Investec Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Investec Bundle

Uncover the strategic positioning of this company's portfolio with a glimpse into its BCG Matrix. See how its products stack up as Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a comprehensive breakdown and actionable insights to optimize your investment strategy.

Stars

Investec's South African Wealth and Investment business is a standout performer, a true 'Star' in the BCG matrix. The segment saw its funds under management surge by an impressive 14.5%, reaching £24.0 billion. This robust growth highlights its significant market share and strong momentum in a vital economic region.

This business is a critical engine for Investec's non-interest revenue, demonstrating its ability to capture market opportunities effectively. Its stellar performance necessitates ongoing strategic investment to solidify its leading position and capitalize on future growth prospects.

Investec's specialist private client and corporate lending in South Africa is a significant growth area, with core loans in Southern Africa increasing by 9% in rand terms. This robust performance highlights a strong market position within a burgeoning segment of its core operating region.

This segment's growth suggests it's a prime candidate for future Cash Cow status within the BCG matrix. Continued strategic focus and investment here are crucial for Investec to leverage its current momentum and solidify its market leadership.

Investec is targeting £18 billion in sustainable and transition finance by 2030, viewing this as a key avenue for both commercial expansion and societal benefit. This strategic focus is underpinned by their consistent recognition as one of the world's most sustainable companies, a title they've held for three consecutive years as per the 2025 Global 100 rankings.

This strong market standing and ambitious financial goal in a rapidly growing sector firmly place sustainable and transition finance within the Stars quadrant of the Investec BCG Matrix. Significant investment is warranted here to solidify market leadership and capitalize on future opportunities.

Digital Banking and Wealth Management Solutions

Investec's focus on digital banking and wealth management solutions positions these offerings as Stars within its business portfolio. The company is channeling substantial investment into technological advancements in this high-growth sector, recognizing it as a crucial gateway for new client acquisition and retention.

This strategic allocation of resources underscores Investec's ambition to secure a dominant market share in the evolving digital financial services landscape. While its current footprint in purely digital services might be less extensive than some competitors, the significant investment and the sector's inherent growth trajectory clearly mark these as Stars.

- High Growth Potential: The digital financial services market is experiencing rapid expansion, driven by increasing consumer adoption of online and mobile banking platforms.

- Significant Investment: Investec's commitment to technology enhancements in these areas signals a strong belief in their future revenue generation and market leadership potential.

- Competitive Landscape: Despite potentially lower current market share in digital-native offerings, the strategic investment aims to bridge this gap and compete effectively with established digital players.

- Future Market Share Capture: By investing in digital banking and wealth management, Investec is positioning itself to capture a larger portion of future market share in these increasingly vital client relationship channels.

Private Equity Funds Solutions

Investec has dedicated over a decade to crafting adaptable finance solutions for private equity funds, drawing on deep market understanding and global expertise. This specialization positions Investec favorably within a sector anticipating robust growth, with deal valuations and expected returns on the rise through 2025.

The private equity landscape is dynamic, with increasing deal sizes and a projected uptick in investor returns for 2025, indicating a fertile ground for capital deployment. Investec's long-standing commitment and proven track record in providing bespoke financial solutions to this niche market are key differentiators. For instance, the firm's ability to offer flexible financing structures, from subscription lines to NAV facilities, directly addresses the evolving needs of PE fund managers navigating complex transactions and seeking to optimize capital efficiency. This strategic focus and established presence are expected to drive further market share gains.

Key aspects of Investec's private equity fund solutions include:

- Flexible financing options: Tailored debt solutions to meet diverse fund structures and investment strategies.

- Deep sector expertise: Over a decade of experience understanding the nuances of the private equity market.

- Global reach: Access to international markets and expert support for cross-border transactions.

- Anticipated market growth: Positioned to capitalize on increasing deal valuations and improved returns projected for 2025.

Investec's South African Wealth and Investment business is a prime example of a Star. Its funds under management grew by 14.5% to £24.0 billion, showcasing strong market share and momentum. This segment is a key driver of non-interest revenue, justifying continued investment to maintain its leading position.

The company's commitment to sustainable and transition finance, targeting £18 billion by 2030, also places it firmly in the Star category. This focus is supported by their consistent recognition as one of the world's most sustainable companies for three consecutive years as per the 2025 Global 100 rankings.

Investec's strategic investment in digital banking and wealth management solutions positions these as Stars. Despite a potentially smaller current digital footprint compared to some rivals, the significant resource allocation and the sector's high-growth trajectory indicate strong future potential for market share capture.

Private equity fund solutions represent another Star for Investec. With over a decade of specialized experience and the private equity market anticipating robust growth through 2025, Investec is well-positioned to capitalize on increasing deal valuations and investor returns.

| Business Segment | BCG Category | Key Performance Indicators | Strategic Rationale |

| South African Wealth & Investment | Star | Funds under management: £24.0 billion (+14.5%) | High market share, strong momentum, significant non-interest revenue driver. Requires ongoing investment. |

| Sustainable & Transition Finance | Star | Target: £18 billion by 2030; Recognized as a most sustainable company (3 consecutive years, 2025 Global 100) | High-growth sector, societal benefit, market leadership potential. Warrants significant investment. |

| Digital Banking & Wealth Management | Star | Significant investment in technology | High-growth sector, crucial for client acquisition/retention, aims to capture future market share. |

| Private Equity Fund Solutions | Star | Over a decade of experience; Anticipated market growth through 2025 | Deep sector expertise, flexible financing, global reach, poised to benefit from increasing deal valuations. |

What is included in the product

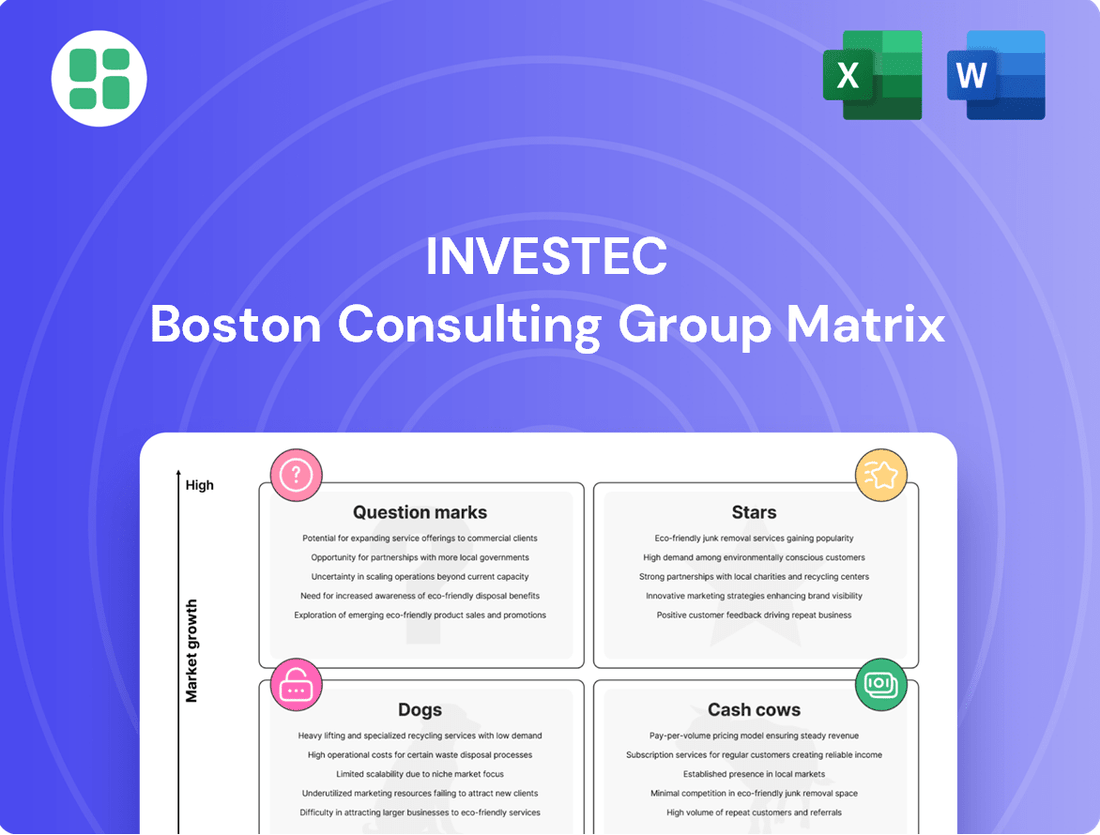

The Investec BCG Matrix analyzes a company's portfolio by product or business unit, categorizing them into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

The Investec BCG Matrix provides a clear, one-page overview, alleviating the pain of complex strategic analysis.

Cash Cows

Investec's established UK and South African private banking operations are clear cash cows within its BCG matrix. These segments cater to high-net-worth individuals and entrepreneurs, consistently delivering substantial revenue and deposit growth.

In 2024, Investec's wealth and investment division, which includes private banking, reported strong performance. For instance, the firm's interim results for the six months ending September 30, 2023, showed a significant increase in funds under management and administration, a testament to client loyalty and the attractiveness of its offerings in these mature markets.

The deep-rooted client relationships and the mature nature of these markets make this business a reliable source of stable cash flow for Investec. This consistent generation of profits underpins the group's ability to invest in other areas of its business.

Investec's South African banking operations are a clear cash cow, demonstrating robust performance. In the fiscal year ending March 31, 2024, this segment reported a significant contribution to the group's overall profitability, with operating profit expected to see at least 5% growth in rand terms. This consistent outperformance, coupled with a strong return on equity, solidifies its position as a reliable generator of substantial cash flow for the company.

Investec's established wealth management operations in South Africa, distinct from recent expansion efforts, represent a solid Cash Cow. This segment consistently generates substantial non-interest revenue through its well-entrenched fee-based services and significant assets under administration.

Despite operating within a mature South African market, Investec commands a high market share, underscoring the reliability and profitability of this division. For instance, as of the fiscal year ending March 31, 2024, Investec reported robust growth in its wealth and investment division, with funds under management and administration reaching £71.2 billion, reflecting the enduring strength of its core offerings.

Property Finance in South Africa

Investec's property finance division in South Africa operates as a classic Cash Cow within the BCG framework. The company holds a commanding market position, boasting the largest market share in this sector.

This established segment is characterized by its provision of bespoke senior debt funding solutions, signifying a stable and substantial revenue stream derived from a mature market. Investec's leadership ensures consistent cash generation.

For instance, in 2024, the South African commercial property market saw continued activity, with Investec playing a pivotal role in financing significant developments. The sector's maturity means lower investment requirements for maintaining market share.

- Dominant Market Share: Investec leads South Africa's property finance sector.

- Stable Revenue Stream: Bespoke senior debt funding provides consistent cash flow.

- Mature Market: Low investment needs to maintain its strong position.

- Significant Cash Generation: The segment reliably produces surplus cash.

Core Customer Deposits and Lending Book

Investec's core customer deposits and lending book represent a classic Cash Cow. The company saw its customer deposits climb to £41.2 billion, a solid 4.1% increase, largely due to robust growth in retail and non-wholesale accounts in both the UK and South Africa. This substantial and dependable deposit base, combined with an expanding loan book, offers a reliable and cost-effective funding stream that underpins its lending operations and generates significant net interest income.

This financial structure is ideal for a Cash Cow because:

- Stable Funding Source: The £41.2 billion in customer deposits provides a consistent and low-cost base for Investec's operations.

- Net Interest Income Generation: The interplay between this funding and the growing loan book directly translates into substantial net interest income.

- Low Growth, High Profitability: While deposit growth might not be explosive, the stability and cost-efficiency allow for consistent, high profitability.

- Foundation for Other Businesses: This reliable income stream supports Investec's investments in other, potentially higher-growth areas of its business.

Investec's core customer deposits and lending book are a prime example of a Cash Cow within the BCG matrix. The company's customer deposits reached £41.2 billion, reflecting a solid 4.1% increase driven by growth in retail and non-wholesale accounts across the UK and South Africa.

| Segment | BCG Classification | Key Characteristics | 2024 Data/Observation |

|---|---|---|---|

| UK Private Banking | Cash Cow | Mature market, high-net-worth clients, stable revenue | Strong performance in funds under management and administration (as of Sep 30, 2023) |

| South African Banking | Cash Cow | Robust performance, significant profitability contribution | Expected operating profit growth of at least 5% in rand terms (FY ending Mar 31, 2024) |

| South African Wealth Management | Cash Cow | High market share, fee-based services, substantial assets | Funds under management and administration reached £71.2 billion (FY ending Mar 31, 2024) |

| South African Property Finance | Cash Cow | Dominant market share, bespoke debt funding, stable cash flow | Pivotal role in financing developments in a mature market (2024 activity) |

| Customer Deposits & Lending Book | Cash Cow | Stable, low-cost funding, net interest income generation | Customer deposits reached £41.2 billion, a 4.1% increase (2024) |

What You’re Viewing Is Included

Investec BCG Matrix

The Investec BCG Matrix preview you are viewing is the identical, fully polished document you will receive immediately after your purchase. This means you'll get the complete strategic analysis, free from any watermarks or demo indicators, ready for immediate application in your business planning.

Dogs

Investec's UK banking operations present a challenging picture within the BCG framework. For the fiscal year ending March 31, 2024, operating profit for this segment showed a slight fluctuation, potentially ranging from a 4% decrease to a 4% increase compared to the prior year. This indicates a mature or perhaps struggling market.

Furthermore, the credit loss ratio in the UK was notably higher than in South Africa, signaling increased risk and potentially lower net returns. This combination of modest growth prospects and elevated risk profiles positions UK banking as a potential cash cow that is not generating sufficient returns, or perhaps a dog that requires careful management or divestment.

Non-core, commoditized offerings within Investec's portfolio, if any remain, would likely represent services with low differentiation and intense competition. These might include basic transactional banking or standardized lending products that don't leverage Investec's specialist capabilities. Such offerings typically exhibit low market share and limited growth potential in the current financial services environment.

For instance, if Investec were to retain a small segment of its business focused on highly commoditized foreign exchange services for small businesses, this would fit the description. In 2024, the global FX market is highly competitive, with major players and fintechs offering razor-thin margins. Businesses seeking such services often prioritize price and ease of execution over specialized advice, making it difficult for a niche player like Investec to gain significant traction or command premium pricing in this segment.

Investec's UK operations are facing challenges with specific impaired loan portfolios, contributing to an anticipated credit loss ratio at the higher end of the 50 to 60 basis points range for 2024. These portfolios are characterized by their low returns and significant capital drain, aligning them with the 'Dog' quadrant of the BCG matrix.

The recognition of impairments within these portfolios highlights their underperformance and the need for strategic intervention. For instance, reports from late 2023 indicated a rise in provisions for such assets across the financial sector, a trend likely continuing into 2024.

Management's strategy for these 'Dog' assets will likely concentrate on a phased reduction or outright divestment, rather than allocating additional capital for growth or turnaround efforts. This approach aims to free up resources and improve overall capital efficiency within the UK segment.

Legacy IT Systems or Non-Integrated Platforms

Legacy IT systems, those older, siloed platforms, often struggle to align with modern strategies like Investec's 'One Investec' initiative or broader digital transformation goals. These systems can become costly burdens, consuming resources for maintenance without delivering substantial growth or efficiency gains. Their presence can actively impede the group's overall performance.

In a 2024 analysis of financial institutions, a significant portion reported that outdated IT infrastructure was a key inhibitor to innovation and customer experience improvements. For instance, a survey indicated that over 60% of banks are still grappling with the challenges of integrating legacy systems into their digital roadmaps, leading to increased operational risks and higher IT spending on upkeep rather than advancement.

- High Maintenance Costs: Legacy systems often require specialized, expensive support and are prone to frequent breakdowns, diverting funds from growth initiatives.

- Limited Scalability and Flexibility: These systems are typically rigid, making it difficult and costly to adapt to changing market demands or integrate new technologies.

- Security Vulnerabilities: Older systems may lack modern security features, leaving them susceptible to cyber threats and data breaches.

- Hindered Digital Transformation: Their inability to integrate with newer platforms creates operational silos, slowing down digital initiatives and impacting overall efficiency.

Small, Niche Ventures with Limited Scalability

Small, niche ventures with limited scalability, often referred to as Dogs in the Investec BCG Matrix, represent businesses or projects that hold a small market share in low-growth industries. These ventures typically struggle to generate substantial revenue or profit, and their future growth prospects are often dim. For instance, a company might have a small experimental project in a highly specialized technological field that, while innovative, hasn't yet found a broad market or demonstrated a clear path to significant expansion.

These "Dogs" often require ongoing investment to maintain operations but offer little return. Their low market share means they lack the competitive advantage to gain traction, and the low-growth environment limits opportunities for organic expansion. Without a strategic pivot or significant innovation, these ventures are unlikely to improve their standing within the portfolio.

- Low Market Share: Ventures in this category typically command a very small percentage of their respective markets.

- Low Market Growth: They operate within industries or segments experiencing minimal or no expansion.

- Limited Profitability: These ventures often break even or incur losses, failing to contribute meaningfully to overall profits.

- Minimal Future Potential: Without a clear strategy for growth or innovation, their long-term viability is questionable.

In the Investec BCG Matrix, "Dogs" represent business units or ventures with low market share in low-growth markets. These typically require ongoing investment to sustain operations but yield minimal returns, often struggling to break even. Their limited profitability and questionable long-term viability necessitate careful strategic consideration, often leading to divestment or restructuring.

Investec's UK banking segment, particularly certain impaired loan portfolios, aligns with the 'Dog' classification. For the fiscal year ending March 31, 2024, these portfolios exhibited low returns and significant capital drain, contributing to an anticipated credit loss ratio at the higher end of the 50 to 60 basis points range. This situation underscores the need for management to focus on reducing or divesting these underperforming assets to improve capital efficiency.

Legacy IT systems within Investec also fit the 'Dog' profile. These outdated platforms are costly to maintain, hinder digital transformation efforts, and pose security risks. A 2024 survey revealed that over 60% of banks struggle with legacy system integration, leading to increased operational costs and stifled innovation, a challenge likely faced by Investec as well.

Small, niche ventures with limited scalability, such as highly commoditized foreign exchange services for small businesses, also fall into the 'Dog' category. The global FX market in 2024 is intensely competitive, with thin margins, making it difficult for such ventures to gain significant market share or command premium pricing.

| Category | Market Share | Market Growth | Profitability | Strategic Implication |

| Dogs | Low | Low | Low/Negative | Divest, Harvest, or Restructure |

| UK Banking Portfolios (Impaired Loans) | Low (within segment) | Low (mature market) | Low/Negative (due to impairments) | Reduce exposure, divest |

| Legacy IT Systems | N/A (internal) | N/A (hinders growth) | High Cost, Low Return | Modernize or replace |

| Commoditized FX Services | Low | Low (highly competitive) | Low | Divest or niche focus |

Question Marks

Emerging digital financial products in their early stages, like novel blockchain-based lending platforms or AI-driven personalized investment advisory tools still finding their footing, represent the question marks in Investec's BCG matrix. These ventures are in high-growth markets, aligning with Investec's strategic focus on digital banking and wealth management. For example, the global fintech market was valued at over $110 billion in 2023 and is projected to grow significantly, but these early-stage products are yet to capture substantial market share.

These nascent products demand considerable investment for research, development, scaling, and market penetration. Their success hinges on proving their value proposition and achieving widespread adoption. Without significant capital infusion, they risk remaining niche or failing to compete against more established digital offerings. Investec's commitment to these areas reflects a long-term vision, acknowledging the potential rewards if these question marks can transition into stars.

Expanding into new niche international markets aligns with the concept of 'Question Marks' in the BCG matrix. These are markets where Investec might have a low market share but sees high growth potential. For instance, exploring fintech opportunities in emerging African economies or specialized wealth management services in Southeast Asia could fit this category.

These ventures often require substantial investment to build market presence and overcome initial hurdles. For example, establishing a new banking subsidiary in a developing market can involve significant upfront capital for licensing, infrastructure, and talent acquisition. Investec's 2024 strategy likely involves identifying and piloting such opportunities, understanding that the initial return on investment might be low.

The burgeoning demand for Environmental, Social, and Governance (ESG) investing is undeniable, with global sustainable investment assets reaching an estimated $37.8 trillion in early 2024, according to the Global Sustainable Investment Alliance. Investec, recognizing this shift, is actively participating in sustainable finance by launching new, targeted ESG-focused investment products designed to capture this growing market.

These new offerings, such as specific ESG equity funds or green bond portfolios, are still in the process of building their client base and establishing market share. While operating within a high-growth sector, they require substantial marketing and client adoption strategies to achieve significant penetration.

Strategic Partnerships with Fintech Companies

Investec views strategic partnerships with FinTech companies as crucial for navigating the evolving financial landscape. These collaborations allow Investec to tap into innovative technologies and expand its reach to new customer segments, positioning them for future growth.

New financial products or services emerging from these early-stage FinTech collaborations, characterized by their nascent market penetration but significant growth potential due to innovation, would be classified as Stars within the BCG Matrix framework. For instance, a partnership focused on developing AI-driven personalized investment advice, currently in pilot phases with limited user adoption but projected to disrupt traditional wealth management, exemplifies this category. By Q2 2024, the global FinTech market was valued at over $2.5 trillion, underscoring the immense growth opportunities available through such strategic alliances.

- Stars: FinTech-driven innovations with low current market share but high growth potential.

- Strategic Importance: Partnerships are key to accessing new technologies and customer bases for digital future growth.

- Market Context: The FinTech sector continues its rapid expansion, with significant investment flowing into innovative solutions.

- Example: AI-powered wealth management tools represent a prime area for such strategic FinTech collaborations.

Specific Green Energy Investment Funds (beyond established)

Investec's commitment extends to emerging green energy funds, such as the Revego Africa Energy Fund. This fund is actively working to secure additional capital to fuel renewable energy projects across the African continent.

While the broader sustainable finance sector is a strong performer (a Star in the BCG Matrix), specific, newer green energy investment funds that are still building their market presence but have significant growth potential are key considerations. These funds, like Revego, are in a phase where they require substantial investment to realize their ambitious expansion plans and solidify their position within their respective sub-sectors.

- Revego Africa Energy Fund: Actively raising capital for renewable projects in Africa.

- Growth Stage: Positioned as potential Stars, needing significant investment to scale.

- Market Potential: Targeting growth in underserved green energy markets.

- Investment Need: Requires substantial funding to achieve ambitious expansion targets.

Question Marks within Investec's BCG matrix represent new ventures or products with high growth potential but currently low market share. These are areas where significant investment is needed to develop and capture market dominance. For instance, the bank's exploration into niche digital lending products or specialized advisory services for emerging markets falls into this category. These initiatives require substantial capital for research, development, and market entry to prove their viability and potential to become future Stars.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.