Indian Oil PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Indian Oil Bundle

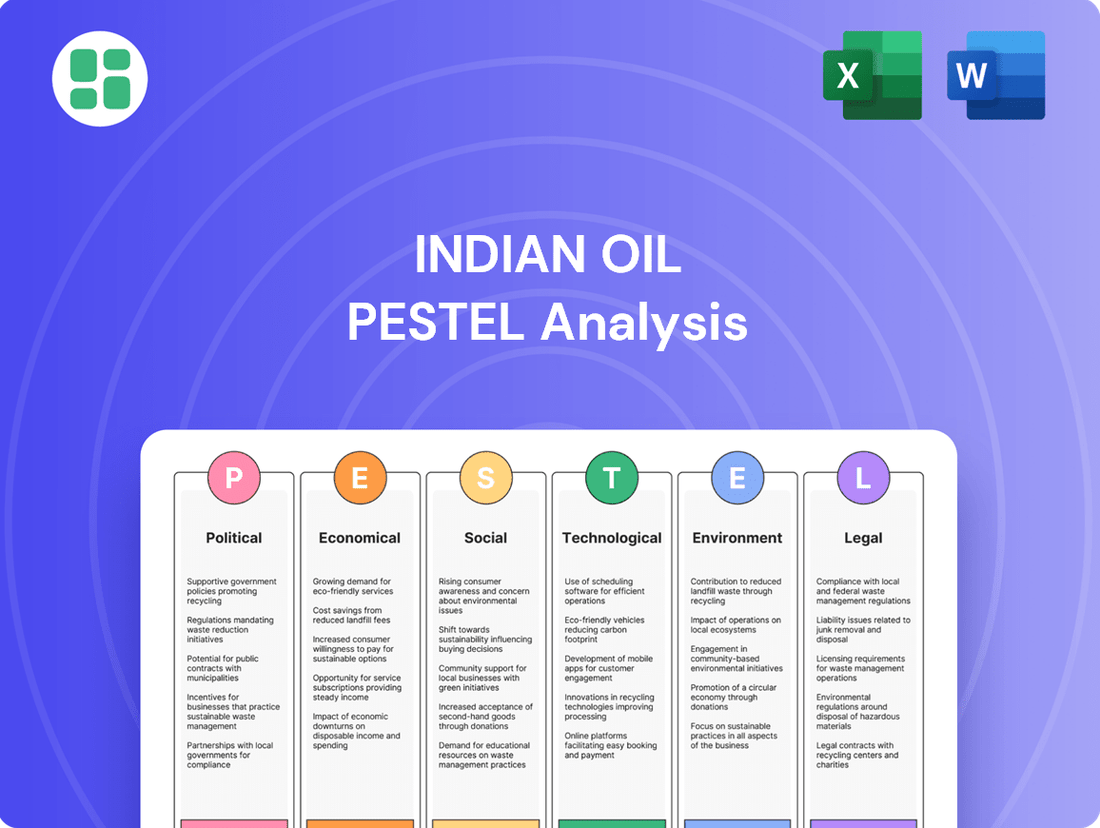

Navigate the complex landscape of the Indian energy sector with our comprehensive PESTLE analysis of Indian Oil. Understand how political stability, economic growth, and technological advancements are shaping its future. Gain a competitive edge by leveraging these critical insights. Download the full analysis now for actionable intelligence and strategic advantage.

Political factors

Government energy policies are a major force shaping Indian Oil Corporation Limited (IOCL). For example, the National Policy on Biofuels aims for 20% ethanol blending in petrol by 2025, pushing IOCL to invest more in biofuel production. This policy directly affects IOCL's operational strategies and future investments.

Regulations across the hydrocarbon value chain, from exploration to distribution, also significantly impact IOCL. These rules compel the company to align its operations with national energy security and sustainability objectives. IOCL's adherence to these directives is crucial for its long-term viability.

Indian Oil Corporation Limited's (IOCL) status as a government-owned entity underscores its strategic importance to India's energy security. This state ownership translates into substantial financial backing, enabling IOCL to play a crucial role in managing fuel prices for consumers and ensuring the consistent supply of essential products like LPG, a vital component of household energy. For instance, in FY23, IOCL's revenue was INR 8,12,349 crore, demonstrating its significant economic footprint.

The government's backing provides IOCL with a stable operational foundation, particularly valuable when navigating market volatilities and fulfilling national energy mandates. This inherent stability is critical for maintaining the supply chain of petroleum products across the vast Indian landscape, aligning with national development goals, such as the ambitious 'Viksit Bharat by 2047' vision, which heavily relies on a robust energy infrastructure.

Indian Oil Corporation Limited (IOCL) faces significant exposure due to its heavy reliance on imported crude oil, sourcing around 85% of its requirements internationally. This dependence makes the company vulnerable to global price volatility and geopolitical uncertainties that can disrupt supply chains.

India's foreign policy and efforts to diversify its crude oil suppliers, such as the notable increase in imports from Russia during the 2024-25 period, are critical for bolstering supply chain resilience and controlling import expenses. These strategic moves aim to mitigate risks associated with geopolitical events and trade disputes.

Geopolitical tensions and international trade conflicts can directly influence the cost of essential raw materials for IOCL, thereby impacting its overall profitability. For instance, disruptions in major oil-producing regions or the imposition of sanctions can lead to sharp increases in crude oil prices, squeezing margins.

LPG Under-recoveries and Subsidies

Indian Oil Corporation Limited (IOCL) frequently experiences under-recoveries in its Liquefied Petroleum Gas (LPG) business due to government-mandated price controls, leading to sales below production costs. Historically, government subsidies have been vital in mitigating these financial shortfalls and ensuring the company's stability. For the fiscal year 2024-2025, the government's approach to subsidy policies, alongside fluctuations in global LPG prices, will significantly impact IOCL's profitability and overall financial health.

The subsidy regime directly influences the cost structure for consumers and, consequently, the revenue realization for IOCL. For instance, during the fiscal year 2023-24, the government provided substantial support to keep LPG prices affordable for households. The projected budget allocation for petroleum subsidies in India for FY2025 continues to be a key indicator of the government's commitment to this sector.

- Government Price Controls: IOCL sells LPG below cost due to administered pricing mechanisms.

- Subsidy Dependence: Historically, government subsidies have been essential to cover LPG under-recoveries.

- FY 2024-2025 Outlook: Future profitability hinges on government subsidy policies and international LPG price trends.

- Impact on Financials: Under-recoveries and subsidy levels directly affect IOCL's net profit and cash flow.

Regulatory Reforms and Ease of Doing Business

India's oil and gas sector is undergoing significant transformation with recent legislative reforms designed to boost efficiency and attract investment. The Oilfields (Regulation and Development) Amendment Bill, enacted in March 2025, is a prime example, aiming to modernize the regulatory landscape.

This new bill introduces a streamlined approach by consolidating various permits into a single petroleum lease, a move intended to simplify operations and enhance the ease of doing business. Such investor-friendly provisions are crucial for drawing in both domestic and international capital, which is vital for unlocking India's vast hydrocarbon reserves and driving up production.

Key aspects of these reforms include:

- Streamlined Licensing: Transition from multiple permits to a single petroleum lease.

- Investor-Friendly Clauses: Introduction of measures to attract private and foreign investment.

- Modernized Framework: Updating regulations to meet contemporary industry needs.

- Production Acceleration: Aiming to boost domestic hydrocarbon output.

Government energy policies significantly influence Indian Oil Corporation Limited (IOCL), particularly the push for biofuels and the broader regulatory framework governing the hydrocarbon sector. IOCL's role as a state-owned entity also highlights its strategic importance for national energy security, supported by substantial government backing. For instance, IOCL's revenue in FY23 was INR 8,12,349 crore, showcasing its economic scale.

India's foreign policy and its impact on crude oil sourcing, such as increased imports from Russia in 2024-25, are crucial for IOCL's supply chain resilience and cost management. Geopolitical events and trade conflicts directly affect raw material costs, influencing IOCL's profitability.

IOCL faces under-recoveries in its LPG business due to government-mandated price controls, with historical reliance on subsidies to cover these shortfalls. The government's subsidy policies for FY 2024-2025, coupled with global LPG price trends, will be critical determinants of IOCL's financial performance.

Recent legislative reforms, like the Oilfields (Regulation and Development) Amendment Bill in March 2025, aim to streamline licensing and attract investment, modernizing the regulatory landscape to boost domestic hydrocarbon production.

| Key Political Factors Affecting IOCL | Description | Impact on IOCL |

| Government Energy Policies | National Policy on Biofuels (20% ethanol blending by 2025), renewable energy targets. | Drives investment in biofuels, influences refining operations and product mix. |

| Regulatory Framework | Hydrocarbon sector regulations, environmental compliance, safety standards. | Ensures operational alignment with national objectives, impacts compliance costs. |

| State Ownership | IOCL is a government-owned Maharatna company. | Provides financial backing, strategic direction, and a mandate for energy security. |

| Subsidy Regimes | Administered pricing for LPG and PDS kerosene. | Leads to under-recoveries, impacts profitability, necessitates government support. |

| Foreign Policy & Trade Relations | Crude oil sourcing diversification, international sanctions, trade agreements. | Affects crude import costs, supply chain stability, and geopolitical risk exposure. |

| Legislative Reforms | Oilfields (Regulation and Development) Amendment Bill (March 2025). | Aims to simplify licensing, attract investment, and boost domestic production. |

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Indian Oil, offering a comprehensive view of its operating landscape.

It provides actionable insights for strategic decision-making by identifying key external drivers and their implications for the company's future growth and challenges.

A PESTLE analysis of Indian Oil, presented in a clear, summarized format, alleviates the pain of sifting through complex data, enabling faster strategic decision-making during critical meetings.

Economic factors

Indian Oil Corporation's performance is heavily tied to global oil price swings. In FY25, the company relied on imports for more than 85% of its crude oil needs. This makes it particularly vulnerable to price volatility.

Geopolitical events and decisions by OPEC+ to adjust production directly influence international crude oil prices. For FY25, India's total crude oil import bill was projected to exceed $150 billion, with IOCL being a major component of this expenditure. Such fluctuations directly impact IOCL's cost of goods sold and, consequently, its profit margins.

India's economy is on a strong growth trajectory, with projections indicating continued expansion through 2024 and 2025. This growth fuels a significant increase in domestic energy demand, making India the third-largest oil consumer worldwide. This robust demand environment is a key factor for Indian Oil Corporation Limited (IOCL).

The burgeoning industrial sector and ongoing urbanization are primary drivers of this escalating energy consumption. Specifically, the demand for transportation fuels and cooking gas is expected to see substantial increases in 2024 and 2025, creating a favorable market for IOCL's extensive product portfolio and supporting its ambitious expansion strategies.

IOCL has set a strategic goal to meet 12.5% of India's total energy requirements by the year 2050. This target underscores the company's commitment to capitalizing on and contributing to the nation's sustained energy demand growth.

Currency exchange rates are a critical factor for Indian Oil Corporation Limited (IOCL) given its substantial reliance on imported crude oil. Fluctuations in the Indian Rupee (INR) against the US Dollar (USD) directly impact IOCL's procurement costs. For instance, if the INR depreciates, the cost of purchasing crude oil in USD terms rises, squeezing profit margins.

The volatility of currency markets presents a significant financial risk. In 2023-2024, the INR experienced periods of depreciation against the USD, averaging around 83 INR to 1 USD for much of the year, which would have increased IOCL's import bill. This necessitates robust financial hedging strategies to mitigate the impact on profitability and maintain financial stability.

Inflation Rates and Operating Expenses

High inflation in India directly impacts Indian Oil Corporation Limited's (IOCL) operating costs, affecting everything from raw materials to employee wages. For instance, the Consumer Price Index (CPI) inflation was reported at 5.02% in April 2024, signaling continued upward pressure on expenses.

Managing these escalating costs is vital for IOCL's profitability, particularly given that fuel prices often face government regulation or subsidies, limiting the ability to pass on increased expenses to consumers. This dynamic creates a challenging environment for maintaining healthy profit margins.

The financial health of IOCL can also be influenced by rising interest costs. For example, in Q2 FY24-25, increased interest expenses could reflect higher borrowing costs due to inflation or a greater reliance on debt financing, both of which warrant close monitoring.

- Inflationary Pressures: India's CPI inflation stood at 5.02% in April 2024, directly increasing IOCL's input costs.

- Cost Management: Rising labor, material, and service costs necessitate efficient operational strategies for IOCL.

- Pricing Constraints: Government controls on fuel prices limit IOCL's ability to fully offset increased operating expenses.

- Interest Costs: Higher interest expenses, as potentially seen in Q2 FY24-25, can impact financial performance due to inflationary or borrowing impacts.

Capital Expenditure and Diversification

Indian Oil Corporation Limited (IOCL) is strategically investing in capital expenditure to bolster its existing infrastructure and venture into promising new sectors such as petrochemicals and renewable energy. This forward-looking approach is crucial for its long-term sustainability and market competitiveness.

The company's financial commitment is evident in its significant capital outlays. For the fiscal year 2024, IOCL reported a capital expenditure of approximately ₹38,660 crore. Looking ahead, the planned capital expenditure for FY25 is set at ₹31,000 crore, underscoring a sustained focus on expansion and modernization.

These investments are directly linked to IOCL's ambitious goal of achieving net-zero emissions by 2046. By channeling funds into diversification, IOCL aims to enhance its entire value chain and establish robust new revenue streams, moving beyond its traditional reliance on fossil fuels.

- FY24 Capital Expenditure: Approximately ₹38,660 crore.

- FY25 Planned Capital Expenditure: ₹31,000 crore.

- Strategic Focus: Expansion of infrastructure, diversification into petrochemicals and renewable energy.

- Long-Term Goal: Achieving net-zero emissions by 2046 through strategic investments.

India's economic growth is a significant tailwind for Indian Oil Corporation Limited (IOCL). With projected GDP growth of around 6.5% for FY25, the country's status as the third-largest oil consumer globally fuels robust demand for IOCL's products. This expansion is driven by a growing industrial base and increasing urbanization, particularly boosting demand for transportation fuels and cooking gas.

Global oil prices remain a critical economic factor for IOCL, which imports over 85% of its crude oil. In FY25, the projected crude oil import bill exceeding $150 billion highlights the company's vulnerability to price volatility influenced by geopolitical events and OPEC+ decisions. Fluctuations directly impact IOCL's cost of goods sold and profit margins.

Currency exchange rates, especially the INR-USD parity, directly affect IOCL's procurement costs. With the INR averaging around 83 to a USD in 2023-2024, any depreciation increases the cost of imported crude. This necessitates strong hedging strategies to manage financial risks and maintain profitability.

Inflationary pressures, with India's CPI at 5.02% in April 2024, increase IOCL's operating expenses across raw materials and wages. The inability to fully pass these costs onto consumers due to regulated fuel prices presents a challenge for maintaining healthy profit margins, further compounded by potentially rising interest costs on borrowings.

| Economic Factor | Impact on IOCL | Key Data/Trend (FY24-FY25) |

|---|---|---|

| Economic Growth | Increased domestic energy demand | India's projected GDP growth ~6.5% (FY25); 3rd largest oil consumer |

| Global Oil Prices | Volatile procurement costs | Imports >85% of crude; Projected import bill >$150 billion (FY25) |

| Currency Exchange Rates | Impact on import costs | INR averaged ~83/USD (2023-24); Depreciation increases costs |

| Inflation | Higher operating expenses | CPI inflation 5.02% (April 2024); Limited ability to pass on costs |

Same Document Delivered

Indian Oil PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Indian Oil PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a detailed breakdown of the external forces shaping Indian Oil's operations and strategies.

The content and structure shown in the preview is the same document you’ll download after payment. It offers valuable insights for strategic planning and risk assessment.

Sociological factors

Societal attitudes are increasingly favoring sustainable energy, pushing consumers toward cleaner alternatives and electric vehicles. This trend directly impacts demand for traditional fuels.

Indian Oil is proactively addressing this shift by significantly expanding its infrastructure for compressed natural gas (CNG), liquefied natural gas (LNG), and electric vehicle (EV) charging. As of early 2024, the company has already established over 7,000 EV charging stations across its retail outlets nationwide, demonstrating a tangible commitment to this evolving energy landscape.

India's rapid urbanization is a significant driver for Indian Oil. As more people move to cities, the demand for transportation fuels, like petrol and diesel, naturally increases. This trend is amplified by a steady rise in vehicle ownership across the nation.

By the end of 2023, India's urban population had surpassed 35%, a figure projected to reach 40% by 2030, according to UN data. This demographic shift directly translates into a growing consumer base for Indian Oil's products, especially in densely populated urban and semi-urban centers.

The company's vast distribution network, comprising over 37,000 retail outlets as of early 2024, is crucial for effectively serving this expanding demand. This widespread presence ensures that Indian Oil can reach consumers even in rapidly developing areas.

Indian Oil's deep commitment to social outreach programs and community development is a significant sociological factor. The company's extensive CSR activities, such as Project POSHAN for nutrition and Project PRERNA for skill development, directly impact societal well-being.

These initiatives, which often focus on empowering local communities, bolstering healthcare access, and preserving national heritage, underscore Indian Oil's multifaceted role beyond its core energy operations. For instance, in FY23, Indian Oil invested over INR 200 crore in various CSR projects, demonstrating a tangible commitment to social upliftment.

Such proactive CSR engagement significantly enhances Indian Oil's brand image and cultivates positive public perception. This alignment with the 'Nation-First' principle resonates with a society increasingly valuing corporate accountability and social contribution, thereby strengthening its social license to operate.

Employment Generation and Workforce Development

Indian Oil Corporation (IOCL) plays a pivotal role in India's employment landscape. As of March 31, 2023, IOCL reported a total workforce of 32,525 employees, underscoring its position as a major job creator across the nation's energy sector. This extensive team supports a wide array of operations, from refining and marketing to exploration and pipeline transportation.

The sheer scale and diversity of IOCL's workforce are significant assets. Employing individuals with expertise in engineering, geology, marketing, and management allows the company to effectively navigate the complexities of the oil and gas industry. This broad skill base is essential for innovation and operational efficiency.

IOCL's commitment to workforce development is evident in its continuous investment in training and skill enhancement programs. These initiatives not only bolster employee capabilities but also contribute to the broader development of India's human capital, ensuring a pipeline of skilled professionals for the energy sector and beyond.

- Significant Employer: Indian Oil employed 32,525 individuals as of March 31, 2023, contributing substantially to national employment.

- Diverse Skill Set: The company's workforce comprises specialists across all facets of the oil and gas value chain, providing a competitive edge.

- Human Capital Development: IOCL's focus on skill development and employee welfare enhances its internal capabilities and supports national human capital growth.

Public Awareness and Environmental Concerns

Growing public awareness about climate change and environmental pollution is increasingly pressuring oil and gas companies, including Indian Oil Corporation Limited (IOCL), to embrace sustainability. This heightened scrutiny means that IOCL's efforts to mitigate its environmental impact are crucial for maintaining its social license to operate. For instance, in the fiscal year 2023-24, IOCL continued its focus on reducing emissions, with specific targets for lowering greenhouse gas intensity across its operations.

IOCL is actively implementing strategies to lessen its environmental footprint. These initiatives encompass reducing gaseous emissions from its refineries and marketing operations, enhancing solid waste management protocols, and making strategic investments in greener technologies and renewable energy sources. The company's commitment to these areas directly influences public perception and stakeholder trust.

- Environmental Initiatives: IOCL's focus on reducing emissions and improving waste management directly addresses public concerns regarding pollution.

- Green Investments: Investments in greener technologies signal a commitment to a more sustainable future, impacting public perception.

- Social License: Positive public perception of environmental efforts is vital for IOCL's continued operation and acceptance within society.

Indian Oil's significant role as an employer, with 32,525 employees as of March 31, 2023, directly impacts societal structure and economic well-being by providing livelihoods and fostering skill development across India.

The company's extensive CSR activities, which saw an investment of over INR 200 crore in FY23, including programs like Project POSHAN and Project PRERNA, demonstrate a strong commitment to community upliftment and social welfare, enhancing its public image.

Societal attitudes are increasingly favoring sustainable energy, influencing consumer choices towards cleaner alternatives and electric vehicles, which Indian Oil is actively addressing by expanding its CNG, LNG, and EV charging infrastructure, having established over 7,000 EV charging stations by early 2024.

Growing public awareness about climate change and environmental pollution pressures IOCL to embrace sustainability, with initiatives focused on reducing emissions and investing in greener technologies, crucial for maintaining its social license to operate.

Technological factors

Indian Oil is heavily investing in technology to boost refinery efficiency and integrate petrochemicals. For instance, the company's ongoing projects at Panipat and Paradip, along with a new polypropylene unit at the Barauni refinery, are designed to expand production capacity and move up the value chain. This includes developing specialized products like specialty chemicals and biopolymers.

The adoption of digital twin technology is a key technological factor, revolutionizing refining operations by improving how assets are managed throughout their lifecycle. This digital approach helps optimize processes and predict maintenance needs, contributing to overall operational excellence.

Indian Oil Corporation Limited (IOCL) is actively deploying cutting-edge exploration and production (E&P) technologies to combat falling domestic crude oil output and lessen its reliance on imports. This strategic technological push is crucial for India's energy security.

The integration of artificial intelligence (AI) and machine learning is significantly boosting the effectiveness of data analysis in IOCL's exploration efforts. Furthermore, policy initiatives like the Open Acreage Licensing Policy (OALP) are designed to incentivize the application of these advanced technological methods to tap into previously unreached hydrocarbon reserves.

IOCL is also implementing technological solutions to mitigate the natural decline in production from its existing, mature oil fields. For instance, advanced reservoir management techniques and enhanced oil recovery (EOR) methods are being employed to maximize output from these established assets.

Indian Oil is strategically investing in green hydrogen and biofuels, aiming for net-zero emissions by 2046. This includes setting up green hydrogen plants, with the first at Panipat, and exploring hydrogen blending into natural gas networks.

The company is also bolstering its renewable energy portfolio, targeting 1 GW of capacity via its subsidiary, Terra Clean Limited, underscoring a significant shift towards sustainable energy solutions.

Digital Transformation and Automation

Indian Oil Corporation Limited (IOCL) is actively integrating digital transformation and automation across its operations. The company is investing in technologies such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT) to streamline processes. For instance, IoT-enabled sensors are being deployed for real-time monitoring of pipelines and refinery assets, enhancing predictive maintenance and reducing downtime.

These technological advancements are crucial for improving efficiency and safety within the oil and gas sector. IOCL's focus on automation extends to its supply chain management, optimizing logistics and inventory control. This digital shift is expected to yield significant cost reductions and performance improvements, aligning with industry trends towards greater digitalization.

- AI and Machine Learning: IOCL is leveraging these for data analytics, predictive maintenance, and optimizing exploration and production processes.

- IoT Integration: Deployment of IoT sensors for real-time asset monitoring, leak detection, and improved safety in refineries and pipelines.

- Automation: Implementation of automated systems in refining, petrochemicals, and fuel distribution to enhance operational efficiency and reduce human error.

- Digital Supply Chain: Optimizing logistics, inventory management, and customer service through digital platforms.

Development of Alternative Fuels and EV Infrastructure

Indian Oil Corporation Limited (IOCL) is making significant strides in alternative fuels and electric vehicle (EV) infrastructure, a key technological shift. The company is actively developing and promoting Compressed BioGas (CBG), aiming to establish 30 CBG plants across India. This initiative directly supports the nation's goal for cleaner energy sources.

Furthermore, IOCL is rapidly expanding its EV charging network, having already installed over 7,000 EV charging stations. This extensive infrastructure development positions IOCL to capitalize on the growing demand for electric mobility. The company's commitment to these technologies underscores a strategic move towards sustainable energy solutions and a diversified fuel portfolio.

- CBG Plant Development: IOCL plans to establish 30 Compressed BioGas plants nationwide.

- EV Charging Network: Over 7,000 EV charging stations have been installed by IOCL.

- National Alignment: These efforts align with India's push for cleaner mobility and sustainable energy.

Indian Oil is heavily investing in advanced technologies to enhance operational efficiency and expand its product portfolio. The company is actively integrating digital solutions, including AI, machine learning, and IoT, across its refining, exploration, and distribution networks. This technological push aims to optimize processes, improve predictive maintenance, and reduce operational costs.

A significant focus is on developing alternative energy sources and infrastructure. IOCL is expanding its Compressed BioGas (CBG) production capacity, with plans for 30 plants, and has already established over 7,000 electric vehicle (EV) charging stations. These initiatives align with India's broader energy transition goals.

The company is also leveraging technology to boost domestic crude oil production and mitigate declining output from mature fields. This includes deploying advanced reservoir management techniques and enhanced oil recovery (EOR) methods, supported by policies like the Open Acreage Licensing Policy (OALP) that encourage technological innovation.

IOCL's strategic technological investments also extend to green hydrogen and biofuels, with a target of net-zero emissions by 2046. This includes setting up green hydrogen plants, such as the one at Panipat, and exploring hydrogen blending in natural gas networks.

| Technology Area | Key Initiatives | Impact/Goal |

|---|---|---|

| Digitalization & Automation | AI, ML, IoT for operations, predictive maintenance, supply chain optimization | Enhanced efficiency, reduced downtime, cost savings |

| Alternative Fuels | Compressed BioGas (CBG) plant development (30 planned) | Promoting cleaner energy, reducing reliance on fossil fuels |

| EV Infrastructure | EV charging station expansion (7,000+ installed) | Supporting electric mobility growth, diversified energy offerings |

| Exploration & Production | Advanced EOR techniques, reservoir management | Maximizing domestic crude oil output, reducing import dependency |

| Green Energy | Green hydrogen plants, biofuels, hydrogen blending | Achieving net-zero emissions by 2046, sustainable energy portfolio |

Legal factors

The Oilfield (Regulation and Development) Amendment Bill, 2024, passed in March 2025, represents a pivotal legal shift for India's oil and gas industry. This amendment updates the foundational 1948 Act, expanding the scope of what constitutes mineral oils and streamlining licensing processes by consolidating various permits into a single petroleum lease.

This legislative reform is designed to significantly boost private and foreign investment. By simplifying the regulatory framework and fostering greater policy certainty, the bill aims to create a more attractive environment for exploration and production activities, potentially leading to increased domestic output and reduced import dependence.

Indian Oil Corporation Limited (IOCL) navigates a complex web of environmental protection acts and regulations in India. The Environment Protection Act of 1986 forms the bedrock of these laws, requiring substantial investments in environmental safeguards. For instance, IOCL's commitment to reducing its carbon footprint is evident in its ongoing projects for emission control and renewable energy integration, a critical area given the global push for Net Zero targets by 2070, a goal India has also committed to.

Compliance extends to stringent mandates like greenhouse gas monitoring and implementing frameworks for carbon capture and storage (CCS) technologies, though large-scale CCS deployment in India is still in nascent stages. Furthermore, regulations often stipulate the establishment of site restoration funds to address the environmental impact of past operations. Failure to adhere to these can result in severe penalties, operational shutdowns, and reputational damage, making proactive environmental management a strategic imperative.

Adding to the regulatory landscape, the Central Consumer Protection Authority issued guidelines in 2024 specifically targeting greenwashing. This means IOCL must ensure its environmental claims are accurate and substantiated, preventing misleading marketing about its sustainability efforts. This directive underscores the growing importance of transparency and genuine environmental performance in the energy sector.

The draft Petroleum and Natural Gas Rules, 2025, introduced in July 2025, are designed to enhance the investment climate. A key feature is an investor-friendly stabilization clause, offering protection to upstream companies against unforeseen fiscal or legal shifts. This aims to provide greater certainty for capital deployment in the sector.

These new regulations also emphasize infrastructure sharing, a move intended to promote efficient resource utilization across the industry. By encouraging shared access to pipelines, storage, and processing facilities, the rules seek to reduce operational costs and improve overall sector productivity.

Furthermore, the Petroleum and Natural Gas Rules, 2025, incorporate strengthened environmental safeguards. This reflects a growing commitment to sustainable practices within India's energy sector, ensuring that resource development aligns with broader ecological protection goals and compliance with international environmental standards.

Competition Laws and Market Deregulation

Competition laws in India's oil and gas sector aim to ensure fair play among players, influencing how companies like Indian Oil Corporation Limited (IOCL) operate. While specific recent actions directly targeting IOCL under competition law aren't highlighted, the broader regulatory environment is key. For instance, the Competition Commission of India (CCI) has previously investigated pricing practices in the fuel retail market.

Recent government reforms have significantly reshaped the market. The deregulation of crude oil and the liberalization of natural gas marketing and pricing are pivotal. These changes allow for greater market-driven price discovery, potentially impacting IOCL's market share and strategic pricing decisions as competition intensifies.

- Deregulation of crude oil: This allows greater flexibility in sourcing and pricing, potentially impacting IOCL's procurement costs and margins.

- Liberalization of natural gas marketing and pricing: This opens up the natural gas sector to more competition, affecting IOCL's position in gas distribution and sales.

- Focus on fair market practices: The Competition Commission of India (CCI) actively monitors the sector to prevent anti-competitive behavior, ensuring a level playing field.

- Impact on market strategies: These legal and regulatory shifts necessitate adaptive strategies for IOCL to maintain its competitive edge in a more open market.

Land Acquisition and Project Clearances

Indian Oil Corporation Limited's (IOCL) infrastructure expansion, from refineries to pipelines and new energy ventures, heavily relies on land acquisition. This process is strictly regulated by Indian land laws, which can be intricate and lengthy, often requiring multiple clearances before projects can commence. For instance, the Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013, sets the framework for these acquisitions.

The legal framework governing land acquisition and project approvals presents a significant hurdle, directly influencing the timelines and overall costs of IOCL's substantial capital investments. Delays in obtaining necessary environmental clearances or navigating land dispute resolutions can add considerable pressure to project budgets and schedules. In 2023-24, IOCL continued to manage several large-scale projects where land acquisition was a critical path item.

Key legal considerations impacting IOCL include:

- Land Acquisition Laws: Adherence to the Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013, ensuring fair compensation and transparent processes.

- Environmental Clearances: Obtaining approvals from bodies like the Ministry of Environment, Forest and Climate Change (MoEFCC) for projects impacting land use and natural resources.

- Regulatory Approvals: Securing permits from various state and central government agencies for construction, operation, and environmental compliance.

- Contractual Agreements: Managing land lease agreements and purchase deeds, ensuring legal validity and protection of IOCL's interests.

The legal framework for India's oil and gas sector, particularly concerning exploration and production, underwent significant updates with the Oilfield (Regulation and Development) Amendment Bill, 2024, passed in March 2025. This legislation streamlines licensing by consolidating permits into a single petroleum lease, aiming to attract more private and foreign investment by enhancing policy certainty.

New regulations, such as the draft Petroleum and Natural Gas Rules, 2025, introduced in July 2025, further bolster the investment climate through investor-friendly stabilization clauses and promote efficient resource utilization via infrastructure sharing mandates.

Indian Oil Corporation Limited (IOCL) must also navigate stringent environmental laws, including the Environment Protection Act of 1986, and adhere to new guidelines against greenwashing, ensuring transparency in its sustainability claims.

The company's infrastructure projects are governed by land acquisition laws like the Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013, which can impact project timelines and costs, as seen in ongoing large-scale projects during 2023-24.

Environmental factors

Indian Oil Corporation Limited (IOCL) is actively aligning with India's ambitious climate change commitments, including the national goal of achieving net-zero emissions by 2070. This strategic imperative drives significant capital allocation towards decarbonization efforts and the expansion of its green energy portfolio.

IOCL has set its own target to achieve net-zero emissions by 2046, a proactive step demonstrating its commitment to a sustainable future. To operationalize this, the company established Terra Clean Limited, a wholly-owned subsidiary dedicated to consolidating and advancing its low-carbon, clean, and green energy businesses.

Indian Oil Corporation Limited (IOCL) is actively engaged in reducing its carbon footprint and controlling pollution throughout its extensive operations. This commitment is demonstrated through initiatives aimed at lowering gaseous emissions, effectively managing solid waste, and exploring advanced technologies such as carbon capture and storage.

In 2023-24, IOCL reported a significant reduction in specific energy consumption, a key indicator of emission efficiency. The company invested ₹2,500 crore in environmental projects during the fiscal year 2023-24, focusing on areas like emission control and water conservation.

Adherence to increasingly stringent environmental regulations set by Indian authorities is paramount. IOCL continues to invest in productive methods for environmental improvement, ensuring compliance and striving for sustainable operational practices.

Indian Oil Corporation Limited (IOCL) is actively expanding its footprint in renewable energy, with significant investments in solar, wind, and green hydrogen projects. This strategic diversification aims to create a cleaner energy portfolio. For instance, IOCL is targeting 10 GW of renewable energy capacity by 2030.

The company is also a strong proponent of biofuels, notably increasing ethanol blending in petrol. By 2025, India aims for 20% ethanol blending in petrol, a target IOCL is heavily supporting through its production facilities. This push reduces dependence on imported crude oil and supports the agricultural sector.

Water Footprint and Resource Conservation

Beyond just greenhouse gas emissions, Indian Oil is actively working to reduce its water usage and conserve resources. This focus on a smaller water footprint is crucial for industrial giants like refineries, as efficient water management aligns with global environmental responsibility. In 2023-24, Indian Oil reported a significant reduction in specific water consumption across its operations, achieving a 5% decrease compared to the previous year.

These initiatives are vital for maintaining operational sustainability and meeting increasingly stringent environmental regulations. The company is investing in advanced water treatment and recycling technologies to minimize freshwater intake. For instance, their Gujarat Refinery implemented a zero liquid discharge (ZLD) system in 2024, a major step in resource conservation.

- Water Footprint Reduction: Indian Oil aims to minimize its water consumption through efficient technologies and practices.

- Resource Conservation: Emphasis on recycling and reusing water resources across all operational units.

- Zero Liquid Discharge (ZLD): Implementation of ZLD systems at key facilities like Gujarat Refinery to eliminate wastewater discharge.

- Operational Efficiency: Sustainable water management contributes to overall operational efficiency and cost savings.

Biodiversity Conservation and Ecological Impact

Indian Oil Corporation Limited (IOCL), as a major player in the oil and gas sector, faces significant environmental responsibilities. Its exploration and production activities, especially in ecologically sensitive regions, carry the potential for substantial ecological impact. For instance, in 2023-24, IOCL continued its focus on environmental stewardship, investing in projects aimed at minimizing its footprint.

The company is mandated to undertake robust biodiversity conservation initiatives and conduct thorough Environmental Impact Assessments (EIAs) for all new developmental projects. These assessments are critical for identifying and mitigating potential adverse effects on local ecosystems, ensuring that operations proceed with minimal disruption.

IOCL's commitment to responsible environmental practices, including biodiversity conservation, is paramount for maintaining its social license to operate and its reputation. This commitment is reflected in its ongoing efforts to integrate sustainability into its core business strategies, aligning with national and international environmental regulations and expectations.

- Ecological Footprint: IOCL's operations, particularly exploration in new territories, can impact local biodiversity and ecosystems.

- EIA Mandate: Environmental Impact Assessments are required for all new developmental projects to evaluate and mitigate ecological risks.

- Conservation Efforts: The company is expected to actively engage in biodiversity conservation and implement measures to protect natural habitats.

- License to Operate: Demonstrating responsible environmental stewardship is crucial for IOCL's social and environmental acceptance.

Indian Oil Corporation Limited (IOCL) is heavily investing in decarbonization and green energy to meet India's net-zero goals by 2070, with IOCL targeting net-zero by 2046. The company invested ₹2,500 crore in environmental projects in FY 2023-24, focusing on emission control and water conservation, and aims for 10 GW of renewable energy capacity by 2030.

IOCL is actively reducing its water footprint, achieving a 5% decrease in specific water consumption in 2023-24 and implementing Zero Liquid Discharge (ZLD) systems at facilities like Gujarat Refinery in 2024. The company also prioritizes biodiversity conservation and conducts thorough Environmental Impact Assessments for new projects to mitigate ecological risks.

| Environmental Focus | Key Initiatives/Targets | Data/Progress |

| Net-Zero Emissions | IOCL Net-Zero Target | 2046 |

| Green Energy Expansion | Renewable Energy Capacity Target | 10 GW by 2030 |

| Environmental Investment | FY 2023-24 Investment | ₹2,500 crore |

| Water Management | Specific Water Consumption Reduction | 5% in FY 2023-24 |

| Water Management | ZLD System Implementation | Gujarat Refinery (2024) |

PESTLE Analysis Data Sources

Our Indian Oil PESTLE Analysis is meticulously constructed using data from official Indian government publications, reputable financial news outlets, and leading energy industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the sector.