IndusInd Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IndusInd Bank Bundle

Unlock the strategic blueprint behind IndusInd Bank's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they effectively serve diverse customer segments and build strong key partnerships. Discover their unique value propositions and revenue streams.

Dive into the operational core of IndusInd Bank's business model. Our full canvas unpacks their key resources, activities, and cost structure, providing a clear roadmap to their market position. Gain actionable insights for your own strategic planning.

Ready to understand IndusInd Bank's competitive advantage? Download the complete Business Model Canvas to explore their customer relationships and channels, offering a clear view of their growth strategy. Elevate your business acumen today.

Partnerships

IndusInd Bank actively collaborates with fintech companies to bolster its digital banking offerings and extend its customer base. These strategic alliances are key to introducing cutting-edge solutions, such as digital escrow services, and streamlining the online account opening experience. For instance, in 2023, IndusInd Bank announced a partnership with a leading fintech to integrate advanced AI-powered customer service chatbots, aiming to improve query resolution times by an estimated 30%.

These partnerships are vital for maintaining a competitive edge in the rapidly evolving digital finance sector. By leveraging the agility and innovation of fintechs, IndusInd Bank can rapidly deploy new features and services that meet modern customer expectations. The bank's commitment to digital transformation, evidenced by a reported 40% increase in digital transaction volumes in FY 2023-24, underscores the importance of these fintech collaborations.

IndusInd Bank's partnerships with global payment networks like Visa, Mastercard, and India's own RuPay are fundamental. These alliances allow the bank to issue and process credit and debit card transactions, a core offering. In 2023, IndusInd Bank reported a significant increase in its credit card portfolio, with outstanding balances reaching ₹30,923 crore, highlighting the crucial role these networks play in transaction volume and revenue generation.

IndusInd Bank collaborates with numerous technology vendors and service providers, crucial for its operational backbone. These partnerships are vital for maintaining its core banking systems, ensuring robust cybersecurity measures, managing cloud infrastructure, and developing its digital platforms. For instance, in 2023, the bank continued its focus on digital infrastructure, with IT expenditure playing a significant role in its overall operational costs.

These collaborations are instrumental in guaranteeing secure and efficient banking operations, directly supporting IndusInd Bank's ambitious digital transformation agenda. By leveraging these external technological capabilities, the bank can consistently introduce and enhance advanced banking features for its diverse customer base, keeping pace with evolving market demands and technological advancements.

Correspondent Banks and Financial Institutions

IndusInd Bank actively partners with correspondent banks and other financial institutions. These collaborations are crucial for facilitating interbank transactions, managing treasury operations, and processing international remittances. For instance, in the fiscal year 2023-24, IndusInd Bank reported a significant volume of foreign exchange transactions, underscoring the importance of these partnerships for its global reach.

These vital relationships enable IndusInd Bank to offer seamless cross-border services, particularly for its Non-Resident Indian (NRI) customer base. They also play a key role in bolstering the bank's liquidity management strategies and reinforcing its international presence. The bank's commitment to expanding its global footprint relies heavily on the strength and breadth of its correspondent banking network.

- Interbank Transactions: Facilitating smooth and efficient movement of funds between financial institutions.

- Treasury Operations: Supporting the bank's management of its assets and liabilities, including foreign currency dealings.

- International Remittances: Enabling customers, especially NRIs, to send and receive money across borders with ease.

- Liquidity Management: Ensuring the bank has adequate funds to meet its short-term obligations.

Government Agencies and Regulators

IndusInd Bank's relationship with government agencies and regulators, particularly the Reserve Bank of India (RBI), is foundational to its operations. This partnership is crucial for navigating the complex regulatory landscape, ensuring compliance with banking laws, and implementing national financial policies. For instance, the RBI's directives on digital banking and customer protection directly shape IndusInd's service offerings and operational frameworks.

These collaborations are vital for IndusInd Bank's participation in government-backed financial inclusion schemes. By working with bodies like the Ministry of Finance, the bank can extend its reach to underserved populations, contributing to broader economic development goals. This synergy allows IndusInd to leverage government initiatives for expanding its customer base and reinforcing its social impact.

Key aspects of this partnership include:

- Regulatory Compliance: Adherence to all RBI guidelines, including capital adequacy ratios and prudential norms, ensures the bank's stability and trustworthiness. In FY23, IndusInd Bank maintained a Capital Adequacy Ratio well above the regulatory requirement.

- Policy Implementation: Active participation in implementing government policies such as the Pradhan Mantri Jan Dhan Yojana (PMJDY) and various credit guarantee schemes.

- Financial Inclusion Initiatives: Collaborating on programs aimed at increasing access to banking services for rural and unbanked segments of the population.

- Digital Transformation Support: Aligning with government drives for digital payments and financial technology adoption, such as the Unified Payments Interface (UPI).

IndusInd Bank's strategic alliances with fintech companies are crucial for enhancing its digital banking capabilities and expanding its market reach. These partnerships enable the introduction of innovative solutions, such as advanced AI chatbots, which in 2023 aimed to improve customer service response times by approximately 30%. The bank's significant 40% surge in digital transaction volumes during FY 2023-24 highlights the critical role these collaborations play in its digital transformation efforts.

What is included in the product

IndusInd Bank's Business Model Canvas focuses on serving retail and corporate customers through a diversified product suite and digital channels, emphasizing customer-centricity and technological innovation to drive growth and profitability.

IndusInd Bank's Business Model Canvas acts as a pain point reliever by offering a structured, visual representation of their operations, enabling swift identification of inefficiencies and opportunities for improvement in areas like customer acquisition and service delivery.

Activities

IndusInd Bank's core activity revolves around attracting and managing a wide spectrum of deposits, from everyday savings and current accounts to term deposits. This diverse deposit base is crucial for its funding strategy.

The bank actively works to grow its retail deposit base, aiming to enhance its CASA (Current Account Savings Account) ratio. In the fiscal year 2023-24, IndusInd Bank reported a CASA ratio of 42.1%, demonstrating a steady increase and a commitment to low-cost funding.

Through continuous product innovation and leveraging digital channels, IndusInd Bank strives to make banking more accessible and attractive for its customers. This focus ensures a stable and cost-effective funding source, vital for its lending operations and overall financial health.

IndusInd Bank actively originates and manages a broad spectrum of loans, encompassing retail, corporate, and microfinance sectors. This diverse portfolio includes vehicle financing, business banking loans, personal loans, and credit card facilities, reflecting a comprehensive approach to credit provision.

The bank's commitment to robust risk assessment is a cornerstone of its loan management strategy. This involves thorough due diligence and ongoing monitoring to mitigate potential credit defaults, ensuring the health of its loan book. Collection processes are also a key focus, aimed at timely recovery and maintaining asset quality.

As of March 31, 2024, IndusInd Bank’s gross advances stood at ₹3,79,909 crore. The bank’s focus on diversified lending segments, supported by strong underwriting and collection mechanisms, positions it to manage its loan portfolio effectively amidst varying economic conditions.

IndusInd Bank actively develops, maintains, and enhances its digital banking platforms, such as the INDIE mobile app and INDIE for Business. These efforts ensure a seamless and secure online experience for customers, covering mobile banking, internet banking, and digital payment solutions.

This focus caters to the growing demand from tech-savvy individual customers and Micro, Small, and Medium Enterprises (MSMEs) for convenient digital services. By Q4 FY24, IndusInd Bank reported a significant 42% of its total advances were disbursed through digital channels, highlighting the importance of these platforms.

Wealth Management and Investment Solutions

IndusInd Bank's wealth management and investment solutions are a cornerstone activity, designed to offer a comprehensive suite of services to its affluent clientele. This involves providing tailored investment strategies, financial planning, and advisory services, crucial for diversifying the bank's revenue streams beyond traditional lending.

By catering to the holistic financial needs of individuals and high-net-worth clients, the bank solidifies its relationships and enhances customer loyalty. This focus allows them to capture a larger share of their clients' financial assets.

- Investment Solutions: Offering a range of investment products including mutual funds, equities, bonds, and alternative investments to meet diverse risk appetites and financial goals.

- Wealth Management Services: Providing personalized wealth management, estate planning, and succession planning for affluent individuals and families.

- Advisory: Delivering expert financial advice and market insights to guide clients in making informed investment decisions.

Risk Management and Compliance

IndusInd Bank's key activities heavily focus on robust risk management and unwavering compliance. This involves a multi-faceted approach to identifying, assessing, and actively mitigating a wide array of financial and operational risks. These include critical areas like credit risk, where the bank carefully evaluates borrower creditworthiness, market risk, which pertains to potential losses from market fluctuations, and increasingly, cybersecurity threats that demand constant vigilance.

Adherence to a stringent regulatory landscape and the maintenance of robust internal control frameworks are not merely procedural; they are foundational to the bank's stability and its reputation for integrity. For instance, in the fiscal year ending March 31, 2024, Indian banks, including IndusInd, operated under evolving regulatory directives from the Reserve Bank of India (RBI) aimed at strengthening the financial system.

- Credit Risk Mitigation: Implementing rigorous credit appraisal processes and ongoing monitoring of loan portfolios to minimize defaults.

- Market Risk Management: Utilizing sophisticated tools and strategies to hedge against adverse movements in interest rates, foreign exchange rates, and equity prices.

- Cybersecurity Defense: Investing in advanced technologies and protocols to protect customer data and banking systems from cyberattacks, a critical concern given the increasing digitalization of financial services.

- Regulatory Compliance: Ensuring full alignment with all applicable banking laws, regulations, and reporting requirements, such as those related to Know Your Customer (KYC) and Anti-Money Laundering (AML) norms.

IndusInd Bank's treasury operations are pivotal, managing the bank's liquidity, investments, and overall balance sheet. This involves strategic deployment of funds in government securities, corporate bonds, and money market instruments to optimize returns while adhering to prudential norms.

The bank actively engages in foreign exchange operations and derivatives trading to manage currency risk and cater to client needs. As of March 31, 2024, the bank's total assets stood at ₹5,17,675 crore, reflecting the scale of its treasury activities.

Treasury functions are critical for interest income generation and maintaining the bank's financial stability. The bank's investment portfolio is carefully managed to balance profitability with safety and liquidity requirements.

| Key Activity | Description | Financial Year 2023-24 Data (as of March 31, 2024) |

|---|---|---|

| Treasury Operations | Managing liquidity, investments, and balance sheet to optimize returns and ensure financial stability. | Total Assets: ₹5,17,675 crore |

| Foreign Exchange & Derivatives | Handling currency transactions and derivatives for risk management and client services. | N/A (Specific data not publicly detailed for this sub-activity) |

| Investment Portfolio Management | Strategic deployment of funds in securities and money market instruments. | N/A (Specific portfolio breakdown not publicly detailed) |

Delivered as Displayed

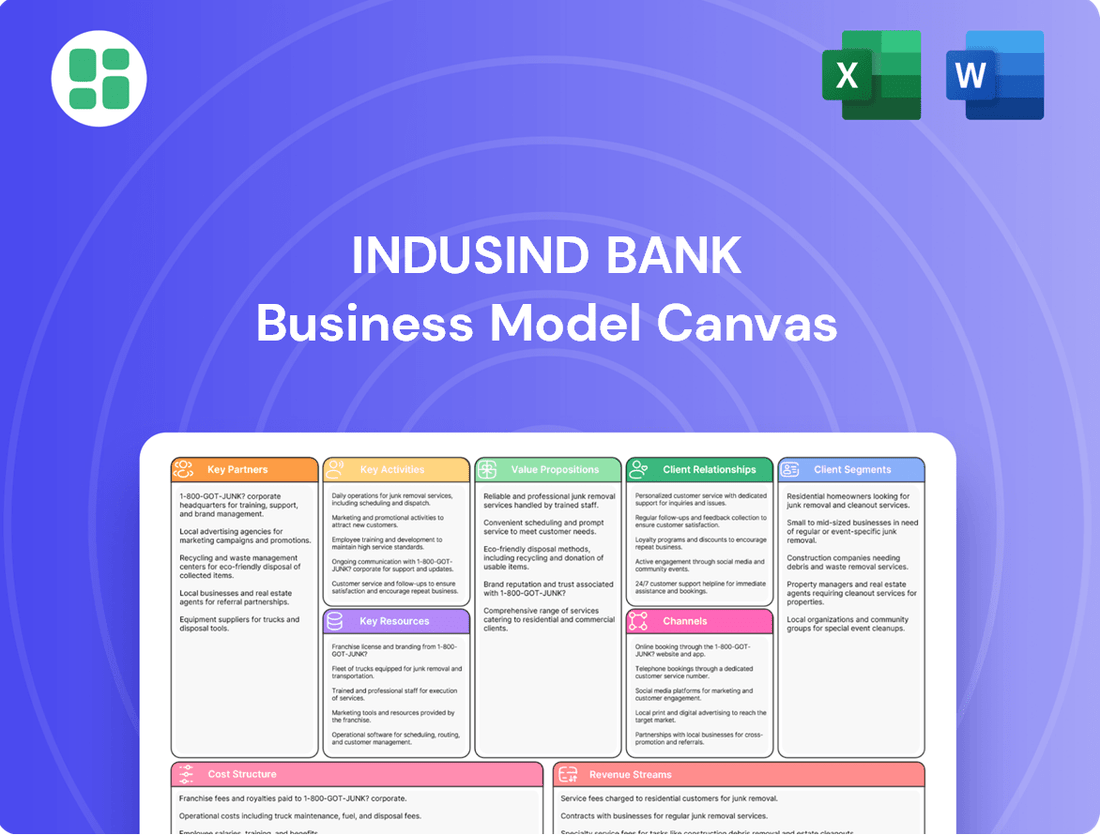

Business Model Canvas

The IndusInd Bank Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive overview details key aspects of their operations, from customer segments to revenue streams, providing a transparent look at their strategic framework. You'll gain access to this complete, ready-to-use document, mirroring precisely what you see here, allowing for immediate analysis and application.

Resources

IndusInd Bank's financial capital, particularly its strong capital adequacy ratios, is a cornerstone of its business model. As of March 31, 2024, the bank reported a robust Common Equity Tier 1 (CET I) ratio of 14.44%, well above the regulatory requirement. This substantial capital base is crucial for underwriting new loans, funding expansion, and weathering economic downturns, directly supporting its ability to serve its diverse customer base.

IndusInd Bank's technology infrastructure is a cornerstone of its business model, encompassing advanced IT systems, robust digital platforms, and secure data centers. These resources are critical for delivering efficient banking services and fostering innovation. For instance, in FY24, the bank continued its significant investments in technology, aiming to enhance customer experience and operational efficiency.

The bank's commitment to digital transformation is evident in its expanding digital platforms, which facilitate seamless transactions and personalized customer interactions. Cybersecurity frameworks are paramount, safeguarding sensitive data and maintaining customer trust in an increasingly digital financial landscape. This focus on secure digital delivery is essential for IndusInd Bank's competitive edge.

IndusInd Bank's human capital is a cornerstone, comprising skilled banking professionals, technology experts, and dedicated customer service teams. This diverse talent pool is crucial for innovation, customer satisfaction, and efficient operations. As of March 31, 2024, the bank employed approximately 27,000 individuals, a testament to its significant investment in human resources to drive its strategic objectives.

Brand Reputation and Trust

IndusInd Bank's brand reputation and the trust it has cultivated are foundational, intangible assets that significantly influence its business model. This strong market perception is crucial for attracting and retaining a loyal customer base, a vital component in the competitive Indian banking landscape.

The bank's brand value directly translates into a lower cost of capital and greater customer stickiness, as individuals and businesses are more inclined to deposit funds and utilize services with institutions they trust. This trust is built through consistent service quality, ethical practices, and a proven track record.

- Brand Value: IndusInd Bank consistently ranks among the top banking brands in India, reflecting its growing market recognition and positive customer sentiment.

- Customer Trust: A significant portion of IndusInd Bank's customer base exhibits high loyalty, demonstrated by sustained deposit growth and repeat business across various financial products.

- Market Perception: The bank is perceived as a forward-thinking and technologically adept financial institution, attracting a diverse clientele including retail, corporate, and SME segments.

- Competitive Standing: In 2024, IndusInd Bank continued to strengthen its position, with its brand equity playing a key role in its ability to compete effectively against both public sector and private sector banks.

Extensive Distribution Network

IndusInd Bank leverages an extensive distribution network as a core resource, encompassing over 2,000 branches and over 2,800 ATMs across India as of March 2024. This substantial physical footprint, which includes a significant presence in rural and semi-urban geographies, ensures broad customer accessibility and service delivery, complementing its digital offerings.

The bank’s network of business correspondent outlets further amplifies its reach, particularly in underserved areas. This multi-channel approach is crucial for customer acquisition and retention, allowing IndusInd Bank to cater to diverse customer segments and their varying banking needs.

- Physical Infrastructure: Over 2,000 branches and 2,800 ATMs as of March 2024.

- Geographic Reach: Significant presence in rural and semi-urban areas.

- Complementary Channels: Physical network supports and enhances digital banking services.

- Customer Accessibility: Ensures broad reach and service availability across India.

IndusInd Bank's robust financial capital, including a Common Equity Tier 1 (CET I) ratio of 14.44% as of March 31, 2024, underpins its ability to lend, expand, and manage risk. This strong capital base is essential for supporting its operations and growth strategies.

The bank's technological infrastructure, a significant area of investment in FY24, enables efficient service delivery and digital innovation. Its advanced IT systems and secure digital platforms are key to enhancing customer experience and maintaining a competitive edge in the digital banking space.

IndusInd Bank's extensive distribution network, comprising over 2,000 branches and 2,800 ATMs as of March 2024, ensures broad customer accessibility across India. This physical presence, augmented by business correspondent outlets, complements its digital channels and broadens its market reach.

Human capital is a critical resource, with approximately 27,000 employees as of March 31, 2024, forming the backbone of its operations. This skilled workforce drives innovation, customer satisfaction, and strategic execution across all banking functions.

Brand value and customer trust are intangible yet vital assets for IndusInd Bank. Its strong market perception as a forward-thinking, technologically adept institution attracts and retains a loyal customer base, contributing to a lower cost of capital and sustained business growth.

| Key Resource | Description | Key Metrics/Data (as of March 31, 2024) |

| Financial Capital | Strong capital adequacy ratios and liquidity. | CET I Ratio: 14.44% |

| Technology Infrastructure | Advanced IT systems, digital platforms, and cybersecurity. | Continued significant investments in FY24 for efficiency and customer experience. |

| Distribution Network | Extensive physical and digital channels. | Over 2,000 Branches, Over 2,800 ATMs. |

| Human Capital | Skilled workforce across banking, technology, and customer service. | Approximately 27,000 employees. |

| Brand Value & Trust | Market recognition, customer loyalty, and positive perception. | Ranked among top banking brands; high customer retention. |

Value Propositions

IndusInd Bank champions a universal banking model, offering a broad spectrum of financial products. This includes everything from basic deposit accounts and diverse loan options like vehicle, micro, and corporate loans, to credit cards and sophisticated investment solutions. This comprehensive suite ensures that individuals, businesses, and even government bodies can find all their banking needs met under one roof.

In 2024, IndusInd Bank continued to solidify its position by expanding its digital offerings and customer touchpoints. The bank reported a significant increase in its retail deposit base, reaching ₹3,72,677 crore as of March 31, 2024, demonstrating strong customer trust and the effectiveness of its wide-ranging product portfolio in attracting and retaining clients across various segments.

IndusInd Bank's digital banking convenience is a cornerstone of its value proposition, offering customers like the INDIE app and INDIE for Business. These platforms provide a seamless, secure, and intuitive way to manage finances, including online account opening and real-time transactions.

This digital-first approach empowers users with 24/7 access and complete control over their financial activities, a crucial advantage in today's fast-paced world. By the end of fiscal year 2024, IndusInd Bank reported a significant increase in its digital transaction volume, highlighting customer adoption of these convenient services.

IndusInd Bank champions personalized customer service by assigning dedicated relationship managers to its business clients. This ensures a direct point of contact for tailored financial advice and solutions. In 2024, the bank continued to emphasize this approach, aiming to deepen customer engagement and foster long-term partnerships.

Competitive Financial Products

IndusInd Bank differentiates itself by providing competitive financial products, including attractive interest rates on savings and fixed deposits, aiming to draw in a broad customer base. For instance, in early 2024, the bank offered fixed deposit rates up to 7.50% for certain tenures, making it a compelling option for savers.

The bank also focuses on specialized lending, offering customized solutions in areas like vehicle finance and microfinance. This tailored approach caters to specific customer needs, fostering loyalty and expanding market reach. In 2023, IndusInd Bank reported a significant growth in its vehicle finance portfolio, reflecting the demand for these specialized offerings.

- Competitive Interest Rates: Offering attractive rates on deposits and loans to attract and retain customers.

- Customized Product Offerings: Providing specialized solutions in segments like vehicle finance and microfinance.

- Market Attractiveness: Aiming to capture market share by meeting diverse customer financial needs with favorable terms.

Robust Security and Reliability

IndusInd Bank prioritizes secure and seamless digital banking, focusing on robust security features for all digital transactions. This commitment underpins customer trust by ensuring a reliable platform for financial management.

The bank's dedication to a strong balance sheet directly supports its reliable digital infrastructure. For instance, as of March 31, 2024, IndusInd Bank reported a robust Capital Adequacy Ratio (CAR) of 15.06%, well above regulatory requirements, indicating financial strength to support its technological investments.

- Enhanced Security Measures: Implementing advanced encryption and multi-factor authentication for digital banking platforms.

- Transaction Integrity: Ensuring the security and accuracy of all financial transactions processed through its digital channels.

- Financial Stability: Maintaining a strong balance sheet to consistently invest in and upgrade security infrastructure.

- Customer Confidence: Building trust through a proven track record of secure and reliable digital banking services.

IndusInd Bank offers a comprehensive suite of banking products and services, catering to a wide range of customer needs from basic savings accounts to specialized corporate finance. This universal banking approach ensures that individuals and businesses can find all their financial solutions conveniently. The bank's commitment to a strong retail deposit base, which stood at ₹3,72,677 crore as of March 31, 2024, highlights its success in attracting and serving a diverse clientele.

The bank's digital platforms, such as the INDIE app, provide seamless and secure 24/7 access to banking services, enhancing customer convenience and control. This digital-first strategy is supported by a robust Capital Adequacy Ratio of 15.06% as of March 31, 2024, demonstrating the financial strength to invest in and maintain secure, reliable digital infrastructure.

IndusInd Bank focuses on personalized customer relationships, particularly for its business clients, by offering dedicated relationship managers. This ensures tailored advice and solutions, fostering deeper engagement and long-term partnerships. The bank also provides competitive offerings, including fixed deposit rates up to 7.50% in early 2024, making it an attractive choice for savers.

| Value Proposition | Description | Key Metric/Data Point (FY24) |

|---|---|---|

| Universal Banking | Broad spectrum of financial products for individuals and businesses. | Retail Deposits: ₹3,72,677 crore (as of Mar 31, 2024) |

| Digital Convenience | Seamless, secure, and intuitive digital banking platforms. | Significant increase in digital transaction volume (FY24) |

| Personalized Service | Dedicated relationship managers for business clients. | Continued emphasis on deepening customer engagement (FY24) |

| Competitive Offerings | Attractive interest rates and specialized lending solutions. | FD rates up to 7.50% (early 2024); Growth in vehicle finance portfolio (2023) |

| Financial Stability & Security | Robust balance sheet supporting secure digital infrastructure. | Capital Adequacy Ratio: 15.06% (as of Mar 31, 2024) |

Customer Relationships

IndusInd Bank assigns dedicated relationship managers to its corporate clients and High Net Worth Individuals. These managers provide personalized service and tailored financial advice, ensuring complex financial needs are met.

This dedicated approach fosters strong, long-term relationships. For instance, in the fiscal year ending March 31, 2024, IndusInd Bank reported a significant growth in its retail advances, partly driven by its focus on personalized client engagement.

IndusInd Bank enhances customer relationships through robust digital self-service platforms, including its INDIE mobile app and internet banking portals. These platforms allow customers to independently manage accounts, conduct transactions, and access a wide array of banking services, significantly boosting convenience and accessibility.

This digital focus reduces reliance on physical branches, streamlining operations and improving customer experience. As of the fiscal year ending March 31, 2024, IndusInd Bank reported a substantial increase in its digital transaction volumes, reflecting strong customer adoption of these self-service channels.

IndusInd Bank’s customer service call centers are a cornerstone of its customer relationships, offering immediate support and query resolution for a wide array of banking needs. These centers are designed to be highly accessible, ensuring customers can efficiently address concerns and receive assistance with various banking services, from account inquiries to transaction support.

Personalized Product Offerings

IndusInd Bank leverages data analytics to tailor financial products, aiming to match individual customer needs and profiles. This personalized approach boosts relevance and deepens customer engagement.

For instance, in fiscal year 2024, IndusInd Bank reported a significant increase in its retail advances, indicating a growing customer base that benefits from these customized offerings.

- Data-Driven Personalization: Utilizing advanced analytics to understand customer behavior and preferences.

- Customized Product Suite: Developing and offering financial products like loans, investments, and insurance that specifically cater to individual customer segments.

- Enhanced Engagement: Proactively presenting relevant financial solutions to customers, leading to higher satisfaction and loyalty.

- Increased Product Penetration: By aligning offerings with needs, the bank aims to increase the uptake of its various financial services among its customer base.

Community Engagement Programs

IndusInd Bank, through its subsidiary Bharat Financial Inclusion Limited (BFIL), actively cultivates community engagement programs. These initiatives are designed to foster deep connections with rural populations by offering vital microfinance services and essential financial literacy training. This approach is crucial for building trust and establishing robust relationships with individuals and communities that have historically been underserved by traditional financial institutions, thereby driving financial inclusion.

In 2024, BFIL continued its commitment to financial inclusion by extending its reach to millions of new customers. The bank reported that its microfinance portfolio, managed by BFIL, served over 10 million active customers by the end of the fiscal year. Financial literacy sessions conducted by BFIL in 2024 reached over 500,000 individuals across various rural districts, equipping them with the knowledge to manage their finances effectively.

- Community Outreach: BFIL's programs directly engage with over 10 million active customers in rural areas as of 2024.

- Financial Literacy Impact: Over 500,000 individuals received financial education in 2024, enhancing their financial decision-making capabilities.

- Trust Building: Consistent engagement through these programs solidifies IndusInd Bank's reputation as a trusted financial partner in underserved communities.

- Inclusion Drive: These efforts are central to IndusInd Bank's strategy for promoting broader financial inclusion across India.

IndusInd Bank employs a multi-faceted approach to customer relationships, combining personalized service with robust digital platforms and community engagement.

Dedicated relationship managers cater to corporate and HNI clients, while digital channels like the INDIE app offer self-service convenience, as evidenced by increased digital transaction volumes in FY24.

The bank also leverages data analytics for product customization, boosting engagement and product penetration, with retail advances showing significant growth in FY24.

Through Bharat Financial Inclusion Limited (BFIL), IndusInd Bank actively builds trust in rural communities by providing microfinance and financial literacy, reaching over 10 million customers and educating over 500,000 individuals in 2024.

| Relationship Aspect | Key Initiatives | FY24 Impact/Data |

|---|---|---|

| Personalized Service | Dedicated Relationship Managers | Growth in retail advances |

| Digital Engagement | INDIE App, Internet Banking | Substantial increase in digital transaction volumes |

| Data-Driven Tailoring | Customer Behavior Analytics | Increased product penetration and customer loyalty |

| Community Inclusion | BFIL Microfinance & Literacy Programs | Over 10 million active customers served by BFIL; 500,000+ individuals received financial literacy training |

Channels

IndusInd Bank leverages a substantial physical branch network to offer traditional banking services, personalized customer support, and a crucial touchpoint for intricate financial dealings. This extensive presence ensures accessibility for a broad customer base across India.

As of March 31, 2025, the bank maintained 3,081 branches and banking outlets. This significant physical footprint supports a wide range of customer interactions, from routine transactions to more complex financial advisory services, reinforcing its commitment to traditional banking values alongside digital innovation.

IndusInd Bank's extensive ATM network is a cornerstone of its customer accessibility strategy, offering 24/7 self-service banking. This network provides vital functions like cash withdrawals and balance checks, ensuring convenience for all account holders.

As of March 31, 2025, the bank operated a substantial 3,027 ATMs across India. This widespread presence directly supports customer engagement and reduces reliance on branch visits for routine transactions.

IndusInd Bank's mobile banking applications, specifically the INDIE app for retail customers and INDIE for Business for MSMEs, act as crucial digital gateways. These platforms provide a wide array of banking services, including seamless payment solutions, loan origination, and comprehensive account management, enabling users to bank conveniently from anywhere.

In 2023, IndusInd Bank reported a significant increase in digital transactions, with its mobile banking platforms playing a pivotal role in this growth. The bank’s focus on enhancing the user experience through these apps has led to a substantial portion of its customer base actively engaging with its digital offerings for daily banking needs.

Internet Banking Portal

IndusInd Bank's internet banking portal serves as a vital digital channel, offering customers secure and extensive capabilities for managing their finances and executing transactions. This platform is indispensable for both individual consumers and business entities, providing convenient access to banking services anytime, anywhere.

The portal facilitates a broad spectrum of banking activities, from simple account inquiries and fund transfers to more complex services like loan applications and investment management. For businesses, it streamlines corporate banking operations, including bulk payments and trade finance, significantly enhancing operational efficiency.

- Digital Transactions: In 2023, digital channels accounted for approximately 90% of IndusInd Bank's total retail transactions, with the internet banking portal being a primary driver.

- Customer Reach: As of early 2024, over 70% of IndusInd Bank's active customer base regularly utilizes the internet banking portal for their banking needs.

- Service Expansion: The portal continuously evolves, integrating new features such as personalized financial dashboards and real-time alerts, further solidifying its role as a central customer touchpoint.

Direct Sales Agents and Partners

IndusInd Bank leverages direct sales agents and strategic partnerships to significantly expand its market presence, particularly in loan origination and product distribution. This approach is crucial for reaching diverse customer segments, especially those in semi-urban and rural geographies where traditional branch networks might be less prevalent.

A prime example of this strategy is the bank's involvement with Bharat Financial Inclusion Ltd. (BFIL), a subsidiary focused on microfinance. Through BFIL, IndusInd Bank effectively extends its financial services to underserved communities, facilitating access to credit and other banking products. In fiscal year 2024, BFIL continued to be a significant contributor to the bank's financial inclusion efforts, demonstrating the efficacy of this partnership-driven model.

- BFIL's Contribution: BFIL, a key partner, plays a vital role in IndusInd Bank's microfinance operations, enhancing reach and customer acquisition in rural and semi-urban areas.

- Loan Origination: Direct sales agents and partners are instrumental in the origination of various loan products, streamlining the application and disbursement process for customers.

- Product Distribution: These channels serve as effective conduits for distributing a wide array of banking products, from savings accounts to insurance, thereby deepening customer relationships.

- Market Penetration: The combined strength of direct sales and partnerships allows IndusInd Bank to penetrate markets more effectively than relying solely on its physical branch network.

IndusInd Bank utilizes a multi-channel approach, blending its extensive physical presence with robust digital platforms and strategic partnerships to serve its diverse customer base. This integrated strategy ensures broad accessibility and caters to varying customer preferences for banking interactions.

The bank's physical network, comprising 3,081 branches and 3,027 ATMs as of March 31, 2025, provides essential face-to-face services and convenient self-service options. Complementing this, digital channels like the INDIE mobile app and internet banking portal handle a significant volume of transactions, with over 70% of active customers using the internet banking portal in early 2024.

Strategic partnerships, notably with Bharat Financial Inclusion Ltd. (BFIL), extend the bank's reach into underserved markets, particularly for microfinance and loan origination. These channels are crucial for product distribution and market penetration, enhancing customer acquisition and deepening relationships.

| Channel | Description | Key Metrics/Data Points |

| Physical Branches | Traditional banking services, personalized support, complex transactions. | 3,081 branches (as of March 31, 2025) |

| ATM Network | 24/7 self-service banking. | 3,027 ATMs (as of March 31, 2025) |

| Mobile Banking (INDIE) | Digital gateway for retail and business banking, payments, loans. | Pivotal in significant digital transaction growth (2023) |

| Internet Banking | Secure online financial management and transactions. | ~90% of retail transactions (2023); Over 70% customer utilization (early 2024) |

| Direct Sales Agents & Partnerships (e.g., BFIL) | Loan origination, product distribution, market expansion. | BFIL significant contributor to financial inclusion (FY2024) |

Customer Segments

IndusInd Bank serves a broad range of retail individuals, from salaried professionals to self-employed entrepreneurs. These customers rely on the bank for essential services like savings and current accounts, personal loans to fund life events, and credit cards for everyday spending and rewards. In 2024, the bank continued to focus on enhancing its digital offerings to meet the evolving needs of this segment, aiming for seamless and convenient banking experiences.

The bank’s strategy for retail individuals also involves catering to their financial aspirations, whether it's saving for a home, funding education, or managing daily expenses. By offering a comprehensive suite of products, including competitive deposit rates and accessible loan options, IndusInd Bank positions itself as a partner in their financial journey. Digital channels are key, with a significant portion of transactions for this segment occurring through mobile and internet banking platforms, reflecting a growing preference for self-service options.

IndusInd Bank actively courts Small and Medium Enterprises (SMEs) by offering specialized financial products. These include vital working capital loans to manage day-to-day operations, term loans for expansion, and a suite of digital payment solutions to streamline transactions.

The bank's 'INDIE for Business' platform further underscores its commitment to this sector, providing a comprehensive digital hub for SME banking needs. SMEs are a cornerstone of India's economic engine, and their robust health directly contributes to IndusInd Bank's diversified and resilient loan portfolio.

In 2024, the SME sector in India continued to be a significant driver of economic activity, with government initiatives aiming to bolster their growth. IndusInd Bank's focus on this segment aligns with this national economic strategy, positioning the bank to benefit from and contribute to India's expanding industrial base.

IndusInd Bank offers extensive wholesale banking services to large corporations, government bodies, and public sector undertakings. These services encompass corporate lending, sophisticated treasury operations, essential trade finance, and bespoke financial solutions tailored to the unique needs of these major clients.

In 2024, IndusInd Bank's corporate banking segment demonstrated robust growth, with its gross advances to large corporates and institutions seeing a significant uptick. The bank's focus on providing integrated financial solutions, including working capital finance and project finance, contributed to its strong performance in this segment, reflecting a strategic emphasis on key institutional relationships.

High Net Worth Individuals (HNIs)

High Net Worth Individuals (HNIs), including Non-Resident Indians (NRIs), represent a crucial customer segment for IndusInd Bank, particularly for its wealth management and investment offerings. The bank focuses on providing specialized banking services designed to meet the complex financial needs of these affluent clients.

IndusInd Bank offers bespoke products and personalized relationship management to cater to the sophisticated financial requirements of HNIs. This approach ensures that clients receive tailored solutions for wealth creation, preservation, and transfer.

- Wealth Management Focus: IndusInd Bank actively targets HNIs for its comprehensive wealth management services, aiming to provide sophisticated investment strategies and financial planning.

- NRI Clientele: A significant portion of the HNI segment includes NRIs, who are offered specialized banking and investment solutions tailored to their cross-border financial needs.

- Dedicated Relationship Management: The bank assigns dedicated relationship managers to HNI clients, ensuring personalized attention and proactive financial advice.

- Product Suite: IndusInd Bank provides a wide array of tailored products, including structured investments, offshore banking, and estate planning services, to meet the diverse and evolving needs of its HNI customers.

Rural and Underserved Populations

IndusInd Bank, through its subsidiary Bharat Financial Inclusion Limited (BFIL), actively serves rural and underserved populations by providing essential microfinance and basic banking services. This strategic focus aims to deepen financial inclusion and capture market share in these often-overlooked segments.

BFIL's operations are crucial for reaching customers in remote areas, offering them access to credit and savings facilities. In 2024, BFIL continued its expansion, with its total microfinance loan portfolio reaching ₹24,920 crore as of March 31, 2024. This demonstrates a significant commitment to empowering these communities financially.

- Financial Inclusion Drive: BFIL's core mission is to bring banking services to the unbanked and underbanked, particularly in rural India.

- Market Expansion: By targeting these segments, IndusInd Bank broadens its customer base and diversifies its revenue streams.

- Loan Portfolio Growth: The microfinance loan portfolio, amounting to ₹24,920 crore by March 2024, highlights the scale of their operations and impact.

- Customer Reach: BFIL serves millions of customers, many of whom are women entrepreneurs, fostering economic empowerment at the grassroots level.

IndusInd Bank’s customer segments are diverse, ranging from individual retail customers and SMEs to large corporations and high-net-worth individuals. The bank also actively engages with rural and underserved populations through its subsidiary, Bharat Financial Inclusion Limited (BFIL). This broad reach allows the bank to cater to a wide spectrum of financial needs and economic profiles.

| Customer Segment | Key Offerings | 2024 Data/Focus |

|---|---|---|

| Retail Individuals | Savings/Current Accounts, Personal Loans, Credit Cards | Enhanced digital offerings for seamless banking. |

| SMEs | Working Capital Loans, Term Loans, Digital Payment Solutions | Focus on 'INDIE for Business' platform for digital hub. |

| Large Corporations/Institutions | Corporate Lending, Treasury Operations, Trade Finance | Robust growth in gross advances; focus on integrated solutions. |

| High Net Worth Individuals (HNIs) / NRIs | Wealth Management, Investment Offerings, Bespoke Banking | Personalized relationship management and tailored products. |

| Rural/Underserved (via BFIL) | Microfinance, Basic Banking Services | Microfinance loan portfolio reached ₹24,920 crore (as of March 31, 2024). |

Cost Structure

Employee salaries and benefits represent a substantial cost for IndusInd Bank, reflecting its extensive network and diverse operations. This category encompasses wages, health insurance, retirement contributions, and other perks for thousands of employees across its branch network, corporate offices, and burgeoning digital platforms.

In the fiscal year 2023-24, IndusInd Bank's employee expenses, including salaries and benefits, amounted to approximately ₹10,400 crore. This significant outlay is crucial for attracting and retaining skilled talent necessary for customer service, risk management, and technological innovation.

IndusInd Bank's investment in technology infrastructure and maintenance is a significant cost driver, essential for its digital-first strategy. These expenses encompass the development, upkeep, and enhancement of core banking systems, mobile applications, and online platforms.

In 2024, the banking sector globally saw increased spending on digital transformation, with cybersecurity measures becoming paramount. IndusInd Bank's expenditure in this area directly supports its ability to offer seamless digital services and protect customer data, which is crucial for maintaining trust and operational efficiency.

IndusInd Bank's significant investment in its physical footprint, encompassing a vast network of branches and ATMs, represents a substantial component of its cost structure. These operational expenses include not only the rent for prime real estate but also ongoing costs for utilities, maintenance, and the administrative overhead required to manage these locations.

For the fiscal year ending March 31, 2024, IndusInd Bank reported total operating expenses of ₹27,533 crore. While specific line items for branch network operations and rent aren't broken out separately in summary financials, these costs are intrinsically linked to the bank's ability to serve its customer base through physical touchpoints.

Marketing and Advertising Expenses

IndusInd Bank allocates significant resources to marketing and advertising, a key cost driver within its business model. These expenditures are crucial for brand building, promoting its diverse financial products, and acquiring new customers. In 2023, the bank reported marketing and advertising expenses of approximately ₹515 crore, reflecting a strategic emphasis on market presence and customer outreach.

The bank's marketing efforts span a wide array of channels, including digital platforms, traditional media, and targeted campaigns. This investment is particularly directed towards promoting its expanding suite of digital products and various loan offerings, aiming to capture a larger market share.

- Brand Building: Continuous investment in creating and reinforcing the IndusInd Bank brand identity across all touchpoints.

- Product Promotions: Campaigns focused on launching and popularizing new banking products, credit cards, and digital services.

- Customer Acquisition: Targeted advertising and outreach programs to attract new retail and corporate clients.

- Digital Marketing: Significant spending on online advertising, social media engagement, and search engine optimization to reach a digitally-savvy audience.

Regulatory Compliance and Legal Costs

IndusInd Bank faces significant expenditures to maintain compliance with the Reserve Bank of India's (RBI) stringent banking regulations. These costs include investments in technology for reporting, staff training on evolving compliance norms, and internal audit functions. For the fiscal year 2023-24, banks, including IndusInd, allocated substantial resources towards these areas, with a notable increase in spending on cybersecurity and data privacy measures to meet regulatory mandates.

Legal fees are also a considerable part of the cost structure, covering advice on new financial products, contract reviews, and litigation. The bank must also account for potential penalties or provisions for any identified accounting discrepancies, ensuring transparency and adherence to financial reporting standards. These proactive measures, though costly, are essential for maintaining operational integrity and stakeholder trust.

- Regulatory Compliance: Costs associated with adhering to RBI guidelines, including Know Your Customer (KYC) norms and Anti-Money Laundering (AML) procedures.

- Legal Expenses: Fees paid to legal counsel for advisory services, contract management, and dispute resolution.

- Audit and Assurance: Expenditure on internal and external audits to ensure financial accuracy and regulatory adherence.

- Penalties and Provisions: Amounts set aside for potential fines or provisions related to non-compliance or accounting irregularities.

IndusInd Bank's cost structure is heavily influenced by its operational scale and strategic priorities, with employee costs being a significant component. These expenses are vital for maintaining a skilled workforce across its extensive network and digital platforms.

Technological investment is another major cost area, supporting the bank's digital-first approach and ensuring robust cybersecurity. The bank's physical presence, comprising numerous branches and ATMs, also incurs substantial operational and rental expenses.

Marketing and advertising are key cost drivers, essential for brand building and customer acquisition, with a growing emphasis on digital channels. Furthermore, the bank incurs significant costs related to regulatory compliance and legal services to ensure adherence to stringent banking norms.

| Cost Category | FY 2023-24 (Approximate) | Significance |

|---|---|---|

| Employee Salaries & Benefits | ₹10,400 crore | Essential for talent acquisition and retention. |

| Technology Infrastructure & Maintenance | Significant investment | Supports digital strategy and cybersecurity. |

| Branch Network & ATM Operations | Integral part of operating expenses | Facilitates physical customer service. |

| Marketing & Advertising | ₹515 crore (2023) | Drives brand building and customer acquisition. |

| Regulatory Compliance & Legal | Substantial allocation | Ensures adherence to RBI norms and operational integrity. |

Revenue Streams

Net Interest Income (NII) is the bedrock of IndusInd Bank's profitability, representing the spread between interest earned on its assets like loans and investments, and interest paid on its liabilities such as deposits and borrowings. This fundamental revenue driver reflects the bank's core lending and deposit-taking activities.

For the fiscal year ending March 31, 2024, IndusInd Bank reported a robust Net Interest Income of ₹36,507.8 crore, showcasing a healthy growth and underscoring its strong position in the banking sector.

IndusInd Bank generates significant revenue through fees and commissions on a wide array of services. This includes income from credit and debit card transactions, wealth management services, and trade finance operations. For instance, in the fiscal year 2024, non-interest income, which heavily comprises these fee-based revenues, stood at INR 14,404 crore, showcasing its importance in diversifying the bank's earnings beyond traditional lending.

IndusInd Bank generates significant revenue from digital transaction fees, a growing segment driven by increased customer adoption of its online platforms like the INDIE app and Bharat Money Stores. These fees are earned on various digital payment solutions, including online fund transfers and other digital banking services.

In fiscal year 2024, digital transactions at IndusInd Bank saw robust growth, reflecting the broader trend of digital banking adoption across India. This segment is crucial for the bank's revenue diversification and is expected to continue its upward trajectory as more customers embrace digital channels for their banking needs.

Foreign Exchange Income

IndusInd Bank generates significant revenue from foreign exchange (forex) transactions. This includes fees and commissions earned from facilitating remittances for Non-Resident Indians (NRIs) and providing currency hedging solutions to its corporate clientele. These activities bolster the bank's non-interest income.

In the fiscal year 2024, IndusInd Bank reported substantial forex income. For instance, its forex income was a key component of its treasury operations, contributing to overall profitability.

- Forex Transaction Revenue: Income derived from buying and selling foreign currencies for customers.

- Remittance Services: Fees and spreads on money transfers by NRIs back to India.

- Currency Hedging: Revenue from offering derivative products to businesses managing foreign exchange risk.

- Contribution to Non-Interest Income: Forex activities are a vital part of the bank's fee-based income streams.

Investment Banking and Treasury Income

IndusInd Bank's investment banking and treasury operations are significant revenue generators. This segment thrives on income derived from managing the bank's own capital, including substantial investments in government securities and other financial instruments. For instance, as of the fiscal year ending March 31, 2024, IndusInd Bank reported a substantial Net Interest Income, a core component influenced by treasury activities.

Beyond managing its own portfolio, the bank also earns from advisory services. These services often revolve around complex financial transactions such as mergers and acquisitions (M&A) and capital market activities, where the bank acts as a trusted advisor to corporations. This advisory income, coupled with the returns from its treasury book, forms a crucial part of its overall financial performance.

- Treasury Operations Income: Revenue from interest on investments in government securities and other financial instruments.

- Investment Income: Returns generated from the bank's proprietary trading and investment activities.

- Advisory Fees: Income earned from providing M&A and capital markets advisory services to corporate clients.

- Net Interest Income (NII): A key indicator reflecting income from lending and investment activities, which includes treasury contributions.

IndusInd Bank's revenue streams are diverse, encompassing both interest-based income and fee-based services. The bank's core business revolves around Net Interest Income (NII), which for the fiscal year ending March 31, 2024, was ₹36,507.8 crore. This highlights the significant earnings from its lending and deposit-taking activities.

Fee and commission income is another crucial component, contributing ₹14,404 crore in non-interest income for FY24. This includes revenue from credit and debit cards, wealth management, and trade finance. Digital transactions and foreign exchange services also add to this fee-based revenue, reflecting the bank's adaptation to evolving customer needs and market dynamics.

| Revenue Stream | Description | FY24 (INR Crore) |

|---|---|---|

| Net Interest Income (NII) | Interest earned on loans and investments minus interest paid on deposits and borrowings. | 36,507.8 |

| Fee & Commission Income | Revenue from services like cards, wealth management, trade finance, and digital transactions. | 14,404 (Non-Interest Income) |

| Forex Transactions | Income from currency exchange and related services for individuals and corporations. | Included in Non-Interest Income |

| Investment Banking & Treasury | Income from managing the bank's capital, investments, and advisory services. | Contributes to NII and Non-Interest Income |

Business Model Canvas Data Sources

The IndusInd Bank Business Model Canvas is constructed using a blend of internal financial statements, customer transaction data, and regulatory filings. This comprehensive approach ensures each component accurately reflects the bank's operational reality and strategic direction.