Investec PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Investec Bundle

Unlock the strategic advantages Investec holds by understanding the intricate political, economic, social, technological, environmental, and legal forces at play. Our comprehensive PESTLE analysis provides the critical insights you need to anticipate market shifts and capitalize on emerging opportunities. Invest in clarity and foresight—download the full report now to gain a decisive edge.

Political factors

The stability of financial regulations in both the UK, overseen by the Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA), and South Africa, managed by the South African Reserve Bank (SARB) and Financial Sector Conduct Authority (FSCA), is a cornerstone for Investec's operational landscape. The FCA's Business Plan for 2024/25, for instance, highlights a commitment to regulatory stability, which is vital for Investec's long-term strategic planning and investment decisions.

Predictable policy frameworks allow Investec to confidently allocate resources and pursue growth opportunities. Conversely, shifts in regulatory priorities, such as the intensified focus on financial crime prevention and the implementation of a robust consumer duty, demand agile and adaptive compliance strategies from Investec to ensure ongoing adherence and mitigate potential risks.

Political stability in South Africa, particularly with the formation of a Government of National Unity, can significantly influence investor confidence and economic growth, impacting Investec's domestic operations. This new political landscape, solidified after the May 2024 elections, aims to balance diverse interests, potentially leading to more predictable economic policies.

The UK government's financial services growth and competitiveness strategy, targeting 2025, seeks to foster innovation and streamline regulations. This initiative could create a more favorable operating environment for Investec in the UK, a key market for the company.

Geopolitical risks and evolving trade tensions significantly influence global economic stability, directly impacting Investec's international market access, funding sources, and diversification strategies. For instance, the ongoing trade disputes between major economies in 2024 continue to create uncertainty, potentially affecting cross-border capital flows and investment opportunities.

While Investec's core operations are in the UK and South Africa, its niche international presence means global political shifts, such as new trade agreements or sanctions, can affect its cross-border activities and the investments of its clients. The increasing focus on economic blocs and regional trade partnerships, evident in 2024, could reshape Investec's operational landscape and client service offerings.

Anti-Money Laundering (AML) and Sanctions Enforcement

Regulators, such as the UK's Financial Conduct Authority (FCA), are significantly stepping up their focus on anti-money laundering (AML) and sanctions enforcement throughout 2024 and into 2025. This heightened scrutiny means financial institutions like Investec face increased pressure to demonstrate stringent compliance measures.

Investec, as a global financial services group, must continually invest in and refine its financial crime systems and controls. This proactive approach is crucial to avoid substantial penalties and safeguard its reputation. The firm is likely to see increased investment in data analytics and artificial intelligence to better identify and target higher-risk transactions and activities, reflecting a broader industry trend.

- Increased Regulatory Fines: In 2023, UK financial services firms faced fines totaling over £560 million for AML and sanctions breaches, a figure expected to rise as enforcement intensifies in 2024/2025.

- Data-Driven Compliance: Expect greater reliance on advanced analytics to detect suspicious patterns, with firms allocating more resources to technology and skilled personnel in this area.

- Reputational Risk Management: A single significant breach can lead to severe reputational damage, impacting customer trust and market standing, making robust controls paramount.

Fiscal Policy and Taxation

Government fiscal policies, particularly tax reforms and public spending, significantly shape the financial landscape for Investec's clientele. In the UK, for instance, the Spring Budget 2024 maintained the headline corporation tax rate at 25%, but introduced measures like the full expensing for leased assets, which could indirectly benefit Investec's corporate clients by encouraging investment. For high-net-worth individuals, changes to capital gains tax or inheritance tax can directly impact disposable income and wealth structuring strategies, influencing their demand for Investec's wealth management services.

Shifts in taxation across key markets such as the UK and South Africa, or even broader international tax regulations, can profoundly affect investment decisions and the overall profitability of Investec's corporate banking divisions. For example, if South Africa were to implement significant changes to its corporate tax structure, it could alter the attractiveness of the market for foreign investment and impact the financial planning needs of businesses operating there. Similarly, global efforts to combat tax avoidance, such as the OECD's Pillar Two rules, necessitate ongoing adjustments in how multinational corporations structure their finances, creating opportunities for specialized advisory services.

- UK Corporation Tax Rate: Remains at 25% as of Spring Budget 2024, impacting Investec's corporate clients.

- Capital Gains Tax (CGT) Considerations: Potential adjustments in the UK or South Africa can influence Investec's wealth management clients' investment strategies.

- Public Spending Impact: Government infrastructure or stimulus spending can create opportunities for Investec's corporate and investment banking arms.

- Global Tax Harmonization: Initiatives like the OECD's Pillar Two require businesses to adapt, presenting advisory needs that Investec can fulfill.

Political stability and government policy are critical for Investec's operations in both the UK and South Africa. The formation of a Government of National Unity in South Africa following the May 2024 elections, aiming for broader consensus, could lead to more predictable economic policies. In the UK, the government's focus on financial services growth and competitiveness, with a target of 2025, suggests a potentially more favorable regulatory environment.

Heightened regulatory scrutiny, particularly around anti-money laundering and sanctions, is a significant political factor. Regulators like the UK's FCA are increasing enforcement, pushing firms like Investec to invest more in compliance technology and personnel. This trend is reflected in the substantial fines levied against UK financial firms for breaches, with expectations of continued intensity through 2024 and 2025.

Government fiscal policies, including tax reforms and public spending, directly influence Investec's clients. The UK's 25% corporation tax rate and specific measures like full expensing for leased assets, as outlined in the Spring Budget 2024, impact corporate clients. Similarly, potential changes to capital gains or inheritance tax in either the UK or South Africa can affect wealth management strategies and client demand.

| Political Factor | Impact on Investec | Relevant Data/Context |

| Regulatory Stability & Enforcement | Influences operational costs, compliance strategies, and risk of penalties. | UK FCA fines for AML/sanctions breaches exceeded £560 million in 2023; expected to rise in 2024/25. |

| Government Fiscal Policies (Taxation & Spending) | Affects client investment decisions, profitability, and demand for services. | UK Corporation Tax at 25% (Spring Budget 2024); potential CGT/inheritance tax changes in UK/SA. |

| Political Stability (South Africa) | Impacts investor confidence and economic growth, affecting domestic operations. | Formation of Government of National Unity post-May 2024 elections, aiming for policy predictability. |

| UK Financial Services Strategy | Could create a more conducive operating environment for Investec's UK business. | UK government's growth and competitiveness strategy targeting 2025. |

What is included in the product

This Investec PESTLE analysis thoroughly examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company, providing a strategic overview of external influences.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for immediate strategic input.

Economic factors

The current high interest rate environment in the UK, with the Bank of England base rate holding steady at 5.25% as of early 2025, presents challenges for Investec's banking division. This climate can dampen lending growth and increase the risk of delayed repayments from businesses, potentially affecting profitability.

Conversely, South Africa is anticipated to see moderating inflation and potential interest rate cuts in 2025. This shift is expected to alleviate pressure on South African households' disposable incomes, fostering an environment conducive to increased credit uptake and benefiting Investec's operations in that region.

Global GDP growth is anticipated to hold steady, with projections around 3.2% to 3.3% for both 2024 and 2025. However, this overall resilience masks considerable differences in economic performance across various regions.

South Africa's economic outlook remains challenging, with real GDP growth forecasted to be a modest 0.8% in 2025. This subdued growth is largely attributed to persistent infrastructure deficits and ongoing energy supply issues.

These economic headwinds in South Africa could directly impact Investec by potentially restricting the growth of its domestic client base and limiting the scope of new investment opportunities within the country.

Currency exchange rate fluctuations, especially between the British Pound (GBP) and the South African Rand (ZAR), directly influence Investec's financial reporting given its presence in both markets. For instance, as of early 2024, the GBP/ZAR exchange rate has seen volatility, with the rand experiencing periods of strengthening against the pound. A stronger rand can enhance the reported value of Investec's South African earnings and assets when converted into GBP, potentially boosting its overall financial statements.

Credit Market Conditions and Lending Demand

South African credit market conditions are anticipated to improve steadily throughout 2025. This easing is projected to fuel a notable acceleration in private sector credit growth, with a particular emphasis on funding infrastructure and renewable energy initiatives. For Investec, successfully leveraging this heightened demand for lending, especially within its corporate and private client divisions in both the UK and South Africa, is a key driver for its revenue expansion.

The demand for credit in South Africa is showing signs of robust recovery, with projections indicating a significant uplift in lending activity. This trend is particularly evident in sectors critical for economic development, such as infrastructure and green energy projects.

- Projected easing of credit conditions in South Africa through 2025.

- Expected acceleration in private sector credit growth, targeting infrastructure and renewables.

- Investec's strategic focus on corporate and private client lending in SA and UK to drive revenue.

Global Market Volatility and Investor Confidence

Global markets in 2024 and early 2025 are characterized by heightened volatility, impacting investor confidence. Elevated equity market volatility, as highlighted in recent financial stability reports, directly influences how clients approach investments and affects the performance of wealth and investment management portfolios.

While Investec's focus on high-net-worth individuals and institutions suggests a degree of resilience, this client base is not immune to broader market sentiment shifts and increased risk aversion. For instance, the VIX index, a common measure of expected stock market volatility, has seen significant fluctuations, reflecting underlying economic uncertainties.

- Elevated Equity Market Volatility: Recent financial stability reviews have consistently pointed to a volatile operating environment, with equity markets experiencing significant swings.

- Impact on Client Behavior: This volatility directly influences how clients, particularly those with substantial assets, make investment decisions, often leading to increased caution or risk aversion.

- Resilience of Niche Clients: Investec's high-net-worth and institutional clients may possess greater capacity to weather market downturns, but their investment performance and sentiment remain susceptible to macroeconomic trends.

- Data Point: For example, in late 2024, the MSCI World Index experienced a notable drawdown of over 8% within a single month, illustrating the rapid shifts in market sentiment.

The UK's persistent high interest rate environment, with the Bank of England rate at 5.25% in early 2025, continues to constrain lending growth and elevate credit risk for Investec. Conversely, South Africa's anticipated interest rate moderation in 2025 is expected to boost consumer spending and credit demand, benefiting Investec's operations there. Global GDP growth is projected to remain stable at around 3.2% for 2024-2025, though regional disparities persist, with South Africa's growth forecast at a modest 0.8% for 2025 due to infrastructure and energy challenges.

Currency fluctuations, particularly the GBP/ZAR exchange rate, significantly impact Investec's financial reporting. A strengthening Rand, as seen periodically in early 2024, enhances the reported value of South African earnings and assets when converted to GBP.

South African credit markets are poised for improvement in 2025, with expectations of accelerated private sector credit growth, especially for infrastructure and renewable energy projects. Investec is strategically positioned to capitalize on this demand through its corporate and private client divisions in both the UK and South Africa, aiming for revenue expansion.

Global equity markets in early 2025 are marked by heightened volatility, influencing investor sentiment and wealth management portfolio performance. While Investec's client base of high-net-worth individuals and institutions shows resilience, they remain susceptible to broader market shifts and increased risk aversion, as evidenced by significant index drawdowns.

| Economic Factor | 2024 Projection | 2025 Projection | Impact on Investec |

|---|---|---|---|

| UK Interest Rates | 5.25% (Bank of England Base Rate) | Likely to remain elevated, potentially impacting lending | Constrained lending growth, increased credit risk |

| South Africa Inflation/Rates | Moderating | Potential rate cuts expected | Improved consumer spending, increased credit demand |

| Global GDP Growth | ~3.2%-3.3% | ~3.2%-3.3% | Overall stable market conditions but regional variations |

| South Africa GDP Growth | Subdued | 0.8% | Limited domestic growth opportunities |

| GBP/ZAR Exchange Rate | Volatile | Continued volatility expected | Affects translation of SA earnings to GBP |

| South Africa Credit Growth | Steady improvement | Notable acceleration, especially in infrastructure/renewables | Key revenue driver for lending divisions |

| Equity Market Volatility | Heightened | Heightened | Influences client investment behavior and portfolio performance |

Preview Before You Purchase

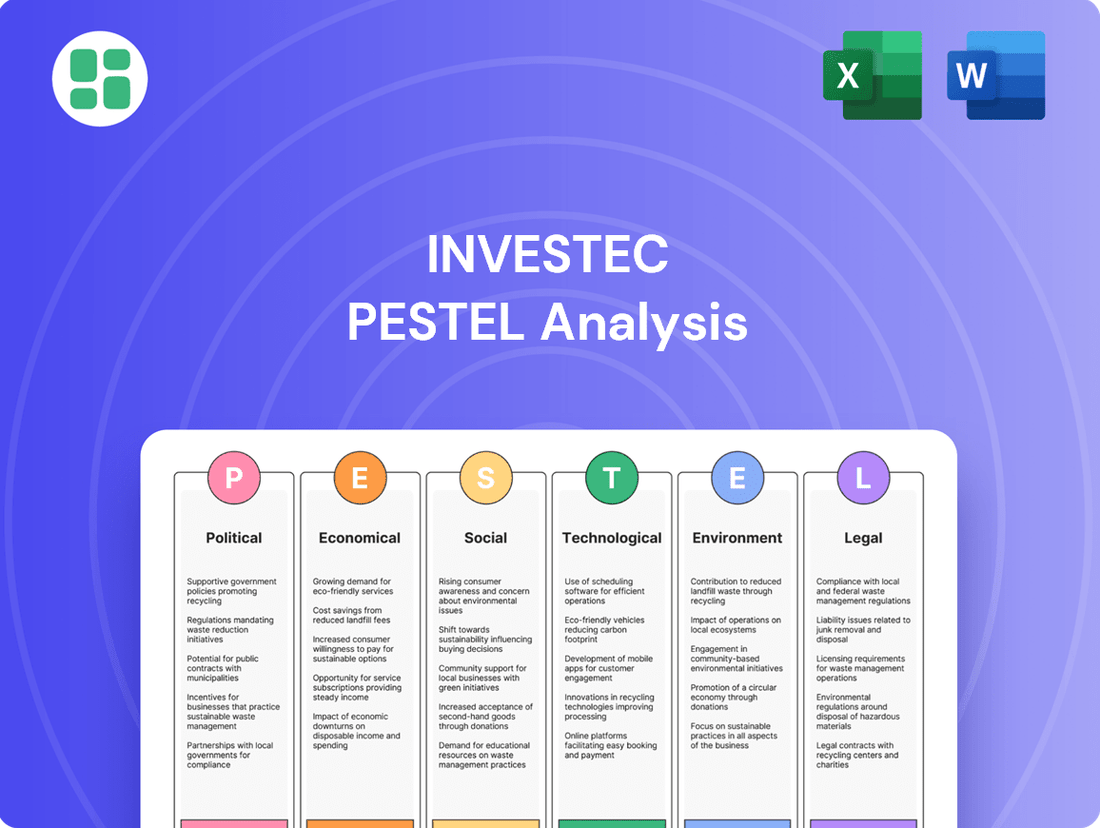

Investec PESTLE Analysis

The preview shown here is the exact Investec PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting Investec.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights for strategic planning.

Sociological factors

Global demographic trends, such as rising life expectancies, are reshaping financial landscapes. This longevity, coupled with the significant 'Great Wealth Transfer' from baby boomers to Gen X and millennials, presents a substantial opportunity for Investec's wealth management divisions. For instance, the U.S. is projected to see $84.4 trillion transferred to heirs in the next decade, a significant portion of which will flow to younger generations.

Successfully engaging these emerging affluent clients, who are often digitally adept and have distinct financial priorities, is crucial for Investec's sustained growth. Understanding their preferences for digital platforms, ESG investments, and personalized financial advice will be key to retaining and expanding its client base in the coming years.

Clients, especially younger demographics, now expect financial services to be tailored, instant, and primarily digital. This means platforms need to be intuitive and offer personalized advice, a trend heavily influenced by their experiences with other consumer tech companies.

Investec's success hinges on blending these digital demands with its established relationship-focused model. For instance, a significant portion of wealth management clients, particularly those under 40, indicate a preference for digital communication channels for routine updates and transactions, according to recent industry surveys from 2024.

The ability to deliver seamless digital interfaces, robust mobile applications, and AI-driven financial insights, all while maintaining a personal touch, is paramount. This dual approach is key to not only meeting but exceeding client expectations, fostering deeper satisfaction and long-term loyalty in a competitive market.

Clients, employees, and investors increasingly expect financial firms to be socially responsible and incorporate Environmental, Social, and Governance (ESG) factors. This trend is driving significant shifts in how financial products are developed and how companies operate, with a clear demand for ethical and sustainable practices.

Investec's focus on sustainability, including its growing range of sustainable products like those supporting renewable energy projects, directly addresses these evolving societal expectations. For instance, by Q1 2025, Investec had facilitated over £500 million in renewable energy financing, demonstrating a tangible commitment to this area.

Income Inequality and Social Mobility

High income inequality, a persistent issue in many economies including South Africa, directly impacts the potential client base for services like those offered by Investec. For instance, in 2023, South Africa's Gini coefficient remained high, indicating significant disparities in income distribution. This means while the high-net-worth segment is a key focus, the broader societal context of wealth concentration can influence market dynamics and Investec's operating environment.

While Investec primarily serves affluent clients, societal conversations and policy debates around wealth distribution and financial inclusion can create indirect pressures. For example, increased public discourse on equitable access to financial services or concerns about wealth concentration could shape regulatory approaches or public perception, potentially affecting Investec's long-term strategy and reputation.

- South Africa's Gini coefficient hovered around 0.63 in recent years, signifying substantial income inequality.

- The growth of the affluent segment, Investec's target market, is directly influenced by the concentration of wealth.

- Broader societal discussions on financial inclusion can indirectly impact Investec's operating environment and brand image.

- Policies aimed at wealth redistribution could alter the competitive landscape for financial institutions.

Talent Attraction and Retention

Attracting and keeping skilled employees is crucial in the fast-paced financial world. Investec must cultivate a positive workplace, provide attractive salaries and benefits, and support ongoing learning to maintain its specialized knowledge base.

The financial services sector in the UK, for example, saw a 3.5% growth in employment in 2024, highlighting the demand for talent. Companies like Investec are increasingly focusing on flexible working arrangements and robust training programs to stand out.

- Competitive Remuneration: Offering salaries and bonuses that align with or exceed industry averages is key. In 2024, average bonuses in UK investment banking reached 15% of base salary.

- Work Culture: A supportive and inclusive environment that values employee well-being and professional growth is a major draw.

- Employee Development: Investing in training, certifications, and clear career progression paths helps retain ambitious professionals.

- Talent Pool: Access to a diverse and highly educated workforce is essential for a specialist financial institution.

Societal expectations regarding corporate responsibility are a significant driver for financial institutions like Investec. There's a growing demand for ethical practices and investments that align with Environmental, Social, and Governance (ESG) principles. Investec's commitment to sustainable financing, such as its £500 million in renewable energy project funding by early 2025, directly addresses these evolving societal values.

Technological factors

The financial services industry is heavily invested in digital transformation, aiming to make operations smoother and more efficient. Investec's commitment to upgrading its banking technology and automation systems is crucial for optimizing all aspects of its business, from customer interactions to internal processes.

By embracing modern infrastructure and automation, Investec can achieve substantial cost reductions and boost overall efficiency. For instance, the global financial services sector saw IT spending increase by approximately 5% in 2024, with a significant portion directed towards digital transformation initiatives, indicating a strong market trend towards technological advancement.

Artificial Intelligence and Machine Learning are fundamentally reshaping wealth management. These technologies enable sophisticated predictive analytics for market trends, highly personalized investment strategies tailored to individual client needs, more robust risk management frameworks, and automated, efficient client communications. For instance, by 2025, AI is projected to manage over $50 trillion in assets globally, highlighting its transformative impact.

Investec can strategically integrate AI-powered tools and AI copilots to significantly boost advisor productivity and enrich the client experience. This integration allows for more informed, data-driven decision-making across the firm. Crucially, Investec must also proactively address the ethical implications of AI, including rigorous bias detection and mitigation to ensure fair and equitable client outcomes.

The increasing digitalization of financial services, including Investec's operations, directly correlates with a heightened risk of cyber threats and data breaches. This necessitates continuous, substantial investment in advanced security protocols and sophisticated fraud prevention mechanisms to safeguard client information and maintain trust.

For Investec, maintaining robust cybersecurity measures and effective incident response capabilities is paramount. Regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK, are increasingly prioritizing data protection and cyber resilience, making adherence to these standards a critical operational and reputational imperative.

Globally, the financial sector experienced a significant rise in cyberattacks in 2024. For instance, reports indicate that the average cost of a data breach in financial services reached $5.9 million in 2024, underscoring the financial implications of inadequate security.

FinTech and Open Banking Adoption

The financial technology (FinTech) sector continues its rapid expansion, fundamentally altering how financial services are accessed and delivered. This includes the proliferation of neo-brokers and the increasing adoption of open banking initiatives, creating a more competitive and dynamic market. Investec must navigate this evolving landscape by considering strategic partnerships and developing its own innovative digital offerings to meet client needs.

Open banking, in particular, presents opportunities for enhanced service integration. For instance, by mid-2024, the UK's Open Banking Implementation Entity (OBIE) reported that over 10 million consumers and businesses were actively using open banking services, demonstrating significant market penetration. Investec can leverage these frameworks to offer more seamless and accessible financial solutions, especially to its specialized client base.

The competitive pressure from FinTechs necessitates a proactive approach. Companies like Revolut and Monzo have gained substantial market share, with Revolut reporting over 40 million customers globally by early 2024. This signals a clear demand for user-friendly digital platforms.

To remain competitive, Investec should focus on:

- Exploring strategic FinTech partnerships to integrate cutting-edge technologies and expand service offerings.

- Developing proprietary digital solutions that cater to the specific needs of Investec's niche clientele, enhancing user experience and accessibility.

- Actively participating in open banking ecosystems to create integrated financial journeys and unlock new revenue streams.

- Monitoring FinTech trends and customer behavior to adapt its digital strategy effectively in response to market shifts.

Blockchain and Digital Currencies

Blockchain technology offers significant potential to revolutionize wealth management by improving security, transparency, and operational efficiency. Asset tokenization, a key application, allows for fractional ownership and easier transfer of illiquid assets, potentially unlocking new investment avenues for clients. The global tokenized assets market is projected to reach $16 trillion by 2030, highlighting the substantial growth anticipated in this area.

Decentralized finance (DeFi), built on blockchain, presents opportunities for innovative financial products and services. While widespread adoption of DeFi and central bank digital currencies (CBDCs) is still in its formative stages, Investec must actively monitor these developments. For instance, the Bank for International Settlements (BIS) reported in 2024 that over 90% of central banks are exploring or developing CBDCs, indicating a significant global trend toward digital currencies.

- Asset Tokenization Growth: The tokenized asset market is expected to expand dramatically, reaching an estimated $16 trillion by 2030, presenting new investment paradigms.

- CBDC Exploration: A vast majority of central banks, over 90% according to BIS in 2024, are actively researching or developing central bank digital currencies.

- DeFi Innovation: Decentralized finance platforms offer potential for novel financial instruments and services, requiring careful evaluation by financial institutions.

- Efficiency Gains: Blockchain's inherent characteristics can streamline back-office operations and enhance the security of financial transactions for firms like Investec.

Technological advancements are driving significant changes in financial services, pushing firms like Investec to adopt digital solutions for efficiency and client engagement. The global financial services sector's IT spending saw an estimated 5% increase in 2024, with digital transformation a key focus, reflecting a strong market trend.

AI and machine learning are revolutionizing wealth management by enabling personalized strategies and robust risk assessment. Projections suggest AI will manage over $50 trillion in assets globally by 2025, highlighting its transformative power.

The rise of FinTech, exemplified by companies like Revolut serving over 40 million customers globally by early 2024, necessitates strategic adaptation. Open banking, with over 10 million active users in the UK by mid-2024, also presents opportunities for integrated financial services.

Blockchain technology and asset tokenization, with the market projected to reach $16 trillion by 2030, offer new investment avenues and operational efficiencies, while over 90% of central banks are exploring CBDCs, signaling a shift towards digital currencies.

| Technology Area | Key Impact | 2024/2025 Data Point |

|---|---|---|

| Digital Transformation | Operational Efficiency & Client Engagement | Global financial services IT spending increased ~5% in 2024 |

| Artificial Intelligence (AI) | Personalized Wealth Management & Risk Assessment | AI projected to manage over $50 trillion in assets globally by 2025 |

| FinTech & Open Banking | Market Disruption & Service Integration | Revolut had >40 million customers globally by early 2024; UK Open Banking had >10 million users by mid-2024 |

| Blockchain & Digital Currencies | Security, Efficiency & New Investment Avenues | Tokenized assets market projected to reach $16 trillion by 2030; >90% of central banks exploring CBDCs (2024) |

Legal factors

Investec navigates a complex regulatory landscape, with key bodies like the UK's Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA), and South Africa's South African Reserve Bank (SARB) and Financial Sector Conduct Authority (FSCA) setting the rules. These regulators oversee everything from capital requirements to consumer protection, directly impacting Investec's operations and strategic planning.

The financial services sector is characterized by constant regulatory evolution. For instance, the UK's Consumer Duty, fully implemented in July 2023, mandates higher standards for customer outcomes, requiring firms like Investec to proactively demonstrate fair treatment. Similarly, ongoing reviews and potential enhancements to frameworks like the Senior Managers and Certification Regime (SM&CR) demand continuous investment in compliance infrastructure and personnel to ensure adherence and mitigate risks of significant fines.

Investec must navigate a complex web of data privacy laws like the UK's GDPR and South Africa's POPIA. Compliance is paramount due to the sensitive client data the company handles, making robust data protection a core operational requirement.

Failure to adhere to these regulations can result in substantial financial penalties; for instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher. Maintaining client trust and mitigating reputational damage from potential data breaches are directly tied to effective data privacy management.

Global and local Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations are tightening, with increased regulatory oversight on financial institutions' defenses against financial crime. For instance, the Financial Action Task Force (FATF) continues to update its recommendations, influencing national laws worldwide.

Investec must proactively adapt its AML/CTF frameworks, enhance client verification processes, and diligently report any suspicious transactions to maintain compliance and safeguard against significant legal penalties and reputational damage. The cost of non-compliance can be substantial, with fines reaching millions of dollars for major institutions.

Consumer Protection and Redress Frameworks

The Financial Conduct Authority's (FCA) ongoing emphasis on consumer protection, notably via the Consumer Duty introduced in 2023, mandates that Investec prioritizes fair customer treatment, transparent communication, and rigorous product suitability assessments. This regulatory shift means Investec must actively demonstrate that its products and services deliver good outcomes for consumers.

The dynamic nature of the redress framework presents significant legal and financial challenges. For instance, the Financial Ombudsman Service (FOS) handled approximately 2.7 million complaints in the year to March 2024, with a notable portion relating to financial services, indicating a heightened risk of costly redress demands for firms like Investec, especially if past practices are found wanting.

Potential for substantial redress requirements, exemplified by the ongoing scrutiny and potential liabilities within the motor finance sector, underscores the critical need for Investec to maintain robust compliance and risk management. The FCA's proactive stance on addressing past mis-selling or unfair practices means that historical business models could face significant financial repercussions in the current regulatory climate.

- Consumer Duty Compliance: Investec must embed fair treatment, clear communication, and suitable products as core operational principles.

- Redress Framework Evolution: The FCA's evolving approach to consumer redress creates ongoing legal and financial risk.

- Sector-Specific Risks: Past issues in areas like motor finance highlight the potential for significant redress liabilities.

- Proactive Risk Mitigation: Robust compliance and risk management are essential to navigate potential redress demands.

Tax Law Changes and Implications

Changes in tax legislation, both domestically and internationally, significantly influence Investec's wealth and investment management operations. For instance, adjustments to capital gains tax rates or dividend tax policies can alter client investment preferences and the attractiveness of specific financial products offered by Investec. As of early 2024, many jurisdictions are reviewing their tax codes, with a focus on digital services taxes and potential adjustments to corporate tax rates, which could impact Investec's global profitability and client advisory services.

Navigating these evolving tax landscapes is crucial for Investec to maintain its competitive edge and client trust. Staying informed about potential changes, such as the proposed reforms to international corporate taxation that could affect multinational financial institutions, allows Investec to proactively adjust its strategies and provide timely, accurate guidance. This ensures both Investec and its clients remain compliant and optimize their financial positions in light of new tax regulations.

- Impact on Investment Strategies: Tax law shifts can alter the after-tax returns of various investments, prompting clients to re-evaluate their portfolios.

- Profitability of Financial Products: Changes in tax treatment for specific financial instruments can directly affect their marketability and Investec's revenue streams.

- Compliance Burden: Investec must invest in robust compliance systems to adhere to complex and frequently updated tax regulations globally.

- Client Advisory Role: Providing expert tax advice is a key differentiator, requiring Investec to possess deep knowledge of current and anticipated tax law changes.

Investec operates within a stringent legal framework, subject to oversight from bodies like the UK's FCA and PRA, and South Africa's SARB and FSCA. These regulators impose rules on capital adequacy, consumer protection, and operational conduct, directly shaping Investec's strategic decisions and risk management. The ongoing implementation of the UK's Consumer Duty, effective from July 2023, mandates a proactive approach to demonstrating fair customer outcomes, requiring significant investment in compliance and process adjustments. Furthermore, evolving data privacy laws, such as GDPR and POPIA, necessitate robust data protection measures to safeguard sensitive client information and avoid substantial penalties, with GDPR fines potentially reaching 4% of global annual turnover.

Environmental factors

Climate change is a significant environmental factor influencing the financial sector, with increasing regulatory scrutiny and investor demand for Environmental, Social, and Governance (ESG) integration. Investec is responding by embedding ESG into its core investment strategies, evidenced by its active engagement with companies on sustainability performance and the growth of its sustainable finance products. For instance, by the end of 2023, Investec reported a substantial increase in its sustainable finance portfolio, aiming to channel billions towards climate-positive initiatives.

Regulatory pressure for green finance is intensifying. In the UK, the Financial Conduct Authority (FCA) is pushing for stricter sustainable finance rules and enhanced climate-related financial disclosures. This means financial institutions like Investec must increasingly demonstrate their commitment to environmental, social, and governance (ESG) principles.

Investec, like its peers, is under pressure to align its business practices and lending activities with green finance mandates. This involves actively reducing exposure to fossil fuel industries and significantly boosting investments in renewable energy sources. For instance, by the end of 2024, many European banks are expected to have updated their climate transition plans, a trend Investec will likely follow, potentially impacting its loan book composition.

Investec, as a significant financial services group, acknowledges its operational environmental footprint, primarily stemming from energy consumption in its offices and waste generation. In 2023, the company reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions by 15% compared to its 2019 baseline, demonstrating a commitment to mitigating its direct impact.

The firm is actively implementing policies to further reduce its environmental impact, such as investing in energy-efficient technologies and promoting responsible waste management across its global operations. Investec also engages with its supply chain, encouraging suppliers to adopt sustainable practices and align with its overarching sustainability objectives, aiming for a collective reduction in environmental impact.

Physical and Transition Risks of Climate Change

Investec's operations are significantly influenced by the physical and transition risks associated with climate change. Physical risks, such as increased frequency and severity of extreme weather events like floods and droughts, can directly impact the value of assets financed or invested in by Investec, potentially leading to loan defaults or reduced investment returns. For instance, a severe drought in an agricultural region where Investec has significant lending exposure could impair crop yields and borrower repayment capacity.

Transition risks arise from the shift towards a lower-carbon economy. These include policy changes, such as carbon pricing or stricter emissions regulations, and technological advancements that can disrupt industries heavily reliant on fossil fuels. Investec's exposure to sectors like traditional energy or heavy manufacturing could face devaluation if these transition risks are not proactively managed. The financial sector is increasingly scrutinizing these exposures, with regulatory bodies like the Bank of England highlighting the systemic importance of climate risk management for financial institutions.

- Physical Risk Example: A major flood in a coastal area where Investec has property investments could lead to substantial asset write-downs.

- Transition Risk Example: A sudden acceleration in electric vehicle adoption could negatively impact the valuation of Investec's investments in traditional internal combustion engine manufacturers.

- Regulatory Focus: The Task Force on Climate-related Financial Disclosures (TCFD) framework is increasingly being adopted, requiring companies like Investec to report on their climate-related risks and opportunities.

- Industry Impact: The global financial sector is expected to see significant shifts in capital allocation as investors prioritize climate-resilient assets, influencing Investec's strategic investment decisions.

Reputational Risk from Environmental Issues

Investec faces reputational risk if it doesn't adequately address environmental concerns. Failing to show a commitment to sustainability can harm its brand, making it less appealing to clients, employees, and investors. For instance, a significant environmental incident could lead to widespread negative media coverage, impacting customer trust and potentially deterring new business. In 2024, many financial institutions are facing increased scrutiny over their financing of fossil fuel projects, with reports highlighting the growing investor demand for transparency on climate-related risks.

Proactive engagement in sustainability is therefore vital for Investec to maintain a positive public image. This includes transparent reporting on environmental, social, and governance (ESG) performance and actively participating in initiatives that promote environmental protection. For example, many banks are now setting targets for reducing their financed emissions, aiming to align their portfolios with climate goals. By demonstrating leadership in these areas, Investec can bolster its reputation and attract stakeholders who prioritize responsible business practices.

- Reputational Damage: Failure to address environmental issues can lead to negative publicity and a decline in public trust.

- Stakeholder Impact: This damage affects Investec's attractiveness to clients, potential employees, and investors.

- Sustainability Initiatives: Proactive engagement in green finance and ESG reporting is key to mitigating these risks.

- Market Trends: In 2024, there's a clear trend of investors favoring financial institutions with strong sustainability credentials and transparent climate risk management.

Environmental factors are increasingly shaping the financial landscape, with climate change posing both risks and opportunities for institutions like Investec. Growing regulatory pressure, such as the FCA's push for enhanced climate disclosures, necessitates a proactive approach to sustainability. Investec's commitment to ESG integration is evident in its expanding sustainable finance portfolio, which by the end of 2023, saw significant growth, channeling billions towards climate-positive initiatives.

The company is actively managing physical and transition risks associated with climate change. Physical risks, like extreme weather events, can impact asset values, while transition risks stem from the shift to a lower-carbon economy, potentially devaluing fossil fuel-reliant sectors. Investec reported a 15% reduction in its Scope 1 and 2 greenhouse gas emissions by the end of 2023 compared to a 2019 baseline, underscoring its operational mitigation efforts.

Reputational risk is also a key consideration; failure to address environmental concerns can damage brand perception and stakeholder trust. Investec's proactive engagement in sustainability, including transparent ESG reporting and participation in environmental initiatives, is crucial for maintaining a positive public image and attracting investors who prioritize responsible practices, a trend gaining significant momentum in 2024.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Investec draws from a diverse range of authoritative sources, including financial reports from regulatory bodies, economic data from international organizations like the IMF and World Bank, and industry-specific market research. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting Investec.