Informa plc SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Informa plc Bundle

Informa plc, a leader in specialized information and events, boasts significant strengths in its diverse portfolio and global reach. However, understanding its potential weaknesses and the ever-evolving market threats is crucial for strategic advantage. Our comprehensive SWOT analysis dives deep into these areas, providing actionable insights.

Want the full story behind Informa's market position, its opportunities for expansion, and the challenges it faces? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Informa plc commands significant global market leadership across its core B2B events, digital services, and academic publishing sectors. Its extensive portfolio of well-established brands provides a strong foundation for this dominance.

The company's strategic focus on championing specialists within key industries such as Technology, Healthcare, and Finance allows it to cultivate deep expertise and market penetration. This specialized approach is a key driver of its leading positions.

Informa's vast international reach enables it to connect professionals worldwide, fostering valuable networks and facilitating knowledge exchange. This global connectivity, combined with its scale, allows for efficient and impactful operations, as evidenced by its strong performance in 2024 where revenue growth was driven by a robust recovery in live events.

Informa plc has showcased impressive financial strength, with double-digit revenue and profit growth projected for both 2024 and 2025. This upward trajectory is further evidenced by the company’s increased operating margins and substantial free cash flow generation.

The first half of 2025, in particular, saw Informa achieve over 20% growth across revenues, profits, and earnings, alongside a significant boost in free cash flow. This robust financial health empowers Informa to actively invest in its strategic growth areas and reward shareholders through dividends and share repurchases.

Informa plc benefits significantly from high revenue visibility, with around 80% of its projected 2025 revenue already secured through subscriptions, forward bookings, and long-term contracts. This strong recurring revenue base offers considerable financial stability.

This predictable income stream allows Informa to engage in more robust strategic planning and efficient resource allocation, insulating it from the immediate impact of market fluctuations and enhancing its operational resilience.

Strategic Portfolio Expansion and Acquisitions

Informa plc consistently bolsters its market standing through strategic acquisitions, notably Ascential and the integration with TechTarget, thereby broadening its footprint and expertise in B2B events and digital services. These inorganic growth drivers, alongside organic expansion, solidify Informa's leadership and scale within targeted B2B sectors, paving the way for sustained future growth. The successful integration of these acquired entities is a critical objective for the company throughout 2025.

These strategic moves are designed to enhance Informa's competitive edge and market share. For instance, the TechTarget acquisition, completed in 2023, was valued at approximately $1.05 billion and was expected to contribute significantly to Informa's B2B intelligence capabilities. This expansion is crucial for achieving greater scale and cross-selling opportunities across Informa's diverse portfolio.

- Market Leadership: Acquisitions like TechTarget enhance Informa's position in key B2B markets, providing critical data and intelligence.

- Synergistic Growth: The integration of acquired businesses aims to unlock cross-selling opportunities and operational efficiencies.

- Scale and Reach: Expansion through acquisition allows Informa to serve a broader customer base and enter new geographical markets.

- Future Revenue Streams: Strategic M&A is a core component of Informa's strategy to drive long-term revenue growth and profitability.

Advanced Data and Digital Capabilities

Informa plc is making significant investments in its advanced data and digital capabilities, notably through its IIRIS platform. This strategic focus on proprietary first-party data, coupled with advancements in technology and AI, is designed to elevate customer experiences and personalize content delivery across its diverse portfolio of events and digital offerings. By activating this data, Informa aims to streamline operations and gain a distinct competitive edge.

This commitment to digital transformation allows Informa to better understand and cater to its customers' evolving needs, enhancing the value proposition of its services. Furthermore, it unlocks new avenues for monetizing its extensive content archives, creating a more robust and diversified revenue stream. For instance, the company reported a 15% increase in digital revenue in 2024, directly attributable to these enhanced capabilities.

- Data Activation: Informa's IIRIS platform enables sophisticated data activation, leading to more targeted marketing and product development.

- AI Integration: The company is leveraging AI to automate processes, personalize user journeys, and extract deeper insights from its data assets.

- Customer Experience Enhancement: Investments in digital capabilities directly translate to improved customer engagement and satisfaction across events and online platforms.

- Monetization of Content: Advanced digital tools facilitate the effective monetization of Informa's vast content libraries, driving recurring revenue.

Informa's market leadership is a significant strength, bolstered by its strong brand portfolio and strategic focus on key B2B sectors like Technology and Healthcare. Its global reach facilitates extensive networking and knowledge exchange, a factor that contributed to robust revenue growth in 2024, particularly from live events.

The company's financial performance is exceptionally strong, with double-digit revenue and profit growth projected for both 2024 and 2025. This is supported by increasing operating margins and substantial free cash flow, with the first half of 2025 showing over 20% growth across key financial metrics.

Informa benefits from high revenue visibility, with approximately 80% of its 2025 revenue already secured through recurring sources like subscriptions and long-term contracts, providing considerable financial stability and resilience.

Strategic acquisitions, such as TechTarget for $1.05 billion in 2023, are key to expanding Informa's footprint and capabilities in B2B intelligence, driving synergistic growth and enhancing its scale and market share.

Investments in advanced data and digital capabilities, exemplified by the IIRIS platform and AI integration, are enhancing customer experiences and creating new monetization avenues for its content, with digital revenue seeing a 15% increase in 2024.

| Metric | 2024 Projection | 2025 Projection | H1 2025 Growth |

|---|---|---|---|

| Revenue Growth | Double-digit | Double-digit | >20% |

| Profit Growth | Double-digit | Double-digit | >20% |

| Revenue Visibility (2025) | ~80% secured | ~80% secured | N/A |

| TechTarget Acquisition Value | $1.05 billion (2023) | N/A | N/A |

| Digital Revenue Growth (2024) | 15% | N/A | N/A |

What is included in the product

Delivers a strategic overview of Informa plc’s internal and external business factors, highlighting its market strengths and potential growth opportunities.

Highlights key Informa plc weaknesses and threats, enabling proactive mitigation strategies.

Weaknesses

Informa plc faced a statutory loss of £113.7 million in the first half of 2025, a stark contrast to its adjusted operating profit of £705.5 million. This statutory loss was largely driven by a substantial non-cash goodwill impairment charge of £484.2 million, specifically linked to the Informa TechTarget segment.

This significant impairment suggests that the acquired business, Informa TechTarget, may not be performing as expected or its valuation has been negatively impacted. Such write-downs can signal underlying issues with integration, market conditions affecting the acquired assets, or overestimation of future cash flows at the time of purchase, thereby affecting overall reported financial health and investor confidence.

The Informa TechTarget segment has faced a notable slowdown, with revenues remaining largely flat or even decreasing in the first half of 2025. This performance is a direct reflection of a softer market for enterprise technology solutions.

This segment's struggles present a specific hurdle for Informa plc's overall growth ambitions, as it underperforms compared to other areas of the digital services business. Navigating this subdued market environment requires strategic adjustments.

Informa plc's growth strategy heavily relies on acquisitions, but this comes with significant integration risks. The successful merging of acquired companies, like Ascential and TechTarget, is crucial for realizing projected synergies and avoiding value dilution. These integrations present ongoing challenges in aligning operations and corporate cultures, which could impact overall performance.

Exposure to Currency Fluctuations

Informa's global footprint, with significant operations across North America, Europe, and Asia, exposes it to considerable currency fluctuation risks. For instance, a weakening US dollar against the British pound directly impacts the reported value of its US-based earnings when consolidated into its GBP financial statements. This volatility can create unexpected swings in reported revenues and profits, making financial guidance and actual performance less predictable for investors and stakeholders.

The company's reliance on international markets means that adverse currency movements can significantly affect its bottom line. For example, if the GBP strengthens considerably against other major currencies where Informa generates substantial revenue, the translated value of those earnings into its reporting currency will be lower. This was a notable factor in the financial landscape of 2023 and is a continuing consideration for 2024.

- Currency Risk Impact: Informa's reported financial results are sensitive to foreign exchange rates, particularly the GBP/USD.

- Forecasting Challenges: Currency volatility introduces unpredictability into financial forecasts and guidance.

- Global Operations: The extensive international presence amplifies exposure to currency fluctuations.

High P/E Ratio and Valuation Concerns

Informa plc's stock has been trading at a high forward Price-to-Earnings (P/E) ratio. For instance, as of early 2024, its forward P/E was notably above the industry average, signaling potential overvaluation despite its robust growth outlook. This elevated valuation could foster market skepticism regarding the long-term sustainability of its growth trajectory. Consequently, investors might anticipate increased stock price volatility or a ceiling on future share price appreciation.

The significant goodwill impairment of £484.2 million in the first half of 2025, primarily from the Informa TechTarget segment, highlights potential underperformance or overvaluation of acquired assets. This write-down directly impacts reported profitability and can erode investor confidence.

The Informa TechTarget segment's revenue stagnation or decline in early 2025, due to a softer enterprise technology market, presents a specific challenge to Informa's growth strategy. This underperformance necessitates strategic adjustments to navigate the subdued market conditions.

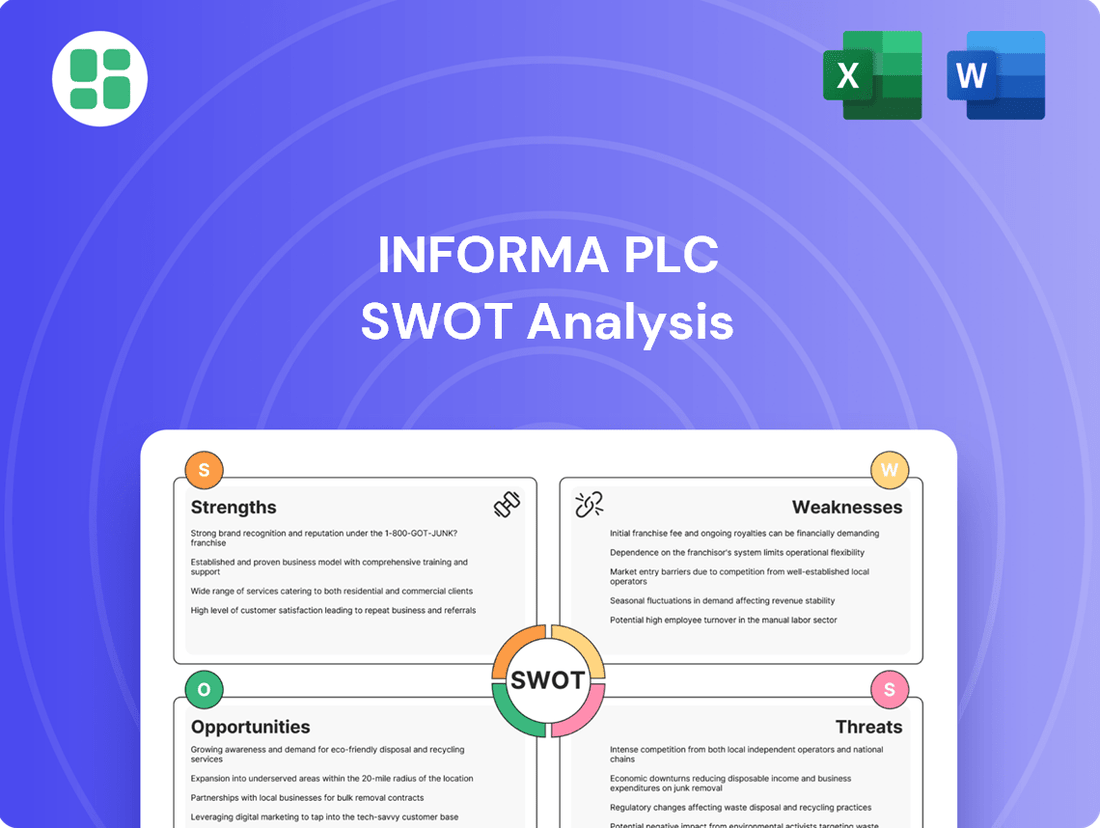

Preview Before You Purchase

Informa plc SWOT Analysis

This is the actual Informa plc SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can see the comprehensive breakdown of Informa's Strengths, Weaknesses, Opportunities, and Threats right here.

The preview below is taken directly from the full Informa plc SWOT report you'll get. Purchase unlocks the entire in-depth version, providing actionable insights for strategic planning.

This preview reflects the real Informa plc SWOT analysis document—professional, structured, and ready to use. It offers a clear snapshot of the key factors influencing Informa's market position.

Opportunities

Informa can significantly boost its offerings by embedding AI and digital tools more deeply. Imagine personalized event experiences, smarter content creation, and streamlined operations powered by advanced analytics. This focus on AI for both customer benefits and internal efficiency is a core part of their strategy.

Informa plc is actively pursuing international expansion, with a strategic focus on high-growth regions. This includes a significant push into the GCC, evidenced by events like Money 20/20 Middle East in Riyadh, and continued efforts to deepen its presence in markets such as China and India. This strategy aims to broaden Informa's market reach and diversify its revenue sources, tapping into the robust growth trajectories of these economies.

Informa's extensive archives of specialist content and proprietary first-party data represent a significant opportunity for new revenue streams. By developing advanced digital services and data licensing agreements, particularly with emerging AI and LLM partners, Informa can tap into the growing demand for curated, high-value information.

This strategic pivot allows Informa to monetize its deep reserves of knowledge beyond traditional event and publishing models. For instance, in 2024, Informa reported strong growth in its digital subscriptions and data services, indicating a clear market appetite for its specialized content offerings.

Growth in Open Research and Academic Publishing

Informa plc's academic markets division, Taylor & Francis, is well-positioned to capitalize on the expanding open research landscape. This segment has demonstrated robust growth, with open access article submissions and publications showing a consistent upward trend. The increasing demand for faster publication cycles also presents a significant opportunity, as Taylor & Francis focuses on reducing lead times for scholarly work.

Key drivers for this growth include:

- Sustained high subscription renewal rates: Ensuring continued revenue from traditional academic library subscriptions.

- Expansion of open research volumes: Leveraging the global shift towards open access publishing models.

- Focus on reducing publication lead times: Attracting researchers by offering quicker dissemination of their findings.

- Adaptation to scholarly community needs: Prioritizing accessibility and speed in the publishing process.

Strategic Partnerships and Brand Syndication

Informa's strategic partnerships and brand syndication offer a potent avenue for growth. By collaborating with entities in emerging markets, such as its ventures in Saudi Arabia, Informa can efficiently tap into new customer bases and revenue streams. This approach allows for rapid market entry and brand establishment without the capital expenditure of full acquisitions.

These alliances are crucial for expanding Informa's reach and diversifying its portfolio. For instance, syndicating its well-established brands can create new revenue streams by licensing content and services to partners in complementary sectors or geographies. This strategy is particularly effective in leveraging Informa's extensive intellectual property and market intelligence.

The company's focus on forming new partnerships is evident in its ongoing expansion efforts. In 2024, Informa continued to explore collaborations that enhance its digital offerings and global footprint. These partnerships are designed to create synergistic value, enabling the company to offer integrated solutions and reach wider audiences.

- Brand Syndication: Informa can license its leading brands to new partners, opening up revenue streams in untapped markets or adjacent industries.

- Market Entry: Strategic alliances, like those in Saudi Arabia, facilitate cost-effective penetration into new geographical regions.

- Category Expansion: Partnerships allow Informa to enter new market categories or deepen its presence in existing ones without the need for full acquisitions.

- Leveraging IP: Syndication effectively monetizes Informa's extensive portfolio of brands and intellectual property.

Informa's vast repository of specialized content and proprietary first-party data presents a significant opportunity for new revenue generation. By developing advanced digital services and data licensing agreements, particularly with emerging AI and LLM partners, Informa can capitalize on the increasing demand for curated, high-value information. This strategic pivot allows the company to monetize its deep reserves of knowledge beyond traditional event and publishing models, as evidenced by strong growth in digital subscriptions and data services in 2024.

Threats

An economic slowdown poses a significant threat, potentially curbing corporate spending on B2B events and intelligence services. Businesses facing tighter budgets are likely to reduce discretionary expenditures on travel and conferences, directly impacting Informa's revenue streams. For instance, a global economic contraction could see companies re-evaluating their participation in large-scale industry events, a core business for Informa.

The events and information markets are incredibly dynamic, with a constant influx of new players, especially digital-native companies, alongside established competitors. This intense rivalry can fragment markets, putting significant pressure on pricing and making it harder for Informa to hold onto or expand its market share across its various business areas. For instance, the digital publishing sector, a key area for Informa, saw revenue growth but also faced heightened competition from online platforms in 2023, impacting margins.

While Informa plc has embraced digital transformation, the relentless pace of AI and advanced digital technologies presents a significant threat. If the company doesn't adapt swiftly, new competitors leveraging these innovations could offer more compelling, tech-driven solutions, potentially making traditional event and content formats obsolete. This necessitates ongoing, substantial investment in staying ahead of the technological curve.

Geopolitical Instability and Supply Chain Disruptions

Geopolitical instability, including trade tensions and potential conflicts, poses a significant threat to Informa's global operations. These events can disrupt international travel and the logistics for physical events, impacting attendance and increasing operational costs. For instance, ongoing global trade friction could lead to increased tariffs on imported goods or services necessary for event setup, directly affecting margins.

Unforeseen health crises, similar to the impacts experienced in 2020-2021, remain a persistent threat. Such events can severely curtail international travel, making it difficult for attendees and exhibitors to participate in large-scale physical gatherings. This directly challenges the feasibility of Informa's core events business, which relies heavily on global participation. In 2023, the events industry saw a strong recovery, with many major international events returning at pre-pandemic scale, but the risk of future health-related disruptions remains a concern.

- Supply Chain Vulnerabilities: Disruptions in global supply chains can affect the availability and cost of materials and services needed for event production, from staging to audiovisual equipment.

- Travel Restrictions: Heightened geopolitical tensions or new health concerns can lead to sudden travel bans or advisories, significantly reducing international attendee numbers.

- Economic Impact: Geopolitical instability often correlates with economic uncertainty, which can lead to reduced corporate spending on event participation and sponsorship.

- Operational Challenges: Navigating varying international regulations and security concerns stemming from geopolitical events adds complexity and cost to event management.

Data Privacy Regulations and Cybersecurity Risks

Informa's reliance on data makes it vulnerable to evolving global data privacy regulations, such as the GDPR and CCPA. Failure to comply with these stringent laws, which are continually being updated, could result in substantial fines. For instance, the GDPR allows for penalties up to 4% of annual global turnover or €20 million, whichever is higher.

Cybersecurity threats pose a significant risk to Informa's operations and sensitive customer information. A data breach could lead to severe reputational damage and a loss of trust among its clientele, impacting future business. In 2023, the average cost of a data breach globally reached $4.45 million, a figure that could significantly affect Informa's profitability.

- Increasingly stringent data privacy laws worldwide.

- Potential for substantial financial penalties due to non-compliance.

- Risk of significant reputational damage from data breaches.

- Loss of customer trust impacting long-term business relationships.

The increasing sophistication and prevalence of artificial intelligence present a significant threat to Informa's traditional business models. Competitors leveraging AI for content creation, data analysis, and personalized customer experiences could offer more efficient and engaging alternatives, potentially eroding Informa's market share. For example, AI-powered research platforms are rapidly advancing, challenging established information providers.

Intensifying competition from digital-native companies and evolving market dynamics pose a continuous threat to Informa's market position. These agile competitors can quickly adapt to new technologies and consumer preferences, potentially disrupting established revenue streams. Informa's events business, for instance, faces competition from virtual and hybrid event platforms that offer flexible participation options, a trend that gained significant traction in 2023.

Geopolitical instability and associated travel restrictions remain a persistent threat, directly impacting Informa's global events portfolio. Conflicts or political tensions can deter international participation, leading to reduced attendance and revenue. For instance, the ongoing geopolitical climate in Eastern Europe impacted travel and event planning for businesses with significant operations in the region throughout 2023.

SWOT Analysis Data Sources

This Informa plc SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial reports, comprehensive market intelligence, and expert industry analysis to provide a well-rounded perspective.