Ingles Markets Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ingles Markets Bundle

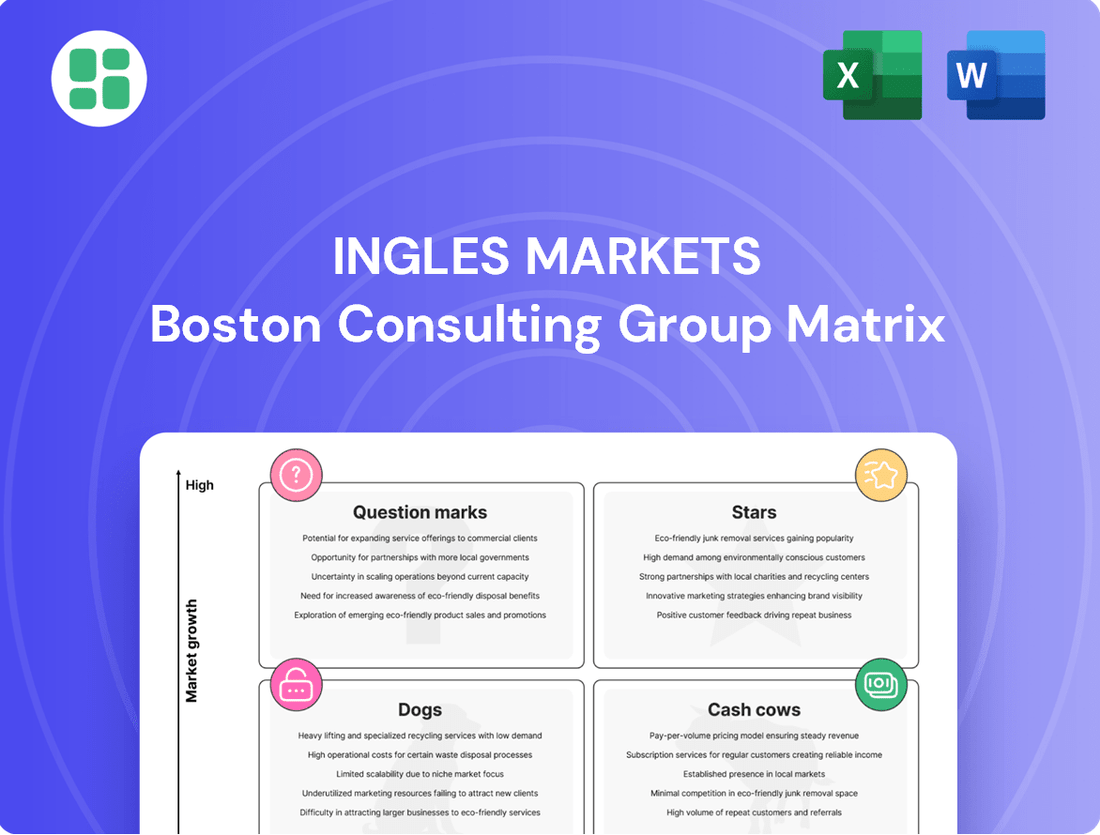

Ingles Markets' BCG Matrix highlights a dynamic portfolio, with some divisions generating steady profits while others require careful consideration for future growth. Understanding which of their offerings are Stars, Cash Cows, Dogs, or Question Marks is crucial for strategic resource allocation.

This preview offers a glimpse into Ingles Markets' strategic positioning. Purchase the full BCG Matrix report to unlock detailed quadrant placements, data-driven insights into market share and growth potential, and actionable recommendations for maximizing profitability and navigating competitive pressures.

Stars

Ingles Markets actively pursues store modernization and strategic relocations as a core part of its growth strategy. This involves significant investment in renovating existing stores to offer enhanced customer experiences and expanding into new, promising markets through relocations. For instance, in fiscal year 2023, Ingles reported capital expenditures of $215.8 million, a substantial portion of which was dedicated to store development and improvements.

Ingles Markets is actively participating in the growing e-commerce trend by offering curbside pickup services. This move directly addresses the rising consumer preference for convenient shopping solutions, especially in the grocery sector.

This digital service is positioned within a high-growth area of the retail grocery landscape. While exact market share data for Ingles' online services isn't publicly available, strengthening these digital offerings is crucial for increasing their presence in the expanding online grocery market. For example, the U.S. online grocery market was projected to reach over $200 billion in 2024, highlighting the significant opportunity.

Ingles Markets' premium private label brands, like Laura Lynn, are positioned as Stars in the BCG Matrix. These exclusive products are seeing significant market growth and are capturing market share from national competitors. For instance, private label sales in the U.S. grocery sector reached an estimated $200 billion in 2023, a trend Ingles is actively leveraging.

Prepared Foods and Meal Solutions

Ingles Markets' prepared foods and meal solutions, encompassing items like home-cooked meal options and bakery goods, tap into a rapidly expanding market. This segment is a key area for Ingles, aligning with consumer demand for convenience. In 2024, the U.S. prepared foods market was valued at approximately $178.5 billion, indicating substantial growth potential.

Focusing on and expanding these offerings could significantly boost Ingles' net sales. By catering to the preference for ready-to-eat meals, the company can capture a larger share of this lucrative market. For instance, Ingles has been noted for its in-store bakery and deli sections, which are central to its prepared foods strategy.

- Market Growth: The prepared foods sector continues to show robust expansion.

- Consumer Demand: Ingles' offerings meet the growing need for convenient meal solutions.

- Sales Potential: Further investment in this area can drive substantial net sales growth.

- Competitive Advantage: Strong in-store bakery and deli operations provide a solid foundation.

Expansion into High-Growth Regional Pockets

Ingles Markets is strategically investing in high-growth regional pockets, focusing on the southeastern United States. These capital expenditures are aimed at identifying and penetrating suburban and exurban areas experiencing rapid population and economic expansion.

By successfully entering these burgeoning markets, Ingles can secure a strong market share, transforming these areas into potential Stars within its BCG Matrix. For instance, in 2024, Ingles continued its expansion efforts, with capital expenditures of $210 million, a significant portion of which is allocated to new store development and remodels in these key growth regions.

The company's success in these areas hinges on its ability to quickly establish a solid presence and cater to the evolving consumer needs of these expanding communities. This strategic focus on high-growth pockets allows Ingles to capitalize on market opportunities and drive future revenue growth.

- Targeted Expansion: Ingles' capital investment strategy prioritizes new store openings and remodels in rapidly growing suburban and exurban areas within its operating footprint.

- Market Penetration: The company aims to achieve a significant market share quickly in these identified high-growth regions.

- 2024 Capital Expenditures: Ingles Markets allocated $210 million in capital expenditures in 2024, with a substantial portion dedicated to new store development in growth markets.

- Strategic Advantage: Successful penetration of these pockets offers the potential to develop new Stars within the BCG Matrix, driving long-term value.

Ingles Markets' premium private label brands, such as Laura Lynn, are prime examples of Stars in the BCG Matrix. These brands are experiencing high market growth and are successfully gaining share against national brands. The U.S. private label grocery market reached an estimated $200 billion in 2023, demonstrating the significant opportunity Ingles is capitalizing on with these offerings.

These private label products are in a high-growth category and are performing exceptionally well for Ingles. Their success indicates strong consumer acceptance and a growing demand for these exclusive items, positioning them as key revenue drivers for the company.

The company's investment in and promotion of these brands are crucial for maintaining their Star status. By continuing to innovate and highlight their private label selection, Ingles can further solidify its market position and drive continued sales growth in this expanding segment.

What is included in the product

Ingles Markets BCG Matrix offers tailored analysis of its product portfolio, highlighting which units to invest in, hold, or divest.

The Ingles Markets BCG Matrix provides a clear, one-page overview, relieving the pain of deciphering complex business unit performance.

Cash Cows

Ingles Markets' established supermarket operations, numbering around 197-198 locations across six southeastern states, are undeniably its core cash cow. These mature stores benefit from strong regional market share and deep customer loyalty, ensuring a consistent and substantial revenue stream.

While some sales figures might show minor fluctuations, these well-entrenched supermarkets remain the primary financial engine driving the company's overall performance. For instance, in the fiscal year ending September 28, 2024, Ingles Markets reported total sales of $6.2 billion, with the vast majority stemming from these established grocery operations.

Milkco, Ingles Markets' fluid dairy processing facility, operates as a classic Cash Cow. This vertical integration allows Ingles to manage its dairy supply chain, serving both its own stores and external clients.

This control over production and distribution translates into cost efficiencies and a consistent, high-volume output of dairy products. The facility generates substantial and reliable cash flow, a hallmark of a Cash Cow, without needing major investments for market expansion. In 2024, Ingles Markets reported that its dairy operations, including Milkco, contributed significantly to its overall profitability, demonstrating the stable income stream this segment provides.

Ingles Markets' neighborhood shopping center holdings, anchored by their own supermarkets, function as classic Cash Cows. These properties generate reliable rental income from diverse tenants, creating a predictable and stable cash flow for the company.

As of the first quarter of 2024, Ingles reported that its real estate segment, which includes these shopping centers, contributed significantly to its overall financial health. This segment consistently provides a low-growth, yet highly dependable, income stream, underscoring their Cash Cow status.

In-store Fuel Centers

Ingles Markets' in-store fuel centers are a prime example of a Cash Cow within the BCG Matrix. Operating 108 fuel stations adjacent to its supermarkets, Ingles leverages these locations for high-volume, consistent cash flow. While gasoline often carries lower margins, the sheer volume of sales, coupled with convenience items, creates a stable revenue stream. These fuel centers are crucial traffic drivers, drawing customers into the main grocery stores, thereby boosting overall sales.

The strategic placement of these fuel centers alongside grocery operations creates a synergistic effect. Customers can conveniently refuel and shop for groceries in one stop, enhancing customer loyalty and basket size. This model capitalizes on the steady demand for fuel, a necessity for many consumers, ensuring a predictable income. For instance, in fiscal year 2023, Ingles Markets reported total revenue of $6.4 billion, with fuel sales contributing significantly to this figure, underscoring their role as a reliable income generator.

- High Volume, Lower Margin: Fuel centers generate substantial sales volume despite typically lower profit margins per gallon.

- Traffic Driver: These stations act as a key attraction, drawing customers to the primary grocery stores.

- Consistent Cash Flow: The stable demand for fuel provides a predictable and reliable income stream.

- Synergistic Operations: Combining fuel sales with grocery shopping enhances customer convenience and loyalty.

Mature Pharmacy Services

Ingles Markets' approximately 115 in-store pharmacies are firmly positioned as Cash Cows within its business portfolio. These pharmacies offer vital healthcare services, fostering customer loyalty and driving consistent foot traffic to its stores.

This mature segment consistently generates significant revenue and cash flow. While growth prospects are modest, their high market penetration within their operating regions ensures a reliable income stream.

- Stable Revenue Generation: The pharmacy segment is a consistent contributor to Ingles Markets' overall financial health.

- Customer Loyalty Driver: Essential healthcare services offered by the pharmacies enhance customer retention and encourage repeat business.

- Mature Market Position: High penetration in service areas indicates a stable, albeit not rapidly expanding, market share.

- Consistent Cash Flow: The mature nature of these operations translates into predictable and reliable cash flow for the company.

Ingles Markets' established supermarket operations are its primary Cash Cows, consistently generating substantial revenue. With around 197-198 locations, these mature stores benefit from strong regional market share and customer loyalty, ensuring a reliable financial engine. In fiscal year 2024, total sales reached $6.2 billion, with the majority coming from these core grocery businesses.

| Business Segment | BCG Matrix Category | Key Characteristics | 2024 Data/Impact |

|---|---|---|---|

| Supermarket Operations | Cash Cow | Mature, high market share, strong customer loyalty | Generated the vast majority of $6.2 billion in total sales |

| Milkco (Dairy Operations) | Cash Cow | Vertical integration, cost efficiencies, high-volume output | Contributed significantly to overall profitability |

| Shopping Centers | Cash Cow | Anchored by supermarkets, reliable rental income | Real estate segment contributed significantly to financial health |

| In-Store Fuel Centers | Cash Cow | High volume, traffic driver, synergistic with grocery | Contributed significantly to $6.4 billion revenue in FY2023 |

| In-Store Pharmacies | Cash Cow | Vital services, customer loyalty, consistent foot traffic | Consistent revenue and cash flow generation |

What You’re Viewing Is Included

Ingles Markets BCG Matrix

The Ingles Markets BCG Matrix preview you are seeing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or demo content, just the complete, analysis-ready report designed for strategic decision-making.

Rest assured, the Ingles Markets BCG Matrix file you are currently viewing is the exact same comprehensive report that will be delivered to you upon completion of your purchase. It's professionally designed and ready for immediate application in your business strategy.

Dogs

Several Ingles Markets locations experienced significant damage from Hurricane Helene in late 2024. This natural disaster resulted in temporary store closures and substantial costs for repairs and cleanup.

As of early 2025, some of these affected stores were still not operational, representing a drain on resources without contributing to revenue. These locations can be categorized as cash traps, fitting the profile of 'Dogs' in the BCG Matrix until they can resume normal business operations.

Ingles Markets' underperforming or outdated store locations can be categorized as Dogs in the BCG Matrix. These are stores that typically show low sales growth and possess a small market share within their respective areas. For instance, stores that haven't seen significant investment in renovations or are located in economically challenged neighborhoods often fall into this category.

These locations may struggle to attract customers due to their dated appearance or a lack of modern amenities, impacting their ability to compete. As of early 2024, Ingles Markets has been actively working on store remodels and upgrades, a strategic move to revitalize such underperforming assets. While specific numbers for underperforming stores aren't publicly disclosed, the company's capital expenditure plans often highlight investments aimed at improving store performance and relevance.

Certain non-food product categories at Ingles Markets are showing signs of weakness. Recent financial reports highlight a decrease in overall non-food sales, suggesting a potential shift in consumer spending or increased competition in these areas.

Specifically, general merchandise and certain non-food product lines are experiencing declining demand. These categories often yield low returns on investment for the shelf space and inventory they occupy, especially when facing intense competition and razor-thin margins. For instance, in their fiscal year 2023, Ingles Markets reported that while total sales increased, the contribution from non-essential, non-food items saw a slowdown, impacting overall profitability metrics for those sections.

Inefficient Legacy IT Systems or Operational Processes

Ingles Markets' inefficient legacy IT systems or operational processes can be categorized as Dogs within the BCG Matrix. These outdated systems are expensive to maintain and prone to errors, offering no competitive edge.

Such inefficiencies drain resources that could otherwise fuel growth or boost profitability. For instance, in 2024, many retail companies reported significant costs associated with maintaining aging IT infrastructure, with some allocating over 60% of their IT budget to simply keeping existing systems running rather than investing in innovation.

- High Maintenance Costs: Legacy systems often require specialized, costly support and frequent repairs.

- Operational Bottlenecks: Inefficient processes slow down operations, impacting customer service and delivery times.

- Lack of Scalability: Outdated technology struggles to adapt to changing market demands or business growth.

- Security Vulnerabilities: Older systems are more susceptible to cyber threats, posing a significant risk.

Highly Commoditized, Undifferentiated Product SKUs

Within Ingles Markets' broad product assortment, highly commoditized, undifferentiated product SKUs are akin to the Dogs in the BCG Matrix. These are items where Ingles struggles to stand out or command premium pricing. For instance, basic staples like sugar or flour, where competition is fierce and consumer loyalty is often price-driven, can fall into this category.

These products typically yield very thin profit margins, often in the low single digits. In 2023, for example, the average gross profit margin for supermarkets in the US hovered around 25%, but for highly commoditized goods, this could be significantly lower, potentially falling below 10%. This minimal profitability means they offer little scope for Ingles to expand its market share, effectively locking up capital with negligible returns.

- Low Profitability: Margins on these items are razor-thin, contributing minimally to overall profitability.

- Limited Differentiation: Products are largely interchangeable with competitors', making it hard to attract customers based on unique features.

- Capital Tie-up: Inventory management for these high-volume, low-margin goods can tie up significant working capital.

- Minimal Growth Potential: The market for these commodities is often mature and saturated, offering little room for expansion.

Ingles Markets' "Dogs" are typically underperforming stores, certain non-food product categories, inefficient legacy IT systems, and highly commoditized product SKUs. These segments exhibit low sales growth and a small market share, often draining resources without contributing significantly to profitability.

For instance, the company's capital expenditure plans in 2024 highlighted investments aimed at revitalizing underperforming store assets, suggesting a strategic effort to address these "Dog" categories. While specific store-level performance data isn't public, the general trend in retail indicates that older, less renovated locations in economically challenged areas are more prone to falling into this classification.

The non-food categories, particularly general merchandise, have shown a slowdown in demand as reported in fiscal year 2023, impacting overall profitability metrics for those sections. This is a common challenge in the retail sector, where maintaining inventory for low-margin, high-competition items can tie up significant working capital.

The financial impact of these "Dog" categories can be substantial, as highlighted by industry trends where maintaining aging IT infrastructure in 2024 consumed over 60% of IT budgets for some companies, diverting funds from innovation and growth initiatives.

| Category | Characteristics | Potential Impact on Ingles | Example |

| Underperforming Stores | Low sales growth, small market share, dated appearance | Resource drain, low ROI | Stores in economically challenged neighborhoods not yet renovated |

| Non-Food Product Categories | Declining demand, low returns on investment, intense competition | Reduced profitability, inventory tie-up | General merchandise, certain seasonal items |

| Inefficient IT Systems | High maintenance costs, operational bottlenecks, security risks | Increased operational expenses, lack of competitive edge | Legacy inventory management or point-of-sale systems |

| Commoditized SKUs | Razor-thin margins, limited differentiation, high volume | Minimal profit contribution, significant working capital requirement | Basic staples like sugar, flour, or basic cleaning supplies |

Question Marks

Ingles Markets is strategically focusing on advanced technology upgrades and digital platforms, recognizing their potential to drive future growth. These investments, which could encompass sophisticated e-commerce features beyond simple curbside pickup, AI-powered inventory systems, and deeper customer data analysis, are positioned in high-growth market segments.

While these technological advancements represent a significant opportunity, they currently hold a low market share for Ingles. The substantial capital outlay required for these upgrades, coupled with the inherent uncertainty of immediate returns, places these initiatives in the 'Question Marks' category of the BCG Matrix.

For context, in 2024, the grocery e-commerce market continued its expansion, with digital sales accounting for a notable portion of overall revenue for many retailers. Companies investing heavily in AI for supply chain optimization, for instance, have reported efficiency gains. Ingles' commitment to these areas signals a forward-looking approach, aiming to capture future market share despite the upfront investment and risk.

Entering new, competitive metropolitan or suburban markets where Ingles lacks brand recognition and established distribution would classify as a Question Mark. This strategy requires substantial investment in marketing and infrastructure to build awareness and operational capacity. For instance, a hypothetical entry into a major, densely populated city could involve significant upfront costs for store development and advertising campaigns to compete with established grocery giants.

Ingles Markets is investing in Green Initiatives to align with increasing consumer demand for sustainability. These efforts aim to improve the company's environmental footprint, a factor that significantly influences purchasing decisions in today's market.

However, substantial investments in large-scale renewable energy projects or advanced waste reduction systems represent significant capital outlays. The direct impact of these initiatives on Ingles' market share and profitability is not yet definitively established, placing them in a position where their future growth potential is uncertain despite the current trend.

Development of Specialized Retail Formats

Ingles Markets could explore specialized retail formats, such as organic-focused or gourmet stores, to tap into growing niche markets. These ventures, while starting with a low market share, represent potential future Stars if successful. For instance, the organic food market in the US was valued at approximately $60 billion in 2023 and is projected to grow significantly.

Developing these specialized formats would require substantial capital investment and a clear strategic focus to assess their long-term viability. Ingles' existing store base, with an average store size of around 50,000 square feet, provides a foundation, but these new concepts might necessitate different footprints and operational models.

- Niche Market Potential: The global specialty food market continues to expand, offering opportunities for differentiated retail experiences.

- Investment and Strategy: New formats require significant capital outlay and a robust strategy to gain traction against established niche players.

- Market Share Growth: Initial low market share is expected, with success hinging on effective market penetration and customer acquisition.

- Viability Assessment: Continuous evaluation of sales performance, customer feedback, and profitability will be crucial to determine if these formats can become Stars.

Pilot Programs for Innovative Customer Engagement

Ingles Markets' pilot programs for innovative customer engagement, such as enhanced loyalty tiers or AI-driven personalized shopping, represent high-growth potential initiatives aimed at increasing customer loyalty. These ventures, while promising for future market share, require substantial investment in research and development and implementation. The actual impact on market share is still under assessment, placing them in a category where future growth is uncertain but potentially high.

These experimental initiatives, including interactive in-store technology, are designed to boost customer retention and engagement. For instance, a pilot might involve rolling out a new mobile app feature offering personalized discounts based on past purchases. Such programs are capital-intensive, and their scalability and effectiveness in driving significant market share gains are yet to be definitively proven. Ingles Markets, like many retailers, is navigating the balance between investing in cutting-edge customer experiences and managing the associated costs and risks.

- Experimental Initiatives: Pilots could include advanced loyalty tiers, AI-powered personalized shopping, or interactive in-store technology.

- Growth Potential: These programs aim to enhance customer stickiness and create high-growth opportunities.

- Cost and Risk: Significant R&D and implementation costs are involved, with market share impact still under evaluation.

- Strategic Placement: These pilots align with a strategy to innovate customer engagement, positioning them as potential future stars if successful, but currently carrying higher risk and unproven market impact.

Ingles Markets' investments in advanced technology, such as AI for inventory management and enhanced e-commerce capabilities, are positioned as Question Marks. While these initiatives target high-growth segments, they currently represent a low market share for Ingles.

Similarly, the exploration of new retail formats, like specialized organic stores, also falls into the Question Mark category. These ventures require significant capital and a robust strategy to gain traction in niche markets, with their ultimate success and market share impact yet to be determined.

Pilot programs for innovative customer engagement, including advanced loyalty tiers and AI-driven personalization, are also Question Marks. These are capital-intensive efforts with uncertain scalability and effectiveness in driving substantial market share gains.

Ingles Markets' commitment to green initiatives, such as large-scale renewable energy projects, represents another area of significant capital outlay with an unestablished direct impact on market share, thus classifying them as Question Marks.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.