Investec Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Investec Bundle

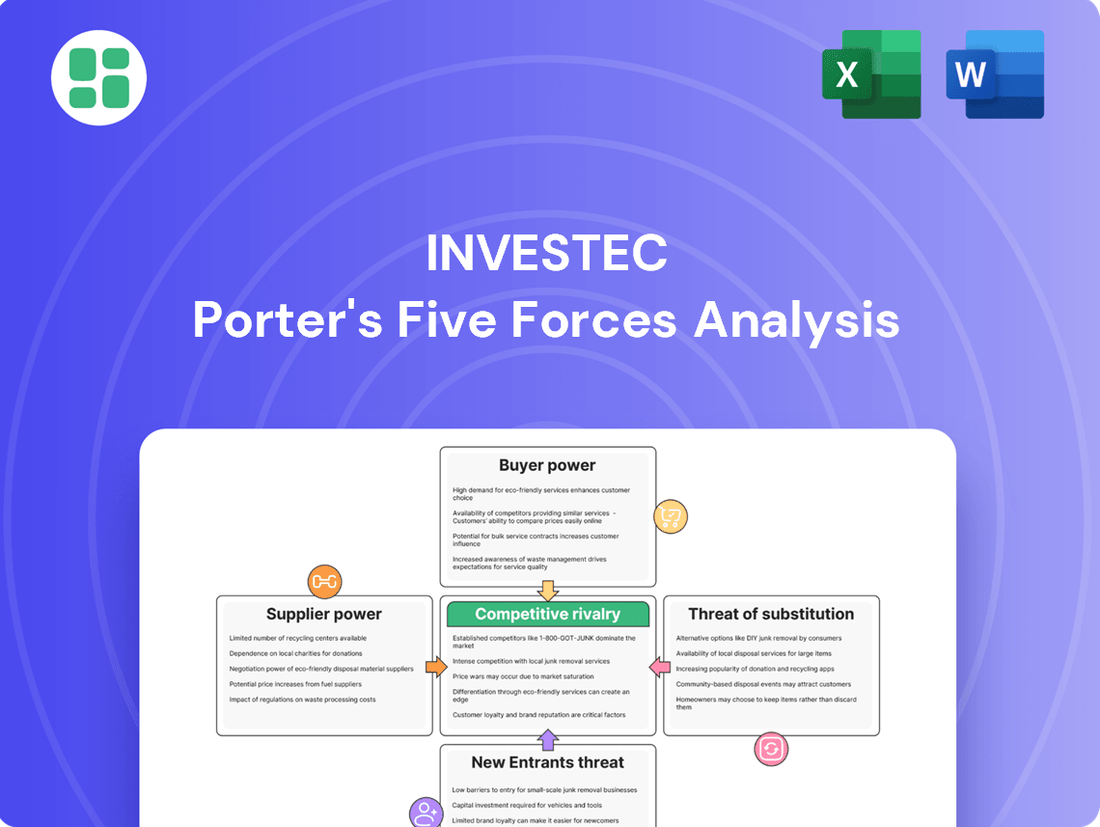

Investec operates within a dynamic financial services landscape, and a Porter's Five Forces analysis reveals the intricate web of competitive pressures it navigates. Understanding the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry is crucial for any stakeholder.

This snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Investec’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Investec benefits from a wide array of suppliers across various sectors, including technology, marketing, and consulting. This diversification prevents over-reliance on any single vendor, thereby limiting individual supplier power. For example, in 2024, the financial services industry saw a continued proliferation of fintech solutions, offering banks like Investec numerous alternative technology partners.

Manageable switching costs in the financial services sector offer Investec significant leverage. While some specialized technology or data providers might create minor dependencies, the overall landscape allows for considerable vendor flexibility. For instance, Investec's vendor agreements often stipulate termination clauses with as little as 30 days' notice, minimizing the financial or operational hurdles associated with changing suppliers.

The increasing availability of cloud services, open-source software, and low-code platforms has significantly lowered the technology entry barriers for financial institutions. This accessibility means that technology providers, while crucial, face their own competitive pressures, which in turn limits their ability to exert substantial bargaining power over established players like Investec.

Influence of Financial Advisors/Accountants (Indirect Suppliers)

Financial advisors and accountants, though not direct suppliers of goods, significantly influence the adoption and design of fintech solutions for their clients. Their recommendations can steer businesses towards specific platforms or features, giving them a degree of indirect bargaining power over pricing and functionality.

These professionals' expertise is critical in tailoring financial technology to meet diverse client needs. For instance, a significant portion of wealth management firms rely on advisor input for technology choices, impacting how Investec might need to adapt its offerings. In 2024, the global fintech market saw continued growth, with a strong emphasis on integrated advisory tools, highlighting the importance of this indirect supplier influence.

- Influence on Adoption: Advisors act as gatekeepers, influencing which fintech products clients adopt.

- Demand for Integration: Their need for seamless integration with existing client management systems can shape product development.

- Pricing Leverage: Recommendations based on perceived value and cost-effectiveness can impact Investec's pricing strategies for B2B fintech solutions.

Human Capital and Talent Acquisition

In specialist banking and wealth management, the ability to attract and keep skilled individuals like relationship managers and financial experts is paramount. This is a significant factor influencing the bargaining power of suppliers, particularly human capital.

A scarcity of qualified talent, especially in growing markets such as Asia and the Middle East, can significantly amplify the leverage of skilled professionals. This often translates into higher expenses for companies like Investec when it comes to recruiting and retaining their workforce.

- Talent Shortage Impact: Reports from 2024 indicate a persistent global shortage in specialized financial roles, with demand outstripping supply by as much as 15% in certain high-growth regions.

- Rising Compensation: This imbalance contributed to an estimated 8-12% increase in average compensation packages for experienced financial professionals in 2024 compared to the previous year.

- Retention Challenges: Firms are investing more in retention strategies, including enhanced benefits and career development programs, to combat the heightened risk of key talent moving to competitors.

Investec's bargaining power with suppliers is generally moderate due to a diverse supplier base and manageable switching costs, particularly in technology. While specialized services can create some dependency, the overall market offers flexibility, limiting suppliers' ability to dictate terms. The financial services sector in 2024 continued to see a wide range of technology providers, reducing reliance on any single entity.

The bargaining power of human capital suppliers, especially skilled financial professionals, presents a more significant challenge. A global shortage in specialized roles, estimated to be around 15% in certain growth regions in 2024, drives up recruitment and retention costs. This scarcity means Investec faces increased competition for talent, leading to higher compensation demands.

| Factor | Impact on Investec | 2024 Data/Trend |

|---|---|---|

| Supplier Diversification | Lowers supplier power | Continued proliferation of fintech solutions |

| Switching Costs | Low to moderate | 30-day termination clauses common |

| Talent Scarcity | Increases supplier (human capital) power | 8-12% rise in compensation for experienced professionals |

| Competition for Talent | Amplifies demands of skilled professionals | Persistent global shortage in specialized financial roles |

What is included in the product

Investec's Porter's Five Forces analysis dissects the competitive intensity within its operating environment, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing firms.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces in a single, actionable dashboard.

Customers Bargaining Power

High net worth clients, a core segment for Investec, often possess significant financial resources and sophisticated investment knowledge. This sophistication translates into demanding expectations for highly personalized service, bespoke financial strategies, and access to exclusive investment opportunities. Their ability to command such tailored solutions grants them considerable bargaining power.

In 2024, the wealth management industry saw continued growth in assets under management for high net worth individuals, with reports indicating a global increase in this segment. These clients, accustomed to premium service, can easily shift their substantial assets to competitors offering superior or more specialized solutions, thereby increasing their leverage over firms like Investec.

Investec's strong customer satisfaction, often surpassing industry benchmarks, highlights a positive foundation. However, a notable segment of high-net-worth individuals remains receptive to exploring or adding new wealth management relationships.

This openness stems from various drivers, including unaddressed financial needs, a search for a broader product suite, and the appeal of enhanced digital platforms. These factors underscore that customer loyalty is not an impenetrable barrier, as clients actively evaluate and consider alternative offerings.

Customers, particularly those from younger, digitally native demographics, now possess unprecedented access to financial data and comparison tools. This widespread availability of information, often facilitated by online platforms and fintech innovations, allows them to easily scrutinize product features and pricing from a multitude of financial institutions. For instance, in 2024, a significant portion of consumers actively used comparison websites before making financial decisions, demonstrating a clear shift towards informed purchasing.

This enhanced transparency directly translates into increased customer bargaining power. Armed with the ability to readily compare offerings from traditional banks, credit unions, and agile fintech startups, consumers are more inclined to seek out the best value. This heightened price sensitivity means that financial service providers must be highly competitive to attract and retain customers, as switching costs are often perceived as low in the digital age.

Volume and Value of Large Clients

The bargaining power of customers is a significant factor for Investec, particularly concerning its large institutional clients and ultra-high net worth individuals. These clients often manage substantial volumes of assets or conduct high-value transactions, making them crucial to Investec's revenue streams. For instance, as of the first half of 2024, Investec's Private Banking and Wealth Management division reported significant inflows, underscoring the importance of these client segments.

The sheer scale of these clients' business with Investec translates directly into considerable negotiating leverage. They can effectively demand more favorable terms, including reduced fees and enhanced service levels, due to the significant revenue they generate. This can force Investec to offer customized agreements, potentially impacting the company's overall profit margins on these key accounts.

- Significant Asset Concentration: Large clients often concentrate a substantial portion of their wealth or business with a single provider like Investec.

- Fee Sensitivity: High-value clients are typically more sensitive to fees and are adept at seeking competitive pricing.

- Customized Service Demands: Their needs often require bespoke solutions, which can increase operational complexity and cost for Investec.

- Switching Costs: While switching costs can exist, for very large clients, the potential savings or improved service can outweigh these costs.

Consolidation of Banking and Wealth Management

Customers are increasingly demanding integrated banking and wealth management services for greater convenience and a unified view of their finances. This trend empowers clients who seek such consolidation, potentially increasing their bargaining power against firms like Investec.

Financial institutions that successfully offer seamless, cross-service solutions are better positioned to meet this demand. For example, as of early 2024, many wealth management firms are investing heavily in digital platforms that combine banking, investment, and advisory services, reflecting client preferences.

This push for integration means clients can more easily switch to providers offering a more comprehensive package, thereby pressuring Investec to bolster its own integrated offerings and potentially offer more competitive terms to retain and attract these discerning customers.

- Client Demand for Integration: A significant driver of customer bargaining power in the banking and wealth management sector.

- Holistic Financial Oversight: Clients desire a single point of contact for all their financial needs, from daily banking to long-term investments.

- Competitive Pressure on Investec: Firms offering superior integrated solutions can attract clients, forcing Investec to enhance its cross-service capabilities.

- Digital Platform Investments: Financial institutions are actively developing platforms that merge banking and wealth management to meet evolving client expectations.

The bargaining power of customers for Investec is substantial, particularly with high-net-worth individuals and institutional clients who manage significant assets. These clients are often well-informed and can easily shift their business to competitors offering better terms or more specialized services, a trend amplified by readily available financial data and comparison tools in 2024. For instance, in the first half of 2024, Investec's Private Banking and Wealth Management division saw considerable inflows, highlighting the critical importance of retaining these large clients who wield considerable negotiating leverage due to the revenue they generate.

| Client Segment | Bargaining Power Drivers | Impact on Investec |

|---|---|---|

| High Net Worth Individuals | Sophisticated financial knowledge, demand for personalized service, access to exclusive opportunities. | Ability to command tailored solutions, potential to shift substantial assets, driving demand for premium service. |

| Institutional Clients | Large asset volumes, high-value transactions, significant revenue generation. | Negotiating leverage for favorable terms (reduced fees, enhanced service), potential impact on profit margins. |

| Digitally Native Demographics | Access to financial data, comparison tools, price sensitivity. | Increased scrutiny of product features and pricing, pressure for competitive offerings, perceived low switching costs. |

Full Version Awaits

Investec Porter's Five Forces Analysis

This preview showcases the complete Investec Porter's Five Forces Analysis, offering an in-depth examination of competitive pressures within the industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no discrepancies or missing information. You're looking at the actual, ready-to-use analysis, providing you with immediate actionable insights upon completion of your transaction.

Rivalry Among Competitors

Investec faces significant competitive rivalry, particularly in its core markets of South Africa and the UK. These regions are characterized by a concentration of powerful, established financial institutions.

In South Africa, Investec contends with formidable local banks including Standard Bank, Absa, Nedbank, and FNB. These entities possess deep market penetration and extensive customer bases, intensifying the competitive landscape.

Similarly, in the UK, Investec must navigate competition from global giants like UBS, Credit Suisse, and Barclays. The presence of these international players, with their vast resources and broad service offerings, further heightens the rivalry for market share and talent.

Investec thrives by carving out a niche, focusing on specialist banking, wealth management, and investment banking. This strategy helps it sidestep direct clashes with large, broad-market banks, allowing it to concentrate on specific client needs.

However, this focused approach doesn't eliminate competitive pressure. Within its specialized areas, Investec faces considerable rivalry from other boutique firms and the dedicated divisions of larger financial institutions. For instance, in wealth management, firms like Charles Stanley and Rathbones compete for similar high-net-worth clients.

In 2024, the wealth management sector continued to see consolidation, with firms actively seeking scale. Investec's ability to maintain its niche appeal amidst this trend is crucial. While specific market share data for Investec's niche segments isn't always publicly dissected, the overall UK wealth management market managed assets were estimated to be in the trillions, highlighting the significant competitive landscape.

Competitors are aggressively pursuing growth, with both established players and new entrants actively expanding into profitable areas like specialist banking and wealth management. For instance, Capitec is making significant inroads into business banking, while other financial institutions are channeling substantial investments into digital platforms to capture high-net-worth individuals. This strategic maneuvering by rivals is intensifying the competitive pressures within the industry.

Impact of Technological Advancements

Technological advancements are intensely reshaping the financial services landscape, fueling fierce competition. Companies are aggressively adopting artificial intelligence, automation, and sophisticated digital platforms to attract and retain customers through superior experiences and streamlined operations. For instance, by the end of 2023, global investment in financial technology (FinTech) reached significant levels, with a notable portion directed towards AI and machine learning applications to personalize services and improve risk management. Investec’s ability to keep pace with these innovations is paramount; failing to invest adequately risks ceding ground to more agile, tech-forward rivals.

The pressure to innovate means that competitors are constantly rolling out new digital products and services. This rapid pace of change requires continuous investment in technology to remain relevant. In 2024, many financial institutions are prioritizing cloud migration and data analytics to gain deeper customer insights and offer more tailored financial solutions. Investec must therefore maintain a robust technology budget to ensure its offerings are competitive and align with evolving client expectations in an increasingly digital-first marketplace.

The impact of technology on competitive rivalry is evident in several key areas:

- Customer Experience Enhancement: Competitors are using AI-powered chatbots and personalized digital interfaces to offer 24/7 support and tailored advice, significantly raising customer expectations.

- Operational Efficiency Gains: Automation of back-office processes, such as data entry and compliance checks, allows rivals to reduce costs and speed up service delivery, creating a pricing advantage.

- Innovative Product Development: FinTech firms and traditional banks alike are leveraging new technologies to create novel investment products, lending platforms, and payment solutions that challenge established market norms.

- Data Analytics and Insights: Advanced analytics enable competitors to better understand market trends and customer behavior, leading to more effective marketing campaigns and product strategies.

Regulatory Scrutiny and Compliance Costs

The financial services industry, including banking and wealth management where Investec operates, faces increasing regulatory scrutiny. For instance, in 2024, global financial regulators continued to emphasize capital adequacy, consumer protection, and anti-money laundering measures, leading to more stringent compliance requirements.

These evolving regulations, while promoting a more stable and fair market, impose substantial operational costs. Firms must invest heavily in compliance technology, legal expertise, and reporting infrastructure. This can disproportionately affect smaller players or those with less diversified business models.

Investec, like its peers, must allocate significant resources to navigate this complex landscape. For example, the ongoing implementation of Basel IV (finalized in 2023 and phased in from 2025) will require banks to hold more capital, impacting lending capacity and profitability. This continuous adaptation to new rules can limit strategic agility and potentially reduce returns compared to entities operating in less regulated sectors.

- Increased Compliance Burden: Financial institutions are facing a growing number of regulations globally, requiring substantial investment in compliance systems and personnel.

- Impact on Profitability: Higher compliance costs can directly reduce net income, affecting Investec's profitability and potentially its ability to compete on price.

- Strategic Constraints: Navigating a complex regulatory environment can limit a firm's capacity for innovation and strategic expansion, especially when compared to less regulated competitors.

- Level Playing Field: While costly, robust regulation can also create a more predictable and secure operating environment, benefiting established institutions that can manage these costs effectively.

Investec operates in highly competitive markets, facing pressure from both large, established players and agile niche competitors. The banking and wealth management sectors in South Africa and the UK are crowded with strong incumbents, demanding continuous innovation and strategic differentiation. This intense rivalry necessitates significant investment in technology and talent to maintain market share and attract clients.

The drive for scale through consolidation in wealth management, as observed in 2024, means Investec must effectively leverage its specialist approach. Competitors are actively investing in digital platforms and AI to enhance customer experience and operational efficiency, creating a dynamic environment where staying ahead technologically is paramount. For instance, the global FinTech investment in 2023, particularly in AI, underscores this trend.

Regulatory changes, such as the ongoing implementation of Basel IV, further shape the competitive landscape by increasing operational costs and potentially impacting lending capacity. While these regulations aim for market stability, they demand substantial compliance investment, influencing Investec's strategic agility and profitability relative to less regulated entities.

| Competitor Type | Key Markets | Competitive Actions | Impact on Investec |

|---|---|---|---|

| Large Incumbents (SA) | South Africa | Deep market penetration, extensive customer bases | Intensified rivalry for market share |

| Global Giants (UK) | United Kingdom | Vast resources, broad service offerings | Heightened competition for market share and talent |

| Niche Firms | Wealth Management, Specialist Banking | Targeted client acquisition, innovative products | Pressure to maintain differentiation and service quality |

| FinTech Innovators | Digital Banking, Investment Platforms | AI adoption, digital transformation, customer experience | Need for continuous technological investment to remain competitive |

SSubstitutes Threaten

The rapid growth of fintech companies presents a substantial threat of substitutes for traditional financial institutions. These nimble firms are introducing specialized, often more affordable, and digitally-focused financial products. For instance, peer-to-peer lending platforms and robo-advisors are increasingly seen as alternatives to conventional banking and wealth management, drawing in customers with their user-friendly interfaces and innovative offerings.

The rise of direct investment platforms and do-it-yourself (DIY) investing presents a significant threat of substitution for traditional wealth management services like those offered by Investec. These online platforms empower individuals to manage their own portfolios, often with lower fees and greater control.

As of 2024, the trend towards self-directed investing continues to grow, with millions of retail investors actively managing their assets online. For instance, a significant portion of trading volume on major stock exchanges now originates from retail investors utilizing these platforms, indicating a shift away from relying solely on professional advice for investment decisions.

Alternative lending, including private credit and direct lending, presents a significant threat of substitution for Investec's traditional banking services. These alternative sources are increasingly offering higher leverage and tailored solutions, especially appealing to private equity and mid-market clients seeking funding. The private credit market, for instance, saw substantial growth, with global private debt fundraising reaching an estimated $1.7 trillion by the end of 2023, demonstrating its increasing viability as a substitute.

Non-Traditional Financial Service Providers

The rise of non-traditional financial service providers presents a significant threat of substitutes for established financial institutions. Large technology and retail companies, such as Apple and Amazon, are increasingly offering financial products and services, leveraging their extensive customer reach and advanced technological infrastructure. For instance, Apple Pay has become a dominant force in mobile payments, and Amazon is expanding its lending services to small businesses.

These tech giants can often provide services at lower costs due to their scale and existing customer relationships, making them attractive alternatives for consumers and businesses. Their ability to integrate financial services seamlessly into their existing ecosystems creates a compelling value proposition that traditional banks may struggle to match.

Consider the following:

- Digital Wallets and Payment Systems: Companies like Google Pay and Apple Pay have captured significant market share, offering convenient alternatives to traditional card transactions and bank transfers. In 2023, global mobile payment transaction volume was projected to exceed $13.5 trillion, showcasing the rapid adoption of these substitutes.

- Fintech Lenders: Online lending platforms and buy-now-pay-later services are increasingly competing with traditional bank loans, offering faster approvals and more accessible credit. The global BNPL market alone was valued at over $127 billion in 2023 and is expected to grow substantially.

- Robo-Advisors and Digital Wealth Management: Automated investment platforms provide low-cost alternatives to traditional financial advisors, democratizing access to investment management. Assets under management in robo-advisory services have seen exponential growth, reaching hundreds of billions of dollars globally.

Shift to Decentralized Finance (DeFi)

The burgeoning interest in decentralized finance (DeFi) represents a significant long-term threat of substitutes for traditional financial institutions like Investec. DeFi, built on blockchain technology, offers alternative avenues for lending, borrowing, investing, and managing assets, potentially bypassing established banking channels.

As DeFi platforms mature and user adoption increases, they provide compelling alternatives for capital management and investment. For instance, the total value locked (TVL) in DeFi protocols, a key metric indicating user engagement and capital flow, reached over $100 billion in early 2024, demonstrating substantial growth and a viable alternative ecosystem.

- DeFi offers alternative financial services: Lending, borrowing, and asset management outside traditional banking.

- Blockchain technology underpins DeFi: Providing transparency and security.

- Growing TVL indicates adoption: Over $100 billion locked in DeFi protocols in early 2024.

- Potential disintermediation: Clients may move capital away from traditional institutions.

The threat of substitutes for Investec is significant, driven by evolving customer preferences and technological advancements. Fintech, direct investment platforms, alternative lending, non-traditional providers, and decentralized finance all offer compelling alternatives that can chip away at Investec's market share.

These substitutes often provide lower costs, greater convenience, and specialized services that traditional institutions may struggle to match. For example, the global mobile payment market exceeded $13.5 trillion in 2023, illustrating the scale of adoption for digital payment substitutes.

| Substitute Category | Key Characteristics | 2023/2024 Data Point |

|---|---|---|

| Fintech Lenders | Faster approvals, accessible credit | Global BNPL market valued over $127 billion |

| Digital Wealth Management | Low-cost, automated investing | Robo-advisor AUM in hundreds of billions globally |

| Decentralized Finance (DeFi) | Alternative financial services, blockchain-based | Over $100 billion Total Value Locked (TVL) in early 2024 |

Entrants Threaten

The threat of new entrants in the fintech sector is amplified by significantly lower capital barriers, particularly for software-centric businesses. Unlike traditional banks requiring massive investments in physical branches and legacy systems, fintech startups can leverage cloud computing, open-source tools, and agile development methodologies. This drastically reduces the initial outlay needed to launch a new venture.

For instance, the cost of developing and deploying a basic mobile payment app or a digital lending platform is a fraction of what it would cost to establish a brick-and-mortar bank branch. This accessibility has fueled a surge in new fintech companies entering the market, often focusing on niche services or underserved customer segments, thereby increasing competitive pressure.

New entrants can carve out success by focusing on specific niche client segments or specialized financial needs that larger, more traditional institutions like Investec might overlook. This allows them to offer highly tailored solutions, potentially chipping away at Investec's market share, particularly in its specialist banking and wealth management divisions.

While technological advancements can lower some barriers to entry in financial services, the industry's heavily regulated nature, especially in banking and investment, remains a significant deterrent. New players must navigate complex licensing procedures and adhere to stringent rules like Basel III and the Digital Operational Resilience Act (DORA), demanding substantial investment in compliance infrastructure and expertise.

Brand Reputation and Trust

Established financial institutions like Investec leverage a strong brand reputation and deep client trust, cultivated over many years. This hard-won credibility acts as a substantial deterrent for potential new entrants aiming to break into the market.

Building this level of client confidence, particularly within the discerning segments of high-net-worth individuals and institutional investors, is a lengthy and resource-intensive undertaking. Newcomers face a significant hurdle in replicating the established trust that incumbents enjoy.

- Brand loyalty: In 2024, a significant percentage of Investec's client base has remained with the firm for over a decade, demonstrating the power of established trust.

- Time to market: Developing a comparable reputation and client network for a new financial services firm could realistically take 10-15 years or more.

- Investment required: New entrants would need to commit substantial capital to marketing, compliance, and service infrastructure to even begin challenging established brands.

Talent Acquisition and Retention

Attracting and keeping skilled professionals, especially those with strong financial knowledge and existing client connections, is a major hurdle for new players in specialist banking and wealth management. Established firms often have a significant advantage here.

New entrants find it difficult to match the deep talent pools and attractive career paths that companies like Investec provide. This makes it tough for them to grow their operations quickly or effectively, as they can't easily replicate the human capital of incumbents.

- Talent as a Barrier: The difficulty in acquiring and retaining top talent acts as a significant barrier to entry, especially in specialized financial sectors.

- Investec's Advantage: Firms like Investec leverage their established reputation and existing employee development programs to hold onto key personnel, making it harder for newcomers to poach talent.

- Impact on New Entrants: Without experienced staff and client relationships, new entrants struggle to build credibility and scale, directly impacting their competitive ability.

While technology lowers some entry barriers in fintech, the high cost and complexity of regulatory compliance, particularly for banking and investment services, remain significant deterrents. Navigating licensing and adhering to rules like DORA requires substantial investment in infrastructure and expertise, a hurdle for many new entrants.

Investec's established brand reputation and client trust, built over years, are formidable barriers. Replicating this credibility, especially with high-net-worth individuals and institutional investors, demands considerable time and resources, making it difficult for newcomers to gain traction.

The difficulty in attracting and retaining skilled professionals with deep financial knowledge and client connections further hinders new entrants. Established firms like Investec benefit from robust talent pools and development programs, giving them a distinct advantage in human capital.

Porter's Five Forces Analysis Data Sources

Our Investec Porter's Five Forces analysis is built upon a robust foundation of data, including Investec's own financial statements, annual reports, and investor presentations. We supplement this with industry-specific market research reports and macroeconomic data to provide a comprehensive view of the competitive landscape.