Ingredion Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ingredion Bundle

Ingredion operates in a dynamic market shaped by intense competition and evolving consumer preferences. Understanding the bargaining power of buyers and the threat of substitutes is crucial for navigating this landscape.

The full Porter's Five Forces Analysis delves deeper, revealing the intricate interplay of these forces and their impact on Ingredion's profitability. Unlock actionable insights to sharpen your strategic edge.

Suppliers Bargaining Power

Ingredion's core business depends on agricultural commodities such as corn, tapioca, and potatoes. While the overall market for these staples typically features a broad base of growers, limiting the power of any single supplier, the situation can shift for specialized or premium ingredients.

For instance, if Ingredion seeks specific non-GMO corn varieties or sustainably certified tapioca, the supplier pool may become more consolidated. This concentration can grant these specialized suppliers greater bargaining power, potentially influencing Ingredion's input costs and supply chain stability. In 2023, global corn prices saw fluctuations due to weather patterns and geopolitical events, impacting raw material costs for companies like Ingredion.

While basic corn or potato starch might be seen as commodities, Ingredion's strategic shift towards innovative and specialty ingredients significantly alters this dynamic. Suppliers offering unique plant varieties or those that can consistently meet Ingredion's rigorous sustainability and quality specifications for these specialized inputs can wield greater bargaining power. For instance, the development of novel sweeteners or texturizers often relies on specific, sometimes limited, agricultural outputs.

Switching raw material suppliers for Ingredion's large-scale operations often incurs substantial costs. These can include the expense and time involved in re-qualifying new suppliers, reconfiguring logistics and supply chains, and the potential for production downtime during the transition. These switching costs effectively raise the barrier for Ingredion to easily change its suppliers, granting established suppliers a degree of leverage.

Threat of Forward Integration by Suppliers

The threat of forward integration by Ingredion's suppliers is generally low. Most of Ingredion's primary agricultural suppliers, such as farmers or basic commodity processors, lack the significant capital, advanced technology, and specialized market knowledge needed to integrate forward into complex ingredient processing. This barrier makes it unlikely for them to directly compete with Ingredion in its core business.

However, a potential long-term threat could emerge from large agricultural conglomerates. These entities possess the resources and scale to potentially expand their operations into more refined ingredient production, thereby entering Ingredion's market space. For instance, companies like Cargill, a major player in global food and agriculture, already have diversified operations that could lean further into specialized ingredient manufacturing.

- Low Integration Risk: Most agricultural suppliers lack the capital and expertise for complex ingredient processing.

- Potential Threat: Large agricultural conglomerates could integrate forward into specialized ingredient production.

- Example: Companies like Cargill have the scale to potentially enter Ingredion's market.

Importance of Ingredion to Suppliers

Ingredion's substantial demand for agricultural commodities gives it considerable leverage over many individual farmers and smaller agricultural cooperatives. As a major purchaser, Ingredion can dictate terms, potentially limiting the bargaining power of these smaller suppliers who rely heavily on its business. This concentration of purchasing power is a key factor in assessing Ingredion's supplier relationships.

Conversely, for larger commodity traders and specialized agricultural producers, Ingredion is just one of several significant buyers in the market. This diversification of customers for suppliers creates a more balanced power dynamic, as these larger entities can shift their business to competitors if Ingredion's terms become unfavorable. In 2023, Ingredion's cost of goods sold was approximately $5.7 billion, highlighting the scale of its procurement operations and its importance to the agricultural supply chain.

- Supplier Dependence: Individual farmers often depend on Ingredion for a substantial portion of their sales, reducing their ability to negotiate favorable pricing.

- Market Diversification for Suppliers: Larger suppliers and traders have multiple avenues for selling their products, which strengthens their bargaining position with Ingredion.

- Commodity Price Volatility: Ingredion's ability to absorb price fluctuations in raw materials, such as corn and sweeteners, can influence its negotiation leverage with suppliers.

- Ingredion's Scale: With revenues exceeding $7 billion in 2023, Ingredion's sheer size as a buyer means its purchasing decisions significantly impact supplier markets.

The bargaining power of Ingredion's suppliers is moderate, influenced by the commodity nature of its core inputs and the growing demand for specialized ingredients. While a broad base of farmers for basic commodities limits individual supplier power, suppliers of unique or sustainably sourced agricultural products can command greater leverage due to more concentrated markets.

Ingredion's significant purchasing volume, with revenues exceeding $7 billion in 2023, provides leverage over smaller suppliers. However, larger commodity traders and specialized producers, who have diversified customer bases, possess stronger bargaining positions. The company's cost of goods sold was approximately $5.7 billion in 2023, underscoring the scale of its procurement needs and its impact on supplier markets.

| Factor | Impact on Ingredion | Example/Data |

|---|---|---|

| Supplier Concentration (Specialty Ingredients) | Increases supplier power | Suppliers of non-GMO corn or certified tapioca may have more leverage. |

| Buyer Concentration (Ingredion's Scale) | Decreases supplier power for smaller suppliers | Ingredion's 2023 revenue of over $7 billion. |

| Supplier Diversification | Increases supplier power | Large traders selling to multiple buyers. |

| Switching Costs | Increases supplier power | Costs associated with re-qualifying suppliers and logistics. |

| Forward Integration Threat | Low for most, potential for conglomerates | Large players like Cargill could move into specialized ingredient manufacturing. |

What is included in the product

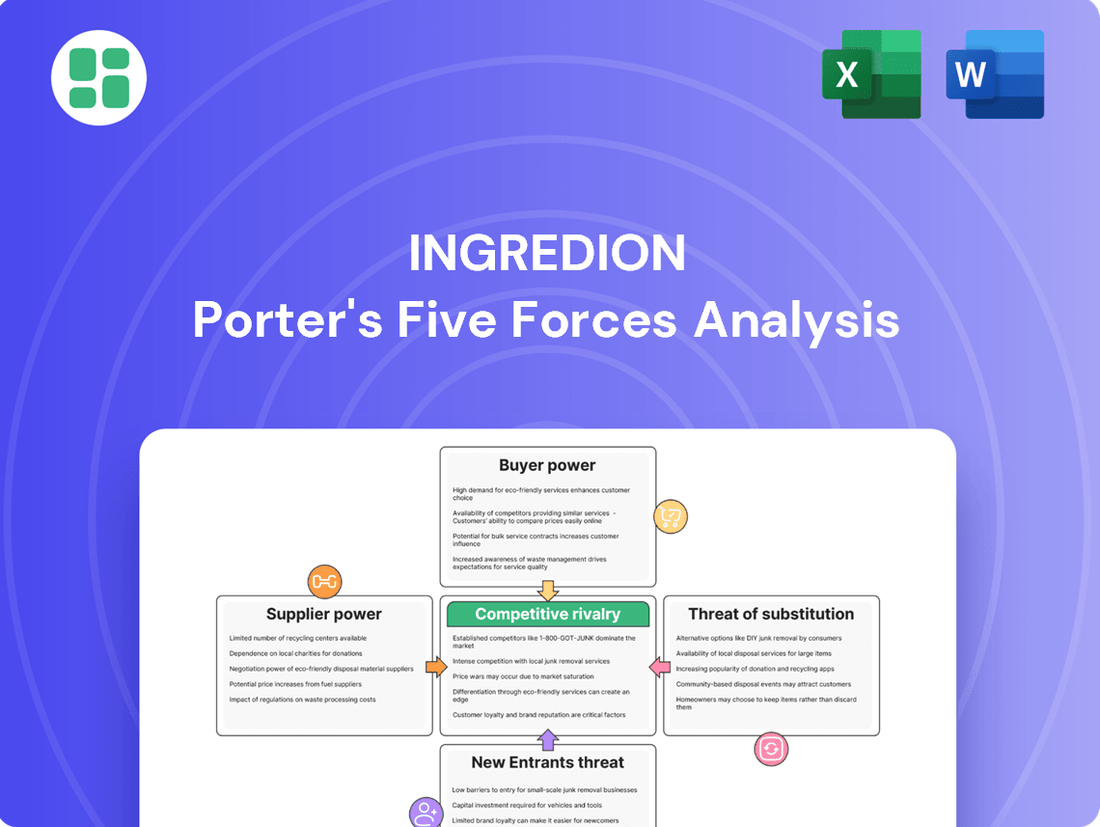

This analysis dissects Ingredion's competitive environment by examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the ingredient industry.

Effortlessly identify and mitigate competitive threats by visualizing Ingredion's Porter's Five Forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Ingredion's customer base is broad, spanning food, beverage, animal nutrition, brewing, and industrial sectors worldwide. While individual customer reliance might be low, major global food and beverage manufacturers can exert influence through their significant purchase volumes, potentially impacting pricing discussions.

Customer switching costs are a significant factor in Ingredion's favor, limiting buyer bargaining power. For instance, a food manufacturer relying on Ingredion's specialty starches might face substantial hurdles if they decide to switch suppliers. These hurdles include the expense and time involved in reformulating their products, conducting rigorous re-testing to ensure quality and taste remain consistent, and obtaining necessary regulatory approvals for the new ingredient. This complexity inherently makes customers more hesitant to switch, fostering loyalty.

Ingredion's strategic emphasis on developing innovative and specialty ingredients, offering distinct advantages in texture, sweetness, nutrition, and sustainability, significantly diminishes the commoditization of its offerings. When these specialized ingredients are integral to a customer's product performance or their unique market appeal, the customer's leverage in price negotiations is naturally curtailed.

Threat of Backward Integration by Customers

The threat of backward integration by Ingredion's customers is generally low. Manufacturing specialized ingredients requires significant capital investment, advanced research and development capabilities, and deep processing expertise, making it impractical for most clients.

While very large food and beverage companies might explore in-house production of some basic ingredients, this is uncommon for the more complex, value-added products Ingredion offers. For instance, in 2024, Ingredion's focus on highly refined starches and sweeteners, which demand proprietary technology, further deters customer integration.

- Low Likelihood of Integration: Specialized capital, R&D, and processing expertise are significant barriers for most customers.

- Limited Scope for Large Conglomerates: Extremely large food and beverage firms might consider basic in-house production, but not typically for Ingredion's specialized offerings.

- Ingredion's Competitive Advantage: The company's proprietary technology in areas like modified starches reduces the incentive for customers to integrate backward.

Customer Price Sensitivity

Customer price sensitivity significantly impacts Ingredion's bargaining power. In highly competitive sectors such as packaged foods, where Ingredion's clients operate, there's considerable pressure on ingredient suppliers to deliver cost-effective solutions. This often translates into customers demanding lower prices.

However, this sensitivity is not uniform across all product categories. For Ingredion's premium or specialized ingredients, customers may exhibit less price sensitivity. They are often willing to pay a premium for ingredients that offer enhanced performance characteristics or cater to evolving consumer preferences, such as clean labels or plant-based alternatives.

- Price Sensitivity in Packaged Foods: In 2024, the packaged food industry continued to face intense competition, with major players like Nestle and Kraft Heinz reporting ongoing efforts to manage input costs. This environment directly pressures ingredient suppliers like Ingredion to offer competitive pricing.

- Premium Product Willingness to Pay: For Ingredion's specialty starches and sweeteners, which often command higher prices due to unique functionalities or alignment with health trends, customers demonstrated a greater willingness to absorb increased costs. For example, demand for high-purity, non-GMO ingredients remained robust, supporting premium pricing strategies.

- Impact on Ingredion's Margins: The dual nature of customer price sensitivity – high for commoditized ingredients and lower for specialized offerings – directly influences Ingredion's gross margins. The company's strategy often involves balancing volume sales of core products with higher-margin sales of differentiated ingredients to mitigate this pressure.

Ingredion faces moderate bargaining power from its customers, largely influenced by the nature of the ingredients purchased. While large volume buyers can negotiate on price for commodity starches, customers seeking Ingredion's specialized, high-performance ingredients exhibit lower price sensitivity due to product differentiation and switching costs.

The threat of backward integration by customers is minimal, as the capital investment and technical expertise required for producing Ingredion's advanced ingredients are substantial barriers. For instance, in 2024, Ingredion's proprietary modified starch technologies remained a significant deterrent to in-house production by most clients.

Customer price sensitivity is a key factor, particularly in the competitive packaged food sector where cost-efficiency is paramount. However, this sensitivity wanes for Ingredion's innovative offerings, such as plant-based sweeteners or clean-label ingredients, where unique product benefits justify higher costs.

| Customer Segment | Price Sensitivity | Switching Costs | Bargaining Power |

|---|---|---|---|

| Large Food & Beverage Manufacturers (Commodity Ingredients) | High | Moderate | Moderate to High |

| Specialty Food Manufacturers (Differentiated Ingredients) | Low to Moderate | High | Low to Moderate |

| Industrial Sector Clients | Moderate | Moderate | Moderate |

Preview the Actual Deliverable

Ingredion Porter's Five Forces Analysis

This preview shows the exact, comprehensive Porter's Five Forces Analysis for Ingredion you'll receive immediately after purchase. It details the competitive landscape, including threats of new entrants, bargaining power of buyers and suppliers, and the intensity of rivalry within the ingredients sector. You'll gain immediate access to this professionally formatted document, ready for your strategic planning and decision-making.

Rivalry Among Competitors

The specialty food ingredients market is a crowded space, featuring a substantial number of global competitors. These range from massive, diversified agricultural companies to niche players focusing on specific ingredient types. This broad spectrum of participants intensifies the competitive landscape Ingredion navigates.

Ingredion faces direct rivalry from major industry names such as ADM, Cargill, Tate & Lyle, Kerry Group, and Roquette. For instance, Tate & Lyle reported revenues of approximately $1.3 billion for the fiscal year ending March 31, 2024, highlighting the scale of operations these competitors maintain. This significant presence from well-established entities underscores the high level of competitive rivalry Ingredion must contend with.

The specialty food ingredients market is on a strong upward trajectory, with projections indicating it could reach between USD 166.17 billion and USD 179.87 billion by 2030-2034. This impressive growth, estimated at a compound annual growth rate (CAGR) of approximately 4.8% to 5.6%, naturally fuels intense competition. As the market expands, more players are drawn in, eager to capture a piece of this lucrative pie, leading to heightened rivalry among existing and new entrants.

Ingredion's competitive landscape is heavily shaped by product differentiation and ongoing innovation. The company actively competes by offering specialized solutions across texture, sweetness, and nutritional enhancement, with a strong focus on clean-label and plant-based ingredients. This commitment to innovation means Ingredion, and its rivals, consistently allocate significant resources to research and development to bring novel ingredients and applications to market, making differentiation a crucial battleground.

In 2023, Ingredion reported a net sales increase to $7.5 billion, underscoring the market's demand for its differentiated ingredient solutions. This growth reflects the success of their R&D efforts in meeting evolving consumer preferences for healthier and more sustainable food options, a trend that intensifies the rivalry among ingredient suppliers to offer unique and high-performing products.

Exit Barriers

Ingredion, like many in the ingredient solutions sector, faces substantial exit barriers. The immense capital required for specialized processing facilities and equipment means that exiting the market isn't a simple decision. For instance, the cost of building or acquiring a modern corn wet-milling plant can easily run into hundreds of millions of dollars.

These high fixed costs, combined with deeply entrenched, long-term customer relationships and integrated supply chain logistics, make it difficult and expensive for companies to leave. These factors can trap capital, forcing even unprofitable operations to continue, thereby intensifying competitive rivalry as firms struggle to recoup their investments.

- High Capital Intensity: Significant investments in specialized processing plants deter new entrants and make exiting costly.

- Long-Term Customer Contracts: Established relationships and supply agreements create inertia, making it hard to disengage.

- Specialized Assets: Processing equipment often has limited alternative uses, increasing the cost of divestment.

Market Concentration and Strategic Alliances

The competitive rivalry in the ingredient solutions market is characterized by the presence of major players such as Ingredion, Archer Daniels Midland (ADM), and Cargill, who command substantial market share. However, the market isn't excessively concentrated, featuring a blend of large-scale operations and specialized niche providers. This dynamic environment fuels intense competition as companies vie for market dominance.

Strategic alliances and acquisitions are prevalent, signaling a proactive approach by industry participants to enhance their capabilities and broaden their market reach. For instance, in 2023, Ingredion completed the acquisition of Lumisys, a move designed to bolster its specialty ingredients portfolio, particularly in the high-growth plant-based protein sector. Such activities underscore the continuous efforts to gain a competitive edge and adapt to evolving consumer demands.

- Market Share Distribution: While Ingredion, ADM, and Cargill are key players, the ingredient solutions market is not dominated by a single entity, allowing for competition from a diverse range of companies.

- Strategic Maneuvers: Companies frequently engage in strategic partnerships and mergers and acquisitions to gain access to new technologies, expand product lines, and increase their geographical footprint.

- Competitive Intensity: The presence of both large, established corporations and agile, specialized firms creates a highly competitive landscape where innovation and strategic positioning are critical for success.

The competitive rivalry within the specialty food ingredients market is intense, driven by a mix of large, diversified players and agile niche specialists. Ingredion directly competes with giants like ADM and Cargill, as well as companies such as Tate & Lyle, which reported approximately $1.3 billion in revenue for its fiscal year ending March 31, 2024. This dynamic landscape necessitates continuous innovation and strategic positioning to maintain market share in a sector projected to reach up to $179.87 billion by 2034.

Ingredion's competitive strategy heavily relies on product differentiation, focusing on clean-label and plant-based ingredients, a segment where innovation is paramount. The company's net sales reached $7.5 billion in 2023, reflecting its success in meeting evolving consumer demands. This focus on R&D is a critical battleground, as rivals also invest heavily to capture growth in this expanding market, estimated to grow at a CAGR of 4.8% to 5.6%.

High exit barriers, including substantial capital investments in specialized facilities (potentially hundreds of millions for a single plant) and long-term customer relationships, contribute to the sustained competitive pressure. These factors trap capital and encourage firms to remain operational, even if less profitable, thereby intensifying rivalry as companies strive to recoup their significant investments and maintain their market presence.

| Key Competitors | 2023 Net Sales (Ingredion) | Market Growth Projection (CAGR) | Key Competitive Factor |

|---|---|---|---|

| ADM | $7.5 Billion | 4.8% - 5.6% | Product Innovation & Differentiation |

| Cargill | $7.5 Billion | 4.8% - 5.6% | Strategic Acquisitions & Partnerships |

| Tate & Lyle | $1.3 Billion (FY 2024) | 4.8% - 5.6% | Clean-Label & Plant-Based Solutions |

| Kerry Group | $7.5 Billion | 4.8% - 5.6% | R&D Investment & Market Reach |

SSubstitutes Threaten

Direct substitutes for Ingredion's starches and sweeteners are readily available, ranging from traditional sugar and various syrups to alternative starches derived from different plant sources. This abundance of alternatives can indeed exert pressure on Ingredion's pricing power and market share, particularly for its more standardized product lines.

The threat of substitutes for Ingredion's products is influenced by how well alternatives meet customer needs for performance and price. For instance, alternative sweeteners might offer lower calories or distinct taste experiences, while different starches could provide comparable textural qualities at varying costs. Customers weigh these substitutes based on their functionality, overall cost-effectiveness, and how well they align with current consumer preferences like clean labels or natural ingredients.

Customers' willingness to switch to substitute ingredients for Ingredion's offerings is largely influenced by how easily they can reformulate their products. For instance, a food manufacturer might hesitate to switch from a familiar corn-based sweetener to a novel plant-based alternative if the latter requires significant re-testing and process adjustments, especially if regulatory approvals for the new ingredient are still pending. Consumer acceptance also plays a crucial role; if consumers perceive a substitute ingredient as healthier or more cost-effective, this can drive adoption. For example, the growing demand for clean-label ingredients in 2024 has encouraged many companies to explore alternatives to artificial additives, increasing the threat of substitutes in certain segments.

Technological Advancements Creating New Substitutes

Technological advancements are a significant threat, constantly introducing new substitutes that can erode Ingredion's market share. Innovations in food science and biotechnology, like precision fermentation for plant-based proteins or the development of novel low-calorie sweeteners, present direct alternatives to Ingredion's traditional ingredient offerings. For instance, the rapidly growing alternative protein market, projected to reach $162 billion by 2030 according to Bloomberg Intelligence, highlights the potential for these substitutes to capture significant consumer demand.

Ingredion actively addresses this threat by strategically investing in its own research and development and innovation labs. This proactive approach allows the company to stay ahead of emerging technologies and develop its own advanced ingredients or solutions that can compete with or even surpass new substitutes. By fostering internal innovation, Ingredion aims to transform potential threats into opportunities for growth and diversification within its product portfolio.

- Emerging Technologies: Precision fermentation, cellular agriculture, and advanced sweetener technologies are creating viable alternatives to traditional ingredients.

- Market Growth of Substitutes: The plant-based food market, a key area for substitutes, saw significant growth, with retail sales in the U.S. reaching $8 billion in 2022, according to the Good Food Institute.

- Ingredion's Response: Investments in R&D, including its 2023 acquisition of Verici, a biotechnology company focused on developing novel ingredients through fermentation, demonstrate a commitment to innovation.

- Impact on Demand: The increasing consumer preference for healthier, sustainable, and novel food options fuels the demand for these technological substitutes.

Impact of Consumer Trends on Substitution

The increasing consumer preference for clean-label, natural, organic, plant-based, and healthier food options, including sugar reduction, significantly impacts ingredient choices. This shift directly influences the threat of substitutes for Ingredion's traditional offerings.

For instance, the demand for plant-based alternatives is surging. In 2024, the global plant-based food market was valued at approximately $40 billion and is projected to grow substantially. This trend favors ingredients like plant-derived starches and sweeteners as substitutes for conventional dairy or animal-based components, and even for refined sugars.

Ingredion's strategic response involves adapting its product development to capitalize on these trends. They are investing in and expanding their portfolio of plant-based ingredients and solutions that cater to sugar reduction goals. For example, their sugar reduction platforms, utilizing stevia and monk fruit, are gaining traction as consumers actively seek lower-sugar alternatives.

- Growing Demand for Plant-Based Ingredients: The global plant-based food market is a key driver, with significant growth in 2024.

- Clean-Label and Health-Conscious Trends: Consumers are actively seeking fewer, recognizable ingredients, pushing for natural and organic options.

- Sugar Reduction Initiatives: This trend directly boosts demand for alternative sweeteners and ingredients that can mimic sugar's functionality.

- Ingredion's Strategic Adaptation: The company is focusing on developing and marketing plant-based and sugar-reduction-friendly ingredient solutions to meet these evolving consumer demands.

The threat of substitutes for Ingredion's products is significant due to the wide availability of alternatives like traditional sugar, syrups, and starches from different plant sources. These substitutes can impact Ingredion's pricing power and market share, especially for its more commoditized offerings.

Customer adoption of substitutes hinges on their performance, price, and alignment with trends like clean labels. For instance, the growing demand for plant-based ingredients in 2024, with the market valued at approximately $40 billion, directly fuels the search for alternatives to Ingredion's traditional ingredients.

Technological advancements, such as precision fermentation and novel sweeteners, are continuously introducing new substitutes. The alternative protein market, projected to reach $162 billion by 2030, exemplifies how innovation can create direct competition for Ingredion's core products.

Ingredion counters this by investing in R&D and acquiring companies like Verici in 2023, focusing on developing its own advanced ingredients and solutions to meet evolving consumer preferences for healthier, sustainable, and novel food options.

Entrants Threaten

The specialty ingredients sector, where Ingredion operates, demands significant upfront investment. Companies need substantial capital for state-of-the-art manufacturing plants, ongoing research and development to innovate new ingredients, and building robust, global supply chains. For instance, establishing a new, modern food ingredient processing facility can easily cost tens of millions, if not hundreds of millions, of dollars.

This high barrier to entry means that only well-funded organizations can realistically consider competing. The sheer scale of investment required to match existing players' capabilities in production capacity, quality control, and distribution networks effectively deters many smaller or less capitalized potential competitors from entering the market.

Ingredion, as an established player in the ingredient solutions market, leverages substantial economies of scale. This allows them to secure raw materials like corn and tapioca at more favorable prices and operate large-scale manufacturing facilities, driving down per-unit production costs.

For instance, Ingredion's global operational footprint and significant purchasing power enable cost advantages that are difficult for newcomers to replicate. In 2023, the company reported net sales of $7.5 billion, underscoring the scale of its operations.

New entrants would face a considerable hurdle in matching these cost efficiencies. Without the volume to negotiate lower input prices or the capacity to amortize fixed costs over a vast output, a new competitor would likely enter with a higher cost structure, making price-based competition challenging.

Ingredion's formidable global distribution network, serving over 120 countries, represents a significant barrier to entry. New entrants would struggle to replicate Ingredion's established logistics and reach. For instance, in 2023, Ingredion reported net sales of $7.5 billion, underscoring the scale of its operations and market penetration.

Furthermore, Ingredion's deep-rooted customer relationships with major food and beverage manufacturers are not easily disrupted. These long-standing partnerships, built on trust and consistent supply, are a crucial competitive advantage. Acquiring similar client loyalty and supply agreements would demand substantial investment and time from any new competitor.

Regulatory Hurdles and Compliance

The food and beverage sector, including players like Ingredion, faces significant regulatory challenges. These include strict food safety standards, evolving labeling laws, and rigorous quality control mandates across global markets. For instance, in 2024, the FDA continued to emphasize enhanced traceability requirements under the Food Safety Modernization Act, demanding substantial investments from any new participant in robust tracking systems.

Navigating this complex web of compliance is a major barrier for potential new entrants. Obtaining necessary certifications, such as those from the Global Food Safety Initiative, requires time, resources, and a deep understanding of international standards. This adds considerable cost and complexity, effectively deterring many smaller or less capitalized businesses from entering the market.

- Stringent Food Safety: Regulations like FSMA in the US require extensive safety protocols.

- Evolving Labeling Laws: Compliance with nutritional and allergen information adds complexity.

- Quality Certifications: Obtaining GFSI-recognized certifications is a significant hurdle.

- Investment in Quality Control: New entrants must allocate substantial capital to quality assurance systems.

Product Differentiation, R&D, and Brand Loyalty

Ingredion's significant investment in R&D, exemplified by its Idea Labs network, fuels product differentiation. This focus on innovation, including proprietary technologies for specialized ingredient solutions, makes it challenging for new entrants to replicate their offerings. For instance, in 2023, Ingredion reported $1.3 billion in sales from specialty ingredients, a key area of differentiation.

New competitors face substantial hurdles in developing comparable, high-value products and establishing brand recognition. Building customer loyalty in a market where Ingredion has long-standing relationships and a reputation for quality requires considerable time and resources. The sheer scale of investment needed for effective R&D and marketing acts as a significant barrier.

- High R&D Investment: New entrants must commit substantial capital to research and development to match Ingredion's specialized ingredient portfolio.

- Proprietary Technologies: Ingredion's unique technologies, developed through its Idea Labs, create a competitive advantage that is difficult to overcome.

- Brand Loyalty and Relationships: Ingredion's established customer base and brand reputation are significant barriers to entry for newcomers.

- Market Saturation: The existing competitive landscape makes it harder for new players to gain market share without significant differentiation.

The threat of new entrants in the specialty ingredients sector, where Ingredion operates, is relatively low due to substantial barriers. High capital requirements for manufacturing and R&D, coupled with established economies of scale and extensive distribution networks, make it difficult for newcomers to compete effectively. For instance, Ingredion's 2023 net sales of $7.5 billion highlight the scale required to be a significant player.

Regulatory hurdles, including stringent food safety standards and quality certifications, add further complexity and cost for potential entrants. Ingredion’s investment in innovation, such as its Idea Labs, also creates a differentiation advantage that new companies struggle to replicate, especially given Ingredion's $1.3 billion in specialty ingredient sales in 2023.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Significant investment needed for facilities, R&D, and supply chains. | Deters smaller, less-funded competitors. |

| Economies of Scale | Lower per-unit costs due to large-scale operations and purchasing power. | New entrants face higher cost structures. |

| Distribution Network | Established logistics and global reach. | Difficult and costly for new players to replicate. |

| Regulatory Compliance | Adherence to food safety, labeling, and quality standards. | Requires substantial time, resources, and expertise. |

| R&D and Differentiation | Investment in proprietary technologies and product innovation. | Challenging for new entrants to match specialized offerings. |

Porter's Five Forces Analysis Data Sources

Our Ingredion Porter's Five Forces analysis is built upon a robust foundation of data, including Ingredion's annual reports, investor presentations, and SEC filings. We also incorporate industry-specific market research from firms like Mintel and Euromonitor, alongside macroeconomic data from sources such as the World Bank and IMF.