Ingles Markets SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ingles Markets Bundle

Ingles Markets boasts strong regional brand loyalty and a focus on fresh, quality products, giving them a solid foundation. However, understanding the competitive pressures and evolving consumer habits is crucial for sustained success.

Want the full story behind Ingles Markets' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Ingles Markets boasts a robust integrated business model, a significant strength that sets it apart. This model extends beyond just groceries, incorporating ownership and operation of shopping centers and gas stations, creating multiple revenue streams and customer touchpoints.

A key component of this integration is its own fluid dairy facility. This allows Ingles to process and supply a substantial portion of its milk products, ensuring quality control and cost efficiency. In fiscal year 2023, the company reported approximately $5.6 billion in total sales, with its dairy operations contributing to this success by also selling to external retailers, thereby generating additional income.

Ingles Markets benefits significantly from its substantial real estate ownership, a key competitive advantage. A large portion of its supermarkets and associated shopping centers are situated on land and properties that Ingles owns outright.

This extensive real estate portfolio not only provides a stable source of rental income from any leased spaces but also helps in keeping operational costs lower compared to rivals who rely heavily on leasing agreements. As of the first quarter of 2024, Ingles Markets reported owning a significant majority of its store locations, contributing to its financial stability.

Ingles Markets boasts a robust regional footprint, primarily serving six Southeastern states. This strategic focus has allowed them to cultivate a strong market share, particularly in smaller towns and suburban communities where national competitors are less prevalent.

This deep regional penetration fosters significant customer loyalty. Ingles' commitment to community engagement, personalized customer service, and catering to local tastes has built a dedicated shopper base, a key asset in the competitive grocery landscape.

Consistent Dividend Payouts

Ingles Markets has a strong history of providing consistent quarterly cash dividends to its shareholders, a testament to its financial stability. This commitment to regular payouts, a practice not universally common in the grocery industry, positions Ingles as an attractive option for investors seeking reliable income streams. For instance, as of early 2024, Ingles Markets continued its pattern of quarterly dividend payments, demonstrating this ongoing shareholder reward strategy.

The company's ability to maintain these payouts reflects a healthy operational performance and a management focus on shareholder returns. This consistency can be a significant draw for income-oriented investors who prioritize predictability in their investment portfolios.

- Financial Stability: Consistent dividend payments signal underlying financial health.

- Shareholder Reward: Demonstrates a commitment to returning value to investors.

- Investor Attraction: Appeals to income-focused investors seeking reliability.

- Industry Rarity: A less common practice in the grocery sector, highlighting a potential competitive advantage.

Strategic Capital Investments in Modernization

Ingles Markets demonstrates a key strength through its ongoing commitment to strategic capital investments in modernizing its operations. Despite economic headwinds, the company is allocating substantial funds towards store upgrades, new locations, and significant renovations. For fiscal year 2024, Ingles Markets announced capital expenditures expected to be in the range of $150 million to $170 million, a clear indicator of their focus on enhancing the physical store base and customer experience.

These investments are designed to ensure Ingles Markets maintains a competitive edge by offering a modern shopping environment and incorporating new technologies. The company's strategic approach prioritizes long-term growth, aiming to improve customer satisfaction and operational efficiency through these capital outlays.

- Store Modernization: Ongoing upgrades to existing store formats.

- New Store Development: Expansion into new markets and replacement of older units.

- Technology Enhancements: Investment in systems to improve customer service and back-end operations.

- Capital Expenditure Focus: Significant planned spending, with FY2024 projections between $150M-$170M.

Ingles Markets' integrated business model is a significant strength, encompassing grocery sales alongside owned shopping centers and gas stations, creating diverse revenue streams. Its own dairy facility further enhances this by ensuring quality control and cost efficiency, with dairy operations also contributing to external sales, as evidenced by fiscal year 2023 total sales of approximately $5.6 billion.

The company's substantial real estate ownership, with a majority of stores on owned land as of Q1 2024, lowers operating costs and provides stable rental income, a key advantage over competitors reliant on leases.

Ingles Markets demonstrates strong financial stability through consistent quarterly cash dividends, a practice that appeals to income-focused investors and highlights the company's commitment to shareholder returns.

Strategic capital investments, with projected FY2024 expenditures between $150 million and $170 million, underscore a commitment to modernizing operations, enhancing the customer experience through store upgrades, new locations, and technology integration.

What is included in the product

Delivers a strategic overview of Ingles Markets’s internal and external business factors, highlighting its strong regional presence and private label success against competitive pressures and evolving consumer preferences.

Provides a clear, actionable roadmap by identifying key strengths to leverage and weaknesses to address, simplifying complex strategic challenges for Ingles Markets.

Weaknesses

Ingles Markets' significant concentration of stores in the Southeastern US, with a strong presence around its North Carolina base, leaves it particularly exposed to regional natural disasters. This geographical focus means that severe weather events can have a disproportionate impact on the company's overall performance.

The impact of Hurricane Helene in late 2024 serves as a stark example. The storm directly affected sales, resulted in substantial losses to both property and inventory, and necessitated temporary store closures, underscoring the financial risks associated with this geographical concentration.

Ingles Markets faced a downturn in fiscal year 2024 and the first half of fiscal 2025. Net sales saw a decrease, and gross profit and net income also declined when compared to earlier periods.

This financial performance dip was significantly influenced by the impact of Hurricane Helene, which disrupted operations and sales. Additionally, broader economic headwinds contributed to the challenging financial environment for the company.

Ingles Markets operates in a fiercely competitive grocery retail environment. Major national players like Walmart and Kroger, alongside strong regional grocers and expanding discount chains, constantly vie for consumer spending. This intense pressure necessitates continuous investment in pricing, product assortment, and customer experience to simply hold ground.

Limited Geographic Diversification

Ingles Markets' concentrated presence in six Southeastern states, while fostering regional strength, inherently limits its geographic diversification. This focus makes the company particularly vulnerable to economic slowdowns or competitive pressures specific to these particular markets. For instance, a significant downturn in the housing market or a surge in new competitors within these six states could disproportionately impact Ingles' overall financial performance compared to a retailer with a broader national footprint.

This limited geographic reach means that Ingles Markets is more exposed to regional economic fluctuations. If the economic conditions in the Southeast, where Ingles primarily operates, experience a downturn, the company's sales and profitability could be significantly affected. This contrasts with larger, more geographically dispersed competitors who can often offset weaker performance in one region with stronger performance in others.

- Geographic Concentration: Operates primarily in six Southeastern states, increasing susceptibility to regional economic downturns.

- Market Saturation Risk: High concentration in specific areas can lead to greater exposure to intense local competition and market saturation.

- Vulnerability to Regional Factors: Susceptible to localized issues like natural disasters or changes in state-specific regulations that might not affect a nationally diversified competitor.

Operational Challenges from External Factors

Ingles Markets, like many retailers, grapples with persistent operational hurdles stemming from external economic pressures. Inflationary trends, for instance, have a direct impact on the cost of goods sold and can erode profit margins if not effectively passed on to consumers. This is particularly challenging in the grocery sector where price sensitivity is high.

Furthermore, the company must navigate rising labor costs. As of early 2024, the U.S. saw continued upward pressure on wages across various sectors, including retail and grocery. These increased labor expenses can significantly affect a company's bottom line, especially for businesses with a large frontline workforce.

Supply chain disruptions, though perhaps less acute than during the peak pandemic years, remain a concern throughout 2024 and into 2025. These disruptions can lead to stockouts of key products, impacting sales and customer satisfaction. Ingles Markets' ability to manage these external factors is crucial for maintaining its operational efficiency and financial health.

- Inflationary Pressures: Rising costs for goods and services directly impact Ingles Markets' cost of sales and can necessitate price adjustments.

- Increased Labor Costs: Wage inflation in the retail sector adds to operating expenses, affecting profitability.

- Supply Chain Volatility: Ongoing disruptions can lead to product availability issues, potentially reducing sales and customer loyalty.

Ingles Markets' limited geographic footprint, primarily concentrated in six Southeastern states, presents a significant weakness. This focus makes the company highly susceptible to regional economic downturns or localized competitive pressures, unlike more diversified national retailers. A slowdown in the Southeast, for example, would directly and disproportionately impact Ingles' overall financial performance.

Preview Before You Purchase

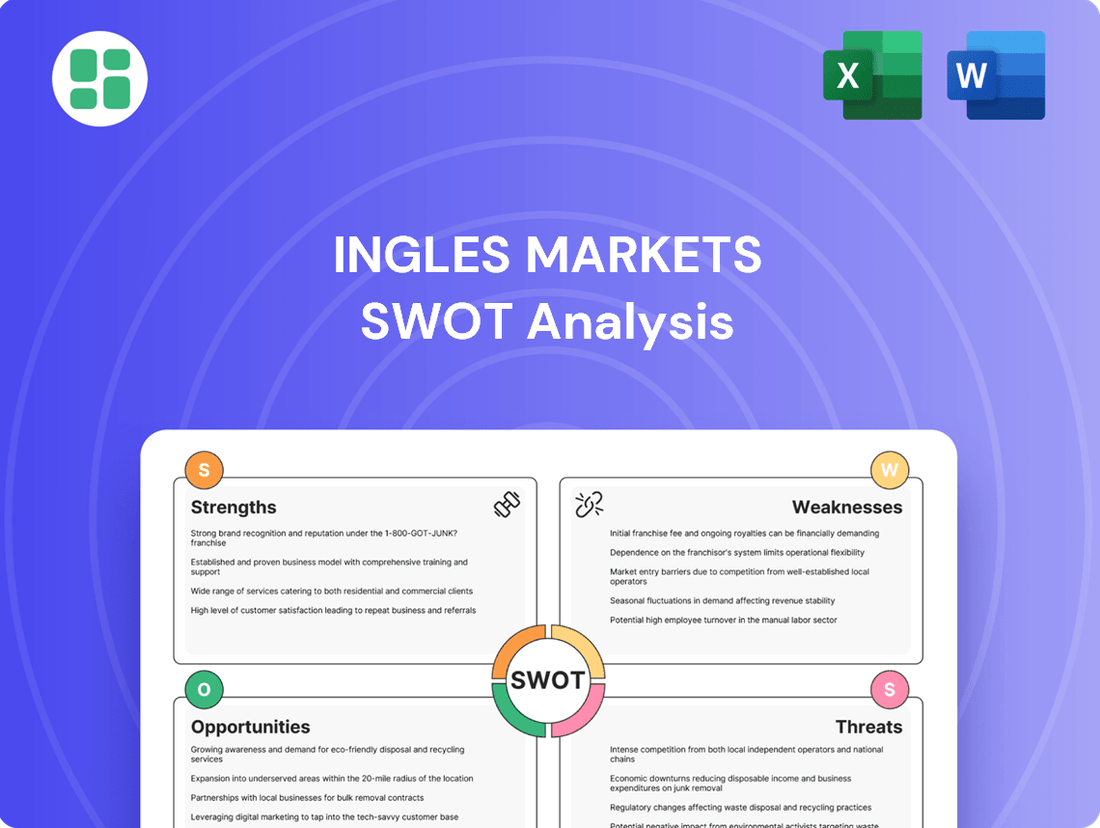

Ingles Markets SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a clear overview of Ingles Markets' Strengths, Weaknesses, Opportunities, and Threats, providing a solid foundation for strategic planning.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain comprehensive insights into Ingles Markets' competitive landscape and internal capabilities.

Opportunities

Ingles Markets is actively pursuing expansion and modernization, with substantial capital investments slated for fiscal year 2025. These efforts include building new stores and undertaking major remodels of existing locations.

These strategic initiatives are designed to elevate the customer experience by offering more convenient layouts and updated amenities, thereby attracting a broader customer base.

For fiscal year 2024, Ingles Markets projected capital expenditures of approximately $200 million, with a significant portion allocated to new store development and store remodels, signaling a strong commitment to growth and improvement.

Ingles Markets can capitalize on the growing consumer shift towards online shopping and convenient options like curbside pickup. This trend presents a substantial opportunity to expand their digital footprint and reach a wider customer base.

The company already has a foundation with online ordering and curbside pickup available at numerous locations. Further investment in enhancing these digital platforms and the underlying technology can directly translate into increased sales and customer engagement.

Ingles Markets is well-positioned to capitalize on the surging consumer interest in health, wellness, and locally-sourced goods. The company's existing emphasis on fresh produce and its established relationships with regional producers provide a solid foundation for expanding these popular categories. This alignment with current market preferences, which saw the U.S. organic food market reach an estimated $60 billion in 2023, presents a significant opportunity for Ingles to attract health-conscious shoppers and boost overall sales.

Development of Prepared Food Market

The prepared food market is booming, presenting a significant opportunity for Ingles Markets to expand its offerings. By investing further in this area, Ingles can capitalize on the growing consumer demand for convenient, ready-to-eat meals that mimic home-cooked quality. This strategic move aligns with evolving customer lifestyles and preferences for quick meal solutions.

Ingles Markets can leverage this trend by:

- Expanding its selection of home-style prepared meals, focusing on variety and quality ingredients.

- Increasing the variety of grab-and-go options, catering to busy shoppers seeking immediate meal solutions.

- Highlighting the convenience factor in marketing efforts to attract customers prioritizing time-saving options.

The U.S. prepared foods market was valued at approximately $150 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 5% through 2028, indicating strong consumer adoption of these convenient options.

Strategic Real Estate Development

Ingles Markets possesses a significant opportunity to leverage its extensive real estate portfolio beyond traditional grocery store footprints. This involves the strategic redevelopment of existing, perhaps underutilized, store locations into multi-tenant spaces or entirely new retail centers. Such initiatives can unlock substantial rental income, creating a diversified revenue stream that complements its core grocery business.

Consider the potential for Ingles to capitalize on the growing demand for mixed-use developments in its operating regions. By transforming older or larger store sites, Ingles could create vibrant community hubs, attracting diverse tenants and increasing property values. For instance, a site that previously housed a single large grocery store could be reconfigured to accommodate several smaller retail shops, restaurants, and even professional services, thereby maximizing the economic return from each square foot of owned land.

- Real Estate Diversification: Ingles can convert older store spaces into additional tenant areas, increasing rental income.

- New Development Potential: Opportunities exist to develop new shopping centers on existing land holdings, creating new revenue streams.

- Maximizing Asset Value: Strategic development can unlock the full economic potential of Ingles' substantial real estate assets.

- Revenue Stream Enhancement: Diversifying beyond grocery sales through retail leasing can improve overall financial resilience.

Ingles Markets can significantly expand its digital and omnichannel capabilities, tapping into the growing online grocery market. With online ordering and curbside pickup already in place, further investment in these platforms can drive sales and customer loyalty.

The company is also positioned to benefit from the increasing consumer focus on health, wellness, and local sourcing. By expanding its offerings in these popular categories, Ingles can attract a broader, health-conscious customer base, aligning with the U.S. organic food market's estimated $60 billion valuation in 2023.

Furthermore, Ingles has a prime opportunity to grow its prepared foods segment, a market valued at approximately $150 billion in 2023. Enhancing its selection of convenient, high-quality ready-to-eat meals caters directly to evolving consumer lifestyles and demand for quick meal solutions.

Ingles Markets can also leverage its extensive real estate holdings for diversification. Redeveloping underutilized store locations into multi-tenant spaces or new retail centers can generate substantial rental income, creating a valuable secondary revenue stream.

Threats

The grocery sector is a battlefield, with new players constantly emerging and existing ones merging, which directly impacts Ingles Markets' slice of the pie. This intense rivalry, fueled by national giants, strong regional competitors, and aggressive discount grocers, demands that Ingles Markets consistently innovate and maintain competitive pricing to hold its ground.

Economic downturns and persistent inflation pose significant threats to Ingles Markets. Rising costs for essential goods like food and fuel, coupled with increasing labor expenses, directly impact the company's operating margins. For instance, during the first quarter of 2024, Ingles reported that inflationary pressures on wages and product costs contributed to a slight compression in gross profit margins, even as sales increased.

Furthermore, economic instability can lead consumers to trade down, opting for less expensive alternatives or reducing overall spending on discretionary items. This shift in consumer behavior directly affects Ingles' sales volume and product mix, potentially hindering revenue growth if the company cannot effectively manage price increases or offer compelling value propositions to its customer base.

Ingles Markets faces significant risks from supply chain disruptions, a vulnerability amplified by global events. For instance, the lingering effects of the COVID-19 pandemic and ongoing geopolitical tensions have demonstrated how quickly shipping backlogs and material shortages can emerge, impacting product availability and leading to higher operational costs for retailers. These disruptions can directly affect Ingles' ability to stock shelves, potentially leading to lost sales and customer dissatisfaction.

The company's reliance on a steady flow of goods means that events such as natural disasters, like hurricanes impacting key agricultural regions, or trade disputes can create significant challenges. For example, in 2024, several major ports experienced delays, increasing transit times for imported goods and driving up freight expenses. Ingles, like its peers, must navigate these unpredictable events, which can directly impact product pricing and the overall efficiency of its distribution network.

Changing Consumer Preferences and Technology Adoption

Ingles Markets faces the significant threat of evolving consumer preferences, particularly the growing demand for online shopping and integrated digital experiences. Failure to adapt quickly to these shifts could alienate customers accustomed to more convenient, tech-forward platforms. For instance, while online grocery sales in the U.S. reached an estimated $100 billion in 2023, a substantial portion of this growth is driven by younger demographics who expect seamless digital integration from all retailers.

The rapid pace of technological advancement presents another challenge. If Ingles Markets doesn't invest in and effectively implement new technologies, such as AI-powered inventory management or personalized digital marketing, it risks falling behind competitors who offer more sophisticated customer interactions. This lag could directly translate to a loss of market share, as consumers gravitate towards retailers that provide a more modern and efficient shopping journey.

- Shifting Demographics: Younger consumers, who are digital natives, increasingly prefer online grocery shopping, a trend that accelerated significantly post-2020.

- Digital Experience Expectations: Consumers expect personalized offers, easy navigation, and efficient checkout processes, whether in-store or online.

- Competitor Innovation: Retailers investing heavily in e-commerce infrastructure and digital customer engagement are gaining a competitive edge.

Regulatory Compliance and Increased Operating Costs

Ingles Markets faces significant threats from evolving regulatory landscapes. Compliance with food safety, labor, and environmental standards at federal, state, and local levels can necessitate substantial capital investments and alter operational procedures. For instance, updated food safety regulations implemented in 2024 and 2025 could require new equipment or enhanced training, directly impacting expenditures.

Furthermore, rising operating costs present a persistent challenge. Increases in utility prices, wages, and the cost of essential goods and services directly squeeze profit margins. For example, the projected rise in energy costs for 2025, estimated to be between 3-5% nationally, will likely affect Ingles' bottom line.

- Increased Capital Expenditures: Anticipated investments in technology and infrastructure to meet new food safety and environmental mandates.

- Rising Utility Costs: Potential for higher electricity and fuel expenses impacting store operations and supply chain logistics.

- Labor Cost Pressures: Continued upward pressure on wages and benefits, particularly in a competitive retail environment.

- Supply Chain Volatility: Fluctuations in the cost of goods, influenced by transportation and raw material expenses.

Intense competition from national, regional, and discount grocers poses a significant threat, forcing Ingles Markets to constantly innovate and maintain competitive pricing to retain market share.

Economic instability, including persistent inflation and potential downturns, directly impacts Ingles' operating margins and consumer spending habits. For example, in Q1 2024, Ingles noted that inflationary pressures on wages and product costs slightly compressed gross profit margins despite sales growth.

Supply chain disruptions, exacerbated by global events and geopolitical tensions, can lead to product shortages and increased operational costs, affecting product availability and customer satisfaction. For instance, port delays in 2024 increased transit times and freight expenses for imported goods.

Evolving consumer preferences, particularly the shift towards online grocery shopping and seamless digital experiences, present a challenge for retailers not adequately investing in e-commerce. U.S. online grocery sales were estimated at $100 billion in 2023, a market segment where digital natives increasingly dominate.

| Threat Category | Specific Risk | Impact on Ingles Markets | Data/Example |

|---|---|---|---|

| Competition | Aggressive pricing and expansion by rivals | Loss of market share, pressure on margins | Intense rivalry from national and discount grocers |

| Economic Factors | Inflation and potential recession | Reduced consumer spending, higher operating costs | Q1 2024: Inflationary pressures on wages/costs compressed margins |

| Supply Chain | Disruptions and increased logistics costs | Product availability issues, higher operational expenses | 2024 port delays increased transit times and freight costs |

| Consumer Behavior | Shift to online and digital engagement | Risk of losing digitally-savvy customers | 2023: U.S. online grocery sales reached $100 billion |

SWOT Analysis Data Sources

This Ingles Markets SWOT analysis is built upon a foundation of robust data, drawing from the company's official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded and accurate strategic overview.