IndusInd Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IndusInd Bank Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping IndusInd Bank's trajectory. Our meticulously researched PESTLE analysis provides a clear roadmap of external forces, empowering you to anticipate challenges and seize opportunities. Don't navigate the complexities alone; download the full version now for actionable intelligence.

Political factors

The Indian government's strong commitment to financial inclusion, exemplified by programs like the Pradhan Mantri Jan Dhan Yojana (PMJDY), actively promotes the extension of banking services to previously unreached communities. This policy directly supports IndusInd Bank's strategic goals by opening avenues for significant customer base expansion, particularly in rural and semi-urban geographies.

As of early 2024, PMJDY has facilitated the opening of over 50 crore (500 million) bank accounts, with a substantial portion belonging to women and individuals in rural areas, underscoring the program's reach and impact. This surge in account ownership translates into a larger pool of potential customers for banks like IndusInd, eager to access digital banking, credit, and insurance products, thereby contributing to broader economic development.

The Indian banking sector, including IndusInd Bank, is shaped by the Reserve Bank of India's (RBI) comprehensive regulatory oversight. Recent legislative updates, such as the anticipated Banking Laws (Amendment) Act, 2025, are designed to bolster governance structures, increase audit transparency, and bolster depositor safeguards, directly impacting operational strategies and overall sector stability.

The Reserve Bank of India's (RBI) monetary policy, particularly its stance on interest rates and liquidity, significantly shapes IndusInd Bank's financial performance. Decisions on the repo rate and liquidity management directly influence the bank's net interest margins (NIMs) and its ability to grow its loan book.

With projections for potential repo rate cuts in fiscal year 2025, IndusInd Bank, like other financial institutions, will need to navigate evolving lending rates. This shift could impact overall profitability, necessitating strategic adjustments in asset-liability management and pricing strategies to maintain competitive positioning and profitability.

Government Initiatives for Digital India

The Indian government's strong emphasis on the 'Digital India' initiative is a significant political factor, driving widespread adoption of digital payment systems like the Unified Payments Interface (UPI). This digital push directly encourages banks, including IndusInd Bank, to accelerate their investments in digital transformation.

This evolving landscape supports IndusInd Bank's strategy to enhance its digital offerings, making financial services more accessible and efficient for a broader customer base. For instance, UPI transactions in India reached an astounding 13.42 billion in the fiscal year 2023-24, highlighting the massive shift towards digital payments.

- Government's Digital India Mission: Fosters a favorable environment for digital banking adoption.

- UPI Growth: Record UPI transactions in FY24 (13.42 billion) underscore the consumer shift to digital.

- Banking Sector Investment: Encourages banks like IndusInd to invest in digital infrastructure and services.

Anti-Fraud and Compliance Enforcement

Regulatory bodies such as SEBI and the RBI are intensifying their focus on financial institutions, particularly concerning accounting practices and the prevention of fraud and insider trading. This heightened scrutiny directly impacts a bank's operational framework and its standing in the market.

Recent instances, including alleged accounting irregularities and suspected fraudulent activities at IndusInd Bank, underscore the paramount importance of strong internal control mechanisms and unwavering compliance adherence. These events serve as a stark reminder of the potential repercussions for lapses.

- Increased Regulatory Oversight: SEBI and RBI have been more proactive in investigating financial misrepresentation and insider dealings, leading to stricter compliance requirements for banks.

- Impact on Reputation: Allegations of fraud can severely damage a bank's reputation, affecting customer trust and investor confidence, as seen in market reactions to past scandals.

- Focus on Internal Controls: Banks are under pressure to bolster their internal audit functions and compliance departments to preemptively identify and mitigate risks associated with financial malfeasance.

- Potential Penalties: Non-compliance or proven fraud can result in significant financial penalties, operational restrictions, and even criminal charges against individuals involved, as per recent enforcement actions across the sector.

Government initiatives like Digital India and the massive adoption of UPI, with 13.42 billion transactions in FY24, are pushing banks like IndusInd to invest heavily in digital transformation. This creates opportunities for wider customer reach and more efficient service delivery.

The Reserve Bank of India's (RBI) monetary policy, particularly interest rate decisions, directly influences IndusInd Bank's profitability through net interest margins. Anticipated repo rate adjustments in fiscal year 2025 will necessitate strategic asset-liability management.

Increased regulatory scrutiny from bodies like SEBI and the RBI, especially concerning accounting practices and fraud prevention, means banks must strengthen internal controls. Past allegations highlight the critical need for robust compliance to maintain trust and avoid penalties.

| Political Factor | Impact on IndusInd Bank | Supporting Data/Trend |

|---|---|---|

| Financial Inclusion Policies (e.g., PMJDY) | Expands customer base, especially in rural areas. | Over 50 crore (500 million) accounts opened by early 2024. |

| Digital India Initiative & UPI Growth | Drives investment in digital banking services. | 13.42 billion UPI transactions in FY23-24. |

| RBI Monetary Policy (Repo Rate) | Affects Net Interest Margins (NIMs). | Potential repo rate cuts in FY25 expected to influence lending rates. |

| Regulatory Oversight (SEBI, RBI) | Demands stronger internal controls and compliance. | Increased focus on accounting practices and fraud prevention. |

What is included in the product

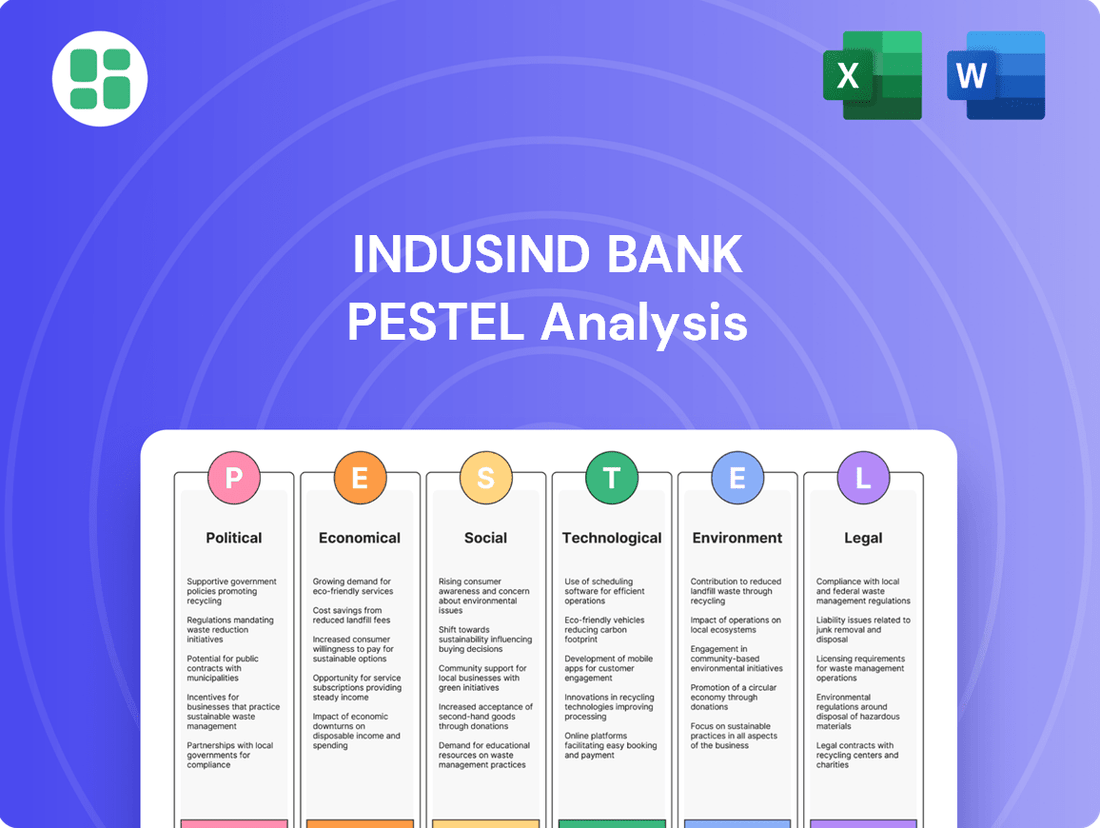

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing IndusInd Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within the bank's operating landscape.

This IndusInd Bank PESTLE analysis offers a concise, easily digestible summary, acting as a pain point reliever by providing clear insights for quick referencing during meetings and presentations.

It functions as a valuable asset for business consultants, offering a neatly organized and aesthetically formatted version of the PESTLE analysis perfect for inclusion in client reports and pitch packs.

Economic factors

India's economy is showing remarkable strength, with projections for its Gross Domestic Product (GDP) growth for the fiscal year 2024-2025 (FY25) hovering between 6.3% and 7%. This robust expansion creates a fertile ground for the banking sector to flourish.

This economic momentum directly translates into increased demand for credit across various sectors. From individual consumers seeking loans for homes and vehicles to large corporations funding expansion and small and medium-sized enterprises (MSMEs) requiring working capital, the appetite for borrowing is high. This surge in credit demand is a significant tailwind for banks like IndusInd, supporting the growth of their loan portfolios and overall business volumes.

India's inflation rate has shown a notable easing trend, with the Consumer Price Index (CPI) reported at 4.83% in April 2024, down from 4.85% in March 2024. This moderation provides room for the Reserve Bank of India (RBI) to consider policy adjustments, although a cautious stance is likely to persist given global economic uncertainties. For IndusInd Bank, this environment directly influences its cost of funds and the borrowing appetite of its customers.

The prevailing interest rate environment remains a critical factor for IndusInd Bank's profitability. While inflation has been trending downwards, the RBI's monetary policy stance, which has kept the repo rate at 6.50% since February 2023, directly impacts the bank's net interest margins (NIMs). Higher interest rates generally support wider NIMs, but they can also dampen loan demand, creating a delicate balance for the bank's growth strategy in 2024 and into 2025.

The Indian banking sector is witnessing robust credit growth, projected to moderate slightly to around 12-14% in fiscal year 2025, down from an estimated 15-16% in FY24. This expansion fuels business opportunities for banks like IndusInd.

Concurrently, asset quality is on an upward trajectory, with Gross Non-Performing Asset (GNPA) ratios for public sector banks falling to a multi-year low of 3.2% as of September 2023, and private banks also showing similar improvements. This trend of declining NPAs signifies a stronger, healthier loan portfolio across the industry.

For IndusInd Bank, these improving asset quality trends mean reduced provisioning requirements, thereby boosting profitability. While the bank made some specific provisions in Q3 FY24, the overall industry health presents a favorable environment for sustained, responsible lending growth and enhanced financial performance.

Increasing Private Consumption and Middle Class Expansion

The burgeoning Indian middle class, projected to reach 475 million by 2030 according to the Economic Times, fuels robust private consumption. This demographic shift directly translates into increased demand for sophisticated financial products and services, presenting a significant growth avenue for IndusInd Bank.

IndusInd Bank is strategically positioned to capitalize on this trend by expanding its retail offerings. The bank is focusing on developing and promoting a wider array of products such as personal loans, home loans, credit cards, and diverse investment solutions, all designed to meet the evolving financial aspirations of this growing consumer base.

- Growing Middle Class: India's middle class is expanding rapidly, driving demand for financial services.

- Rising Private Consumption: Increased disposable incomes lead to higher spending on goods and services, including financial products.

- Retail Banking Focus: IndusInd Bank is enhancing its retail product portfolio to cater to these evolving consumer needs.

- Product Diversification: The bank is offering a broader range of loans, credit cards, and investment options.

Global Economic Uncertainties

Global economic uncertainties, including a potential slowdown in major economies and ongoing geopolitical tensions, present significant risks to India's economic trajectory and, by extension, its banking sector. These external factors can directly impact capital flows into India, affecting foreign investment and liquidity. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.9% in 2024, down from 3.0% in 2023, highlighting a challenging global environment.

IndusInd Bank must closely track these global dynamics as they can influence crucial areas of its business. Trade finance volumes might contract if global demand weakens, and shifts in investor sentiment due to international instability can lead to volatility in equity markets and currency exchange rates, impacting the bank's profitability and risk profile. The World Bank's January 2024 forecast indicated that emerging market and developing economies, including India, face headwinds from tighter global financial conditions and subdued commodity prices.

- Global Growth Slowdown: IMF forecasts global growth at 2.9% for 2024, a slight dip from 3.0% in 2023, indicating a less robust international economic environment.

- Geopolitical Risks: Ongoing conflicts and political instability in various regions can disrupt supply chains, increase energy costs, and dampen international trade, creating ripple effects for economies like India.

- Capital Flow Sensitivity: Indian banks, including IndusInd, are susceptible to fluctuations in foreign portfolio investment, which can be influenced by global risk appetite and interest rate differentials.

- Trade Finance Impact: A slowdown in global trade directly affects the demand for trade finance services, a key revenue stream for many banking institutions.

India's economy is poised for strong growth, with GDP projected between 6.3% and 7% for FY25, creating a favorable environment for banking sector expansion and increased credit demand across all segments. This economic momentum is supported by moderating inflation, with CPI at 4.83% in April 2024, allowing for potential policy adjustments by the RBI while keeping interest rates steady at 6.50% since February 2023.

Robust credit growth, anticipated to be around 12-14% in FY25, coupled with improving asset quality, evidenced by multi-year low GNPA ratios in the banking sector, presents a healthy operational landscape for IndusInd Bank. The expanding middle class, projected to reach 475 million by 2030, is a key driver for increased private consumption and demand for diversified financial products, which IndusInd Bank is actively catering to with its retail banking focus.

Global economic headwinds, including a projected slowdown in global growth to 2.9% in 2024 as per the IMF, and ongoing geopolitical risks, pose challenges. These external factors can impact capital flows, trade finance volumes, and market volatility, requiring IndusInd Bank to remain vigilant and adaptable to maintain its financial performance and risk profile.

| Economic Factor | Data Point | Implication for IndusInd Bank |

|---|---|---|

| GDP Growth (FY25 Projection) | 6.3% - 7% | Supports increased credit demand and loan portfolio growth. |

| Inflation (CPI, April 2024) | 4.83% | Moderation allows for potential policy flexibility, influencing cost of funds. |

| Repo Rate | 6.50% (since Feb 2023) | Impacts Net Interest Margins (NIMs) and borrowing appetite. |

| Credit Growth (FY25 Projection) | 12% - 14% | Indicates continued business opportunities in lending. |

| GNPA Ratio (Public Sector Banks, Sep 2023) | 3.2% (multi-year low) | Signifies improved industry asset quality, reducing provisioning needs. |

| Middle Class Projection (by 2030) | 475 million | Drives demand for retail financial products and services. |

| Global Growth Projection (2024) | 2.9% (IMF) | Potential headwinds for capital flows and trade finance. |

What You See Is What You Get

IndusInd Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of IndusInd Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Gain actionable insights into the strategic landscape shaping the bank's future.

Sociological factors

India's digital landscape is rapidly evolving, with a significant portion of its population gaining digital literacy and widespread smartphone adoption. This shift directly impacts how people engage with financial services.

IndusInd Bank is well-positioned to capitalize on this trend by enhancing its digital banking offerings. For instance, as of Q4 FY24, the bank reported a substantial increase in its digital transaction volumes, demonstrating the growing reliance on its online and mobile platforms by customers.

This digital transformation allows IndusInd Bank to reach a wider customer base, including those in remote areas, and provide them with convenient access to banking services. The bank's investment in user-friendly mobile apps and online portals directly addresses the demand for seamless digital interactions, fostering greater customer engagement and loyalty.

Societies increasingly expect financial services to be available to everyone, no matter where they live or their economic standing. This push for financial inclusion means banks need to reach remote and underserved populations.

IndusInd Bank's strategy directly addresses this by expanding its digital banking capabilities and physical presence. For instance, as of March 2024, IndusInd Bank reported a significant increase in its branch network and ATM deployments, particularly in rural and semi-urban areas, reflecting a commitment to accessibility.

This focus aligns with India's national financial inclusion objectives, aiming to bring more people into the formal banking system. The bank's digital initiatives, such as its mobile banking app and online account opening processes, further democratize access to financial products and services.

Modern customers increasingly demand banking experiences that feel uniquely theirs, moving beyond one-size-fits-all solutions. This societal shift means IndusInd Bank must increasingly focus on personalized offerings, leveraging data to anticipate and meet individual customer needs.

The drive for hyper-personalization is a significant sociological factor, pushing banks like IndusInd to adopt technologies such as artificial intelligence. For instance, by Q4 FY24, IndusInd Bank reported a substantial increase in digital transactions, indicating a customer preference for convenient, tech-enabled interactions that can be further tailored.

Demographic Shifts and Youth Population

India's demographic profile, characterized by a substantial youth population, presents a vast opportunity for banking and financial services. As of 2024, India's median age is around 28.7 years, with a significant portion of the population falling within the 15-34 age bracket. This segment is increasingly digital-native and seeks convenient, technology-driven banking solutions. IndusInd Bank can leverage this by focusing on innovative digital products and user-friendly platforms that resonate with tech-savvy younger consumers.

The growing aspiration and increasing disposable incomes among India's youth further amplify this potential. This demographic is actively seeking financial products that align with their lifestyle, from digital payments and investment apps to personalized loan offerings. IndusInd Bank's strategic focus on digital transformation positions it well to capture this burgeoning market segment.

- Youthful Demographics: India’s median age of approximately 28.7 years in 2024 signifies a large consumer base entering their prime earning and spending years.

- Digital Adoption: A significant percentage of this young population is highly proficient with digital technologies, driving demand for mobile banking and online financial services.

- Market Potential: This demographic shift offers IndusInd Bank a substantial opportunity to expand its customer base and market share through tailored digital offerings and financial inclusion initiatives.

Trust and Reputation in the Banking Sector

Public trust is the bedrock of the banking sector. Recent global events, including instances of financial misconduct and escalating cyber threats, have significantly impacted this trust. For IndusInd Bank, this means that demonstrating unwavering ethical conduct and maintaining transparent communication channels are paramount. These efforts are essential for bolstering its reputation and ensuring continued customer confidence in its services.

A strong reputation translates directly into customer loyalty and a willingness to engage with financial services. In the 2024 fiscal year, IndusInd Bank reported a customer base exceeding 35 million, underscoring the importance of trust in retaining and growing this base. Negative publicity, whether stemming from operational failures or perceived ethical lapses, can swiftly lead to customer attrition and damage long-term growth prospects.

- Customer Confidence: Maintaining high levels of public trust is critical for retaining IndusInd Bank's existing customer base and attracting new clients.

- Reputation Management: Proactive strategies to address public concerns and highlight ethical practices are vital for safeguarding IndusInd Bank's brand image.

- Cybersecurity Incidents: The potential for cyberattacks to erode trust necessitates robust security measures and clear communication protocols in the event of a breach.

- Ethical Governance: A commitment to strong corporate governance and transparent financial reporting reinforces the bank's credibility in the marketplace.

Societal expectations are increasingly shifting towards greater financial inclusion, pushing banks like IndusInd to serve remote and underserved populations. This aligns with national objectives, and IndusInd's expansion of its digital and physical presence, particularly in rural areas, as seen in its branch network growth by March 2024, directly addresses this demand.

Customers now expect personalized banking experiences, moving away from one-size-fits-all approaches. IndusInd Bank's investment in AI and data analytics to anticipate customer needs is a direct response to this trend, evidenced by the substantial increase in digital transactions by Q4 FY24, indicating a preference for tailored, tech-enabled interactions.

India's youthful demographic, with a median age of around 28.7 years in 2024, presents a significant opportunity for banks. This digitally native segment seeks convenient, technology-driven solutions, making IndusInd Bank's focus on innovative digital products and user-friendly platforms crucial for capturing this market.

Public trust remains paramount, especially in light of global financial misconduct and cyber threats. IndusInd Bank's commitment to ethical conduct and transparent communication is vital for maintaining customer confidence, as reflected in its customer base exceeding 35 million in FY24. Robust cybersecurity measures are essential to protect this trust.

Technological factors

IndusInd Bank is heavily invested in digital transformation, with offerings like its INDIE app enabling seamless self-onboarding and contactless transactions. This focus is crucial as India witnesses a surge in UPI and mobile banking adoption, with transaction volumes reaching significant milestones.

The Unified Payments Interface (UPI) processed over 15 billion transactions in 2023, a clear indicator of the shift towards digital payments. For IndusInd Bank, this trend necessitates continuous innovation in its digital channels to cater to evolving customer expectations for speed and convenience, ensuring it stays competitive in the rapidly digitizing financial landscape.

IndusInd Bank is increasingly integrating Artificial Intelligence (AI) and Machine Learning (ML) to sharpen its competitive edge. These technologies are pivotal for elevating customer experiences through personalized services and bolstering risk management, notably in areas like fraud detection. For instance, in 2024, the banking sector saw a significant uptick in AI-driven fraud prevention, with many institutions reporting a reduction in fraudulent transactions by as much as 15-20%.

By harnessing AI and ML, IndusInd Bank can develop more sophisticated credit scoring models, anticipate evolving customer demands, and automate routine operational tasks. This strategic adoption is projected to drive substantial gains in operational efficiency, a trend already evident in global banking where AI adoption is linked to improved profitability and reduced operational costs, with some estimates suggesting cost savings of up to 25% in specific back-office functions.

The expanding digital footprint of banking services, including those offered by IndusInd Bank, naturally amplifies cybersecurity risks. The Banking, Financial Services, and Insurance (BFSI) sector in India remains a significant target for sophisticated cyberattacks, posing a constant challenge.

To counter these evolving threats, IndusInd Bank is compelled to allocate substantial resources towards state-of-the-art cybersecurity solutions, robust data protection protocols, and continuous employee training. This proactive approach is crucial for safeguarding sensitive customer information and preserving the bank's reputation and customer trust.

In 2023, India's BFSI sector experienced a notable increase in cyber incidents, with ransomware and phishing attacks being particularly prevalent. For instance, reports indicated a significant rise in financial fraud cases targeting digital banking platforms, underscoring the urgency for enhanced security measures.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) are increasingly being considered by banks for their potential to boost transparency, efficiency, and security in financial operations. While still in the early stages of widespread adoption within the Indian banking sector, IndusInd Bank could find future opportunities in utilizing these technologies for streamlined interbank transactions and more robust record-keeping.

The global blockchain in banking market was valued at approximately USD 1.5 billion in 2023 and is projected to grow significantly, indicating a clear trend towards exploring these innovations. This growth is fueled by the promise of reduced transaction costs and faster settlement times, which are critical for competitive banking.

- Enhanced Security: DLT's cryptographic nature offers a high level of security, making it harder to tamper with transaction records.

- Increased Efficiency: Blockchain can automate processes like reconciliation and settlement, reducing manual intervention and speeding up operations.

- Improved Transparency: Shared ledgers provide a single, immutable source of truth for all participants, fostering greater trust and accountability.

Rise of Fintech Collaborations and Embedded Finance

The banking sector in 2024 and 2025 is witnessing a significant surge in fintech collaborations and the expansion of embedded finance. This trend sees financial services seamlessly integrated into non-financial platforms, creating new avenues for customer engagement and service delivery. For IndusInd Bank, this presents a dual dynamic of competitive challenge from agile fintechs and a substantial opportunity for strategic partnerships.

IndusInd Bank can proactively engage with fintech innovators to leverage their technological prowess and customer-centric approaches. By embracing Banking-as-a-Service (BaaS) models, the bank can extend its financial solutions to a wider audience through these integrated platforms. This strategy allows for the offering of contextual financial products, such as point-of-sale financing or insurance at the time of purchase, thereby enhancing customer convenience and driving new revenue streams.

- Fintech Investment Growth: Global fintech funding reached an estimated $150 billion in 2023, with a projected continued upward trend in 2024-2025, signaling strong investor confidence in the sector.

- Embedded Finance Market Size: The embedded finance market is anticipated to grow to over $7 trillion by 2030, highlighting the immense potential for banks to participate in this evolving landscape.

- BaaS Adoption: Over 60% of banks globally are exploring or actively implementing BaaS strategies to expand their digital offerings and reach new customer segments.

Technological advancements are reshaping banking, with IndusInd Bank leveraging digital tools like its INDIE app for seamless transactions, mirroring India's rapid UPI adoption, which saw over 15 billion transactions in 2023.

The bank is integrating AI and ML for personalized customer experiences and enhanced risk management, a trend supported by a 15-20% reduction in fraud reported by some institutions using AI in 2024.

While blockchain offers future potential for efficiency and security, the immediate focus remains on robust cybersecurity to combat increasing threats in the BFSI sector, which saw a rise in cyber incidents in 2023.

Fintech collaborations and embedded finance are creating new opportunities, with global fintech funding estimated at $150 billion in 2023 and the embedded finance market projected to exceed $7 trillion by 2030.

| Technology Focus | Key Development/Trend | IndusInd Bank Relevance/Action | Supporting Data (2023-2025 Projection) |

| Digital Transformation | UPI Adoption Surge | INDIE app for self-onboarding, contactless transactions | 15+ billion UPI transactions in 2023 |

| Artificial Intelligence (AI) / Machine Learning (ML) | Personalization & Risk Management | Sophisticated credit scoring, fraud detection | 15-20% fraud reduction via AI (reported by some banks in 2024) |

| Cybersecurity | Increased Cyber Threats | Investment in advanced solutions, data protection | Rise in BFSI cyber incidents (e.g., ransomware, phishing) in 2023 |

| Fintech & Embedded Finance | Industry Collaboration | Exploring BaaS, strategic partnerships | $150 billion global fintech funding (2023); $7+ trillion embedded finance market by 2030 (projection) |

Legal factors

The Banking Laws (Amendment) Act, 2025, effective August 2025, brings substantial changes to India's banking sector, focusing on modernization and enhanced governance. IndusInd Bank must adapt its operations to align with these new regulations.

Key amendments address corporate governance, aiming for greater transparency and accountability, alongside stricter requirements for audit quality to bolster financial integrity. These changes are designed to strengthen depositor protection, a critical aspect for customer trust and the overall stability of the banking system.

The Reserve Bank of India (RBI) has significantly tightened its grip on digital lending with new regulations effective from 2024. These rules mandate explicit customer consent for data usage, enforce data localization requirements, and demand increased transparency in lending practices. For IndusInd Bank, this means a critical need to fortify its compliance frameworks to ensure all digital lending operations adhere strictly to these guidelines, thereby mitigating risks of penalties and reputational damage.

IndusInd Bank's financial health is significantly shaped by the Reserve Bank of India's (RBI) prudential norms. These include capital adequacy requirements, largely aligned with Basel III, and rules for setting aside provisions for non-performing assets (NPAs). These regulations directly impact the bank's ability to lend and its overall profitability.

Recent regulatory adjustments, such as higher risk weights for unsecured retail loans and project finance, are particularly relevant for 2024 and 2025. For instance, as of December 31, 2023, IndusInd Bank's Capital to Risk-Weighted Assets Ratio (CRAR) stood at a robust 15.15%, well above the regulatory minimum. However, changes in risk weights could necessitate adjustments to its capital planning and provisioning strategies to maintain these favorable ratios.

Consumer Protection Laws and Grievance Redressal

Consumer protection laws are a significant factor for IndusInd Bank, mandating stringent adherence to fair practices and transparent dealings. The Reserve Bank of India (RBI) continuously updates its guidelines to safeguard customer interests, impacting how banks handle services, fees, and lending. For instance, the RBI's recent focus on digital lending practices underscores the need for clear communication regarding interest rates and charges. In 2023, the RBI reported a substantial increase in customer complaints, highlighting the critical importance of robust grievance redressal mechanisms for financial institutions like IndusInd.

IndusInd Bank must navigate these evolving legal landscapes to maintain customer trust and mitigate potential legal challenges. Failure to comply with consumer protection regulations can lead to penalties and reputational damage. The bank's commitment to transparent communication, fair charges, and ethical loan practices is paramount. As of early 2024, regulatory bodies are intensifying scrutiny on how financial institutions manage customer grievances, emphasizing the need for efficient and accessible redressal channels.

- RBI's Customer Service Directions: Mandate clear communication on fees, charges, and service quality.

- Digital Lending Guidelines: Require transparency in interest rates, processing fees, and recovery practices.

- Grievance Redressal Framework: Banks must have effective internal mechanisms and adhere to timelines for resolving customer complaints.

- Fair Practices Code: Ensures ethical conduct in all customer interactions, from account opening to loan recovery.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Norms

The evolving landscape of Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations demands continuous investment in sophisticated systems and rigorous processes at IndusInd Bank. Failure to comply can result in substantial fines and reputational damage.

For instance, in 2023, Indian banks collectively paid over ₹50 crore in penalties for various regulatory non-compliance issues, underscoring the financial impact of lapses in areas like KYC. IndusInd Bank, like its peers, must maintain vigilant oversight to ensure adherence to these critical norms.

- Regulatory Scrutiny: Increased focus from bodies like the Financial Intelligence Unit (FIU) means banks must demonstrate proactive AML/KYC measures.

- Technological Investment: Banks are investing in advanced analytics and AI to enhance transaction monitoring and customer due diligence.

- Cross-border Compliance: Adherence to international AML standards, such as those set by the Financial Action Task Force (FATF), is crucial for global operations.

The Banking Laws (Amendment) Act, 2025, effective August 2025, introduces significant updates to India's banking sector, emphasizing modernization and improved governance, necessitating operational adjustments for IndusInd Bank.

Stricter corporate governance, enhanced audit quality, and strengthened depositor protection are key amendments aimed at bolstering financial integrity and customer trust.

The Reserve Bank of India's 2024 digital lending regulations mandate explicit consent for data usage, data localization, and greater transparency, requiring IndusInd Bank to enhance its compliance frameworks to avoid penalties.

Environmental factors

IndusInd Bank is actively embedding Environmental, Social, and Governance (ESG) principles across its operations, from how it underwrites loans to how it reports its performance. This strategic alignment with global sustainability objectives and growing stakeholder demand for responsible finance is becoming a core part of its business model.

For instance, in its 2023-24 reporting, IndusInd Bank highlighted its progress in sustainable finance, noting a significant increase in its green portfolio. The bank reported a 15% year-on-year growth in its sustainable finance book, reaching INR 12,500 crore by March 2024, demonstrating a tangible commitment to environmentally conscious lending.

The Reserve Bank of India (RBI) has released draft guidelines for climate-related risk disclosure, aiming to bring Indian banks in line with global practices. These regulations, expected to be effective from the 2025-26 financial year, will mandate banks to report on their exposure to climate risks and any associated opportunities.

IndusInd Bank needs to establish comprehensive systems for evaluating and mitigating climate-related financial risks. This includes assessing both the direct impact on its own operations and the indirect risks embedded within its extensive loan and investment portfolios.

The financial sector is increasingly prioritizing green financing, with instruments like green loans, green bonds, and green deposits gaining traction to fund environmentally sound projects. IndusInd Bank can tap into this trend to attract investors focused on sustainability and bolster its commitment to a greener economy.

In 2023, the Indian green bond market saw significant growth, with issuances reaching approximately $10 billion, indicating a strong investor appetite for sustainable investments. IndusInd Bank's participation in this market could enhance its brand image and attract a new segment of capital.

Operational Environmental Footprint

IndusInd Bank, like any large commercial institution, has an environmental footprint largely shaped by its day-to-day operations. This includes the energy used to power its branches and data centers, the waste produced from office supplies, and the significant amount of paper consumed in banking transactions. Managing these aspects is crucial for sustainability.

The bank is committed to reducing its environmental impact. This involves implementing energy-efficient technologies across its facilities and promoting digital banking solutions to decrease paper reliance. For example, in FY23, IndusInd Bank reported a reduction in its carbon footprint, though specific figures for operational energy consumption and waste generation are not publicly detailed in a way that allows for direct comparison to previous years or industry benchmarks. However, the bank's sustainability reports highlight ongoing efforts in green initiatives.

- Energy Efficiency: Investments in energy-saving equipment and practices across its extensive branch network.

- Waste Management: Initiatives to reduce, reuse, and recycle office waste, with a focus on minimizing paper consumption through digitalization.

- Digital Transformation: Promoting online and mobile banking services to lessen the need for physical paper-based transactions.

- Sustainable Sourcing: Efforts to procure environmentally friendly office supplies and materials.

Regulatory Pressure for Environmental Compliance

IndusInd Bank, like all financial institutions, faces increasing regulatory pressure concerning environmental sustainability. This means a growing need to integrate eco-friendly practices into operations and transparently report on environmental performance. Adherence to environmental laws and active contribution to national environmental goals, such as those outlined in India's Nationally Determined Contributions (NDCs) under the Paris Agreement, are becoming critical.

The Reserve Bank of India (RBI) has been actively promoting sustainable finance. For instance, the RBI's Sustainable Finance initiatives encourage banks to consider Environmental, Social, and Governance (ESG) factors in their lending and investment decisions. This regulatory push is driving banks to develop frameworks for assessing climate-related risks and opportunities within their portfolios.

Key areas of regulatory focus for banks like IndusInd Bank include:

- Green Financing: Increasing the proportion of lending towards environmentally friendly projects and sectors.

- Climate Risk Management: Developing robust systems to identify, assess, and manage risks arising from climate change.

- Disclosure and Reporting: Enhancing transparency through standardized reporting on environmental impact and sustainability efforts, aligning with global frameworks.

- Operational Efficiency: Implementing measures to reduce the bank's own carbon footprint, such as energy efficiency in branches and data centers.

IndusInd Bank is increasingly focused on environmental factors, integrating ESG principles into its operations and reporting. The bank saw a 15% year-on-year growth in its sustainable finance book, reaching INR 12,500 crore by March 2024, reflecting a commitment to eco-conscious lending. The Indian green bond market also experienced substantial growth in 2023, with issuances around $10 billion, indicating strong investor interest in sustainable investments.

Regulatory bodies like the Reserve Bank of India (RBI) are pushing for greater climate-related risk disclosure and sustainable finance initiatives. These efforts aim to align Indian banks with global standards, requiring them to report on climate risks and opportunities. IndusInd Bank is actively developing systems to manage these risks across its loan and investment portfolios.

The bank is also working to reduce its operational environmental footprint through energy efficiency in its branches and data centers, alongside waste management and digitalization to decrease paper consumption. These initiatives are crucial for meeting evolving environmental regulations and stakeholder expectations.

| Metric | FY23/24 Data | Trend/Target |

| Sustainable Finance Book Growth | 15% YoY | Increasing |

| Green Bond Market Issuance (India) | ~$10 billion (2023) | Growing |

| RBI Climate Risk Disclosure Guidelines | Draft released, effective FY25-26 | Mandatory reporting |

PESTLE Analysis Data Sources

Our IndusInd Bank PESTLE analysis is built on a comprehensive review of data from reputable financial news outlets, official Reserve Bank of India (RBI) publications, and global economic forecasts. This ensures our insights into political, economic, and technological factors are current and well-supported.