Indian Oil Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Indian Oil Bundle

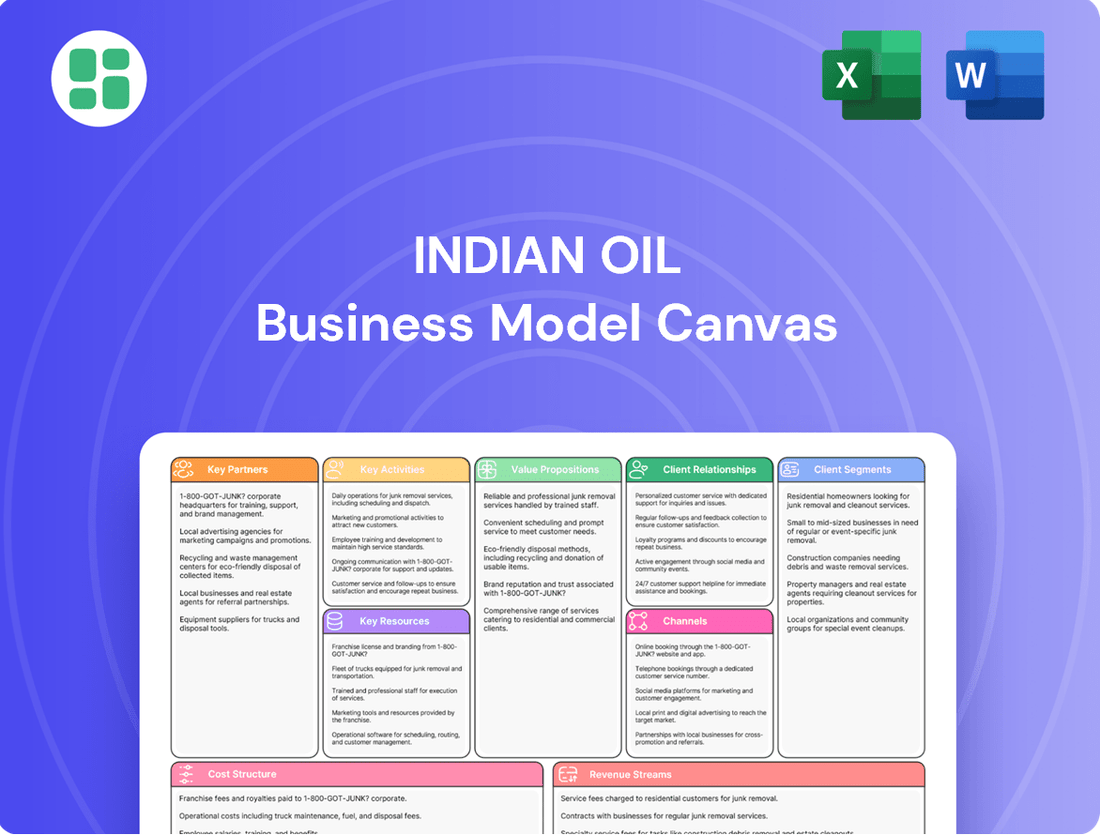

Unlock the strategic core of Indian Oil's operations with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with diverse customer segments, leverage key partnerships, and generate revenue across the energy sector. Discover the intricate value propositions and cost structures that fuel their market dominance.

Want to understand the engine behind Indian Oil's success? Our full Business Model Canvas provides a clear, actionable blueprint, detailing their key resources, activities, and channels. This is your chance to gain deep insights into a leading energy player's strategy.

Dive into the complete Business Model Canvas for Indian Oil and gain a strategic advantage. See how they manage their cost structure, build customer relationships, and create value in a dynamic market. Download the full, professionally crafted document to inform your own business planning.

Partnerships

Indian Oil Corporation Limited (IOCL) leverages its status as a government-owned entity to forge critical partnerships with various government bodies and other Public Sector Undertakings (PSUs). These collaborations are instrumental in executing large-scale strategic projects, implementing national energy policies, and bolstering India's energy security. For instance, IOCL's involvement in city gas distribution (CGD) networks often involves coordination with state governments and regulatory authorities.

These alliances are vital for navigating complex regulatory landscapes and achieving national energy objectives. IOCL's participation in initiatives like the revival of fertilizer plants or the development of broader energy policy frameworks highlights the symbiotic relationship with government entities. Such partnerships ensure alignment with national priorities and facilitate the massive capital investments required for infrastructure development in the energy sector.

In 2023-24, IOCL continued to play a significant role in government-led energy initiatives. The company's extensive network and infrastructure are crucial for the successful rollout of national energy programs, contributing to economic growth and energy accessibility across India.

Indian Oil Corporation Limited (IOCL) actively collaborates with technology and digital solution providers to drive operational excellence and digital advancement. These partnerships are crucial for modernizing its extensive infrastructure and integrating Industry 4.0 capabilities.

A significant example of this strategy is IOCL's April 2025 agreement with ABB India. This collaboration focuses on implementing integrated automation and digital solutions across IOCL's vital pipeline network. The aim is to significantly enhance real-time monitoring and bolster predictive maintenance efforts, ensuring greater efficiency and reliability.

Indian Oil Corporation Limited (IOCL) actively pursues international collaborations to bolster its upstream operations and secure vital crude oil supplies. This includes strategic alliances for maritime logistics, such as discussions with the Shipping Corporation of India for acquiring Very Large Crude Carriers (VLCCs), crucial for efficient global transportation. In 2023, IOCL's crude oil imports reached approximately 170 million barrels, highlighting the importance of these partnerships for supply chain resilience.

Renewable Energy & Green Hydrogen Partners

Indian Oil Corporation Limited (IOCL) is actively building strategic alliances within the renewable energy sector to bolster its green initiatives. Key partnerships are being established with entities such as NTPC Green Energy Limited and SJVN Limited. These collaborations are designed to accelerate the development of substantial renewable energy capacities, encompassing solar and wind power generation.

The focus extends to green hydrogen projects, a critical component of India's energy transition strategy. By teaming up with these specialized firms, IOCL aims to diversify its energy mix and contribute significantly to the nation's ambitious net-zero emission goals. For instance, as of early 2024, IOCL has committed to developing significant renewable energy projects, with a target of achieving 5 GW of renewable capacity by 2030.

- NTPC Green Energy Limited: Collaboration on large-scale solar and wind projects.

- SJVN Limited: Joint ventures for renewable energy capacity expansion, including green hydrogen.

- Diversification: Expanding IOCL's energy portfolio beyond traditional fossil fuels.

- Net-Zero Targets: Supporting India's commitment to reducing carbon emissions.

Automotive & Motorsport Industry

Indian Oil Corporation Limited (IOCL) actively collaborates with the automotive sector to drive advancements in fuel technology. A prime example is their partnership with motorsport organizations, such as becoming the official fuel partner for the FIM Asia Road Racing Championship from 2024 to 2026.

During this championship, IOCL supplies its specialized STORM-Ultimate Racing Fuel, demonstrating their commitment to product innovation and performance in high-stakes environments. This strategic engagement enhances brand visibility within niche, performance-oriented markets.

- Fuel Development: Partnering with automotive manufacturers for advanced fuel formulations.

- Motorsport Sponsorship: Official Fuel Partner for FIM Asia Road Racing Championship (2024-2026) with STORM-Ultimate Racing Fuel.

- Brand Visibility: Showcasing product capabilities in specialized and competitive segments.

IOCL's key partnerships extend to technology providers like ABB India, focusing on digital solutions for pipeline networks, as seen in their April 2025 agreement. They also collaborate with renewable energy leaders such as NTPC Green Energy and SJVN Limited to expand solar, wind, and green hydrogen capacities, aiming for 5 GW by 2030. Furthermore, partnerships with automotive sectors, including the FIM Asia Road Racing Championship (2024-2026), showcase their advanced fuel development and brand presence.

| Partner | Area of Collaboration | Key Objective/Impact | Timeline/Status |

|---|---|---|---|

| ABB India | Integrated automation and digital solutions for pipeline networks | Enhanced real-time monitoring, predictive maintenance, operational efficiency | Agreement in April 2025 |

| NTPC Green Energy Limited | Large-scale solar and wind projects | Accelerating renewable energy capacity development | Ongoing |

| SJVN Limited | Renewable energy capacity expansion, green hydrogen projects | Diversifying energy mix, contributing to net-zero goals | Ongoing |

| FIM Asia Road Racing Championship | Official Fuel Partner | Showcasing STORM-Ultimate Racing Fuel, brand visibility in performance segments | 2024-2026 |

What is included in the product

A comprehensive business model for Indian Oil, detailing its vast network of retail outlets, refineries, and distribution channels, serving diverse customer segments from individual consumers to industrial clients.

This model outlines Indian Oil's value proposition centered on reliable energy supply, product quality, and a wide product portfolio, supported by robust infrastructure and strategic partnerships.

Indian Oil's Business Model Canvas acts as a pain point reliever by providing a structured, visual overview that simplifies complex operations and identifies areas for efficiency improvements.

It offers a clear, one-page snapshot of their entire value chain, enabling rapid identification and resolution of operational bottlenecks.

Activities

Indian Oil's primary function is the refining of crude oil, operating 11 refineries across India with a substantial 70.25 million tonnes per annum capacity. This core activity is crucial for transforming raw crude into a diverse portfolio of essential petroleum products that fuel the nation's economy.

The company is actively pursuing strategic expansions to bolster its refining capabilities. By 2050, Indian Oil aims to reach 88 MTPA, with an intermediate target of 98 MTPA by FY26-27, through both brownfield upgrades and new greenfield projects. This forward-looking approach guarantees a consistent and growing supply of refined products to meet India's increasing energy demands.

Indian Oil Corporation Limited (IOCL) operates a vast network of over 20,000 kilometers of cross-country pipelines, a critical artery for transporting crude oil and refined petroleum products throughout India. This extensive infrastructure is a core activity, ensuring the efficient and reliable movement of vital energy resources.

In the fiscal year 2024-25, IOCL achieved a remarkable milestone, recording its highest-ever pipeline throughput of 100.477 million metric tonnes (MMT). This figure underscores the company's operational excellence and its pivotal role in the nation's energy supply chain, highlighting its capacity to meet growing demand.

Indian Oil's marketing and distribution is a cornerstone, ensuring fuels reach every corner of India. As of FY24, this translates to a massive infrastructure of over 37,472 retail outlets, complemented by 2,110 CNG stations and 9,059 EV charging stations, showcasing a commitment to diverse energy needs.

This extensive network is crucial for making petroleum products, lubricants, and other derivatives readily available to a broad customer base, from individual vehicle owners to industrial clients. The sheer scale of operations underpins Indian Oil's market leadership.

Diversification into Petrochemicals and Gas

Indian Oil is strategically expanding into petrochemicals and natural gas, aiming to boost its revenue streams beyond traditional refining. This diversification is crucial for capturing higher margins and aligning with India's push for cleaner energy sources.

The company is making substantial investments to ramp up its petrochemical production. For instance, plans are underway to significantly increase polypropylene output, a key plastic feedstock, thereby moving up the value chain.

Expansion of city gas distribution (CGD) networks is another cornerstone of this strategy. By investing in gas infrastructure, Indian Oil is positioning itself to capitalize on the growing demand for natural gas in urban areas for domestic, commercial, and industrial use.

- Petrochemical Expansion: Indian Oil plans to increase its petrochemical production capacity, with a focus on products like polypropylene.

- Natural Gas Growth: The company is actively expanding its City Gas Distribution (CGD) network to cater to rising natural gas demand.

- Investment Focus: Major capital expenditures are allocated towards setting up new petrochemical plants and enhancing gas infrastructure.

- Strategic Alignment: This diversification supports India's energy transition goals and strengthens Indian Oil's integrated business model.

Investing in Green Energy and R&D

Indian Oil Corporation Limited (IOCL) is actively investing in green energy and research and development (R&D) to drive its transition towards sustainability. This includes significant capital allocation for expanding its capacity in solar power and advancing green hydrogen production initiatives. IOCL aims to reach 31 GW of green energy capacity.

The company's R&D efforts are focused on developing advanced biofuels and establishing robust electric mobility infrastructure, reflecting a commitment to diversified clean energy solutions. Furthermore, IOCL is exploring the development of lithium-ion battery manufacturing capabilities as part of its strategy to support the growing electric vehicle market.

- Green Energy Capacity Expansion: Targeting 31 GW of green energy capacity.

- Alternative Energy Focus: Investments in solar, green hydrogen, and biofuels.

- Electric Mobility Infrastructure: Development of charging stations and battery manufacturing.

- R&D for Sustainability: Research into net-zero technologies and sustainable practices.

Indian Oil's key activities encompass refining, transportation via extensive pipelines, and a vast marketing and distribution network. The company is also strategically diversifying into petrochemicals and natural gas, alongside significant investments in green energy and R&D.

| Activity Area | Key Metrics/Developments (FY24/FY25) | Strategic Focus |

|---|---|---|

| Refining | 11 refineries, 70.25 MTPA capacity; Targeting 98 MTPA by FY26-27 | Capacity expansion, operational efficiency |

| Pipelines | Over 20,000 km network; 100.477 MMT throughput in FY24-25 | Efficient product transportation, network enhancement |

| Marketing & Distribution | 37,472+ retail outlets, 2,110 CNG stations, 9,059 EV charging stations (FY24) | Extensive reach, diverse energy offerings |

| Petrochemicals & Natural Gas | Increasing polypropylene output, expanding CGD networks | Revenue diversification, higher value addition |

| Green Energy & R&D | Targeting 31 GW green energy capacity; investments in solar, green hydrogen, EV infrastructure | Sustainability, future energy transition |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you see here is not a sample; it's a direct preview of the actual document you will receive upon purchase. This means you'll get the complete, professionally structured Indian Oil Business Model Canvas, ready for your immediate use. No alterations or placeholders – what you preview is precisely what you will download.

Resources

Indian Oil boasts an impressive refining capacity, operating 11 refineries that collectively process a vast amount of crude oil. This extensive refining capability is a cornerstone of its business, allowing for efficient production of a wide array of petroleum products to meet diverse market demands.

Complementing its refining prowess is an expansive cross-country pipeline network spanning over 20,000 kilometers. This robust infrastructure is critical for the cost-effective and timely nationwide distribution of refined products, ensuring reach and accessibility across India.

Indian Oil's vast marketing and distribution network is a cornerstone of its business model. With over 60,000 customer touchpoints, including retail outlets, LPG distributors, and aviation fuel stations spread across India, the company possesses unparalleled market reach. This extensive infrastructure is crucial for ensuring efficient product delivery and accessibility to a diverse customer base, from urban centers to remote rural areas.

Indian Oil's robust business model is significantly powered by its extensive human capital, boasting a workforce of over 30,000 employees. This includes a substantial contingent of highly skilled engineers, scientists, and experienced management professionals.

The deep expertise of this team across the entire hydrocarbon value chain, from exploration and production to refining, marketing, and distribution, is crucial. Their proficiency in research and development is particularly vital for driving innovation, especially as Indian Oil expands into new energy sectors.

In 2024, Indian Oil's commitment to nurturing this talent is evident in its continued investment in training and development programs. This focus ensures that its workforce remains at the forefront of technological advancements and strategic planning, essential for maintaining operational excellence and competitive advantage.

Intellectual Property and R&D Capabilities

Indian Oil Corporation Limited (IOCL) leverages its robust Research and Development (R&D) capabilities as a cornerstone of its business model. The R&D Centre in Faridabad is instrumental in driving innovation across key sectors including refining, petrochemicals, and lubricants. This focus enables IOCL to develop high-performance products and proprietary technologies, thereby strengthening its market position.

IOCL's commitment to R&D is evident in its development of specialized fuels and advanced materials. For instance, the creation of fuels like 'STORM' showcases their ability to innovate in response to evolving market demands and technological advancements. This continuous investment in intellectual property and R&D directly contributes to their competitive advantage and operational efficiency.

- R&D Focus Areas: Lubricants, refining, petrochemicals, bioenergy, hydrogen, nanotechnology.

- Key Innovations: Development of specialized fuels like 'STORM' and proprietary refining technologies.

- Strategic Impact: Enhances competitive edge, supports product differentiation, and drives future growth opportunities.

Financial Capital and Government Support

As a government-owned Maharatna Public Sector Undertaking (PSU), Indian Oil Corporation Limited (IOCL) enjoys significant financial backing and strategic guidance from the Government of India. This robust government support is a cornerstone of IOCL's business model, providing a strong foundation for its extensive operations and future growth. For the fiscal year 2023-24, IOCL reported a robust financial performance, underscoring the stability that government ownership provides.

- Government Ownership: IOCL is a Maharatna PSU, signifying its strategic importance and substantial operational and financial autonomy granted by the Indian government.

- Financial Strength: This backing enables IOCL to undertake massive capital expenditures, crucial for its infrastructure development, such as refinery upgrades and pipeline expansions, ensuring long-term operational stability.

- Strategic Support: The government's strategic direction aids IOCL in aligning its business objectives with national energy policies, facilitating diversification into new energy sectors and ensuring a consistent supply of petroleum products.

- Investment Capacity: IOCL's financial capacity, bolstered by government support, allows for significant investments in projects like the ongoing expansion of its Paradip refinery, which is set to increase its capacity by 4 million metric tonnes per annum.

Indian Oil's key resources are its extensive refining infrastructure, a vast pipeline network, and a widespread marketing and distribution system. Its significant human capital, comprising over 30,000 skilled employees, and robust Research and Development capabilities are also critical assets.

The company's status as a Maharatna PSU provides substantial financial backing and strategic alignment with national energy policies.

These resources collectively enable Indian Oil to maintain operational excellence, drive innovation, and ensure a consistent supply of petroleum products across India.

| Resource Category | Key Assets | Capacity/Scale (as of 2024 data) | Strategic Importance |

|---|---|---|---|

| Infrastructure | Refineries | 11 operational refineries | Core processing capability for petroleum products |

| Infrastructure | Pipelines | Over 20,000 km of cross-country pipelines | Efficient and cost-effective nationwide distribution |

| Market Reach | Marketing & Distribution Network | Over 60,000 customer touchpoints | Unparalleled market access and product accessibility |

| Human Capital | Employees | Over 30,000 employees | Expertise across the hydrocarbon value chain, R&D focus |

| Intellectual Property | R&D Capabilities | Faridabad R&D Centre, proprietary technologies | Innovation, product development, competitive advantage |

| Financial & Strategic | Government Ownership (PSU) | Maharatna status, government backing | Financial stability, capital expenditure capacity, strategic alignment |

Value Propositions

Indian Oil's commitment to a reliable and widespread energy supply is a cornerstone of its business model. The company ensures a consistent availability of vital petroleum products, including petrol, diesel, and LPG, reaching every corner of India's diverse geography. This ubiquitous presence is crucial for powering the nation's economy and meeting the daily energy needs of its vast population.

With a significant refining capacity, Indian Oil plays a pivotal role in India's energy security. In 2023-24, the company's refining throughput reached an impressive 69.5 million metric tonnes, underscoring its ability to process crude oil into essential fuels. This robust operational capability, coupled with an extensive distribution network, guarantees that energy remains accessible even in the most remote regions, fulfilling a critical national requirement.

Indian Oil Corporation Limited (IOCL) boasts a significantly diversified product portfolio that extends well beyond conventional fuels. This strategic breadth includes petrochemicals, high-performance lubricants under the SERVO brand, and specialized fuels like STORM, catering to a wide array of industrial and consumer needs.

Further demonstrating its commitment to evolving energy landscapes, IOCL is actively investing in and expanding its clean energy offerings. This includes compressed natural gas (CNG) for transportation, compressed biogas (CBG) as a renewable alternative, and the development of electric vehicle (EV) charging infrastructure.

This extensive product range is a key value proposition, allowing IOCL to capture market share across multiple sectors and mitigate risks associated with reliance on a single product category. For instance, in the fiscal year 2023-24, IOCL's gross refining and marketing margins were reported at a healthy level, reflecting the strength derived from its diversified operations.

Indian Oil is making significant strides in its sustainability journey, channeling substantial investments into renewable energy sources, green hydrogen initiatives, and the development of biofuels. This strategic pivot is geared towards achieving net-zero emissions by 2046, aligning with global environmental imperatives and national sustainability targets.

This dedication to cleaner energy solutions directly appeals to a growing segment of environmentally aware consumers and businesses. By offering viable alternatives to traditional fossil fuels, Indian Oil is not only meeting market demand but also actively contributing to a healthier planet.

In 2023-24, Indian Oil's capital expenditure on its green initiatives, including biofuels and renewables, was approximately ₹30,000 crore, underscoring the scale of its commitment. This investment is crucial for developing the infrastructure necessary to support a cleaner energy ecosystem.

Quality Assurance and Brand Trust

Indian Oil Corporation Limited (IOCL) places significant emphasis on Quality Assurance and Brand Trust, critical components of its business model. As a prominent government-owned enterprise, IOCL consistently adheres to stringent product quality and service reliability standards. This dedication cultivates deep-seated trust among its vast customer base.

The company’s commitment to excellence is further validated by its recent accolades. In 2024, IOCL was recognized as an Iconic Brand of India and a Trusted Brand. These recognitions underscore the enduring confidence consumers place in IOCL’s offerings and operations.

- Upholding High Standards: IOCL's status as a government entity necessitates adherence to rigorous quality control measures across its product lines, from fuels to lubricants.

- Customer Confidence: The 'Iconic Brand of India 2024' and 'Trusted Brand 2024' awards reflect strong customer loyalty and belief in IOCL's reliability.

- Brand Equity: These recognitions contribute significantly to IOCL's brand equity, differentiating it in a competitive market and reinforcing its value proposition.

Convenience and Accessibility through Digitalization

Indian Oil Corporation Limited (IOCL) is making significant strides in enhancing customer convenience and accessibility through its digital initiatives. This focus on digitalization is a key part of their business model, ensuring modern consumers can easily access services.

IOCL's user-friendly websites and mobile applications are central to this strategy. Customers can effortlessly manage LPG refills, locate nearby fuel stations, and even check fuel prices, all from their smartphones.

For instance, in the fiscal year 2023-24, IOCL reported a substantial increase in digital transactions, reflecting the growing adoption of these convenient platforms by its customer base.

- Digital Platforms: User-friendly websites and mobile apps for services like LPG refills and fuel station locators.

- Customer Experience: Enhancing ease of access and service delivery for modern consumers.

- Digital Transactions: Growing adoption of digital channels for a seamless customer journey.

- Accessibility: Improving reach and convenience across a wide customer demographic.

Indian Oil's value proposition centers on providing reliable and ubiquitous energy access across India, supported by a vast refining capacity and an extensive distribution network. The company's diversified product portfolio, including petrochemicals and lubricants, alongside a growing commitment to clean energy solutions like CNG and EV charging, caters to a broad spectrum of market needs.

Furthermore, IOCL's emphasis on quality assurance and brand trust, evidenced by recognitions like Iconic Brand of India 2024, fosters deep customer loyalty. Digital initiatives enhance customer convenience, offering seamless access to services through user-friendly platforms.

| Value Proposition | Description | Supporting Data/Facts (2023-24 unless otherwise stated) |

|---|---|---|

| Reliable Energy Access | Ensuring consistent availability of petroleum products nationwide. | Refining throughput of 69.5 million metric tonnes. |

| Product Diversification | Offering a wide range of fuels, petrochemicals, and lubricants. | SERVO brand lubricants, STORM high-performance fuels. |

| Clean Energy Focus | Investing in renewable energy, biofuels, and EV infrastructure. | Capital expenditure of ~₹30,000 crore on green initiatives. |

| Brand Trust & Quality | Maintaining high standards and fostering customer confidence. | Recognized as Iconic Brand of India 2024 and Trusted Brand 2024. |

| Digital Convenience | Enhancing customer experience through digital platforms. | Substantial increase in digital transactions. |

Customer Relationships

Indian Oil cultivates robust relationships with its extensive network of over 30,000 retail outlets and 13,000 LPG distributors. This network management involves providing ongoing support, comprehensive training programs, and performance-based incentives. For instance, in FY23, Indian Oil invested significantly in dealer development programs, enhancing their operational efficiency and customer engagement capabilities.

Indian Oil Corporation Limited (IOCL) actively engages customers through its digital ecosystem, encompassing a robust website, a user-friendly mobile app, and active social media presence. This digital outreach is crucial for building strong customer relationships.

In 2024, IOCL's digital platforms facilitate seamless transactions like LPG cylinder bookings and provide essential services such as a fuel station locator. This direct engagement allows for immediate query resolution and efficient feedback collection, directly contributing to improved customer satisfaction and fostering loyalty.

Indian Oil Corporation Limited (IOCL) actively cultivates customer loyalty through its XTRAREWARDS program, boasting over 3.2 crore members. This extensive loyalty scheme is a cornerstone of their customer relationship strategy, designed to encourage repeat purchases and build lasting brand connections.

Furthermore, IOCL leverages branded product promotion, notably with its XTRAGREEN fuel portfolio. By highlighting the benefits and quality of these specialized products, they aim to differentiate themselves in the market and provide tangible value that incentivizes customers to return.

Institutional and Industrial Client Management

Indian Oil Corporation Limited (IOCL) cultivates strong relationships with its institutional and industrial clients through a strategy of long-term partnerships, bespoke supply chain solutions, and dedicated customer support. This approach ensures that large-scale consumers of fuel, lubricants, and petrochemicals receive not only reliable product delivery but also technical assistance precisely aligned with their unique operational demands.

For these key clients, IOCL emphasizes customized product offerings and bulk supply agreements, often underpinned by robust logistical networks. This tailored service model aims to optimize their energy procurement and consumption, fostering loyalty and mutual growth.

- Long-term Contracts: Securing multi-year agreements that provide supply stability and predictable pricing for industrial clients.

- Customized Solutions: Developing specific product blends or delivery schedules to meet diverse industrial requirements, from manufacturing to transportation sectors.

- Dedicated Account Management: Assigning specialized teams to manage client relationships, offering proactive support and addressing operational challenges.

- Technical Support: Providing expert advice on product usage, storage, and efficiency to enhance client operations, as evidenced by their comprehensive technical service centers.

Community Outreach and Social Responsibility

Indian Oil extends its commitment beyond fuel sales by actively participating in community outreach and social responsibility programs. These initiatives are crucial for building strong customer relationships and fostering a positive brand perception.

In 2023-24, Indian Oil's CSR spending reached ₹570.97 crore, demonstrating a significant investment in societal well-being. This commitment is channeled into key areas like education, healthcare, water conservation, and rural development, directly impacting the lives of communities where it operates.

- Educational Support: Indian Oil supports educational infrastructure and provides scholarships, aiming to improve learning outcomes and access to education for underprivileged students.

- Healthcare Initiatives: The company contributes to healthcare facilities, organizes health camps, and promotes health awareness programs to improve community health standards.

- Skill Development: Indian Oil invests in vocational training and skill development programs, empowering local populations with employable skills and fostering economic self-reliance.

- Environmental Stewardship: Beyond its core business, the company engages in environmental conservation efforts, including tree plantation drives and water resource management.

Indian Oil fosters deep connections through its extensive dealer and distributor network, offering training and incentives to over 30,000 retail outlets and 13,000 LPG distributors, as seen in their FY23 dealer development investments.

Digital engagement is paramount, with a user-friendly app and website facilitating LPG bookings and a fuel station locator, enhancing customer satisfaction through seamless transactions and feedback mechanisms in 2024.

The XTRAREWARDS program, with over 3.2 crore members, is a key loyalty driver, encouraging repeat business and brand affinity. Branded products like XTRAGREEN also provide tangible value, differentiating IOCL and incentivizing customer return.

Institutional clients benefit from long-term partnerships, bespoke supply chain solutions, and dedicated account management, ensuring reliable delivery and technical support tailored to their specific operational needs.

Channels

Indian Oil’s vast network of over 37,472 retail outlets, commonly known as petrol pumps, serves as its most crucial channel for direct customer engagement. This extensive physical presence ensures widespread accessibility for individual motorists and commercial fleets alike, offering essential fuels like petrol and diesel.

These outlets are not merely points of sale; they are integrated service hubs providing lubricants, convenience store items, and increasingly, EV charging facilities, thereby enhancing customer convenience and loyalty. By the end of fiscal year 2023-24, Indian Oil reported a significant presence, with its retail network forming the backbone of its fuel distribution strategy across India.

Indian Oil Corporation Limited (IOCL) leverages an extensive network of 12,880 LPG distributors across India. This vast distribution system is crucial for ensuring the availability of cooking gas to a wide customer base.

Complementing the distributors, IOCL operates 99 bottling plants strategically located throughout the country. These plants are essential for refilling and preparing LPG cylinders for delivery.

This robust channel infrastructure is vital for the widespread availability and direct home delivery of cooking gas cylinders to millions of Indian households. It plays a significant role in supporting government initiatives like Pradhan Mantri Ujjwala Yojana, which aims to provide clean cooking fuel.

Indian Oil Corporation Limited (IOCL) is actively broadening its City Gas Distribution (CGD) networks. This expansion focuses on delivering Compressed Natural Gas (CNG) for the automotive sector and Piped Natural Gas (PNG) for residential and industrial consumers.

These CGD networks are crucial for reaching urban and semi-urban populations, directly supporting India's commitment to cleaner energy alternatives. By 2024, IOCL's CGD footprint covers numerous geographical areas, aiming to increase access to natural gas for millions.

The company's investment in CGD infrastructure is a key component of its strategy to diversify its energy offerings and capitalize on the growing demand for environmentally friendly fuels. This channel is vital for achieving national energy transition goals.

Direct Sales to Industrial & Institutional Customers

Indian Oil Corporation Limited (IOCL) directly serves industrial and institutional customers by providing bulk petroleum products, petrochemicals, and specialized fuels. This channel is crucial for large-volume deliveries to sectors like power generation, aviation, and manufacturing, ensuring tailored solutions and reliable supply chains.

IOCL's direct sales approach caters to the specific needs of industrial clients, offering customized product grades and delivery schedules. For instance, in the fiscal year 2023-24, IOCL continued to be a primary fuel supplier to various industries, including aviation, where it operates aviation fuelling stations at major airports.

- Bulk Supply: Facilitates large-volume procurement of fuels and petrochemicals for industrial operations.

- Customized Solutions: Offers tailored product specifications and delivery logistics to meet diverse client requirements.

- Key Sectors Served: Includes power plants, manufacturing units, airlines, and large institutional consumers.

- Supply Chain Efficiency: Employs dedicated logistics and a direct sales force for seamless and timely deliveries.

Digital Platforms and Mobile Applications

Indian Oil Corporation Limited (IOCL) increasingly utilizes its official website and mobile applications to offer a wide array of customer services. These digital channels facilitate convenient online LPG bookings, seamless bill payments, and easy access to fuel station locators, significantly enhancing customer accessibility and supporting modern, efficient interactions.

These digital platforms are crucial for customer engagement, providing self-service options that streamline transactions and improve overall customer satisfaction. For instance, IOCL's mobile app, 'myIOC', allows users to manage their LPG accounts, track orders, and even provide feedback, reflecting a commitment to digital transformation.

- Digital Customer Reach: In 2023-24, IOCL's digital platforms continued to see robust user engagement, with millions of transactions processed through its website and mobile applications for services like LPG refills and loyalty program management.

- Enhanced Convenience: The availability of online booking for Indane LPG refills through these platforms has reduced customer wait times and improved the overall user experience, a key differentiator in the competitive energy market.

- Data-Driven Insights: IOCL leverages the data generated from these digital interactions to understand customer behavior, personalize offerings, and identify areas for service improvement, thereby driving operational efficiency.

- Mobile App Adoption: The 'myIOC' application has become a primary interface for many customers, offering features such as digital payments, real-time order tracking, and access to exclusive offers, further solidifying its role in IOCL's business model.

Indian Oil's retail outlets, numbering over 37,472 as of fiscal year 2023-24, represent its primary channel for direct consumer interaction, offering fuels, lubricants, and convenience items. These outlets are evolving into service hubs, incorporating EV charging, enhancing customer convenience and loyalty across India.

Customer Segments

Individual motorists and vehicle owners represent a massive customer base for Indian Oil Corporation Limited (IOCL). This segment encompasses millions of individuals who own private cars, motorcycles, and also commercial vehicles, all of whom depend on IOCL for essential fuels like petrol and diesel, as well as lubricants.

Their primary needs are straightforward: consistent fuel availability, assured quality of products, and the convenience of accessing these services through IOCL's extensive network of retail outlets spread across India. In 2023-24, IOCL operated over 37,000 retail outlets, a testament to their reach and commitment to serving this segment.

Households represent a primary customer segment for Indian Oil, particularly for Liquefied Petroleum Gas (LPG) used in cooking. This segment is highly sensitive to the reliability and safety of their fuel supply. In 2023-24, Indian Oil continued to serve millions of these households across India, underscoring their critical role in the company's distribution network.

As urban areas see a rise in Piped Natural Gas (PNG) infrastructure, households in these regions are becoming an increasingly important customer base for this cleaner fuel alternative. Affordability remains a key driver for both LPG and PNG adoption among Indian households, influencing their purchasing decisions and fuel choices.

Indian Oil's commercial and industrial clients are a vast group, encompassing transportation companies, manufacturing units, power generation facilities, construction businesses, and even the agricultural sector. These entities rely heavily on Indian Oil for bulk petroleum products, specialized lubricants, and various petrochemicals essential for their daily operations.

The demand from this segment is primarily shaped by the need for operational efficiency and the scale of their activities. For instance, in 2023-24, the industrial sector's consumption of petroleum products remained robust, with significant volumes going into manufacturing and power generation, reflecting their critical role in India's economic engine.

Aviation and Marine Sectors

Indian Oil Corporation Limited (IOCL) plays a crucial role in fueling the aviation and marine sectors, acting as a key supplier of specialized fuels. For airlines, IOCL operates aviation fuelling stations, ensuring the availability of Aviation Turbine Fuel (ATF). This segment demands highly specific fuel grades and a consistent, reliable supply chain to maintain flight schedules. In 2023-24, IOCL's aviation business saw a significant uptick, with ATF sales volume increasing by approximately 13.7% compared to the previous year, reflecting the recovery in air travel.

The marine sector also relies on IOCL for its fuel needs, providing marine fuels to the shipping industry. These operations require fuels that meet stringent international environmental standards and robust logistical support for bunkering operations across various ports. The company's commitment to these high-volume, technically demanding sectors underscores its importance in supporting India's trade and connectivity infrastructure.

- Aviation Sector: IOCL supplies Aviation Turbine Fuel (ATF) to over 100 airports in India and abroad, catering to domestic and international carriers.

- Marine Sector: IOCL is a major supplier of marine fuels, including High Sulphur Fuel Oil (HSFO) and Low Sulphur Fuel Oil (LSFO), to the Indian shipping industry and international vessels.

- Demand Characteristics: Both sectors exhibit high volume demands and require adherence to specialized fuel specifications and efficient, dependable supply logistics.

- Market Presence: In FY 2023-24, IOCL's total fuel sales across all segments reached over 100 million metric tonnes, with aviation and marine contributing substantially.

Government and Public Sector Undertakings

Indian Oil Corporation Limited (IOCL) is a crucial supplier to various government entities, including defense forces and other Public Sector Undertakings (PSUs). This segment is characterized by substantial, often long-term contracts for essential energy supplies. For instance, in FY 2023-24, IOCL continued to be a primary fuel provider for the Indian armed forces, ensuring operational readiness across diverse terrains.

The procurement from government departments and PSUs typically involves large volumes, reflecting the scale of national operations. These partnerships are often strategic, supporting critical national infrastructure development and defense preparedness. IOCL's role extends to providing specialized fuels and lubricants vital for military equipment and government vehicle fleets, underscoring its importance in national security and public service delivery.

- Government Departments: IOCL supplies fuel to ministries, state governments, and their agencies for their operational needs.

- Defense Establishments: This includes providing aviation turbine fuel (ATF) for the Air Force, diesel for Army vehicles, and marine fuels for the Navy.

- Public Sector Undertakings (PSUs): IOCL serves other PSUs like railways, state transport corporations, and power generation companies with their fuel requirements.

- Strategic Importance: These relationships are vital for national infrastructure projects and ensuring energy security for defense and public services.

Indian Oil's customer segments are diverse, ranging from individual motorists relying on petrol and diesel to households dependent on LPG for cooking. The company also serves large commercial and industrial clients requiring bulk fuels and specialized lubricants, along with the aviation and marine sectors needing specific aviation turbine fuel and marine fuels, respectively. Furthermore, government entities, including defense forces and other PSUs, form a significant customer base for essential energy supplies.

| Customer Segment | Key Needs | 2023-24 Data/Facts |

|---|---|---|

| Individual Motorists | Consistent fuel availability, assured quality, convenience | Operated over 37,000 retail outlets |

| Households | Reliable and safe LPG supply, affordability | Continued to serve millions of households with LPG |

| Commercial & Industrial | Bulk fuels, specialized lubricants, petrochemicals, operational efficiency | Industrial sector consumption remained robust |

| Aviation & Marine | Specific fuel grades, reliable supply chain, environmental compliance | ATF sales volume increased ~13.7%; Total fuel sales over 100 million metric tonnes |

| Government & PSUs | Large volume fuel supplies, strategic partnerships, national security | Primary fuel provider for Indian armed forces |

Cost Structure

The primary expense for Indian Oil is the acquisition of crude oil, a global commodity whose prices can swing significantly. For the fiscal year ending March 31, 2024, Indian Oil Corporation reported a total revenue of ₹813,927 crore, with the cost of crude oil and petroleum products forming the largest portion of its expenses.

These international price fluctuations directly influence Indian Oil's raw material costs and, consequently, its overall profitability. The company's financial performance is therefore closely tied to the global energy market's dynamics, making effective procurement and hedging strategies crucial.

Indian Oil's refining and processing expenses are substantial, reflecting the operational costs of its 11 refineries. These include significant outlays for energy, essential chemicals, catalysts, ongoing maintenance, and skilled labor, all crucial for transforming crude oil into usable products.

These costs are directly tied to the volume of crude oil processed and the efficiency of the refining operations. For instance, in the fiscal year 2023-24, Indian Oil's refining throughput reached 69.5 million metric tons, directly impacting the scale of these associated expenses.

Indian Oil's marketing, distribution, and logistics are a significant cost center, driven by the sheer scale of its operations. Maintaining its vast network of over 37,000 retail outlets, extensive pipeline infrastructure, and numerous LPG bottling plants requires substantial investment in freight, storage, and transportation fleets. For instance, in the fiscal year 2023-24, the company's marketing, selling, and distribution expenses amounted to approximately ₹50,000 crore, reflecting the ongoing operational costs and capital expenditure necessary to keep this intricate supply chain running efficiently across India.

Capital Expenditure for Infrastructure Development

Indian Oil Corporation (IOCL) consistently makes substantial capital expenditures to bolster its infrastructure. In the fiscal year 2023-24, IOCL's capital expenditure was reported to be around ₹22,000 crore (approximately $2.6 billion USD), a significant portion of which is allocated to refining and petrochemical projects, as well as expanding its marketing network and exploring new energy avenues. These investments are vital for maintaining competitiveness and driving future growth in a dynamic energy landscape.

These significant outlays are directed towards enhancing existing refining capacities, building new petrochemical complexes, and extending their vast pipeline networks. Furthermore, IOCL is actively investing in future-ready infrastructure, including the development of electric vehicle (EV) charging stations and green hydrogen production facilities, signaling a strategic shift towards cleaner energy sources.

- Refining Capacity Expansion: Continued investment in upgrading and expanding refinery throughput to meet growing fuel demand.

- Petrochemical Projects: Funding for new and existing petrochemical plants to diversify revenue streams and capture value-added products.

- Pipeline Network Augmentation: Capital allocated for extending and modernizing the extensive pipeline infrastructure for efficient product transportation.

- New Energy Infrastructure: Investments in EV charging stations and green hydrogen facilities to align with energy transition goals.

Personnel and Administrative Expenses

Indian Oil Corporation's cost structure is significantly influenced by its extensive workforce. Salaries, wages, employee benefits, and ongoing training programs for its large team represent a substantial and recurring operational expense. General administrative overheads, encompassing office space, utilities, and support staff, further contribute to these personnel and administrative costs.

In the fiscal year 2023-24, Indian Oil reported significant employee-related expenses. For instance, their total employee benefits and remuneration costs were a key component of their overall expenditure. These costs are essential for maintaining a skilled and motivated workforce across its vast network of refineries, pipelines, and marketing outlets.

- Personnel Costs: Indian Oil's commitment to its large workforce, encompassing salaries, wages, and benefits, is a primary cost driver.

- Administrative Overheads: General administrative expenses, including office infrastructure and support functions, add to the overall personnel and administrative expenditure.

- Training and Development: Investment in employee training and development is crucial for maintaining operational efficiency and fostering innovation within the company.

- R&D Investment: Costs associated with research and development are vital for enhancing intellectual capital and driving future technological advancements in the energy sector.

Indian Oil's cost structure is dominated by the purchase of crude oil and petroleum products, which form the largest expense category. This is followed by significant outlays for refining and processing, marketing, distribution, and logistics. Capital expenditures for infrastructure development and employee-related costs also represent substantial ongoing expenditures.

| Cost Category | FY 2023-24 (Approximate Figures) | Impact |

|---|---|---|

| Crude Oil & Petroleum Products Acquisition | Largest portion of total expenses (₹813,927 crore total revenue) | Highly sensitive to global price volatility |

| Refining & Processing | Significant operational costs for 11 refineries | Influenced by throughput (69.5 million MT in FY23-24) and efficiency |

| Marketing, Distribution & Logistics | Approximately ₹50,000 crore | Reflects extensive network maintenance and transportation costs |

| Capital Expenditure | Around ₹22,000 crore ($2.6 billion USD) | Investment in refining, petrochemicals, marketing, and new energy |

| Personnel & Administrative Costs | Substantial recurring expense | Includes salaries, benefits, training, and general overheads |

Revenue Streams

Indian Oil's primary revenue engine is the sale of refined petroleum products. This includes everyday essentials like petrol and diesel, alongside kerosene, LPG for cooking, and aviation turbine fuel (ATF) for aircraft. These sales are the bedrock of the company's financial performance, directly reflecting the nation's energy consumption needs.

In the fiscal year 2023-24, Indian Oil reported a gross revenue from operations of approximately ₹8.09 lakh crore, with the bulk of this stemming from the sale of petroleum products. This figure underscores the immense scale of their operations and the critical role these products play in India's economy, driving transportation, industry, and household energy requirements.

Indian Oil Corporation Limited (IOCL) generates significant revenue from the sale of petrochemicals, a vital segment of its integrated refining and marketing operations. These products, including widely used polymers like polypropylene, are derived from crude oil processing.

For fiscal year 2023-24, IOCL reported a notable increase in its petrochemical sales volume, reaching approximately 3.5 million metric tons. This growth underscores the segment's expanding contribution to the company's top line, driven by both domestic demand and strategic capacity enhancements.

As IOCL continues its diversification efforts into higher-value specialty chemicals and downstream products, the petrochemical segment is poised to become an even more substantial revenue driver. This strategic focus aims to capitalize on growing market opportunities and reduce reliance on traditional fuel sales.

Indian Oil's revenue from Natural Gas Sales, encompassing Compressed Natural Gas (CNG) for vehicles and Piped Natural Gas (PNG) for homes and businesses, is a significant and growing contributor. This segment benefits directly from substantial investments in India's City Gas Distribution (CGD) networks, facilitating wider accessibility and adoption.

The company's commitment to the nation's transition towards a gas-based economy fuels this revenue stream's expansion. For instance, in the fiscal year 2023-24, Indian Oil's marketing volume for natural gas reached approximately 26.5 million standard cubic meters per day, underscoring the increasing demand and its role in powering India's energy future.

Lubricants and Special Products Sales

Indian Oil Corporation Limited (IOCL) generates significant revenue through its lubricants and special products segment. This includes sales under its well-established SERVO brand, which offers a wide range of automotive and industrial lubricants. The company also markets specialized fuels tailored for specific applications, such as STORM-Ultimate Racing Fuel and AV Gas 100 LL, catering to niche markets that often command premium pricing due to their specialized nature and performance requirements.

In the fiscal year 2023-24, IOCL's total revenue from operations stood at approximately ₹809,808 crore. While specific segment-wise revenue for lubricants and special products isn't always broken out separately in headline figures, it forms a crucial part of their overall profitability and market presence. For instance, the lubricants business is a key contributor to IOCL's diversified revenue streams, leveraging brand equity and product innovation to capture market share.

- Brand Strength: The SERVO brand is a household name in India, signifying quality and reliability, which drives consistent sales volume for IOCL's lubricant products.

- Niche Market Focus: Specialized products like STORM-Ultimate Racing Fuel and AV Gas 100 LL target specific, high-value segments, allowing for premium pricing strategies and enhanced profit margins.

- Market Leadership: IOCL maintains a strong position in the Indian lubricant market, consistently ranking among the top players, which translates into substantial revenue generation from this segment.

- Product Diversification: Beyond traditional lubricants, the portfolio of special products demonstrates IOCL's ability to innovate and cater to evolving industry needs, further broadening its revenue base.

Other Business Activities & Diversified Ventures

Indian Oil Corporation Limited (IOCL) diversifies its revenue streams beyond traditional fuel sales. These include income from its exploration and production (E&P) segment, where it extracts crude oil and natural gas. Additionally, IOCL earns fees from the utilization of its extensive pipeline network, a crucial infrastructure for energy transportation across India.

The company is actively expanding into new, future-oriented businesses. This encompasses revenue generation from electric vehicle (EV) charging services and battery swapping stations, tapping into the growing demand for sustainable mobility solutions. IOCL is also exploring ventures in data centers, nuclear power, and critical mineral mining, positioning itself for long-term growth and market relevance.

- Exploration & Production: Revenue from domestic and international crude oil and natural gas extraction.

- Pipeline Tariffs: Fees charged for transporting petroleum products and natural gas through IOCL's vast pipeline infrastructure.

- EV Charging & Battery Swapping: Income generated from providing charging services and battery exchange facilities for electric vehicles.

- Emerging Ventures: Future revenue potential from planned investments in data centers, nuclear power, and critical mineral mining.

Indian Oil's revenue is significantly bolstered by its lubricants and special products segment, notably under the SERVO brand. This segment benefits from strong brand recognition and a focus on niche markets, allowing for premium pricing on specialized fuels and automotive/industrial lubricants.

The company's commitment to diversification is evident in its growing revenue from natural gas sales, including CNG and PNG, supported by India's expanding City Gas Distribution network. In FY 2023-24, IOCL's natural gas marketing volume reached approximately 26.5 million standard cubic meters per day, highlighting increasing demand.

Beyond core fuels, IOCL generates income from its exploration and production activities, as well as pipeline tariffs for transporting energy resources. Furthermore, the company is actively developing new revenue streams in areas like electric vehicle charging and battery swapping, alongside future ventures in data centers and nuclear power.

| Revenue Stream | Description | FY 2023-24 Data Point |

|---|---|---|

| Petroleum Products Sales | Sale of petrol, diesel, LPG, ATF, etc. | Gross Revenue from Operations: ₹8.09 lakh crore |

| Petrochemicals | Sale of polymers and other petrochemical products. | Sales Volume: ~3.5 million metric tons |

| Natural Gas Sales | CNG and PNG sales for vehicles, homes, and businesses. | Marketing Volume: ~26.5 MMSCMD |

| Lubricants & Special Products | Sales under SERVO brand, specialized fuels. | Integral part of overall revenue, leveraging brand equity. |

| Exploration & Production | Revenue from crude oil and natural gas extraction. | Domestic and international production activities. |

| Pipeline Tariffs | Fees for product and gas transportation. | Utilization of extensive pipeline infrastructure. |

| Emerging Businesses | EV charging, battery swapping, data centers, etc. | Focus on future growth and new market opportunities. |

Business Model Canvas Data Sources

The Indian Oil Business Model Canvas is built upon a foundation of robust financial reports, extensive market research on the energy sector, and internal operational data. These sources provide a comprehensive view of the company's performance and strategic direction.