Interpublic Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interpublic Group Bundle

Interpublic Group (IPG) navigates a complex advertising and marketing landscape where buyer power from large clients is substantial, and the threat of new entrants is moderate due to high brand recognition needs. The bargaining power of suppliers, while present, is often balanced by IPG's scale.

The complete report reveals the real forces shaping Interpublic Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The advertising and marketing sector, including Interpublic Group (IPG), thrives on specialized expertise. Roles like creative directors, data scientists, and AI specialists are in high demand, creating a talent scarcity. This shortage empowers these professionals, allowing them to command competitive compensation and benefits packages. For instance, in 2024, the average salary for a senior data scientist in the marketing tech industry saw a notable increase, reflecting this demand.

Major digital media platforms such as Google, Meta, Amazon, and TikTok wield significant influence as suppliers of advertising space and crucial user data. Their immense user engagement and advanced proprietary technologies grant them considerable sway over ad pricing, audience reach, and targeting precision. In 2023, digital advertising spending globally reached an estimated $600 billion, with these platforms capturing a substantial portion of this market.

The marketing industry's swift advancement, especially in AI and data analytics, means Interpublic Group (IPG) heavily depends on outside tech providers for advanced capabilities. IPG's need for specialized AI partners to enhance predictive modeling and analytics underscores this reliance.

This dependence grants these technology vendors considerable leverage, as their innovations are vital for IPG to offer competitive, data-informed services. For instance, the global AI market in advertising and marketing was projected to reach over $40 billion by 2024, highlighting the significant investment and reliance on these vendors.

Data Providers and Analytics Tools

The bargaining power of data providers and analytics tool developers is significant for Interpublic Group (IPG). Access to comprehensive and high-quality consumer data is crucial for crafting effective, personalized marketing campaigns. These specialized providers and tool creators wield considerable influence because their offerings are essential for precise targeting and measuring campaign success.

IPG's capacity to effectively integrate and leverage these data assets directly impacts its performance. Consequently, robust data suppliers are not just vendors but critical partners whose capabilities can greatly enhance IPG's competitive edge. In 2023, for instance, the global data analytics market was valued at approximately $100 billion, highlighting the substantial investment and reliance on these services across industries.

- Data Dependency: Marketing agencies like IPG rely heavily on external data sources for consumer insights and campaign optimization.

- Specialized Expertise: Providers of advanced analytics tools offer unique capabilities that are difficult and costly for IPG to replicate internally.

- Market Value: The significant market size for data analytics underscores the value and demand for these services, strengthening providers' bargaining position.

- Strategic Partnerships: IPG's ability to secure favorable terms with key data providers is vital for maintaining its service quality and competitive pricing.

Content Production and Specialized Services

For significant advertising projects, Interpublic Group (IPG) relies on external production companies and specialized freelance talent for content creation, including film, photography, and digital animation. These suppliers can wield considerable influence due to their unique creative skills, technical proficiency, and ability to produce top-tier, impactful content.

The specialized nature of these services often leads to high switching costs for specific campaigns, as finding comparable expertise and capacity can be challenging. For instance, a major 2024 campaign might require a specific animation studio that took over a year to develop its proprietary software, making a quick pivot to another provider impractical and costly.

- High Switching Costs: Sourcing specialized creative and technical talent for large-scale projects can involve significant time and financial investment in finding and onboarding new suppliers.

- Unique Capabilities: Certain production houses or freelancers possess unique artistic styles or technological advantages that are difficult to replicate, giving them leverage.

- Capacity Constraints: In periods of high demand, the limited capacity of top-tier production suppliers can increase their bargaining power.

The bargaining power of suppliers for Interpublic Group (IPG) is notably influenced by specialized talent and technology providers. In 2024, the demand for AI and data analytics expertise in marketing continues to drive up compensation for these professionals, increasing their leverage. Furthermore, key digital media platforms like Google and Meta hold substantial power due to their vast user bases and advanced targeting capabilities, commanding significant ad spend.

IPG's reliance on specialized creative production houses and freelance talent for high-quality content also grants these suppliers leverage. The unique skills and technical proficiencies required for major campaigns, coupled with potential capacity constraints during peak periods, mean these providers can negotiate favorable terms, especially when switching costs are high due to project-specific expertise.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on IPG | 2024/2023 Data Points |

|---|---|---|---|

| Specialized Talent (e.g., Data Scientists, AI Specialists) | High demand, scarcity of skills, specialized knowledge | Increased labor costs, potential talent acquisition challenges | Senior data scientist salaries in marketing tech saw notable increases in 2024. |

| Digital Media Platforms (e.g., Google, Meta) | Vast user engagement, advanced targeting technology, market dominance | Influence over ad pricing, audience reach, and targeting precision | Global digital ad spend reached ~$600 billion in 2023, with these platforms capturing a significant share. |

| Technology Providers (AI, Analytics Tools) | Proprietary technology, essential for competitive services, market growth | Dependency on external innovation, potential for increased software/service costs | Global AI market in advertising projected to exceed $40 billion by 2024. |

| Creative Production Houses & Freelancers | Unique creative skills, technical proficiency, high switching costs for specific projects | Potential for higher project costs, challenges in finding comparable alternatives | A major 2024 campaign might require a specific animation studio with proprietary software, leading to high switching costs. |

What is included in the product

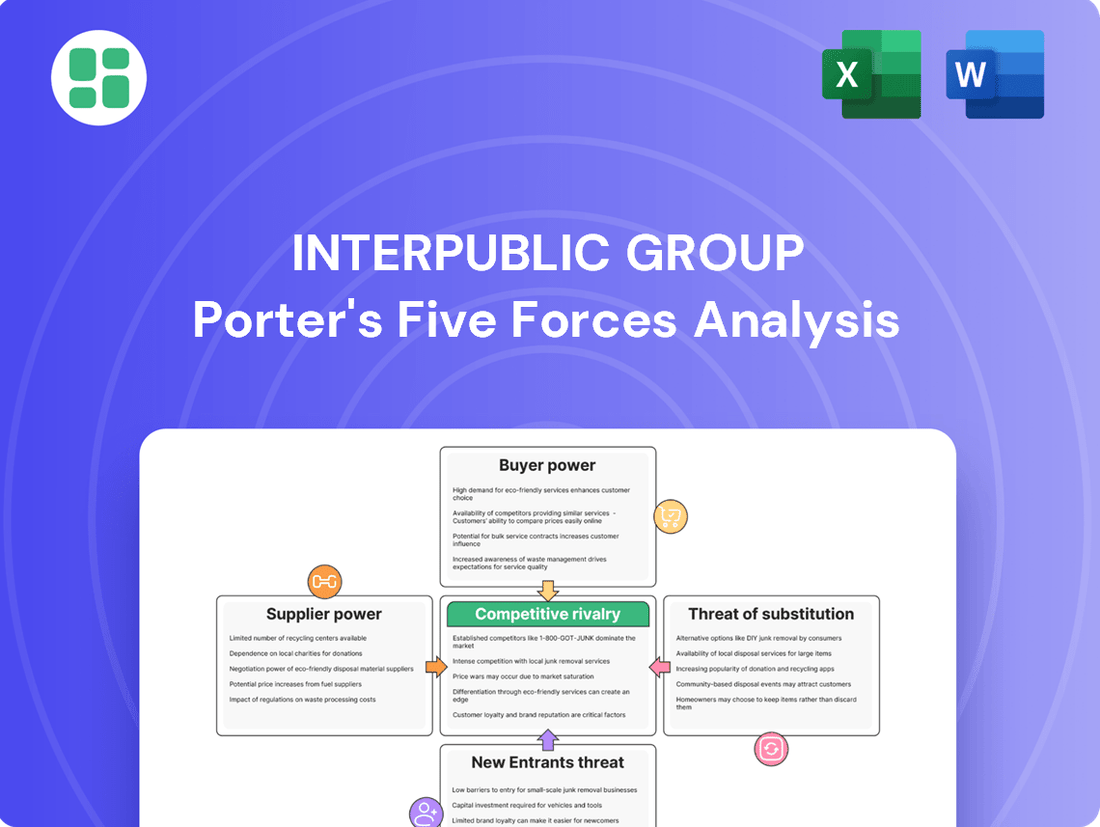

This analysis unpacks the competitive intensity within the advertising and marketing services industry for Interpublic Group, examining threats from new entrants, buyers, suppliers, substitutes, and rivals.

Gain immediate clarity on competitive pressures with a visual breakdown of each force, enabling swift strategic adjustments.

Customers Bargaining Power

Interpublic Group's (IPG) major clients, often multinational corporations with broad industry and regional reach, wield considerable bargaining power. This strength stems from the sheer volume of marketing business they represent, allowing them to consolidate their spending with a select few global advertising holding companies like IPG.

These large clients can leverage their significant spend to negotiate competitive pricing, favorable contract terms, and demand integrated service solutions across IPG's diverse agency network. For instance, in 2023, IPG reported that its top 10 clients accounted for approximately 30% of its total revenue, highlighting the concentration of business and the inherent power these clients possess.

A significant factor influencing Interpublic Group's (IPG) bargaining power of customers is the increasing trend of large advertisers bringing marketing functions in-house, particularly in digital, content creation, and data analytics. This shift directly reduces their dependence on external agencies like IPG for routine tasks.

This in-housing strategy empowers clients, giving them greater leverage in negotiations. For instance, if IPG's pricing or performance doesn't align with client expectations, clients can credibly threaten to bring more services in-house, thereby pressuring IPG for better terms.

The growth in marketing technology (MarTech) spending by advertisers, projected to reach over $300 billion globally by 2025, underscores the capability and willingness of clients to develop internal marketing expertise, further amplifying their bargaining power against traditional agencies.

Clients are increasingly demanding clear, quantifiable returns on their marketing investments, pushing agencies like Interpublic Group (IPG) to demonstrate tangible value. This focus on measurable ROI shifts power to customers who can scrutinize campaign performance and compare agency effectiveness. For instance, in 2024, many clients are leveraging advanced analytics platforms to track key performance indicators (KPIs) like customer acquisition cost (CAC) and return on ad spend (ROAS) with greater precision than ever before.

This heightened demand for accountability means IPG must continually prove its worth through data-driven results. Agencies that can clearly articulate and demonstrate the impact of their strategies on a client's bottom line gain a significant advantage. The ability to provide transparent reporting on campaign outcomes, often through shared dashboards and regular performance reviews, becomes a critical factor in client retention and new business acquisition.

Low to Moderate Switching Costs

Clients of advertising agencies like Interpublic Group generally face low to moderate switching costs. While changing agencies can involve some initial disruption, it's not an insurmountable hurdle, particularly with the rise of specialized agencies and direct marketing technologies. This ease of transition empowers clients.

The advertising landscape is highly competitive, offering clients numerous choices. If a client is unhappy with an agency's service, innovation, or pricing, they have the flexibility to move their business elsewhere. This dynamic keeps agencies focused on delivering value and maintaining client satisfaction.

- Client Retention Focus: Agencies must consistently demonstrate value to prevent clients from seeking alternatives.

- Impact of Specialization: The growth of niche agencies makes it easier for clients to find specialized expertise, increasing their options.

- Technological Influence: Direct marketing platforms reduce reliance on traditional agency models, further lowering switching barriers.

- Industry Competition: In 2024, the global advertising market is projected to reach over $700 billion, indicating a highly competitive environment where client loyalty is earned through performance.

Access to Direct Marketing Technologies

The increasing availability of direct marketing technologies significantly bolsters customer bargaining power. Platforms for programmatic advertising, robust CRM systems, and sophisticated analytics dashboards are now readily accessible to clients. This direct access allows clients to manage core marketing functions themselves, diminishing their reliance on traditional agencies for execution.

For Interpublic Group (IPG), this necessitates a strategic shift. IPG must differentiate itself by providing value that extends beyond basic execution. This includes offering deep strategic insights, managing complex technology integrations, and delivering creative differentiation that clients cannot easily replicate with off-the-shelf tools. For instance, by 2024, the global marketing technology market was valued at over $50 billion, highlighting the scale of tools available to clients.

- Direct Technology Access: Clients can now independently manage programmatic advertising, CRM, and analytics.

- Reduced Agency Dependence: Basic execution tasks are increasingly handled in-house by clients.

- IPG's Strategic Imperative: Agencies must offer superior strategic guidance, integration expertise, and creative innovation.

- Market Context: The vast marketing technology market underscores the tools available to empower clients.

Interpublic Group's (IPG) customers, especially large global corporations, possess significant bargaining power due to their substantial advertising spend. This allows them to consolidate business with fewer agencies, negotiate better pricing, and demand integrated services across IPG's network. In 2023, IPG's top 10 clients represented about 30% of its revenue, underscoring this client leverage.

Clients are increasingly bringing marketing functions in-house, particularly in digital and data analytics, reducing their reliance on external agencies. This trend, supported by the projected over $300 billion global MarTech spending by 2025, empowers clients to negotiate more favorable terms by threatening to insource further.

Clients demand clear ROI, scrutinizing campaign performance with advanced analytics tools. In 2024, this focus on measurable results means IPG must consistently prove its value through data-driven insights and transparent reporting to retain clients and win new business in a competitive market where global advertising revenue is expected to exceed $700 billion.

| Factor | Description | Impact on IPG | Supporting Data/Trend |

| Client Concentration | Large clients represent a significant portion of revenue. | High bargaining power for major clients. | Top 10 clients accounted for ~30% of IPG revenue in 2023. |

| In-housing Trend | Clients bringing marketing functions in-house. | Reduced reliance on agencies, increased negotiation leverage. | Global MarTech spending projected to exceed $300 billion by 2025. |

| Demand for ROI | Clients require demonstrable, quantifiable marketing results. | Pressure on IPG to deliver data-backed performance. | Clients use advanced analytics for precise KPI tracking in 2024. |

| Switching Costs | Relatively low costs for clients to change agencies. | Clients can easily move business, demanding better value. | Highly competitive advertising market ($700B+ global revenue projection). |

Full Version Awaits

Interpublic Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of the Interpublic Group, detailing the competitive landscape within the advertising and marketing services industry. You're looking at the actual document; once your purchase is complete, you’ll get instant access to this exact, professionally formatted file, ready for your strategic review.

Rivalry Among Competitors

The advertising and marketing services landscape is heavily concentrated, with Interpublic Group (IPG) facing robust competition from a handful of global holding companies. Key rivals like WPP, Omnicom, Publicis Groupe, Dentsu, and Havas vie intensely for major clients and market dominance.

This intense rivalry fuels aggressive bidding wars and a constant drive for innovation across the industry. For instance, in 2023, Omnicom reported revenue of $7.7 billion, while WPP announced revenues of £15.5 billion, highlighting the scale of these operations and the financial stakes involved in securing lucrative contracts.

Each major player strives to stand out by excelling in creativity, advanced data analytics, and leveraging cutting-edge technology. This competitive pressure compels companies like IPG to continually invest in talent and new capabilities to maintain their edge in securing and retaining top-tier clients.

The advertising industry is locked in an intense digital transformation and AI race, with agencies heavily investing to gain an edge. This competition centers on leveraging AI for personalized campaigns, automated processes, and predictive analytics to boost effectiveness and efficiency. For instance, in 2024, major holding companies are significantly increasing their AI research and development budgets, with some projecting AI to contribute a substantial percentage to their operational efficiencies by year-end.

The advertising industry, while anticipating substantial growth, especially in digital segments, sees fierce competition for market share. For instance, in 2023, global advertising spending was estimated to reach over $700 billion, with digital channels accounting for a significant portion of this. This growth fuels the rivalry among major players.

Holding companies are constantly vying for dominance, with some, like Publicis Groupe, demonstrating robust organic growth in specific periods, signaling potential shifts in market leadership. Interpublic Group's (IPG) own financial results highlight this competitive landscape, where organic growth rates serve as a critical metric for assessing its position against rivals.

Differentiation through Specialization and Integration

Competitive rivalry within the advertising and marketing services industry is intense, with firms like Interpublic Group (IPG) differentiating themselves through a dual focus on specialized expertise and integrated service offerings. Agencies don't just compete on cost; they vie for clients by showcasing unique capabilities in areas like healthcare marketing or public relations, alongside the capacity to blend these specialized services into cohesive, end-to-end solutions. IPG's organizational structure, which encompasses a portfolio of distinct, specialized agencies, is designed to deliver precisely this kind of comprehensive, integrated client experience.

The ability to consistently deliver both groundbreaking creative work and demonstrably data-driven outcomes is paramount for agencies seeking to distinguish themselves in a saturated marketplace. For instance, in 2023, IPG reported net revenue of $10.2 billion, with a significant portion attributed to clients seeking integrated solutions that leverage both creative prowess and analytical insights to drive measurable business results.

- Specialized Expertise: Agencies highlight niche competencies in sectors such as technology, automotive, or financial services.

- Integrated Solutions: Offering a full suite of services, from digital advertising and social media to traditional media buying and analytics, under one roof.

- Data-Driven Creativity: Combining artistic talent with advanced analytics to create campaigns that resonate and perform.

- Client-Centric Approach: Tailoring strategies to meet specific client needs and demonstrating ROI through performance metrics.

Talent Wars and Employer Branding

The competition for top-tier talent, especially in fields like data science, AI, and digital creative services, intensely fuels rivalry within the advertising and marketing industry. Agencies are locked in a battle to not only attract but also retain these highly sought-after professionals. This war for talent is often waged through the strength of an employer's brand, emphasizing company culture, work-life balance initiatives, and clear pathways for career advancement.

A robust talent pool is absolutely critical for an agency's success. It directly dictates their capability to develop and execute innovative, high-impact solutions for clients. For example, in 2024, many leading agencies reported significant increases in recruitment costs and retention bonuses as they vied for individuals with specialized digital skills. This intense competition means that a strong employer brand isn't just a nice-to-have; it's a fundamental strategic imperative for maintaining a competitive edge.

- Intensified competition for specialized skills in data science, AI, and digital creative roles.

- Agencies differentiate through culture, work-life balance, and professional development to attract and retain talent.

- A strong talent pool is directly linked to an agency's ability to deliver innovative client solutions.

Competitive rivalry within the advertising and marketing services sector is a defining characteristic for Interpublic Group (IPG). The industry is dominated by a few large global holding companies, creating a highly concentrated market where firms like WPP, Omnicom, and Publicis Groupe are direct competitors. This intense competition means that agencies must constantly innovate and differentiate themselves to win and retain clients.

The battle for market share is fierce, driven by aggressive pricing strategies and a relentless pursuit of creative and technological excellence. For instance, in 2023, global advertising spending exceeded $700 billion, with digital channels accounting for a substantial portion, making this a highly lucrative but contested arena. Agencies like IPG must demonstrate superior performance and ROI to stand out.

Furthermore, the race to integrate Artificial Intelligence (AI) into campaign development and execution is a significant driver of rivalry in 2024. Companies are heavily investing in AI capabilities to enhance personalization, automate processes, and gain predictive insights, directly impacting their ability to deliver effective client solutions.

The competitive landscape is further shaped by the ongoing competition for top talent, particularly in specialized areas like data science and AI. Agencies are actively investing in recruitment and retention strategies, recognizing that a skilled workforce is crucial for delivering innovative client work and maintaining a competitive edge.

| Competitor | 2023 Revenue (Approx.) | Key Focus Areas |

|---|---|---|

| Interpublic Group (IPG) | $10.2 billion | Specialized expertise, integrated solutions, data-driven creativity |

| WPP | £15.5 billion ($19.6 billion) | Global reach, creative excellence, digital transformation |

| Omnicom Group | $7.7 billion | Data analytics, technology integration, brand building |

| Publicis Groupe | €13.1 billion ($14.2 billion) | Digital marketing, AI-driven insights, customer experience |

SSubstitutes Threaten

Clients are increasingly bringing marketing functions in-house, especially for social media, content creation, and basic media buying. This shift is fueled by a desire for cost savings and tighter integration with their overall business strategy. For Interpublic Group (IPG), this represents a significant threat as clients can now perform tasks previously outsourced to agencies.

Large management and technology consulting firms are a significant threat of substitutes for Interpublic Group's marketing and advertising services. Companies like Accenture and Deloitte have heavily invested in their digital marketing and customer experience capabilities, directly encroaching on traditional agency territory. For instance, Accenture Song, a prominent player, reported revenues of approximately $14 billion in fiscal year 2023, showcasing their substantial scale and reach in areas like digital transformation and data strategy, which are core to modern marketing.

Advertisers, particularly small and medium-sized businesses, increasingly bypass traditional advertising agencies by directly placing ads on popular platforms. In 2024, platforms like Google, Meta, and TikTok continued to enhance their self-serve advertising tools, making it easier for businesses to manage campaigns without agency intervention. This trend directly challenges the need for agency services in media planning and buying.

Specialized Boutique Agencies and Freelancers

The rise of specialized boutique agencies and skilled freelancers presents a significant threat of substitutes for Interpublic Group (IPG). Clients can bypass large, integrated agencies by engaging niche firms focused on specific marketing disciplines such as digital advertising, content creation, or data analytics. For instance, the global influencer marketing market was valued at approximately $21.1 billion in 2023 and is projected to grow substantially, showcasing the demand for specialized services.

Furthermore, the accessibility of freelance platforms has democratized access to marketing expertise. Businesses can now easily find and hire individual specialists for discrete tasks, offering a more agile and potentially cost-effective solution compared to retaining a full-service agency for every need. This trend allows for greater flexibility in project execution and budget management.

- Niche Specialization: Boutique agencies offer deep expertise in areas like SEO, social media, or PR, directly competing with IPG's broader service offerings.

- Freelance Talent Pool: Platforms connect businesses with individual experts for specific project needs, providing an alternative to comprehensive agency retainers.

- Cost and Flexibility: These substitutes often provide more competitive pricing and greater adaptability for targeted marketing campaigns.

- Market Growth: The expanding markets for specialized services, such as the aforementioned influencer marketing, highlight the increasing viability of these alternatives.

Marketing Software as a Service (SaaS) Solutions

The threat of substitutes for marketing SaaS solutions is significant for Interpublic Group (IPG). Clients can directly purchase and implement marketing automation, CRM, and analytics software, bypassing the need for agency services for execution. This direct access allows brands to manage email campaigns, track customer journeys, and analyze performance independently.

While IPG leverages these tools in its offerings, the ability for clients to license them directly diminishes IPG's unique value proposition in execution. For instance, platforms like HubSpot and Salesforce offer comprehensive marketing and CRM capabilities that can be managed in-house. In 2024, the SaaS market continued its robust growth, with marketing automation software alone projected to reach over $7 billion globally, indicating a substantial pool of readily available alternatives.

- Direct Client Access: Brands can acquire and deploy marketing SaaS tools without agency intermediation.

- In-House Campaign Management: Clients can independently execute email campaigns and customer journey tracking.

- Independent Performance Analysis: SaaS platforms enable clients to analyze marketing performance without external support.

- Market Growth: The marketing automation SaaS sector's projected growth highlights the increasing availability and adoption of these substitutes.

The threat of substitutes for Interpublic Group (IPG) is substantial, as clients increasingly opt for in-house solutions or specialized alternatives. This trend is driven by a desire for cost efficiency and greater control over marketing functions. IPG faces direct competition from technology consulting firms, self-serve advertising platforms, niche agencies, and marketing SaaS solutions.

| Substitute Type | Key Characteristics | Impact on IPG | Example/Data Point (2023-2024) |

|---|---|---|---|

| In-house Marketing Teams | Cost savings, tighter integration | Reduced agency outsourcing | Clients bringing social media, content creation in-house |

| Consulting Firms (e.g., Accenture) | Digital marketing & CX capabilities | Direct encroachment on agency services | Accenture Song revenue ~$14 billion (FY23) |

| Self-Serve Platforms (e.g., Google, Meta) | Direct ad placement, ease of use | Bypassing agencies for media buying | Enhanced self-serve tools in 2024 |

| Niche/Boutique Agencies & Freelancers | Specialized expertise, flexibility | Fragmented market, competitive pricing | Global influencer marketing market ~$21.1 billion (2023) |

| Marketing SaaS Solutions | Direct access to tools (automation, CRM) | Diminished IPG value in execution | Marketing automation SaaS market projected >$7 billion (2024) |

Entrants Threaten

Establishing a global advertising and marketing services network comparable to Interpublic Group's (IPG) demands immense capital. Think billions of dollars for infrastructure, cutting-edge technology, attracting top-tier talent, and building a presence across numerous international markets. For instance, in 2023, major holding companies like IPG, Omnicom, and WPP continued to invest heavily in digital transformation and data analytics, further raising the bar for entry.

The sheer scale and intricate operational complexity of managing diverse agencies worldwide present a significant financial hurdle. Newcomers face the challenge of replicating IPG's established global footprint and integrated service offerings, which requires substantial and sustained investment, making it difficult for smaller or less capitalized players to compete effectively.

Interpublic Group (IPG) and its well-established agencies boast decades of experience, cultivating robust client relationships and a formidable brand reputation. This deep-seated trust and loyalty present a significant barrier for new entrants aiming to compete for major global advertising accounts.

Newcomers struggle to replicate IPG's proven track record and earn the confidence of large advertisers, a process often involving lengthy sales cycles and substantial switching costs that deter clients from moving to unproven entities.

The advertising and marketing industry, including giants like Interpublic Group (IPG), faces a significant threat from new entrants due to the intense competition for specialized talent. The need for a diverse workforce encompassing creative visionaries, sharp strategists, and cutting-edge technologists means new players must contend with a highly competitive talent landscape.

Established firms like IPG leverage their strong employer brands and vast recruitment networks, making it challenging for newcomers to attract and retain the necessary expertise. The ongoing 'talent wars' in the sector, where demand often outstrips supply for skilled professionals, further hinder the ability of new entrants to scale their operations rapidly and effectively compete.

Technological Complexity and Data Infrastructure

The marketing industry's increasing reliance on advanced data analytics, artificial intelligence, and programmatic advertising presents a substantial hurdle for newcomers. Establishing the requisite technological infrastructure, including sophisticated data processing capabilities and access to extensive, often proprietary, data sets, demands significant capital investment and specialized expertise.

Interpublic Group's strategic moves, such as its investments in data analytics firms like Acxiom, which provides customer data management services, and its collaborations with AI leaders, underscore the high entry barrier. These actions highlight the critical need for cutting-edge technology and data resources that new entrants must replicate or acquire to compete effectively.

- High Capital Investment: New entrants face substantial costs in building or acquiring advanced data analytics platforms and AI capabilities.

- Data Access and Management: Gaining access to and effectively managing large, high-quality proprietary data sets is a significant challenge.

- Technological Expertise: The need for specialized talent in data science, AI, and programmatic advertising creates a knowledge gap for new players.

- IPG's Strategic Investments: IPG's focus on data and AI, evidenced by acquisitions and partnerships, sets a high technological benchmark.

Regulatory and Compliance Burdens

The advertising and marketing industry, which Interpublic Group (IPG) operates within, faces significant hurdles for new entrants due to stringent regulatory and compliance burdens. Navigating global operations means adhering to a complex array of rules concerning data privacy, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), alongside consumer protection and intellectual property laws.

Meeting these diverse regulatory requirements across various countries demands substantial investment in legal and operational resources. For instance, in 2024, companies operating in the EU continued to grapple with the ongoing GDPR enforcement, with fines reaching millions of euros for non-compliance. This complexity and cost create a substantial barrier for new players attempting to enter the market.

- Data Privacy Compliance: New entrants must invest heavily in systems and personnel to ensure adherence to global data privacy regulations like GDPR and CCPA.

- Consumer Protection Laws: Understanding and complying with varying consumer protection statutes in different markets adds significant operational complexity and cost.

- Intellectual Property Rights: Safeguarding and respecting IP rights across jurisdictions requires dedicated legal expertise and robust internal processes.

- Increased Operational Risk: The cost and complexity of compliance elevate the operational risk for new entrants, potentially hindering their ability to compete effectively with established firms like IPG.

The threat of new entrants into the advertising and marketing services sector, where Interpublic Group (IPG) operates, is moderate but presents significant challenges. The industry demands substantial upfront capital, not just for infrastructure but also for attracting top-tier talent and establishing a global presence. For example, in 2023, major players continued significant investments in digital transformation, raising the bar for any newcomers.

New entrants face the daunting task of replicating IPG's established global network and integrated service offerings. This requires immense and sustained investment, making it difficult for smaller, less capitalized entities to compete effectively against established giants. The sheer scale and complexity of operations are considerable hurdles.

The established reputation and deep client relationships of firms like IPG are formidable barriers. Newcomers struggle to build the same level of trust and demonstrate a proven track record, which often involves lengthy sales cycles and significant switching costs for clients, deterring them from engaging with unproven entities.

The need for specialized talent in areas like data science, AI, and creative strategy creates a competitive talent landscape. Established companies leverage their strong employer brands and extensive networks, making it tough for new players to attract and retain the necessary expertise, especially given the ongoing 'talent wars' in the sector.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Interpublic Group leverages data from financial reports, industry-specific market research, and competitor disclosures. We also incorporate insights from trade publications and economic databases to provide a comprehensive view of the advertising and marketing services landscape.