Ipsos Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ipsos Bundle

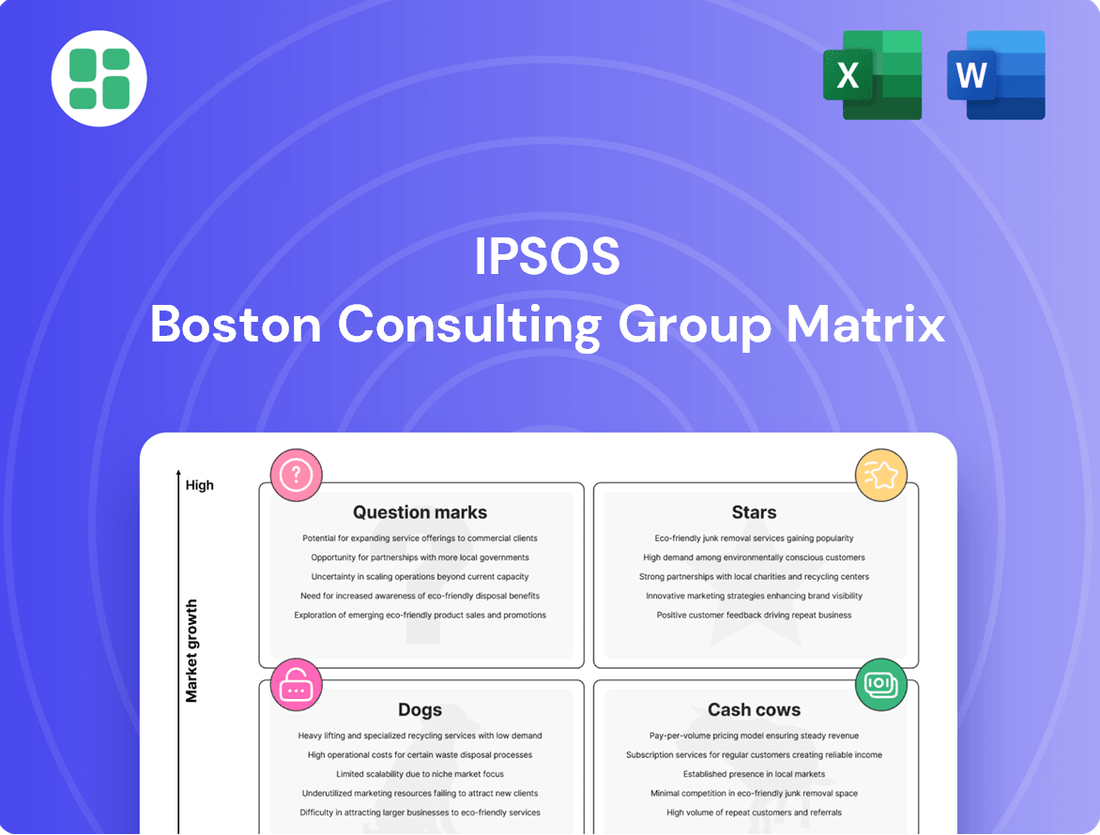

Unlock the strategic power of the BCG Matrix to understand your company's product portfolio. See how your products stack up as Stars, Cash Cows, Dogs, or Question Marks, and gain a crucial edge in market positioning. Purchase the full BCG Matrix for a comprehensive breakdown and actionable insights to drive your business forward.

Stars

Ipsos is making significant strides in AI-powered research, with notable growth in offerings like Ipsos Facto, PersonaBot, and Signals GenAI. These platforms are designed to streamline market research processes by automating data handling and delivering insights much faster.

This technological investment is a key driver for Ipsos, enabling them to offer enhanced efficiency and speed to their clients. The company views these AI tools as crucial for maintaining its competitive edge and fostering future expansion within the insights sector.

The Ipsos.Digital platform is a standout performer, demonstrating robust organic growth. In the first half of 2024, its revenues surged by 37%, and for the full year 2024, it achieved a 30% increase.

This agile, on-demand DIY research solution boasts an operating margin that is approximately double the group's average. Its success is driven by its ability to deliver rapid market research through automation, offering clients real-time insights.

The platform's ongoing expansion and impressive financial results highlight its substantial market share within the expanding agile research sector, significantly enhancing client decision-making efficiency.

Ipsos stands out as a global leader in Customer Experience (CX) insights, assisting businesses in crafting, tracking, and delivering exceptional customer journeys to foster profitable expansion. The CX market remains a critical focus for CEOs, and Ipsos's extensive CX offerings, encompassing analytics and consulting, place it advantageously in this rapidly expanding sector.

The company is dedicated to demonstrating a 'Return on Customer Experience Investment (ROCXI)', achieved through enhanced customer retention and increased advocacy. For instance, in 2024, many companies reported significant increases in customer lifetime value by prioritizing CX initiatives, with some seeing improvements of over 15% in retention rates.

Innovation and New Service Lines

Ipsos's strategic push into new service lines, encompassing platforms, ESG solutions, advanced data analytics, and specialized advisory, is a significant driver of its growth. These innovative offerings represented more than 22% of the Group's total revenue in 2024, demonstrating their increasing importance to the company's financial performance.

The company's commitment to innovation is evident in its consistent launch of new products and services. This proactive approach aims to solidify Ipsos's leadership in emerging research areas and capture evolving market demands.

The performance of these new services is particularly strong, with a 10% organic growth rate recorded in the first nine months of 2024. This growth trajectory indicates that these segments are not only expanding but are also gaining market share, positioning them as key contributors to Ipsos's future success.

- New Services Revenue: Over 22% of Group revenue in 2024.

- New Services Organic Growth: 10% in the first nine months of 2024.

- Strategic Focus: Platforms, ESG, data analytics, and advisory.

- Market Position: Aiming for leadership in emerging research fields.

Healthcare/Pharmaceutical Research (outside the US)

Ipsos's healthcare research sector, particularly outside the United States, is demonstrating robust performance. In the first half of 2025, this segment achieved organic growth exceeding 5%.

This positive trajectory is fueled by increasing demand from key players in the pharmaceutical industry. There's a notable surge in interest for research related to groundbreaking areas such as oncology, rare diseases, and the rapidly evolving GLP-1 studies.

Further bolstering its capabilities, Ipsos recently integrated InMoment's Healthcare division in Germany. This strategic acquisition enhances Ipsos's specialized knowledge and solidifies its market standing within this expanding and dynamic sector.

- Global Healthcare Organic Growth: Over 5% in H1 2025.

- Key Growth Drivers: Oncology, rare diseases, and GLP-1 research.

- Strategic Expansion: Acquisition of InMoment's Healthcare division in Germany.

- Market Position: Strengthened expertise in a high-demand sector.

Stars in the BCG matrix represent business units or products that have a high market share in a high-growth market. These are typically market leaders that require significant investment to maintain their growth and market position. Companies aim to nurture their Stars, as they have the potential to become Cash Cows in the future when market growth slows down.

Stars are characterized by substantial revenue generation and often require ongoing investment to fend off competitors and capitalize on market opportunities. For example, a rapidly growing tech product with a dominant market share would be considered a Star. The key is that both the market itself and the company's position within it are strong and expanding.

While Stars are promising, they are not always profitable due to the high investment needed. However, their strong market share in a growing industry suggests they are well-positioned for future success and can eventually become the company's primary source of cash.

The strategic goal with Stars is to manage them effectively, ensuring they continue to grow and eventually transition into Cash Cows. This often involves reinvesting profits back into the business unit to maintain its competitive advantage and expand its reach.

What is included in the product

The Ipsos BCG Matrix analyzes a company's product portfolio by categorizing units into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

Visualize your portfolio's performance and identify areas for strategic growth.

Cash Cows

Traditional brand health tracking and advertising effectiveness services are Ipsos's cash cows, forming a substantial 49.2% of its consumer segment revenue in 2024. These services, deeply embedded in the market, capitalize on established client relationships and high market share.

Operating in mature markets, these offerings generate predictable, consistent cash flow. This stability is achieved with minimal need for significant new investment in promotion, allowing Ipsos to leverage its existing infrastructure and expertise effectively.

Public Opinion Polling, representing 14.9% of Ipsos's net sales in 2024, functions as a Cash Cow. This segment benefits from Ipsos's strong global presence and a consistent demand for understanding public sentiment and lifestyle shifts.

While growth in this area can be cyclical, tied to electoral events and political climates, Ipsos's brand recognition and broad client base secure a significant market share. This stability allows the company to generate reliable revenue from these core services.

Ipsos' media measurement and audience research division operates as a classic cash cow within the BCG matrix. This segment leverages Ipsos' deep expertise in understanding consumer behavior across traditional and digital media, including press, television, radio, and the internet.

This is a mature market where Ipsos has cultivated a strong, established presence, evidenced by consistent recurring contracts. In 2023, the global market for media measurement and audience research was valued at approximately $10 billion, with Ipsos holding a significant share due to its long-standing relationships and reliable data delivery.

The stable revenue generated from these established services, characterized by high market share in a low-growth industry, provides a consistent and predictable cash flow for Ipsos. This allows the company to fund investments in other, more dynamic areas of its business.

Customer and Employee Relationship Management (ERM)

Customer and Employee Relationship Management (ERM) services represent a stable Cash Cow for the organization. In 2024, this segment contributed 20.7% of net sales, highlighting its consistent revenue generation. These offerings are deeply embedded in client operations, focusing on enhancing customer satisfaction and retention, as well as boosting employee engagement.

The nature of ERM services, often secured through long-term contracts and recurring project work, ensures predictable income streams. This stability is a hallmark of a Cash Cow, operating within a mature yet indispensable market segment.

- Segment Contribution: 20.7% of net sales in 2024.

- Market Position: Stable and well-established within a mature market.

- Revenue Model: Characterized by long-term contracts and recurring projects.

- Key Focus: Customer satisfaction, retention, and employee engagement.

Market Strategy & Understanding (Established Segments)

Ipsos's established market strategy focuses on general market studies and consumer understanding within mature industries. This service line, while not experiencing explosive growth, leverages Ipsos's deep expertise and extensive client relationships to maintain a significant market share.

The reliability of these established segments is crucial for Ipsos's overall profitability. For instance, in 2024, the market research industry saw steady demand for insights into consumer behavior in sectors like fast-moving consumer goods (FMCG) and automotive, where Ipsos holds a strong position.

- Established Segments: Core offerings include general market studies and consumer understanding in mature industries.

- Market Share: Ipsos maintains a high market share due to its extensive client base and expertise in these areas.

- Profitability: These segments provide a reliable and consistent contribution to the company's overall financial performance.

- 2024 Data: Steady demand was observed in sectors like FMCG and automotive, where Ipsos is a key player.

Traditional brand health tracking and advertising effectiveness services are Ipsos's cash cows, forming a substantial 49.2% of its consumer segment revenue in 2024. These services, deeply embedded in the market, capitalize on established client relationships and high market share.

Public Opinion Polling, representing 14.9% of Ipsos's net sales in 2024, functions as a Cash Cow. This segment benefits from Ipsos's strong global presence and a consistent demand for understanding public sentiment and lifestyle shifts.

Ipsos' media measurement and audience research division operates as a classic cash cow within the BCG matrix, generating stable revenue from established services with high market share in a low-growth industry.

Customer and Employee Relationship Management (ERM) services represent a stable Cash Cow for the organization, contributing 20.7% of net sales in 2024, due to long-term contracts and recurring projects in a mature market.

| Service Segment | 2024 Revenue Contribution | BCG Category | Market Characteristics | Key Strengths |

|---|---|---|---|---|

| Brand Health & Ad Effectiveness | 49.2% (Consumer Segment) | Cash Cow | Mature, High Market Share | Established Client Relationships |

| Public Opinion Polling | 14.9% (Net Sales) | Cash Cow | Mature, Cyclical Demand | Global Presence, Brand Recognition |

| Media Measurement & Audience Research | Significant Recurring Contracts | Cash Cow | Mature, Stable Demand | Deep Expertise, Reliable Data |

| Customer & Employee Relationship Management | 20.7% (Net Sales) | Cash Cow | Mature, Indispensable | Long-Term Contracts, Embedded Services |

Full Transparency, Always

Ipsos BCG Matrix

The Ipsos BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive report, meticulously crafted by strategy experts, contains no watermarks or demo content, ensuring you get the complete, analysis-ready tool for your strategic planning needs.

Dogs

Undifferentiated basic data collection services, often characterized by simple surveys or data gathering without sophisticated analysis, are typically found in the "Question Mark" or potentially "Dog" quadrant of the BCG Matrix. These services face significant price pressure as many providers can offer similar raw data, leading to commoditization. For instance, a basic online survey platform might cost a fraction of what a full-service market research firm charges for data collection alone.

In 2024, the market research industry continues to shift towards data interpretation and actionable insights. Companies that solely offer raw data collection without adding value through analytics, strategic recommendations, or specialized industry knowledge are likely to experience low growth. If these services represent a significant portion of a company's offerings and are not integrated into a broader, higher-value service portfolio, they can drag down overall performance, mirroring the characteristics of a "Dog" in the BCG Matrix.

Legacy research methodologies, often characterized by manual data collection and processing, are increasingly falling into the 'dog' category of the Ipsos BCG Matrix. These methods struggle to compete with the speed and efficiency offered by digital and AI-driven alternatives, leading to declining demand from clients who prioritize rapid insights. For instance, traditional focus groups, while still having niche applications, have seen their market share diminish as online qualitative research platforms gain traction, offering broader reach at a lower cost.

The inefficiency of these older approaches is a significant factor. Manual data entry and analysis, for example, are prone to human error and are considerably slower than automated processes. In 2023, the global market for AI in market research was valued at over $2.5 billion, a figure expected to grow significantly, highlighting the shift away from manual-intensive methods that can no longer meet client expectations for real-time data and actionable intelligence.

Ipsos's US public affairs sector faced a downturn in 2024, largely attributed to the natural ebb following significant electoral cycles and the conclusion of substantial one-off government contracts. This situation resulted in negative organic growth for the company in this specific segment within the United States.

This performance places Ipsos's US public affairs contracts in the "question mark" category of the BCG matrix. It signifies a low market share within a high-growth, albeit volatile, sub-segment of the broader market research industry.

Niche Research in Shrinking Industries

When considering niche research services within industries that are shrinking or undergoing significant disruption, these offerings can be categorized as 'dogs' in the Ipsos BCG Matrix. The inherent decline in market size for these sectors naturally caps any potential for substantial growth for Ipsos.

For instance, if Ipsos offers highly specialized market research for the traditional print media industry, which has seen a consistent revenue decline, this would likely fall into the dog category. The shrinking demand limits the ability to expand market share or generate significant new revenue streams.

- Shrinking Market Size: Industries like traditional print advertising or physical media sales have experienced significant contraction. For example, global print advertising revenue has been on a downward trend for years.

- Limited Growth Potential: Even with specialized expertise, the overall market contraction restricts the upside for research services in these areas.

- Low Market Share: While Ipsos might hold a strong position within a niche, the absolute size of the market means their overall market share remains small.

- Focus on Efficiency: For 'dog' segments, the strategy often shifts to maintaining profitability through cost efficiency rather than aggressive growth initiatives.

Services Heavily Impacted by US Pharma Restructuring

The US pharmaceutical sector's ongoing restructuring has significantly dampened Ipsos's related service offerings. This industry shift, characterized by consolidations and strategic realignments among major players, has directly translated into reduced demand for market research and advisory services within this specific US segment.

Consequently, Ipsos's activities in this area are experiencing a downturn, reflecting a low market share and low growth trajectory for these particular services in the US. For instance, the US pharmaceutical market, while vast, saw a slowdown in R&D spending growth in late 2023 and early 2024 due to patent cliffs and increased regulatory scrutiny, impacting market research budgets.

- Reduced R&D Investment: Major pharmaceutical companies have been re-evaluating their R&D pipelines, leading to fewer projects requiring extensive market analysis.

- Mergers and Acquisitions: Increased M&A activity often results in the consolidation of market research vendors, potentially reducing the number of active service providers.

- Shifting Regulatory Landscape: Evolving regulations in the US can necessitate costly adjustments for pharmaceutical firms, diverting resources from external research services.

Dogs represent business units or product lines with low market share in slow-growing or declining industries. These offerings typically generate just enough cash to maintain themselves but offer little prospect for significant growth or profitability. Companies often consider divesting or phasing out 'dog' segments to reallocate resources to more promising areas.

For instance, in 2024, specialized market research services focused on declining print media sectors would likely be classified as dogs. The shrinking demand and limited growth potential mean that even a strong market share within this niche would not translate into substantial overall revenue or profit for Ipsos.

The strategy for managing 'dogs' usually involves minimizing investment and maximizing cash flow, if possible, or a complete exit. The focus shifts from expansion to efficiency, ensuring these segments do not drain valuable resources.

In 2023, the global advertising spend on print media continued its decline, with some estimates showing a year-over-year decrease of over 5% in key markets, underscoring the challenges for research services tied to this sector.

| BCG Matrix Segment | Characteristics | Example for Ipsos (2024 Context) | Strategic Implication |

|---|---|---|---|

| Dogs | Low market share, low growth industry | Market research for legacy software systems with declining adoption rates; Specialized research for industries facing significant technological obsolescence. | Divest, harvest, or minimize investment. Focus on cost efficiency. |

| Low profitability, often break-even | |||

| Require minimal investment to maintain |

Question Marks

Ipsos is actively exploring and implementing synthetic data and synthetic participant research, utilizing generative AI to build new datasets and improve product testing methodologies. This innovative approach holds significant promise for future growth within the market research industry.

While Ipsos is a leader in this emerging space, the widespread adoption of synthetic data is still in its early phases. Consequently, Ipsos currently possesses a comparatively small market share in this developing sector.

Advanced neuro-marketing and biometric research represent emerging, high-growth areas within the market research landscape. Companies are increasingly investing in these specialized fields to gain a more profound understanding of consumer behavior and emotional responses, moving beyond traditional surveys.

While specific financial data for Ipsos's investment in these niche areas is proprietary, the broader market for neuromarketing is projected to grow significantly. For instance, some reports estimate the global neuromarketing market could reach billions of dollars by the mid-2020s, indicating substantial growth potential.

For Ipsos, these fields likely represent strategic investments aimed at building market share in a competitive environment. The high-investment nature suggests a long-term commitment to developing expertise and proprietary technologies in these cutting-edge research methodologies.

Blockchain's application in market research, focusing on data security, transparency, and tokenized incentives, represents a nascent but rapidly expanding frontier. While specific Ipsos initiatives in this area are proprietary, the broader market for blockchain in research is still in its infancy, meaning any current market share for such solutions would be minimal.

Specific AI-driven Predictive Analytics in New Verticals

Ipsos's predictive analytics, while robust, faces a question mark when applied to nascent, high-growth sectors like specialized metaverse applications or cutting-edge robotics. These areas present significant untapped market potential, but Ipsos's established presence and data accumulation are still developing.

The challenge lies in leveraging existing predictive models in environments with limited historical data and unique market dynamics. For instance, predicting consumer behavior within emerging virtual worlds requires adapting methodologies beyond traditional market research, a task that is underway but not yet proven at scale.

- Untapped Market Potential: New verticals offer substantial growth opportunities, but also carry inherent risks due to their evolving nature.

- Data Scarcity: Predictive analytics heavily relies on historical data, which is scarce in rapidly emerging sectors.

- Methodological Adaptation: Existing predictive models may need significant recalibration to accurately forecast trends in novel industries.

- Competitive Landscape: While market share is yet to be captured, new entrants and established tech players are also vying for dominance in these spaces.

New Geographic Market Entry with Innovative Offerings

Entering a new geographic market with an innovative service, where Ipsos lacks an established foothold, firmly places such ventures in the question mark category of the BCG matrix. These initiatives demand substantial capital infusion to build brand awareness and capture market share within potentially high-growth territories. For instance, Ipsos’ strategic acquisitions in Europe, such as Infas in Germany and BVA Family, exemplify this approach of investing in new markets with novel offerings.

These question mark strategies are characterized by their inherent uncertainty and the need for careful resource allocation. The success of entering a new geographic market with innovative offerings hinges on robust market research and a well-defined go-to-market strategy.

- Market Uncertainty: High potential for growth but also significant risk due to lack of established presence.

- Investment Requirement: Substantial capital is needed for market penetration and product development.

- Strategic Acquisitions: Examples like Infas (Germany) and BVA Family acquisitions demonstrate Ipsos' commitment to this strategy.

- Potential for High Returns: Successful entry can lead to significant market share and profitability in the long term.

Question Marks in the Ipsos BCG Matrix represent initiatives with low market share but high growth potential. These are often new ventures or emerging technologies where Ipsos is investing to build future market leadership. The key challenge is identifying which Question Marks will evolve into Stars and which will fail.

Ipsos’s ventures into synthetic data and advanced neuro-marketing exemplify Question Marks. While current market share in these niche areas is small, the projected growth of these sectors, potentially reaching billions of dollars in the coming years, signals significant future opportunity. These investments require careful management and strategic decision-making to navigate the inherent uncertainties.

The success of these Question Mark initiatives is crucial for Ipsos’s long-term growth strategy. By investing in these high-potential areas, Ipsos aims to diversify its revenue streams and maintain its competitive edge in the evolving market research landscape. The company’s strategic acquisitions in new geographic markets also fall into this category, requiring substantial investment for market penetration.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.