Informa plc Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Informa plc Bundle

Informa plc operates in a dynamic landscape shaped by intense rivalry and the significant bargaining power of its customers. Understanding these forces is crucial for navigating its competitive environment.

The full Porter's Five Forces Analysis dives deep into the threat of new entrants and the influence of substitute products, offering a comprehensive view of Informa plc's strategic position.

Ready to move beyond the basics? Get a full strategic breakdown of Informa plc’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Informa plc, like many in the events sector, faces significant bargaining power from a limited number of high-quality venues and key service providers. This scarcity means these premium suppliers, essential for large-scale and high-profile events, can command higher prices and dictate terms due to their exclusivity and high demand. For instance, in 2024, major convention centers in key global cities often operate at near-full capacity, giving them considerable leverage when negotiating contracts with event organizers like Informa.

For its scholarly research divisions, Informa's suppliers are often academics and researchers who create niche content. If these creators possess highly specialized knowledge or unique datasets, their bargaining power is amplified, particularly when their work is in high demand or exclusive. For instance, Taylor & Francis, a key Informa division, relies on these experts to publish cutting-edge research, giving them leverage in negotiations.

Informa's reliance on specialized B2B digital services and event platforms means technology and software providers with proprietary solutions hold considerable sway. These suppliers can command higher prices or more favorable terms due to the unique nature of their offerings.

The switching costs for Informa to move away from these proprietary systems are substantial. Migrating complex data sets and retraining personnel represent significant financial and operational hurdles, giving these suppliers leverage.

For instance, in 2024, the average cost for businesses to migrate cloud-based enterprise software can range from tens of thousands to millions of dollars, depending on the complexity and scale of the operation. This high barrier to entry solidifies the bargaining power of key technology vendors.

Impact of Supplier Reputation on Event Quality

The reputation of suppliers significantly influences the perceived quality and reliability of Informa's events and publications. When a supplier consistently delivers high-quality services, it bolsters Informa's brand image and customer trust, granting these dependable suppliers greater bargaining power. For instance, in 2023, Informa's reliance on specialized technology providers for virtual and hybrid events meant that disruptions from less reliable partners could lead to significant attendee dissatisfaction, reinforcing the value of established, reputable vendors.

This dependence on supplier quality means Informa often prioritizes securing services from well-regarded providers, even if it means higher costs. The risk of a reputational hit from a supplier failure can outweigh potential cost savings. Informa's strategic partnerships with leading venue operators and content creators, for example, are often built on long-term relationships that ensure consistent delivery, reflecting this prioritization.

- Supplier Reliability as a Key Factor: Informa's event success hinges on the consistent performance of its suppliers, impacting brand perception.

- Reputational Risk Mitigation: Poor supplier performance can damage Informa's reputation and customer satisfaction, increasing supplier leverage.

- Prioritizing Established Relationships: Informa often favors dependable, reputable suppliers over solely cost-driven choices.

- Impact on Negotiation Power: Trusted suppliers with a proven track record gain an advantage in pricing and terms due to Informa's reliance on their quality.

Potential for Vertical Integration by Suppliers

Suppliers, particularly those with unique technology or valuable content, may contemplate vertical integration. This means they could offer their services directly to Informa's end customers or even develop their own competing platforms. For instance, a specialized data analytics provider could bypass Informa's distribution channels and sell directly to researchers or businesses.

This potential for forward integration significantly bolsters supplier bargaining power. It creates an alternative revenue stream for them, allowing them to capture more value by cutting out intermediaries like Informa. In 2024, the trend of content creators and technology firms exploring direct-to-consumer models continues to grow, putting pressure on traditional intermediaries.

- Suppliers may offer services directly to Informa's customers.

- New competing platforms could be launched by suppliers.

- This forward integration offers suppliers alternative revenue streams.

- Bypassing intermediaries like Informa enhances supplier leverage.

Informa's bargaining power with suppliers is influenced by the concentration of suppliers and the uniqueness of their offerings. For instance, in the events sector, a limited number of premium venues in key cities can dictate terms due to high demand, as seen with convention center occupancy rates often exceeding 80% in 2024.

For its academic publishing arm, Taylor & Francis, the power of individual researchers with specialized, in-demand content is significant. These experts can command higher royalties or exclusive publication rights, impacting Informa's content acquisition costs.

The high switching costs associated with proprietary B2B digital platforms, often running into hundreds of thousands of dollars for migration in 2024, further empower technology vendors. Informa's reliance on these specialized systems means suppliers offering unique solutions have considerable leverage.

Suppliers with strong reputations for quality and reliability also hold greater bargaining power, as Informa prioritizes these relationships to mitigate reputational risks, a factor highlighted by attendee satisfaction metrics in hybrid events in 2023.

| Supplier Characteristic | Impact on Informa | Example (2024 Data/Trends) |

|---|---|---|

| Supplier Concentration (Events) | Increased leverage for few high-quality venues | High occupancy rates in major convention centers |

| Uniqueness of Content (Publishing) | Power for academics with niche, in-demand research | Exclusive publication deals for cutting-edge studies |

| Switching Costs (Technology) | Leverage for proprietary software providers | High costs to migrate complex enterprise systems |

| Supplier Reputation | Advantage for reliable, quality-focused providers | Mitigating reputational risk in hybrid event delivery |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Informa plc's position in the information services and events industry.

Instantly visualize the competitive landscape and identify potential threats or opportunities with a dynamic, interactive five forces model.

Customers Bargaining Power

Informa plc operates in the B2B events sector where, despite serving large corporations, its customer base of exhibitors and attendees is typically fragmented. This means that many smaller businesses and individual professionals participate, rather than a few dominant buyers.

This fragmentation significantly dilutes the bargaining power of any single customer. No one exhibitor or attendee accounts for a substantial enough portion of Informa's overall revenue to exert considerable leverage over pricing or terms.

For instance, in 2024, Informa's diverse portfolio of events across various industries meant that even major clients represented a small percentage of the company's total income, reinforcing the low individual customer bargaining power.

Customers for B2B digital services and academic content are becoming more price-aware. This is driven by easier access to information and a wider array of competing services. For instance, in 2024, a significant portion of B2B buyers reported that price was a primary factor in their purchasing decisions for digital solutions, with some studies indicating over 60% of IT decision-makers prioritizing cost-effectiveness.

The ability to quickly compare different service providers and their pricing online significantly amplifies customer leverage. When digital services become standardized or commoditized, this comparison power becomes even more pronounced, allowing customers to negotiate better terms or switch to more affordable alternatives. This trend is particularly evident in areas like subscription-based software and online research platforms.

Customers across Informa's diverse divisions, especially within its influential events and robust B2B communities, are increasingly vocal about their desire for highly personalized experiences. They expect content that is uniquely tailored to their interests and demonstrably delivers a clear return on investment.

This escalating demand for bespoke solutions and services that offer tangible value significantly amplifies customer bargaining power. Informa's clients now have the latitude to select providers who not only meet these specific needs but also excel in fostering superior engagement and delivering exceptional value.

Switching Costs Vary by Service Type

Customer switching costs at Informa plc are not uniform across its diverse service offerings. For instance, securing large, integrated event sponsorships or committing to long-term academic subscriptions often involves significant upfront investment and the establishment of deep relationships, making the cost and effort to switch to a competitor substantial. This can include the need to migrate extensive data or re-establish trust and operational workflows.

Conversely, for individual event attendance or basic digital subscriptions, customers face much lower switching costs. This flexibility allows them to readily explore and move to competing platforms or events if they perceive better value or offerings. This disparity in switching costs directly impacts the bargaining power of customers within different segments of Informa's business.

In 2024, the digital subscription market, a key area for Informa, continued to see intense competition. While Informa's premium content and data offerings aim to increase stickiness, the ease with which users can access alternative information sources means that price and perceived value remain critical factors, especially for less integrated services. For example, a report from Statista in late 2023 indicated that over 60% of consumers surveyed would switch digital subscription services for a lower price point, highlighting the sensitivity to cost in less embedded offerings.

- High Switching Costs: Long-term academic journal subscriptions and major event sponsorships involve significant relationship building and data integration, creating barriers to switching.

- Low Switching Costs: Individual event tickets and standard digital content access offer customers greater freedom to move to competitors based on price and perceived value.

- Market Dynamics (2024): The digital subscription landscape remains competitive, with a notable consumer willingness to switch services for cost savings, impacting customer bargaining power.

Collective Bargaining Power of Institutional and Corporate Buyers

Institutional and corporate buyers, including large corporations and academic institutions, wield considerable collective bargaining power when purchasing multiple subscriptions or booking significant events. Their substantial budget commitments enable them to negotiate more favorable terms and discounts, directly influencing Informa's pricing strategies.

For instance, in 2024, major clients often secure volume discounts that can reduce per-unit costs significantly. This collective leverage allows these buyers to demand customized packages or preferential access, thereby impacting Informa's revenue streams and profit margins on large-scale deals.

- Significant Budget Commitments: Large buyers can commit substantial funds, giving them leverage.

- Negotiation of Favorable Terms: This leverage translates into negotiated discounts and customized packages.

- Impact on Pricing Strategies: Informa must consider this power when setting prices for its offerings.

While individual customers have limited power due to fragmentation, large institutional buyers can exert significant influence. These entities, such as major corporations and universities, often negotiate volume discounts and customized packages, directly impacting Informa's pricing. This collective bargaining power is a key factor in how Informa structures its deals and manages revenue streams from its larger clients.

| Customer Segment | Bargaining Power Level | Key Drivers |

|---|---|---|

| Individual Event Attendees/Subscribers | Low | Fragmentation, Low Switching Costs |

| Small to Medium Businesses (Exhibitors/Digital Users) | Moderate | Price Sensitivity, Ease of Comparison |

| Large Corporations/Academic Institutions | High | Volume Commitments, Negotiation of Terms |

Preview the Actual Deliverable

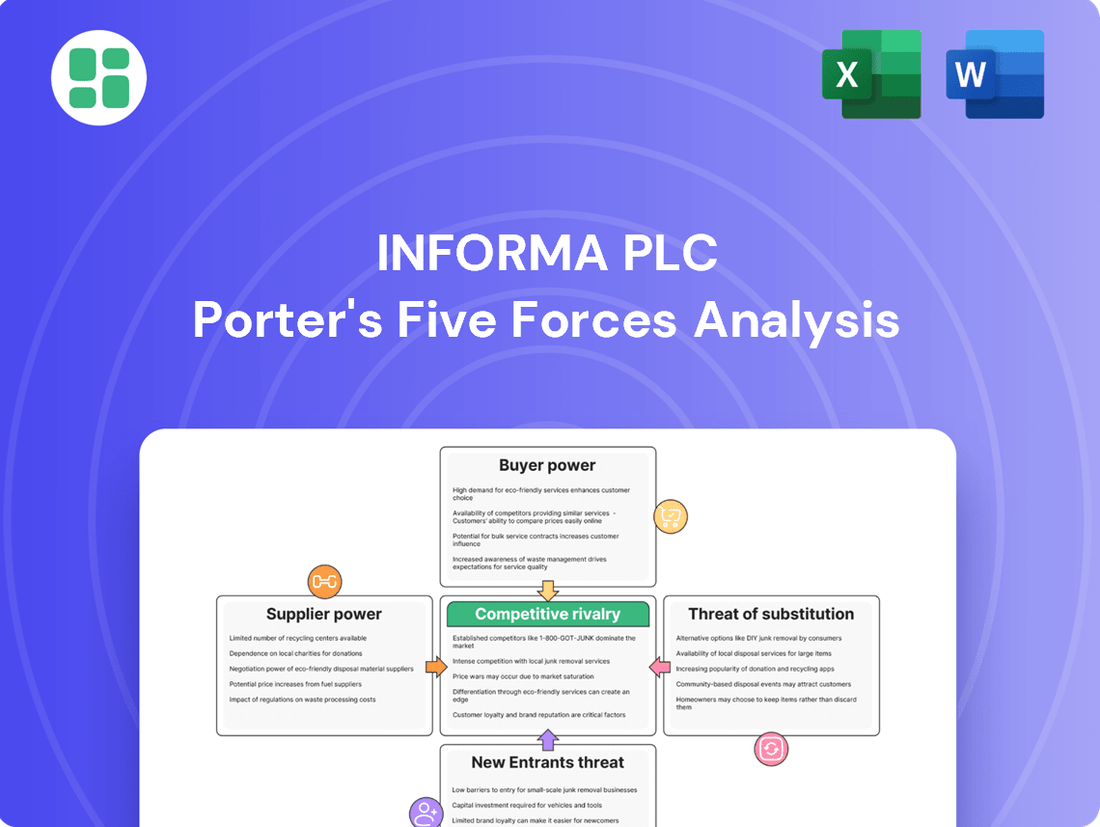

Informa plc Porter's Five Forces Analysis

This preview showcases the complete Informa plc Porter's Five Forces Analysis, providing a detailed examination of competitive forces within its industry. The document you see here is the exact, professionally written analysis you will receive immediately after purchase, ensuring no surprises or missing sections. You can confidently download and utilize this comprehensive report, which delves into supplier power, buyer power, threat of new entrants, threat of substitutes, and industry rivalry as they pertain to Informa plc.

Rivalry Among Competitors

Informa plc faces intense competition from a broad spectrum of global and specialized rivals. Companies like Clarivate, GlobalData, Delinian, Pearson, and Future actively compete for market share across Informa's core segments of events, intelligence, and academic publishing. This diverse competitive landscape means Informa must constantly innovate and adapt to retain its position.

The B2B events sector is fragmenting, with a growing emphasis on transaction-led, content-led, and experience-led formats. Informa's strategic pivot towards specialized market niches and distinctive content is designed to create a competitive edge. However, this specialization does not shield it from robust competition within each of these defined areas.

In academic publishing, the rise of Open Access models is reshaping traditional revenue streams and competitive dynamics. Informa, through its Taylor & Francis Group, is navigating this shift by focusing on high-impact research and specialized scholarly communities, a strategy that intensifies rivalry with other publishers embracing similar approaches.

The competitive landscape for Informa plc is characterized by intense rivalry, with competitors heavily investing in digital transformation and artificial intelligence to gain market advantage. This arms race in innovation is evident as companies strive to offer cutting-edge solutions and enhanced customer value.

Informa's strategic investments, such as its focus on AI and the development of its IIRIS platform for first-party data, underscore the imperative to remain competitive. These moves highlight a market where continuous innovation and data utilization are crucial for differentiation and sustained growth.

M&A Activity and Portfolio Expansion

The information and events sector is characterized by robust merger and acquisition (M&A) activity. Companies actively pursue acquisitions to broaden their service offerings, enhance operational scale, and establish a presence in new geographical regions or specialized market segments. This consolidation trend is a key driver of competitive dynamics.

Informa plc has strategically utilized M&A to bolster its market position. Notably, its acquisition of Ascential's digital commerce business for £837 million in 2023, and its combination with TechTarget, exemplify this strategy. These moves are designed to consolidate leadership and achieve greater economies of scale within its operational areas.

- Informa's Ascential Acquisition: The £837 million deal in 2023 significantly expanded Informa's digital commerce intelligence capabilities.

- TechTarget Combination: This strategic combination aimed to create a leading B2B data and analytics business, enhancing Informa's market reach and product portfolio.

- Industry Consolidation: The ongoing M&A trend reflects a broader industry effort to gain competitive advantage through scale and diversification.

Impact of Digitalization on Traditional Business Models

The increasing digitalization of services has significantly ramped up competition for traditional business models, particularly in sectors like events and publishing. Informa, while possessing robust digital capabilities, faces a landscape where new competitors can readily emerge by leveraging online content distribution and virtual event platforms. This dynamic necessitates constant adaptation and innovation to maintain market share.

Informa's 2023 revenue reached £2.9 billion, demonstrating its scale, but the digital shift presents ongoing challenges. For instance, the ease with which virtual events can be organized means that specialized niche competitors can quickly enter the market, offering tailored experiences that may challenge Informa's broader offerings. This intensifies the pressure to innovate and differentiate digital products.

- Digital Transformation Pressure: Traditional event organizers and publishers are compelled to accelerate their digital transformation to remain competitive against agile online-first rivals.

- Virtual Event Competition: The proliferation of virtual event platforms lowers the barrier to entry, allowing new players to quickly offer specialized or cost-effective alternatives to established players like Informa.

- Content Monetization Challenges: The ease of online content distribution means traditional publishers face ongoing pressure to find sustainable digital monetization strategies as free or low-cost alternatives proliferate.

Informa plc operates in a highly competitive environment, facing rivals across its event, intelligence, and academic publishing segments. The ongoing digital transformation and the rise of Open Access models in publishing intensify this rivalry. Competitors like Clarivate, GlobalData, and Pearson are actively innovating, particularly with investments in AI and data analytics, to capture market share.

The company's strategic acquisitions, such as the £837 million purchase of Ascential's digital commerce business in 2023 and its combination with TechTarget, highlight the industry's consolidation trend. These moves aim to bolster Informa's scale and market position against competitors who are also pursuing similar growth strategies.

The increasing digitalization of services, especially in the events sector with the proliferation of virtual platforms, lowers barriers to entry. This allows niche competitors to emerge, challenging established players like Informa and demanding continuous adaptation and innovation in digital product offerings and content monetization.

| Competitor | Primary Business Areas | Key Competitive Strategy |

| Clarivate | Information Services, Analytics | Data-driven insights, AI integration |

| GlobalData | Market Research, Intelligence | Specialized industry analysis, digital platforms |

| Pearson | Education, Publishing | Digital learning solutions, Open Access initiatives |

| Future | Media, Publishing | Niche content specialization, digital audience growth |

SSubstitutes Threaten

The proliferation of free online content, including news, blogs, and research platforms, presents a substantial threat of substitutes for Informa's paid offerings. For instance, platforms like Wikipedia and numerous academic repositories offer readily accessible information that can often fulfill a user's immediate informational needs without a subscription cost.

The Open Access movement further amplifies this threat, making a significant portion of academic research freely available. In 2024, the Open Access market continued its expansion, with estimates suggesting that over 50% of scholarly articles published globally were available through Open Access channels by the end of the year, directly competing with Informa's subscription-based journals and databases.

Businesses are increasingly exploring in-house events and private corporate networking platforms as substitutes for traditional B2B exhibitions. This trend allows companies to directly engage their target audience, control the narrative, and potentially reduce costs associated with external event participation. For instance, a significant portion of companies surveyed in late 2023 indicated a growing preference for virtual or hybrid internal events to foster employee connection and client engagement, bypassing the need for third-party organizers like Informa.

Informa's intelligence services face a significant threat from alternative data and intelligence sources. These substitutes include a growing number of specialized data providers, consultancies that offer tailored research projects, and the increasing ability of client organizations to leverage their own internal data analytics capabilities. For example, the proliferation of advanced data analytics platforms in 2024 empowers businesses to derive their own market insights, potentially reducing reliance on external intelligence providers.

Shift to Virtual and Hybrid Event Formats

The growing prevalence of virtual and hybrid event formats, a trend significantly amplified by recent global circumstances, offers a compelling alternative to traditional in-person gatherings. This shift directly impacts the perceived value of physical attendance, potentially drawing audiences away from purely in-person experiences.

While Informa has invested in and offers hybrid event capabilities, the very existence of virtual participation options can diminish the necessity for attendees to be physically present. This can translate into reduced demand for traditional event components, impacting revenue streams that rely on physical attendance.

For example, in 2024, the events industry continued to navigate this evolving landscape. Many organizations reported a sustained interest in virtual components, with a significant portion of attendees preferring hybrid or fully virtual access for cost and convenience reasons. This indicates that substitutes are not merely a temporary phenomenon but a structural change in how events are consumed.

- Virtual and hybrid formats offer cost savings for attendees, making them a strong substitute for purely in-person events.

- Informa's investment in hybrid solutions acknowledges this trend, but the core threat remains the reduced necessity of physical presence.

- Data from 2024 suggests a persistent demand for virtual participation, impacting the revenue potential of traditional, in-person event models.

- The perceived value of physical attendance may decline as virtual engagement tools become more sophisticated and accessible.

Professional Social Networks and Online Communities

Professional social networks and online communities present a significant threat of substitutes for Informa plc's offerings. Platforms like LinkedIn, which boasts over 1 billion members globally as of early 2024, provide a readily accessible and often free alternative for professionals to network, share insights, and stay updated on industry news. This directly competes with Informa Connect's B2B communities and networking events, particularly for individuals seeking more casual or broad information exchange rather than highly curated, paid experiences.

These digital spaces facilitate knowledge sharing and trend discovery, mimicking some of the value propositions offered by Informa's events and subscription services. For instance, industry-specific groups on LinkedIn or specialized forums allow professionals to engage in discussions, ask questions, and learn from peers, often without incurring direct costs. This accessibility and low barrier to entry make them a compelling substitute, especially for smaller businesses or individual professionals managing tighter budgets.

- LinkedIn's User Base: Over 1 billion members globally as of early 2024, indicating a vast pool of potential users for substitute networking and information gathering.

- Cost-Effectiveness: Many professional social networks and online communities offer free basic access, posing a cost advantage over Informa's paid events and communities.

- Information Accessibility: These platforms enable rapid dissemination and discovery of industry trends and knowledge, directly substituting for some of the information-gathering functions of Informa's services.

The rise of free online content, including news aggregators and open-access academic journals, directly competes with Informa's paid subscriptions. For example, by the end of 2024, over half of all published scholarly articles were estimated to be open access, offering a cost-free alternative to Informa's research databases.

Businesses are increasingly opting for in-house events and private digital platforms as substitutes for traditional B2B exhibitions. This trend allows for more targeted engagement and cost control, bypassing third-party organizers. In late 2023, surveys indicated a growing preference for internal virtual events to foster client connections, reducing reliance on external event participation.

Informa's intelligence services face competition from specialized data providers and the growing capacity of companies to leverage their own internal analytics. By 2024, advanced analytics platforms empowered businesses to derive their own market insights, lessening the need for external intelligence providers.

The prevalence of virtual and hybrid event formats offers a compelling alternative to purely in-person gatherings, impacting the perceived value of physical attendance. While Informa offers hybrid solutions, the ease of virtual participation can reduce demand for traditional event components.

Professional networks like LinkedIn, with over 1 billion members globally by early 2024, provide a free platform for networking and information exchange, substituting for some of Informa Connect's B2B communities and events.

| Substitute Type | Key Characteristics | Impact on Informa | 2024 Data Point |

|---|---|---|---|

| Free Online Content | Accessibility, Cost-effectiveness | Reduces demand for paid subscriptions | >50% of scholarly articles were open access |

| In-house/Private Events | Targeted engagement, Cost control | Decreased reliance on external event organizers | Growing preference for internal virtual events |

| Internal Data Analytics | Customized insights, Self-sufficiency | Reduced need for external intelligence services | Increased adoption of advanced analytics platforms |

| Virtual/Hybrid Events | Convenience, Cost savings for attendees | Diminished necessity of physical presence | Sustained interest in virtual participation |

| Professional Networks | Broad reach, Free access | Direct competition for networking and information | LinkedIn exceeded 1 billion members |

Entrants Threaten

Launching major B2B events or building a respected academic publishing brand demands substantial upfront capital. Think about securing prime venues, managing complex logistics, investing in cutting-edge technology, and acquiring high-quality content. For instance, organizing a global industry conference can easily cost millions, making it a formidable hurdle for newcomers.

These considerable financial commitments act as a significant deterrent, effectively limiting the pool of potential new entrants. The sheer scale of investment needed to compete effectively in these sectors means only well-funded organizations can realistically consider entering the market, thereby protecting established players like Informa plc.

Informa plc enjoys a significant advantage due to its established brand reputation and deep-rooted customer loyalty across its specialized markets. Newcomers face a considerable hurdle in replicating this trust, which is vital for attracting exhibitors, attendees, and authors.

Building a comparable level of brand recognition and customer allegiance would require substantial investment in marketing and a considerable amount of time, making it difficult for new entrants to effectively compete with established players like Informa.

Informa's significant advantage lies in its proprietary first-party data, such as the IIRIS platform, and its deep, cultivated industry expertise across various sectors. Newcomers would face immense difficulty in replicating this specialized knowledge and data repository, which are fundamental to Informa's success in delivering targeted content and facilitating valuable industry connections.

Regulatory Hurdles and Compliance in Academic Publishing

The academic publishing industry presents substantial regulatory and compliance challenges for potential new entrants. These include adhering to rigorous peer review standards, safeguarding intellectual property rights, and maintaining ethical publishing practices. Navigating these established norms requires significant investment in infrastructure and expertise, creating a barrier to entry.

In 2024, the academic publishing landscape continued to emphasize transparency and integrity. For instance, the Committee on Publication Ethics (COPE) provided updated guidelines on ethical conduct, which new entrants must meticulously follow. Failure to comply with these evolving standards can severely damage a new publisher's reputation and hinder its acceptance within the academic community.

The financial implications of these regulatory hurdles are considerable. New entrants must allocate resources not only to content acquisition and production but also to establishing robust compliance frameworks. For example, investing in sophisticated plagiarism detection software and ensuring adherence to data privacy regulations like GDPR (General Data Protection Regulation) adds to the initial operational costs, potentially exceeding millions of dollars for a new, credible publisher.

- Regulatory Complexity: Academic publishing is governed by strict ethical codes and legal frameworks, including those related to copyright and plagiarism.

- Credibility and Trust: New entrants must build trust within the scholarly community, which is heavily reliant on established peer review processes and a proven track record of integrity.

- Compliance Costs: Meeting regulatory requirements, such as those set by organizations like COPE, and implementing robust quality control measures represent significant financial outlays.

- Intellectual Property: Protecting and respecting intellectual property rights is paramount, requiring legal expertise and careful management of author agreements.

Economies of Scale and Scope

Informa's extensive reach across events, intelligence, and publishing creates significant economies of scale and scope. This allows them to achieve cost advantages in areas like marketing, technology development, and content creation. For instance, a unified technology platform for their diverse digital offerings can be amortized over a much larger revenue base than a niche competitor could manage.

New entrants face a substantial hurdle in matching Informa's cost structure and breadth of services. Without a comparable scale, new players would struggle to compete on price or offer the same comprehensive suite of products and services that Informa provides to its various customer segments.

- Cost Efficiencies: Informa's scale allows for lower per-unit costs in marketing and content production.

- Broad Offerings: A wide portfolio deters new entrants who cannot match the breadth of services.

- Technology Investment: Informa can spread significant technology investments across multiple business units.

- Market Reach: Existing scale provides wider market access, making it harder for new entrants to gain traction.

The threat of new entrants for Informa plc is moderate, primarily due to the high capital requirements and established brand loyalty in its core markets. Building a strong reputation in academic publishing or launching major B2B events demands significant investment, creating a substantial barrier for newcomers. For example, the cost of organizing a large international conference can easily run into millions of dollars, a figure that deters many potential competitors.

Informa's existing brand recognition and deep customer relationships are difficult to replicate, especially in specialized sectors. New entrants would need to invest heavily in marketing and time to build comparable trust and attract key stakeholders like exhibitors, attendees, and authors. This established credibility, built over years, provides a significant competitive moat.

The academic publishing sector, in particular, presents regulatory complexities. New entrants must adhere to strict ethical standards, peer review processes, and intellectual property laws. Compliance with guidelines from bodies like COPE in 2024, for instance, requires investment in robust systems and expertise, adding to the cost of entry. Failure to meet these standards can severely damage a new publisher's reputation.

Furthermore, Informa benefits from economies of scale and scope, allowing it to achieve cost efficiencies in marketing, technology, and content creation. This broad operational scale makes it challenging for smaller, new entrants to match Informa's cost structure or offer a comparable breadth of services, thus limiting their ability to compete effectively on price or value proposition.

Porter's Five Forces Analysis Data Sources

Our Informa plc Porter's Five Forces analysis leverages data from Informa's annual reports, investor presentations, and public filings, supplemented by industry-specific market research reports and competitor analysis from reputable sources.