Interpublic Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interpublic Group Bundle

Interpublic Group, a titan in advertising and marketing, boasts formidable strengths in its diverse portfolio and global reach, yet faces challenges from evolving digital landscapes and intense competition. Understanding these dynamics is crucial for navigating the future of marketing.

Want the full story behind IPG's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Interpublic Group boasts a significant global footprint, operating through a vast network of agencies that offer specialized services ranging from advertising and media buying to public relations and cutting-edge digital marketing solutions. This expansive presence enables IPG to effectively serve a broad spectrum of clients across numerous industries and international markets, solidifying its status as a leading global marketing services provider.

As of the first quarter of 2024, IPG reported net revenue of $2.1 billion, up 1.9% year-over-year, demonstrating the continued demand for its diverse service offerings. The company's portfolio includes well-established agency brands, such as McCann Worldgroup and MullenLowe, which contribute significantly to its robust industry reputation and ongoing growth trajectory.

Interpublic Group (IPG) boasts a wide array of marketing services, extending beyond traditional advertising to include robust media planning, buying, and sophisticated digital marketing. Its commitment to data-driven approaches is a significant strength, exemplified by platforms like Acxiom, which houses approximately 2.5 billion consumer identities, enabling highly targeted and effective precision marketing campaigns.

Interpublic Group (IPG) exhibits robust financial health, underscored by consistent positive cash flow generation over the past five years. This financial resilience is further evidenced by its double-digit returns on capital, signaling efficient use of resources.

The company's commitment to profitability is reflected in its ChartMill Profitability Rating of 7/10, indicating enduring competitive advantages. For the full year 2024, IPG maintained a strong adjusted EBITA margin of 16.6%, showcasing its operational discipline.

This sustained financial strength provides IPG with the capacity to strategically invest in innovation and growth initiatives, thereby reinforcing its position as an industry leader.

Commitment to Innovation and AI Integration

Interpublic Group (IPG) is demonstrating a strong commitment to innovation, particularly through its significant investments in digital capabilities and Artificial Intelligence (AI). This focus is essential for maintaining a competitive edge in the rapidly evolving advertising landscape. For instance, IPG has partnered with companies like Aaru to utilize AI-powered predictive simulations, aiming to speed up and refine marketing campaigns.

The integration of generative AI across IPG's content creation processes is another key aspect of this innovation drive. This strategic adoption of AI is designed to enhance efficiency and creativity, directly addressing the changing demands of clients. By embracing these advanced technologies, IPG is positioning itself to deliver more sophisticated and effective marketing solutions.

IPG's dedication to innovation is further evidenced by its strategic investments and partnerships. In 2023, IPG reported a revenue of $9.07 billion, underscoring its substantial market presence. The company's proactive approach to adopting AI and digital advancements is crucial for its future growth and ability to meet the complex needs of its global clientele.

- AI Integration: IPG is actively incorporating AI, including generative AI, across its operations to optimize marketing efforts and content creation.

- Strategic Partnerships: Collaborations with technology firms like Aaru highlight IPG's commitment to leveraging cutting-edge tools for predictive simulations and campaign enhancement.

- Digital Capabilities: Significant investments in digital transformation are a core component of IPG's strategy to stay competitive and meet evolving client expectations.

Resilience in Challenging Market Conditions

Interpublic Group (IPG) has demonstrated notable resilience, successfully navigating a volatile market. This strength is underscored by the solid performance of key segments such as IPG Mediabrands and IPG Health, which have been instrumental in the company's ability to weather economic uncertainties.

Management has proactively implemented strategic restructuring programs designed to boost operating efficiencies and achieve structural expense savings. These initiatives are crucial for mitigating market headwinds and securing the company's financial stability.

- Resilient Performance: IPG Mediabrands and IPG Health have shown strong results, contributing to the company's stability.

- Strategic Restructuring: Management's focus on operational efficiencies and cost savings aims to bolster financial health.

- New Business Momentum: Ongoing wins in new business are expected to offset market challenges and support future growth.

Interpublic Group's diverse service portfolio, encompassing advertising, media, and digital marketing, provides a broad client base and revenue streams. Its strong global presence, with agencies worldwide, allows it to cater to international market needs effectively. The company's commitment to data-driven strategies, exemplified by its Acxiom platform, enables precise targeting and enhanced campaign effectiveness.

IPG's financial stability is a key strength, marked by consistent positive cash flow and efficient capital utilization, as shown by its double-digit returns on capital. For the full year 2024, the company achieved a robust adjusted EBITA margin of 16.6%, indicating strong operational management and profitability.

The company's proactive embrace of innovation, particularly in AI and digital capabilities, is crucial for staying ahead in the dynamic marketing landscape. Strategic investments and partnerships, such as with Aaru for AI-powered simulations, demonstrate this forward-thinking approach. IPG reported $9.07 billion in revenue for 2023, highlighting its significant market scale.

IPG's resilience is evident in the strong performance of segments like IPG Mediabrands and IPG Health, which have helped the company navigate market volatility. Strategic restructuring efforts aimed at improving efficiency and reducing costs further bolster its financial footing. Continued new business wins are expected to offset market challenges and drive future growth.

| Metric | 2023 (Full Year) | Q1 2024 |

| Revenue | $9.07 billion | $2.1 billion |

| Adjusted EBITA Margin | 16.6% | N/A |

| Net Revenue Growth (YoY) | N/A | 1.9% |

What is included in the product

Delivers a strategic overview of Interpublic Group’s internal and external business factors, highlighting its strengths in creative talent and client relationships alongside opportunities in digital transformation and global expansion, while acknowledging weaknesses in integration and threats from increased competition.

Offers a clear framework to identify Interpublic Group's competitive advantages and areas for improvement, simplifying complex strategic challenges.

Weaknesses

Interpublic Group (IPG) faces significant revenue pressures, evidenced by a 1.8% organic net revenue decline in Q4 2024. This resulted in a meager 0.2% organic growth for the entirety of 2024, highlighting challenges in expanding its core business.

The outlook for 2025 remains subdued, with an initial forecast predicting an organic decline of 1% to 2%. This projection is partly attributed to client losses experienced in 2024, signaling a difficult environment for retaining and growing business.

These revenue challenges are compounded by broader industry trends, including clients increasingly scrutinizing advertising budgets and a pronounced shift towards performance-based marketing strategies. This necessitates IPG adapting its service offerings to meet evolving client demands.

Interpublic Group's significant goodwill impairment of $232.1 million in 2024 raises concerns about the valuation of past acquisitions. This suggests that the company may have overpaid for some of its acquired assets, or that market conditions have shifted negatively, impacting their expected performance.

The impairment signals that these acquired businesses are not generating the cash flows originally projected, potentially affecting Interpublic's overall financial health and necessitating a review of its acquisition strategy.

Interpublic Group (IPG) is actively engaged in an accelerated business transformation program designed to boost its service capabilities and achieve structural cost reductions. This initiative focuses on enhancing operational efficiencies and consolidating corporate functions to streamline operations.

However, this necessary restructuring comes with substantial upfront costs. For instance, IPG reported $203.3 million in charges during the first quarter of 2025, directly attributable to the expenses involved in optimizing its operational framework and rectifying existing inefficiencies.

Talent Retention and Rising Staff Costs

Interpublic Group, like many in the marketing agency sector, grapples with the challenge of attracting and retaining skilled professionals, especially those with expertise in digital marketing and data analytics. This intense competition for talent directly contributes to escalating staff costs. For instance, in 2024, the U.S. Bureau of Labor Statistics reported that average hourly earnings for advertising, public relations, and related professionals saw an increase, reflecting broader inflationary pressures and demand for specialized skills.

These rising labor expenses, further amplified by cost-of-living adjustments and potential shifts in government labor policies, place significant pressure on agency profit margins. To counter this, IPG, alongside its competitors, needs to strategically invest in robust employee benefit programs and continuous professional development opportunities. This is crucial for securing and keeping the industry's top performers.

- High Demand for Digital and Data Specialists: The marketing industry's need for talent proficient in digital channels and data analysis remains a key driver of talent acquisition costs.

- Inflationary Impact on Wages: General economic inflation and cost-of-living increases are directly translating into higher salary expectations and overall staff costs for agencies in 2024 and projected into 2025.

- Competitive Compensation and Development Needs: IPG must offer competitive compensation packages and invest in training to remain an attractive employer in a tight labor market.

Dependence on Economic Conditions and Client Spending

Interpublic Group (IPG), like all major advertising and marketing firms, faces significant headwinds when the broader economy falters. The industry is inherently tied to client discretionary spending, which shrinks during periods of economic uncertainty. For instance, during the initial COVID-19 outbreak in 2020, many companies slashed their advertising budgets, directly impacting IPG's revenue streams.

This sensitivity to economic cycles means IPG's financial performance can be quite volatile. A slowdown in consumer spending or business investment, often triggered by inflation or geopolitical instability, directly translates to reduced marketing budgets for IPG's clients. This can lead to project cancellations or postponements, directly affecting the company's top line and profitability.

- Economic Sensitivity: Advertising spend is often one of the first areas clients cut during economic downturns.

- Client Spending Patterns: IPG's revenue is directly correlated with how much clients are willing and able to spend on marketing.

- Market Volatility: Geopolitical events and economic recessions can cause significant fluctuations in IPG's income.

- Agility Requirement: The company must maintain flexibility in its operations and client base to weather these economic storms.

Interpublic Group faces ongoing revenue challenges, with a projected 1% to 2% organic decline for 2025, stemming from client losses in 2024 and increased client scrutiny on advertising budgets. The company's substantial $232.1 million goodwill impairment in 2024 also signals potential overvaluation of past acquisitions, impacting expected future cash flows and overall financial health.

Furthermore, IPG's transformation program, while necessary for efficiency, incurred $203.3 million in charges in Q1 2025, highlighting the immediate financial impact of restructuring efforts. The company also contends with rising labor costs due to high demand for digital and data specialists, with U.S. advertising professionals' average hourly earnings increasing in 2024, squeezing profit margins.

| Metric | 2024 (Actual/Est.) | 2025 (Projected) | Impact |

| Organic Net Revenue Growth | 0.2% | -1% to -2% | Revenue pressure, client retention issues |

| Goodwill Impairment | $232.1 million | N/A | Concerns over acquisition valuation |

| Transformation Charges | $203.3 million (Q1 2025) | N/A | Upfront costs for restructuring |

| Labor Costs | Increasing | Increasing | Margin pressure, need for competitive compensation |

Preview the Actual Deliverable

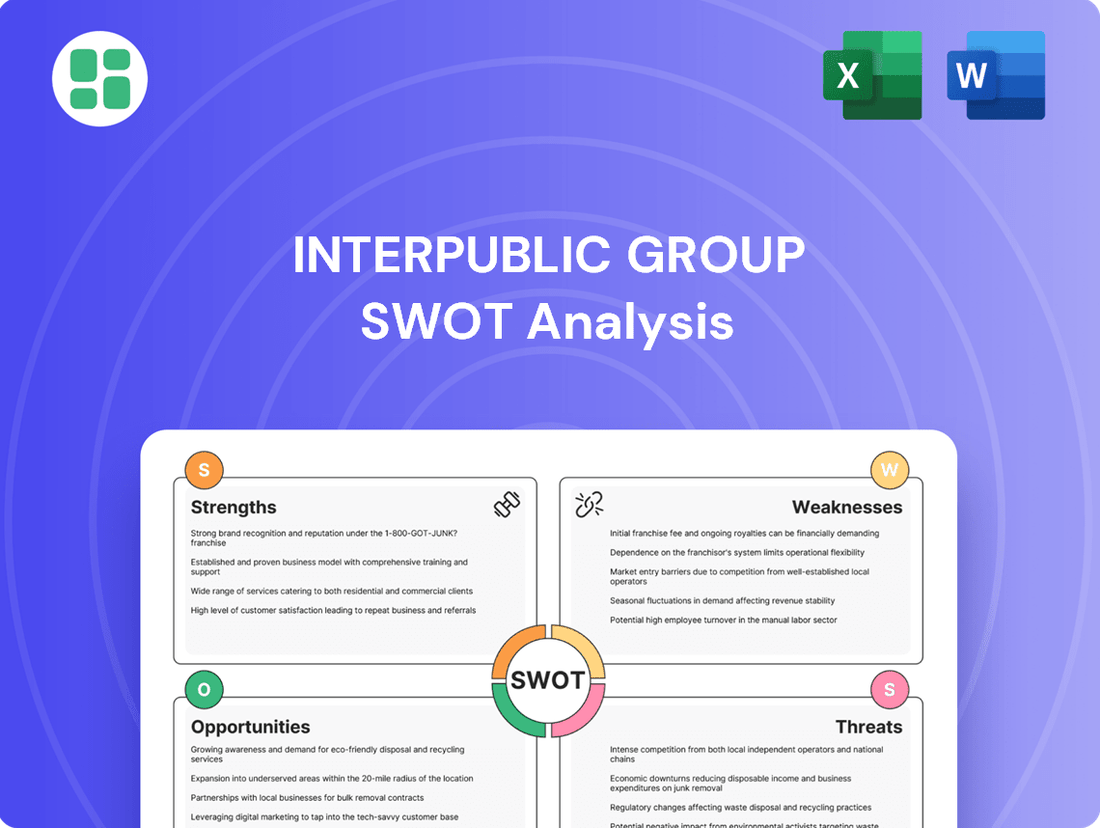

Interpublic Group SWOT Analysis

This preview reflects the real Interpublic Group SWOT analysis document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual SWOT analysis file, showcasing the key insights into IPG's Strengths, Weaknesses, Opportunities, and Threats. The complete version becomes available after checkout, offering a comprehensive understanding of their strategic position.

Opportunities

Interpublic Group (IPG) can seize the opportunity presented by the growing adoption of AI and automation to boost its operational efficiency and client outcomes. AI tools offer a pathway to streamline creative workflows, automate mundane tasks, and unlock richer data insights, ultimately leading to more effective campaigns.

By integrating AI into content creation, IPG can counter the industry trend of clients bringing marketing functions in-house. For instance, in 2024, agencies are increasingly investing in AI platforms to drive productivity, with many reporting significant time savings on tasks like media buying and reporting.

The accelerating digital transformation and the booming e-commerce marketing landscape present significant avenues for Interpublic Group (IPG). IPG is well-positioned to leverage the escalating need for comprehensive digital strategies, encompassing social commerce, mobile-first initiatives, and sophisticated digital media services.

Agencies that effectively navigate these evolving platforms and consumer engagement patterns are poised for substantial growth. For instance, global e-commerce sales were projected to reach over $6.3 trillion in 2023, a figure expected to climb further, underscoring the immense potential within this sector for IPG's digital marketing capabilities.

Interpublic Group (IPG) can bolster its expertise by acquiring specialized agencies focused on AI, data analytics, and niche digital marketing sectors. These moves are crucial for staying competitive in rapidly evolving markets.

Strategic partnerships offer another avenue for growth, allowing IPG to leverage external innovation and expand its service offerings without the full commitment of an acquisition. This flexibility is key in the fast-paced advertising landscape.

The potential merger with Omnicom, a significant industry development, could forge a more robust entity with enhanced capabilities in understanding consumer behavior and a greater capacity to invest in cutting-edge technologies, potentially reshaping the competitive environment.

Increased Demand for Data Analytics and Precision Marketing

The marketing world is increasingly driven by data, creating a significant opportunity for Interpublic Group (IPG) in advanced data analytics, customer experience (CX) implementation, and loyalty/CRM strategies. As clients seek more precise audience targeting and measurable results, IPG's established data infrastructure positions it well to capitalize on this trend. This demand is reflected in the projected growth of the global big data and business analytics market, which was anticipated to reach over $300 billion in 2024, highlighting the substantial potential for IPG to offer enhanced, data-driven solutions that deliver tangible brand growth and improved business outcomes for its clients.

IPG can leverage its existing data capabilities to offer:

- Enhanced Precision Marketing: Utilizing advanced analytics to identify and target specific customer segments with personalized messaging, increasing campaign effectiveness.

- Integrated CX Solutions: Developing and implementing comprehensive customer experience strategies that foster loyalty and drive repeat business.

- Data-Driven Accountability: Providing clients with clear metrics and demonstrable ROI for marketing investments, solidifying IPG's value proposition.

- Growth in Loyalty Programs: Expanding services around customer relationship management (CRM) and loyalty program execution to deepen client engagement.

Emerging Market Expansion and Diversification

Interpublic Group (IPG) has a significant opportunity to tap into the growing advertising markets of emerging economies. As these regions develop, disposable incomes rise, leading to increased consumer spending and a greater demand for marketing services. For instance, in 2024, global ad spending in emerging markets is projected to see robust growth, potentially outperforming more mature markets.

Expanding into these diverse geographies can also act as a crucial hedge against potential slowdowns or declines in established markets. By diversifying its revenue streams geographically, IPG can mitigate risks associated with economic downturns or shifts in consumer behavior in any single region. This strategic move aligns with the broader trend of global companies seeking new growth avenues beyond saturated Western markets.

Key opportunities include:

- Targeting high-growth emerging economies: Focusing on regions with rapidly expanding middle classes and increasing digital penetration.

- Adapting marketing strategies: Tailoring campaigns to local cultural nuances and consumer preferences in new markets.

- Leveraging digital transformation: Capitalizing on the surge in digital advertising spend within these developing economies.

Interpublic Group (IPG) can capitalize on the increasing demand for specialized digital marketing services, particularly in areas like social commerce and mobile-first strategies, as global e-commerce sales were projected to exceed $6.3 trillion in 2023. The company is also positioned to benefit from the growing importance of data analytics and customer experience (CX) initiatives, with the global big data market anticipated to surpass $300 billion in 2024, enabling IPG to offer more precise marketing and demonstrate clear ROI.

Threats

Interpublic Group (IPG) operates in a fiercely competitive landscape, grappling with pressure from legacy rivals, agile newcomers, and the growing influence of consulting firms entering the marketing services arena. The industry's fragmentation, marked by the rise of specialized agencies and novel business models, intensifies this challenge.

For instance, in 2024, the global advertising market is projected to reach over $600 billion, with a significant portion of this growth driven by digital channels where competition is particularly fierce. This necessitates IPG's constant pursuit of innovation and distinctiveness to secure and expand its client base.

A significant threat Interpublic Group (IPG) faces is the increasing tendency for clients to bring marketing services, especially content creation and creative functions, in-house. This move is often driven by a desire for greater cost efficiency and control over their marketing efforts.

While the rise of AI-powered external solutions might temper the growth of in-housing in some areas, it remains a persistent challenge for traditional advertising and marketing agencies like IPG. Clients are looking for tangible benefits and clear returns on investment.

To counter this, IPG must continually prove its superior value proposition and demonstrate a compelling return on investment (ROI) that in-house teams may struggle to match. This means focusing on specialized expertise, innovative strategies, and measurable campaign success.

Interpublic Group, like all agencies, faces significant hurdles from tightening data privacy rules, such as GDPR and CCPA, and the decline of third-party cookies. These shifts directly impact the effectiveness of data-driven marketing, potentially limiting precise audience targeting and personalization efforts. For instance, the ongoing deprecation of third-party cookies, a trend accelerating in 2024 and beyond, forces a fundamental rethink of how consumer insights are gathered and used ethically.

Navigating this evolving landscape requires substantial investment in compliance and the development of new, privacy-centric data strategies. Agencies must prioritize robust data protection measures and explore alternative, consent-based methods for data acquisition. Failure to adapt could lead to reduced campaign efficacy and a competitive disadvantage in a market increasingly focused on consumer trust and transparent data practices.

Economic Volatility and Reduced Ad Spending

Global economic conditions, including potential policy shifts and ongoing geopolitical tensions, are significant threats impacting marketing budgets. For Interpublic Group (IPG), this translates to a direct correlation between economic stability and client spending on advertising and marketing services. For instance, in 2024, many regions are grappling with persistent inflation and higher interest rates, which are already prompting businesses to scrutinize discretionary spending, including marketing investments.

Fluctuations in key economic indicators like interest rates, inflation levels, and currency exchange rates create a volatile operating environment. These shifts can lead to reduced client budgets, project postponements, and a general dampening of market activity. This uncertainty directly affects IPG's revenue streams and overall financial performance, making forecasting and strategic planning more challenging.

- Economic Slowdown Concerns: Projections for global GDP growth in 2024 and 2025 indicate a potential slowdown in key markets, which historically correlates with decreased advertising expenditure.

- Inflationary Pressures: Persistent inflation can erode client profitability, leading them to cut back on marketing as a cost-saving measure.

- Interest Rate Hikes: Higher borrowing costs for businesses can reduce available capital for marketing initiatives.

- Geopolitical Instability: Conflicts and trade disputes can disrupt supply chains and consumer confidence, indirectly impacting ad spending.

Disruption from AI and New Technologies

The rapid evolution of artificial intelligence and other emerging technologies poses a significant threat to Interpublic Group (IPG). AI's ability to automate tasks and generate content could make traditional marketing approaches less effective, potentially disrupting IPG's core services. For instance, AI-driven platforms are increasingly capable of personalized advertising and content creation, directly competing with agency offerings.

This technological shift also fuels the rise of specialized AI agencies, intensifying competition. These new players can leverage AI for efficiency and targeted campaigns, potentially undercutting established agencies. IPG needs to proactively adapt to these changes.

Managing the risks associated with these advancements is crucial for IPG's continued relevance and success. Failure to integrate AI effectively or counter new AI-centric business models could lead to a loss of market share and competitive disadvantage. For example, while IPG has invested in AI capabilities, the speed of innovation means continuous adaptation is necessary to maintain an edge.

- AI advancements could render traditional marketing methods obsolete, impacting IPG's service offerings.

- New, specialized AI agencies are emerging, increasing competitive pressure.

- IPG must strategically adapt to AI-driven automation and new business models to mitigate disruption.

- The company's 2024-2025 strategy must prioritize AI integration and innovation to remain competitive.

The increasing client tendency to bring marketing services in-house poses a significant threat, driven by cost efficiency and control demands.

Tightening data privacy regulations and the decline of third-party cookies directly impact data-driven marketing effectiveness, necessitating substantial investment in new strategies.

Global economic uncertainties, including inflation and geopolitical tensions, can lead to reduced marketing budgets, directly affecting IPG's revenue streams.

The rapid evolution of AI and emerging technologies, including the rise of specialized AI agencies, intensifies competition and could disrupt IPG's core services if not strategically integrated.

| Threat Category | Specific Concern | Impact on IPG | 2024/2025 Relevance |

| In-housing Trend | Clients bringing creative/content in-house | Reduced demand for agency services | Persistent challenge; clients seeking clear ROI |

| Data Privacy & Cookies | GDPR, CCPA, cookie deprecation | Limited targeting/personalization, compliance costs | Accelerating in 2024/2025; requires new data strategies |

| Economic Volatility | Inflation, interest rates, geopolitical risks | Reduced client marketing budgets, revenue uncertainty | Key concern in 2024/2025 markets |

| Technological Disruption (AI) | AI automation, specialized AI agencies | Potential obsolescence of traditional methods, increased competition | Requires continuous AI integration and adaptation |

SWOT Analysis Data Sources

This Interpublic Group SWOT analysis is built upon a robust foundation of data, drawing from Interpublic's official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded and actionable strategic overview.