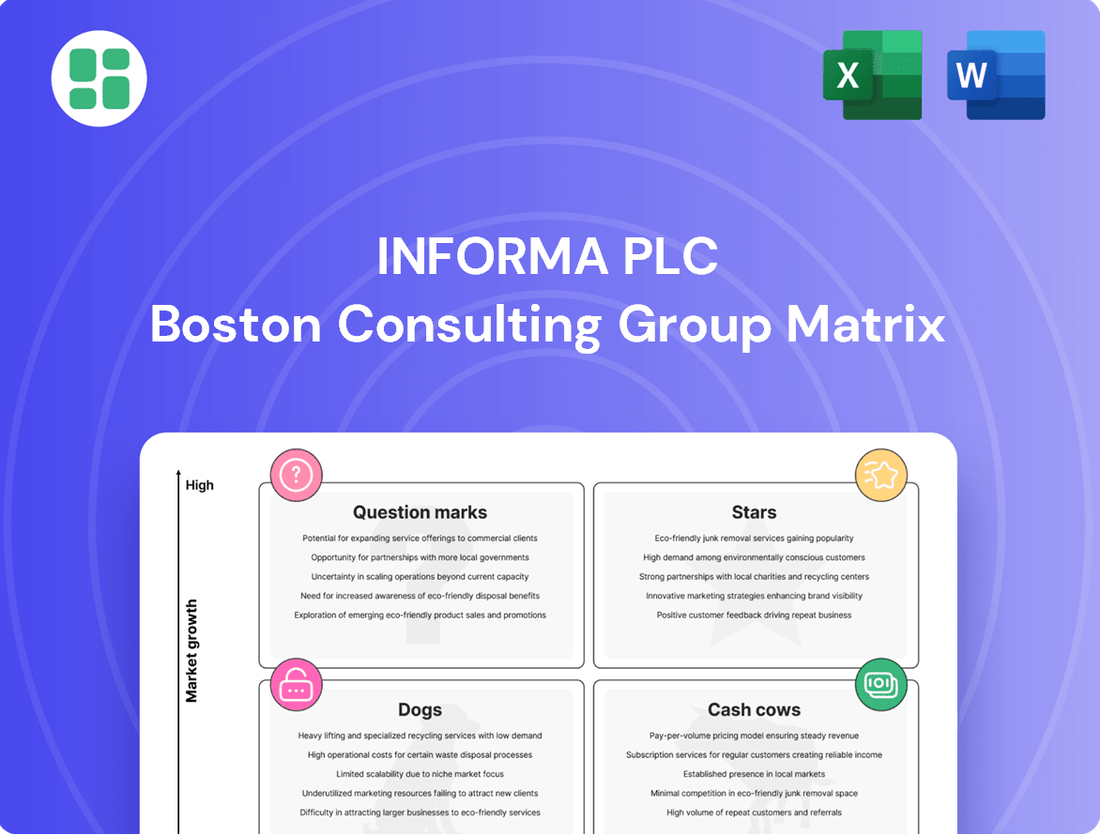

Informa plc Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Informa plc Bundle

Curious about Informa plc's strategic positioning? This glimpse into their BCG Matrix highlights key product categories, but the real power lies in understanding the nuances of each quadrant. Discover which of Informa's offerings are poised for growth and which require careful management.

Unlock the full potential of this analysis by purchasing the complete Informa plc BCG Matrix. Gain access to detailed quadrant placements, actionable insights, and a clear roadmap to optimize your investment and product portfolio decisions.

Stars

Informa Markets' B2B events, especially in robust sectors like Healthcare and Construction, showcase a dominant market position within expanding business-to-business event landscapes. These events are consistently achieving significant revenue growth, with the Live B2B Events segment alone surpassing 8% growth, underscoring their industry leadership and ongoing expansion.

The persistent demand for top-tier live B2B events, which provide distinctive experiences and specialized content, remains strong. This sustained interest firmly establishes these segments as critical drivers of future growth for Informa.

Informa's newly formed Festivals business, which includes major acquisitions like Ascential's Cannes Lions and Money20/20, is strategically positioned to capitalize on the growing demand for experience-driven B2B events. These events thrive in dynamic markets, offering immersive content and fostering robust community engagement.

The focus on high-impact, inspirational business gatherings places this segment in a high-growth area with substantial market potential. For instance, Informa reported in its 2023 full-year results that its Informa Connect division, which houses many of these events, saw revenue grow by 15% on a like-for-like basis, driven by strong performance in its specialist events portfolio.

Within Taylor & Francis, the academic markets are seeing significant growth in Open Research submissions and publications. This surge reflects the academic community's increasing demand for accessible knowledge. In the first half of 2025, this segment demonstrated a robust 11.9% revenue growth, underscoring Informa's successful strategy in this expanding area.

AI Data Licensing Agreements

Informa plc's strategic focus on AI data licensing agreements, particularly through its Taylor & Francis division, highlights a burgeoning high-growth area. These non-recurring agreements tap into Informa's vast content repositories, making them highly valuable for artificial intelligence development.

The financial impact is substantial, with these data licensing deals generating over $75 million in 2024 alone. This revenue stream is projected to continue its strong performance into 2025, demonstrating the significant and immediate value being unlocked from Informa's intellectual property.

This segment is aptly categorized as an emerging star within the BCG matrix. The rapid expansion of the AI sector and the increasing demand for high-quality, curated data fuel this growth, positioning Informa favorably in the evolving data economy.

- AI Data Licensing Revenue: Exceeded $75 million in 2024.

- Growth Driver: Leveraging extensive content archives through Taylor & Francis.

- Future Outlook: Agreements continue into 2025, indicating sustained demand.

- BCG Classification: Emerging Star due to rapid growth and market demand.

Strategic Expansion in Asia and Africa

Informa's strategic focus on expanding its B2B Live Events in Asia and Africa highlights these regions as stars in its portfolio. The company is actively pursuing growth in these dynamic markets, aiming to capitalize on increasing demand for in-person business interactions. This expansion is a key driver for Informa's overall international revenue growth targets.

By 2025, Informa has set an ambitious goal to increase revenue from its international operations by 15%. This objective underscores the significant potential seen in emerging economies, particularly within the Asian and African continents. The company's investment in these regions reflects a calculated strategy to tap into new market opportunities and strengthen its global presence.

- Geographic Focus: Asia and Africa are identified as key growth markets for Informa's B2B Live Events.

- Strategic Objective: To increase international revenue by 15% by 2025, driven by these expanding regions.

- Market Opportunity: Capitalizing on the growing demand for B2B interactions and new market penetration.

- Segment Strength: The B2B Live Events segment is particularly well-positioned to benefit from this international expansion.

Informa's AI data licensing, driven by its Taylor & Francis division, is a prime example of a star in the BCG matrix. This segment is experiencing rapid growth, with over $75 million in revenue generated in 2024 from these licensing agreements. The demand for curated data for AI development continues to surge, positioning Informa to leverage its extensive content archives for significant future earnings.

The company's strategic expansion of its B2B Live Events into Asia and Africa also places these geographic markets as stars. Informa aims to boost international revenue by 15% by 2025, with a strong focus on these dynamic regions. This growth is fueled by increasing demand for in-person business interactions and Informa's proactive market penetration strategies.

| BCG Category | Segment/Market | Key Growth Drivers | Financial Highlight (2024/2025 Projections) | Strategic Importance |

|---|---|---|---|---|

| Stars | AI Data Licensing (Taylor & Francis) | High demand for curated data in AI development, Informa's extensive content archives | Exceeded $75 million in 2024 revenue; continued strong performance projected into 2025 | Leveraging intellectual property for high-value, recurring revenue streams |

| Stars | B2B Live Events (Asia & Africa Expansion) | Increasing demand for in-person business interactions, new market penetration | Targeting 15% international revenue growth by 2025, driven by these regions | Expanding global footprint and capturing growth in emerging economies |

What is included in the product

Highlights which Informa plc business units to invest in, hold, or divest based on market growth and share.

A clear BCG Matrix visualization helps leadership quickly identify underperforming units, easing the pain of strategic indecision.

Cash Cows

Informa Markets' core exhibition portfolio, particularly in sectors like Construction and Pharma, functions as a robust cash cow for Informa plc. These are large, established B2B events with a significant market share in mature, stable industries. Their transaction-led model generates consistent, predictable revenue from exhibitors, contributing substantially to the company's free cash flow.

These established exhibitions benefit from high market share in mature industries, meaning they require less intensive marketing spend to maintain their position. For example, Informa's acquisition of Tarsus Group in 2023, which includes significant exhibition assets, highlights the ongoing strategic importance of these mature, cash-generative businesses. In 2023, Informa reported revenue growth driven by its Events division, where exhibitions are a primary component.

Taylor & Francis' core subscription journals, boasting over 2,500 peer-reviewed titles, represent a significant cash cow for Informa plc. This segment benefits from strong subscription renewal rates, a testament to its established position in the academic publishing market.

Operating within a mature but stable academic landscape, Taylor & Francis commands a high market share. This dominance translates into high customer retention and consistent cash collection, underpinning its role as a reliable revenue generator.

The consistent performance of these journals provides Informa with stable revenue streams and healthy profit margins. This financial stability allows for continued investment in other business areas.

Informa Connect's established B2B communities, particularly in Finance and Life Sciences, are prime examples of cash cows within Informa plc's portfolio. These platforms have cultivated deep networks and deliver crucial knowledge, consistently generating revenue through memberships, training programs, and high-profile events.

While these mature sectors may exhibit moderate market growth, Informa's strong market leadership in these areas allows for significant profit margins and a reliable, steady cash flow. For instance, Informa's 2023 financial results showed continued strength in its Knowledge and Events segments, which house these community-based businesses, contributing significantly to the company's overall profitability.

Recurring Data & Intelligence Services (Ex-Divested)

Informa plc's remaining core recurring data and intelligence services, particularly those linked to B2B events and academic publishing, function as robust cash cows. These segments offer crucial insights and data to niche B2B markets, benefiting from consistent demand and strong customer retention.

These services are characterized by high revenue visibility, with Informa plc reporting that approximately 80% of its 2025 revenue is already committed or visible. This predictability underscores their cash cow status.

The stability of these recurring revenue streams is a significant advantage for Informa plc.

- Stable Demand: Specialized B2B markets exhibit consistent need for data and intelligence.

- High Customer Loyalty: Long-term relationships foster recurring revenue.

- Revenue Visibility: Around 80% of 2025 revenue is already secured.

- Profitability: These services typically have high margins due to their established nature.

Long-Standing Brand Franchises in Stable Markets

Informa's portfolio features several long-standing brand franchises, particularly within its B2B markets and academic publishing segments, which are classic cash cows. These established brands have deep roots and global recognition, fostering significant customer loyalty and trust. This allows them to maintain strong market positions with relatively minimal investment, ensuring consistent and robust cash flow for the company.

These cash cow brands benefit from mature, stable markets where competition is often less intense due to high barriers to entry, such as established reputations and extensive distribution networks. Their consistent profitability is a key strength, providing the financial foundation for Informa to invest in growth areas or other business units.

- Brand Strength: Informa's brands like Lloyd's List and Taylor & Francis are recognized globally, indicating strong brand equity.

- Market Penetration: Deep penetration in niche B2B sectors and academic fields ensures a stable customer base.

- Profitability: These segments typically exhibit high profit margins due to established market positions and recurring revenue models.

- Cash Generation: The mature nature of these businesses means they generate substantial free cash flow, supporting overall corporate financial health.

Informa plc's established exhibitions, particularly in sectors like Construction and Pharma, are significant cash cows. These events benefit from high market share in mature industries, requiring less marketing investment to maintain their position. Informa's acquisition of Tarsus Group in 2023, which includes substantial exhibition assets, underscores the strategic value of these mature, cash-generating businesses. The Events division, a primary driver of Informa's revenue growth in 2023, heavily features these exhibitions.

Taylor & Francis' extensive portfolio of over 2,500 peer-reviewed journals acts as another core cash cow. The high subscription renewal rates demonstrate its strong standing in academic publishing. This segment operates in a stable academic market with significant market share, leading to strong customer retention and consistent cash flow, making it a reliable revenue generator for Informa.

Informa Connect's established B2B communities in Finance and Life Sciences also function as cash cows. These platforms leverage deep networks and deliver essential knowledge, consistently generating revenue through memberships, training, and events. Despite moderate market growth, Informa's leadership in these sectors ensures high profit margins and steady cash flow, as reflected in the continued strength of its Knowledge and Events segments in 2023.

Recurring data and intelligence services, especially those tied to B2B events and academic publishing, are robust cash cows for Informa plc. These services provide critical insights to niche B2B markets, benefiting from consistent demand and high customer loyalty. Informa plc has stated that approximately 80% of its 2025 revenue is already committed, highlighting the predictability of these recurring revenue streams.

| Business Segment | BCG Category | Key Characteristics | Financial Contribution (Illustrative) |

| Informa Markets Exhibitions (Construction, Pharma) | Cash Cow | High market share, mature industry, stable demand, consistent revenue from exhibitors | Significant contributor to free cash flow, high profit margins |

| Taylor & Francis Journals | Cash Cow | High subscription renewal rates, strong market share in academic publishing, recurring revenue | Reliable revenue generator, stable profit margins |

| Informa Connect Communities (Finance, Life Sciences) | Cash Cow | Deep B2B networks, consistent revenue from memberships and events, market leadership | Steady cash flow, high profit margins |

| Recurring Data & Intelligence Services | Cash Cow | High revenue visibility (approx. 80% of 2025 revenue committed), niche B2B markets, strong customer retention | Predictable revenue streams, high profitability |

Preview = Final Product

Informa plc BCG Matrix

The Informa plc BCG Matrix preview you are seeing is the exact, fully formatted report you will receive immediately after purchase. This ensures you get a comprehensive, analysis-ready document without any watermarks or demo content. You can confidently use this preview as a true representation of the professional strategic tool that will be yours to download and implement.

Dogs

Underperforming legacy print publications, particularly those considered non-core to Informa plc's digital-first strategy, would likely fall into the Dogs quadrant of the BCG Matrix. These titles often struggle with low market share in industries experiencing decline or stagnation, such as certain segments of the traditional print media landscape.

For instance, while Informa has aggressively pursued digital transformation, some of its older, niche print publications may not have a strong online presence or appeal to rapidly growing digital audiences. These assets could be draining resources without generating substantial returns, a classic characteristic of a Dog. Informa's 2023 annual report, for example, highlights continued investment in digital growth, underscoring the strategic shift away from traditional print models where such assets might reside.

Marginal Events with Limited Growth Potential represent a category within the BCG Matrix where opportunities are scarce and returns are unlikely to be substantial. These are often smaller, localized events, or those catering to highly specialized niches that struggle to attract significant attendance or exhibitor participation. For instance, a regional trade show for a declining industry might fall into this category, showing minimal year-over-year growth.

These events typically hold a low market share within their respective segments, which are themselves characterized by low growth rates. Financially, they often operate at a breakeven point or even incur losses, indicating a lack of profitability. An example could be a niche hobby convention that has seen its core demographic shrink over the past decade, consistently failing to cover its operational costs without external subsidies.

Given their limited growth prospects and poor potential for returns, investing further in these marginal events is generally not advisable. Companies often consider discontinuing them or exploring consolidation opportunities with similar, underperforming events to mitigate losses and reallocate resources to more promising ventures. In 2024, many event organizers are scrutinizing their portfolios, with reports indicating a trend of divesting or sunsetting events that do not demonstrate a clear path to profitability or significant market expansion.

Outdated digital platforms or services are prime candidates for the Dogs quadrant of the BCG Matrix. These are digital offerings that have failed to adapt to rapid technological shifts and changing consumer expectations. For instance, a legacy e-commerce platform that hasn't implemented mobile-first design or personalized recommendations might see its user engagement plummet.

Such platforms typically exhibit low market share and low growth potential. In 2024, many companies are still grappling with the costs of maintaining these aging systems, which often drain resources without generating significant returns. Consider a company that invested heavily in a proprietary content management system in the early 2010s; by 2024, it likely struggles to compete with flexible, cloud-based solutions, leading to low user adoption and minimal revenue contribution.

Non-Core, Divested Intelligence Businesses

Informa plc's former Pharma Intelligence, Maritime Intelligence, and EPFR Fund Flow Intelligence businesses, prior to their divestment, likely occupied the 'Dog' quadrant of the BCG Matrix. These divisions, while generating revenue, were not strategically aligned with Informa's core growth objectives and represented underperforming assets. Their sale, part of the Growth Acceleration Plan 2 (GAP 2), allowed for capital reallocation towards more promising ventures.

- Divested Businesses: Pharma Intelligence, Maritime Intelligence, EPFR Fund Flow Intelligence.

- Strategic Fit: Viewed as non-core or underperforming relative to Informa's future growth focus.

- Capital Reallocation: Divestment enabled focus on high-growth areas under GAP 2.

- Financial Impact: While specific 2024 financial data for these divested entities is not applicable, Informa's overall strategy aims to enhance profitability through strategic portfolio management.

Specific Niche Training Programs with Low Enrollment

Within Informa Connect's vast portfolio, niche training programs with consistently low enrollment and diminishing market relevance would fall into the Dogs category of the BCG matrix. These offerings likely represent a small fraction of Informa's overall revenue, perhaps even a net cost if marketing and operational expenses outweigh the minimal income generated. For instance, a highly specialized program on a technology that has been largely superseded, or a regulatory training course for a market that has significantly shrunk, would fit this description. Such programs require disproportionate marketing spend for negligible returns, indicating a strategic need for review.

Consider these examples of programs that might be classified as Dogs:

- Outdated Software Training: Programs focused on legacy enterprise software that has been replaced by newer, more efficient systems, with enrollment numbers in the low dozens annually.

- Obsolete Industry Compliance: Training modules for regulations that are no longer in effect or have been significantly amended, attracting only a handful of participants seeking historical context rather than current applicability.

- Hyper-Specialized Niche Skills: Courses targeting extremely narrow skill sets with a very limited professional pool, where annual attendance might not even reach double digits.

Dogs in Informa plc's BCG Matrix typically represent underperforming assets with low market share in slow-growing or declining industries. These could include legacy print publications that haven't transitioned effectively to digital or niche training programs with dwindling demand. Informa's strategic divestments, such as Pharma Intelligence, highlight a move to shed these less profitable ventures.

In 2024, the focus remains on optimizing the portfolio by identifying and managing these 'Dog' assets. This often involves either divesting them to free up capital or exploring ways to minimize their resource drain without significant investment. The company's continued emphasis on digital transformation suggests that any remaining print-centric or outdated digital offerings are prime candidates for this classification.

The financial performance of these 'Dog' segments is characterized by low profitability and minimal growth potential. For instance, a niche trade show that struggles to attract exhibitors due to a shrinking industry might break even at best. Informa's 2023 reports indicate a strategic pruning of the portfolio, aiming to enhance overall efficiency and focus resources on high-growth areas.

These underperforming units require careful management to prevent them from becoming significant drains on company resources. The strategic decision to divest certain businesses in the past demonstrates Informa's approach to managing its 'Dog' portfolio by removing assets that no longer align with its growth objectives.

Question Marks

Informa TechTarget, a significant entity within Informa plc's portfolio, is positioned as a Question Mark in the BCG matrix. This classification stems from its operation within the high-growth enterprise technology sector, yet it has experienced a revenue decline of roughly 4.3% in the first half of 2025, accompanied by a substantial non-cash impairment charge.

Informa has designated 2025 as a 'Foundation Year' for Informa TechTarget, signaling a strategic focus on building a base for future expansion. This implies the business currently possesses considerable growth potential but struggles with a low market share and profitability, necessitating significant investment to capture market position.

Informa plc is making substantial investments in new digital products and the integration of artificial intelligence across its operations. These efforts are aimed at boosting efficiency and fostering innovation throughout the company.

While these AI-driven solutions represent a high-growth sector, they are currently in their nascent stages of development, meaning their market share is yet to be firmly established. The company's 2023 annual report highlighted significant R&D spending, with a notable portion allocated to digital transformation and AI capabilities, though specific figures for these new products are often embedded within broader investment categories.

These ventures are considerable cash consumers due to the extensive development and deployment required. However, their strategic importance lies in their potential to evolve into future Stars within Informa's portfolio, provided they achieve successful adoption and widespread scaling across the company's varied business segments.

Emerging niche communities within Informa Connect, focusing on new or rapidly developing B2B sectors, are positioned as question marks in the BCG matrix. These communities target nascent industries with high growth potential, but Informa is still in the process of building its market share and influence. For example, Informa Connect's ventures into rapidly evolving tech sectors like AI ethics or sustainable supply chain management represent these emerging communities.

These nascent communities require significant investment in content creation, fostering engagement, and targeted marketing to achieve critical mass and demonstrate long-term sustainability. For instance, in 2024, Informa Connect has allocated substantial resources to develop specialized content and host targeted events for these growing sectors, aiming to establish leadership. The success of these question marks hinges on their ability to capture market share before the industries mature.

Small-Scale, Pilot Event Launches in New Geographies/Sectors

Informa plc often initiates small-scale pilot events in new geographic regions or specialized sectors. These ventures are strategically positioned as Question Marks within the BCG matrix, reflecting their status in potentially high-growth markets but with currently low market share and significant upfront investment requirements.

The success of these pilot events is critically dependent on achieving swift market acceptance and enabling effective scaling. Without sufficient traction, they risk transitioning into the Dog category, characterized by low growth and low market share.

- Strategic Rationale: Informa's approach allows for testing market viability with reduced risk before committing to larger-scale rollouts.

- Financial Implications: Initial investment in pilot events can be substantial, impacting short-term profitability until market share is established.

- Market Dynamics: Success hinges on factors like local economic conditions, competitive landscape, and the ability to attract a critical mass of attendees and exhibitors.

- 2024 Context: Informa’s ongoing expansion into emerging markets, such as Southeast Asia and specific niche technology sectors, exemplifies this strategy, with early indicators of growth in events like their AI summits in Singapore and Jakarta during 2024.

Targeted Acquisitions in Fragmented, Growing Markets

Informa plc's strategy actively pursues inorganic growth by acquiring businesses in fragmented, high-growth B2B markets. This approach is central to its business model, aiming to consolidate market share and leverage synergies.

Recent acquisitions, such as Ascential which was completed in October 2024 for approximately £1.4 billion, initially represent Question Marks within Informa's BCG matrix. These entities require substantial post-acquisition investment and careful strategic integration to realize their full potential and drive future growth.

The integration process for acquisitions like Ascential involves optimizing operations, cross-selling opportunities, and expanding market presence within Informa's existing portfolio. Success hinges on effectively managing these new assets to transition them from Question Marks to Stars or Cash Cows.

- Ascential Acquisition: Informa plc acquired Ascential in October 2024 for £1.4 billion, targeting its digital commerce and marketing businesses.

- Market Fragmentation: The strategy focuses on fragmented markets where consolidation can lead to significant market share gains.

- Synergy Realization: Post-acquisition investment is crucial for unlocking synergies and improving the acquired businesses' profitability and market position.

- Strategic Integration: Informa aims to integrate these acquisitions effectively to drive growth and enhance its overall business portfolio.

Question Marks in Informa plc's portfolio represent business units or ventures with high growth potential but currently low market share. These require significant investment to capture market position and can evolve into Stars or, if unsuccessful, Dogs.

Informa TechTarget, despite operating in a high-growth sector, experienced a revenue decline in early 2025, underscoring its Question Mark status. The company is investing heavily in AI and digital products, which are also nascent, high-potential but low-share ventures.

Emerging niche communities within Informa Connect and pilot events in new markets exemplify this strategy, demanding substantial investment and swift market acceptance to succeed.

The acquisition of Ascential in October 2024 for £1.4 billion also initially positions it as a Question Mark, requiring strategic integration and investment to realize its potential.

| Business Unit/Venture | Market Growth | Market Share | Investment Need | Potential Outcome |

|---|---|---|---|---|

| Informa TechTarget | High | Low | High | Star or Dog |

| New AI/Digital Products | High | Low | High | Star or Dog |

| Emerging Niche Communities (Informa Connect) | High | Low | High | Star or Dog |

| Pilot Events (New Markets/Sectors) | High | Low | High | Star or Dog |

| Ascential (Post-Acquisition) | High | Low (initially) | High | Star or Cash Cow |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial reports, industry analyses, and consumer behavior studies, to accurately position business units.