Ingredion Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ingredion Bundle

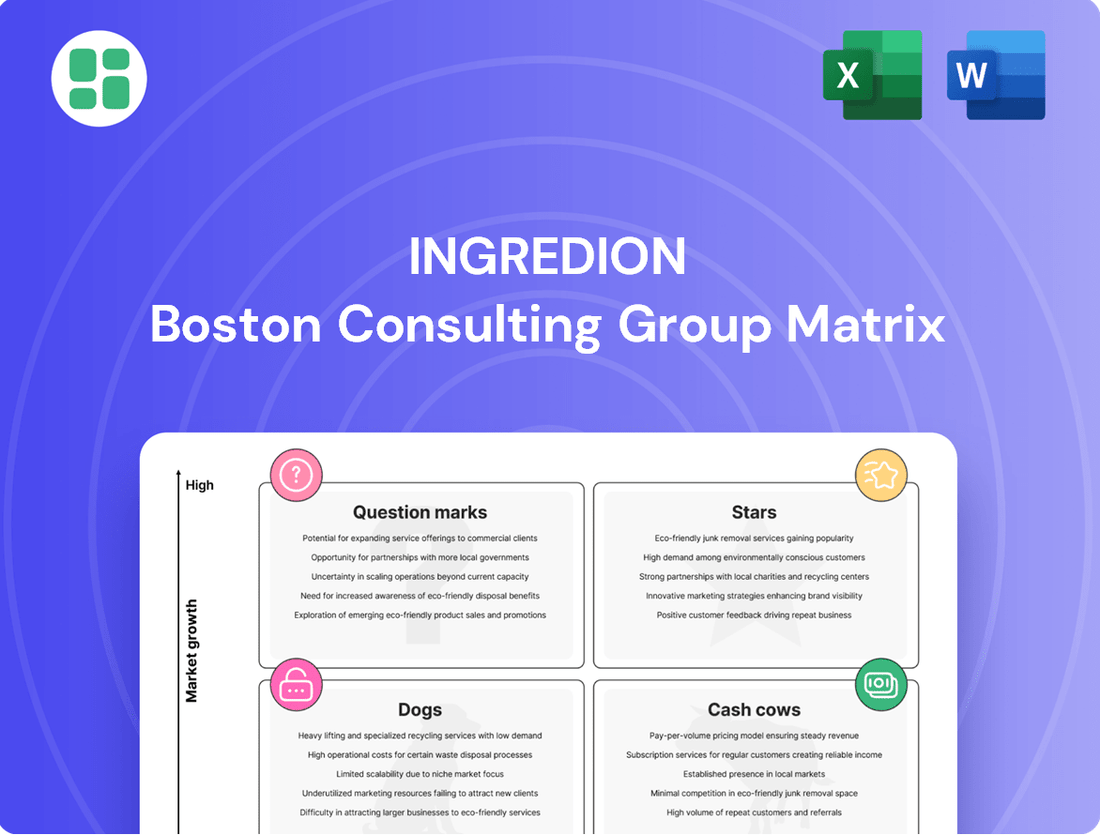

Unlock the strategic potential of Ingredion's product portfolio with a clear understanding of its position within the BCG Matrix. See which products are driving growth (Stars), generating consistent revenue (Cash Cows), lagging behind (Dogs), or require further investment (Question Marks).

This preview offers a glimpse into Ingredion's strategic landscape; purchase the full BCG Matrix report for a comprehensive breakdown of each product's quadrant placement, data-driven insights, and actionable recommendations to optimize your investment and product development strategies.

Don't miss out on the complete picture! Secure your copy of Ingredion's full BCG Matrix to gain a decisive edge in a dynamic market, complete with quadrant-specific strategies and the clarity needed to make impactful business decisions.

Stars

The Texture & Healthful Solutions segment is a powerhouse for Ingredion, driving substantial growth. This area, encompassing everything from clean-label ingredients to functional solutions, saw impressive volume increases and a significant jump in operating income during the first half of 2025.

Ingredion's strategic investment in natural fibers, plant-based proteins, and hydrocolloids directly taps into the booming clean-label market. This segment is poised for continued expansion, with projections indicating robust growth through 2032, reflecting evolving consumer demand for healthier, more transparent food options.

Ingredion's plant-based proteins are positioned as a Star in the BCG matrix. The company commands a significant 12.6% global market share in this burgeoning sector, which is expected to see a robust 7.9% annual growth rate until 2030.

With over $200 million invested to establish a leading presence, Ingredion is actively driving innovation. The introduction of products like VITESSENCE Pea 100 HD in July 2024 underscores their commitment to this high-potential market.

Ingredion's commitment to sustainable ingredient solutions, anchored by its 2030 All Life plan, is a significant growth engine. This focus provides a distinct competitive edge in the market.

The company is actively pursuing ambitious environmental goals, including substantial reductions in carbon emissions and increased sourcing of renewable electricity. For instance, Ingredion reported a 12% reduction in Scope 1 and 2 greenhouse gas emissions intensity by the end of 2023 compared to their 2019 baseline, demonstrating tangible progress.

Furthermore, Ingredion is making strides in sustainably sourcing key crops, a critical aspect for its supply chain and brand reputation. This dedication to sustainability appeals strongly to environmentally conscious investors and customers, bolstering brand equity and operational efficiency.

Clean-Label & Transparency Offerings

Ingredion's focus on clean-label and transparency offerings is a significant driver of its business strategy. The company recognizes the growing consumer preference for ingredients that are simple, natural, and free from artificial additives. This trend is particularly evident in the Texture & Healthful Solutions segment, which has seen robust growth as Ingredion innovates to meet this demand.

The company's commitment to transparency is further solidified through strategic partnerships, such as those with platforms like HowGood. These collaborations allow consumers to easily access information about the ingredients used in their food, building trust and appealing to a health-conscious demographic. Ingredion's investment in these areas positions it well to capitalize on the expanding clean-label market.

Key aspects of Ingredion's clean-label and transparency strategy include:

- Innovation in plant-based and minimally processed ingredients

- Expanding product portfolios to meet clean-label demands

- Leveraging partnerships for enhanced supply chain transparency

- Responding to evolving consumer preferences for natural and recognizable ingredients

Innovation Through Ingredion Idea Labs

Ingredion Idea Labs serves as the company's engine for innovation, developing novel ingredient solutions that command higher value. These global centers focus on collaborating with customers to create ingredients that align with current market trends. For instance, their work on functional native starches and prebiotic fibers is a prime example of this strategy.

This commitment to research and development is key to Ingredion's future growth. By investing in Idea Labs, the company ensures a steady stream of high-potential products. In 2024, Ingredion reported a significant portion of its revenue derived from new product introductions, underscoring the success of this innovation model.

- Ingredion Idea Labs: Global innovation hubs driving new ingredient development.

- Customer Co-creation: Focus on developing solutions tailored to client needs.

- On-Trend Ingredients: Development of products like functional starches and prebiotic fibers.

- R&D Investment: Fueling a pipeline of high-growth potential products.

Ingredion's plant-based protein offerings are a clear Star in their portfolio. These ingredients are experiencing rapid growth, driven by strong consumer demand for alternative protein sources. Ingredion's significant market share and ongoing investment in this area solidify its position as a leader.

The company's strategic focus on plant-based proteins, supported by substantial capital allocation and product innovation like VITESSENCE Pea 100 HD launched in July 2024, highlights its commitment to this high-growth market. This segment is expected to continue its upward trajectory, aligning with broader dietary shifts.

Ingredion's plant-based protein products are well-positioned due to the sector's robust growth, projected at 7.9% annually until 2030. With a 12.6% global market share, Ingredion is a dominant player, leveraging over $200 million in investments to maintain its competitive edge.

The company's dedication to innovation within the plant-based protein space, exemplified by its Idea Labs, ensures a continuous flow of new and improved ingredients. This focus directly addresses the increasing consumer preference for sustainable and health-conscious food options.

| Product Category | BCG Status | Market Growth Rate | Ingredion Market Share | Key Investment/Innovation |

|---|---|---|---|---|

| Plant-Based Proteins | Star | 7.9% (CAGR to 2030) | 12.6% | $200M+ investment, VITESSENCE Pea 100 HD (July 2024) |

What is included in the product

The Ingredion BCG Matrix provides a strategic overview of its business units, categorizing them by market share and growth rate.

It offers insights into which units to invest in, hold, or divest to optimize Ingredion's portfolio.

Ingredion's BCG Matrix provides a clear, actionable overview of its portfolio, alleviating the pain of strategic uncertainty.

Cash Cows

Ingredion's core starches, like corn and tapioca, are classic cash cows. This segment is Ingredion's bedrock, transforming plant materials into essential starches. The market for these products is mature, meaning it's not growing rapidly, but Ingredion holds a significant share.

These starches are fundamental ingredients across numerous sectors, from food and beverages to paper and pharmaceuticals. Their consistent demand translates into reliable and predictable cash flow for Ingredion. For instance, Ingredion's starch business, a substantial part of its revenue, consistently contributes to its financial stability. In 2023, Ingredion reported net sales of $7.07 billion, with its specialty ingredients segment, which includes starches, being a key driver.

Conventional sweeteners like glucose syrups and dextrose are Ingredion's bedrock, representing a substantial revenue stream and a dominant market share in the food and beverage sector. These are staple ingredients, ensuring consistent, high-volume sales due to their widespread use.

As these products operate in mature markets, they require minimal aggressive promotional spending, translating into robust cash flow for Ingredion. For instance, in 2023, Ingredion's specialty ingredients segment, which includes many of these sweeteners, saw significant growth, contributing to the company's overall financial strength.

The Food & Industrial Ingredients segment in the US/Canada is a significant contributor, bolstered by new multi-year customer agreements. These contracts are crucial for Ingredion, allowing them to effectively pass on inflationary pressures and improve their profit margins.

While sales saw a dip in early 2024 due to lower corn prices, the segment's strong foundation remains. Ingredion’s established relationships with its customers and its efficient operations ensure this sector continues to be a reliable source of profit for the company.

Co-products and By-products

Ingredion's efficient processing of raw materials, particularly corn, yields valuable co-products such as corn gluten feed and refined corn oil. These by-products are not merely waste but contribute significantly to the company's profitability by generating revenue from existing operational streams. This strategy enhances overall operational efficiency and provides a stable, low-cost income source.

These co-products represent Ingredion's cash cows within the BCG matrix framework. They are products with high market share in slow-growing markets, requiring minimal investment to maintain their position. For instance, in 2023, Ingredion reported that its specialty ingredients, which include many of these value-added co-products, continued to show strong performance, contributing to the company's overall revenue diversification.

- Corn Gluten Feed: A high-protein ingredient used primarily in animal feed, benefiting from stable demand in the livestock sector.

- Refined Corn Oil: A versatile product used in food manufacturing and other industrial applications, capitalizing on consistent consumer and industrial needs.

- Revenue Contribution: These co-products collectively represent a significant portion of Ingredion's revenue, demonstrating their role as reliable profit generators.

Established Industrial Starches

Established Industrial Starches are Ingredion's cash cows. These segments, including paper and corrugating, are mature but provide consistent, high-volume demand. Ingredion leverages its strong market position to generate reliable cash flow with limited need for further investment.

- Sector Diversification: Ingredion's industrial starches extend beyond food, serving critical industries like paper manufacturing and packaging (corrugating).

- Stable Demand & Cash Flow: These mature applications exhibit consistent demand, enabling Ingredion to maintain market share and generate predictable cash flows.

- Low Investment Needs: Due to their established nature, these businesses require minimal growth investment, maximizing their contribution to Ingredion's overall profitability.

- Market Position: Ingredion's established presence in these industrial sectors allows for strong pricing power and operational efficiency, further solidifying their cash cow status.

Ingredion's core starches and conventional sweeteners are prime examples of cash cows within its BCG matrix. These products benefit from established market positions and consistent, high-volume demand in mature sectors like food, beverages, and paper. Their stability allows Ingredion to generate robust cash flow with minimal need for significant new investment.

The company's efficient processing also yields valuable co-products such as corn gluten feed and refined corn oil. These by-products capitalize on stable demand in animal feed and food manufacturing, respectively, contributing reliably to Ingredion's profitability. Ingredion's strong market share in these segments ensures they remain dependable profit generators.

| Product Category | Market Growth | Market Share | Cash Flow Generation | Investment Requirement |

|---|---|---|---|---|

| Core Starches (e.g., Corn, Tapioca) | Low | High | High | Low |

| Conventional Sweeteners (e.g., Glucose, Dextrose) | Low | High | High | Low |

| Co-products (e.g., Corn Gluten Feed, Refined Corn Oil) | Low | High | High | Low |

Preview = Final Product

Ingredion BCG Matrix

The Ingredion BCG Matrix preview you see is the definitive document you will receive upon purchase, offering a comprehensive strategic overview. This means the exact same professionally formatted analysis, complete with all data points and visual representations, will be yours to download and utilize immediately. There are no hidden pages or altered content; what you preview is precisely what you will acquire, ready for immediate application in your business strategy discussions and planning.

Dogs

Ingredion's commoditized basic starches in intensely competitive regions often fall into the Dogs quadrant of the BCG matrix. These are typically undifferentiated products facing saturated markets with limited growth potential and low profit margins. For example, in 2024, the global starch market, while large, sees significant price pressure on basic corn starch derivatives in regions like North America and Europe due to oversupply from multiple producers.

These products might consume valuable company resources, such as manufacturing capacity and sales efforts, without generating substantial returns. In 2023, Ingredion's specialty ingredient segment showed robust growth, highlighting the contrast with its more basic starch offerings in mature markets where innovation is slower and competition is fierce, leading to minimal market share gains.

While Ingredion's Latin America segment generally shows strength, certain areas within its Food & Industrial Ingredients division are facing headwinds. For instance, parts of the region, particularly Brazil and Mexico, have seen reduced demand in key sectors like brewing. This slowdown directly impacts sales and profitability for those specific product lines or sub-regions.

These localized challenges, such as the aforementioned decline in brewing volumes, can cause specific Food & Industrial Ingredients segments in Latin America to underperform. If these macroeconomic or demand-related issues persist, these segments could be classified as Dogs within Ingredion's portfolio. For example, in early 2024, reports indicated a softening in consumer spending in some Latin American markets, affecting demand for certain processed food ingredients.

Ingredion’s legacy products, those catering to outdated consumer preferences or facing regulatory pressure, are likely positioned as Dogs in the BCG Matrix. These might include artificial sweeteners or certain processed ingredients that don't align with the burgeoning clean-label movement. For instance, a decline in demand for high-fructose corn syrup, a staple for decades, exemplifies this trend as consumers increasingly seek natural alternatives.

Products like traditional starches used in less health-conscious applications could also fall into this category. While specific financial data for Ingredion's individual product lines isn't publicly disclosed, the broader industry trend shows a significant shift away from artificial ingredients. In 2024, reports indicate a continued surge in demand for plant-based and minimally processed ingredients, directly impacting the market share of older, less relevant offerings.

Non-strategic Divested Businesses

Ingredion's recent sale of its South Korea operations in the first quarter of 2024 exemplifies the strategic divestiture of non-core assets. This move suggests that these businesses, while previously part of Ingredion's structure, are now viewed as having a limited strategic alignment with the company's primary objectives.

Such divested entities often exhibit characteristics of lower growth potential or a less dominant market position when compared to Ingredion's core competencies in specialty ingredients and plant-based proteins. The company's focus is clearly on optimizing its portfolio for higher value and strategic advantage.

- South Korea Divestiture: Ingredion completed the sale of its South Korea business in Q1 2024.

- Non-Strategic Focus: This action highlights Ingredion's strategy of shedding non-core assets.

- Portfolio Optimization: The divestment aims to sharpen focus on businesses with stronger strategic fit and growth prospects.

Products Affected by Supply Chain Disruptions Without Strategic Importance

Products facing significant supply chain issues, like those stemming from plant fires that reduce output, and which aren't core to future growth, might be reclassified as Dogs in the BCG Matrix. This is because their diminished volume and profitability make them less attractive. For instance, if Ingredion’s specialty starch line, which represents a smaller portion of their revenue and isn't a primary focus for innovation, experiences prolonged production halts due to a fire, its strategic importance wanes.

Such products, when struggling with operational challenges and lacking strategic alignment, can become cash drains rather than contributors. Ingredion’s 2024 performance, for example, might show that while overall revenue grew, certain niche product categories were heavily impacted by these disruptions, leading to a decline in their relative market share and profitability, fitting the Dog profile.

- Reduced Profitability: Supply chain disruptions increase costs and decrease sales volume, directly impacting profit margins for non-strategic products.

- Low Growth Potential: Products not identified as strategic growth drivers are unlikely to recover quickly from production setbacks.

- Resource Diversion: Continued investment in struggling, non-strategic product lines can divert resources from more promising areas of the business.

Ingredion's commoditized basic starches in intensely competitive regions often fall into the Dogs quadrant of the BCG matrix. These are typically undifferentiated products facing saturated markets with limited growth potential and low profit margins. For example, in 2024, the global starch market, while large, sees significant price pressure on basic corn starch derivatives in regions like North America and Europe due to oversupply from multiple producers.

These products might consume valuable company resources, such as manufacturing capacity and sales efforts, without generating substantial returns. In 2023, Ingredion's specialty ingredient segment showed robust growth, highlighting the contrast with its more basic starch offerings in mature markets where innovation is slower and competition is fierce, leading to minimal market share gains.

Ingredion’s legacy products, those catering to outdated consumer preferences or facing regulatory pressure, are likely positioned as Dogs in the BCG Matrix. These might include artificial sweeteners or certain processed ingredients that don't align with the burgeoning clean-label movement. For instance, a decline in demand for high-fructose corn syrup, a staple for decades, exemplifies this trend as consumers increasingly seek natural alternatives.

Ingredion's recent sale of its South Korea operations in the first quarter of 2024 exemplifies the strategic divestiture of non-core assets. This move suggests that these businesses, while previously part of Ingredion's structure, are now viewed as having a limited strategic alignment with the company's primary objectives.

Question Marks

Ingredion's investment in novel fermentation-derived ingredients positions them in a potentially high-growth segment of the food industry. These innovative products, leveraging advanced biotechnology, cater to the increasing consumer demand for sustainable and novel food solutions.

As these fermentation technologies are still in their nascent stages, Ingredion faces a dynamic market where establishing significant market share requires substantial research and development. The company's commitment to innovation in this area is crucial for capitalizing on future market opportunities.

Ingredion's involvement with the Colombian government on Bienestarina Más Nuestra highlights a strategic move into niche nutritional supplements within developing markets. This collaboration, focused on a vital product for children's health, indicates a recognition of high-growth potential in these specialized segments.

While these initiatives are in their nascent stages, with current market share being minimal, they represent a significant long-term growth opportunity. Success in these early ventures could pave the way for substantial expansion, leveraging Ingredion's expertise in ingredient solutions for health-focused products.

Ingredion's commitment to emerging technologies in sustainable sourcing and production is evident in its investments in areas like advanced regenerative agriculture. For instance, companies exploring precision agriculture, which leverages AI and IoT for optimized resource use, saw a market value of approximately $10.2 billion in 2023, projected to reach $32.4 billion by 2030. These high-growth areas, while not yet major revenue drivers for Ingredion, are crucial for building future competitive advantages, necessitating significant upfront capital.

Advanced Texture Systems for New Food Formulations

Ingredion's advanced texture systems are crucial for developing novel food formulations, particularly in emerging categories like hybrid meat/dairy products. This area is experiencing significant growth, driven by consumer demand for innovative and plant-based alternatives. The company's investment in this segment aims to capture a share of this expanding market.

While Ingredion is actively innovating in specialized texture solutions, market penetration and customer adoption are still in early stages. This necessitates continued strategic investment and development to solidify its position. The global market for plant-based foods, a key driver for these texture systems, was projected to reach over $74 billion by 2030, highlighting the substantial opportunity.

- High-Growth Market: Developing specialized texture systems for hybrid and complex food formulations is a significant growth opportunity.

- Ingredion's Innovation: The company is actively developing solutions for these advanced texture needs.

- Nascent Adoption: Market share and widespread adoption of these new texture systems are still developing.

- Strategic Investment: Focused investment is required to drive market penetration and capture share in this evolving space.

Specific Geographic Expansions with Untapped Potential

Ingredion's strategic focus on specific geographic expansions with untapped potential aligns with the 'Question Marks' quadrant of the BCG matrix. This involves targeting new markets or underpenetrated segments within existing regions where the company has a limited footprint but anticipates significant future growth. These ventures necessitate considerable initial investment to establish market presence and capture share.

For instance, Ingredion's expansion into Southeast Asia, particularly in countries like Vietnam and Indonesia, presents such an opportunity. These markets exhibit rising consumer demand for processed foods and beverages, driven by a growing middle class and increasing urbanization. Ingredion's investment in local production and distribution networks in these areas is a prime example of this strategy.

In 2024, the demand for specialty ingredients in emerging economies, including those in Asia-Pacific, is projected to grow at a compound annual growth rate (CAGR) of over 6%. Ingredion's commitment to these regions, evidenced by its ongoing capital expenditures, aims to capitalize on this trend.

- Targeted Market Entry: Expansion into regions like Sub-Saharan Africa, where Ingredion's presence is currently minimal but the food processing sector is showing early signs of growth.

- High Growth Potential: Focus on markets with increasing disposable incomes and a rising preference for value-added food ingredients, such as plant-based proteins and clean-label starches.

- Substantial Investment Required: Commitment of capital for building new facilities, establishing robust supply chains, and developing local sales and marketing teams to penetrate these nascent markets.

- Strategic Partnerships: Exploring joint ventures or acquisitions to accelerate market entry and gain local expertise in these high-potential, yet underdeveloped, geographic areas.

Ingredion's strategic initiatives in emerging markets, such as its expansion into Sub-Saharan Africa, represent classic Question Mark plays. These regions offer substantial long-term growth prospects due to increasing disposable incomes and a growing demand for processed foods.

The company is investing in building local infrastructure and partnerships to establish a foothold in these nascent, high-potential markets. This requires significant capital outlay with uncertain, but potentially high, future returns.

For example, the food ingredients market in Africa is projected to grow significantly, with specific segments like sweeteners and starches expected to see robust expansion in the coming years. Ingredion's targeted approach aims to capture a share of this burgeoning demand.

| Market Segment | Projected Growth (CAGR 2024-2029) | Ingredion's Focus |

|---|---|---|

| African Food Ingredients | ~5-7% | Plant-based proteins, clean-label starches, sweeteners |

| Sub-Saharan Africa Processed Foods | ~8-10% | Building local supply chains, distribution networks |

| Sweeteners in Emerging Markets | ~6-8% | Expanding sweetener portfolios for local tastes |

BCG Matrix Data Sources

Our Ingredion BCG Matrix is built on a robust foundation of internal financial data, proprietary market research, and extensive industry analysis to provide strategic clarity.