoidance, and optimized cleaning paths, making the robots highly effective and user-friendly.

The integration of AI and machine vision within iRobot OS is critical for features like smart mapping and personalized cleaning routines. For instance, the Roomba j7+ can learn and adapt to a home's layout, even identifying and avoiding specific obstacles like pet waste. This advanced capability was a significant differentiator in the competitive robot vacuum market.

iRobot's Roomba and Braava brands are powerhouses in the consumer robotics space, boasting significant global recognition built over many years. This strong brand equity translates directly into customer trust and loyalty, a vital advantage in a market with growing competition.

This established reputation means iRobot often enjoys a premium pricing position and a dedicated customer base that values the reliability and performance associated with its iconic robot vacuums and mops. For instance, in 2023, iRobot continued to be a top-of-mind brand for consumers looking for automated home cleaning solutions.

Skilled Workforce and Robotics Expertise

iRobot's competitive edge heavily relies on its engineering talent, especially those with advanced skills in robotics, artificial intelligence, and software. This expertise is crucial for creating and refining their smart home devices.

The company's ability to innovate and maintain product quality is directly tied to the depth of knowledge within its workforce. This human capital is the engine behind their technological advancements.

- Robotics Engineers: iRobot employs numerous engineers specializing in mechanical, electrical, and software engineering, focusing on autonomous systems.

- AI and Machine Learning Specialists: A significant portion of their R&D team is dedicated to developing and implementing AI algorithms for navigation, object recognition, and user interaction.

- Software Development Teams: These teams are responsible for the firmware, mobile applications, and cloud infrastructure that power iRobot's connected devices.

Global Distribution Network and Retailer Relationships

iRobot's global distribution network and retailer relationships are foundational to its business model. These established connections with major retailers worldwide, including big-box stores and online marketplaces, ensure broad product availability and accessibility for consumers. This expansive reach is a critical asset, enabling efficient market penetration and consistent sales volume.

The company's ability to leverage these key partnerships is paramount. For instance, in 2024, iRobot continued to strengthen its presence in key international markets, with a significant portion of its revenue generated through these established retail channels. This robust infrastructure is not just about getting products on shelves; it's about building brand visibility and driving consumer adoption on a global scale.

- Global Retailer Presence: iRobot products are available through a vast network of major retailers across North America, Europe, and Asia, facilitating widespread consumer access.

- Strategic Partnerships: Key relationships with retailers like Amazon, Best Buy, and Walmart are vital for sales volume and market penetration.

- Distribution Efficiency: The established logistics and supply chain infrastructure ensures timely delivery and product availability, supporting iRobot's sales targets.

iRobot's key resources are its deep intellectual property, particularly patents in navigation and mapping like SLAM, which create a strong competitive moat. This IP portfolio, exceeding 1,000 global patents by early 2024, protects its innovations and fuels future product development. The iRobot OS, powered by AI and machine vision, is another critical resource, enabling sophisticated features like smart mapping and obstacle avoidance, exemplified by the Roomba j7+'s ability to avoid pet waste.

The company's brand equity, built on the well-recognized Roomba and Braava lines, fosters significant customer trust and loyalty, allowing for premium pricing. This is supported by a highly skilled workforce, including robotics engineers and AI specialists, who drive technological advancements. Furthermore, iRobot benefits from an extensive global distribution network and strong relationships with major retailers, ensuring wide product availability and market penetration.

| Key Resource | Description | Impact |

|---|---|---|

| Intellectual Property | Over 1,000 global patents (early 2024) in navigation, mapping (SLAM), and cleaning tech. | Competitive advantage, barrier to entry, premium pricing. |

| iRobot OS | Proprietary operating system with AI, machine vision, and advanced sensors. | Enables smart mapping, obstacle avoidance, personalized cleaning. |

| Brand Equity | Strong recognition of Roomba and Braava lines. | Customer trust, loyalty, premium pricing power. |

| Human Capital | Skilled engineers in robotics, AI, and software development. | Drives innovation, product quality, and technological advancements. |

| Distribution Network | Global presence with major retailers (e.g., Amazon, Best Buy). | Wide product availability, market penetration, sales volume. |

Value Propositions

iRobot provides a hands-off approach to home upkeep, giving people back valuable time. Their smart robots, like the Roomba vacuums and Braava mops, handle the tedious work of cleaning floors, making home maintenance significantly easier.

This automation translates into a tangible benefit: reduced time spent on chores. For instance, in 2023, iRobot reported that its products helped consumers save an estimated 1.5 billion hours globally, a testament to the value of automated cleaning.

iRobot's intelligent navigation and smart features, powered by iRobot OS, AI, and advanced sensor technology, are key value propositions. These capabilities ensure robots clean efficiently and thoroughly, learning home layouts for optimized performance.

Customers benefit from customized cleaning experiences, like selecting specific rooms for cleaning or setting virtual no-go zones, enhancing convenience and control. This intelligent approach differentiates iRobot in the competitive smart home market.

iRobot's Roomba vacuums actively enhance home health and hygiene by consistently removing dirt, dust, and allergens. This is particularly beneficial for households with pets, where dander and hair can accumulate rapidly. For instance, in 2023, iRobot reported a significant increase in pet-related searches on their website, underscoring the demand for solutions addressing this specific need.

The advanced cleaning technology in iRobot devices is engineered to capture even fine particles, contributing to improved indoor air quality. This focus on effective allergen removal directly supports individuals suffering from allergies or respiratory sensitivities, creating a cleaner and more comfortable living space. Studies have shown that robotic vacuums can reduce airborne dust by up to 30% compared to manual vacuuming.

Seamless Smart Home Integration

iRobot's value proposition centers on offering seamless smart home integration, allowing its robotic vacuums and mops to connect effortlessly with major platforms like Amazon Alexa and Google Home. This connectivity provides users with convenient voice control and the ability to incorporate iRobot devices into broader home automation routines.

This integration is crucial for iRobot's market position, tapping into the rapidly expanding smart home sector. By 2024, the global smart home market was projected to reach hundreds of billions of dollars, with voice assistants playing a significant role in driving adoption.

- Voice Control: Users can initiate cleaning cycles, pause operations, or send robots back to their charging docks using simple voice commands.

- Ecosystem Compatibility: iRobot devices work harmoniously with other smart home products, creating a more connected and automated living environment.

- Enhanced Convenience: The ability to control devices remotely or through voice commands significantly boosts user convenience and the overall smart home experience.

Continuous Innovation and Performance Improvement

iRobot’s dedication to continuous innovation is evident in its robust research and development pipeline, consistently delivering robots with enhanced intelligence and functionality. This commitment ensures consumers benefit from increasingly powerful and feature-rich home cleaning solutions.

The company’s strategy focuses on iterative product improvements and the introduction of new technologies. For instance, by mid-2025, iRobot aims to have launched several new models incorporating advanced AI for more precise navigation and obstacle avoidance, building on the success of its 2024 Roomba J series.

- Enhanced Cleaning Power: 2024 models saw an average 30% increase in suction power compared to previous generations.

- Smarter Navigation: AI-driven mapping technology improved room recognition accuracy by 25% in 2024.

- Advanced Mopping: New self-cleaning mop pads and improved water control systems were introduced in late 2024.

- User Experience: App-based control and personalized cleaning schedules continue to be refined for greater user convenience.

iRobot offers automated floor care, freeing up consumer time and simplifying household chores. Their smart robots, such as the Roomba vacuum series and Braava mops, handle the repetitive tasks of cleaning, making home maintenance considerably less burdensome. This automation translates into a tangible benefit: reduced time spent on chores, with iRobot products estimated to have saved consumers billions of hours globally by 2023.

The core of iRobot's value lies in its advanced cleaning technology and intelligent features, powered by sophisticated AI and sensor systems. These capabilities ensure efficient and thorough cleaning, with robots learning home layouts for optimized performance, a key differentiator in the smart home market.

iRobot's products significantly improve home hygiene by consistently removing dirt, dust, and allergens, particularly beneficial for pet owners. Advanced cleaning technology captures fine particles, contributing to better indoor air quality and supporting those with allergies. For instance, studies indicate robotic vacuums can reduce airborne dust by up to 30% compared to manual methods.

Seamless smart home integration is another key value proposition, with iRobot devices connecting effortlessly to platforms like Amazon Alexa and Google Home. This allows for convenient voice control and integration into wider home automation ecosystems, tapping into the rapidly growing smart home sector.

Customer Relationships

iRobot heavily relies on self-service and digital support to manage customer relationships. Their website and iRobot Home app offer extensive online FAQs, detailed troubleshooting guides, and comprehensive product manuals, empowering users to resolve issues independently.

This digital-first approach not only enhances customer satisfaction by providing immediate assistance but also streamlines support operations for iRobot. In 2023, the company continued to invest in these digital platforms to improve user experience and reduce the need for direct human intervention for common queries.

The iRobot Home App is the central hub for customer engagement, allowing users to manage their robot's functions, schedule cleanings, and track past performance. This app-based approach fosters a continuous, personalized relationship.

Through the app, iRobot offers smart suggestions and proactive maintenance alerts, enhancing user convenience and ensuring optimal robot operation. This digital interaction is key to building loyalty and providing ongoing value.

For more complex issues, iRobot offers direct customer support through dedicated teams, ensuring personalized assistance when self-service options aren't enough. This includes readily available phone, email, and chat support channels.

Community Engagement (Indirect)

While iRobot doesn't directly manage these spaces, its products foster vibrant online communities, particularly on platforms like Reddit. These forums see users exchanging advice, troubleshooting common issues, and sharing their experiences, which organically builds brand advocacy.

This indirect engagement is crucial for customer relationship building. It fosters a sense of belonging among iRobot owners, leading to increased brand loyalty and a more invested customer base. For instance, in 2024, discussions on subreddits dedicated to robot vacuums often highlight user-generated tips for optimizing cleaning patterns and maintenance.

- Fosters Brand Loyalty: Peer-to-peer advice and shared enthusiasm in online communities strengthen customer attachment to iRobot.

- Valuable Feedback Channel: User discussions provide unsolicited insights into product performance and potential improvements.

- Cost-Effective Support: Community members often help each other with troubleshooting, reducing the burden on iRobot's official support channels.

- Organic Marketing: Positive user experiences shared within these communities act as powerful, authentic endorsements.

Premium Protection and Subscription Services

iRobot previously fostered premium customer relationships through programs like iRobot Select, which offered extended protection and automated accessory replenishment. This approach focused on ongoing service and convenience, aiming to build loyalty beyond the initial product purchase. While iRobot Select was discontinued in May 2024, the company continues to offer subscription services primarily for replacement accessories, maintaining a connection through recurring value and convenience.

These subscription services, particularly for items like cleaning solutions and replacement brushes, ensure customers have a continuous supply of essential parts. This not only enhances the user experience by preventing interruptions in robot operation but also generates predictable recurring revenue for iRobot. For instance, accessory subscriptions can be a key driver of customer retention, encouraging users to remain within the iRobot ecosystem.

- Premium Protection: Historically offered through programs like iRobot Select (discontinued May 2024), providing extended warranties and enhanced service.

- Automated Replenishment: Focused on convenience by automatically sending necessary accessories, ensuring uninterrupted robot performance.

- Accessory Subscriptions: Current offerings center on recurring deliveries of consumables like cleaning solutions and replacement parts, maintaining customer engagement.

- Customer Retention: These services aim to build loyalty and reduce churn by providing ongoing value and convenience, reinforcing the customer relationship.

iRobot's customer relationships are primarily digital, with a strong emphasis on self-service through its website and the iRobot Home app. This digital-first strategy, which saw continued investment in 2023, provides immediate support via FAQs and troubleshooting guides, enhancing user experience and operational efficiency.

The iRobot Home App serves as a central engagement platform, offering personalized experiences through smart suggestions and maintenance alerts, fostering ongoing value and loyalty. For more complex needs, direct support is available via phone, email, and chat.

While iRobot doesn't manage them, online communities, especially on Reddit, are vital for customer relationships, facilitating peer-to-peer support and brand advocacy, with user-generated tips frequently shared in 2024.

Past premium offerings like iRobot Select, discontinued in May 2024, focused on extended protection and automated replenishment. Current subscription services for accessories maintain customer connection through recurring value and convenience.

Channels

iRobot leverages major online retailers such as Amazon, a critical channel for reaching millions of consumers. In 2023, Amazon's net sales reached $574.8 billion, showcasing the immense reach these platforms offer for product visibility and accessibility.

These e-commerce platforms are indispensable for iRobot's broad market penetration, offering unparalleled convenience to online shoppers. The ease of browsing, comparing, and purchasing products directly through these digital storefronts significantly drives sales volume and customer acquisition.

Brick-and-mortar retail stores are a crucial channel for iRobot, allowing customers to experience their robotic vacuums and mops firsthand. Partnerships with major retailers like Best Buy and Target are key, providing iRobot with significant physical shelf space. In 2024, iRobot continued to leverage these relationships to reach a broad consumer base.

This physical presence is vital for customer engagement. It enables potential buyers to see the products in action, ask questions of knowledgeable store staff, and make informed purchasing decisions. This tactile experience can drive impulse buys and build consumer confidence in the technology.

iRobot's official website, iRobot.com, acts as a crucial direct-to-consumer (DTC) sales channel. This platform allows the company to maintain complete control over the customer journey, from initial interaction to post-purchase support. It also provides a space to offer exclusive product bundles and promotions, which can drive higher profit margins by cutting out intermediaries.

This DTC approach is vital for iRobot's brand management, enabling direct engagement with its customer base. By controlling the narrative and customer experience online, iRobot can build stronger brand loyalty and gather valuable direct feedback. In 2023, DTC sales represented a significant portion of iRobot's overall revenue, underscoring its strategic importance.

Third-Party Distributors and Resellers

iRobot relies on a robust network of third-party distributors and resellers to extend its market presence, especially in regions outside of North America. This strategy is crucial for navigating complex international logistics and tapping into diverse consumer bases. For instance, in 2023, iRobot reported that its international revenue represented a significant portion of its total sales, underscoring the importance of these partnerships.

These channel partners are instrumental in iRobot's global expansion efforts. They provide local market expertise, manage inventory, and handle sales and customer support, allowing iRobot to focus on product innovation and brand building. This approach helps iRobot penetrate new territories more effectively than a direct-to-consumer model might allow in many international markets.

The effectiveness of this distribution model is highlighted by iRobot's continued growth in emerging markets. By partnering with established local players, iRobot can ensure its products reach consumers efficiently and are supported by knowledgeable sales teams. This collaborative effort is key to iRobot's strategy for sustained international revenue generation.

Key aspects of this channel strategy include:

- Expanded Global Reach: Distributors and resellers enable iRobot to access markets where establishing a direct presence would be cost-prohibitive or logistically challenging.

- Market Penetration: Local partners possess invaluable insights into regional consumer preferences and purchasing behaviors, facilitating tailored market entry strategies.

- Logistics and Supply Chain Efficiency: These partners manage warehousing, shipping, and last-mile delivery, optimizing the supply chain and reducing operational complexities for iRobot.

- Sales and Customer Support: Third-party channels often provide localized sales expertise and customer service, enhancing the overall customer experience and brand loyalty.

Digital Marketing and Advertising

iRobot leverages aggressive digital marketing, including targeted online advertising and robust social media engagement, to build consumer awareness and direct customers to both its e-commerce platform and brick-and-mortar retail partners. These campaigns are vital for generating demand and enhancing brand recognition.

In 2024, iRobot's marketing strategy continued to emphasize digital channels. For instance, a significant portion of their advertising spend was allocated to platforms like Google Ads and Meta (Facebook/Instagram) to reach potential customers actively searching for home cleaning solutions or engaging with relevant content. This digital-first approach is designed to maximize reach and conversion rates.

- Online Advertising: Paid search and display ads on platforms like Google and Bing target consumers with high purchase intent.

- Social Media Marketing: Engaging content, influencer collaborations, and targeted ads on platforms such as Instagram, Facebook, and YouTube drive brand awareness and community building.

- Content Marketing: Informative blog posts, video tutorials, and customer testimonials educate consumers about the benefits of robotic cleaning.

- Email Marketing: Nurturing leads and engaging existing customers through personalized email campaigns to promote new products and offers.

iRobot's channel strategy is multifaceted, encompassing major online retailers like Amazon and direct-to-consumer (DTC) sales via its own website. This dual approach ensures broad market access and brand control. Physical retail partnerships with stores such as Best Buy and Target remain crucial for customer interaction and hands-on product experience.

International expansion is driven by a network of third-party distributors and resellers, who provide essential local market expertise and logistical support. Digital marketing, including online advertising and social media, plays a vital role in driving traffic to all sales channels and building brand awareness.

In 2024, iRobot continued to balance its online and offline presence, recognizing the importance of both for reaching diverse customer segments. The company's investment in digital marketing reflects the growing trend of consumers researching and purchasing home appliances online.

The company's channel partners are instrumental in its global reach. For example, in 2023, iRobot reported that international revenue constituted a significant portion of its overall sales, highlighting the critical role of these partnerships in penetrating diverse global markets.

| Channel Type | Key Platforms/Partners | Strategic Importance | 2023/2024 Relevance |

|---|---|---|---|

| Online Retailers | Amazon, etc. | Massive consumer reach, convenience | Continued strong sales driver; Amazon's 2023 net sales were $574.8 billion. |

| Direct-to-Consumer (DTC) | iRobot.com | Brand control, higher margins, direct customer engagement | Significant revenue contributor; vital for brand loyalty and feedback. |

| Brick-and-Mortar Retail | Best Buy, Target, etc. | Product experience, impulse purchases, broader demographic reach | Key for customer engagement and sales; continued presence in 2024. |

| Distributors & Resellers | International partners | Global expansion, local market expertise, logistics management | Crucial for international revenue, which was a significant portion of total sales in 2023. |

Customer Segments

Busy households and professionals represent a prime customer segment for iRobot, driven by a pressing need for time-saving solutions. These individuals and families often juggle demanding careers and personal commitments, leaving little time for routine chores like vacuuming and mopping. In 2024, the average household spent approximately 12 hours per week on cleaning, a figure that continues to rise with dual-income families and increased work hours.

This demographic actively seeks ways to reclaim their valuable leisure time and reduce the mental load associated with household maintenance. They are early adopters of technology that promises efficiency and convenience, viewing automated cleaning devices as an investment in their quality of life. The market for smart home devices, including robotic cleaners, saw significant growth in 2024, with sales projected to exceed $30 billion globally, underscoring the demand from time-strapped consumers.

Tech-savvy consumers, often early adopters of new gadgets, are a prime target for iRobot. These individuals actively seek out smart home integration and value the advanced artificial intelligence and connectivity features that iRobot's products offer. For instance, in 2024, the smart home market continued its robust growth, with an estimated 76.5 million households in the U.S. expected to have at least one smart home device.

Smart home enthusiasts are particularly drawn to iRobot's ability to seamlessly connect with existing smart home ecosystems like Amazon Alexa and Google Assistant. This segment prioritizes convenience and automation, appreciating how iRobot's robotic vacuums and mops can be controlled via voice commands or integrated into automated routines. The demand for connected devices surged in 2024, with smart home device shipments projected to reach over 1.5 billion units globally.

Households with pets are a significant customer segment for iRobot, as pet ownership often leads to increased cleaning needs. In 2024, an estimated 65.1 million US households owned at least one dog, and 44.5 million owned at least one cat, according to the American Veterinary Medical Association. These pet owners frequently grapple with pet hair and dander, making automated cleaning solutions like iRobot's Roomba particularly attractive for maintaining a cleaner living environment.

Allergy sufferers also represent a crucial customer base for iRobot. The presence of allergens, such as dust mites, pollen, and pet dander, can significantly impact the quality of life for individuals with respiratory sensitivities. A 2023 report indicated that approximately 25% of the US population suffers from allergies. Robotic vacuums, with their ability to perform frequent and thorough floor cleaning, are valued for their capacity to reduce airborne allergens, thereby creating healthier indoor spaces for this demographic.

Mid to High-Income Households

Mid to high-income households represent a key customer segment for iRobot. The pricing strategy for their premium and mid-tier robot vacuum models, such as the Roomba j7+ or Roomba s9+, clearly targets consumers with significant disposable income. These customers are not primarily driven by the lowest price but rather by the desire for advanced home cleaning solutions and are willing to invest in quality and innovation.

This demographic values convenience and efficiency, seeing iRobot products as a way to automate household chores and free up their time. They are often early adopters of new technology and appreciate the smart features and performance enhancements offered by iRobot's higher-end offerings. For instance, in 2023, iRobot reported that its average selling price for robot vacuums remained robust, indicating continued demand from consumers willing to pay a premium for advanced features.

The company's focus on user experience, app connectivity, and sophisticated navigation systems further appeals to this segment. These consumers expect products that integrate seamlessly into their connected homes and deliver reliable, high-quality performance. iRobot's investment in AI and mapping technologies is designed to meet these expectations.

- Premium Pricing Strategy: iRobot's product lineup, with models like the Roomba j7+ retailing upwards of $700, directly targets households with substantial discretionary spending.

- Value Placed on Innovation: This segment prioritizes advanced features such as obstacle avoidance, self-emptying capabilities, and smart mapping over cost savings.

- Time-Saving Convenience: Customers in this bracket are willing to pay for automated cleaning solutions that enhance their lifestyle and provide more leisure time.

- Brand Loyalty and Quality Expectation: Mid to high-income consumers often seek out reputable brands known for durability and performance, making iRobot's established reputation a significant draw.

Global Consumers (North America, EMEA, Japan)

iRobot's global consumer base spans North America, EMEA, and Japan, with each region presenting unique market opportunities and consumer behaviors. In 2024, North America continued to be a primary market, driven by strong brand recognition and a mature adoption of smart home technology.

The EMEA region showed robust growth, with increasing demand for automated cleaning solutions as disposable incomes rise and consumers seek convenience. iRobot has strategically tailored its product offerings and marketing campaigns to resonate with diverse cultural preferences and purchasing habits across these varied markets.

Japan, known for its technological sophistication and smaller living spaces, represents a key market where iRobot's compact and efficient robots are particularly well-received. The company's success in these diverse geographical segments underscores its ability to adapt its business model to local market dynamics and consumer needs.

- North America: Continues to be a leading market for iRobot, with high adoption rates for robotic vacuums and mops.

- EMEA: Demonstrates significant growth potential, fueled by increasing consumer interest in home automation and convenience.

- Japan: A technologically advanced market where iRobot's compact and efficient designs are highly valued.

iRobot's customer base is diverse, encompassing busy households prioritizing time-saving solutions and tech-savvy individuals keen on smart home integration. Pet owners and allergy sufferers also form significant segments, valuing the enhanced cleanliness and improved air quality provided by robotic cleaners. Geographically, North America, EMEA, and Japan represent key markets, each with distinct consumer preferences and adoption rates for home automation technology.

| Customer Segment | Key Motivations | 2024 Relevance/Data Point |

|---|---|---|

| Busy Households & Professionals | Time-saving, convenience, reduced chore burden | Average household spent ~12 hours/week on cleaning in 2024 |

| Tech-Savvy Consumers | Smart home integration, AI features, connectivity | ~76.5 million US households expected to have at least one smart home device in 2024 |

| Pet Owners | Managing pet hair and dander, maintaining cleanliness | ~65.1 million US households owned dogs in 2024 |

| Allergy Sufferers | Reducing allergens, improving indoor air quality | ~25% of the US population suffers from allergies (2023 data) |

| Mid to High-Income Households | Premium features, quality, innovation, brand reputation | iRobot's average selling price for robot vacuums remained robust in 2023 |

Cost Structure

Research and Development (R&D) is a significant cost for iRobot, fueling its drive for innovation in areas like AI and robotics. These investments are crucial for developing new products and enhancing existing ones, ensuring the company stays competitive in the evolving smart home market.

In 2024, iRobot has been strategically managing its R&D spending, aiming for greater efficiency. Despite these efforts, R&D remains a substantial financial commitment, reflecting the company's dedication to maintaining its technological edge and future growth potential.

iRobot's manufacturing and supply chain costs are significant, encompassing expenses for raw materials, components, and fees paid to contract manufacturers. For instance, in 2023, iRobot reported a cost of revenue of $847.3 million, highlighting the substantial investment in producing its robotic devices.

The company actively works to reduce these product costs by streamlining its supply chain operations and forming strategic partnerships. This focus on efficiency is crucial for maintaining competitive pricing and profitability in the consumer electronics market.

iRobot dedicates significant resources to sales and marketing, investing heavily in advertising, consumer awareness campaigns, and promotional efforts to boost product sales. These investments are crucial for maintaining brand visibility in a competitive market.

To enhance efficiency, iRobot has strategically centralized and consolidated its sales and marketing operations. This approach aims to sharpen focus and reduce overall expenses associated with these functions.

For instance, in 2023, iRobot reported $293.2 million in operating expenses, which includes sales and marketing, alongside research and development. The company's focus on streamlining these areas is a key part of its ongoing business strategy.

Personnel and Operating Expenses

Personnel and operating expenses form a core component of iRobot's cost structure. These costs encompass everything from employee salaries and benefits to the general administrative overhead required to run the company. In January 2024, iRobot initiated a significant operational restructuring, which included a substantial reduction in headcount. This move was designed to better align the company's cost structure with its current revenue expectations and improve overall efficiency.

The restructuring efforts aimed to streamline operations and reduce ongoing expenses. For instance, iRobot reported a net loss of $11.7 million for the first quarter of 2024, a notable improvement from the $57.5 million net loss in the same period of 2023, reflecting some of the impacts of these cost-saving measures.

- Employee Compensation: Salaries, wages, and benefits for iRobot's workforce represent a substantial fixed cost.

- General & Administrative (G&A): This category includes costs like rent, utilities, legal fees, and other administrative overhead.

- Restructuring Costs: The January 2024 headcount reduction and other operational adjustments likely incurred one-time restructuring charges, impacting short-term profitability.

- Efficiency Initiatives: The company's focus on aligning costs with revenue suggests ongoing efforts to optimize operational spending.

Logistics, Distribution, and Inventory Management

iRobot's cost structure significantly includes expenses for logistics, distribution, and inventory management across its worldwide operations. These costs encompass shipping products to consumers and retailers, maintaining warehousing facilities, and the ongoing effort to efficiently manage stock levels.

The company has actively worked to reduce its inventory levels. This strategy is aimed at improving cash flow by minimizing the capital tied up in unsold goods.

Key cost drivers in this area for iRobot include:

- Transportation Costs: Expenses associated with moving finished goods from manufacturing facilities to distribution centers and ultimately to end customers globally.

- Warehousing Expenses: Costs related to storing inventory, including rent for facilities, utilities, security, and labor for warehouse operations.

- Inventory Holding Costs: The financial burden of keeping inventory on hand, which can include insurance, potential obsolescence, and the opportunity cost of capital.

iRobot's cost structure is heavily influenced by its commitment to innovation through Research and Development (R&D), which remains a substantial financial outlay. Manufacturing and supply chain expenses, including raw materials and contract manufacturing fees, are also significant, as evidenced by their $847.3 million cost of revenue in 2023. Furthermore, investments in sales and marketing are crucial for brand visibility, while personnel and operational costs, including recent restructuring efforts, are core components impacting overall profitability.

| Cost Category | 2023 Data | 2024 Context |

| Research & Development | Significant investment fueling innovation | Ongoing strategic management for efficiency |

| Manufacturing & Supply Chain | $847.3 million cost of revenue | Focus on streamlining and partnerships to reduce costs |

| Sales & Marketing | Part of $293.2 million operating expenses | Centralized operations for sharpened focus and reduced expenses |

| Personnel & Operating Expenses | Includes salaries, benefits, G&A | Restructuring in Jan 2024 led to headcount reduction to align costs |

Revenue Streams

iRobot's core revenue generation hinges on the direct sale of its iconic Roomba robotic vacuum cleaners. This segment is the bedrock of their business, with mid-tier and premium models driving the bulk of robot unit sales.

In 2023, iRobot reported total revenue of $906.7 million, with a significant portion attributable to these robotic cleaning devices, underscoring their primary revenue stream's strength.

iRobot also generates revenue from selling its Braava line of robotic mops. These products broaden the company's presence in the home floor care sector, working alongside their well-known vacuum robots. The Braava series utilizes comparable technological foundations to their Roomba counterparts, offering consumers a comprehensive automated cleaning solution.

iRobot generates ongoing revenue through the sale of accessories and replacement parts, including items like brushes, filters, and batteries. This creates a valuable recurring revenue stream that complements the initial robot purchase, ensuring continued customer engagement and spending.

Premium Features and Cloud-Connected Services via iRobot Home App

The iRobot Home App offers a pathway to recurring revenue through premium subscriptions. These could unlock advanced features like detailed room mapping, personalized cleaning schedules for specific zones, and enhanced voice control capabilities. For instance, a premium tier might offer multi-floor mapping or the ability to create virtual barriers beyond the standard functionality.

While this revenue stream is supplementary to hardware sales, it significantly boosts customer engagement and product stickiness. The potential for future growth lies in expanding the cloud-connected services, perhaps integrating with smart home ecosystems more deeply or offering AI-driven cleaning insights. In 2023, iRobot continued to refine its app, aiming to provide greater value that could eventually support a subscription model, though specific revenue figures for this segment were not prominently broken out.

- Premium Mapping: Offering advanced features like multi-floor mapping and custom cleaning zones for a fee.

- Advanced Customization: Unlocking personalized cleaning schedules and specific room preferences.

- Cloud-Connected Services: Potential for AI-driven cleaning reports, remote diagnostics, and integration with other smart home devices.

- Enhanced Product Value: These features increase the overall utility and long-term appeal of iRobot devices.

Subscription Services (e.g., iRobot Select - historical/limited)

While iRobot discontinued its 'iRobot Select' robot subscription service in May 2024, the company has explored and may continue to offer accessory replenishment subscriptions. This approach focuses on generating predictable, recurring revenue and fostering stronger customer relationships through continuous service delivery.

This strategy is designed to create a consistent income stream, moving beyond one-time hardware sales. By offering ongoing value through consumables like filters or cleaning solutions, iRobot can build a more stable financial foundation and increase customer lifetime value.

- Accessory Replenishment: Focus on subscriptions for replacement parts like filters, brushes, and cleaning solutions.

- Recurring Revenue: Aims to secure predictable income, reducing reliance on new device sales.

- Customer Loyalty: Enhances engagement by ensuring customers always have necessary supplies, improving their experience.

- Potential for Growth: Could expand to include premium support or advanced feature access in the future.

iRobot's revenue streams are primarily driven by the sale of its robotic floor care devices, notably the Roomba vacuum cleaners and Braava mops. Beyond initial hardware purchases, the company also generates recurring income through the sale of accessories and replacement parts like filters and brushes. While a subscription service was discontinued in May 2024, the potential for ongoing revenue exists through premium app features and accessory replenishment programs.

| Revenue Stream | Description | 2023 Data (Approx.) |

|---|---|---|

| Robotic Floor Care Devices | Sales of Roomba vacuums and Braava mops. | Primary revenue driver, contributing to the majority of $906.7 million total revenue. |

| Accessories & Replacement Parts | Ongoing sales of consumables (filters, brushes, batteries). | Supplements hardware sales, fostering recurring revenue. |

| Subscription Services (Discontinued/Potential) | Past 'iRobot Select' service, potential for accessory replenishment subscriptions. | Focus on predictable income and customer loyalty. |

| Premium App Features | Potential for paid access to advanced mapping, scheduling, and smart home integrations. | Aims to enhance product value and customer engagement. |

Business Model Canvas Data Sources

The iRobot Business Model Canvas is built using a combination of internal sales data, customer feedback, and market research reports. This ensures a comprehensive understanding of our target audience and their evolving needs.