IndusInd Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IndusInd Bank Bundle

IndusInd Bank navigates a competitive landscape shaped by the bargaining power of its customers and the intense rivalry among existing players. Understanding these forces is crucial for any stakeholder looking to grasp the bank's strategic positioning.

The complete report reveals the real forces shaping IndusInd Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Depositors wield significant bargaining power in the Indian banking landscape, a sector characterized by intense competition. With numerous institutions actively seeking customer deposits, individuals and businesses have ample choices. This competitive environment means banks must work harder to attract and retain these vital capital providers.

Customers can readily compare offerings, from interest rates on savings and fixed deposits to the ease and features of digital banking platforms. Low switching costs allow depositors to move their funds with minimal friction, putting pressure on banks like IndusInd to offer compelling value propositions. For instance, in 2024, the average savings account interest rate across major Indian banks hovered around 3.5-4%, with some offering higher promotional rates, illustrating the need for competitive pricing.

Consequently, IndusInd Bank, to secure the necessary capital for its lending activities, must consistently offer attractive deposit rates and a superior customer experience. This includes seamless digital transactions, responsive customer service, and a broad range of deposit products tailored to diverse needs. Failure to do so could result in a gradual erosion of its deposit base, impacting its ability to fund its operations and growth initiatives.

The bargaining power of technology and software vendors for IndusInd Bank is generally moderate to high. This is particularly true for critical, specialized solutions such as core banking platforms, robust cybersecurity software, and sophisticated data analytics tools. While the market offers several providers, the significant costs and operational disruptions associated with switching or integrating new systems can create a degree of vendor lock-in, giving these suppliers leverage.

IndusInd Bank's dependence on these vendors for its digital transformation, operational efficiency, and data management capabilities underscores this power. For instance, in 2023, the global banking software market was valued at approximately $30 billion, with significant investments in digital banking solutions, indicating the critical nature of these technology partnerships.

The bargaining power of skilled human capital for IndusInd Bank is notably high, especially in specialized fields such as digital banking, data analytics, risk management, and wealth management. This elevated power stems from a pervasive demand for these expertise across the entire financial services sector, creating a fiercely competitive landscape for acquiring and retaining proficient employees.

In 2024, the average salary for a data scientist in India’s banking sector saw an increase, reflecting the high demand for such skills. For instance, reports indicated a rise of 10-15% in compensation for these roles compared to the previous year. This intense competition necessitates that IndusInd Bank proactively invest in attractive compensation packages, robust training and development programs, and cultivate a positive and engaging work environment to successfully draw in and retain top-tier talent.

Interbank Market and Financial Institutions

The bargaining power of the interbank market and other financial institutions supplying wholesale funding to IndusInd Bank is generally considered moderate. This is because while banks like IndusInd can tap into multiple funding channels, the cost of borrowing can escalate significantly during times of economic strain or when liquidity is scarce, thereby shifting more leverage towards the lenders.

For instance, in 2024, interbank lending rates, such as the Marginal Standing Facility (MSF) rate and the repo rate, influenced the cost of funds for banks. While specific figures fluctuate, the Reserve Bank of India's monetary policy actions directly impact these rates, demonstrating the dynamic nature of this power. IndusInd Bank's strategy of diversifying its funding base, including retail deposits and other wholesale sources, serves to dilute the influence of any single supplier of funds.

The ability of IndusInd Bank to access a broad spectrum of funding sources is key to managing this supplier power. This diversification includes:

- Retail Deposits: A stable base of customer deposits provides a cost-effective and reliable funding source.

- Wholesale Funding: Access to money markets, certificates of deposit, and commercial paper allows for flexibility.

- Interbank Borrowings: Short-term borrowing from other banks, though subject to market conditions.

- Bonds and Debt Instruments: Issuing debt to raise capital from institutional investors.

Regulatory Bodies

The bargaining power of regulatory bodies, such as the Reserve Bank of India (RBI), is exceptionally high for banks like IndusInd Bank. These bodies establish the complete operational framework, directly influencing costs and strategic decisions.

Regulations concerning capital adequacy, asset quality, and lending practices are critical. For instance, the RBI's Basel III norms mandate specific capital ratios, impacting how much capital IndusInd Bank must hold. In 2023, the Indian banking sector's average Capital Adequacy Ratio (CAR) remained robust, with IndusInd Bank consistently meeting these requirements.

- RBI's Authority: The RBI dictates operational rules, affecting everything from lending to digital security.

- Capital Requirements: Regulations like Basel III necessitate strong capital buffers, impacting profitability and risk-taking.

- Compliance Costs: Adhering to evolving regulations incurs significant operational and technological expenses for banks.

- Strategic Impact: Regulatory changes force continuous adaptation in business models and risk management strategies.

The bargaining power of suppliers for IndusInd Bank is largely influenced by the nature of the input and the concentration of suppliers. For critical technology and software, this power can be substantial due to specialized needs and high switching costs, as seen in the global banking software market valued at approximately $30 billion in 2023. Conversely, for less specialized operational inputs, the power of suppliers is more diffused.

The bank's reliance on specialized technology vendors for core banking and cybersecurity solutions means these suppliers can exert significant leverage. This is further amplified by the substantial investments required for integration and the operational risks associated with system changes. For example, the increasing demand for advanced data analytics tools in the financial sector in 2024 highlights the growing importance and potential power of specialized tech providers.

IndusInd Bank mitigates supplier power by diversifying its vendor base where possible and by fostering long-term relationships with key providers. However, the inherent nature of specialized financial technology often limits the ability to switch easily, maintaining a moderate to high level of supplier bargaining power in these critical areas.

| Supplier Type | Bargaining Power Level | Key Factors Influencing Power | Example for IndusInd Bank |

|---|---|---|---|

| Technology & Software Vendors | Moderate to High | Specialization, switching costs, vendor lock-in, criticality of solutions | Core banking platforms, cybersecurity software, data analytics tools |

| Interbank Market & Wholesale Funding Providers | Moderate | Liquidity conditions, economic climate, alternative funding sources | Money markets, certificates of deposit, commercial paper |

| Skilled Human Capital | High | Demand for specialized skills, competition for talent, industry-wide shortages | Data scientists, digital banking experts, risk management professionals |

What is included in the product

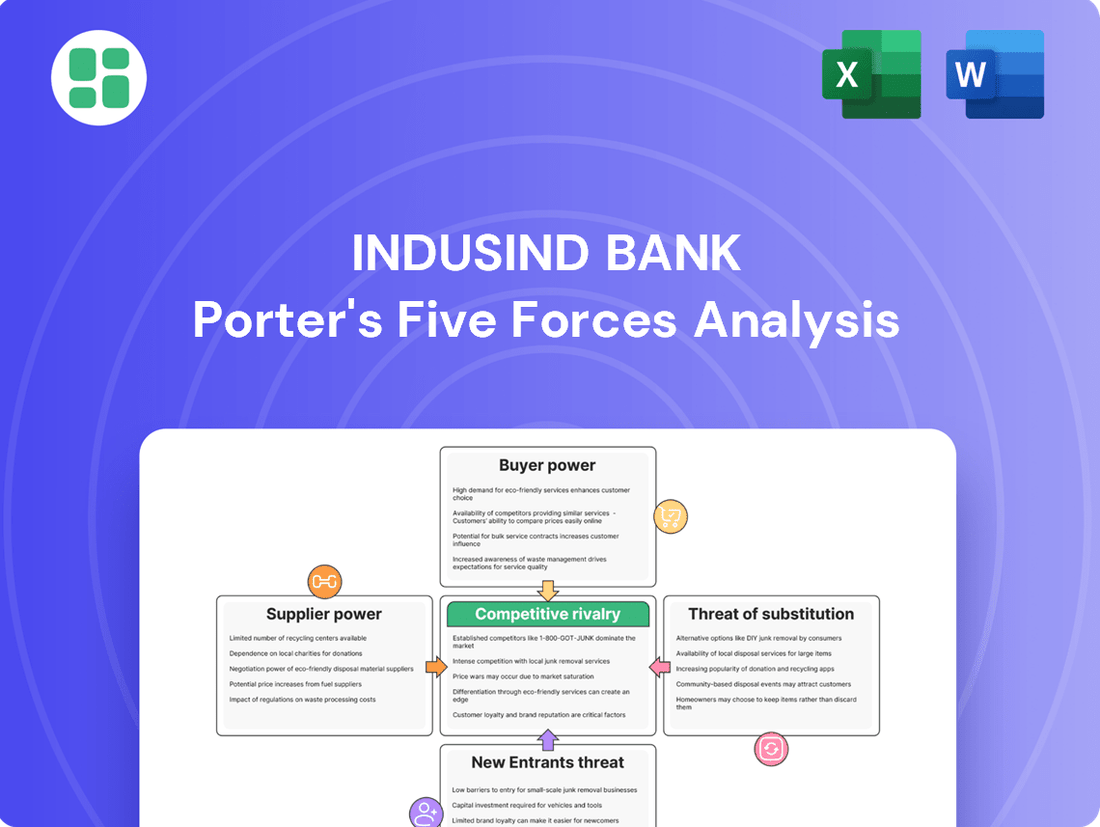

This analysis unpacks the competitive forces impacting IndusInd Bank, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each force, allowing for targeted strategic adjustments.

Customers Bargaining Power

The bargaining power of individual retail customers is notably high for IndusInd Bank. This is largely due to the sheer volume of choices available, encompassing public sector banks, numerous private banks, and emerging small finance banks, not to mention the proliferation of digital payment platforms.

Customers can effortlessly compare offerings, scrutinizing interest rates on savings accounts and loans, various service fees, and the overall convenience provided by digital banking solutions. For instance, in 2024, the Indian banking sector saw continued growth in digital transactions, with UPI alone processing billions of transactions monthly, highlighting the ease with which customers can switch providers based on digital capabilities and cost.

To counter this, IndusInd Bank needs to focus on creating distinct value propositions. This involves offering superior customer service that goes beyond basic transactions, maintaining competitive pricing structures for its products, and continuously innovating its digital banking platforms to provide a seamless and engaging user experience.

Corporate and wholesale clients wield considerable bargaining power with banks like IndusInd. Their substantial financial requirements, including large-scale loans and complex treasury services, allow them to negotiate for better interest rates and customized terms. In 2023, corporate loan growth for Indian banks, including IndusInd, was robust, indicating these clients are actively seeking and securing financing, which amplifies their negotiating position.

The ability of these major clients to move significant business volumes between financial institutions means IndusInd must offer competitive pricing and superior service to retain them. This leverage is particularly pronounced given the competitive landscape for corporate banking services in India, where multiple players vie for these high-value relationships.

Government entities wield significant bargaining power with banks like IndusInd. Their needs often involve managing public funds, financing large infrastructure projects, and supporting public sector undertakings, which are substantial revenue streams for banks. For instance, in 2023, Indian public sector banks reported significant growth in their government business, indicating the scale of these relationships.

These government contracts typically involve rigorous competitive bidding processes. Banks must demonstrate not only competitive pricing but also the capacity to meet stringent regulatory requirements and specialized service demands. IndusInd Bank's success in securing and retaining such business hinges on its ability to offer tailored solutions and maintain compliance.

Digital Service Expectation

Customers today expect a smooth, all-encompassing digital banking experience. This means they can readily switch to competitors, including fintech companies, that offer better mobile apps, online tools, and quick payment options. For instance, in 2023, the average number of mobile banking sessions per active user for leading banks often exceeded 10 per month, highlighting the intensity of digital engagement.

IndusInd Bank is actively addressing this by investing heavily in its digital infrastructure. Their strategy includes enhancing mobile banking features, streamlining online account opening, and integrating advanced payment technologies. This focus is crucial as customer loyalty is increasingly tied to the quality and convenience of digital interactions. A report from early 2024 indicated that over 70% of banking transactions for many institutions were already being conducted digitally.

- Digital Expectations Drive Switching: Customer demand for seamless digital services empowers them to switch providers easily.

- Fintech Competition Intensifies: The rise of fintechs offering superior digital solutions increases competitive pressure.

- IndusInd's Digital Focus: The bank's digital transformation efforts are a direct response to evolving customer demands.

- Data Supports Digital Shift: High engagement with mobile banking and a significant portion of transactions occurring digitally underscore this trend.

Access to Diverse Financial Products

Customers today enjoy a vast selection of financial products, extending far beyond what traditional banks offer. They can easily access mutual funds, invest directly in stocks, and utilize numerous online lending platforms. This accessibility means customers aren't tied to one institution for all their financial requirements, significantly boosting their ability to shop around for the best deals and services.

This increased choice directly translates to greater bargaining power for customers. They can cherry-pick individual products from different providers, forcing banks like IndusInd to compete more aggressively on pricing and service quality for each offering. For instance, a customer might get a mortgage from one bank, manage their investments through a brokerage, and use a digital wallet from a fintech company, all while still maintaining a primary checking account elsewhere.

- Increased Product Choice: Customers can select from a wide range of banking, investment, and lending products from various providers.

- Reduced Reliance on Single Bank: Diversification of financial services means customers are not dependent on one bank for all their needs.

- Enhanced Bargaining Power: The ability to compare and choose from multiple options empowers customers to negotiate better terms and pricing.

- IndusInd Bank's Strategy: The bank aims to offer a comprehensive product suite to encourage cross-product engagement and customer retention amidst this competitive landscape.

The bargaining power of customers for IndusInd Bank is substantial, driven by the ease of switching and the availability of numerous alternatives, including digital platforms and fintech solutions. This is amplified by evolving customer expectations for seamless digital experiences, with data from early 2024 indicating over 70% of banking transactions for many institutions occurring digitally, underscoring the importance of mobile banking engagement, which often sees over 10 sessions per active user monthly.

Customers can now easily compare offerings across a wider spectrum of financial products, not just traditional banking services. This diversification means individuals can source mortgages from one provider, investments from another, and digital wallets from a third, forcing banks like IndusInd to compete aggressively on price and service quality for each product to retain customer loyalty.

| Customer Segment | Bargaining Power Drivers | Impact on IndusInd Bank |

|---|---|---|

| Retail Customers | High availability of digital banking, ease of switching, competitive interest rates, service fees. | Requires competitive pricing and superior digital user experience to retain. |

| Corporate Clients | Large transaction volumes, need for customized financial solutions, ability to move business between banks. | Demands tailored services and aggressive pricing for loans and treasury operations. |

| Government Entities | Significant revenue potential, stringent regulatory requirements, competitive bidding processes. | Necessitates specialized solutions, compliance expertise, and competitive bids to secure contracts. |

What You See Is What You Get

IndusInd Bank Porter's Five Forces Analysis

This preview shows the exact IndusInd Bank Porter's Five Forces analysis you'll receive immediately after purchase, detailing the competitive landscape and strategic implications for the bank. You'll gain a comprehensive understanding of the industry's bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This document is fully formatted and ready for your immediate use, offering actionable insights into IndusInd Bank's market position.

Rivalry Among Competitors

The Indian banking landscape, especially within the private sector, is a fiercely contested arena. Established giants like HDFC Bank, ICICI Bank, Axis Bank, and Kotak Mahindra Bank are locked in a perpetual battle, vying for market share through aggressive product development, competitive pricing, superior customer service, and advanced digital offerings that span all customer demographics. This intense rivalry necessitates that IndusInd Bank continuously strives for innovation and unique value propositions to sustain and enhance its standing in the market.

Public sector banks (PSBs) remain a formidable force in India's banking landscape. Despite facing operational hurdles, their extensive branch networks, particularly in semi-urban and rural regions, ensure a substantial market share. For instance, as of March 2024, PSBs accounted for approximately 58% of total banking assets in India, highlighting their deep penetration and customer reach. Their government backing instills confidence and provides a stable customer base.

These PSBs leverage their inherent advantages, such as lower cost of funds and widespread presence, to offer competitive pricing and services. This creates a significant competitive pressure for private sector banks like IndusInd Bank. IndusInd Bank, in contrast, differentiates itself through its emphasis on agile, technology-driven, and customer-centric solutions, aiming to capture market share by offering superior service and innovative products.

The financial landscape is increasingly shaped by the rise of Small Finance Banks (SFBs) and Non-Banking Financial Companies (NBFCs), presenting a growing challenge to established players like IndusInd Bank. These entities are carving out significant market share in specialized lending areas such as microfinance, affordable housing, and vehicle financing, areas where they can offer tailored solutions.

SFBs and NBFCs often benefit from leaner operational structures and greater agility, enabling them to target niche markets with competitive pricing and flexible terms. For instance, by Q3 FY24, the total advances of SFBs reached approximately INR 1.55 trillion, demonstrating their expanding reach and impact on the broader credit market.

This specialized competition necessitates that IndusInd Bank remains vigilant, continuously evaluating the strategies and offerings of these focused competitors. Adapting to these evolving dynamics by innovating in product development and customer service will be crucial for maintaining a competitive edge in these segments.

Disruption from Fintech Companies

Fintech companies are significantly reshaping the banking landscape, particularly in areas like digital payments, peer-to-peer lending, and wealth management. These innovative, technology-focused firms are capturing specific, lucrative segments of the market, directly impacting traditional revenue streams. For instance, by mid-2024, the global fintech market was projected to reach over $33 billion, highlighting the rapid growth and influence of these disruptors.

- Digital Payments: Fintechs have streamlined payment processes, offering faster and often cheaper alternatives to traditional bank transfers.

- Peer-to-Peer Lending: Platforms connect borrowers directly with lenders, bypassing traditional banking intermediaries.

- Wealth Management: Robo-advisors and digital investment platforms provide accessible and automated investment services.

- Customer Interaction: Fintechs often offer superior user experiences, drawing customers away from legacy banking systems.

While not always offering a full suite of banking services, fintechs effectively siphon off high-margin transactions and customer engagement. IndusInd Bank, like other established institutions, faces the imperative to either innovate and compete directly with these agile players or forge strategic partnerships to integrate their services and maintain market relevance. The increasing adoption of digital banking services, with a significant portion of transactions occurring online by 2024, underscores this competitive pressure.

Race for Digital Dominance and Customer Experience

The banking sector is locked in an intense competition for digital supremacy and exceptional customer experiences. Banks are pouring resources into cutting-edge technology, artificial intelligence, and sophisticated data analytics. This investment is crucial for tailoring services to individual customer needs and optimizing internal processes. For instance, by the end of fiscal year 2024, Indian banks collectively saw a significant surge in digital transaction volumes, underscoring the importance of this shift.

IndusInd Bank's strategic emphasis on digital banking is paramount for maintaining its competitive edge. This focus allows the bank to offer seamless, user-friendly platforms and personalized financial solutions. In 2023, digital channels accounted for a substantial portion of retail transactions across the Indian banking industry, a trend expected to continue its upward trajectory.

- Digital Transformation Investment: Banks are allocating significant capital to enhance their digital infrastructure and capabilities.

- Customer Experience Focus: Superior digital interfaces and personalized services are key differentiators in attracting and retaining customers.

- AI and Data Analytics: Leveraging these technologies enables banks to understand customer behavior and offer proactive solutions.

- Competitive Necessity: Staying ahead in the digital race is no longer optional but a fundamental requirement for survival and growth in the modern banking landscape.

The Indian banking sector is characterized by intense competition, with private sector banks like HDFC Bank, ICICI Bank, and Axis Bank aggressively vying for market share through innovation and superior customer service. Public sector banks, holding a significant portion of total banking assets as of March 2024, continue to exert pressure with their extensive networks and lower cost of funds. Furthermore, the rise of agile Small Finance Banks and Non-Banking Financial Companies, which saw their total advances reach approximately INR 1.55 trillion by Q3 FY24, and disruptive fintech firms, with the global fintech market projected to exceed $33 billion by mid-2024, further intensify this rivalry.

| Competitor Type | Key Differentiators | Market Share Impact | IndusInd Bank's Response |

|---|---|---|---|

| Private Sector Banks | Product innovation, competitive pricing, digital offerings | Direct competition for retail and corporate customers | Focus on agile, technology-driven, customer-centric solutions |

| Public Sector Banks | Extensive branch networks (especially rural), government backing | Significant asset base (approx. 58% of total banking assets in March 2024), customer loyalty | Leveraging digital channels and personalized services to counter reach |

| SFBs & NBFCs | Niche market focus (microfinance, affordable housing), operational agility | Capturing specialized lending segments, growing credit market influence | Monitoring specialized offerings, innovating in product development |

| Fintech Companies | Digital payments, P2P lending, wealth management, superior UX | Siphoning high-margin transactions, impacting customer engagement | Investing in digital transformation, exploring strategic partnerships |

SSubstitutes Threaten

Digital payment platforms and mobile wallets like UPI, Google Pay, and Paytm are strong substitutes for traditional bank transactions. These services provide instant, convenient, and often fee-free ways to handle everyday payments, lessening the need for direct bank account usage for many consumers. For instance, UPI transactions in India surged to over 10 billion in the first half of 2024, highlighting their widespread adoption.

Peer-to-peer (P2P) lending platforms represent a significant threat of substitutes for IndusInd Bank, particularly in the personal and small business loan segments. These platforms directly connect borrowers with investors, often bypassing traditional financial institutions. For example, in 2023, the Indian P2P lending market saw substantial growth, with transaction volumes increasing significantly, indicating a growing preference for these alternative financing channels.

P2P platforms frequently offer faster loan approvals and more flexible repayment structures compared to conventional bank loans. This agility can attract customers seeking immediate funding solutions. As of early 2024, several P2P platforms in India reported processing loan applications within days, a stark contrast to the often longer turnaround times at traditional banks, forcing IndusInd Bank to streamline its own lending processes to remain competitive.

Investors today have a plethora of direct investment options available, bypassing traditional banking channels for wealth growth. Platforms offering access to mutual funds, stocks, bonds, and even alternative investments like cryptocurrencies and real estate crowdfunding are readily accessible. This trend significantly reduces reliance on bank-provided investment products or simple savings accounts for capital appreciation.

For instance, the Indian mutual fund industry saw its Assets Under Management (AUM) surge to approximately ₹53.4 trillion by March 2024, a testament to the growing investor preference for direct market participation. This highlights a clear threat to banks like IndusInd, as customers can achieve investment goals outside of their traditional offerings.

To counter this, IndusInd Bank needs to bolster its wealth management and investment advisory services. Offering competitive, tailored investment solutions and personalized financial planning can help retain customers who might otherwise seek these services from specialized fintech firms or direct market platforms.

Non-Banking Financial Companies (NBFCs) for Lending

Non-Banking Financial Companies (NBFCs) present a notable threat of substitutes for IndusInd Bank, particularly in specialized lending areas. These entities, focusing on segments like housing finance, vehicle finance, and gold loans, often offer a more agile and customer-centric approach. For instance, NBFCs have been actively expanding their market share in retail lending. In FY23, the NBFC sector's credit growth stood at 10.4%, demonstrating their competitive momentum against traditional banks.

NBFCs frequently differentiate themselves through faster loan processing times and highly customized financial products. This can be a significant draw for borrowers who find the procedural complexities of traditional banking cumbersome. Their specialized nature allows for a deeper understanding of niche market needs, enabling them to craft attractive propositions. As of December 2023, NBFCs accounted for approximately 25% of the total credit disbursed in India, highlighting their substantial role as alternative lenders.

- NBFCs compete in specialized lending segments like housing and vehicle finance.

- They often offer quicker loan processing and tailored products.

- NBFC credit growth reached 10.4% in FY23.

- NBFCs represented about 25% of total credit disbursed in India by December 2023.

Emerging Decentralized Finance (DeFi) Solutions

While still in its early stages in India, the growing adoption of decentralized finance (DeFi) presents a potential long-term threat of substitution for traditional banking services. DeFi platforms, leveraging blockchain technology for lending, borrowing, and asset management, aim to disintermediate financial processes, potentially offering lower transaction costs and enhanced transparency compared to conventional banking models.

For instance, global DeFi lending volumes have seen significant growth, with total value locked (TVL) in DeFi protocols reaching hundreds of billions of dollars at various points in recent years, demonstrating the appeal of these alternative financial mechanisms. IndusInd Bank needs to closely monitor the evolution of DeFi, particularly its regulatory landscape and user adoption rates within India, to assess its potential impact on its customer base and service offerings.

Exploring the integration of blockchain technology for internal efficiencies or customer-facing solutions could be a strategic response. As of early 2024, the Indian government continues to explore regulatory frameworks for digital assets and blockchain, which will significantly shape the future of DeFi in the country.

- DeFi's Potential to Bypass Intermediaries: DeFi platforms directly connect lenders and borrowers, reducing reliance on traditional financial institutions like IndusInd Bank.

- Cost and Transparency Advantages: DeFi often boasts lower fees and greater transaction visibility due to its blockchain foundation.

- Global DeFi Growth Metrics: The total value locked in DeFi protocols has fluctuated but has consistently remained in the tens to hundreds of billions of dollars globally, indicating significant market interest.

- IndusInd Bank's Strategic Imperative: Proactive monitoring and potential adoption of blockchain technology are crucial for IndusInd Bank to remain competitive.

The threat of substitutes for IndusInd Bank is substantial, driven by evolving digital payment systems and alternative lending platforms. Digital payment solutions like UPI are increasingly preferred for daily transactions, reducing the need for traditional banking services for everyday money movement. In the first half of 2024, UPI transactions in India surpassed 10 billion, underscoring this shift.

Peer-to-peer lending platforms and Non-Banking Financial Companies (NBFCs) offer faster, more flexible loan options, directly competing with IndusInd Bank's core lending business. NBFCs, for instance, saw credit growth of 10.4% in FY23 and accounted for about 25% of total credit disbursed in India by December 2023, showcasing their growing market presence.

Furthermore, readily accessible investment platforms allow individuals to bypass banks for wealth creation, with Indian mutual fund AUM reaching ₹53.4 trillion by March 2024. While Decentralized Finance (DeFi) is nascent in India, its global growth, with hundreds of billions locked in protocols, signals a potential long-term disruptive force that banks must monitor.

| Substitute Category | Key Characteristics | Impact on IndusInd Bank | 2024/Recent Data Point |

|---|---|---|---|

| Digital Payment Platforms (e.g., UPI) | Convenience, Speed, Lower/No Fees | Reduced transaction volumes, decreased reliance on traditional payment methods | Over 10 billion UPI transactions (H1 2024) |

| P2P Lending Platforms | Faster approvals, flexible terms, direct investor access | Loss of personal and SME loan market share | Significant growth in Indian P2P lending market (2023) |

| NBFCs | Specialized lending, agility, customer-centricity | Competition in retail and specialized loan segments | 10.4% credit growth (FY23); 25% of total credit disbursed (Dec 2023) |

| Direct Investment Platforms | Access to stocks, bonds, mutual funds, crypto | Reduced demand for bank savings and investment products | ₹53.4 trillion Indian MF AUM (Mar 2024) |

| DeFi | Disintermediation, potential lower costs, transparency | Long-term threat to traditional financial intermediation | Global DeFi TVL in hundreds of billions of dollars |

Entrants Threaten

The threat of new entrants into the Indian banking sector is significantly dampened by robust regulatory hurdles. The Reserve Bank of India (RBI) mandates substantial capital requirements, often in the hundreds of crores of rupees, and enforces rigorous compliance standards for any entity seeking a banking license. For instance, in 2024, the RBI continued its cautious approach to new banking licenses, emphasizing stability and customer protection.

Establishing a commercial bank in India, like IndusInd Bank, requires immense capital. Think billions of rupees for branches, technology, and a robust network. This massive financial barrier significantly discourages new players from entering the market, as only well-funded organizations can even contemplate such a venture.

Brand loyalty and the trust deficit for newcomers pose a significant barrier for potential new entrants into the banking sector, directly impacting IndusInd Bank. Established players like IndusInd Bank have cultivated deep-rooted customer relationships over many years, a critical asset in an industry where trust is paramount. For instance, in 2023, IndusInd Bank reported a customer base exceeding 35 million, a testament to its established presence and the loyalty it commands.

Newcomers would face a formidable challenge in replicating this level of credibility and winning over customer confidence, particularly for essential banking services. Gaining trust for core offerings such as savings accounts and lending requires substantial time and consistent positive customer experiences, which new entrants lack from the outset. This existing trust acts as a powerful moat, protecting incumbents like IndusInd Bank from disruptive forces.

Economies of Scale and Network Effects

Established banks like IndusInd Bank leverage significant economies of scale, making it difficult for new entrants to compete on cost. Their vast operational infrastructure, technological investments, and customer acquisition strategies are far more efficient. For instance, in 2023, major Indian banks reported substantial cost-to-income ratios, often below 50%, a benchmark new players would find challenging to replicate initially.

Network effects further solidify the position of incumbents. IndusInd Bank's extensive branch network, ATM accessibility, and robust digital platforms create a self-reinforcing advantage. Customers are drawn to the convenience and widespread availability of services, making it harder for newcomers to gain traction. By the end of FY24, IndusInd Bank operated over 2,500 branches and 7,000 ATMs across India, a physical footprint that represents a considerable barrier to entry.

- Economies of Scale: Lower per-unit costs in operations, technology, and marketing for established banks.

- Network Effects: Increased value of services as more customers and access points are added, benefiting incumbents.

- High Initial Investment: New entrants require massive capital to build comparable infrastructure and customer base.

Evolution of Fintechs as Potential Future Competitors

While obtaining direct banking licenses remains a significant hurdle, the dynamic evolution of fintech companies presents an indirect, yet potent, long-term threat to established players like IndusInd Bank. These agile entities, often starting with specialized financial services, possess the potential to broaden their offerings into banking-like products by capitalizing on their growing customer bases and advanced technological capabilities, especially if regulatory frameworks become more permissive.

The threat isn't immediate disruption but rather a gradual encroachment as fintechs mature. For instance, by the end of 2024, the Indian fintech sector was projected to reach a valuation of over $1 trillion, indicating substantial growth and innovation. This expansion could see them offering services that directly compete with traditional banking functions.

- Fintech Expansion: Many fintechs are moving beyond payments and lending to offer wealth management and investment solutions, blurring the lines with traditional banking.

- Customer Data Advantage: Fintechs often have a strong understanding of customer behavior, which can be leveraged to develop highly personalized banking products.

- Regulatory Arbitrage: As fintechs innovate, they may operate in regulatory grey areas, creating a competitive advantage until regulations catch up.

- Partnership/Acquisition Opportunities: IndusInd Bank needs to stay vigilant, considering strategic partnerships or acquisitions of successful fintechs to integrate their technology and customer reach.

The threat of new entrants for IndusInd Bank is generally low due to high capital requirements and stringent regulatory approvals from the Reserve Bank of India. These barriers, including extensive compliance and operational standards, make it exceptionally difficult and costly for new entities to establish a banking presence. For example, in 2024, the RBI maintained a cautious stance on new banking licenses, prioritizing financial stability.

The established brand recognition and deep customer loyalty enjoyed by IndusInd Bank, with over 35 million customers by 2023, present a significant hurdle for any newcomer. Replicating the trust and extensive service network, which includes over 2,500 branches and 7,000 ATMs by FY24, requires substantial time and investment that new entrants lack.

Economies of scale and network effects further solidify IndusInd Bank's competitive position, making it challenging for new players to match operational efficiencies and service accessibility. While fintechs pose an indirect threat through innovation and potential regulatory arbitrage, the direct threat of new banking entrants remains mitigated by these incumbent advantages.

Porter's Five Forces Analysis Data Sources

Our IndusInd Bank Porter's Five Forces analysis is built upon a robust foundation of data, drawing from official company filings, financial statements, and investor relations reports. We also incorporate insights from reputable industry research firms and macroeconomic data providers to ensure a comprehensive understanding of the competitive landscape.