Ionis PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ionis Bundle

Unlock the critical external factors shaping Ionis’s trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to significant technological advancements, understand the forces that could impact their innovation and market share. Equip yourself with actionable intelligence to refine your investment strategy or competitive positioning. Download the full PESTLE analysis now and gain the foresight you need to thrive.

Political factors

Government healthcare spending policies are a critical factor for Ionis Pharmaceuticals. For instance, in the United States, the Centers for Medicare & Medicaid Services (CMS) plays a significant role in determining reimbursement rates for drugs, influencing market access and affordability for Ionis's therapies. Changes in national healthcare budgets, such as shifts in funding for rare disease treatments or the expansion or contraction of government-sponsored health programs, directly impact the potential uptake and commercial success of Ionis's high-cost specialty drugs.

The political landscape surrounding drug pricing is a key consideration for Ionis Pharmaceuticals. Regulations like the Inflation Reduction Act (IRA) in the United States, enacted in 2022, are beginning to impact how drug prices are negotiated for certain high-cost Medicare Part D drugs. This evolving framework could limit the revenue Ionis can generate from its approved therapies and influence pricing decisions for its extensive pipeline.

Globally, there's a persistent political push to control healthcare expenditures, which frequently translates into discussions and policy shifts aimed at improving drug affordability. For Ionis, this means potential scrutiny on the pricing of its innovative treatments, impacting both current sales and the economic viability of future product launches. For instance, the IRA’s initial price negotiation list, released in late 2023, included several high-spend Medicare drugs, signaling a new era of government intervention in drug pricing.

The stringency and efficiency of regulatory bodies like the FDA and EMA are paramount for Ionis. In 2024, the FDA continued its focus on accelerating the review of novel therapies, with many of Ionis's programs targeting rare diseases which often benefit from expedited pathways. However, the overall approval timelines can still vary significantly, impacting market entry.

Political influence can subtly shape regulatory processes, particularly for groundbreaking technologies like antisense oligonucleotides. While direct political interference is rare, shifts in government priorities or public health concerns can influence the speed and scrutiny applied to new drug applications, potentially affecting Ionis's development timelines.

Delays in regulatory approval, whether due to increased scrutiny or unexpected data requirements, pose a significant risk to Ionis's commercial success. For instance, a setback in the approval of a key drug candidate in 2024 could have directly impacted projected revenue streams and investor confidence.

International Trade Policies

Ionis Pharmaceuticals' global reach is significantly shaped by international trade policies. Agreements like the Trans-Pacific Partnership (TPP) or bilateral trade deals can either facilitate or hinder market access for its innovative therapies. For instance, changes in intellectual property (IP) protection laws in key markets directly impact Ionis's ability to secure patent rights and prevent unauthorized use of its RNA-targeted medicines, a critical factor for recouping substantial R&D investments.

Trade disputes and tariffs present tangible financial risks. A hypothetical 10% tariff on imported active pharmaceutical ingredients (APIs) from a major supplier could increase Ionis's cost of goods sold, potentially impacting profitability and pricing strategies for its approved drugs like SPINRAZA or future pipeline candidates. Such policies can also lead to supply chain disruptions, affecting the timely delivery of life-saving treatments to patients worldwide.

Navigating varying international IP landscapes is paramount. As of early 2024, the global pharmaceutical IP environment remains dynamic, with ongoing discussions around patent linkage and data exclusivity in regions such as the European Union and emerging markets. Ionis must continually monitor and adapt its strategies to comply with these evolving regulations, ensuring robust protection for its groundbreaking RNA-targeting technology.

- Global Trade Agreements: Ionis operates within a framework influenced by international trade pacts that can affect market entry and pricing.

- Intellectual Property Protection: The strength and consistency of IP laws across different countries are crucial for safeguarding Ionis's technological innovations and commercial viability.

- Tariffs and Trade Barriers: Imposed tariffs or trade disputes can inflate operational costs and create logistical challenges for a company with global supply chains and distribution networks.

- Regulatory Harmonization: Differences in regulatory approval processes and IP enforcement between nations add complexity to international market expansion strategies for Ionis's therapies.

Biotechnology Industry Lobbying Efforts

The biotechnology and pharmaceutical sectors are significant players in shaping healthcare policy through extensive lobbying. These efforts aim to influence legislation concerning drug pricing, research and development incentives, and regulatory pathways, directly impacting companies like Ionis Pharmaceuticals.

Ionis, either directly or through industry groups such as BIO (Biotechnology Innovation Organization), actively advocates for policies that support scientific advancement and ensure market access for its innovative therapies. For instance, in 2023, the BIO reported spending over $20 million on lobbying efforts, highlighting the substantial resources dedicated to influencing policy.

These advocacy activities are crucial for Ionis as they can help to:

- Protect intellectual property rights, ensuring patent protection for novel drug candidates.

- Promote favorable reimbursement policies, facilitating patient access to advanced treatments.

- Influence regulatory frameworks, streamlining the approval process for new therapies.

- Secure government funding for R&D, supporting the pipeline of future innovations.

Government healthcare spending and policy directly impact Ionis's revenue potential. For example, the Inflation Reduction Act (IRA) of 2022 introduced drug price negotiation for certain Medicare Part D drugs, a framework that began impacting high-spend drugs in late 2023 and could affect Ionis's pricing strategies for its pipeline. Shifts in national healthcare budgets, particularly for rare diseases, also influence market access and affordability of Ionis's specialty therapies.

What is included in the product

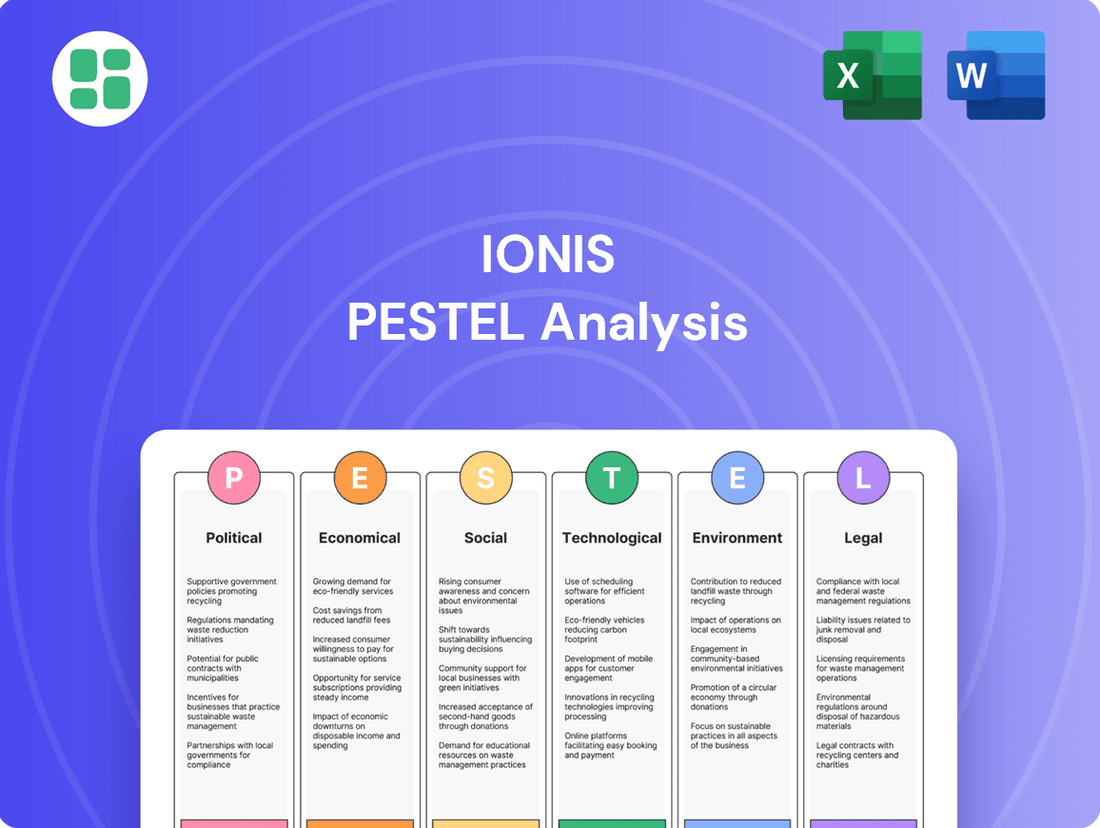

The Ionis PESTLE Analysis provides a comprehensive examination of external macro-environmental factors influencing the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a clear, actionable summary of external factors impacting Ionis, enabling focused strategic decision-making and mitigating the pain of information overload.

Economic factors

Global economic growth projections for 2024 and 2025 indicate a moderate but uneven recovery. The International Monetary Fund (IMF) projected global growth at 3.2% for 2024, with a slight uptick expected in 2025. However, persistent inflation and geopolitical tensions continue to pose recession risks, particularly in developed economies.

Economic slowdowns directly influence healthcare spending. For instance, during a recession, governments and individuals often reduce discretionary spending, which can include healthcare. This tightening of budgets may lead to slower adoption rates for new, high-cost therapies like those developed by Ionis Pharmaceuticals, impacting revenue streams.

Conversely, robust economic expansion generally correlates with increased healthcare investment and improved patient affordability. A healthy economy in key markets for Ionis, such as North America and Europe, could translate to greater patient access to its treatments and a stronger demand for its innovative RNA-targeted therapies.

Global healthcare spending is projected to reach $11.6 trillion by 2025, up from an estimated $10 trillion in 2023, according to Deloitte. This growth, driven by aging populations and advancements in medical technology, directly impacts the market for innovative therapies like those developed by Ionis Pharmaceuticals. Increased spending on neurological disorders and rare diseases, areas where Ionis focuses its research, signals expanding market opportunities for its antisense oligonucleotide therapies.

However, the landscape isn't without its challenges. Many countries are implementing cost-containment measures to manage rising healthcare budgets. For instance, in 2024, the US government continued to explore policies aimed at negotiating prescription drug prices. Such initiatives can put downward pressure on drug pricing and reimbursement rates, requiring Ionis to demonstrate clear value and cost-effectiveness for its treatments to secure favorable market access.

Rising inflation in 2024 and 2025 directly impacts Ionis Pharmaceuticals by increasing the costs associated with its core operations. This includes higher expenses for essential research and development activities, the manufacturing of its complex therapies, and the procurement of necessary raw materials. For instance, a projected inflation rate of 3.5% in the US for 2024 could significantly elevate these operational overheads.

Simultaneously, the economic environment of higher interest rates, potentially remaining elevated through 2025, presents a dual challenge. Ionis may face increased borrowing costs for crucial capital expenditures, such as expanding manufacturing facilities or investing in new research platforms. This increased cost of capital can dampen profitability and influence strategic decisions regarding the allocation of resources to its extensive drug development pipeline.

The combined effect of inflation and higher interest rates creates considerable economic pressure on the financial viability of Ionis's drug development projects. Projects with longer timelines and substantial upfront investment are particularly susceptible, as the present value of future returns diminishes with higher discount rates, potentially impacting the company's ability to fund and advance its most promising therapeutic candidates.

Access to Capital for Biotech Innovation

The biotechnology sector's reliance on external funding makes access to capital a critical economic factor for companies like Ionis. Venture capital, private equity, and public market financing are the lifeblood for the extensive research and development (R&D) and pipeline expansion that characterize biotech innovation. A strong investment climate directly fuels Ionis's ability to advance its numerous drug candidates and forge strategic collaborations.

In 2024, the biotech funding landscape showed signs of recovery after a challenging period. For instance, while venture capital deal volume saw fluctuations, the average deal size for later-stage biotech companies remained robust, indicating continued investor confidence in proven assets. Public market offerings, though sensitive to broader economic conditions, provided avenues for established companies to raise significant capital for pipeline advancement. For Ionis, this means that while securing funding for its diverse portfolio remains a priority, the overall health of these capital markets will directly influence the scale and speed of its R&D initiatives and potential strategic moves.

- Venture Capital Investment: In the first half of 2024, venture capital funding for biotech startups and growth-stage companies saw a notable uptick compared to the same period in 2023, with a particular focus on companies with strong clinical data.

- Public Market Access: Initial Public Offerings (IPOs) in the biotech sector in 2024 have generally achieved higher valuations than in the preceding year, reflecting renewed investor appetite for promising therapeutic areas.

- Strategic Partnerships: Ionis's ability to attract significant milestone payments and royalties from partnerships is directly tied to the financial health and strategic priorities of its larger pharmaceutical collaborators, who themselves are influenced by capital market conditions.

- Impact of Interest Rates: Rising interest rates in late 2023 and early 2024 have increased the cost of capital for all companies, potentially making debt financing less attractive and increasing the pressure on equity valuations for biotech firms.

Reimbursement Policies from Payers

Ionis Pharmaceuticals' financial health is heavily influenced by the reimbursement policies set by private and public health insurers. These policies directly impact how easily patients can access and afford Ionis's innovative therapies, such as those for rare genetic diseases. Favorable reimbursement is key to Ionis's revenue streams.

Conversely, restrictive reimbursement policies can create significant hurdles. This includes complex prior authorization processes, narrow networks, or outright denials of coverage, all of which can slow down market penetration and negatively affect sales figures. For example, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to refine coverage decisions for gene therapies, a sector where Ionis is active, making payer negotiations a critical ongoing task.

- Payer Influence: Private insurers and government programs like Medicare and Medicaid dictate coverage and co-pays for Ionis's drugs.

- Market Access Challenges: Unfavorable reimbursement can limit patient access and sales growth, as seen with ongoing debates around pricing for orphan drugs.

- Policy Evolution: Changes in payer policies, such as value-based agreements or preferred drug lists, can significantly alter Ionis's revenue projections for 2025.

Global economic growth is projected to be moderate in 2024 and 2025, with the IMF forecasting 3.2% growth for 2024. However, persistent inflation and geopolitical risks could dampen this expansion, impacting healthcare spending and investment in innovative therapies. Rising inflation in 2024 and 2025 directly increases Ionis's operational costs for R&D and manufacturing, potentially around 3.5% in the US. Higher interest rates through 2025 also elevate borrowing costs for capital expenditures, impacting profitability and strategic resource allocation for Ionis's drug development pipeline.

Preview Before You Purchase

Ionis PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Ionis PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You can trust that the detailed insights and strategic considerations presented are precisely what you'll gain access to immediately after your purchase.

Sociological factors

The world's population is getting older, with projections showing a significant increase in individuals over 65. By 2050, it's estimated that nearly 1.6 billion people will be in this age group, a substantial rise from around 700 million in 2020. This demographic shift directly fuels the demand for treatments targeting age-related conditions and chronic diseases, many of which Ionis Pharmaceuticals specializes in. For instance, the prevalence of cardiovascular diseases, a major focus for Ionis, is notably higher in older populations.

This growing segment of elderly patients represents a larger and more consistent market for Ionis's innovative therapies. The increasing incidence of conditions like Huntington's disease and various neurological disorders, often associated with aging, further expands the potential patient base for Ionis's antisense oligonucleotide technology. Understanding these epidemiological trends and demographic shifts is crucial for Ionis to effectively tailor its market strategies and R&D efforts, ensuring its pipeline aligns with the evolving healthcare needs of a global aging society.

Patient advocacy groups are powerful allies for companies like Ionis, especially in the realm of rare diseases. These organizations are instrumental in driving awareness and securing funding for crucial research, often directly impacting the pace of drug development. For instance, the Cystic Fibrosis Foundation’s venture philanthropy model, which invested heavily in early-stage research, led to the development of groundbreaking therapies. Ionis frequently partners with such groups to gain insights into patient needs, refine clinical trial designs, and ensure that new treatments become accessible to those who need them most. This collaboration can significantly speed up the journey from lab to patient, particularly for conditions with limited treatment options.

Public acceptance of genetic therapies, including Ionis's RNA-targeted treatments, is a significant factor. A 2024 survey indicated that while awareness of gene therapy is growing, a substantial portion of the public still harbors concerns about long-term safety and ethical implications. This sentiment directly affects patient recruitment for clinical trials and market adoption of approved therapies, making clear communication about Ionis's scientific advancements and patient outcomes essential for building trust.

Healthcare Access and Equity

Societal emphasis on healthcare access and equity directly impacts Ionis Pharmaceuticals' strategy for distributing and pricing its advanced therapies. As the world increasingly prioritizes reducing health disparities, Ionis must consider how its treatments reach diverse patient populations, including those in underserved regions. This focus can shape market entry strategies and necessitate flexible pricing models to ensure broader accessibility. For instance, in 2024, global health organizations continue to push for equitable access to innovative medicines, a trend that directly influences pharmaceutical companies like Ionis.

Initiatives designed to bridge healthcare gaps and guarantee fair access to new medical treatments can significantly affect Ionis's pricing strategies and overall market penetration. Companies are increasingly evaluated not just on therapeutic innovation but also on their commitment to global health equity. Ionis's ability to navigate these evolving societal expectations, particularly concerning affordability and availability in low- and middle-income countries, will be crucial for its long-term success and reputation. The World Health Organization's ongoing efforts to improve access to essential medicines in developing nations serve as a key benchmark.

- Ionis must adapt pricing models to address disparities in healthcare access, a growing global concern in 2024.

- Equitable distribution strategies are becoming paramount for pharmaceutical companies aiming for broad market reach and positive societal impact.

- Underserved populations and global health initiatives represent significant considerations for Ionis's market access and pricing decisions.

- The company's commitment to addressing healthcare equity can influence its brand perception and regulatory approvals in various markets.

Changing Lifestyles and Disease Patterns

Evolving lifestyles, driven by increased sedentary behavior and dietary shifts, are contributing to a rise in chronic diseases. This trend directly impacts the market for treatments, potentially expanding opportunities for companies like Ionis that focus on conditions such as cardiovascular disease and diabetes. For instance, the World Health Organization reported in 2024 that non-communicable diseases, largely lifestyle-related, accounted for an estimated 74% of all deaths globally.

Environmental factors also play a crucial role in shaping disease patterns. Air pollution, for example, is increasingly linked to respiratory and cardiovascular issues, creating a need for novel therapeutic interventions. Global health trends, including the growing prevalence of neurological disorders, present significant opportunities for Ionis's antisense technology. The Alzheimer's Association noted in 2024 that over 6 million Americans were living with Alzheimer's disease, a number projected to nearly double by 2050.

- Increased sedentary lifestyles contribute to a higher incidence of metabolic disorders, a key area for Ionis's research.

- Environmental factors like air pollution are being linked to a greater burden of respiratory and cardiovascular diseases, expanding potential markets.

- The rising global prevalence of neurological conditions, such as Alzheimer's and Parkinson's, creates significant demand for innovative treatments.

- Ionis's strategic alignment with these emerging public health needs through its R&D pipeline is crucial for future growth.

Societal attitudes towards health and wellness are shifting, with a greater emphasis on preventative care and personalized medicine. This inclination favors companies like Ionis, which develop targeted therapies for specific genetic conditions. Furthermore, the increasing global focus on mental health and neurological disorders, such as the projected rise in Alzheimer's cases to over 10 million by 2050 in the US alone, directly aligns with Ionis's research in these areas.

The growing influence of patient advocacy groups is undeniable, as seen with organizations like the Cystic Fibrosis Foundation's successful investment models. These groups are vital for raising awareness, securing research funding, and influencing regulatory pathways, which can accelerate the market entry of innovative treatments like those from Ionis. Public perception of genetic therapies, while improving, still requires clear communication regarding safety and ethical considerations, as highlighted by ongoing public surveys in 2024.

Societal expectations for healthcare access and equity are increasingly shaping pharmaceutical strategies. Ionis must navigate these demands by considering accessible pricing models and equitable distribution, particularly as global health organizations continue to advocate for reduced health disparities. This commitment to global health equity is becoming a key differentiator, influencing brand perception and market access.

Technological factors

Continuous innovation in RNA-targeted therapeutics, including improvements in antisense oligonucleotide (ASO) chemistry and delivery systems, directly impacts Ionis Pharmaceuticals' core business. For instance, advancements in lipid nanoparticle (LNP) delivery, a key area of research for many RNA-based therapies, are crucial for enhancing drug efficacy and reducing off-target effects. Ionis's commitment to ASO chemistry, evidenced by their ongoing research and development pipeline, positions them to capitalize on these evolving technological landscapes.

Staying at the forefront of these advancements is essential for maintaining a competitive edge and expanding the applicability of Ionis's platform. This includes research into new targetable RNA sequences and mechanisms, a critical factor in drug discovery. As of early 2024, the global RNA therapeutics market is projected to grow significantly, with ASOs representing a substantial segment, underscoring the importance of technological leadership for companies like Ionis.

The competitive landscape in antisense technology is intensifying, with new biotech firms and established pharmaceutical giants actively developing competing RNA-based therapies and alternative treatment modalities. This dynamic environment presents a significant technological challenge for Ionis Pharmaceuticals. For instance, in 2024, the global RNA therapeutics market was valued at approximately $9.5 billion and is projected to grow substantially, indicating robust investment and innovation from various players.

To maintain its leadership position, Ionis must relentlessly innovate and clearly differentiate its proprietary antisense technology from emerging competitors. This includes not only refining its existing platform but also exploring novel delivery mechanisms and target engagement strategies. Keeping a close watch on competitor pipelines, such as those focusing on siRNA or CRISPR-based gene editing, and understanding their technological breakthroughs is crucial for strategic planning and maintaining a competitive edge.

The increasing integration of digital health solutions, like wearable devices and telehealth platforms, presents significant opportunities for Ionis. These technologies can revolutionize patient monitoring within clinical trials, leading to more efficient data collection and potentially faster drug development timelines. For instance, the global digital health market was valued at approximately $211 billion in 2023 and is projected to grow substantially, indicating a strong trend towards data-driven healthcare.

Advanced data analytics, powered by big data, offers Ionis the capability to accelerate target identification and refine patient stratification for its therapeutic programs. By analyzing vast datasets from real-world evidence, the company can gain deeper insights into disease progression and patient responses, optimizing the selection of participants for clinical studies and improving the likelihood of success. This analytical power is crucial in the competitive landscape of genetic medicine.

Biomanufacturing Innovations

Advances in biomanufacturing, including continuous manufacturing and automation, are significantly improving the efficiency and cost-effectiveness of producing RNA therapeutics like those developed by Ionis. These technological leaps are crucial for scaling up production to meet commercial demand and lowering the overall cost of goods, ultimately ensuring a more reliable and timely supply chain for these life-changing treatments.

Ionis, like many in the biotech sector, benefits directly from these innovations. For instance, the adoption of single-use bioreactors and advanced single-pass tangential flow filtration (SPTFF) systems can reduce batch times and increase yield. By mid-2024, the biopharmaceutical industry saw substantial investment in advanced manufacturing technologies, with reports indicating a significant portion of capital expenditure directed towards automation and process intensification to meet growing market needs.

- Enhanced Efficiency: Continuous biomanufacturing can reduce processing times by up to 50% compared to traditional batch methods.

- Cost Reduction: Automation and improved purification techniques can lower manufacturing costs per dose, making therapies more accessible.

- Scalability: Innovations facilitate the rapid scaling of production to meet the demands of a growing patient population for Ionis's drug pipeline.

- Quality Control: Advanced process analytical technology (PAT) integrated into automated systems improves real-time monitoring and ensures consistent product quality.

AI and Machine Learning in Drug Discovery

AI and machine learning are revolutionizing drug discovery, offering Ionis significant advantages. These technologies can pinpoint new drug targets and forecast how effective and safe potential compounds might be. For instance, in 2024, AI platforms are being used to analyze vast biological datasets, potentially cutting down the years typically spent on early-stage research.

By integrating AI/ML, Ionis can accelerate its development pipeline, leading to faster market entry for new therapies. This also extends to optimizing clinical trials, making them more efficient and increasing the likelihood of positive outcomes. The global AI in drug discovery market was valued at approximately $1.5 billion in 2023 and is projected to grow substantially, indicating strong industry adoption.

- Target Identification: AI algorithms can sift through genomic and proteomic data to identify novel disease targets more rapidly than traditional methods.

- Compound Screening: ML models predict the efficacy and toxicity of drug candidates, reducing the number of compounds that need to be synthesized and tested experimentally.

- Clinical Trial Optimization: AI can aid in patient selection, trial site selection, and predicting trial outcomes, potentially lowering costs and improving success rates.

- Accelerated Timelines: Early adoption and effective implementation of AI/ML can shave years off the typical 10-15 year drug development cycle.

Technological advancements in RNA therapeutics, particularly in antisense oligonucleotide (ASO) chemistry and delivery systems, are fundamental to Ionis Pharmaceuticals' success. Innovations like lipid nanoparticle (LNP) delivery are crucial for improving drug efficacy and minimizing side effects, a key focus for Ionis's R&D. The global RNA therapeutics market, a significant portion of which is ASOs, was valued at approximately $9.5 billion in 2024, highlighting the competitive and rapidly evolving technological landscape.

Legal factors

Ionis Pharmaceuticals' business model heavily relies on robust patent protection for its innovative antisense technology and specific drug candidates. The duration of market exclusivity granted by these patents directly influences Ionis's revenue potential and its ability to maintain market leadership. For instance, as of early 2024, Ionis has a strong portfolio of patents covering its antisense oligonucleotide (ASO) technology, with many key drug candidates protected by patents extending well into the 2030s.

The legal landscape governing intellectual property rights is a critical factor. Changes in patent law or differing interpretations in various jurisdictions can significantly affect Ionis's ability to enforce its rights and prevent competitors from entering the market with similar technologies. The company actively monitors and engages with evolving IP regulations globally to safeguard its innovations.

Litigation related to patent infringement poses a persistent risk for Ionis. Protecting its intellectual property often involves defending its patents against challenges from competitors or pursuing legal action against those who infringe. For example, the pharmaceutical industry frequently sees patent disputes, and Ionis, like its peers, must allocate resources to manage these legal complexities and protect its market share.

Ionis Pharmaceuticals navigates a complex web of legal and ethical frameworks for its clinical trials. These regulations, covering everything from informed patient consent to rigorous data safety monitoring and trial design, are paramount for Ionis's operations. For instance, the U.S. Food and Drug Administration (FDA) mandates strict adherence to Good Clinical Practice (GCP) guidelines, which are continuously updated.

Maintaining compliance across diverse global markets presents a significant challenge, as regulatory landscapes vary. Non-compliance can lead to costly trial delays, substantial fines, or even outright suspension of research, impacting Ionis's product pipeline and financial performance. In 2023, the pharmaceutical industry saw increased regulatory scrutiny, with the FDA issuing warning letters for protocol deviations in several clinical studies.

Ethical considerations, particularly for Ionis's innovative genetic therapies, are under intense scrutiny. Ensuring patient well-being and the responsible advancement of novel treatments requires constant vigilance and adaptation to evolving ethical standards. The ethical review boards overseeing Ionis's trials play a crucial role in safeguarding participants and upholding the integrity of the research process.

Ionis Pharmaceuticals must strictly adhere to global data privacy regulations like Europe's GDPR and the US's HIPAA. This is paramount due to Ionis's access to sensitive patient information gathered during clinical trials and ongoing market surveillance. Failure to comply can result in substantial fines and significant damage to the company's reputation.

Maintaining robust and secure data management systems represents a considerable legal and operational challenge for Ionis. For instance, the GDPR mandates specific consent mechanisms and data breach notification protocols, impacting how Ionis collects and stores patient data. The financial implications of a data breach could be severe, with GDPR fines potentially reaching up to 4% of annual global turnover or €20 million, whichever is higher.

Product Liability and Malpractice Lawsuits

As a biopharmaceutical company, Ionis Pharmaceuticals is exposed to product liability and malpractice lawsuits. These arise if its gene-silencing therapies cause unexpected adverse events or if there are manufacturing defects. Such legal actions can lead to significant financial damages and reputational harm.

For instance, the pharmaceutical industry, in general, has seen substantial settlements. In 2023, pharmaceutical companies paid billions in settlements related to product liability claims, underscoring the financial risks involved. Ionis must maintain robust pharmacovigilance systems to monitor drug safety closely and secure comprehensive insurance coverage to mitigate these potential liabilities.

- Product Liability Risk: Potential claims from patients experiencing unforeseen side effects from Ionis's therapies.

- Malpractice Exposure: Lawsuits stemming from alleged negligence in drug development or manufacturing processes.

- Financial Impact: Significant penalties, legal defense costs, and potential loss of market trust.

- Mitigation Strategies: Comprehensive insurance, rigorous quality control, and proactive pharmacovigilance are crucial.

Antitrust Regulations

Antitrust regulations are crucial for Ionis, as they shape how the company can grow through mergers, acquisitions, and strategic collaborations in the pharmaceutical sector. These laws aim to prevent any single entity from gaining too much market power, which could stifle competition and innovation. For instance, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) in the US, along with similar bodies globally, scrutinize deals for potential antitrust concerns. In 2024, the FTC continued its aggressive stance on antitrust enforcement, reviewing a significant number of healthcare industry transactions, with a particular focus on potential market concentration.

Ionis's partnerships, such as its ongoing collaborations with Biogen and AstraZeneca, must navigate these antitrust frameworks to ensure they do not lead to monopolistic practices. Any future mergers or acquisitions by Ionis would face rigorous review to assess their impact on market competition. For example, if Ionis were to acquire a company with a dominant position in a specific therapeutic area, regulators would closely examine whether this move would limit patient access to treatments or drive up prices. The ongoing trend of increased regulatory scrutiny in 2024 and projected into 2025 means that Ionis must proactively plan for compliance.

- Regulatory Oversight: Antitrust laws are enforced by agencies like the FTC and DOJ, impacting Ionis's M&A and partnership strategies.

- Market Competition: Compliance ensures Ionis's actions do not create monopolies or hinder competition, protecting patient access and pricing.

- Enforcement Trends: Increased antitrust enforcement in 2024, particularly in healthcare, necessitates careful navigation of regulatory requirements for Ionis's growth plans.

- Strategic Impact: Changes in antitrust enforcement can directly affect Ionis's ability to form alliances and expand its market presence through acquisitions.

Ionis Pharmaceuticals operates within a stringent legal framework that governs drug development, intellectual property, and business practices. Key legal factors include patent protection for its antisense oligonucleotide technology, which is crucial for market exclusivity and revenue generation, with many patents extending into the 2030s. The company must also navigate complex global regulations for clinical trials, ensuring patient safety and data integrity, as exemplified by the FDA's Good Clinical Practice guidelines.

Furthermore, Ionis faces risks from product liability and malpractice lawsuits, a common concern in the pharmaceutical industry where billions are paid in settlements annually, as seen in 2023. Adherence to data privacy laws like GDPR and HIPAA is also critical, with potential fines for non-compliance reaching significant percentages of global turnover. Antitrust regulations, actively enforced by bodies like the FTC, shape Ionis's M&A and partnership strategies, with increased scrutiny in the healthcare sector observed in 2024.

| Legal Factor | Impact on Ionis | Mitigation/Consideration |

| Intellectual Property (Patents) | Secures market exclusivity for ASO technology and drug candidates. Key patents extend into the 2030s. | Active monitoring of IP laws, legal defense against infringement. |

| Clinical Trial Regulations | Ensures patient safety and data integrity, impacting trial timelines and approval processes. | Strict adherence to GCP, continuous monitoring of regulatory updates. |

| Product Liability & Malpractice | Risk of financial damages and reputational harm from adverse drug events or manufacturing defects. | Robust pharmacovigilance, comprehensive insurance, rigorous quality control. |

| Data Privacy (GDPR, HIPAA) | Requires secure patient data handling; non-compliance incurs substantial fines (e.g., up to 4% of global turnover for GDPR). | Implementing secure data management systems, ensuring proper consent mechanisms. |

| Antitrust Regulations | Governs M&A and partnerships, preventing monopolistic practices. Increased enforcement in healthcare in 2024. | Strategic planning for compliance, careful review of transactions. |

Environmental factors

Ionis Pharmaceuticals, like its peers in the biotech sector, is under growing pressure to implement greener manufacturing processes. This involves reducing waste, cutting energy use, and ensuring raw materials are sourced responsibly. For instance, in 2024, the pharmaceutical industry saw a significant push for circular economy principles in production, aiming to cut waste by 20% by 2030.

Adopting these sustainable practices isn't just about environmental stewardship; it's also a strategic move. Companies that can showcase a strong commitment to environmental, social, and governance (ESG) principles are increasingly attractive to investors. By Q3 2025, ESG-focused funds are projected to manage over $3 trillion globally, highlighting the financial incentive for Ionis to prioritize sustainability.

The environmental footprint of global clinical trials is becoming a significant concern for companies like Ionis. Factors such as extensive travel for site monitoring and patient recruitment, the substantial waste generated from single-use medical supplies, and the energy demands of maintaining trial sites all contribute to this impact. For instance, a 2024 report by the Sustainable Clinical Trials initiative highlighted that the healthcare sector's carbon footprint is comparable to that of the aviation industry, with clinical trials being a notable contributor.

Ionis must proactively assess and develop strategies to lessen these environmental effects as part of its corporate sustainability goals. This includes optimizing logistics for the transport of investigational medicinal products and other trial materials to minimize emissions, as well as exploring waste reduction and recycling programs at trial locations. The company's supply chain for clinical trial materials, which often involves temperature-controlled shipping and specialized packaging, presents a key area for environmental improvement.

Ionis Pharmaceuticals relies on a global supply chain for critical raw materials, manufacturing components, and the distribution of its life-saving drugs. This intricate network is increasingly exposed to disruptions from extreme weather events, such as hurricanes, floods, and prolonged droughts, which are becoming more frequent and intense due to climate change.

These climate-related disruptions pose a significant risk to Ionis's operations, potentially leading to manufacturing delays and shortages of essential medicines. For instance, the average annual cost of natural disasters in the US alone has seen a substantial increase, with 2023 witnessing over 25 major weather and climate events costing at least $1 billion each, according to NOAA data.

To mitigate these risks and ensure business continuity, Ionis must prioritize supply chain resilience. This involves proactive measures such as diversifying suppliers across different geographical regions and conducting thorough risk assessments to identify and address potential vulnerabilities before they impact operations.

Biopharmaceutical Waste Management

The biopharmaceutical industry, including companies like Ionis, faces stringent environmental regulations regarding the disposal of hazardous waste generated throughout its operations. This waste can include chemical byproducts from drug synthesis and biological materials from research. Proper management is crucial to prevent environmental contamination and ensure regulatory compliance, with significant penalties for non-adherence.

Ionis must navigate a complex web of rules governing the safe handling, treatment, and disposal of this specialized waste. For instance, the Resource Conservation and Recovery Act (RCRA) in the United States sets standards for hazardous waste management. In 2023, the global biopharmaceutical waste management market was valued at approximately USD 12.5 billion, and it’s projected to grow, reflecting the increasing focus on these environmental aspects.

- Regulatory Compliance: Ionis must adhere to national and international regulations like RCRA and the European Waste Framework Directive to manage chemical and biological waste safely.

- Environmental Protection: Responsible waste management is vital to prevent the release of harmful substances into soil, water, and air, safeguarding ecosystems and public health.

- Operational Costs: Implementing robust waste management systems incurs costs for specialized disposal services, training, and infrastructure, impacting overall operational expenses.

- Market Trends: The increasing emphasis on sustainability is driving demand for innovative and eco-friendly waste treatment technologies within the biopharmaceutical sector.

ESG Investor Pressure

The increasing emphasis on Environmental, Social, and Governance (ESG) criteria by investors significantly shapes corporate actions, particularly concerning environmental responsibility. Ionis Pharmaceuticals' capacity to secure and maintain investment from ESG-minded investors hinges on its clarity and effectiveness in environmental management.

A robust ESG profile can enhance Ionis's access to funding and diminish the perceived risk associated with its investments. For instance, as of early 2024, the global ESG investing market is projected to reach over $50 trillion, underscoring the substantial capital pool influenced by these factors.

- Investor Demand: A growing number of institutional investors, including major pension funds and asset managers, are integrating ESG metrics into their investment decisions.

- Capital Access: Companies with strong ESG ratings often find it easier and cheaper to raise capital, as they are viewed as less risky and more sustainable.

- Reputational Benefits: Demonstrating strong environmental stewardship can bolster Ionis's brand image and appeal to a wider investor base.

- Regulatory Alignment: Proactive environmental management can position Ionis favorably in anticipation of evolving environmental regulations.

Ionis Pharmaceuticals, like its peers, faces increasing pressure to adopt greener manufacturing processes, focusing on waste reduction and energy efficiency. The pharmaceutical industry's collective push for circular economy principles aims for a 20% waste reduction by 2030, a goal Ionis must align with.

The environmental impact of clinical trials, including travel and waste from single-use supplies, is a growing concern. In 2024, reports indicated the healthcare sector's carbon footprint rivals aviation, with trials being a significant contributor.

Climate change poses risks to Ionis's global supply chain through extreme weather events, which caused over 25 major U.S. disasters exceeding $1 billion each in 2023 alone.

Stringent regulations govern the disposal of hazardous waste in biopharma, with the global waste management market valued at $12.5 billion in 2023, highlighting compliance costs and market trends towards eco-friendly solutions.

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from official government publications, reputable financial institutions, and leading market research firms. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and socio-cultural trends to ensure comprehensive insights.