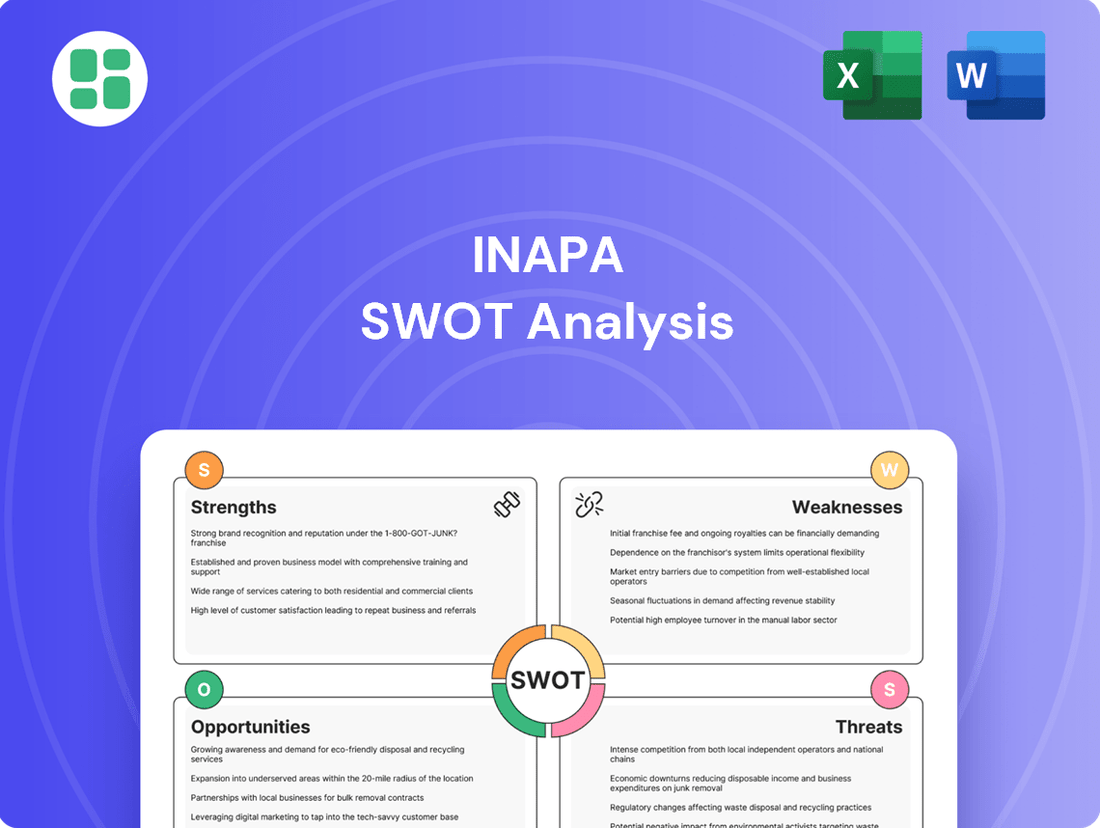

Inapa SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inapa Bundle

Inapa's market position is shaped by a unique blend of strengths, like its established distribution network, and potential weaknesses, such as reliance on specific product lines. Understanding these dynamics is crucial for navigating the competitive landscape.

Want the full story behind Inapa's opportunities for expansion and the threats it faces? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Despite Inapa's group-wide insolvency, its subsidiaries historically commanded leading positions in specific European paper and packaging distribution markets. For instance, Inapa España was a significant player in the Spanish market, and Inapa Italia held a strong presence in Italy's packaging sector. This established market footprint, built over years of operation, represents a tangible asset for potential acquirers of these individual business segments.

Inapa's strength lies in its diversified product offerings, encompassing paper, packaging, and visual communication materials. This broad portfolio helps mitigate risks associated with any single market segment.

The non-paper segments, especially visual communication, showed promising organic growth in 2023. This indicates these product lines have independent market demand and value, contributing positively to Inapa's overall performance.

Inapa's strength lies in its value-added services, extending beyond mere paper distribution to include digital printing and specialized logistics. These services are particularly appealing in the current market, where clients increasingly seek integrated solutions. For instance, Inapa's digital printing capabilities allow for customized, on-demand production, a growing segment within the printing industry.

These niche offerings differentiate Inapa from competitors focused solely on traditional paper sales. In 2024, the demand for digital printing solutions saw a significant uptick, with the global digital printing market projected to reach over $30 billion. Inapa's investment in these areas positions it well to capture this expanding market share.

The logistics services further enhance Inapa's value proposition, providing a comprehensive supply chain solution for its clients. This integrated approach can be a strong selling point for potential acquirers looking to expand their service portfolio and gain access to Inapa's established client base and operational expertise in these specialized areas.

Potential for Segment Recovery Under New Ownership

Even though Inapa's parent company faced insolvency, specific business units, particularly those in packaging and visual communication, demonstrated resilience. These segments, often profitable on their own, present a strong case for recovery and growth under new, financially sound ownership. The ongoing sale processes underscore the independent market value and viability of these operations, attracting external interest.

The market's continued engagement with Inapa's individual segments is a key strength. For instance, by early 2024, reports indicated significant buyer interest in Inapa's Portuguese packaging division, with valuations suggesting its standalone potential. This external validation points to the inherent value within these units, separate from the parent company's financial distress.

- Independent Profitability: Certain Inapa segments, like specialized packaging, operated profitably even amidst the parent company's financial challenges.

- Market Interest: Ongoing sale processes for specific Inapa business units in 2024 highlight external confidence in their standalone viability.

- Asset Value: The underlying assets and established customer bases within these segments represent tangible value for potential acquirers.

Operational Footprint Across Europe

Inapa's strength lies in its extensive operational footprint, maintaining a presence in 10 European countries. This wide geographical reach positions the company favorably within the fragmented European distribution market. Even if the entire Inapa entity faces restructuring, its individual regional operations and established logistical networks represent significant, potentially salvageable assets.

This broad operational base allows for diverse market penetration and resilience. For instance, Inapa's operations in key markets like Germany and France, which are significant contributors to the European IT distribution sector, offer substantial value. The company's ability to serve multiple national markets efficiently is a key differentiator.

- Geographical Diversification: Operations in 10 European countries reduce reliance on any single market, mitigating country-specific economic risks.

- Logistical Network: Established infrastructure across these regions facilitates efficient supply chain management and timely product delivery.

- Market Access: The presence in multiple countries provides direct access to a broad customer base and diverse market dynamics.

- Potential for Divestment: Individual regional operations can be attractive acquisition targets for competitors looking to expand their European presence, offering a path to value realization.

Inapa's core strength resides in its established market positions across various European countries, particularly in paper and packaging distribution. These historical footholds, like Inapa España's significant role in Spain and Inapa Italia's strong presence in Italy, offer tangible value for potential acquirers of these individual business segments. The company's diversified product portfolio, spanning paper, packaging, and visual communication, further enhances its resilience by mitigating risks tied to any single market segment. Promising organic growth in non-paper segments, especially visual communication, in 2023 highlights the independent market demand and value of these product lines.

The company's value-added services, including digital printing and specialized logistics, are a key differentiator. These integrated solutions cater to growing client demand, with digital printing experiencing a significant uptick. The global digital printing market was projected to exceed $30 billion in 2024, indicating Inapa's strategic investment in this area positions it well. Furthermore, the resilience of certain profitable segments, such as specialized packaging, even during the parent company's financial distress, underscores their standalone viability. This is further evidenced by significant buyer interest in Inapa's Portuguese packaging division by early 2024, validating its independent market value.

Inapa's extensive operational footprint across 10 European countries is a significant advantage, providing broad market access and reducing reliance on any single economy. This geographical diversification, coupled with established logistical networks, facilitates efficient supply chain management and timely delivery. Operations in key markets like Germany and France, crucial for the European IT distribution sector, offer substantial value. The potential for divestment of these individual regional operations presents an attractive avenue for competitors seeking to expand their European reach and realize value.

| Strength | Description | Supporting Data/Context |

|---|---|---|

| Established Market Positions | Leading positions in specific European paper and packaging distribution markets. | Inapa España significant player in Spain; Inapa Italia strong in Italy's packaging sector. |

| Diversified Product Portfolio | Offers paper, packaging, and visual communication materials. | Mitigates risk associated with single market segments. |

| Value-Added Services | Digital printing and specialized logistics. | Digital printing market projected to exceed $30 billion in 2024; caters to growing demand for integrated solutions. |

| Segmental Resilience & Profitability | Certain segments, like specialized packaging, remained profitable. | Demonstrated standalone viability, attracting buyer interest by early 2024. |

| Extensive Operational Footprint | Presence in 10 European countries. | Provides broad market access and logistical efficiency; key markets include Germany and France. |

What is included in the product

Analyzes Inapa’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

The Inapa SWOT analysis provides a clear, actionable framework to identify and address strategic weaknesses, alleviating the pain of unclear direction and missed opportunities.

Weaknesses

Inapa's declaration of insolvency in July 2024, stemming from a €12 million cash shortfall at its German subsidiary, is a critical weakness. This signifies a profound inability to manage its financial commitments, indicating a severe operational instability.

Inapa's financial health has taken a serious downturn, with the company reporting a significant €8 million net loss in 2023. This marks a sharp contrast to its prior profitability, signaling a concerning trend.

Adding to these woes, Inapa carried a substantial net debt of €207 million as of December 2023. This high level of indebtedness, coupled with the recent losses, paints a picture of a precarious financial position.

These combined factors indicate a rapid deterioration in the company's financial performance and balance sheet strength. The considerable debt burden, in particular, makes a swift and effective recovery a formidable challenge.

Inapa's delisting from Euronext Lisbon in October 2024, a direct consequence of its insolvency, significantly damages its credibility with investors. This move effectively severs its ties to public capital markets, a critical avenue for raising funds and facilitating shareholder liquidity.

The insolvency-driven delisting creates substantial hurdles for any future attempts at financial restructuring or securing new investment. Without the transparency and accessibility of a public listing, Inapa faces a more challenging and costly path to attract the capital needed for recovery or growth.

Loss of Centralized Control and Fragmentation

Inapa's recent turmoil, marked by the resignation of its CEO and board, has severely undermined its centralized control. This leadership vacuum, coupled with the divestment of various group segments and ongoing insolvency proceedings for other parts, has led to significant operational fragmentation. For instance, by early 2024, multiple subsidiaries were actively seeking buyers or were already in administration, disrupting any unified strategic execution.

This loss of a cohesive leadership structure and the piecemeal sale of assets directly contribute to a decline in operational efficiency. Without a central guiding hand, individual business units may pursue divergent strategies, hindering synergies and increasing the likelihood of duplicated efforts or missed opportunities. The overall business model becomes less integrated and more susceptible to market shifts.

The fragmentation also presents challenges in maintaining a consistent brand identity and customer experience across the remaining or divested operations. This can dilute Inapa's market presence and make it harder to implement group-wide initiatives, such as technological upgrades or sustainability programs, which rely on coordinated efforts. The ongoing restructuring efforts, while necessary, exacerbate this inherent weakness.

Dependence on Declining Traditional Paper Market

Inapa's reliance on the traditional paper market presents a significant vulnerability. This sector has been in a steady decline for years as digital alternatives become more prevalent. This trend directly impacted Inapa's performance, with its paper distribution segment experiencing a notable downturn.

The company's historical revenue streams were heavily weighted towards paper, making it susceptible to the broader industry's contraction. Despite attempts to branch out, the core business continued to feel the pressure. For instance, in 2023, Inapa reported a 20% decrease in sales specifically within its paper distribution operations, underscoring the severity of this weakness.

- Secular Decline: The global shift towards digitalization continues to erode demand for traditional paper products.

- Revenue Impact: A substantial portion of Inapa's revenue remains tied to this declining market, creating financial strain.

- 2023 Sales Drop: The company experienced a 20% reduction in paper distribution sales in 2023, highlighting the immediate impact.

Inapa's financial distress is a major weakness, highlighted by its July 2024 insolvency declaration due to a €12 million cash shortfall at its German subsidiary. This financial instability is compounded by an €8 million net loss in 2023 and a significant net debt of €207 million as of December 2023, painting a picture of severe financial precarity.

The company's delisting from Euronext Lisbon in October 2024, a direct result of its insolvency, cripples its access to public capital markets and severely damages investor confidence, making future fundraising and restructuring efforts extremely difficult.

Inapa suffers from severe operational fragmentation and a loss of centralized control, exacerbated by the resignation of its CEO and board. The piecemeal divestment of group segments, with multiple subsidiaries in administration by early 2024, disrupts unified strategy execution and diminishes operational efficiency.

The company's heavy reliance on the declining traditional paper market is a critical vulnerability. This sector's secular decline, driven by digitalization, directly impacted Inapa's performance, with paper distribution sales dropping 20% in 2023.

| Financial Metric | Value | Date | Impact |

|---|---|---|---|

| Insolvency Declaration | €12 million cash shortfall (German subsidiary) | July 2024 | Severe operational instability |

| Net Loss | €8 million | 2023 | Sharp contrast to prior profitability |

| Net Debt | €207 million | December 2023 | Precarious financial position |

| Euronext Lisbon Delisting | Yes | October 2024 | Damaged investor credibility, severed public market ties |

| Paper Distribution Sales | -20% | 2023 | Significant impact from market decline |

What You See Is What You Get

Inapa SWOT Analysis

The preview you see is the actual Inapa SWOT analysis document you'll receive upon purchase. You're getting a genuine look at the professional quality and structure of the full report. Once you buy, the complete, detailed analysis will be yours to download.

Opportunities

The strategic divestment of units like Inapa Packaging SAS and Inapa France SAS offers a clear path to organizational streamlining. This move is designed to significantly reduce the company's overall debt burden, a critical step towards financial health.

By shedding underperforming or non-core assets, Inapa can unlock capital and foster a more focused operational structure. This strategic pruning creates an opportunity for the remaining, healthier segments to thrive, potentially attracting new investment or operating with greater agility.

For instance, the sale of Inapa Packaging SAS in late 2024 aimed to bolster Inapa's balance sheet, with initial reports suggesting a potential reduction in liabilities by tens of millions of euros, allowing for a more concentrated approach on its core printing and distribution businesses.

The European paper packaging market is experiencing robust growth, with projections indicating a significant expansion driven by escalating consumer and regulatory pressure for sustainable, recyclable, and compostable alternatives. This trend is particularly amplified by the booming e-commerce sector, which relies heavily on efficient and environmentally conscious packaging solutions.

Inapa's packaging divisions, assuming a successful acquisition and subsequent revitalization, are strategically positioned to leverage this powerful market momentum. The company can tap into the increasing demand for eco-friendly paper-based packaging, aligning its offerings with the evolving preferences of both consumers and businesses across Europe.

Digital transformation presents significant opportunities for Inapa to boost efficiency and create innovative service offerings. By embracing smart packaging and advanced analytics powered by AI, the company can optimize its supply chains.

Investing in these digital technologies can help any remaining or newly acquired Inapa operations gain a competitive edge. For instance, the global smart packaging market was valued at approximately USD 34.5 billion in 2023 and is projected to reach USD 70.9 billion by 2030, growing at a CAGR of 10.9% according to some market reports.

Market Consolidation in Packaging Sector

The European packaging sector is consolidating, with companies seeking to improve margins and expand delivery reach across regions. This presents a chance for Inapa's robust packaging divisions to be integrated into larger, more established entities. Such a move could unlock significant benefits, including economies of scale and enhanced market access.

For instance, the global packaging market was valued at approximately $1.1 trillion in 2024, with projections indicating continued growth. Within this landscape, consolidation is a key driver, as seen in recent M&A activities. Inapa's packaging operations, particularly those with strong regional presence and specialized capabilities, are well-positioned to attract interest from larger players looking to bolster their portfolios.

This strategic alignment could lead to:

- Improved operational efficiency through shared resources and streamlined supply chains.

- Access to broader distribution networks and a wider customer base.

- Enhanced bargaining power with suppliers due to increased volume.

- Greater investment capacity for innovation and sustainable packaging solutions.

Renewed Focus on High-Growth Non-Paper Segments

Inapa's visual communication segment demonstrated resilience in 2023, posting positive performance even as other areas faced headwinds. This outperformance highlights a significant opportunity to shift strategic emphasis towards these higher-growth, non-paper-dependent sectors.

Future investment or a new ownership structure could strategically prioritize these visual communication segments. This focus aims to enhance overall profitability and bolster the company's long-term sustainability.

- Strategic Shift: Capitalize on the visual communication segment's positive momentum by reallocating resources and attention.

- Investment Focus: Direct future capital expenditures and potential acquisitions towards expanding capabilities in high-margin visual communication areas.

- Diversification Benefit: Leverage the success of visual communication to de-risk the business from traditional paper market volatility.

- Market Potential: Tap into the growing demand for visual communication solutions, which are less susceptible to the decline seen in traditional paper markets.

The divestment of certain Inapa units, such as Inapa Packaging SAS and Inapa France SAS, streamlines operations and reduces debt, allowing remaining segments to focus and potentially attract investment. The European paper packaging market is growing due to e-commerce and sustainability demands, presenting an opportunity for Inapa's packaging divisions to capitalize on eco-friendly solutions. Digital transformation offers efficiency gains and innovative services, with the smart packaging market projected for substantial growth. Consolidation in the European packaging sector could also lead to Inapa's packaging operations being integrated into larger entities, offering economies of scale and market access.

Inapa's visual communication segment showed resilience in 2023, indicating an opportunity to shift strategic focus towards these higher-growth, non-paper-dependent sectors to enhance profitability and sustainability.

| Opportunity Area | Key Driver | Inapa's Position | Market Data (2023/2024) |

|---|---|---|---|

| Paper Packaging Growth | E-commerce & Sustainability Demand | Strategic positioning for eco-friendly solutions | European paper packaging market expanding; Global packaging market ~ $1.1 trillion in 2024 |

| Digital Transformation | AI & Smart Packaging | Potential for supply chain optimization & new services | Global smart packaging market valued at ~$34.5 billion in 2023 |

| Industry Consolidation | Margin Improvement & Reach Expansion | Attractive target for larger players seeking portfolio enhancement | Key trend in European packaging sector |

| Visual Communication Strength | Resilience & Higher Growth | Opportunity for strategic focus & resource reallocation | Segment demonstrated positive performance in 2023 |

Threats

The most significant threat Inapa faces is the potential for full liquidation across its entire group. This dire scenario looms if the company cannot devise and execute viable solutions for its individual entities or implement a comprehensive restructuring plan. Such an outcome would mean the complete halt of all operations, leading to a total loss of remaining asset value for both shareholders and creditors.

Extended insolvency proceedings for companies like Inapa can be devastating. For instance, prolonged uncertainty in such cases often sees asset values plummet, as seen in various retail bankruptcies where inventory depreciates rapidly. This also leads to a significant loss of skilled employees who seek more stable opportunities, impacting operational efficiency.

Furthermore, the extended period of doubt surrounding a company's survival severely damages crucial relationships with customers and suppliers. Customers may switch to more reliable competitors, and suppliers might demand stricter payment terms or cease supplying altogether, as observed in the supply chain disruptions during the 2023 retail sector challenges.

This prolonged uncertainty deters potential new business, as clients are hesitant to engage with a company facing an uncertain future. It also accelerates the loss of market share to competitors who are perceived as more stable, ultimately deepening the financial distress and making recovery even more challenging.

Inapa's remaining market segments, particularly packaging, are characterized by intense competition. Established industry giants and nimble new companies are vying for market share, making it challenging for Inapa to stand out.

The company's financially distressed situation severely hinders its ability to compete effectively. It struggles to offer competitive pricing, deliver superior service, or invest in crucial innovation, which can result in a continued decline in its market position.

Volatile Raw Material Prices and Supply Chain Disruptions

The paper and packaging sector is notoriously sensitive to swings in pulp prices, a key input material. For Inapa, especially given its precarious financial standing, absorbing these price hikes would be a significant challenge, potentially crippling any remaining operations.

Global supply chain disruptions, which have been a persistent issue, further exacerbate this threat. These disruptions can lead to delays in receiving essential raw materials and impact delivery schedules, creating a domino effect on Inapa's ability to function.

For context, the global pulp market saw price increases in late 2023 and early 2024 due to factors like reduced production in some regions and strong demand. For instance, Northern bleached softwood kraft (NBSK) pulp prices in Europe hovered around $1,000-$1,200 per ton during this period, a level that would strain a company like Inapa.

- Volatile Pulp Prices: Inapa faces significant risk from unpredictable fluctuations in the cost of pulp, a primary raw material.

- Supply Chain Vulnerability: The company's current state makes it highly susceptible to disruptions in global logistics and material availability.

- Impact on Operations: These external shocks could severely hinder Inapa's ability to maintain production and meet customer demands.

Ongoing Decline in Graphic Paper Demand

The ongoing structural decline in graphic paper demand, driven by widespread digitalization, poses a significant long-term threat. Despite some growth in packaging segments, Inapa's exposure to the graphic paper sector will continue to face diminishing consumption. This persistent trend is expected to exert sustained downward pressure on both demand volumes and profit margins for the foreseeable future.

For instance, global newsprint consumption has seen a steep decline; in 2023, it was approximately 30% lower than in 2019. Similarly, uncoated woodfree paper, often used for commercial printing, experienced a notable contraction in demand throughout 2023 and early 2024.

- Digitalization's Impact: Continued shift from print to digital media reduces the need for graphic papers.

- Market Contraction: Expect ongoing decreases in demand for products like printing and writing papers.

- Margin Pressure: Lower demand often leads to increased price competition and squeezed profit margins.

- Industry Trends: Global paper production capacity for graphic papers has been adjusted downwards in response to these market realities.

Inapa's precarious financial situation leaves it highly vulnerable to external economic shocks, particularly volatile pulp prices and supply chain disruptions. For example, global pulp prices saw increases in late 2023 and early 2024, with NBSK pulp in Europe reaching approximately $1,000-$1,200 per ton, a cost Inapa would struggle to absorb. The ongoing structural decline in graphic paper demand due to digitalization, with newsprint consumption down about 30% from 2019 levels by 2023, further pressures its market segments.

| Threat | Description | Impact on Inapa |

|---|---|---|

| Volatile Pulp Prices | Unpredictable fluctuations in the cost of pulp, a key raw material. | Inability to absorb price hikes, crippling operations. |

| Supply Chain Disruptions | Delays in receiving raw materials and impacting delivery schedules. | Severe hindrance to production and meeting customer demands. |

| Digitalization & Graphic Paper Decline | Shift from print to digital media reducing demand for graphic papers. | Diminishing consumption, downward pressure on volumes and margins. |

| Intense Market Competition | Vying for market share against established giants and nimble new companies. | Difficulty in standing out, inability to offer competitive pricing or invest in innovation. |

SWOT Analysis Data Sources

This Inapa SWOT analysis is built upon a robust foundation of data, incorporating verified financial statements, comprehensive market research reports, and expert industry commentary. These diverse sources ensure a well-rounded and accurate assessment of the company's strategic position.