Ionis Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ionis Bundle

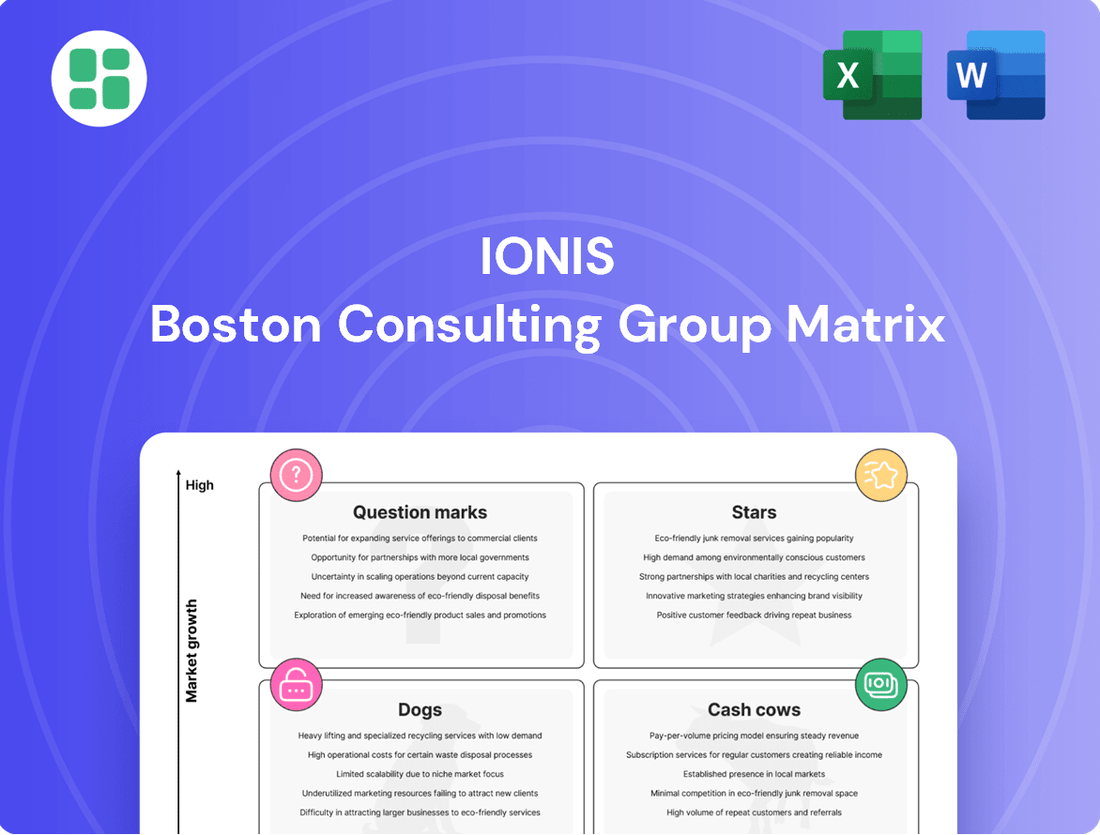

Uncover the strategic potential within this company's product portfolio using the BCG Matrix. See which products are poised for growth (Stars), which are generating consistent revenue (Cash Cows), which require careful consideration (Question Marks), and which may be underperforming (Dogs).

This glimpse into the BCG Matrix is just the beginning. Purchase the full report for a comprehensive quadrant breakdown, actionable insights, and a clear roadmap to optimize your investment and product development strategies.

Stars

WAINUA, co-developed with AstraZeneca, represents a significant advancement in treating ATTRv-PN, a rare and debilitating neurological disorder. Its approval in the US in December 2023 and subsequent launch in early 2024 marked a pivotal moment for patients seeking accessible treatment options.

As the sole self-administered auto-injector therapy for ATTRv-PN, WAINUA offers unparalleled convenience and patient empowerment, a key differentiator in the market. This unique delivery method addresses a critical unmet need, allowing patients to manage their condition from the comfort of their homes.

The drug has demonstrated robust commercial momentum, exhibiting substantial sequential sales growth throughout 2024 and into Q1 2025. Analysts project WAINUA's peak sales to reach approximately $1.8 billion by 2039, underscoring its strong market adoption and promising long-term growth trajectory in a therapeutic area with significant unmet medical needs.

TRYNGOLZA (olezarsen), Ionis's inaugural independent product, secured FDA approval in December 2024 for familial chylomicronemia syndrome (FCS). This rare genetic disorder, previously lacking U.S. approved treatments, marks a significant milestone for Ionis. The drug's launch in late 2024 positions Ionis as a fully integrated commercial-stage biotech, directly generating product revenue.

TRYNGOLZA's early performance is promising, with anticipated European approval and potential expansion into the broader severe hypertriglyceridemia (sHTG) market. This strategic move could significantly bolster Ionis's market presence and revenue streams in the coming years.

Donidalorsen is poised to enter the market in 2025 as a novel RNA-targeted therapy for hereditary angioedema (HAE), aiming to be the first prophylactic treatment of its kind. Its PDUFA date is set for August 21, 2025, marking a critical milestone.

Phase 3 clinical trials have shown remarkable results, with donidalorsen achieving substantial and consistent decreases in HAE attack frequency. Patients who transitioned to donidalorsen from existing treatments experienced even greater reductions in attacks and expressed a strong preference for the new therapy.

This promising profile positions donidalorsen as a strong contender for market leadership within the HAE therapeutic landscape, addressing a significant unmet need for patients experiencing breakthrough attacks.

Olezarsen for Severe Hypertriglyceridemia (sHTG)

Olezarsen, beyond its existing indication for familial chylomicronemia syndrome (FCS), is showing promise in Phase 3 trials for severe hypertriglyceridemia (sHTG). This condition impacts a much broader patient population, estimated to be in the millions.

The recent positive topline results from the ESSENCE study, which demonstrated significant triglyceride reductions in patients with moderate hypertriglyceridemia, strongly support olezarsen's potential in the sHTG market.

Key pivotal Phase 3 data for sHTG are anticipated in Q3 2025. Approval following these results could unlock substantial market expansion and revenue growth for the drug.

- Olezarsen's sHTG trials are in Phase 3.

- ESSENCE study showed significant triglyceride reduction.

- Pivotal Phase 3 data for sHTG expected Q3 2025.

- Potential for significant market expansion and revenue growth.

ION582 for Angelman Syndrome

ION582 is a key asset in Ionis's pipeline, targeting Angelman syndrome, a debilitating neurological disorder. The company anticipates initiating Phase 3 trials for ION582 in the first half of 2025, a significant step given the current lack of disease-modifying treatments.

Positive Phase 2 data and a clear path forward with the FDA for the Phase 3 study design highlight ION582's strong potential. This represents a substantial opportunity within the rare pediatric disease space, addressing a critical unmet medical need.

ION582 is positioned to be a major contributor to Ionis's neurology franchise, reflecting its strategic importance.

- Program: ION582 for Angelman Syndrome

- Development Stage: Poised for Phase 3 in H1 2025

- Market Opportunity: High unmet need in a rare pediatric neurodevelopmental disorder

- Strategic Importance: Future growth driver for Ionis's neurology franchise

Stars in the BCG matrix represent products with high market share in a high-growth market. These are typically the most promising products, demanding significant investment to maintain their growth trajectory and market dominance. For Ionis, WAINUA and olezarsen (TRYNGOLZA) in its expanded indication for severe hypertriglyceridemia (sHTG) are prime examples of potential Stars. Their strong clinical data, market potential, and ongoing development efforts position them as key future revenue drivers.

| Product | Indication | Market Growth | Market Share | Projected Peak Sales (USD Billion) |

|---|---|---|---|---|

| WAINUA | ATTRv-PN | High | Sole self-administered auto-injector | ~1.8 (by 2039) |

| Olezarsen (sHTG) | Severe Hypertriglyceridemia | High (millions of patients) | Emerging | Significant expansion potential |

What is included in the product

The Ionis BCG Matrix offers a strategic overview of its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

Clear visualization of product portfolio performance for strategic decision-making.

Cash Cows

SPINRAZA, developed in partnership with Biogen, continues to be a robust cash cow for Ionis. In 2024, it generated global sales of $1.6 billion, with Ionis receiving $216 million in royalty revenue.

Despite modest sales growth, SPINRAZA's position as the pioneering treatment for spinal muscular atrophy (SMA) guarantees a steady and significant income stream. The potential approval of a higher-dose formulation in the U.S. and EU could further solidify its long-term market standing and cash flow generation.

QALSODY, developed in partnership with Biogen, represents a significant advancement in treating SOD1-ALS, a rare genetic form of the disease. It secured accelerated approval, contributing to Ionis's royalty revenue. In 2024, QALSODY generated $32 million in global sales, demonstrating its market presence.

While QALSODY serves a specialized patient population, its sales trajectory in 2024 has been positive. Recent approvals in key markets like China and Japan further solidify its position as a stable, albeit modest, revenue generator for Ionis. This product stream requires minimal direct commercial investment from Ionis, making it a valuable component of their portfolio.

Tegsedi (inotersen) represents a mature product for Ionis, holding its ground in the transthyretin amyloidosis with polyneuropathy (ATTRv-PN) market. Despite the emergence of newer, self-administered options like WAINUA, Tegsedi continues to generate consistent revenue, likely from patients who are already established on the therapy or prefer its administration profile.

While specific 2024 sales figures for Tegsedi aren't publicly broken out, its ongoing market presence indicates it functions as a stable cash generator for Ionis. This revenue stream, even if low-growth, supports the company's broader portfolio, particularly as WAINUA captures new patient segments.

Established Licensing Agreements

Established licensing agreements represent a significant Cash Cow for Ionis Pharmaceuticals. These collaborations, often involving substantial upfront payments and ongoing royalties, provide a reliable and predictable revenue stream. For instance, Ionis has historically benefited from partnerships that allow other companies to develop and commercialize its innovative therapies, thereby generating consistent income that fuels further research and development.

These licensing deals are crucial for Ionis's financial stability. They allow the company to monetize its extensive intellectual property without bearing the full cost and risk of global commercialization for every asset. This strategy diversifies revenue sources beyond direct product sales, which is particularly important for a company with a robust pipeline still in development.

- Revenue Generation Ionis consistently generates substantial R&D revenue and upfront payments from its numerous licensing and collaboration agreements with pharmaceutical partners.

- Predictable Income Stream Agreements, such as those with partners for therapies like sapablursen, provide a stable and predictable stream of non-product revenue.

- Pipeline Funding This diversified revenue base allows Ionis to fund its extensive pipeline while maintaining financial flexibility.

Proprietary Antisense Technology Platform

Ionis's proprietary antisense technology platform is a significant cash cow, serving as the engine for its drug discovery and development. This foundational platform consistently generates new drug candidates, fueling a robust pipeline and attracting valuable partnerships. The platform's proven track record, evidenced by multiple FDA-approved drugs like Spinraza and Tegsedi, validates its long-term economic viability and ongoing appeal to collaborators.

The sustained interest from partners, such as its collaboration with AstraZeneca for cardiovascular diseases and Biogen for neurological disorders, underscores the platform's enduring value. This intellectual property provides Ionis with a distinct competitive advantage, ensuring a continuous stream of value creation through licensing deals and milestone payments.

- Antisense Technology: The core platform enabling the development of novel therapeutics.

- Approved Drugs: Multiple marketed products validate the platform's efficacy and commercial potential.

- Partnerships: Lucrative collaborations with major pharmaceutical companies demonstrate the platform's value and market demand.

- Pipeline Generation: The platform's ability to consistently create new drug candidates ensures future revenue streams.

Cash cows in Ionis's portfolio are products that generate consistent, significant revenue with minimal ongoing investment, funding further research and development. SPINRAZA and Tegsedi, along with established licensing agreements and the core antisense technology platform, represent these vital revenue streams.

| Product/Asset | 2024 Revenue (Ionis Share) | Status | Key Driver |

|---|---|---|---|

| SPINRAZA | $216 million (royalties) | Mature, stable | Pioneering SMA treatment |

| QALSODY | $32 million (global sales, Ionis royalties) | Growth potential | SOD1-ALS treatment, new market approvals |

| Tegsedi | Undisclosed (consistent revenue) | Mature | ATTRv-PN market presence |

| Licensing Agreements | Significant, predictable | Ongoing | Monetizing intellectual property |

| Antisense Platform | Drives partnerships & pipeline | Foundational | Enables new drug development |

Delivered as Shown

Ionis BCG Matrix

The Ionis BCG Matrix preview you're viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks or demo content, just a professional and actionable strategic tool ready for immediate implementation in your business planning. You'll gain access to a comprehensive analysis designed for clarity and impactful decision-making, ensuring you get exactly what you need to navigate your product portfolio effectively. This preview guarantees that the final, unedited report will be delivered directly to you, empowering your strategic insights without any hidden surprises.

Dogs

Ionis Pharmaceuticals, like many biotechs, manages a pipeline with early-stage programs that may not progress. These often represent investments in research that don't yield marketable drugs due to efficacy, safety, or strategic shifts. For instance, in 2023, Ionis reported significant R&D expenses, a portion of which would naturally be allocated to these less successful early endeavors.

Programs targeting highly competitive or saturated markets, where Ionis's treatments don't offer a clear advantage, face significant hurdles. For instance, in the crowded cardiovascular disease market, where numerous generics and established brands exist, a new drug with only incremental benefits would struggle to capture market share. The cost of marketing and sales in such environments can easily outweigh the potential revenue, making these programs financially precarious.

Ionis Pharmaceuticals, while targeting unmet needs, can encounter challenges with ultra-rare diseases. These indications often mean very few patients, driving up development and manufacturing expenses significantly. If a drug for such a condition doesn't show truly outstanding results or faces hurdles getting reimbursed, its ability to make money becomes uncertain.

The substantial investment required for these niche therapies might not be justified by the potential revenue, pushing such programs into the 'dog' category of the BCG matrix. For instance, a gene therapy targeting a condition with only a few hundred patients globally, costing hundreds of millions to develop, could struggle to recoup its costs even with premium pricing.

Investigational Drugs with Negative or Inconclusive Trial Results

Investigational drugs that falter in clinical trials, failing to meet crucial endpoints or exhibiting concerning safety issues, are categorized as dogs within the Ionis BCG Matrix. These setbacks often trigger program discontinuation or lengthy delays, necessitating significant financial write-offs as the invested capital will not translate into a marketable product.

For instance, in 2024, a significant number of pharmaceutical companies faced challenges with pipeline candidates. While specific drug names are often confidential until later stages, the overall trend indicates that a substantial portion of early-stage drug development does not reach commercialization. Data from industry analyses in 2024 suggested that approximately 90% of drugs entering clinical trials do not ultimately receive regulatory approval, with failure rates being particularly high in Phase II and Phase III trials.

- Failure to meet primary endpoints in clinical trials is a key indicator for a dog.

- Unfavorable safety profiles can also relegate investigational drugs to the dog category.

- Such failures result in substantial financial write-offs, impacting a company's bottom line.

- These discontinued programs represent investments that do not yield commercial products, affecting future revenue projections.

Older Assets Facing Patent Expiry and Generic Competition

Older assets in Ionis's portfolio, particularly those nearing patent expiry, are vulnerable to becoming 'dogs' in the BCG matrix. As patents lapse, generic versions of these drugs enter the market, drastically cutting into sales and profitability. This is a common lifecycle challenge for pharmaceutical companies.

While Ionis's current pipeline focuses on newer therapies, any established but less dominant drug facing patent cliffs would see its market share and revenue significantly diminish. For instance, while Tegsedi's patent expiry is further out, the principle applies to any older, less competitive asset. By 2024, the market landscape for many older drugs has already shifted dramatically due to generic entry.

- Patent Expiry Impact: Drugs losing patent protection face immediate price erosion and increased competition.

- Generic Competition: The entry of generics can reduce a drug's revenue by over 80% within its first year on the market.

- Revenue Decline: Older, less differentiated drugs are particularly susceptible to becoming 'dogs' as their revenue streams shrink.

- Strategic Shift: Companies like Ionis must manage these older assets while investing in newer, high-growth potential therapies to maintain portfolio health.

Dogs in Ionis's BCG matrix are pipeline candidates with low market share and low growth prospects, often due to clinical trial failures or intense competition. These programs consume resources without generating significant returns. For example, a drug failing Phase II trials in 2024, with no clear path to market, would be classified here.

The high failure rate in drug development, with around 90% of drugs entering clinical trials not reaching approval by 2024, means many Ionis programs could become dogs. These represent sunk costs, impacting overall R&D efficiency. Companies must strategically manage these to free up capital for more promising ventures.

Older drugs facing patent expiry and significant generic competition also fall into the dog category. By 2024, the market impact of generics, often reducing revenue by over 80% in the first year, solidifies this classification. Ionis must therefore focus on innovating to avoid its portfolio becoming dominated by these low-return assets.

| BCG Category | Ionis Pipeline Example | Market Share | Market Growth | Financial Implication |

|---|---|---|---|---|

| Dogs | Investigational drug failing Phase II trials (e.g., a 2024 event) | Low | Low | Resource drain, potential write-offs |

| Dogs | Older asset nearing patent expiry (e.g., pre-2024 patent cliff) | Low (due to generics) | Low (due to market saturation) | Declining revenue stream |

Question Marks

Pelacarsen, a promising therapy for Lp(a)-driven cardiovascular disease, is a key player in Ionis's pipeline. This drug, a late-stage program partnered with Novartis, is anticipated to have Phase 3 HORIZON study data released in the latter half of 2025. Its potential lies in addressing elevated Lp(a), a significant yet largely unmet cardiovascular risk factor, indicating a substantial market opportunity.

The success of Pelacarsen is intrinsically linked to positive clinical trial outcomes and subsequent market acceptance. Targeting a broad patient base with a high unmet medical need, the drug's ultimate market penetration remains a critical variable to monitor.

Zilganersen, an investigational antisense oligonucleotide, targets Alexander disease (AxD), a severe and fatal leukodystrophy. Currently, there are no FDA-approved treatments for this ultra-rare condition. The market for such a specialized therapy is inherently small, posing a challenge for commercial viability even with positive clinical outcomes.

Topline data from Zilganersen's Phase 1-3 trial are anticipated in late 2025. While the drug addresses a significant unmet medical need, its extremely limited patient population presents a key question mark for its commercial success. This success will hinge on the trial results and the company's ability to effectively identify and treat the few individuals affected by AxD.

IONIS-MAPTRx, in partnership with Biogen, is positioned as a question mark within the Ionis BCG matrix for Alzheimer's disease. The FDA's Fast Track designation highlights the significant unmet need and potential market size for Alzheimer's treatments, a condition affecting millions globally, with the number of individuals aged 65 and older projected to reach 73 million by 2030 in the US alone.

However, the drug's placement as a question mark stems from the historically high failure rate of Alzheimer's drug candidates; numerous promising therapies have failed in late-stage clinical trials. Success for IONIS-MAPTRx hinges entirely on demonstrating robust and consistent clinical efficacy in ongoing and future studies, a critical factor given the immense challenges in treating this neurodegenerative disease.

ION464 (SNCA) in Multiple System Atrophy (MSA)

ION464 represents a significant investment in a high unmet need area for Multiple System Atrophy (MSA). As a Phase 2 program targeting alpha-synuclein, it addresses a rare and debilitating neurodegenerative disorder. The lack of approved disease-modifying therapies for MSA underscores the potential impact of ION464, but the small patient population presents commercialization challenges.

Ionis Pharmaceuticals' ION464 faces a complex market dynamic within the Ionis BCG Matrix. While its therapeutic potential for MSA is high, the limited patient numbers, estimated to affect around 1 in 50,000 people, translate to a smaller market size. This places it in a position requiring substantial R&D investment to prove efficacy and navigate regulatory pathways, potentially categorizing it as a Question Mark due to its uncertain commercial future despite its therapeutic promise.

- Therapeutic Potential: ION464 targets alpha-synuclein, a key protein implicated in MSA, a disease with no current disease-modifying treatments.

- Market Size: MSA is a rare disease, impacting a limited patient population, which poses challenges for commercial viability.

- Development Stage: As a Phase 2 program, ION464 requires significant further investment to demonstrate safety and efficacy through later-stage trials.

- Uncertainty: The combination of a small patient pool and the inherent complexities of neurodegenerative disease development creates significant uncertainty regarding its market success.

Ulefnersen for FUS-ALS

Ulefnersen is currently in Phase 3 trials for FUS-ALS, a rare genetic form of Amyotrophic Lateral Sclerosis. Otsuka holds the global commercialization rights for this therapeutic candidate.

While FUS-ALS represents an unmet medical need, the patient population is small, impacting the potential market size for Ulefnersen. For instance, the prevalence of FUS-ALS is estimated to be a small fraction of the overall ALS cases, which themselves are relatively rare.

The commercial viability of Ulefnersen hinges on successful Phase 3 outcomes and its ability to gain traction within this specialized patient group. This places it in a position of uncertainty within the Ionis BCG matrix, likely categorized as a question mark due to its development stage and niche market focus.

- Development Stage: Phase 3 for FUS-ALS.

- Commercial Rights: Licensed to Otsuka.

- Market Size: Limited due to the rarity of FUS-ALS.

- Commercial Potential: Uncertain, dependent on Phase 3 results and market penetration.

Question Marks in Ionis's BCG matrix represent products with high potential but also significant uncertainty, requiring further investment to clarify their future. These are typically early-stage or mid-stage development programs where clinical and commercial success is not yet assured. Ionis's pipeline includes several such candidates, each facing unique hurdles and opportunities.

ION464 for Multiple System Atrophy (MSA) exemplifies this category. While targeting a significant unmet need in neurodegenerative disease, its small patient population, estimated at around 1 in 50,000, presents a commercialization challenge. This necessitates substantial R&D investment to prove efficacy and navigate regulatory pathways, making its market future uncertain despite therapeutic promise.

Similarly, Ulefnersen for FUS-ALS, a rare genetic form of ALS, is in Phase 3 trials. Although it addresses an unmet need, the limited patient population for FUS-ALS impacts its market size. Its commercial viability hinges on successful Phase 3 outcomes and market penetration within this niche, placing it as a question mark due to its development stage and focused market.

IONIS-MAPTRx for Alzheimer's disease also falls into this bracket. Despite FDA Fast Track designation and a large potential market, the historically high failure rate of Alzheimer's drugs creates significant uncertainty. Success for IONIS-MAPTRx depends entirely on demonstrating robust clinical efficacy, a critical factor given the disease's complexity.

| Product | Indication | Development Stage | Market Potential | Key Uncertainty |

|---|---|---|---|---|

| ION464 | Multiple System Atrophy (MSA) | Phase 2 | Limited (rare disease) | Commercial viability due to small patient pool |

| Ulefnersen | FUS-ALS | Phase 3 | Limited (rare genetic ALS) | Phase 3 success and market penetration |

| IONIS-MAPTRx | Alzheimer's Disease | Clinical Trials | High (large patient population) | High historical failure rate of Alzheimer's drugs |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and expert commentary to ensure reliable, high-impact insights.