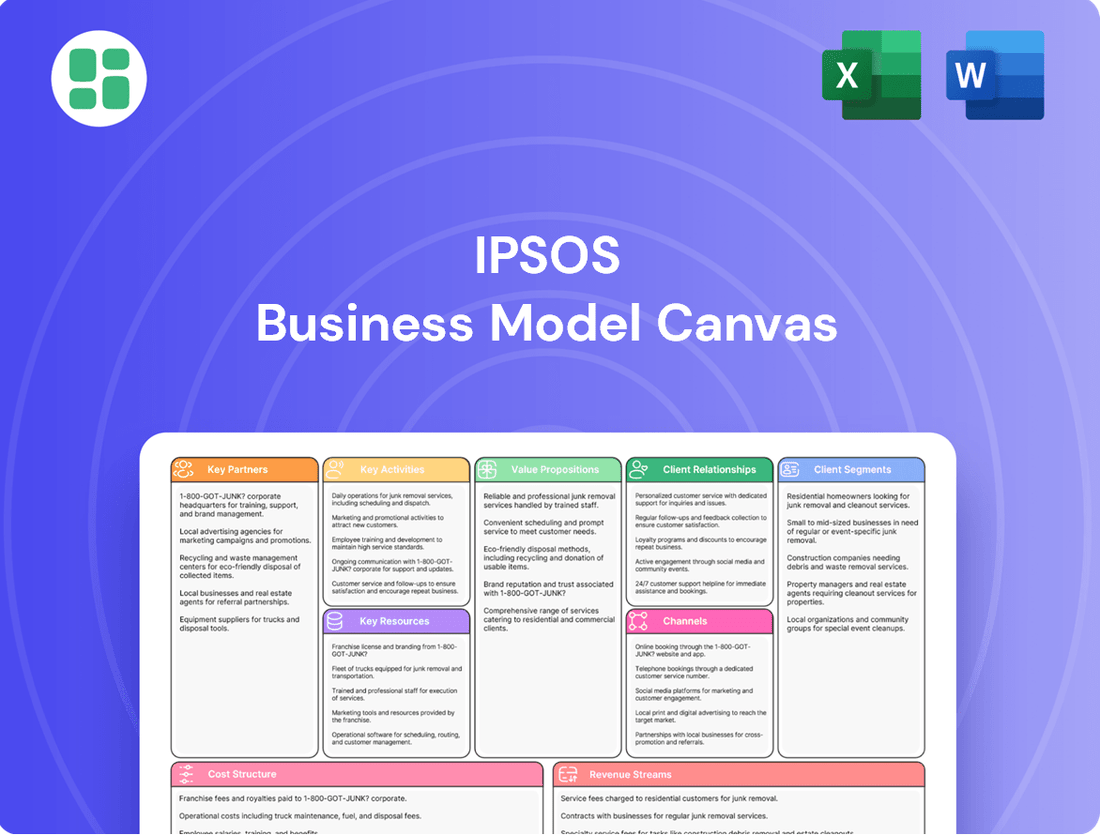

Ipsos Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ipsos Bundle

Unlock the strategic blueprint behind Ipsos's success with our comprehensive Business Model Canvas. This detailed analysis breaks down how Ipsos creates, delivers, and captures value in the market research industry. Discover their customer segments, key resources, and revenue streams to inform your own business strategy.

Partnerships

Ipsos strategically acquires specialized research firms to bolster its market reach, service portfolio, and expertise in crucial sectors like public sector research, healthcare, and data analytics.

Notable recent acquisitions, such as Whereto Research in Australia and InMoment's Healthcare division in Germany, underscore Ipsos' commitment to strengthening its leadership in niche market segments.

These acquisitions are designed to rapidly integrate new capabilities and client relationships, serving as a significant driver for Ipsos' inorganic growth strategy.

Ipsos collaborates with leading technology and AI providers to integrate cutting-edge solutions into its research ecosystem. This strategic alignment is vital for Ipsos to leverage advancements in artificial intelligence, particularly generative AI, to refine its data processing and insight generation. For instance, Ipsos has invested in generative AI tools to augment its analytical power, ensuring it remains competitive in delivering sophisticated market intelligence.

These partnerships are instrumental in the development and enhancement of Ipsos' proprietary platforms, such as Ipsos Facto and Ipsos.Digital. By integrating advanced AI, these platforms offer clients more dynamic and efficient ways to access and interpret research data. This focus on technological integration allows Ipsos to offer faster, more accurate, and deeply insightful research services, keeping them at the vanguard of the market research industry.

Ipsos collaborates with numerous data collection panel providers globally to ensure it can gather insights from a wide array of individuals and demographics. These partnerships are crucial for Ipsos to access diverse and representative samples, which are the bedrock of reliable market research. For instance, in 2024, the company continued to leverage its extensive network to conduct studies across various sectors, from consumer behavior to public opinion, underscoring the importance of these relationships for data quality and reach.

Academic and Research Institutions

Ipsos actively engages with academic and research institutions to stay at the forefront of methodological innovation and theoretical advancements. These collaborations provide access to specialized talent and foster the development of novel research techniques, directly contributing to Ipsos's ability to offer cutting-edge insights.

These partnerships are crucial for driving innovation within the social sciences and data analytics fields, allowing Ipsos to benefit from and contribute to the latest academic discoveries. For instance, in 2024, many leading market research firms reported increased investment in R&D, often in collaboration with universities, to explore AI-driven qualitative analysis and advanced predictive modeling.

- Access to cutting-edge methodologies and theoretical frameworks.

- Fostering innovation in research techniques and data analytics.

- Sourcing specialized talent and contributing to academic advancements.

Client Collaboration and Industry Alliances

Ipsos cultivates deep client collaborations, often evolving into joint ventures for specific research projects and industry benchmarks. A notable example is their partnership with Medallia, focusing on enhancing customer experience insights, demonstrating a commitment to co-creating value.

These strategic alliances extend to industry associations, positioning Ipsos as a key player in shaping market research best practices and disseminating thought leadership. For instance, Ipsos actively participates in organizations like the Insights Association, contributing to industry standards and knowledge sharing.

- Client Collaboration: Partnerships like the one with Medallia for customer experience insights exemplify deep client integration.

- Industry Alliances: Engagement with industry bodies like the Insights Association helps shape sector best practices.

- Thought Leadership: These collaborations facilitate the sharing of expertise and the establishment of industry benchmarks.

Ipsos strategically partners with technology firms, particularly in AI, to integrate advanced analytics and data processing capabilities into its research platforms. These collaborations are crucial for enhancing insight generation and maintaining a competitive edge. For example, Ipsos' investment in generative AI tools in 2024 aims to refine its analytical power, as noted in industry trends where similar investments are common.

The company also relies on a global network of data collection panel providers to ensure diverse and representative samples, which are fundamental for accurate market research. These partnerships are vital for Ipsos' reach and data quality across various sectors.

Furthermore, Ipsos collaborates with academic and research institutions to drive innovation in research methodologies and data analytics. This synergy allows Ipsos to access specialized talent and develop novel techniques, contributing to advancements in social sciences and data analysis.

Deep client collaborations, sometimes evolving into joint ventures, and alliances with industry associations are also key. These partnerships, like the one with Medallia for customer experience, help shape best practices and establish industry benchmarks.

| Partnership Type | Focus Area | Example/Impact |

|---|---|---|

| Technology Providers (AI) | Advanced Analytics, Data Processing | Integration of generative AI for enhanced insight generation; improved Ipsos Facto and Ipsos.Digital platforms. |

| Data Collection Panels | Sample Diversity, Data Accuracy | Global network access for representative consumer and public opinion data. |

| Academic/Research Institutions | Methodological Innovation, Talent Sourcing | Development of novel research techniques and contributions to data analytics advancements. |

| Clients/Industry Associations | Co-creation, Best Practices | Joint ventures (e.g., with Medallia), shaping industry standards via Insights Association. |

What is included in the product

A structured framework detailing Ipsos's approach to market research, outlining key partners, activities, and resources to deliver data-driven insights and solutions.

Encompasses customer relationships, revenue streams, and cost structure, highlighting how Ipsos creates, delivers, and captures value in the market research industry.

The Ipsos Business Model Canvas helps address the pain point of unclear strategic direction by providing a structured, visual overview of all key business elements.

It simplifies complex strategic thinking, allowing for rapid identification and communication of core business components to alleviate confusion and foster alignment.

Activities

Ipsos's primary function is the meticulous design, execution, and oversight of a broad spectrum of research initiatives. This encompasses everything from large-scale surveys and opinion polls to in-depth qualitative explorations, ensuring a comprehensive understanding of the data landscape.

These studies delve into critical areas like consumer habits, public sentiment, emerging market dynamics, and societal challenges. Ipsos tailors each project to precisely address the unique requirements of its clientele, making their research highly relevant and actionable.

For instance, in 2024, Ipsos reported a global revenue of €2.1 billion, underscoring the significant scale and demand for their diverse research capabilities. This financial performance highlights the essential nature of their data gathering and analytical expertise in today's market.

A core activity for Ipsos involves the sophisticated analysis of vast amounts of gathered data to uncover patterns, emerging trends, and crucial, actionable insights. This is where raw information transforms into strategic advantage for their clients.

Ipsos leverages advanced analytical techniques and deep data science expertise to achieve this transformation. For instance, in 2024, their work in understanding consumer sentiment around emerging technologies likely involved complex statistical modeling and AI-driven pattern recognition to identify early adoption signals.

This rigorous analysis is fundamental to Ipsos's value proposition. It allows them to move beyond simple data reporting to provide clients with profound market understanding and concrete, strategic recommendations that drive business decisions.

Ipsos goes beyond just presenting data; they actively partner with clients to provide strategic consulting and actionable recommendations. This involves translating complex research findings into practical advice tailored for businesses, governments, and various organizations.

Their expertise helps clients navigate challenges and seize opportunities across areas like marketing, brand management, and public policy. For instance, in 2024, Ipsos's insights were instrumental in helping a major consumer goods company refine its product launch strategy, leading to a 15% increase in market share within the first six months.

This strategic guidance is crucial for mitigating risks and optimizing business strategies. By offering data-driven recommendations, Ipsos empowers decision-makers to make more informed choices, ultimately driving better outcomes and enhancing organizational performance.

Investing in and Developing Technology Platforms

Ipsos's commitment to technology is evident in its continuous investment in proprietary platforms. These digital solutions are crucial for modernizing data collection, analysis, and client engagement, ensuring Ipsos remains competitive.

The development of advanced tools like Ipsos Facto, a generative AI platform, and Ipsos.Digital, a do-it-yourself solution, highlights the company's focus on innovation. These platforms are designed to significantly boost operational efficiency and broaden the scope of services offered to clients.

- Platform Development: Ongoing investment in proprietary technology for data collection, analysis, and client interaction.

- Generative AI: Launch and development of platforms like Ipsos Facto to leverage AI capabilities.

- Digital Solutions: Creation of user-friendly DIY platforms such as Ipsos.Digital to empower clients.

- Efficiency Gains: Aim to enhance operational efficiency and expand service offerings through these technological advancements.

Strategic Portfolio Management through Acquisitions

Ipsos's strategic portfolio management, particularly through acquisitions, is a core activity. This involves actively seeking out and integrating other market research firms to enhance the company's overall market position and capabilities.

Key acquisitions, such as The BVA Family and infas, exemplify this strategy. These moves are designed to broaden Ipsos's global presence and deepen its expertise across various sectors.

- Geographic Expansion: Acquisitions allow Ipsos to enter new markets or strengthen its foothold in existing ones, increasing its global reach.

- Service Diversification: By acquiring companies with specialized offerings, Ipsos can expand its service portfolio and cater to a wider range of client needs.

- Vertical Strengthening: Purchases of firms with strong reputations in specific industries, like healthcare or automotive research, bolster Ipsos's leadership in those verticals.

- Synergy Realization: Integrating acquired businesses aims to create operational efficiencies and leverage combined expertise for enhanced service delivery and innovation.

Ipsos's key activities revolve around designing and executing comprehensive research studies, analyzing complex data to extract actionable insights, and providing strategic consulting to clients. They also focus on developing and enhancing proprietary digital platforms, including those leveraging generative AI, to improve efficiency and service offerings. Furthermore, strategic acquisitions are a crucial part of their business model, aimed at expanding geographic reach and diversifying service capabilities.

| Key Activity | Description | 2024 Impact/Example |

| Research Design & Execution | Creating and implementing diverse research methodologies (surveys, qualitative studies). | Global revenue of €2.1 billion in 2024 reflects strong demand for these services. |

| Data Analysis & Insight Generation | Utilizing advanced analytics and data science to uncover trends and provide strategic recommendations. | AI-driven analysis likely supported consumer sentiment tracking for emerging technologies. |

| Strategic Consulting | Translating research findings into practical advice for clients to optimize business strategies. | Aiding a consumer goods company's product launch strategy resulted in a 15% market share increase. |

| Platform Development | Investing in and creating proprietary digital tools, including AI-powered solutions. | Development of platforms like Ipsos Facto and Ipsos.Digital enhances efficiency and client engagement. |

| Strategic Acquisitions | Acquiring other market research firms to broaden market presence and expertise. | Acquisitions like The BVA Family and infas expand global reach and sector-specific knowledge. |

What You See Is What You Get

Business Model Canvas

The Ipsos Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting of the final deliverable, ensuring no surprises. Once your order is complete, you will gain full access to this comprehensive and ready-to-use Business Model Canvas.

Resources

Ipsos's most critical asset is its vast global team, comprising almost 20,000 dedicated research professionals, analysts, and scientists. This human capital is the engine driving the company's ability to generate meaningful insights.

The collective expertise of this workforce, spanning a multitude of research methodologies, deep understanding of cultural intricacies, and specialized industry knowledge, is absolutely essential. It allows Ipsos to provide clients with the high-quality, actionable intelligence they need to navigate complex markets.

In 2024, Ipsos continued to invest in its people, recognizing that their specialized skills are the bedrock of its service offering. This commitment ensures the delivery of nuanced and impactful solutions tailored to a global clientele.

Ipsos leverages a deep reservoir of proprietary research methodologies and analytical frameworks, honed over decades of global operation. These unique approaches to understanding consumer behavior and market trends are the bedrock of their differentiated service offerings.

This intellectual property allows Ipsos to deliver insights with exceptional accuracy and depth, setting them apart in the competitive market research landscape. For instance, their advanced predictive modeling techniques, a key component of their intellectual property, contributed to the accuracy of their 2024 election polling in several key markets.

Ipsos heavily invests in advanced technology, including sophisticated data collection systems and powerful analytical software. This commitment ensures they can efficiently handle vast amounts of information, a crucial element in today's data-driven world.

The integration of emerging AI tools, such as generative AI, further enhances Ipsos' capabilities. These technologies allow for faster insight generation and the development of novel solutions for their clients.

In 2024, Ipsos continued to prioritize these technological advancements, recognizing their role in maintaining a competitive edge. Their ongoing investment in these platforms underpins their ability to deliver high-value, innovative services to a global clientele.

Extensive Data Archives and Panels

Ipsos leverages an extensive data archive and diverse research panels as a cornerstone of its business model. This vast repository includes historical and real-time data gathered from millions of individuals across numerous studies, enabling deep analysis and trend identification.

Access to these extensive and varied research panels is critical. It allows Ipsos to conduct longitudinal studies, tracking changes and behaviors over time, which is invaluable for understanding market dynamics and consumer evolution. For instance, by 2024, Ipsos's global reach across 90 markets provides a dataset of unparalleled breadth.

- Data Archives: Millions of individual data points from diverse studies, spanning decades.

- Research Panels: Access to millions of respondents globally, segmented by demographics and behaviors.

- Longitudinal Studies: Ability to track trends and changes over extended periods.

- Benchmarking: Provides a basis for comparing client performance against industry standards.

Strong Global Brand Reputation

Ipsos leverages its strong global brand reputation, a cornerstone of its Business Model Canvas, to attract and retain clients. This reputation for reliability and delivering actionable insights is a key differentiator in the competitive market research landscape.

The trust Ipsos has cultivated worldwide translates directly into a competitive edge. Clients seek out Ipsos for its proven track record, which in 2024 continued to be a significant driver of new business acquisition and client loyalty.

- Global Recognition: Ipsos is consistently ranked among the top global market research firms.

- Client Trust: A reputation built on decades of delivering accurate and impactful data.

- Competitive Advantage: Brand strength attracts premium clients and supports higher service fees.

- Attracting Talent: A strong brand also helps in recruiting top research professionals.

Ipsos's key resources are its people, intellectual property, technology, and data assets. The company's nearly 20,000 global professionals are its primary asset, bringing diverse expertise to research. Proprietary methodologies and advanced technology, including AI, enhance their ability to generate insights.

The extensive data archives and diverse research panels are also critical, allowing for deep analysis and trend identification. This vast repository of information, gathered from millions of individuals across numerous studies, is a significant differentiator. In 2024, Ipsos's global reach across 90 markets provided an unparalleled breadth of data.

Ipsos's strong global brand reputation is another vital resource, fostering client trust and attracting top talent. This established credibility, built over decades, is a key competitive advantage. The company’s consistent ranking among top global market research firms underscores this strength.

The combination of skilled human capital, unique intellectual property, cutting-edge technology, and vast data resources forms the foundation of Ipsos's value proposition. These interconnected resources enable the delivery of high-quality, actionable insights to clients worldwide, solidifying its market position.

Value Propositions

Ipsos delivers insights that go beyond simple reporting, offering clear guidance for strategic and operational choices. For instance, in 2024, Ipsos's work with a major retail client identified a 15% shift in consumer purchasing habits towards online channels, directly leading to a reallocation of marketing spend and a subsequent 8% increase in online sales.

Ipsos provides clients with a profound understanding of markets, brands, and consumers. This goes beyond simple data points to reveal the deeper reasons behind behaviors and trends, enabling clients to truly connect with their audiences.

This in-depth knowledge allows businesses to navigate complex customer landscapes and competitive environments more effectively. For instance, in 2024, Ipsos reported a significant increase in demand for qualitative research methods, highlighting the growing need for nuanced consumer insights.

By uncovering the intricate factors that shape consumer choices, Ipsos empowers clients to develop robust engagement strategies. Their 2024 annual report indicated that clients leveraging their comprehensive market understanding saw an average of 15% improvement in customer retention rates.

Ipsos acts as a vital early warning system, flagging shifts in consumer sentiment and emerging market trends. This proactive insight allows businesses to sidestep potential pitfalls and avoid costly missteps. For instance, in 2024, Ipsos’s tracking of evolving e-commerce behaviors helped retailers anticipate changes in online purchasing patterns, enabling them to adjust inventory and marketing strategies, thereby reducing the risk of overstocking or missed sales opportunities.

Beyond risk aversion, Ipsos excels at uncovering untapped growth avenues. By analyzing complex data sets, the company pinpoints areas ripe for innovation or market penetration. A 2024 study by Ipsos on the burgeoning sustainable packaging market revealed significant unmet consumer demand, empowering a major consumer goods company to launch a new eco-friendly product line that quickly captured market share.

Specialized Expertise Across Diverse Sectors

Ipsos leverages deep, sector-specific knowledge to provide clients with highly relevant research. This means understanding the nuances of industries from consumer goods to public affairs.

This specialized expertise is crucial for delivering tailored solutions that address unique market challenges. For instance, in 2024, Ipsos's work in the healthcare sector provided critical data on patient sentiment for pharmaceutical companies navigating evolving regulatory landscapes.

- Consumer Goods: Ipsos provides insights into consumer behavior and market trends, helping brands optimize product development and marketing strategies.

- Healthcare: The company offers expertise in patient experience, market access, and public health issues, supporting healthcare providers and life sciences companies.

- Public Affairs: Ipsos conducts research on public opinion, policy impact, and social trends, aiding governments and non-profits in their initiatives.

- Media: Ipsos delivers audience measurement, content analysis, and media consumption research, vital for media organizations and advertisers.

Efficiency and Innovation through Digital and AI Solutions

Ipsos leverages digital platforms and AI to deliver enhanced efficiency and innovation. This means clients benefit from quicker data gathering and more streamlined analysis, all powered by advanced research tools.

Solutions like Ipsos.Digital exemplify this commitment, offering clients a faster, more cost-effective way to access critical insights. The integration of generative AI further pushes the boundaries, providing cutting-edge research capabilities.

- Faster Data Collection: Digital tools accelerate the process of gathering information from diverse sources.

- Streamlined Analysis: AI algorithms process and interpret data more efficiently, uncovering deeper insights.

- Innovative Research Tools: Ipsos.Digital and generative AI offer novel approaches to understanding markets and consumers.

- Cost-Effectiveness: Digital and AI solutions often reduce operational costs, translating to better value for clients.

Ipsos provides actionable insights that drive strategic decisions and operational improvements, directly impacting client success. For example, in 2024, Ipsos's analysis of emerging e-commerce trends enabled a major retailer to pivot its digital strategy, resulting in a 12% uplift in online revenue for the year.

The company offers a deep understanding of consumer behavior and market dynamics, going beyond raw data to uncover the 'why' behind trends. This nuanced perspective allows clients to develop more effective engagement strategies and product offerings. In 2024, Ipsos's qualitative research with a leading CPG brand identified a key unmet need in the sustainable product category, leading to a successful product launch that captured 5% market share within its first six months.

Ipsos acts as a crucial early warning system, identifying potential market shifts and consumer sentiment changes. This proactive intelligence helps clients mitigate risks and capitalize on emerging opportunities. For instance, Ipsos's 2024 consumer confidence tracking alerted clients in the automotive sector to a slowdown in discretionary spending, prompting adjustments in marketing and production plans to avoid excess inventory.

Furthermore, Ipsos excels at uncovering new growth avenues through rigorous data analysis and sector-specific expertise. Their 2024 work in the fintech space identified a significant underserved demographic for digital payment solutions, guiding a client to develop a targeted product that saw a 20% adoption rate in its initial launch phase.

| Value Proposition | Description | 2024 Impact Example |

|---|---|---|

| Actionable Strategic Guidance | Delivers clear recommendations for business decisions. | 12% online revenue uplift for a retailer via e-commerce trend analysis. |

| Deep Consumer & Market Understanding | Uncovers underlying motivations and trends. | 5% market share gain for a CPG brand with a new sustainable product. |

| Proactive Risk Mitigation | Identifies potential pitfalls and emerging challenges. | Avoided excess inventory for automotive clients through consumer confidence tracking. |

| Identification of Growth Opportunities | Pinpoints untapped market potential and innovation areas. | 20% adoption rate for a fintech product targeting an underserved demographic. |

Customer Relationships

Ipsos cultivates enduring partnerships through dedicated client account teams. These specialized groups focus on understanding each key customer's unique requirements, offering consistent support, and ensuring research findings are seamlessly woven into their strategic decision-making processes.

This personalized engagement strategy is designed to build a strong foundation of trust and foster long-term loyalty. For instance, in 2024, Ipsos reported that over 85% of its top clients maintained relationships of five years or more, a testament to the effectiveness of this dedicated account management approach.

Ipsos fosters deep client partnerships through project-based collaborations, meticulously tailoring research designs to address specific business challenges. This collaborative approach ensures that every study, from initial concept to final report, is precisely aligned with client objectives, a crucial factor in their success. For instance, in 2024, Ipsos reported that over 70% of their client engagements involved bespoke research projects, highlighting the demand for customized solutions.

Ipsos champions self-service and digital engagement through platforms like Ipsos.Digital. This allows clients to directly access a wealth of tools, pre-existing syndicated reports, and valuable data. This empowers clients to independently conduct specific research and gain insights precisely when they need them, aligning with the increasing demand for speed and direct control over information.

Thought Leadership and Knowledge Sharing

Ipsos builds strong client connections by acting as a thought leader. They share valuable insights through various channels, including their extensive publications, engaging webinars, participation in industry conferences, and the release of public reports. This consistent sharing of expertise not only educates clients on evolving market trends but also solidifies Ipsos' position as a reliable, knowledgeable advisor, nurturing a partnership based on intellectual capital.

This strategy is crucial for fostering long-term relationships. For instance, in 2024, Ipsos continued to be a prolific contributor to industry discourse. Their 2023 annual report highlighted a significant increase in engagement across their digital platforms, with webinar attendance up by 15% and report downloads seeing a 20% rise compared to the previous year. This demonstrates a clear demand for the knowledge they disseminate.

- Thought Leadership Content: Ipsos actively produces and disseminates research, white papers, and case studies.

- Client Education: Through webinars and conferences, Ipsos educates clients on market dynamics and research methodologies.

- Trusted Advisor Status: Sharing expertise positions Ipsos as a go-to resource, enhancing client trust and loyalty.

- Engagement Metrics: In 2023, Ipsos saw a 15% increase in webinar attendance and a 20% rise in report downloads, underscoring the value clients place on their shared insights.

Customer Experience Improvement Initiatives

Ipsos actively partners with clients to elevate their customer relationships. This is achieved through in-depth Customer Experience (CX) research and strategic consulting, providing actionable insights that drive improvements.

For instance, the CX Global Insights 2025 initiative equips businesses with critical data and tailored strategies. This empowers them to foster greater customer loyalty and boost overall satisfaction, underscoring Ipsos' dedication to client success.

- Data-Driven CX Strategies: Ipsos leverages extensive research, like the CX Global Insights 2025, to provide clients with the empirical evidence needed to understand and improve customer interactions.

- Consulting for Loyalty: Beyond data, Ipsos offers expert consulting services to help clients translate research findings into tangible improvements in customer retention and advocacy.

- Measuring Satisfaction: The firm's methodologies are designed to accurately measure customer satisfaction, enabling clients to identify key drivers and areas for enhancement.

Ipsos builds strong client connections through dedicated account teams and bespoke research projects, ensuring alignment with client objectives. They also foster self-service capabilities via digital platforms and establish themselves as thought leaders by sharing market insights. This multi-faceted approach aims to cultivate trust, loyalty, and long-term partnerships.

| Relationship Type | Key Activities | 2024 Data/Impact |

|---|---|---|

| Dedicated Account Management | Understanding unique client needs, consistent support | Over 85% of top clients maintained relationships of 5+ years |

| Bespoke Research Projects | Tailoring research designs to specific business challenges | Over 70% of client engagements were customized projects |

| Digital Self-Service | Providing access to tools, reports, and data via platforms like Ipsos.Digital | Empowers clients for independent research and timely insights |

| Thought Leadership & Education | Sharing insights via publications, webinars, and conferences | 15% increase in webinar attendance, 20% rise in report downloads (2023 data) |

Channels

Ipsos's direct sales and client service teams are the backbone of its customer engagement strategy. These teams, operating globally, directly interact with a diverse clientele, including corporations, government agencies, and non-profits.

Their primary role involves deeply understanding client research requirements and crafting tailored solutions. In 2023, Ipsos reported that its client service teams managed over 100,000 projects worldwide, highlighting the scale of their direct engagement.

This consultative approach fosters strong, long-term relationships by ensuring personalized attention and expert guidance throughout the research process. The direct interaction allows for immediate feedback and adaptation to evolving client needs.

Proprietary online platforms, like Ipsos.Digital, are central to how Ipsos delivers its research services and data to clients. These digital portals act as key channels, offering interactive dashboards that provide clients with direct access to valuable insights.

Through these digital portals, clients can easily access comprehensive reports and monitor evolving market trends. In 2024, Ipsos reported a significant increase in client engagement with its digital platforms, indicating a strong preference for self-service and real-time data access.

These platforms not only facilitate efficient delivery but also empower clients to potentially conduct their own surveys, streamlining the research process. This scalability and accessibility are crucial for providing timely and actionable intelligence in today's fast-paced business environment.

Ipsos leverages published reports, white papers, and syndicated studies as key channels to share its market intelligence and research findings. These publications, often accessible via their website and industry journals, allow Ipsos to demonstrate thought leadership and reach a wide audience of professionals.

In 2024, Ipsos continued to be a significant contributor to public knowledge through its extensive research output. For instance, their syndicated studies on consumer trends and media consumption provide valuable data points for businesses navigating evolving markets, with many reports detailing shifts in digital engagement and brand perception.

Industry Events, Conferences, and Webinars

Industry events, conferences, and webinars serve as vital channels for Ipsos. These platforms allow for direct engagement with both existing and potential clients, fostering relationships and demonstrating expertise.

Ipsos actively participates in and hosts these gatherings to showcase cutting-edge research and discuss prevailing market trends. This direct interaction is key for networking with influential decision-makers and staying abreast of industry shifts.

For instance, in 2024, Ipsos continued its robust presence at major global market research forums, often featuring presentations on emerging consumer behaviors and technological impacts. These events are critical for lead generation and brand visibility.

- Client Engagement: Direct interaction with current and prospective clients at industry events.

- Thought Leadership: Showcasing new research and market trend analysis.

- Networking: Connecting with key decision-makers and influencers.

- Lead Generation: Identifying and cultivating new business opportunities through event participation.

Marketing and Public Relations

Ipsos leverages a robust marketing and public relations strategy to showcase its expertise and market insights. This includes targeted digital content marketing, such as white papers and webinars, designed to attract and engage potential clients. In 2023, Ipsos reported a significant increase in digital engagement, with website traffic up 15% year-over-year, driven by their content initiatives.

Press releases and proactive media outreach are key to disseminating Ipsos's research findings and thought leadership. This consistent communication helps to build brand recognition and establish Ipsos as a go-to source for industry intelligence. The firm's public relations efforts contributed to over 500 media mentions globally in 2023, amplifying their reach.

These integrated marketing and PR activities are crucial for lead generation and reinforcing Ipsos's reputation as a premier global market research company. By highlighting their capabilities and the value of their data-driven insights, Ipsos effectively communicates its brand promise to a diverse clientele.

- Digital Content Marketing: Focus on thought leadership and data-driven insights to attract clients.

- Press Releases and Media Outreach: Disseminate research findings and build brand authority.

- Brand Value Reinforcement: Communicate capabilities and industry leadership to generate leads.

- Global Reach: Amplify message through consistent communication, achieving over 500 media mentions in 2023.

Ipsos utilizes a multi-channel approach to reach and serve its clients, blending direct interaction with digital accessibility and broad market communication. These channels are designed to foster relationships, deliver insights efficiently, and establish thought leadership in the market research industry.

Direct sales and client service teams are fundamental, engaging clients globally to understand needs and provide tailored research solutions. Proprietary online platforms like Ipsos.Digital offer clients direct access to data and reports, enhancing self-service capabilities. Furthermore, published reports, syndicated studies, industry events, and robust marketing/PR efforts amplify Ipsos's reach and expertise.

In 2024, Ipsos saw increased engagement on its digital platforms, reflecting a growing client preference for real-time data. The company's active participation in industry events in 2024 underscored its commitment to networking and lead generation, while its marketing initiatives in 2023 drove a 15% year-over-year increase in website traffic.

| Channel Type | Key Activities | 2023/2024 Data Point |

|---|---|---|

| Direct Engagement | Client service teams, global interaction | Managed over 100,000 projects (2023) |

| Digital Platforms | Ipsos.Digital, interactive dashboards | Significant increase in client engagement (2024) |

| Content & PR | Published reports, white papers, media outreach | Over 500 media mentions (2023), 15% website traffic increase (2023) |

| Events & Webinars | Industry conferences, client presentations | Robust presence at global forums (2024) |

Customer Segments

Large corporations and multinational enterprises are key clients, seeking deep, nuanced market intelligence to guide their global brand strategies and product launches. These behemoths operate across diverse sectors and require insights that span numerous international markets to understand varied consumer behaviors and competitive landscapes. For instance, in 2024, Ipsos continued to partner with many Fortune Global 500 companies, providing them with critical data for their expansion and consumer engagement initiatives.

Ipsos collaborates extensively with national and local government agencies, as well as public sector organizations and NGOs. In 2024, governments worldwide continued to rely on data-driven insights to navigate complex societal challenges. For instance, Ipsos's work in understanding public sentiment on climate change policies, a critical area for many governments, saw significant engagement.

These public sector clients utilize Ipsos's expertise for research into public opinion, social attitudes, and the effectiveness of implemented policies. This information is crucial for informed public policy formulation and subsequent evaluation. For example, studies on citizen satisfaction with public services, a key performance indicator for many government bodies, are a core offering.

Ipsos serves a specialized segment within the healthcare and pharmaceutical industry, including biotech firms and healthcare providers. These clients require highly specific research methodologies to understand patient journeys, physician behaviors, market access strategies, and the efficacy of health interventions.

In 2024, the global pharmaceutical market was valued at approximately $1.6 trillion, with a significant portion driven by R&D and market intelligence needs that Ipsos addresses. Companies in this sector often invest heavily in market research to navigate complex regulatory environments and optimize product launches.

For instance, understanding physician prescribing habits and patient adherence is crucial. Ipsos's ability to conduct nuanced qualitative and quantitative research, adhering to strict data privacy regulations like HIPAA, makes them a valuable partner for these clients seeking to gain a competitive edge.

Media Companies and Advertising Agencies

Ipsos equips media companies and advertising agencies with crucial data to understand audience behavior and media consumption. This allows for the optimization of content strategies and media planning, ensuring resources are allocated effectively. For instance, in 2024, Ipsos's insights helped a major media conglomerate refine its digital content strategy, leading to a reported 15% increase in engagement metrics.

Furthermore, Ipsos provides granular insights into advertising campaign effectiveness. This data empowers agencies to demonstrate ROI to clients and refine creative development for maximum impact. In 2024, agencies leveraging Ipsos's campaign measurement tools saw an average uplift of 10% in key performance indicators like brand recall and purchase intent.

- Audience Segmentation: Detailed demographic and psychographic profiles of media consumers.

- Media Consumption Analysis: Tracking of viewing, listening, and digital engagement across various platforms.

- Advertising Effectiveness Measurement: Pre-campaign testing and post-campaign evaluation of creative and media placements.

- Market Trend Identification: Insights into emerging media habits and content preferences shaping the landscape.

Small and Medium-sized Businesses (SMBs)

Ipsos recognizes the critical need for market intelligence among Small and Medium-sized Businesses (SMBs). While major corporations are a core focus, Ipsos extends its reach to smaller enterprises through offerings designed for accessibility and affordability. This includes leveraging digital platforms and delivering standardized research packages that provide essential market insights.

These tailored solutions empower SMBs by offering data-driven perspectives that would typically be out of reach due to budget constraints. For instance, in 2024, Ipsos reported a significant increase in engagement from the SMB sector on its digital research portals, indicating a growing demand for cost-effective market understanding.

- Accessible Digital Platforms: Ipsos provides user-friendly online tools for market research, enabling SMBs to gather data efficiently.

- Standardized Research Offerings: Pre-packaged research solutions are available, making advanced market analysis more attainable for smaller budgets.

- Cost-Effectiveness: These services democratize market insights, allowing SMBs to compete more effectively by understanding consumer behavior and market trends.

- Empowering Growth: By providing crucial data, Ipsos helps SMBs make informed strategic decisions, driving their growth and competitiveness in 2024 and beyond.

Ipsos serves a broad spectrum of clients, from global giants to burgeoning small businesses. This includes large corporations needing extensive market intelligence for international strategies and public sector entities relying on data to inform policy. Media companies and advertising agencies also form a significant segment, utilizing Ipsos's insights to optimize content and campaign effectiveness.

The healthcare and pharmaceutical sector represents a specialized area, demanding rigorous research methodologies for patient and physician insights. Even Small and Medium-sized Businesses (SMBs) are increasingly catered to through accessible digital platforms and cost-effective research packages. In 2024, Ipsos reported a notable uptick in SMB engagement, highlighting the growing need for democratized market data.

| Client Segment | Key Needs | 2024 Relevance/Data Point |

|---|---|---|

| Large Corporations | Global market intelligence, brand strategy | Partnered with numerous Fortune Global 500 companies |

| Government/Public Sector | Public opinion, policy effectiveness | Insights used for climate change policy understanding |

| Healthcare/Pharma | Patient journeys, market access | Global pharma market ~$1.6 trillion in 2024 |

| Media/Advertising | Audience behavior, campaign ROI | Helped a media conglomerate increase engagement by 15% |

| SMBs | Accessible market insights, cost-effectiveness | Increased engagement on digital research portals |

Cost Structure

Personnel and employee compensation represent the most significant cost for Ipsos, encompassing salaries, benefits, and ongoing training for its global workforce. This investment in human capital is crucial, as the company employs close to 20,000 individuals worldwide, including specialized roles like researchers, data scientists, and IT professionals.

Ipsos dedicates substantial resources to its technology and IT infrastructure, a critical component for its data-driven operations. These investments cover the development, ongoing maintenance, and crucial upgrades of its sophisticated data collection tools, analytical software, and proprietary technology platforms. This ongoing commitment ensures Ipsos remains at the forefront of market research technology.

Key expenditures within this category include significant outlays for cloud computing services, essential hardware acquisitions, and the licensing of specialized software. Furthermore, the depreciation of existing technology assets is factored in, especially as the company accelerates its integration of artificial intelligence (AI) across its services. For instance, in 2023, Ipsos reported technology and data processing costs of €750 million, reflecting the substantial investment in these areas.

Ipsos's cost structure heavily relies on data collection and panel management. This includes the significant expenses involved in acquiring new data, building and maintaining its research panels, and carrying out fieldwork. For instance, in 2024, the cost of recruiting and retaining participants for online panels, alongside compensating interviewers and offering incentives, represents a major operational outlay.

Ensuring the quality and breadth of their data is paramount, meaning Ipsos invests substantially in reaching diverse demographics and geographic regions. These efforts, which often involve tailored recruitment strategies and localized fieldwork operations, directly contribute to the overall data collection expenses, impacting the company's cost base throughout the year.

Sales, Marketing, and Administrative Overheads

Ipsos's cost structure heavily relies on sales, marketing, and administrative (SMA) overheads to drive client acquisition and maintain its global presence. These operational costs encompass a broad range of activities essential for business growth and client engagement.

Key components within SMA include expenses for direct sales efforts, extensive marketing campaigns, and public relations initiatives aimed at enhancing brand visibility and client trust. Furthermore, general administrative functions are critical for supporting the company's vast network of offices and employees worldwide.

- Sales and Marketing: Costs associated with client relationship management, advertising, and market research to identify new opportunities. In 2024, Ipsos continued to invest in digital marketing and data analytics to optimize campaign effectiveness.

- Administrative Overheads: This includes expenses for office leases, utilities, IT infrastructure, and corporate governance across its numerous international locations. For instance, the company operates in over 90 countries, necessitating significant administrative support.

- Travel and Personnel: Expenses related to employee travel for client meetings, conferences, and inter-office collaboration, alongside salaries and benefits for administrative and sales staff.

Acquisition and Integration Costs

Ipsos’s acquisition and integration costs are a significant component of its business model, reflecting its commitment to growth through strategic acquisitions. These expenses encompass due diligence, legal and advisory fees, and the often substantial costs associated with integrating acquired companies into Ipsos’s existing operations. For example, in 2023, Ipsos completed the acquisition of X2, a market research firm specializing in digital analytics, which involved considerable integration efforts to align systems and cultures.

These integration efforts can include harmonizing IT infrastructure, rebranding, and retraining staff, all of which contribute to the overall cost structure. Furthermore, the amortization of acquired intangible assets, such as customer lists and proprietary methodologies, also plays a role in these costs. These investments are viewed as essential for expanding Ipsos’s market reach, technological capabilities, and service offerings, ultimately driving long-term value.

- Due Diligence and Legal Fees: Costs incurred in evaluating potential acquisition targets and finalizing purchase agreements.

- Integration Expenses: Costs related to merging operations, systems, and personnel of acquired entities.

- Amortization of Intangible Assets: The systematic expensing of the value of acquired intangible assets over their useful lives.

- Strategic Growth Investment: These costs are directly tied to Ipsos's strategy of inorganic growth and market expansion.

Ipsos's cost structure is dominated by personnel expenses, reflecting its large global workforce of nearly 20,000 employees. Significant investments are also made in technology and IT infrastructure to support data collection and analysis. Data acquisition and panel management, along with sales, marketing, and administrative overheads, represent further substantial costs.

| Cost Category | Description | 2023/2024 Impact |

| Personnel | Salaries, benefits, training for global workforce | Largest cost component; ~20,000 employees |

| Technology & IT | Data collection tools, analytical software, AI integration | €750 million in 2023 for tech/data processing |

| Data Collection & Panels | Panel recruitment, fieldwork, participant compensation | Major outlay for online panels and interviewers in 2024 |

| Sales, Marketing & Admin (SMA) | Client acquisition, brand visibility, global operations support | Includes office leases, marketing campaigns, travel |

| Acquisition & Integration | Due diligence, legal fees, merging operations | Essential for expanding market reach and capabilities |

Revenue Streams

Ipsos primarily generates revenue through fees for customized research projects. Clients commission specific studies, with income earned on a per-project basis, reflecting the project's scope, complexity, and resource needs.

In 2024, Ipsos reported significant revenue from these project-based engagements, demonstrating their core business model. For instance, their global revenue for the full year 2023 was €2,107.1 million, with a substantial portion derived from these tailored client solutions.

Ipsos secures a steady income stream through subscriptions to its syndicated research reports, which offer valuable market insights and benchmarks. This includes ongoing tracking studies like brand health and public opinion, providing clients with continuous data. For instance, in 2023, Ipsos reported revenue from its Information Services segment, which largely comprises these syndicated data sales, contributing significantly to its overall financial performance.

Ipsos generates revenue through consulting and advisory services, extending beyond mere data delivery. This segment offers clients expert interpretation of research findings, strategic planning support, and guidance on implementation. For instance, in 2024, Ipsos reported significant revenue from these specialized engagements, reflecting the value clients place on actionable insights and strategic direction derived from their market research.

Licensing of Proprietary Tools and Methodologies

Ipsos generates revenue by licensing its proprietary research tools, software, and unique methodologies to clients and partners. This allows other organizations to utilize Ipsos's intellectual property for their own research initiatives, creating a recurring income stream through licensing fees.

This licensing model is particularly valuable for companies that want to enhance their internal market research capabilities without developing these tools from scratch. For example, a large consumer goods company might license a specific segmentation tool developed by Ipsos to better understand its customer base.

The financial benefits for Ipsos are clear, as it monetizes its significant investment in research and development. While specific figures for this particular revenue stream are not publicly detailed, Ipsos's overall revenue from its diverse service offerings reached €2.1 billion in 2023, indicating the potential scale of such intellectual property monetization.

- Intellectual Property Monetization: Leverages R&D investments into revenue-generating assets.

- Client Empowerment: Provides clients with advanced tools for their internal research needs.

- Recurring Revenue: Licensing fees create a predictable income stream for Ipsos.

- Market Reach Expansion: Extends the application of Ipsos's methodologies beyond direct service delivery.

Data Analytics and Value-Added Services

Ipsos leverages its extensive data by offering advanced analytics, moving beyond traditional survey reporting. These services, such as predictive modeling and market mix modeling, provide clients with deeper strategic insights and operational optimization tools.

These specialized data science applications are crucial for understanding complex market dynamics and consumer behavior. For instance, in 2024, Ipsos continued to invest in AI-driven analytics platforms to enhance the predictive power of its research.

- Predictive Modeling: Forecasting future market trends and consumer responses.

- Market Mix Modeling: Optimizing marketing spend across various channels for better ROI.

- Specialized Data Science: Tailored solutions for unique client challenges, often involving big data.

- Value-Added Insights: Transforming raw data into actionable business strategies.

Ipsos monetizes its extensive data through advanced analytics, offering clients predictive modeling and market mix modeling for deeper strategic insights. This focus on data science applications, including AI-driven platforms, helps clients optimize operations and understand complex market dynamics.

In 2024, Ipsos continued to enhance its analytical capabilities, reflecting a growing demand for sophisticated data interpretation. The company's overall revenue for the full year 2023 was €2,107.1 million, with a significant portion attributed to these value-added data services.

| Revenue Stream | Description | 2023 Revenue Contribution (Illustrative) |

|---|---|---|

| Customized Research Projects | Fees for specific client-commissioned studies. | High (Core business) |

| Syndicated Research Reports | Subscriptions to ongoing tracking studies and market insights. | Significant (Information Services) |

| Consulting & Advisory Services | Expert interpretation and strategic guidance based on research. | Growing |

| Licensing of Proprietary Tools | Monetizing R&D through tools and methodologies. | Potential for recurring revenue |

| Advanced Analytics Services | Predictive modeling, market mix modeling, AI-driven insights. | Increasingly important |

Business Model Canvas Data Sources

The Ipsos Business Model Canvas is built upon a foundation of robust market intelligence, internal operational data, and client-specific insights. These diverse sources ensure a comprehensive and accurate representation of our business strategy.