Ipsos Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ipsos Bundle

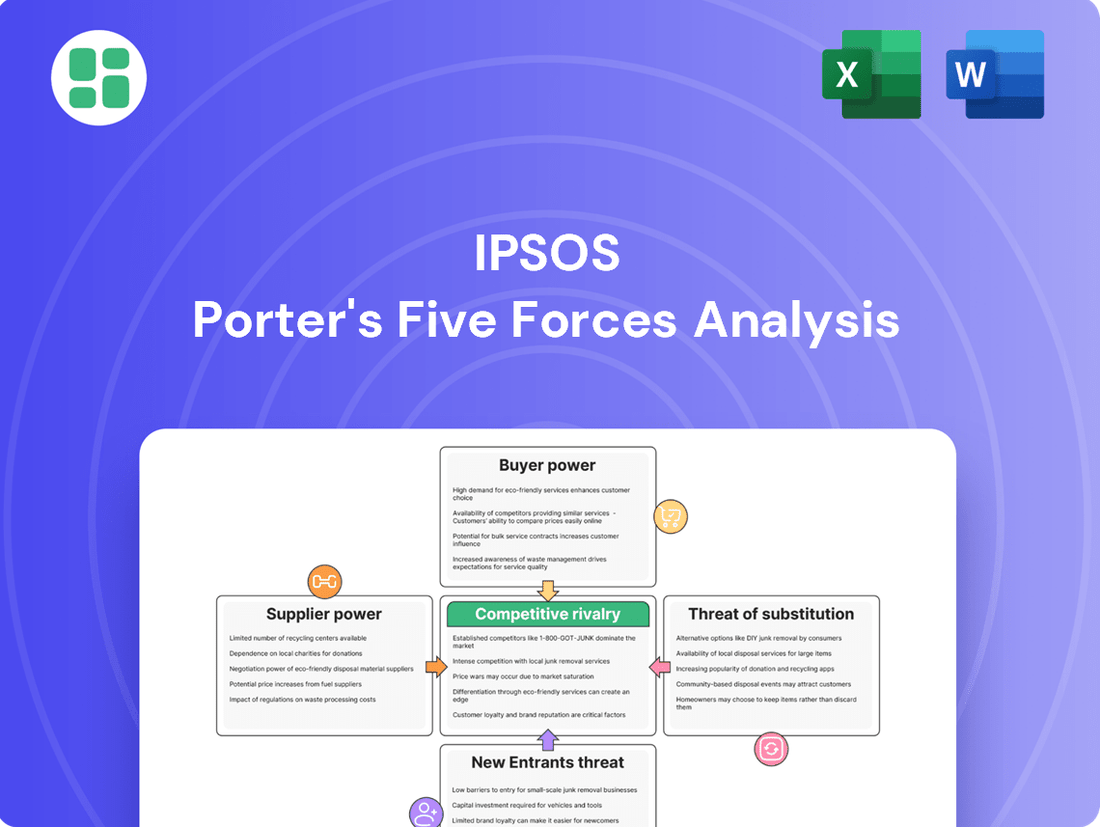

Ipsos navigates a complex market shaped by powerful forces. Understanding the intensity of buyer power, the threat of new entrants, and the bargaining power of suppliers is crucial for any stakeholder. This brief overview highlights the critical competitive pressures Ipsos faces.

The complete Porter's Five Forces Analysis for Ipsos offers a deep dive into these dynamics, providing a data-driven framework to assess competitive intensity and identify strategic opportunities. Unlock actionable insights to inform your strategy.

Suppliers Bargaining Power

Ipsos leverages a broad spectrum of data sources, encompassing survey responses, publicly available information, and social media analytics. This extensive network, particularly its diverse survey panels, means no single supplier can exert significant control over Ipsos's operations. For instance, in 2024, Ipsos reported engaging with millions of survey respondents globally, illustrating the sheer scale and fragmentation of its data inputs.

Key suppliers for Ipsos in the technology and software realm include providers of survey platforms, advanced data analytics software, and cutting-edge AI tools. The increasing reliance on AI and machine learning within market research means specialized technology vendors could see their bargaining power grow.

For instance, the global AI in market research market was valued at approximately USD 1.5 billion in 2023 and is projected to reach over USD 5 billion by 2030, indicating significant growth and potential leverage for AI solution providers. Ipsos's strategic focus on internalizing AI and technology capabilities, as detailed in their 2024 investor updates, is a direct effort to mitigate this rising supplier power by developing in-house expertise and reducing reliance on external software and AI services.

The market research sector, including firms like Ipsos, relies heavily on specialized talent such as data scientists, statisticians, and qualitative researchers. The availability of these skilled professionals directly impacts operational costs and project execution capabilities.

A significant factor in 2024 is the ongoing demand for advanced analytics and AI expertise. The scarcity of individuals with these niche skills grants them considerable bargaining power, allowing them to command higher salaries and more favorable working conditions.

Ipsos's proactive strategy to attract, develop, and retain top-tier talent is therefore a critical component in mitigating the supplier power exerted by these specialized individuals. This focus on human capital is essential for maintaining a competitive edge.

Panel and Respondent Recruitment Costs

Suppliers of survey panels and respondent recruitment services wield considerable bargaining power, particularly when Ipsos requires access to specialized or difficult-to-reach demographic segments. The expense and caliber of acquiring varied and representative samples directly influence Ipsos's operational expenditures and the trustworthiness of its market research findings. For instance, in 2024, the average cost per completed survey interview could range significantly, from $5 for general population surveys to upwards of $50 for highly specialized B2B or medical panels.

The escalating cost of acquiring quality respondents is a direct consequence of increased competition among research firms and the growing complexity of sampling methodologies. This pressure on recruitment costs directly impacts Ipsos's profitability and its ability to offer competitive pricing for its services. The market for reliable panel providers is somewhat consolidated, giving established players more leverage in price negotiations.

- Supplier Power: Moderate to High, especially for niche or hard-to-reach demographics.

- Cost Impact: Directly affects Ipsos's operational expenses and data reliability.

- Market Dynamics: Consolidation among panel providers can increase supplier leverage.

- Future Trends: The emergence of synthetic data could potentially disrupt traditional respondent recruitment models.

Infrastructure and Cloud Services

Ipsos’s dependence on sophisticated IT infrastructure and cloud services, like those offered by Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform, highlights the significant bargaining power of these suppliers. The critical nature of these services for Ipsos's global data processing and operations, coupled with the substantial costs and complexities involved in switching providers, grants these cloud giants considerable leverage. For instance, in 2024, the global cloud computing market was valued at over $600 billion, demonstrating the scale and dominance of a few key players.

These high switching costs, often running into millions of dollars for large enterprises like Ipsos due to data migration, integration, and retraining, mean that suppliers can command premium pricing and favorable contract terms. This necessitates that Ipsos cultivate strategic, long-term relationships and negotiate carefully to mitigate the impact of supplier power on its operational costs and efficiency.

- High Switching Costs: Migrating vast datasets and reconfiguring complex cloud-based workflows for a global research firm like Ipsos involves significant financial and operational hurdles, making it difficult to change providers quickly.

- Market Concentration: The cloud services market is dominated by a few major players, such as AWS, Azure, and Google Cloud, which reduces the number of viable alternatives for Ipsos and concentrates bargaining power among these providers.

- Criticality of Service: Ipsos relies on these services for its core operations, including data storage, analytics, and client delivery, making service continuity and reliability paramount, which further strengthens supplier leverage.

Suppliers of specialized talent, particularly in areas like AI and advanced data analytics, hold significant bargaining power. The scarcity of these skilled professionals, essential for Ipsos's evolving research methodologies, allows them to command higher compensation and favorable terms. For example, in 2024, demand for data scientists with AI expertise far outstripped supply, driving up salary expectations by as much as 20-30% compared to general data analysts.

The bargaining power of survey panel providers is also considerable, especially for accessing niche or hard-to-reach demographics. The cost and quality of respondent recruitment directly impact Ipsos's operational expenses and the reliability of its data. In 2024, the average cost per completed survey interview for specialized panels could range from $15 to $75, reflecting the effort and precision required.

| Supplier Type | Bargaining Power | Impact on Ipsos | 2024 Data/Trend |

|---|---|---|---|

| Specialized Talent (AI/Data Science) | High | Increased labor costs, talent acquisition challenges | Demand for AI skills up 40% YoY; Salary premiums of 20-30% |

| Survey Panel Providers | Moderate to High (for niche segments) | Higher respondent acquisition costs, data quality considerations | Cost per interview for niche panels $15-$75 |

| Technology & Software Vendors (AI/Cloud) | Moderate to High | Potential for increased software licensing fees, integration costs | Global AI in Market Research market projected to grow to $5B by 2030 |

What is included in the product

Ipsos' Porter's Five Forces analysis dissects the competitive intensity and profitability of the market research industry by examining threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and rivalry among existing competitors.

Pinpoint competitive threats and opportunities with a visual representation of all five forces, making strategic planning less overwhelming.

Customers Bargaining Power

Ipsos's strength lies in its extensive and varied client base, encompassing businesses, governments, and various organizations across numerous industries. This wide reach is a key factor in managing customer bargaining power.

While major multinational clients, due to their substantial project volumes and strategic significance, can indeed wield considerable influence, Ipsos's diversified client portfolio effectively mitigates the impact of any single customer. For instance, in 2024, Ipsos reported that its top 10 clients represented approximately 15% of its total revenue, a figure that has remained relatively stable, indicating a healthy spread of business.

This strategic diversification not only dilutes the bargaining power of individual large clients but also significantly reduces the risk associated with revenue concentration, providing a more stable financial foundation.

The bargaining power of customers in the market research sector is significantly amplified by the sheer availability of alternative providers. Clients can easily shift their business from one firm to another, especially given the fragmented nature of the industry. This landscape includes not only major global players like Kantar and NielsenIQ but also a multitude of smaller, niche firms and the growing capability of in-house research teams. This ease of switching, combined with competitive pricing strategies, directly empowers customers.

Many large corporations are building or enhancing their in-house data analytics and market research teams. This shift lessens their reliance on external market research firms. For instance, a growing number of Fortune 500 companies now have dedicated analytics departments, a trend that accelerated significantly in 2023 and 2024.

The rise of accessible 'do-it-yourself' (DIY) research platforms is another key factor. These tools allow clients to perform basic research tasks themselves, diminishing the need for traditional service providers for simpler projects. This democratization of research tools puts pressure on established firms to differentiate by offering deeper, more strategic insights, not just data collection.

Demand for Actionable Insights and ROI

Clients are increasingly scrutinizing the tangible benefits derived from research investments, pushing for clear demonstrations of return on investment (ROI). This demand means that simply providing data is no longer sufficient; the focus has shifted to actionable insights that directly translate into business improvements and measurable outcomes.

This growing emphasis on demonstrable ROI significantly bolsters the bargaining power of customers. They can now more effectively negotiate terms and pricing based on the perceived or proven value and strategic impact of the insights delivered. For instance, in 2024, many clients began to request performance-based clauses in contracts, linking payment to specific, pre-defined business metrics influenced by the research.

- Clients demand proof of ROI: Research providers must show how their insights lead to increased revenue, reduced costs, or improved market share.

- Shift from data to strategy: The value is in the strategic recommendations and their implementation, not just the raw data collection.

- Negotiating power increases: Clients can leverage the need for demonstrable impact to secure better pricing or contract terms.

- Need for continuous value demonstration: Companies like Ipsos must consistently prove the effectiveness of their insights to retain clients in a competitive market.

Price Sensitivity and Budget Constraints

Customers' price sensitivity significantly impacts market research firms like Ipsos. When economic conditions tighten, or individual budgets are strained, consumers and businesses alike become more focused on cost. This heightened awareness of price can exert considerable downward pressure on the fees for market research services. For instance, during periods of economic uncertainty, clients might reduce their research spending or seek out lower-cost alternatives, forcing Ipsos to be highly competitive on pricing.

This price sensitivity necessitates that companies like Ipsos not only focus on efficiency to manage costs but also strongly differentiate their offerings. Value beyond mere cost becomes crucial; this could include superior data quality, more insightful analysis, specialized expertise, or innovative methodologies. By highlighting these unique selling propositions, Ipsos can justify its pricing and retain clients even when budgets are tight.

The bargaining power of customers is amplified by their ability to switch providers or even conduct basic research themselves using readily available data. For example, in 2024, many companies are leveraging AI-powered analytics tools to gain initial insights, potentially reducing their reliance on external market research for certain tasks. This trend underscores the need for Ipsos to continually innovate and demonstrate a clear return on investment for its services.

- Price Sensitivity: In 2024, economic factors continue to make customers highly sensitive to the cost of market research services.

- Budget Constraints: Many organizations are operating with tighter budgets, leading them to scrutinize research expenditures more closely.

- Value Differentiation: Ipsos must emphasize the unique value and insights it provides to justify its pricing against more cost-effective alternatives.

- Competitive Landscape: The availability of self-service analytics tools empowers customers to conduct some research independently, increasing their bargaining power.

Customers' bargaining power is a significant force in the market research industry. The ease with which clients can switch providers, coupled with the increasing availability of DIY research tools and in-house analytics capabilities, allows them to negotiate more effectively. This situation is further exacerbated by a strong emphasis on demonstrable return on investment (ROI), pushing research firms to prove the tangible business impact of their insights. In 2024, this trend saw clients increasingly requesting performance-based contract clauses, directly linking payment to measurable outcomes derived from research.

| Factor | Impact on Bargaining Power | Supporting Data (2024) |

|---|---|---|

| Switching Costs | High | Low switching costs due to fragmented industry and readily available alternatives. |

| DIY Research Tools | Increases Power | Growing adoption of AI-powered analytics tools by companies for initial insights. |

| In-house Capabilities | Increases Power | Acceleration of Fortune 500 companies building dedicated analytics departments. |

| Price Sensitivity | High | Clients scrutinize research expenditures due to budget constraints and economic uncertainty. |

| Demand for ROI | Increases Power | Clients requesting performance-based clauses in contracts, linking payment to business metrics. |

Full Version Awaits

Ipsos Porter's Five Forces Analysis

This preview showcases the complete Ipsos Porter's Five Forces Analysis, demonstrating the exact professional formatting and comprehensive content you will receive immediately upon purchase. What you see here is the final, ready-to-use document, ensuring no discrepancies or missing sections after your transaction. You're looking at the actual, professionally written analysis, so you can be confident in the quality and completeness of the deliverable you'll gain instant access to.

Rivalry Among Competitors

The market research sector is a battleground, featuring formidable global titans such as Kantar, NielsenIQ, and GfK, alongside a vibrant ecosystem of specialized niche firms. This dynamic creates a fiercely contested environment where Ipsos must vie for dominance across a wide array of service offerings and international markets.

Competitive rivalry in the market research sector is intensely fueled by firms differentiating themselves through cutting-edge technology, especially AI and machine learning, coupled with deep industry-specific knowledge. This technological prowess allows companies to offer more sophisticated data analysis and actionable insights, setting them apart from competitors.

Investments in AI-driven platforms are a critical battleground, with companies pouring resources into tools that enhance data collection, streamline analysis, and generate predictive insights. For instance, in 2024, the global AI market was projected to reach over $200 billion, with significant portions dedicated to business intelligence and analytics, reflecting this trend.

The market research sector is experiencing significant consolidation, with major firms acquiring smaller, niche companies to broaden their service offerings and geographic presence. This trend intensifies competition as these larger entities gain enhanced data analytics capabilities and broader market reach.

Ipsos, for instance, has actively engaged in acquisitions, integrating acquired businesses to bolster its data analytics and global standing. This strategic move by Ipsos, and similar actions by competitors, fuels rivalry by concentrating market share and expertise among fewer, larger players.

Emphasis on Speed, Quality, and Actionable Insights

The market research industry is intensely competitive, with a strong focus on delivering insights rapidly and accurately. Businesses today need information that is not only high-quality but also readily usable to make quick decisions. This demand for speed and actionability is a major driver of competition.

Competitors are constantly pushing to get insights into clients' hands faster. They achieve this by using advanced real-time data analytics and automating various processes. This continuous innovation puts pressure on all companies in the sector to improve their operations and stay ahead.

- Speed: The average turnaround time for qualitative research projects has decreased significantly, with many clients expecting initial findings within days, not weeks.

- Quality: Ensuring data accuracy and methodological rigor remains paramount, even as speed increases. Clients are less tolerant of errors.

- Actionability: Insights must translate directly into strategic recommendations. Generic data is no longer sufficient; clients want clear guidance on what to do next.

- Innovation: Companies investing in AI-powered analytics and predictive modeling are gaining a competitive edge by offering more sophisticated and timely solutions.

Global Reach and Local Nuance

Ipsos navigates a competitive landscape where global scale must harmonize with local market intricacies. This means maintaining consistent research methodologies worldwide while adapting to diverse cultural nuances and consumer behaviors. Competitors excelling in specific regions or possessing deep sector-specific knowledge can present a formidable challenge by offering highly localized and specialized insights.

The intensity of competition is amplified by the need to balance global brand consistency with the agility required for local market relevance. For instance, while Ipsos might leverage its global network for large-scale studies, smaller, regionally focused firms can often provide more granular and culturally attuned analysis within their specific territories. This dynamic requires Ipsos to continuously refine its approach to ensure its global capabilities resonate effectively at the local level.

In 2024, the market research industry continues to see consolidation, but also the rise of niche players. Companies like NielsenIQ, Kantar, and GfK remain significant global competitors, each with their own strengths in specific sectors or regions. Ipsos's ability to integrate global data platforms with localized expertise is crucial for maintaining its competitive edge against these established players and emerging specialists.

- Global Scale vs. Local Adaptation: Ipsos must balance standardized global research practices with the need for culturally sensitive, region-specific insights to effectively serve diverse client needs.

- Regional Competitors: Firms with strong footholds in particular geographic markets, such as those in Asia-Pacific or Europe, can offer highly tailored solutions that challenge Ipsos’s broader offerings.

- Industry Specialization: Competitors deeply embedded in specific industries, like healthcare or automotive research, can outmaneuver generalists by providing unparalleled sector-specific expertise.

- Data Integration: The ability to seamlessly integrate global data sets with local market intelligence is a key differentiator in a fragmented competitive environment.

The market research sector is characterized by intense rivalry, with established global players like Kantar, NielsenIQ, and GfK, alongside specialized niche firms, vying for market share. This competition is driven by the need for speed, accuracy, and actionable insights, pushing companies to invest heavily in AI and advanced analytics. Consolidation through acquisitions further intensifies this rivalry, as firms expand their capabilities and reach.

| Competitor | Key Differentiators | 2024 Focus Areas |

|---|---|---|

| Kantar | Brand strength, media insights, consumer panels | AI-driven analytics, data integration, sustainability research |

| NielsenIQ | Retail measurement, consumer behavior, data analytics | Omnichannel insights, predictive analytics, e-commerce solutions |

| GfK | Consumer goods, technology, automotive research | Digital transformation, AI-powered insights, market intelligence |

| Ipsos | Global reach, diverse service offerings, public affairs | AI integration, data science capabilities, client-centric solutions |

SSubstitutes Threaten

Many large corporations are increasingly developing sophisticated internal data analytics and market intelligence departments. These in-house teams allow companies to conduct their own research and derive insights without relying on external providers.

This growing internal capability directly substitutes for the services offered by external analytics firms. For example, in 2024, a significant percentage of Fortune 500 companies reported expanding their data science teams, aiming to reduce reliance on third-party insights.

Clients can leverage their own proprietary data and analytical tools, diminishing the perceived need to outsource these functions. This self-sufficiency reduces the bargaining power of external analytics providers.

The proliferation of big data and AI-driven analytics platforms presents a significant threat of substitutes for traditional market research. These platforms can glean consumer insights from vast digital datasets, including social media activity and online behavior, often in real-time. For instance, companies are increasingly leveraging AI to analyze customer sentiment from online reviews, a process that can be faster and more comprehensive than traditional surveys. In 2024, the global big data analytics market was valued at over $270 billion, underscoring the substantial investment and adoption of these alternative insight-gathering methods.

General management consulting firms are a significant threat of substitutes for market research firms. These consultancies, with their deep industry knowledge and analytical prowess, increasingly provide strategic advice that encompasses market understanding, directly competing with the insights market research traditionally offers. For instance, in 2024, major consulting firms like McKinsey & Company and Boston Consulting Group continued to expand their data analytics and AI capabilities, enabling them to deliver sophisticated market assessments as part of broader strategic engagements.

Social Media Listening and Sentiment Analysis Tools

Specialized social media listening and sentiment analysis tools offer a potent substitute for traditional market research. These platforms provide real-time insights into public opinion and brand perception by monitoring online conversations, a capability that traditional methods often lack in speed and cost-effectiveness. For instance, in 2024, companies increasingly leverage these tools for rapid brand health checks and competitive intelligence, bypassing lengthy survey processes.

These tools can be seen as substitutes because they deliver similar, albeit often more granular and immediate, data points to what traditional qualitative and quantitative research aims to achieve. They allow businesses to gauge sentiment, identify emerging trends, and understand customer feedback at a scale and pace previously unimaginable. This shift is evident in the growing market for these technologies; the global social media analytics market was valued at approximately $10.5 billion in 2023 and is projected to reach over $25 billion by 2028, indicating a strong preference for these digital alternatives.

- Cost Efficiency: Social media listening tools can be significantly more cost-effective than commissioning large-scale traditional research studies.

- Real-time Data: They provide immediate feedback on public sentiment and brand perception, crucial for agile decision-making.

- Scalability: These platforms can monitor millions of online conversations simultaneously, offering broad insights.

- Trend Identification: They excel at spotting nascent trends and shifts in consumer behavior as they emerge online.

Automated Insights and Predictive Analytics

The rise of automated insights and predictive analytics presents a significant threat of substitutes for traditional market research. Advanced AI and machine learning models can now forecast market trends and consumer behavior, reducing the need for bespoke research projects. This offers a scalable and efficient alternative for businesses seeking actionable intelligence.

For instance, in 2024, the global market for business analytics software, which heavily incorporates predictive capabilities, was projected to reach over $35 billion. Companies leveraging these tools can gain insights faster and at a lower cost compared to traditional methods.

- Scalability: Automated systems can process vast datasets, providing insights for a broad range of business needs without proportional increases in human resources.

- Cost-Efficiency: Predictive analytics platforms often operate on a subscription basis, which can be more cost-effective than commissioning multiple custom research studies.

- Speed: AI-driven analysis can deliver insights in near real-time, enabling quicker decision-making in rapidly evolving markets.

- Accessibility: Many platforms are becoming more user-friendly, democratizing access to sophisticated analytical tools for a wider range of professionals.

The threat of substitutes for market research is substantial, with many alternatives offering similar insights more efficiently. Companies are increasingly building in-house data analytics teams, reducing their reliance on external firms. For example, many large corporations expanded their data science departments in 2024 to conduct their own research.

Big data and AI-driven platforms are powerful substitutes, providing real-time consumer insights from digital footprints. The global big data analytics market exceeded $270 billion in 2024, highlighting the adoption of these methods. General management consultancies also offer market understanding as part of broader strategic services, further competing with traditional market research.

Specialized social media listening tools provide quick, cost-effective sentiment analysis and trend spotting. The global social media analytics market was valued at approximately $10.5 billion in 2023, showing a strong shift towards these digital alternatives. Automated insights and predictive analytics further reduce the need for bespoke research, with the business analytics software market projected to surpass $35 billion in 2024.

Entrants Threaten

Setting up a global market research operation demands immense capital. This includes building out vast data collection networks, sophisticated analytics software, and a significant employee base. For instance, a company looking to rival Ipsos would need to invest billions in technology and infrastructure to achieve comparable reach and analytical capabilities.

New players face a substantial financial hurdle to enter the market and effectively challenge established firms like Ipsos. These established companies leverage their existing economies of scale, which new entrants struggle to match without considerable upfront investment, making direct competition financially prohibitive.

In the market research industry, brand reputation and trust are incredibly important. Clients make significant business decisions based on the insights Ipsos provides, so they need to be sure those insights are accurate and unbiased. This reliance on credibility creates a substantial barrier for new companies trying to enter the field.

Establishing a strong, trustworthy brand in market research isn't a quick process. It requires years of consistently delivering high-quality work and successfully completing projects. For example, Ipsos has a long history of providing reliable data, which has helped build its reputation. Newcomers struggle to replicate this level of trust quickly, as clients are hesitant to entrust them with sensitive business information and critical decision-making data.

A significant hurdle for new players in the market research industry is gaining access to comprehensive and reliable data panels. Building and maintaining large, diverse, and high-quality respondent pools is a costly and time-consuming endeavor, requiring substantial upfront investment in technology, recruitment, and quality control.

For instance, Ipsos, a global leader in market research, reported revenues of €2.1 billion in 2023, underscoring the scale of operations required to maintain a competitive edge, which includes robust data panel infrastructure. New entrants often struggle to replicate this established network and the trust associated with reputable panel providers, making it difficult to gather accurate and representative data for their clients.

Specialized Expertise and Talent Pool

The market research industry, particularly with its increasing reliance on advanced analytics, AI, and sophisticated methodologies, requires a workforce possessing deep specialized expertise and experience. This complexity acts as a significant barrier to entry for newcomers. For instance, a recent report indicated that companies are increasingly seeking professionals with advanced degrees in statistics, data science, and behavioral economics, skills that are not easily acquired or quickly developed.

Attracting and retaining top-tier talent in areas like data science, advanced statistical modeling, and nuanced qualitative research represents a substantial challenge for new entrants. The competition for these skilled individuals is fierce, often involving established players with more resources and established employer brands. In 2024, the demand for data scientists with market research experience saw a notable increase, with average salaries for such roles rising by an estimated 15% compared to the previous year, making it an expensive proposition for startups.

- High Demand for Specialized Skills: The need for professionals proficient in areas like AI-driven analytics, predictive modeling, and advanced qualitative techniques is critical.

- Talent Acquisition Costs: New companies face significant hurdles in attracting and retaining top data scientists and researchers due to high salary expectations and competitive benefits packages.

- Experience Gap: A lack of proven experience in navigating complex market research projects and delivering actionable insights can deter clients from engaging with new firms.

Regulatory and Data Privacy Compliance

The market research industry faces significant hurdles for new entrants due to the complex web of data privacy regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Companies must invest heavily in legal expertise and robust data security infrastructure to ensure compliance, directly increasing upfront operational costs and acting as a substantial barrier.

These compliance requirements mean new players must build sophisticated systems for data handling, consent management, and breach notification from the outset. For instance, in 2024, companies operating within the EU faced fines for non-compliance with GDPR, with some penalties reaching millions of Euros, underscoring the financial risk associated with regulatory missteps.

- Regulatory Burden: Navigating and adhering to evolving data privacy laws like GDPR and CCPA requires substantial legal and technical resources.

- Compliance Costs: Significant investment is needed in data security infrastructure, privacy officers, and ongoing legal counsel.

- Operational Complexity: Implementing strict data handling protocols and consent mechanisms adds layers of operational complexity for new entrants.

- Reputational Risk: Non-compliance can lead to severe financial penalties and irreparable damage to a new company's reputation.

New entrants face substantial capital requirements to establish global operations, build data networks, and acquire sophisticated analytics software, making it difficult to compete with established firms like Ipsos. For example, Ipsos's 2023 revenue of €2.1 billion highlights the immense scale of investment needed to maintain a competitive edge, a significant barrier for newcomers.

Building a trusted brand and acquiring reliable data panels are critical challenges. Ipsos's long-standing reputation for delivering accurate insights and its robust respondent networks are hard to replicate quickly, as clients prioritize proven credibility. In 2024, the demand for specialized data science talent in market research surged, with salaries increasing by an estimated 15%, further escalating costs for new entrants.

Navigating complex data privacy regulations like GDPR and CCPA demands significant investment in legal expertise and data security infrastructure. Non-compliance risks, such as the multi-million Euro fines seen in 2024 for GDPR violations, present a substantial financial and reputational threat to new companies entering the market research space.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including company financial statements, industry-specific market research reports, and expert interviews with key stakeholders to provide a comprehensive view of competitive dynamics.