Ingredion PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ingredion Bundle

Navigate the complex external landscape impacting Ingredion with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that are shaping the company's strategic direction and market opportunities. Gain a critical advantage by leveraging these expert insights to inform your own business planning and investment decisions. Download the full PESTLE analysis now to unlock actionable intelligence.

Political factors

Government policies, especially those concerning agriculture and international trade, play a crucial role in shaping Ingredion's access to raw materials and its overall cost of operations. For instance, agricultural subsidies in major corn-producing nations like the United States, a key input for Ingredion, can stabilize supply and influence pricing, impacting the company's cost of goods sold.

The stability and cost of Ingredion's plant-based ingredients, such as corn and tapioca, are directly tied to government support programs. In 2024, the U.S. Department of Agriculture's farm bill continues to provide significant support for corn production, which underpins Ingredion's starch and sweetener operations. Similarly, policies affecting tapioca cultivation in countries like Thailand can alter Ingredion's sourcing costs and availability.

Any shifts in these governmental stances, whether it's a modification to farm support initiatives or the introduction of new commodity-specific incentives, have a direct ripple effect on Ingredion's financial performance and the predictability of its supply chain. For example, changes to import/export tariffs on agricultural commodities could significantly alter Ingredion's procurement strategies and profitability in 2025.

Global trade agreements and tariffs significantly shape Ingredion's operational environment, given its presence in approximately 120 countries. For instance, the U.S. imposed tariffs on goods from China and other nations in recent years, impacting supply chains and ingredient costs. These trade policies directly influence Ingredion's ability to source raw materials and distribute finished products efficiently across its international network.

Ingredion's reliance on global sourcing and manufacturing means political stability in key regions is paramount. Unforeseen geopolitical events, like the ongoing conflict in Ukraine, directly impact raw material availability and pricing. For instance, the disruption of grain and vegetable oil supplies from the Black Sea region in 2024 continued to exert upward pressure on commodity markets, affecting Ingredion's input costs.

Geopolitical instability can also exacerbate food safety concerns. Supply chain disruptions stemming from conflicts or trade disputes can create vulnerabilities that opportunistic actors might exploit, leading to instances of food fraud. This was a growing concern in 2024, with regulatory bodies worldwide increasing scrutiny on supply chain integrity to prevent adulteration and ensure consumer safety.

The availability and cost of essential plant-based inputs, crucial for Ingredion's product portfolio, are particularly sensitive to political shifts. Trade policies, tariffs, and sanctions implemented by governments in 2024 and projected into 2025 can significantly alter the economics of sourcing ingredients like corn, sugar, and tapioca, directly impacting Ingredion's operational efficiency and profitability.

Food Security Policies

National and international food security agendas significantly shape the landscape for companies like Ingredion, impacting everything from raw material allocation to pricing. Governments worldwide are increasingly focused on ensuring stable domestic food supplies, which can directly affect the availability and cost of key ingredients. For instance, policies aimed at bolstering local grain production might lead to export restrictions on commodities such as corn, a primary input for Ingredion's starches and sweeteners.

These governmental priorities can create both challenges and opportunities. A focus on food security might incentivize Ingredion to invest in more resilient and localized supply chains. Conversely, it could also introduce volatility in raw material markets. For example, in 2024, several nations implemented or considered export bans on certain food staples to manage domestic inflation and availability, a trend that could continue and necessitate strategic adjustments in sourcing for Ingredion.

The drive for food security also influences the types of agricultural practices that are supported and incentivized. Governments may offer subsidies or tax breaks for crops grown using sustainable methods or for those that contribute most effectively to national food reserves. This could steer Ingredion’s raw material procurement towards specific crop types or cultivation techniques, potentially altering production costs and the company's environmental footprint.

- Governmental focus on food security can lead to export restrictions on essential agricultural commodities, impacting Ingredion's raw material supply.

- Policies prioritizing domestic food production may increase the cost or reduce the availability of key inputs like corn and tapioca.

- In 2024, nations like India and some Southeast Asian countries explored or implemented export controls on rice and wheat, demonstrating the real-world impact of food security policies on global commodity markets.

- Incentives for sustainable or domestically focused agriculture could reshape Ingredion's sourcing strategies and operational costs.

Regulatory Environment for Food Innovation

Government stances on novel food ingredients and biotechnology significantly influence Ingredion's innovation pipeline. For instance, the European Union's updated guidelines for novel food applications, implemented in 2024, aim to clarify and potentially expedite the approval process for ingredients derived from sources like precision fermentation. This regulatory evolution directly impacts Ingredion's ability to introduce new, sustainable solutions to the market.

Policies that either streamline or create hurdles for new ingredient approvals, particularly those involving biotechnology and alternative proteins, are critical. Ingredion's investment in areas like plant-based proteins means that the speed and clarity of regulatory frameworks, such as those being reviewed by the U.S. Food and Drug Administration (FDA) for cultivated meat and fermentation-derived ingredients, directly affect market entry timelines and the overall success of their innovation strategy.

- EU's Novel Food Regulation: Ongoing reviews and potential amendments in 2024-2025 could impact the approval timelines for ingredients Ingredion is developing.

- FDA's Approach to Biotechnology: The FDA's evolving stance on genetically modified organisms (GMOs) and novel processing techniques influences Ingredion's R&D in areas like enzyme-modified ingredients.

- Global Harmonization Efforts: Ingredion monitors international regulatory trends, as differing standards for ingredient safety and labeling can create market access challenges, particularly for innovative products.

Government policies heavily influence Ingredion's operational landscape, from agricultural subsidies affecting raw material costs to trade agreements shaping global market access. For example, the U.S. farm bill's continued support for corn production in 2024 directly impacts Ingredion's input costs, while evolving trade tariffs projected into 2025 can alter sourcing and profitability.

Geopolitical stability is paramount, as conflicts like the one in Ukraine in 2024 continued to disrupt global commodity supplies, driving up prices for Ingredion's key ingredients. Furthermore, national food security agendas are leading some countries to consider export restrictions on staples, potentially impacting Ingredion's supply chain resilience and ingredient availability through 2025.

Regulatory frameworks for novel ingredients, particularly those involving biotechnology, are critical for Ingredion's innovation. The EU's updated Novel Food Regulation in 2024 and the FDA's ongoing review of fermentation-derived ingredients directly influence market entry timelines for Ingredion's new product development.

What is included in the product

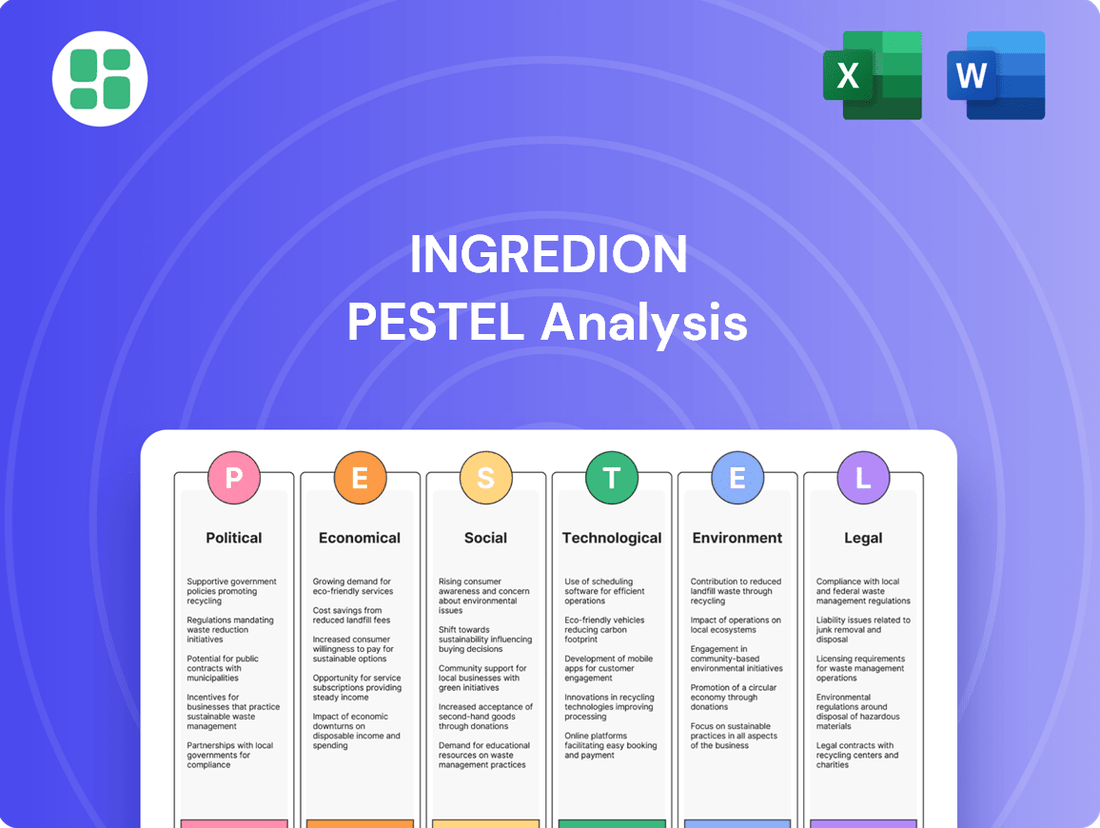

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Ingredion, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and detailed sub-points with specific examples to support strategic decision-making and scenario planning.

A PESTLE analysis for Ingredion offers a clean, summarized version of external factors, relieving the pain point of sifting through complex data for easy referencing during meetings or presentations.

Economic factors

Global economic expansion is a key driver for Ingredion, as a robust economy generally translates to higher consumer spending on food and beverages. For instance, the IMF projected global growth at 3.2% for both 2023 and 2024, indicating a stable, albeit moderate, economic environment. This generally supports demand for Ingredion's diverse ingredient portfolio.

Consumer purchasing power directly correlates with demand for Ingredion's products. When economies are strong, consumers tend to purchase more processed and value-added food items, which often utilize specialized ingredients. Conversely, during economic slowdowns, there's a noticeable shift towards more basic, less processed foods, potentially impacting Ingredion's sales volumes and the mix of ingredients sold.

Ingredion's profitability is directly tied to the fluctuating costs of its primary ingredients like corn, tapioca, and potatoes. These agricultural commodities are subject to significant price swings influenced by weather patterns, global supply and demand, and geopolitical instability. For instance, the U.S. corn price saw considerable volatility in late 2023 and early 2024 due to weather concerns and export demand.

This inherent volatility in commodity markets presents a substantial challenge for Ingredion's long-term financial planning and can directly impact its profit margins. Managing these unpredictable price movements requires robust risk management strategies, including hedging and strategic sourcing. The company's ability to navigate these price fluctuations is a key determinant of its financial performance.

Rising inflation presents a significant challenge for Ingredion, as seen in the persistent consumer price index (CPI) increases throughout 2024 and into early 2025. This trend directly elevates the company's expenses for essential inputs like raw materials, energy, and logistics. While Ingredion can pass some costs to customers, the lag and market sensitivity mean operational margins could be squeezed.

The current interest rate environment, with central banks maintaining higher rates to combat inflation, also impacts Ingredion. Increased borrowing costs for capital expenditures, such as facility upgrades or acquisitions, can deter investment or necessitate more rigorous financial modeling. For instance, a 100 basis point increase in interest rates on a $500 million debt issuance could add $5 million annually to financing costs.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant challenge for Ingredion, a global enterprise with operations spanning numerous countries. As of early 2024, the company's financial performance is directly influenced by the varying strength of currencies like the Euro, Brazilian Real, and Chinese Yuan against the US Dollar. For instance, a stronger US Dollar can diminish the reported value of sales made in weaker foreign currencies, impacting Ingredion's consolidated earnings.

These movements also affect the cost of raw materials sourced internationally. If Ingredion imports key ingredients into a market where the local currency has weakened, those imported goods become more expensive. Conversely, a weaker dollar can make Ingredion's products more competitive in export markets by making them cheaper for foreign buyers.

- Impact on Reported Earnings: Ingredion's Q1 2024 earnings report highlighted how foreign currency translation adjustments impacted net sales, showing a modest negative effect due to a stronger US Dollar in key markets.

- Raw Material Costs: The cost of corn, a primary ingredient, can fluctuate in price not only due to agricultural factors but also due to the exchange rate when sourced from countries with different currencies.

- Market Competitiveness: In markets like Europe, where the Euro weakened against the dollar in late 2023, Ingredion's products potentially became more attractively priced for local customers compared to domestic competitors whose costs were primarily in Euros.

- Hedging Strategies: Ingredion employs financial instruments to hedge against extreme currency volatility, aiming to mitigate the impact of adverse exchange rate movements on its profitability.

Supply Chain Costs and Efficiency

Rising costs in logistics, transportation, and energy significantly affect Ingredion's supply chain. For instance, the global average cost of shipping a 40-foot container saw substantial increases throughout 2024, impacting the cost of goods sold. These increased expenses directly challenge Ingredion's ability to maintain efficient operations and deliver products globally.

Global supply chain disruptions, a persistent issue in recent years, continue to pose operational hurdles. Ingredion, like many in the food ingredients sector, faces challenges in sourcing raw materials and ensuring timely delivery. These disruptions can lead to higher inventory holding costs and potential stock-outs, influencing customer satisfaction and Ingredion's market responsiveness.

Optimizing the supply chain is paramount for Ingredion's cost competitiveness. The company is likely investing in strategies such as route optimization software and exploring alternative transportation methods to mitigate rising fuel surcharges. In 2024, many companies in the sector reported that investments in supply chain technology and visibility tools were crucial for navigating these cost pressures and improving delivery reliability.

- Logistics Costs: Global container shipping rates, while fluctuating, remained elevated in 2024 compared to pre-pandemic levels, directly increasing Ingredion's transportation expenses.

- Energy Prices: Volatile energy markets in 2024 continued to influence transportation and manufacturing costs, impacting Ingredion's operational budget.

- Disruption Impact: Ingredion's reliance on a global network means that events like port congestion or geopolitical instability can delay shipments and increase overall supply chain costs.

- Efficiency Focus: Ingredion's strategic initiatives likely include enhancing warehouse management and inventory forecasting to improve supply chain efficiency and reduce the impact of rising costs.

Ingredion's performance is closely tied to global economic health, with higher consumer spending on food and beverages in expanding economies boosting demand for its ingredients. The IMF's projection of 3.2% global growth for both 2023 and 2024 suggests a stable, albeit moderate, economic backdrop that supports Ingredion's diverse product portfolio.

Consumer purchasing power directly impacts demand for Ingredion's specialized ingredients. Strong economies encourage spending on processed foods, while downturns can lead consumers to opt for more basic items, affecting Ingredion's sales mix and volumes.

The company's profitability hinges on managing volatile agricultural commodity prices like corn, tapioca, and potatoes. Factors such as weather, global supply-demand dynamics, and geopolitical events contribute to price swings, as seen with corn prices in late 2023 and early 2024.

Persistent inflation, evident in consumer price index increases through early 2025, raises Ingredion's operational costs for raw materials, energy, and logistics, potentially squeezing profit margins despite efforts to pass costs to consumers.

Full Version Awaits

Ingredion PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Ingredion PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides actionable insights for strategic planning and market understanding.

Sociological factors

Consumers worldwide are increasingly prioritizing healthier food choices, with a notable surge in demand for plant-based, clean-label, and minimally processed items. This shift means people are paying closer attention to what's in their food, actively seeking products without artificial ingredients. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162 billion by 2030, showcasing the scale of this dietary evolution.

This evolving consumer landscape directly benefits Ingredion, as its portfolio of specialized starches, sweeteners, and nutritional ingredients is well-positioned to meet these growing demands. The company's ability to provide ingredients that enhance texture, flavor, and nutritional profiles in plant-based and clean-label products makes it a key player in this expanding market segment.

A growing global focus on health and wellness is significantly shaping consumer preferences for food and beverages. This heightened awareness drives demand for ingredients that support specific dietary needs, such as reduced sugar content, improved gut health, and increased protein. For instance, the global market for functional foods, which includes products offering health benefits beyond basic nutrition, was valued at approximately $280 billion in 2023 and is projected to reach over $400 billion by 2030, demonstrating a clear consumer shift.

Ingredion is well-positioned to capitalize on this trend by offering a portfolio of nutritional and specialty ingredients. These ingredients cater directly to consumer desires for healthier options, supporting manufacturers in developing products that align with wellness goals. The company's investment in plant-based proteins and sugar reduction solutions, for example, directly addresses key areas of consumer interest in 2024 and beyond.

Consumers are increasingly scrutinizing the environmental and social footprint of their food purchases, driving a demand for ingredients that are both sustainably sourced and ethically produced. This trend encompasses a growing interest in practices like regenerative agriculture, minimizing carbon emissions, and ensuring supply chain transparency. For instance, a 2024 report indicated that over 60% of consumers consider sustainability a key factor in their food buying decisions.

Ingredion's strategic investments in sustainable sourcing initiatives and ingredient innovation directly address these evolving consumer values. The company's commitment to reducing its environmental impact, such as its 2025 goal to decrease greenhouse gas emissions by 25% compared to a 2019 baseline, resonates with this conscious consumer base. This alignment positions Ingredion favorably in a market where ethical consumption is becoming a significant differentiator.

Demographic Shifts and Urbanization

Global demographic shifts, including a projected population increase to nearly 8.6 billion by 2030, are fundamentally altering how and what people eat. Urbanization is a key driver here, with the UN estimating that 60% of the world's population will live in urban areas by 2030. This concentration of people in cities fuels a higher demand for convenient, processed, and ready-to-eat food options.

Ingredion is well-positioned to capitalize on these trends by offering specialized ingredients that facilitate the creation of innovative food formats. Think about the growing demand for plant-based alternatives and snacks designed for busy urban lifestyles. The company's ingredient portfolio, including starches and sweeteners, can be integral to developing these products.

Specifically, by 2025, the global convenience food market is projected to reach over $1.3 trillion, underscoring the significant market opportunity. Ingredion’s ability to provide functional ingredients that improve texture, shelf-life, and taste in these convenient formats directly addresses consumer needs driven by urbanization and changing work patterns.

- Growing Urban Population: By 2030, an estimated 60% of the global population will reside in urban centers, increasing demand for convenient food solutions.

- Population Growth: The world population is expected to reach approximately 8.6 billion by 2030, further amplifying the need for efficient food production and consumption.

- Convenience Food Market Growth: The global convenience food market is anticipated to exceed $1.3 trillion by 2025, highlighting a strong consumer preference for ready-to-eat and easily prepared meals.

- Lifestyle Adaptations: Urban living often necessitates faster meal preparation and on-the-go eating, creating opportunities for ingredients that enhance the appeal and functionality of convenient food products.

Cultural and Regional Food Trends

The increasing globalization of food tastes, with consumers actively seeking out new culinary experiences, presents a significant avenue for ingredient innovation. This trend is particularly evident in the rise of fusion flavors, where distinct regional cuisines are blended, creating demand for versatile and novel ingredient solutions. Ingredion's ability to adapt its portfolio to meet these diverse and evolving preferences, incorporating international spices and unique ingredient pairings, will be crucial for capitalizing on these opportunities.

Emerging global food trends, such as the growing interest in plant-based diets and functional foods, are also reshaping consumer demand. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162 billion by 2030, highlighting a substantial shift. Ingredion's strategic focus on developing and promoting ingredients that support these trends, like plant-based proteins and fibers, aligns with consumer preferences and market growth projections for 2024 and beyond.

- Globalization of Tastes: Consumers are increasingly adventurous, seeking out international flavors and fusion dishes, driving demand for diverse ingredient profiles.

- Plant-Based Momentum: The plant-based food sector continues its rapid expansion, with market projections indicating sustained high growth through 2030.

- Functional Food Demand: There's a growing consumer interest in foods that offer health benefits beyond basic nutrition, creating opportunities for ingredients with perceived wellness attributes.

- Regional Adaptation: Ingredion must tailor its ingredient offerings to specific regional palates and culinary traditions to effectively serve a global customer base.

Societal attitudes towards health and wellness continue to evolve, with consumers actively seeking out foods that contribute to their well-being. This includes a strong preference for ingredients that are perceived as natural, minimally processed, and offer specific health benefits, such as improved digestion or increased protein intake. Ingredion's focus on clean-label ingredients and functional food components directly aligns with these consumer priorities, positioning the company to meet the demands of a health-conscious market in 2024 and 2025.

The increasing awareness of environmental and ethical considerations is also a significant societal factor influencing purchasing decisions. Consumers are more likely to support brands that demonstrate a commitment to sustainability, ethical sourcing, and transparency throughout their supply chains. Ingredion's efforts in regenerative agriculture and its stated goals for reducing greenhouse gas emissions by 2025 are key differentiators that resonate with this growing segment of socially conscious consumers.

Demographic shifts, particularly the ongoing trend of urbanization and population growth, are reshaping food consumption patterns. As more people move to cities, there's a greater demand for convenient, ready-to-eat, and easily prepared food options. Ingredion's ingredient solutions, which can enhance the texture, shelf-life, and overall appeal of convenience foods, are therefore well-suited to capitalize on these evolving lifestyle needs driven by urbanization.

The global palate is becoming increasingly diverse and adventurous, with consumers actively exploring new flavors and culinary experiences from around the world. This globalization of taste drives demand for versatile ingredients that can be used in a wide range of applications, including fusion cuisine and plant-based alternatives. Ingredion's adaptability in developing and supplying ingredients that cater to these evolving international preferences is crucial for its success in the dynamic global food market.

Technological factors

Innovations like high-pressure processing and precision fermentation are revolutionizing food ingredient creation. These advancements allow companies like Ingredion to develop novel ingredients with enhanced functionalities, offering consumers new textures and improved nutritional benefits. For instance, precision fermentation is a key technology for producing proteins and other complex molecules, expanding the toolkit for ingredient developers.

Ingredion is leveraging these processing technologies to boost the performance of its plant-based product lines. By employing techniques such as advanced extrusion, the company can create improved textures and enhance the stability of ingredients derived from plants. This focus on technological integration is crucial for meeting the growing demand for innovative and high-quality plant-based foods, a market segment that saw significant growth in 2024, with global sales projected to reach over $70 billion by 2025.

Biotechnology is rapidly changing the ingredient landscape, with advancements like metabolic engineering and synthetic biology enabling the creation of novel, sustainable options. This includes the rise of alternative proteins and ingredients grown through cellular agriculture, offering exciting new avenues for product development.

Ingredion is well-positioned to capitalize on these trends, potentially expanding its offerings with innovative plant-based ingredients to satisfy growing consumer demand for healthier and more environmentally friendly food choices. The global alternative protein market, for instance, was valued at approximately $40 billion in 2023 and is projected to reach over $150 billion by 2030, highlighting the significant market opportunity.

The food industry's embrace of digital tools like AI, IoT, and blockchain is revolutionizing how supply chains operate. These technologies are key to improving traceability and forecasting demand, directly impacting companies like Ingredion.

Ingredion benefits from enhanced logistics and transparency, ensuring product safety from origin to consumer. For instance, in 2024, the global supply chain management market was valued at over $25 billion and is projected to grow significantly, underscoring the importance of these digital advancements for operational efficiency.

Automation and Robotics in Manufacturing

The food manufacturing sector, including Ingredion's operations, is seeing a significant surge in automation and robotics. This technological shift is pivotal for enhancing efficiency, boosting precision, and ensuring consistent product quality. For Ingredion, this translates directly into more streamlined processes, leading to potential reductions in labor expenses and more robust quality assurance as raw agricultural products are transformed into valuable ingredients.

The adoption of advanced robotics and automated systems in food processing is not just about speed; it's about achieving a higher degree of accuracy in tasks like sorting, processing, and packaging. This precision is crucial for Ingredion's diverse ingredient portfolio. For instance, in 2024, the global industrial robotics market was projected to reach over $50 billion, with a substantial portion dedicated to the food and beverage industry, highlighting the investment and focus in this area.

- Efficiency Gains: Automated systems can operate continuously, reducing downtime and increasing throughput.

- Precision and Consistency: Robots perform tasks with unwavering accuracy, minimizing errors and ensuring uniform ingredient quality.

- Cost Reduction: Lower labor costs and reduced waste contribute to improved profitability.

- Enhanced Safety: Automating hazardous or repetitive tasks protects human workers.

Sustainable Manufacturing and Waste Reduction Technologies

Technological advancements in sustainable manufacturing and waste reduction are becoming increasingly vital for companies like Ingredion. Innovations such as energy-efficient processing equipment and advanced water recycling systems directly contribute to minimizing environmental impact. For instance, the adoption of Industry 4.0 technologies, including AI-powered predictive maintenance for machinery, can lead to significant energy savings and reduced downtime. In 2023, the global market for industrial energy efficiency technologies was valued at over $30 billion, indicating a strong trend towards resource conservation.

Ingredion can leverage these technologies to achieve its sustainability targets, such as reducing greenhouse gas emissions and water usage. The company's commitment to upcycling food waste, for example, can be enhanced by new bio-processing technologies that convert by-products into valuable ingredients or energy. These efforts not only reduce Ingredion's carbon footprint but also align with growing consumer demand for environmentally responsible products. By 2025, it's projected that companies investing in circular economy technologies will see a 10-15% increase in operational efficiency.

Key technological factors driving this shift include:

- Advanced Filtration and Purification: Technologies enabling closed-loop water systems and minimizing wastewater discharge.

- Biotechnology for Waste Valorization: Innovations in enzymatic or microbial processes to convert food waste into higher-value products.

- Smart Factory Solutions: IoT sensors and data analytics for real-time monitoring and optimization of energy and resource consumption.

- Renewable Energy Integration: Technologies facilitating the adoption of on-site renewable energy sources for manufacturing operations.

Technological advancements in food processing, such as high-pressure processing and precision fermentation, are enabling Ingredion to create novel ingredients with improved textures and nutritional profiles. These innovations are particularly impactful for plant-based products, a market projected to exceed $70 billion by 2025. Biotechnology, including metabolic engineering, is also a key driver, fostering the development of sustainable alternatives and expanding the global alternative protein market, which was valued at approximately $40 billion in 2023.

Digital tools like AI and IoT are transforming supply chains, enhancing traceability and demand forecasting for companies like Ingredion. The global supply chain management market's growth, exceeding $25 billion in 2024, highlights the importance of these digital solutions for operational efficiency. Automation and robotics are also crucial, with the industrial robotics market projected to surpass $50 billion in 2024, improving precision, consistency, and cost-effectiveness in food manufacturing.

Ingredion is also benefiting from technological shifts towards sustainable manufacturing and waste reduction, with innovations in energy efficiency and water recycling. The adoption of Industry 4.0 technologies, including AI for predictive maintenance, contributes to significant energy savings, a trend supported by the over $30 billion global market for industrial energy efficiency technologies in 2023. These advancements allow Ingredion to meet sustainability targets and capitalize on the growing demand for environmentally responsible products, with circular economy investments potentially boosting operational efficiency by 10-15% by 2025.

| Key Technological Areas | Impact on Ingredion | Market Data (2023-2025) |

| Advanced Food Processing (HPP, Precision Fermentation) | Novel ingredient development, enhanced plant-based products | Plant-based market >$70B by 2025 |

| Biotechnology (Metabolic Engineering, Synthetic Biology) | Sustainable ingredient creation, alternative proteins | Alternative protein market ~$40B (2023) |

| Digitalization (AI, IoT, Blockchain) | Supply chain optimization, traceability, demand forecasting | Supply chain management market >$25B (2024) |

| Automation & Robotics | Increased efficiency, precision, cost reduction in manufacturing | Industrial robotics market >$50B (2024) |

| Sustainable Manufacturing Technologies (Industry 4.0) | Energy savings, waste reduction, resource optimization | Industrial energy efficiency market >$30B (2023) |

Legal factors

Ingredion operates within a stringent global framework of food safety regulations, emphasizing principles like Hazard Analysis and Critical Control Points (HACCP) and robust traceability. These are not merely guidelines but essential pillars for market entry and maintaining consumer confidence. For instance, the US FDA's Food Traceability Final Rule, implemented in early 2023, mandates enhanced record-keeping for specific food products, directly impacting how Ingredion manages its supply chain data.

Staying ahead of evolving standards, such as the EU's updated novel food safety assessments, is crucial for Ingredion's access to key international markets. Failure to comply with these regulations, which can include stricter allergen labeling or new ingredient approval processes, carries significant risks. These risks manifest as costly product recalls, substantial financial penalties, and irreparable damage to the company's reputation, as seen with past industry-wide recall events costing millions of dollars.

Labeling and nutritional claim regulations are a dynamic landscape that directly affects Ingredion. For instance, China's updated food labeling standards, implemented in 2023, mandate more precise ingredient disclosures and allergen information, impacting how Ingredion's starches and sweeteners are presented in finished goods sold there. Similarly, the U.S. FDA's ongoing review and potential revision of the 'healthy' claim criteria, as seen with discussions around nutrient density in 2024, could influence the marketing of Ingredion's lower-sugar or fiber-enriched ingredients.

Intellectual property laws are crucial for Ingredion, safeguarding its innovations in areas like plant-based proteins and sugar reduction technologies. The company's ability to patent new ingredient formulations and manufacturing processes allows it to protect its significant R&D expenditures, estimated to be in the hundreds of millions annually, and maintain market exclusivity.

Strong intellectual property rights enable Ingredion to prevent competitors from replicating its proprietary solutions, thereby securing its competitive advantage. This protection is particularly vital in the rapidly evolving food ingredient sector, where differentiation through unique product offerings is key to sustained growth and profitability.

Antitrust and Competition Laws

Ingredion must navigate a complex web of antitrust and competition laws across its global operations, ensuring fair market practices and avoiding monopolistic tendencies. These regulations directly shape the company's ability to pursue strategic growth through mergers, acquisitions, and partnerships.

For instance, in 2024, regulatory bodies like the U.S. Federal Trade Commission (FTC) and the European Commission continue to scrutinize large-scale business combinations for potential anti-competitive effects. Ingredion's past acquisitions, such as its 2018 acquisition of SunOptic, were subject to review, highlighting the ongoing importance of compliance.

- Merger Scrutiny: Antitrust authorities globally, including the FTC, actively review proposed mergers and acquisitions to prevent market concentration.

- Collaboration Guidelines: Competition laws dictate the terms and conditions under which companies can collaborate on research, development, or market access to prevent collusion.

- Market Dominance: Ingredion must avoid practices that could be construed as abusing a dominant market position, which could lead to significant fines and operational restrictions.

- Jurisdictional Differences: Compliance requires understanding and adhering to varying antitrust frameworks in key markets like North America, Europe, and Asia.

International Trade Laws and Customs

Ingredion navigates a complex web of international trade laws and customs, directly impacting its global supply chain. These regulations, including tariffs and import/export quotas, influence the cost and speed of moving essential ingredients like corn and sugar, as well as finished products, across different countries. For instance, in 2024, ongoing trade disputes and the implementation of new trade agreements continued to reshape market access for agricultural commodities.

Shifting geopolitical landscapes and protectionist measures can erect significant trade barriers, increasing operational complexity and potentially raising the cost of goods. Ingredion's ability to source raw materials and distribute its specialty ingredients is directly tied to the stability and predictability of these international trade frameworks. The World Trade Organization (WTO) reported that trade restrictions imposed by various nations in 2024 impacted key agricultural trade flows, necessitating agile adaptation by companies like Ingredion.

- Tariff Volatility: Fluctuations in tariffs on key agricultural inputs and processed goods create cost uncertainties for Ingredion's global operations.

- Non-Tariff Barriers: Evolving import/export licensing requirements and sanitary/phytosanitary standards can create logistical hurdles and delays.

- Trade Agreement Changes: Modifications to trade pacts, such as those involving major agricultural producers, directly affect Ingredion's sourcing strategies and market access.

- Geopolitical Impact: International sanctions or trade embargoes can disrupt supply chains and necessitate the redirection of raw material flows.

Ingredion must navigate a complex web of antitrust and competition laws across its global operations, ensuring fair market practices and avoiding monopolistic tendencies. These regulations directly shape the company's ability to pursue strategic growth through mergers, acquisitions, and partnerships.

For instance, in 2024, regulatory bodies like the U.S. Federal Trade Commission (FTC) and the European Commission continue to scrutinize large-scale business combinations for potential anti-competitive effects. Ingredion's past acquisitions, such as its 2018 acquisition of SunOptic, were subject to review, highlighting the ongoing importance of compliance.

Merger scrutiny by authorities like the FTC actively reviews proposed combinations to prevent market concentration. Competition laws also dictate collaboration guidelines, preventing collusion in research or market access, and Ingredion must avoid practices that could be construed as abusing a dominant market position, which could lead to significant fines.

Environmental factors

Climate change is increasingly impacting agricultural yields, a critical factor for Ingredion, a major processor of corn, tapioca, and potatoes. Extreme weather events, such as the severe droughts experienced in parts of the U.S. Midwest in 2023, directly affect corn production, a key ingredient for Ingredion. These events can lead to reduced crop quality and quantity, driving up raw material costs and potentially disrupting Ingredion's supply chain.

The volatility in crop yields due to climate change translates into higher and more unpredictable raw material expenses for Ingredion. For instance, the U.S. Department of Agriculture (USDA) reported a significant drop in the national average corn yield for 2023 compared to previous years due to adverse weather conditions. This directly impacts Ingredion's cost of goods sold and can affect profit margins.

Supply chain disruptions are another major concern. Flooding in key agricultural regions, as seen in parts of South America affecting tapioca cultivation, can hinder harvesting and transportation. Ingredion's reliance on these global supply chains means that localized climate events can have broader implications for ingredient availability and delivery timelines throughout 2024 and into 2025.

Water scarcity poses a significant environmental challenge for Ingredion, impacting its agricultural supply chains and processing operations. In 2024, regions critical for corn and soybean production, key Ingredion inputs, faced varying degrees of water stress, with some areas experiencing drought conditions that could affect yields and raw material costs. The company's reliance on water-intensive agricultural processes demands robust water management strategies.

To address this, Ingredion is investing in water conservation technologies and efficient management practices across its facilities. For instance, by 2025, Ingredion aims to reduce its water intensity by 15% compared to a 2019 baseline, a target that requires continuous innovation in water recycling and usage optimization. This proactive approach is essential to ensure operational continuity and mitigate the financial risks associated with dwindling water resources.

Consumers, investors, and regulators are increasingly pushing companies to shrink their environmental impact, particularly greenhouse gas emissions. This growing pressure means businesses must actively manage and reduce their carbon footprint to remain competitive and meet evolving expectations.

Ingredion's dedication to cutting absolute greenhouse gas emissions and increasing its use of renewable electricity is vital for its long-term viability. For instance, by the end of 2023, Ingredion achieved a 17% reduction in absolute Scope 1 and 2 GHG emissions compared to a 2019 baseline, demonstrating tangible progress in this area. This commitment is not just about environmental responsibility; it's a strategic imperative to satisfy stakeholders and ensure continued market access.

Waste Management and Circular Economy Initiatives

The growing emphasis on a circular economy is significantly influencing how companies like Ingredion operate, pushing for waste minimization and innovative by-product reuse. This global trend prioritizes reducing environmental impact through sustainable practices.

Ingredion is actively pursuing ambitious waste management goals, including aiming for 100% avoidance of waste sent to landfills. Furthermore, the company is focused on upcycling waste streams into valuable, sustainable products or packaging solutions, directly addressing environmental concerns.

These initiatives are crucial for several reasons:

- Regulatory Compliance: Increasingly stringent environmental regulations worldwide mandate better waste management and reduced landfill dependency.

- Cost Savings: By upcycling waste, companies can reduce disposal costs and potentially generate new revenue streams from by-products.

- Brand Reputation: Demonstrating a commitment to sustainability and circular economy principles enhances brand image and appeals to environmentally conscious consumers and investors.

- Resource Efficiency: The circular economy model promotes the efficient use of resources, reducing reliance on virgin materials and mitigating supply chain risks.

Biodiversity and Land Use

The increasing global focus on biodiversity and responsible land use directly impacts agricultural inputs, a core area for Ingredion. Concerns over land degradation and biodiversity loss are prompting stricter regulations and consumer demand for sustainably sourced ingredients. Ingredion is actively addressing this through its commitment to regenerative agriculture, aiming to improve soil health and reduce environmental impact across its supply chain.

Ingredion's strategy includes robust risk assessments for agricultural biodiversity and a clear objective of achieving zero deforestation in its sourcing practices. This proactive approach is crucial for maintaining access to raw materials and building resilience against environmental challenges. By investing in sustainable farming methods, Ingredion aims to mitigate the negative effects of conventional agriculture on ecosystems.

For instance, Ingredion reported in its 2023 Sustainability Report that it engaged with over 13,000 farmers in sustainable agriculture programs. These initiatives often include practices that enhance biodiversity, such as cover cropping and reduced tillage, which help prevent soil erosion and improve water retention. The company's efforts are aligned with broader industry trends and regulatory pressures to ensure the long-term viability of agricultural landscapes.

Key initiatives and their impact include:

- Regenerative Agriculture Programs: Ingredion is expanding its support for farmers adopting practices that enhance soil health and biodiversity, aiming for broader adoption by 2030.

- Biodiversity Risk Assessments: The company conducts assessments to understand and mitigate biodiversity risks within its key sourcing regions, particularly for crops like corn and sugar.

- Zero Deforestation Commitment: Ingredion is working towards eliminating deforestation from its supply chain, with specific targets for key commodities.

- Supplier Engagement: In 2023, Ingredion engaged with over 13,000 farmers on sustainable agriculture practices, fostering a more environmentally conscious supply base.

Ingredion faces increasing pressure from consumers and regulators to reduce its environmental footprint, particularly concerning greenhouse gas emissions. The company reported a 17% reduction in absolute Scope 1 and 2 GHG emissions by the end of 2023 compared to a 2019 baseline, demonstrating progress in this critical area.

The company is also actively pursuing ambitious waste management goals, aiming for 100% avoidance of waste sent to landfills and focusing on upcycling waste streams into valuable, sustainable products or packaging solutions, aligning with circular economy principles.

Ingredion is expanding its support for farmers adopting regenerative agriculture practices to enhance soil health and biodiversity. In 2023, the company engaged with over 13,000 farmers on sustainable agriculture practices, underscoring its commitment to a more environmentally conscious supply base and mitigating biodiversity risks.

| Environmental Factor | Ingredion's Action/Impact | Data/Target (as of latest reporting) |

|---|---|---|

| Greenhouse Gas Emissions | Reducing absolute Scope 1 & 2 GHG emissions | 17% reduction by end of 2023 (vs. 2019 baseline) |

| Waste Management | Aiming for 100% waste avoidance from landfills; upcycling waste streams | Ongoing initiatives; focus on circular economy principles |

| Biodiversity & Land Use | Expanding regenerative agriculture; engaging farmers on sustainable practices | Engaged over 13,000 farmers in 2023; aiming for broader adoption by 2030 |

PESTLE Analysis Data Sources

Our Ingredion PESTLE Analysis is meticulously constructed using data from leading international organizations like the World Bank and IMF, alongside comprehensive market research reports and government regulatory updates. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors impacting the food ingredient industry.