Interpublic Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interpublic Group Bundle

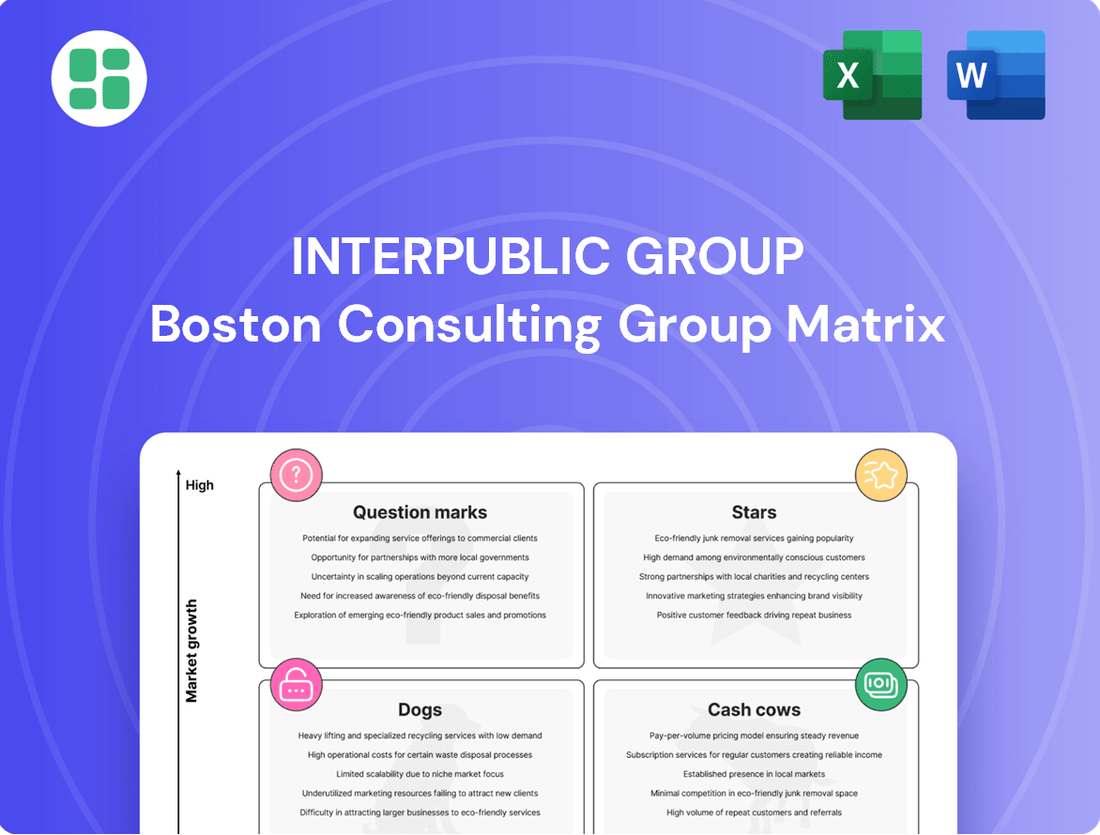

Unlock the strategic potential of Interpublic Group with our comprehensive BCG Matrix analysis. Understand precisely how their diverse portfolio aligns with market growth and competitive share, identifying your key growth drivers and resource drains.

This preview offers a glimpse into the powerful insights contained within the full BCG Matrix report. Get the complete breakdown to pinpoint Interpublic Group's Stars, Cash Cows, Dogs, and Question Marks, empowering you with data-driven decisions for optimal resource allocation and future growth.

Don't just guess where Interpublic Group's investments should be directed; know with certainty. Purchase the full BCG Matrix for actionable strategies and a clear roadmap to capitalize on opportunities and mitigate risks within their dynamic market landscape.

Stars

Interpublic Group (IPG) is making substantial investments in AI, notably with its Agentic Systems for Commerce (ASC). This platform aims to deliver sophisticated insights for e-commerce operations, reflecting a broader industry shift towards AI as a key driver in advertising. ASC is positioned as a high-potential offering that could secure market leadership if it gains widespread traction.

Acxiom, a key player within Interpublic Group's (IPG) data analytics and MarTech offerings, is a significant contributor to the 'Media, Data and Engagement Solutions' segment. Its growth trajectory reflects the increasing demand for data-driven marketing strategies.

As the marketing landscape evolves, Acxiom's expertise in harnessing consumer data for precise targeting and quantifiable results places it in a robust, high-growth market. This strategic capability offers IPG a distinct advantage in delivering effective, data-informed solutions.

Interpublic Group's (IPG) Digital Transformation & Experience Design segment, exemplified by agencies like Code and Theory, is a significant star. This area, focusing on advanced digital platforms and user experience design, is booming as companies worldwide embrace digital integration. Code and Theory's success in crafting AI-driven experiences for leading tech firms underscores the high demand and IPG's strong position to capitalize on this expanding market.

IPG Mediabrands (Digital Media Buying & Planning)

IPG Mediabrands, a key player in digital media buying and planning, shows robust growth. This segment is fueled by the ongoing migration of advertising budgets to digital platforms. It's a prime example of a Star in the BCG Matrix due to its strong market position and the inherent growth of the digital advertising sector.

Significant client acquisitions, like winning the Amgen U.S. media review in late 2024, underscore its competitive strength. The continued expansion of retail media and Connected TV (CTV) advertising further bolsters its position in this high-growth market.

- Strong Organic Growth: IPG Mediabrands has experienced significant organic growth, driven by strategic client wins.

- Digital Shift Tailwind: The segment benefits directly from the substantial and ongoing shift of advertising spend towards digital channels.

- Key Growth Areas: Retail media and Connected TV (CTV) are identified as particularly strong growth areas for the business.

- Strategic Positioning: IPG Mediabrands' focus on media, data, and engagement solutions positions it favorably for continued market expansion.

Specialized Communications (e.g., Golin, Sports Marketing)

Interpublic Group's specialized communications, including agencies like Golin in public relations and their sports marketing practices, are demonstrating robust growth. These areas are thriving by meeting evolving client demands for more focused engagement and immersive experiences.

Within the broader communications landscape, these specialized segments are outperforming due to their ability to cater to niche markets. For instance, Golin has consistently been recognized for its innovative campaigns, contributing to IPG's strong position in the PR sector.

IPG's sports marketing division is also a key growth driver, leveraging the increasing commercialization of sports globally. In 2024, the sports marketing industry continued its upward trajectory, with IPG well-positioned to capture a significant share of this expanding market.

- Golin's strong performance in public relations highlights the demand for specialized communication strategies.

- IPG's sports marketing practice benefits from the growing global sports economy.

- These niche segments within communications are experiencing high growth due to targeted client needs.

- IPG's established expertise allows for a substantial market share in these expanding sub-sectors.

Interpublic Group's (IPG) AI-driven platforms like Agentic Systems for Commerce (ASC) and its data analytics arm, Acxiom, are positioned as Stars. These segments exhibit high market growth and strong competitive positions, reflecting the industry's increasing reliance on data and AI for effective marketing. IPG Mediabrands also shines as a Star, capitalizing on the digital media migration and growth in retail media and CTV. Specialized communications, including Golin and sports marketing, are also Stars due to their niche market dominance and the expanding global sports economy.

| Segment | Market Growth | IPG's Position | Key Drivers |

|---|---|---|---|

| AI Platforms (ASC) | High | Strong | E-commerce optimization, AI adoption |

| Data Analytics (Acxiom) | High | Strong | Data-driven marketing, precise targeting |

| Media Buying (Mediabrands) | High | Strong | Digital ad spend shift, CTV, Retail Media |

| Specialized Communications | High | Strong | Niche markets, Sports marketing growth |

What is included in the product

This BCG Matrix analysis highlights Interpublic Group's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

The Interpublic Group BCG Matrix provides a clear visual of business unit performance, alleviating the pain of strategic uncertainty.

Cash Cows

Interpublic Group's (IPG) established global creative agencies, exemplified by McCann Worldgroup, function as significant cash cows. These agencies command substantial market share, built on enduring partnerships with prominent multinational corporations, ensuring a consistent revenue stream.

Despite some organic declines in the broader 'Integrated Advertising & Creativity Led Solutions' segment, these core creative powerhouses consistently deliver robust profits with comparatively modest investment requirements for maintaining their market position. Their stability is crucial for IPG's financial health, acting as a reliable source of capital.

In 2023, IPG reported total revenue of $10.2 billion, with its Integrated Advertising segment, which includes these creative powerhouses, contributing a significant portion, highlighting their foundational role in generating steady cash flow for the group.

Traditional media buying for stable clients, a core component of IPG Mediabrands, acts as a cash cow for Interpublic Group. This segment, while not experiencing high growth, commands a significant market share in established advertising avenues. For instance, in 2024, traditional media like television and print still accounted for a substantial portion of advertising spend, even as digital channels continued to expand rapidly.

These mature operations generate consistent revenue with lower reinvestment needs compared to newer, high-growth areas. This allows them to be a reliable source of cash flow, supporting other, more experimental ventures within the group. The stability of these long-term client relationships in traditional media buying underpins their cash cow status.

Interpublic Group's core traditional public relations services, operated by its large PR firms, hold a significant market share. This dominance is built on vast client portfolios and a strong global presence, ensuring consistent demand for essential corporate communications and reputation management.

These established PR services are considered cash cows for IPG. While not experiencing rapid expansion, they generate stable, high-margin revenue streams. For instance, in 2023, IPG's Media & Communications segment, which includes its PR operations, reported organic revenue growth of 5.7%, underscoring the consistent performance of these core offerings.

Large-Scale Event and Experiential Marketing (Mature Offerings)

Interpublic Group's (IPG) large-scale event and experiential marketing services, particularly those catering to major clients, are firmly positioned as Cash Cows. These mature offerings have secured a substantial market share, consistently delivering reliable revenue streams. While sensitive to broader economic trends, the established nature of these activations ensures predictable cash flow for IPG.

These established experiential solutions benefit from long-standing client relationships and a proven track record. For instance, IPG's agencies are frequently engaged for recurring large-scale brand activations and corporate events. In 2023, IPG reported organic growth of 7.0%, with its Media and Experiential segments showing particular strength, underscoring the consistent demand for these services.

- Market Dominance: IPG holds a significant share in the large-scale event and experiential marketing sector, leveraging its established infrastructure and client base.

- Consistent Revenue: Repeat engagements from major clients for brand activations and events provide a stable and predictable revenue stream.

- Cash Flow Generation: These mature offerings are key contributors to IPG's overall cash flow, supporting investments in other business areas.

- Resilience: Despite market fluctuations, the demand for high-impact experiential marketing from established brands remains robust, ensuring continued profitability.

Global Production and Content Creation Hubs

Interpublic Group's global production and content creation hubs function as significant cash cows within its BCG Matrix. These centralized units offer essential services, acting as a shared resource that supports numerous campaigns across IPG's diverse agency portfolio.

These hubs are highly efficient, benefiting from economies of scale that enable them to handle a substantial volume of creative output. Their strong internal market share is a testament to their vital role in servicing the entire agency network, ensuring consistent cash flow generation.

- High Internal Market Share: These hubs are integral to IPG's operations, servicing a vast majority of internal client needs.

- Consistent Cash Flow: Their steady demand and efficient operations translate into reliable revenue streams for the group.

- Economies of Scale: Centralization allows for cost efficiencies in production and content creation, boosting profitability.

- Strategic Importance: They provide a critical, cost-effective backbone for the creative output of all IPG agencies.

Interpublic Group's (IPG) established global creative agencies, like McCann Worldgroup, are prime examples of cash cows. They possess substantial market share due to long-standing client relationships, ensuring a steady revenue stream. Even with some organic declines in the broader Integrated Advertising segment, these core agencies consistently yield strong profits with minimal investment needed to maintain their position.

Traditional media buying, a key part of IPG Mediabrands, also functions as a cash cow. While not experiencing high growth, this segment holds a significant market share in established advertising channels. For instance, in 2024, traditional media like television and print continued to represent a considerable portion of advertising spend, providing a reliable cash flow with lower reinvestment needs compared to emerging areas.

IPG's core traditional public relations services, managed by its large PR firms, maintain a dominant market share. This is built on extensive client portfolios and a global footprint, guaranteeing consistent demand for essential corporate communications. These services are stable, high-margin revenue generators, as seen in the Media & Communications segment's 5.7% organic revenue growth in 2023.

Large-scale event and experiential marketing services for major clients are also considered cash cows for IPG. These mature offerings have secured significant market share, delivering reliable revenue streams. IPG's agencies are frequently tapped for recurring large-scale brand activations, with the Media and Experiential segments showing particular strength in 2023, contributing to IPG's overall 7.0% organic growth.

| IPG Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Approximate) | 2024 Outlook (General) |

|---|---|---|---|---|

| Global Creative Agencies (e.g., McCann Worldgroup) | Cash Cow | High market share, stable revenue, low investment | Significant portion of Integrated Advertising segment | Continued stability, focus on client retention |

| Traditional Media Buying (IPG Mediabrands) | Cash Cow | Established channels, consistent demand, mature market | Substantial within Media & Communications | Steady performance, potential for optimization |

| Traditional Public Relations | Cash Cow | Dominant market share, strong client portfolios, essential services | Key part of Media & Communications segment | Reliable revenue, high-margin services |

| Event & Experiential Marketing | Cash Cow | Repeat engagements, proven track record, mature offerings | Strong performance in Media & Experiential segments | Consistent demand for large-scale activations |

What You’re Viewing Is Included

Interpublic Group BCG Matrix

The Interpublic Group BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or demo content, just a professional, analysis-ready report designed for strategic decision-making.

Dogs

Interpublic Group (IPG) has strategically divested or classified certain digital specialist agencies, like Huge and portions of R/GA, as held for sale. This classification suggests these entities were perceived to have low market share and limited growth potential within IPG's overall business structure.

These divestitures align with IPG's broader strategy to streamline operations and concentrate resources on more profitable segments of its advertising and marketing services. The move signals that these digital agencies were viewed as underperforming assets, impacting the company's overall growth trajectory.

Certain digital agencies within Interpublic Group (IPG), like MRM, have seen their revenues decline. This trend, described as 'continued decreases,' is impacting the company's overall performance by counteracting growth in other, more successful areas.

These underperforming units likely hold a small market share within the highly competitive digital advertising space. Their struggle to adapt to rapid industry changes suggests they are in a weak position, making them prime candidates for strategic reviews or significant restructuring efforts to improve their viability.

Interpublic Group (IPG) anticipates a 2025 organic revenue decline, partly attributed to significant client losses experienced in the prior year. This situation directly impacts specific agencies or service lines within IPG that have seen their market share diminish, now facing considerable challenges.

These underperforming units, characterized by reduced market share and negative growth, necessitate strategic adjustments, which could range from intensive restructuring to potential divestment. Such situations directly affect IPG's consolidated financial performance, clearly signaling areas of weakness that require immediate attention.

Outdated Traditional Media Services

Segments of Interpublic Group (IPG) focused solely on traditional media, like print and broadcast advertising, are likely facing significant challenges. These areas haven't effectively adapted to the digital landscape, leading to shrinking market share and minimal growth opportunities. Global advertising expenditure continues its strong migration towards digital platforms, making these legacy services less appealing to advertisers seeking broader reach and measurable results.

For instance, while digital advertising spend in the US was projected to reach approximately $375 billion in 2024, traditional media's share continues to diminish. This trend places IPG's outdated traditional media services in a precarious position. If these units cannot be substantially reinvented to incorporate digital capabilities or integrated into broader offerings, they risk becoming costly burdens, draining resources without generating adequate returns.

The implications for IPG are clear:

- Declining Relevance: Purely traditional media services are losing ground as advertising budgets increasingly favor digital channels.

- Low Growth Prospects: The limited adaptation to digital means these segments are unlikely to experience significant market expansion.

- Cash Trap Potential: Without strategic transformation or divestment, these services can consume capital without delivering proportional value.

- Strategic Imperative: IPG must either revitalize these offerings with digital integration or consider phasing them out to reallocate resources to more promising areas.

Certain Regional or Niche Agencies with Limited Scale

Certain regional or niche agencies within Interpublic Group (IPG) might be categorized as 'Dogs' in the BCG Matrix. These are typically smaller operations with limited market share in their specific regions or specialized sectors. For instance, a regional advertising firm in a mature, slow-growth market might fit this description.

These agencies often face challenges in achieving substantial profitability or contributing significantly to IPG's overall expansion. Their scale may not allow for the efficiencies seen in larger, more dominant entities within the group. In 2024, IPG has been actively reviewing its portfolio to optimize performance, and such units could be candidates for strategic reassessment.

- Limited Market Share: These agencies operate in markets where IPG's presence is not dominant, leading to lower revenue potential.

- Stagnant or Declining Sectors: Focus on niche industries that are not experiencing growth can hinder performance.

- Profitability Concerns: Lower revenue and potential lack of scale can make it difficult to achieve healthy profit margins.

- Strategic Review: IPG may consider consolidation, divestiture, or restructuring for these underperforming units.

Agencies within Interpublic Group (IPG) that are classified as Dogs in the BCG Matrix typically exhibit low market share and operate in low-growth sectors. These units often struggle with profitability and require significant strategic attention, potentially leading to divestment or restructuring.

For example, some of IPG's smaller, regional advertising firms or those focused on declining traditional media formats might fall into this category. In 2024, IPG's portfolio optimization efforts likely identified such underperforming assets that consume resources without generating substantial returns.

These "Dogs" represent a drag on overall company performance, necessitating careful management to either revitalize them or remove them from the portfolio to reallocate capital to more promising ventures.

Interpublic Group's strategic decisions in 2024 and beyond will likely involve addressing these low-performing units to improve overall efficiency and focus on high-growth areas.

| BCG Category | Characteristics | IPG Examples (Illustrative) | Strategic Implications |

|---|---|---|---|

| Dogs | Low Market Share, Low Growth | Regional agencies in mature markets, niche traditional media services | Divestment, consolidation, or turnaround efforts |

Question Marks

Early-stage AI and advanced analytics ventures within Interpublic Group (IPG) are currently positioned as Question Marks. These are experimental platforms and tools that are just beginning to find their footing, distinct from more established data providers. While their market share is minimal, the overall market for these innovative solutions is projected for substantial expansion.

These nascent AI and analytics ventures require considerable capital infusion for development and scaling. Their future success hinges on IPG's sustained investment and the actual market acceptance of these cutting-edge technologies. For instance, the global AI market was valued at approximately $196.6 billion in 2023 and is anticipated to grow significantly, presenting a fertile ground for IPG's early-stage bets.

Interpublic Group's emerging commerce media initiatives are positioned as Stars within the BCG matrix. This sector is experiencing explosive growth, with the global retail media market projected to reach $125.7 billion by 2027, a significant jump from $38.1 billion in 2022. IPG is actively investing in and developing its capabilities in this dynamic space, aiming to capture a substantial share of this expanding market.

When Interpublic Group (IPG) enters new, rapidly developing advertising markets where it currently has a limited presence, these operations function as question marks in the BCG matrix. They are in high-growth environments but start with low market share, requiring significant investment in local talent, infrastructure, and client acquisition to become viable. Their success is uncertain and depends heavily on effective market penetration strategies and adapting to local consumer behaviors and regulatory landscapes.

Specialized Digital Content Formats (e.g., Metaverse, Web3)

Interpublic Group (IPG) is likely positioning itself within the specialized digital content formats category, such as metaverse advertising and Web3 integrations, as a potential future growth engine. These areas represent high-potential, nascent markets where IPG's current market share is expected to be minimal given their early stage. Significant capital investment is required for experimentation and capability building in these rapidly evolving spaces.

These emerging digital frontiers, while holding substantial long-term promise, demand considerable investment for development and expertise acquisition. As of early 2024, the metaverse advertising market, though still developing, is projected to reach tens of billions of dollars in the coming years, with companies like IPG needing to establish a foothold. Web3 technologies, including NFTs and decentralized platforms, also present new avenues for content creation and consumer engagement, requiring strategic exploration.

- Market Potential: Emerging digital platforms like the metaverse and Web3 offer significant, albeit currently undefined, long-term growth opportunities for specialized content and advertising.

- Current Market Share: IPG's penetration in these highly specialized and nascent digital content formats is likely very low, reflecting the early stage of market development.

- Capital Investment: Significant capital expenditure is necessary for IPG to experiment, build expertise, and develop capabilities in these cutting-edge digital environments.

- Strategic Exploration: These areas represent a strategic bet on future consumer behavior and technological shifts, requiring proactive engagement and investment to avoid being left behind.

New Service Offerings from Strategic Restructuring

Interpublic Group (IPG) is actively reshaping its service portfolio as part of a broader business transformation initiative. This strategic move involves consolidating certain functions and introducing new, integrated solutions designed to meet evolving client needs. These enhanced offerings, while positioned for future growth, are currently in their nascent stages, meaning they possess high potential but are characterized by low initial market share as they work to establish client traction and adoption.

These new service configurations are essentially IPG's 'question marks' within the BCG matrix. They represent areas where the company is investing heavily to foster growth and market penetration. For instance, IPG's focus on data analytics and AI-driven marketing solutions, while a growing area across the industry, requires significant nurturing. In 2023, IPG reported a 3.3% organic revenue growth, indicating a generally positive market reception to their overall strategy, but the specific performance of these nascent services would be tracked closely for their ability to move towards 'stars'.

- New Integrated Solutions: IPG is consolidating functions to offer more holistic client services, a move that could lead to innovative, cross-disciplinary offerings.

- Low Initial Market Share: These enhanced services, while strategically important, are in the early stages of market penetration and client adoption.

- High Potential, High Investment: IPG is dedicating resources to nurture these offerings, aiming to cultivate them into future growth drivers for the company.

- Industry Context: The advertising and marketing services industry saw significant shifts in 2024, with increased demand for specialized digital and data-centric services, providing a fertile ground for IPG's new offerings if they can capture market attention.

Interpublic Group's (IPG) early-stage AI and advanced analytics ventures are categorized as Question Marks. These initiatives are characterized by minimal current market share but operate within a rapidly expanding market. Significant capital is required for their development and scaling, with success contingent on sustained investment and market acceptance.

The global AI market's valuation, around $196.6 billion in 2023, underscores the substantial growth potential for these nascent IPG ventures. Their future performance hinges on IPG's commitment to innovation and the successful adoption of these technologies by clients, aiming to transition them from Question Marks to Stars.

| IPG Venture Category | Market Growth Potential | Current Market Share | Capital Requirement | Key Success Factor |

| Early-Stage AI & Analytics | High | Low | High | Market Acceptance & Sustained Investment |

BCG Matrix Data Sources

Our Interpublic Group BCG Matrix leverages comprehensive data from financial statements, industry growth reports, and internal performance metrics to provide strategic insights.