Indian Oil Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Indian Oil Bundle

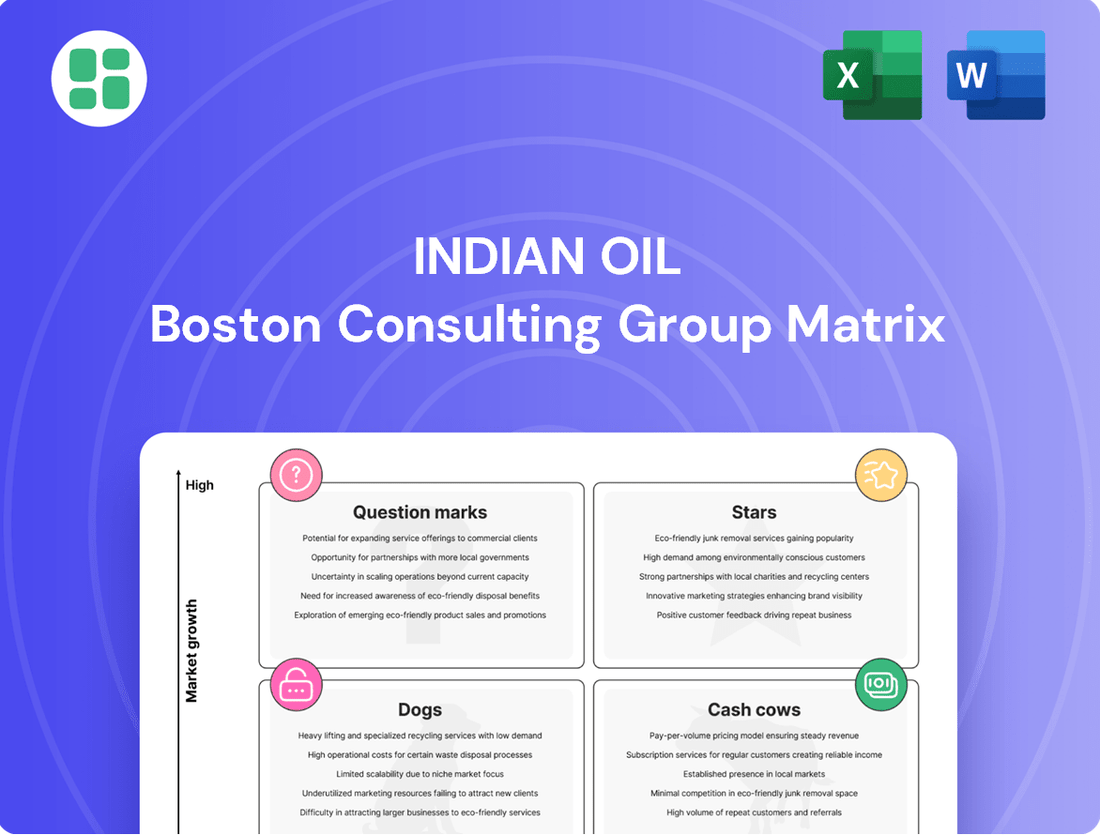

Curious about Indian Oil's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse product portfolio stacks up in terms of market share and growth potential. Understand which segments are fueling growth and which require careful management.

Don't just wonder, know! Purchase the full Indian Oil BCG Matrix report for an in-depth quadrant analysis, actionable insights into their Stars, Cash Cows, Dogs, and Question Marks, and a clear roadmap for optimizing their business strategy.

Stars

Indian Oil is making a substantial push into petrochemicals, planning to boost its capacity to 14 million tonnes annually by 2030, a nearly threefold increase. This strategic move targets the burgeoning demand in India, which is currently reliant on imports for many petrochemical products.

The company's investment in new facilities and the integration of petrochemical production within its refineries are key to capturing this growth. By 2024, Indian Oil's petrochemical capacity was already a significant contributor, and this expansion is set to solidify its position in a market projected to grow robustly.

Indian Oil's foray into green hydrogen production, particularly with its Panipat plant aiming for 10,000 tonnes per annum by December 2027, positions it as a significant player in a burgeoning market. This strategic move supports India's ambitious National Green Hydrogen Mission and Indian Oil's own net-zero objectives.

The company's investment in green hydrogen infrastructure, including plans for nationwide dispensing pumps, underscores its commitment to capturing a leading share in this high-potential, early-stage sector. This aligns with a forward-looking strategy focused on sustainable energy solutions and market leadership.

Indian Oil's renewable energy portfolio is a significant growth area, with a clear target of 31 GW by 2030. This ambitious goal is being driven by substantial investments in solar, wind, and hybrid projects, managed through its subsidiary, Terra Clean Ltd. This strategic move into renewables is designed to meet the company's own energy needs and tap into broader market demand.

The company has recently approved equity investments totaling 5.30 GW of renewable energy capacity. This signals a strong commitment to the energy transition and positions Indian Oil to capitalize on the expanding renewable energy market.

EV Charging Infrastructure

Indian Oil is making significant strides in the burgeoning EV charging infrastructure market. As of March 2025, the company, along with other Oil Marketing Companies (OMCs), had established close to 26,000 EV charging stations nationwide, with Indian Oil accounting for more than half of these installations by OMCs.

- Dominant Market Position: Indian Oil leads OMCs in EV charging station deployment, having set up over 13,000 stations.

- Rapid Expansion: The total OMC charging network reached nearly 26,000 stations by March 2025, with ongoing expansion plans.

- High-Growth Potential: While EV adoption is still in its growth phase, IOC's strong presence positions it favorably to capitalize on future acceleration in the sector.

Refinery Capacity Enhancements

Indian Oil is actively enhancing its refinery capacity to meet India's rising demand for petroleum products. These strategic investments are designed to solidify its position in the market.

- Panipat Refinery Expansion: Capacity is set to increase from 15 million metric tonnes per annum (MMTPA) to 25 MMTPA, with completion expected by December 2025.

- Gujarat Refinery Upgrade: The refinery's capacity will be boosted from 13.7 MMTPA to 18 MMTPA, also targeting a December 2025 completion.

- Meeting Future Demand: These expansions are critical for India Oil to maintain its substantial market share in refining and cater to the projected growth in energy consumption.

- Core Infrastructure Investment: The significant capital expenditure on these projects underscores a commitment to strengthening core operational capabilities and ensuring future market leadership.

Indian Oil's significant investments in petrochemicals and green hydrogen production position these segments as potential Stars in its BCG matrix. The company's petrochemical capacity is slated for a near threefold increase to 14 million tonnes annually by 2030, addressing strong domestic demand. Similarly, its ambitious green hydrogen initiatives, including a 10,000 tonnes per annum plant by December 2027, tap into a high-growth, emerging market aligned with national sustainability goals.

These ventures represent forward-looking strategies to capture significant market share in sectors with substantial future potential. The company's commitment is further evidenced by its rapid expansion of EV charging infrastructure, where it already leads among Oil Marketing Companies.

| Business Segment | Current Status/Expansion | Projected Growth/Impact | BCG Category |

|---|---|---|---|

| Petrochemicals | Capacity to reach 14 MTPA by 2030 (nearly 3x current) | Addresses high import reliance, targets burgeoning demand | Star |

| Green Hydrogen | Panipat plant aiming for 10,000 TPA by Dec 2027 | Supports National Green Hydrogen Mission, aligns with net-zero goals | Star |

| EV Charging Infrastructure | Over 13,000 stations deployed by March 2025 (leading OMC) | Capitalizes on accelerating EV adoption, high-growth potential | Star |

What is included in the product

This overview highlights which Indian Oil units to invest in, hold, or divest based on their market share and growth.

The Indian Oil BCG Matrix provides a clear, one-page overview, simplifying complex business unit analysis for strategic decision-making.

Cash Cows

Indian Oil’s petroleum refining and marketing segment is a clear Cash Cow. The company commands a significant 42% share of India's Petroleum Oil and Lubricants market, underscoring its dominant position. This robust performance is further evidenced by achieving its highest-ever sales volumes in FY 2024-25, surpassing 100 million metric tonnes, demonstrating consistent cash generation from a mature yet expanding sector.

Indian Oil's extensive cross-country pipeline network, spanning over 20,000 KMs, is a significant asset. In FY 2024-25, this network achieved its highest-ever throughput, exceeding 100 million metric tons (MMT). This vast infrastructure is a cornerstone of its operations, ensuring reliable and cost-effective transportation of crude oil and refined products throughout India.

The maturity and high utilization of this pipeline network translate into a stable and predictable cash flow for Indian Oil. Given its established presence and operational efficiency, the need for substantial new growth investments in this segment is relatively low, characteristic of a cash cow business model.

Indian Oil's LPG marketing and distribution segment is a classic Cash Cow within its BCG Matrix. The company commands a significant share of India's LPG market, serving millions of homes with its extensive distribution infrastructure.

This segment benefits from a mature market where LPG is a stable and indispensable energy source. Indian Oil's established presence and widespread network translate into consistent demand and reliable cash flow for the company.

In the fiscal year 2023-24, Indian Oil reported marketing volumes of 109.5 million metric tons across all its products, with LPG distribution forming a substantial part of this. The company continues to expand its LPG customer base, reaching over 14.5 crore connections by the end of FY24, underscoring its dominant position and the segment's cash-generating power.

Lubricants and Special Products

Indian Oil's Lubricants and Special Products segment is a robust performer within its BCG matrix, acting as a significant cash cow. The company boasts a substantial footprint in the lubricants sector, complemented by its strategic offerings in niche aviation fuels. This diversification provides a stable revenue base, often yielding higher profit margins than traditional bulk fuel sales due to the specialized nature of these products and their operation within less volatile market segments.

In 2024, Indian Oil's lubricants business continued to demonstrate resilience. The company's extensive distribution network and strong brand recall in the automotive and industrial lubricant segments are key drivers. For instance, its SERVO brand remains a market leader, contributing significantly to the company's profitability.

The segment's strength lies in its ability to generate consistent cash flows. Investments here are primarily geared towards maintaining existing market share and implementing incremental product enhancements rather than pursuing rapid expansion. This strategic approach ensures sustained profitability from a mature yet vital business area.

- Market Leadership: Indian Oil's SERVO brand holds a dominant position in the Indian lubricants market.

- High-Margin Products: Lubricants and special products, including aviation fuels, typically offer better margins than bulk petroleum products.

- Stable Demand: These segments benefit from relatively stable demand, contributing to consistent cash generation.

- Strategic Focus: Investment priorities are on maintaining market share and incremental improvements, ensuring sustained cash flow.

City Gas Distribution (CGD) Networks

Indian Oil is actively growing its City Gas Distribution (CGD) networks, aiming for a presence in 49 geographical areas. This expansion aligns with India's goal to boost natural gas's contribution to the national energy mix. The CGD sector, while experiencing growth, represents a mature market with established infrastructure, generating consistent cash flow.

This segment is considered a Cash Cow for Indian Oil. The company's substantial investments in building out these networks, covering a significant portion of the country's urban centers, ensure a steady revenue stream. For instance, by the end of fiscal year 2023-24, Indian Oil had commissioned over 21,500 kilometers of natural gas pipelines, serving millions of households and industrial customers.

- Steady Revenue Generation: The widespread adoption of piped natural gas for domestic, commercial, and industrial use provides a reliable income source.

- Mature Market Dynamics: Existing infrastructure and customer base in urban areas contribute to predictable cash flows, even with ongoing expansion.

- Market Share Consolidation: Indian Oil's extensive network development allows it to capture a significant share of the growing demand for cleaner fuels.

- Contribution to Energy Transition: The CGD business plays a vital role in shifting consumers towards natural gas, supporting national environmental and energy security goals.

Indian Oil's petroleum refining and marketing segment is a clear Cash Cow, holding a substantial 42% share of India's Petroleum Oil and Lubricants market. The company achieved its highest-ever sales volumes in FY 2024-25, exceeding 100 million metric tonnes, showcasing consistent cash generation from this mature sector.

The extensive 20,000+ KMs of cross-country pipelines, which achieved over 100 MMT throughput in FY 2024-25, represent a stable cash flow generator due to high utilization and low new investment needs.

Indian Oil's LPG marketing and distribution, serving millions with its vast network, is a classic Cash Cow. In FY 2023-24, LPG distribution was a significant part of its 109.5 MMT total marketing volumes, with over 14.5 crore connections by FY24 end.

The Lubricants and Special Products segment, including aviation fuels, acts as a robust cash cow. The SERVO brand's market leadership and the segment's stable demand, with investments focused on maintaining share, ensure consistent profitability.

Indian Oil's City Gas Distribution (CGD) networks, spanning 49 geographical areas and over 21,500 km of pipelines by FY24 end, are considered Cash Cows, providing steady revenue from a mature market with established infrastructure.

| Business Segment | BCG Category | Key Performance Indicator (FY 2024-25 unless stated) | Market Share/Reach | Cash Flow Characteristic |

|---|---|---|---|---|

| Petroleum Refining & Marketing | Cash Cow | Highest-ever sales volumes (>100 MMT) | 42% of POL market | Consistent cash generation |

| Pipeline Network | Cash Cow | Highest-ever throughput (>100 MMT) | Over 20,000 KMs | Stable, predictable cash flow |

| LPG Marketing & Distribution | Cash Cow | Over 14.5 crore connections (FY24 end) | Significant share of LPG market | Reliable cash flow |

| Lubricants & Special Products | Cash Cow | SERVO brand market leadership | Dominant in lubricants sector | Sustained profitability |

| City Gas Distribution (CGD) | Cash Cow | Over 21,500 km pipelines commissioned (FY24 end) | Presence in 49 geographical areas | Steady revenue stream |

Preview = Final Product

Indian Oil BCG Matrix

The Indian Oil BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive analysis, meticulously crafted by industry experts, will be yours to download and utilize without any watermarks or demo content. You can confidently expect the exact same strategic insights and professional presentation that will empower your business planning and decision-making processes.

Dogs

Indian Oil's upstream segment, while crucial for integration, includes exploration and production (E&P) assets that may not be delivering optimal results. Some of these assets could be characterized as 'Dogs' within the BCG framework if they possess a low market share in a mature or declining production segment.

These underperforming E&P assets might be tying up valuable capital that could be better deployed in more promising ventures, thus limiting overall returns compared to other, more robust business segments within Indian Oil's portfolio.

Indian Oil Corporation's legacy refining processes or older product lines that are less efficient or face declining demand due to technological advancements fall into the 'Dogs' category of the BCG Matrix. For instance, if certain older refinery units are operating at significantly lower conversion rates compared to modern facilities, they might represent a legacy asset. In 2023, the global refining industry saw a trend towards upgrading older plants to improve efficiency and meet stricter environmental standards, highlighting the pressure on less advanced operations.

Certain niche retail outlets within Indian Oil's vast network, particularly those in extremely remote or low-demand locations, can exhibit characteristics of Dogs in the BCG Matrix. These outlets often face challenges with profitability due to consistently low sales volumes and can require significant operational overhead relative to their revenue generation.

For instance, while Indian Oil operates over 36,000 retail outlets as of early 2024, a small percentage might fall into this category. If these underperforming outlets do not serve a critical strategic purpose, such as maintaining market presence or serving a specific community need, their continued operation might not be economically viable.

Optimizing the operational efficiency of these niche outlets or considering divestment strategies could be a prudent approach to improve the overall financial health and resource allocation of Indian Oil's retail segment.

Inefficient Auxiliary Operations

Inefficient auxiliary operations within Indian Oil, such as older logistics or underutilized maintenance facilities, may fall into the Dogs category. These non-core functions often consume resources without contributing significantly to the company's primary refining, marketing, or petrochemical activities. For instance, if a particular fuel distribution network is proving excessively costly to maintain and shows minimal potential for expansion, it could be classified here.

Such operations typically have low market share and low growth prospects. Consider a scenario where an older, less efficient storage depot for specialized lubricants is operating at a fraction of its capacity and requires significant capital for modernization. This would represent an inefficient auxiliary operation with limited future potential.

- Outdated logistics: Older transport fleets or inefficient route planning for non-core product delivery.

- Underutilized infrastructure: Maintenance workshops or storage facilities not central to current business needs and operating at low capacity.

- High operating costs: Auxiliary functions with disproportionately high expenditure relative to their revenue generation or strategic importance.

- Limited growth potential: Operations that are unlikely to see significant market share gains or revenue increases in the foreseeable future.

High-Cost, Low-Yield Crude Processing

Certain refining operations within Indian Oil, particularly those mandated to process high-cost or low-yield crude oil due to contractual terms or specific refinery setups, can be categorized as Dogs in the BCG Matrix. These segments consistently deliver lower profit margins when contrasted with broader industry benchmarks. For instance, if a particular crude stream costs $90 per barrel and yields only 70% of usable product, while a competitor processes crude at $70 per barrel yielding 90%, the margin differential becomes stark.

While Indian Oil's overall refining business might be a strong Cash Cow, these specific, less profitable crude processing streams exhibit characteristics of a Dog. This means they generate low returns and have limited growth potential in their current configuration.

- Low Profitability: Processing expensive or low-yield crude can result in margins below the industry average, potentially impacting overall refinery profitability.

- Contractual Constraints: Obligations to process specific crude types, even if uneconomical, can trap these segments in a low-performance state.

- Limited Growth Prospects: Without significant investment in upgrading refinery configurations, these streams are unlikely to see substantial improvements in yield or cost-efficiency.

- Impact on Overall Performance: While the larger refining segment is a Cash Cow, these 'Dog' segments can drag down overall performance metrics if not managed strategically.

Within Indian Oil's diverse portfolio, 'Dogs' represent business units or assets with low market share in mature or declining industries. These segments, like certain older refining units or underperforming retail outlets in remote areas, consume capital without generating substantial returns. For example, while Indian Oil operates over 36,000 retail outlets as of early 2024, a small fraction might exhibit 'Dog' characteristics due to consistently low sales volumes and high overheads relative to revenue.

These underperforming areas, such as inefficient auxiliary operations or specific crude processing streams with low yields, are characterized by low growth prospects and often high operating costs. The company must strategically manage these by optimizing efficiency or considering divestment to reallocate resources to more promising ventures.

Indian Oil's legacy refining processes or older product lines that are less efficient or face declining demand due to technological advancements fall into the 'Dogs' category of the BCG Matrix. In 2023, the global refining industry saw a trend towards upgrading older plants to improve efficiency and meet stricter environmental standards, highlighting the pressure on less advanced operations.

Certain niche retail outlets within Indian Oil's vast network, particularly those in extremely remote or low-demand locations, can exhibit characteristics of Dogs in the BCG Matrix. These outlets often face challenges with profitability due to consistently low sales volumes and can require significant operational overhead relative to their revenue generation.

| Category | Characteristics | Example within Indian Oil | Potential Strategy |

| Dogs | Low Market Share, Low Growth Prospects | Underperforming retail outlets in remote areas, inefficient older refinery units, legacy lubricant storage facilities | Divestment, optimization, or selective investment for essential service |

Question Marks

Indian Oil is actively developing its hydrogen dispensing network for mobility, notably piloting India's first such station. This initiative targets a high-growth market, aiming to support the burgeoning adoption of hydrogen-powered vehicles.

While the market for hydrogen mobility shows significant future potential, the current adoption rate of hydrogen vehicles in India remains low. Consequently, Indian Oil's market share in this specific segment is presently minimal, classifying it as a Question Mark in the BCG matrix.

Developing a comprehensive hydrogen dispensing infrastructure requires substantial capital investment. This strategic move positions Indian Oil to capture future market growth, but the immediate returns are uncertain, reflecting the inherent risks and potential of a nascent industry.

Indian Oil is actively investing in advanced biofuels, particularly focusing on co-processing non-edible oils for Sustainable Aviation Fuel (SAF) and developing alcohol-to-jet SAF facilities. This strategic move positions them to tap into a rapidly expanding market.

The global SAF market is projected for substantial growth, with estimates suggesting it could reach over $15 billion by 2030, driven by increasing environmental regulations and airline commitments. However, Indian Oil's current market share within these specialized advanced biofuel segments remains minimal.

These ventures into advanced biofuels and SAF represent high-growth potential areas for Indian Oil. Yet, they demand significant investment in research and development, alongside considerable effort in market creation and adoption, aligning them with the characteristics of a 'Question Mark' in the BCG matrix.

Indian Oil Corporation (IOC) has entered into a binding term sheet to establish a joint venture for manufacturing lithium-ion cells in India. This strategic move directly addresses the burgeoning demand for electric vehicle (EV) applications and broader energy storage solutions. The Indian government's push for EV adoption, aiming for 30% of new vehicle sales to be electric by 2030, underscores the immense growth potential of this sector.

While this venture targets a high-growth market, IOC's current market share in lithium-ion cell manufacturing is effectively zero, positioning it as a new entrant. The lithium-ion battery market in India was projected to reach approximately $10 billion by 2027, indicating substantial future revenue streams but also intense competition.

This endeavor necessitates significant capital investment and carries inherent high risks, typical of pioneering new technology manufacturing. However, the potential rewards are equally substantial, aligning with the high-growth, high-risk profile of a star business in the BCG matrix, especially given the strategic importance of domestic battery production for India's energy security and economic development.

Compressed Biogas (CBG) Plants Expansion

Indian Oil Corporation Limited (IOCL) is strategically expanding its Compressed Biogas (CBG) plant footprint, with plans to establish 30 new facilities under the Sustainable Alternative Towards Affordable Transportation (SATAT) initiative. This expansion underscores India's commitment to developing sustainable and indigenous energy solutions, a sector experiencing significant growth. While the CBG market itself shows high growth potential, IOCL's current market share within this niche segment of the broader energy market is still in its nascent stages, reflecting the need for greater market penetration to drive profitability for these ventures.

The CBG market is projected to reach USD 1.5 billion by 2025, driven by government incentives and a growing demand for cleaner fuels. IOCL's investment in 30 additional CBG plants positions them to capitalize on this expansion. These projects, while holding considerable growth prospects, require substantial market acceptance and offtake agreements to ensure their economic viability and transition them from question marks to stars in the BCG matrix.

- SATAT Initiative: Indian Oil plans to set up 30 additional CBG plants.

- Market Growth: India's CBG market is expanding due to a push for sustainable energy.

- Market Share: IOCL's share in the CBG segment is developing, indicating potential for growth.

- Profitability Drivers: High growth prospects necessitate increased market penetration for profitability.

Exploration and Production in New/Challenging Basins

Indian Oil Corporation (IOC) is strategically targeting exploration and production (E&P) in new and challenging basins to boost its upstream integration. This move aligns with a global trend of seeking reserves in less explored or technically difficult areas, where significant growth potential exists. For instance, by the end of fiscal year 2024, IOC had secured stakes in several such blocks, aiming to diversify its resource base beyond conventional fields.

These frontier ventures are inherently capital-intensive and carry a higher degree of uncertainty regarding success rates. IOC's current market share in these challenging basins is relatively low, reflecting the early stage of its involvement. Projects in these areas are often categorized as question marks in the BCG matrix, requiring substantial investment without guaranteed returns. However, a successful discovery could transform these question marks into Stars, significantly enhancing the company's long-term production profile and profitability.

- Capital Investment: Exploration in challenging basins demands significant upfront capital, often running into hundreds of millions of dollars per block.

- Risk Profile: Success rates in frontier exploration can be as low as 1 in 10, making it a high-risk, high-reward proposition.

- Market Share: IOC's participation in these new basins is nascent, with its current market share being minimal, indicating substantial room for growth.

- Potential Upside: Discovering commercially viable reserves in these areas could lead to substantial production increases and revenue generation, shifting the segment from a question mark to a star performer.

Indian Oil's ventures into emerging sectors like hydrogen mobility and advanced biofuels, including Sustainable Aviation Fuel (SAF), are classified as Question Marks. These areas offer high growth potential, driven by global sustainability trends and government initiatives, but currently represent nascent markets for the company.

The significant capital investment required for infrastructure development and research, coupled with low current market penetration, characterizes these segments. Indian Oil's strategic focus is on building market share and achieving profitability in these high-risk, high-reward ventures.

The company's entry into lithium-ion cell manufacturing also falls into the Question Mark category. While targeting the rapidly expanding electric vehicle market, the zero current market share and substantial investment needs highlight the inherent uncertainties and future potential of this segment.

Similarly, the expansion of Compressed Biogas (CBG) plants, though supported by government initiatives like SATAT, requires increased market acceptance and offtake agreements to transition from a Question Mark to a more stable business unit.

| Business Segment | BCG Classification | Market Growth Potential | Current Market Share | Investment/Risk |

| Hydrogen Mobility | Question Mark | High | Minimal | High Capital / High Risk |

| Advanced Biofuels (SAF) | Question Mark | High | Minimal | High R&D / Market Creation Effort |

| Lithium-ion Cell Manufacturing | Question Mark | Very High | Zero | Very High Capital / High Risk |

| Compressed Biogas (CBG) | Question Mark | High | Nascent | Substantial Market Acceptance Needed |

BCG Matrix Data Sources

Our Indian Oil BCG Matrix is built on a foundation of robust data, integrating financial disclosures, market growth metrics, and competitor benchmarks for strategic clarity.