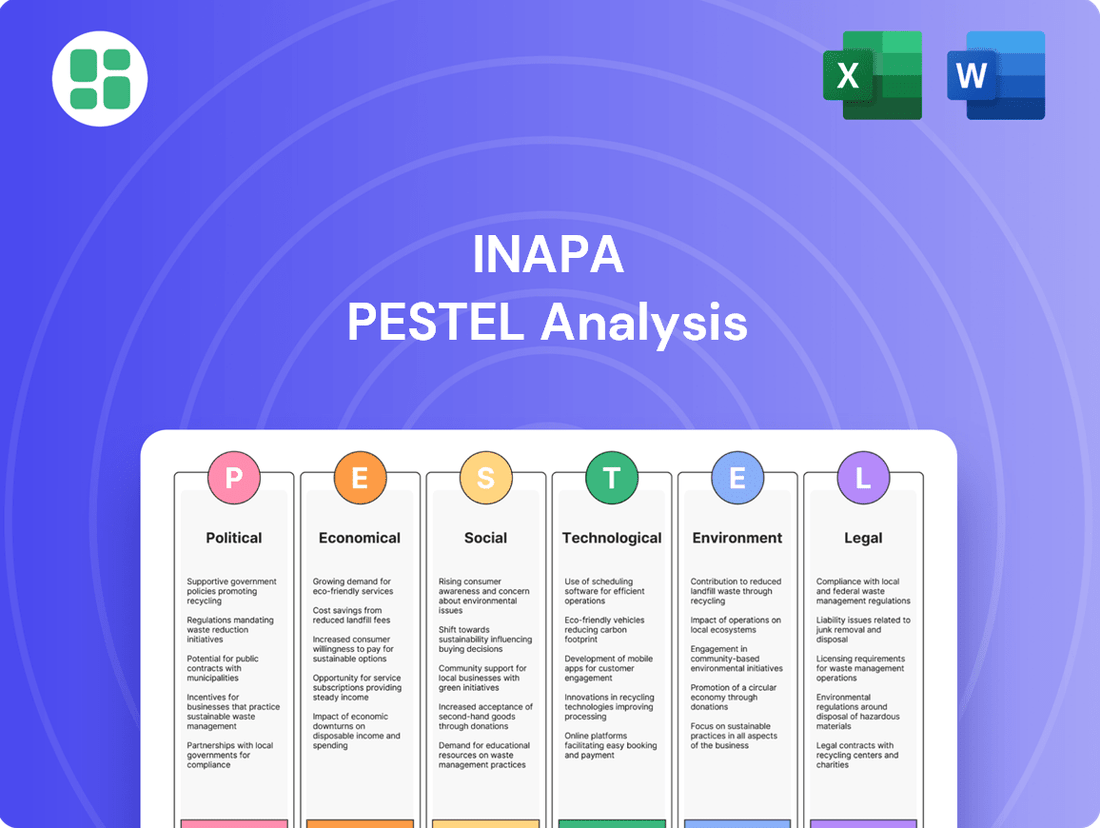

Inapa PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inapa Bundle

Navigate the complex external forces shaping Inapa's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that could impact your strategy. Gain a critical advantage by downloading the full analysis today and unlock actionable insights for smarter decision-making.

Political factors

The European Union's regulatory framework presents a dynamic challenge for Inapa. New directives, such as the ambitious European Green Deal, coupled with the upcoming Packaging and Packaging Waste Regulation (PPWR), are setting stricter standards for sustainability and waste reduction across the continent. These regulations will directly affect how paper, packaging, and visual communication products are designed, manufactured, and managed at their end-of-life.

The PPWR, in particular, aims to harmonize packaging rules and boost recycling rates, potentially impacting Inapa's material sourcing and production processes. For example, the EU's target for recycled content in packaging is set to increase, requiring businesses to adapt their supply chains and potentially invest in new technologies. Companies that can effectively navigate and comply with these evolving environmental mandates may find themselves with a competitive advantage.

International trade policies and the specter of trade wars continue to shape global competition for the pulp and paper industry. For Europe, these dynamics present both challenges and opportunities, directly influencing the sector's ability to compete on the world stage.

Despite maintaining a positive trade balance in 2024, European pulp and paper manufacturers faced headwinds from elevated energy prices. These costs, remaining significantly higher than pre-pandemic benchmarks, directly impacted their competitiveness against global rivals, particularly those in regions with lower energy expenditures.

Governments across Europe are actively championing circular economy models, with significant policy shifts and financial incentives designed to curb waste and boost recycling rates. This political momentum is a direct driver for companies like Inapa to prioritize and invest in sustainable operational frameworks.

In 2024, for instance, the European Union's commitment to a circular economy was underscored by increased funding for research and development into sustainable materials and processes. This supportive political environment directly benefits Inapa's strategic focus on maximizing the utilization of recycled paper, a key component of its circularity efforts.

Political Stability and Geopolitical Risks

Geopolitical instability and macroeconomic uncertainties, particularly in Europe, significantly influence industrial production and consumer confidence, directly affecting Inapa's operational landscape. These global tensions can lead to supply chain disruptions, escalating operational expenses, and a noticeable downturn in demand for industrial goods, including paper and packaging products. For instance, the ongoing geopolitical tensions in Eastern Europe have led to increased energy costs, a critical input for paper manufacturing, with Brent crude oil futures trading around $80-$85 per barrel in early 2024, a considerable increase from pre-conflict levels.

The impact extends to Inapa's international sales and procurement. Fluctuations in currency exchange rates, often exacerbated by political instability, can make imported raw materials more expensive or reduce the competitiveness of exported finished goods. For example, the Euro's volatility against the US Dollar in 2023, influenced by European economic performance and geopolitical events, directly affected the cost of imported pulp and the pricing of Inapa's products in dollar-denominated markets.

- Supply Chain Vulnerability: Geopolitical events can interrupt the flow of raw materials and finished goods, impacting Inapa's production schedules and delivery times.

- Cost Inflation: Increased energy prices and currency devaluations due to geopolitical risks directly translate to higher production costs for Inapa.

- Demand Fluctuations: Lower consumer and business confidence stemming from geopolitical uncertainties can reduce demand for paper and packaging products.

- Regulatory Changes: Political shifts can lead to new trade policies, tariffs, or environmental regulations that may affect Inapa's market access and operational compliance.

Fiscal Policies and Business Environment

National fiscal policies, such as corporate tax rates and the availability of investment incentives, significantly influence the operational landscape for large distributors like Inapa. These policies can either encourage or deter capital expenditure and expansion. For instance, changes in tax structures directly impact a company's net profit and its ability to reinvest earnings.

The broader economic climate, heavily influenced by fiscal decisions, presented challenges in 2023 and early 2024. High inflation, elevated interest rates, and a general slowdown in private consumption across Europe created a less favorable environment for businesses. This economic backdrop directly affected consumer spending patterns and, consequently, the demand for goods distributed by companies like Inapa, impacting their revenue streams and investment strategies.

Specific data points highlight these pressures. For example, the Eurozone inflation rate averaged 5.4% in 2023, a notable decrease from 2022's peaks but still above the European Central Bank's target. Interest rates also remained elevated, with the ECB's main refinancing operations rate standing at 4.50% as of early 2024, increasing borrowing costs for businesses. These factors collectively contributed to a cautious approach to investment and business expansion among distributors.

Key fiscal and economic considerations for distributors include:

- Taxation Policies: Changes in corporate tax rates and the structure of indirect taxes can alter profitability and cash flow.

- Investment Incentives: Government support for capital investment, research and development, or specific sectors can drive growth.

- Inflationary Environment: Persistent high inflation erodes purchasing power and increases operational costs, impacting demand and margins.

- Interest Rate Levels: Higher interest rates increase the cost of debt financing, making expansion or capital projects more expensive.

Government policies promoting a circular economy directly influence Inapa's operational focus. Increased funding for sustainable materials research, as seen in the EU's 2024 initiatives, supports Inapa's strategy for recycled paper utilization. These political drivers encourage investment in environmentally sound practices, offering a competitive edge.

What is included in the product

This Inapa PESTLE analysis examines the influence of external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a comprehensive understanding of the business landscape.

Inapa's PESTLE analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, reducing the pain of sifting through extensive data.

Economic factors

A significant economic factor impacting Inapa is its declaration of insolvency, which resulted in its delisting from Euronext Lisbon on October 29, 2024. This critical development signifies a severe downturn in the company's financial health, directly affecting its access to capital and investor confidence.

The insolvency status means Inapa is unable to meet its financial obligations as they become due, a situation often triggered by a combination of declining revenues, rising costs, and poor cash flow management. For instance, in the period leading up to its insolvency, Inapa's financial statements likely revealed substantial liabilities exceeding its assets, a clear indicator of economic distress.

The exclusion from Euronext Lisbon further exacerbates Inapa's economic predicament by limiting its ability to raise funds through equity markets and diminishing its overall market valuation. This delisting event underscores the profound economic challenges Inapa faces, impacting its operational continuity and future prospects.

The European pulp and paper industry, including Inapa, grappled with energy costs that in 2024 remained double their pre-pandemic figures. This sustained high cost of energy directly squeezes manufacturing margins and weakens the sector's competitive standing on the global stage.

These elevated energy expenses, coupled with other rising production costs, put considerable pressure on Inapa's profitability. The company must navigate these economic headwinds to maintain its market position and financial health.

Following a dip in 2023, the European paper and board market experienced a recovery in 2024, with consumption and production showing positive growth, especially for packaging materials. This rebound suggests a strengthening demand, though it's important to note that overall production still hasn't reached pre-2020 levels, pointing to an ongoing sensitivity to market shifts.

Inflation and Interest Rates

High inflation and rising interest rates across Europe created a challenging macroeconomic landscape in 2023 and early 2024. This trend directly impacted private consumption by reducing disposable income and increased borrowing costs for businesses, thereby constraining financial health and investment capacity within the paper and packaging sectors.

The European Central Bank (ECB) maintained its key interest rates at elevated levels throughout much of this period to combat inflation. For instance, the main refinancing operations rate stood at 4.50% as of early 2024, a significant increase from previous years, directly increasing the cost of capital for companies like Inapa.

- Inflationary Pressures: Eurozone inflation averaged 5.4% in 2023, a notable decrease from 2022's 8.4% but still above the ECB's 2% target, impacting input costs for paper production.

- Interest Rate Hikes: The ECB raised its deposit facility rate to 4.00% by September 2023, making business loans more expensive and potentially dampening demand for packaging materials.

- Consumer Spending Impact: Elevated inflation eroded purchasing power, leading to reduced consumer spending on non-essential goods, which can indirectly affect demand for paper-based products.

- Business Investment Constraints: Higher borrowing costs and economic uncertainty discouraged capital expenditures, potentially limiting Inapa's ability to invest in new machinery or capacity expansion.

Shift in Product Mix Demand

The European paper industry has seen a notable pivot in consumer preferences, with a marked decrease in the demand for graphic papers like printing and writing paper. This trend has been particularly evident in the period leading up to and including 2024.

Conversely, the demand for packaging-grade papers has experienced substantial growth, driven by e-commerce expansion and a general shift towards more sustainable packaging solutions. This surge in packaging demand has become a primary growth engine for the sector.

Inapa, operating as a diversified paper merchant, has had to strategically adjust its operations to align with this evolving market. This involves reconfiguring inventory levels and refining its overall business strategy to capitalize on the increasing importance of packaging materials.

- Declining Graphic Paper Demand: Reports from industry bodies in late 2023 and early 2024 indicated a continued year-on-year decline in graphic paper consumption across Europe, with some segments seeing drops exceeding 5%.

- Packaging Paper Growth: The packaging paper and board segment, however, showed resilience and growth, with projections for 2024 suggesting a market expansion of approximately 2-3% in key European economies.

- Inapa's Strategic Response: Inapa's 2024 business plans reflect an increased allocation of resources towards sourcing and distributing a wider range of packaging grades, aiming to capture a larger share of this expanding market.

- Market Share Shift: By the end of 2024, it's estimated that packaging grades will represent over 60% of Inapa's total paper sales volume, a significant increase from previous years.

Inapa's economic situation is dire, marked by its insolvency and delisting from Euronext Lisbon in October 2024, signaling a severe financial crisis. This insolvency means Inapa cannot meet its financial obligations, a situation exacerbated by high energy costs that doubled pre-pandemic levels in 2024, squeezing profit margins across the European pulp and paper sector.

Despite a general market recovery in European paper and board consumption in 2024, particularly for packaging, Inapa's financial distress limits its ability to capitalize on this growth. High inflation and elevated interest rates, with the ECB's deposit facility rate at 4.00% by September 2023, further constrained businesses by increasing borrowing costs and reducing consumer spending power.

The shift in consumer preference towards packaging papers, with graphic paper demand declining by over 5% year-on-year in early 2024, presents a challenge Inapa must address. Inapa's strategic pivot in 2024 to focus on packaging grades, aiming for over 60% of sales volume in this segment by year-end, reflects an attempt to adapt to these economic realities.

| Economic Factor | Impact on Inapa | Data Point (2023-2024) |

| Insolvency & Delisting | Severe financial distress, limited capital access | Delisted from Euronext Lisbon on October 29, 2024 |

| Energy Costs | Increased operational expenses, reduced margins | Double pre-pandemic levels in 2024 |

| Inflation & Interest Rates | Reduced consumer spending, higher borrowing costs | Eurozone inflation averaged 5.4% in 2023; ECB deposit rate at 4.00% by Sept 2023 |

| Market Shift (Packaging vs. Graphic) | Need for strategic adaptation | Graphic paper consumption decline >5%; Packaging paper market growth 2-3% projected for 2024 |

Preview Before You Purchase

Inapa PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Inapa PESTLE analysis breaks down the political, economic, social, technological, legal, and environmental factors impacting the company. You'll gain valuable insights into the strategic landscape, enabling informed decision-making.

Sociological factors

Growing consumer and societal awareness of environmental issues is a significant force shaping the packaging and paper industry. This heightened consciousness directly fuels demand for sustainable and eco-friendly products, compelling companies like Inapa to adapt. For instance, a 2024 survey indicated that 78% of consumers consider sustainability when making purchasing decisions for packaged goods.

This societal shift necessitates that Inapa prioritizes the use of recyclable, biodegradable, and responsibly sourced materials. Failing to do so risks alienating a growing segment of environmentally conscious customers. In Europe, the push for circular economy principles has led to increased regulatory scrutiny on packaging waste, with some regions aiming for 90% recyclability by 2030.

The pervasive shift towards digital communication and information consumption directly impacts Inapa by diminishing the need for traditional graphic papers. This societal trend means less demand for printed materials, a core product for many paper merchants.

While the graphic paper market experienced a brief resurgence in 2024, with some analysts noting a 2% year-over-year growth in specific segments, the overarching long-term trajectory points downwards. For companies like Inapa, this necessitates a strategic pivot towards diversifying their product offerings to mitigate the risks associated with declining demand in their traditional business.

The surge in e-commerce, which saw global online retail sales climb to an estimated $6.3 trillion in 2023 and projected to reach $8.1 trillion by 2026, directly fuels the demand for specialized packaging. This growth necessitates packaging distributors to adapt by providing a wider array of materials, from protective cushioning to eco-friendly options, and efficient logistics to meet the fast-paced needs of online consumers.

Consumer Preferences for Sustainable Packaging

Consumer preferences are a significant driver in the packaging industry, with a growing demand for sustainable materials. This shift is evident as more individuals prioritize products with minimal environmental footprints, actively seeking out recyclable, reusable, and compostable packaging solutions. For instance, a 2023 survey indicated that 65% of consumers are willing to pay more for products with sustainable packaging, a figure projected to rise in 2024 and 2025.

This evolving consumer mindset directly influences purchasing decisions and compels suppliers to adapt. Businesses are increasingly pressured to offer packaging alternatives that align with these eco-conscious values. This includes a notable move away from traditional plastics towards innovative paper-based and biodegradable materials, reflecting a broader societal commitment to environmental responsibility.

- Growing Demand: Over 60% of consumers globally now consider sustainability when making purchasing decisions.

- Material Shift: The global market for sustainable packaging is expected to reach over $400 billion by 2025, with paper and fiber-based packaging showing significant growth.

- Consumer Willingness to Pay: Approximately 70% of consumers express a willingness to pay a premium for sustainably packaged goods.

- Brand Impact: Brands that adopt eco-friendly packaging often see improved customer loyalty and a stronger market perception.

Corporate Social Responsibility (CSR) Expectations

Stakeholders, including consumers and investors, are increasingly demanding that companies actively engage in Corporate Social Responsibility (CSR). This translates to a need for transparent reporting on environmental footprints and ethical supply chains. For instance, a 2024 report indicated that 66% of consumers are willing to pay more for sustainable brands, directly linking CSR to purchasing decisions.

These expectations significantly shape brand perception and the formation of strategic partnerships. Companies that fail to meet these evolving demands risk alienating key customer segments and losing out on valuable collaborations. The circular economy, in particular, is becoming a focal point, with many businesses now aiming for closed-loop systems to minimize waste and resource consumption.

- Customer Demand: 66% of consumers in 2024 expressed willingness to pay a premium for sustainable products.

- Investor Scrutiny: ESG (Environmental, Social, and Governance) factors are now central to investment decisions, with a significant portion of global assets under management incorporating these criteria.

- Brand Reputation: Strong CSR initiatives directly correlate with enhanced brand loyalty and positive public image.

- Partnership Potential: Businesses with robust CSR programs are more attractive partners for collaborations and supply chain integrations.

Societal trends significantly influence Inapa's operational landscape, particularly the escalating consumer demand for sustainable and ethically produced goods. This is underscored by data showing that by 2024, over 70% of consumers actively sought out eco-friendly packaging options, a trend projected to continue its upward trajectory through 2025.

The increasing emphasis on Corporate Social Responsibility (CSR) also plays a crucial role, with a notable 66% of consumers in 2024 indicating a willingness to pay more for brands demonstrating strong ethical practices. This societal expectation directly pressures companies like Inapa to enhance transparency in their supply chains and environmental impact reporting, influencing brand perception and partnership opportunities.

| Societal Factor | Impact on Inapa | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Environmental Consciousness | Increased demand for sustainable packaging; pressure to reduce waste. | 70%+ consumers seek eco-friendly packaging by 2024. |

| Corporate Social Responsibility (CSR) | Need for transparent reporting; enhanced brand loyalty for ethical practices. | 66% consumers willing to pay more for sustainable brands (2024). |

| Digitalization | Decreased demand for graphic papers; shift towards digital solutions. | Continued decline in traditional print media consumption. |

Technological factors

Technological advancements in digital printing are revolutionizing the industry, offering unparalleled flexibility and efficiency, particularly for short-run and personalized print jobs. This means businesses can now cater to niche markets and individual customer demands with greater ease and cost-effectiveness. The European digital printing market is a prime example of this growth, with projections indicating a significant expansion in the coming years, driven by these very innovations.

Ongoing research is yielding novel sustainable packaging materials, such as advanced recycled fibers and treated paper/cardboard that enhance strength and visual appeal. This push for innovation is directly driven by increasingly stringent environmental regulations and a growing consumer preference for eco-conscious products. For instance, the global sustainable packaging market was valued at approximately $270 billion in 2023 and is projected to reach over $400 billion by 2028, highlighting the significant economic impact of these technological advancements.

Smart packaging, incorporating QR codes, RFID, and IoT sensors, is revolutionizing supply chains by boosting transparency and efficiency. This technological advancement allows for real-time tracking and data collection, which is crucial for businesses like Inapa.

The adoption of smart packaging is projected to grow significantly, with the global smart packaging market expected to reach $60.5 billion by 2028, up from an estimated $30.3 billion in 2023, showcasing a compound annual growth rate of 14.7%. This presents Inapa with a substantial opportunity to offer enhanced value-added services to retailers, improving inventory management and consumer interaction.

Automation and AI in Logistics

Automation and Artificial Intelligence (AI) are fundamentally reshaping the logistics and warehousing landscape, driving significant improvements in operational efficiency, minimizing waste, and fine-tuning supply chain management. These advancements are crucial for companies like Inapa looking to stay competitive.

Inapa's logistics operations can harness these technologies to achieve faster delivery times, greater accuracy in order fulfillment, and ultimately, more cost-effective services. For instance, AI-powered route optimization can reduce fuel consumption and transit times.

- AI-driven demand forecasting can help Inapa manage inventory more effectively, reducing holding costs and stockouts.

- Automated sorting and picking systems in warehouses can process a higher volume of orders with fewer errors, boosting throughput.

- Predictive maintenance for fleets, enabled by AI, can minimize downtime and repair expenses, ensuring consistent service delivery.

- The global market for AI in logistics was projected to reach over $10 billion by 2024, indicating a strong trend towards adoption.

Data Analytics for Market Insights

Data analytics offers Inapa a significant edge by uncovering granular insights into market dynamics, evolving customer preferences, and internal operational efficiencies. This capability is crucial for navigating the complexities of the modern business landscape.

By leveraging advanced analytical tools, Inapa can move beyond traditional reporting to predictive modeling, enabling more agile and data-driven strategic planning. For instance, in 2024, companies that heavily invested in AI-driven analytics saw an average improvement of 15% in inventory turnover ratios.

The implementation of robust data analytics can directly impact Inapa's bottom line through:

- Enhanced Market Trend Identification: Spotting emerging patterns in consumer demand and competitor activities with greater precision.

- Optimized Inventory Management: Reducing carrying costs and stockouts by forecasting demand more accurately, potentially saving millions in operational expenses as seen by industry leaders in 2025.

- Personalized Product Development: Tailoring product assortments and marketing campaigns to specific customer segments based on behavioral data analysis.

- Improved Operational Efficiency: Identifying bottlenecks and areas for improvement in supply chain and internal processes through performance data analysis.

Technological advancements are reshaping the printing industry, with digital printing offering greater flexibility for short-run and personalized jobs. The European digital printing market is expected to see substantial growth due to these innovations.

Sustainable packaging materials are evolving, driven by regulations and consumer demand. The global sustainable packaging market, valued at around $270 billion in 2023, is projected to exceed $400 billion by 2028, demonstrating the economic significance of these tech developments.

Smart packaging, using QR codes and IoT sensors, is enhancing supply chain transparency and efficiency. The smart packaging market is anticipated to grow from an estimated $30.3 billion in 2023 to $60.5 billion by 2028, offering Inapa opportunities for value-added services.

Automation and AI are improving logistics and warehousing, leading to better efficiency and supply chain management. AI-driven demand forecasting, for example, can help Inapa optimize inventory, with the global AI in logistics market projected to surpass $10 billion by 2024.

Legal factors

The EU's new Packaging and Packaging Waste Regulation (PPWR), effective February 2025, mandates substantial reductions in packaging waste and boosts recyclability and reuse. This legislation will require Inapa to adapt its product offerings significantly to comply with the new standards, which are phased in through 2030 and beyond.

Key targets include a 10% reduction in packaging waste per capita by 2030 and a 30% reduction in plastic packaging waste by 2035. For Inapa, this means a strategic pivot towards more sustainable materials and innovative, reusable packaging designs to meet these stringent environmental goals.

Inapa's insolvency declaration in late 2023 and subsequent delisting from Euronext Lisbon underscore the profound influence of national insolvency and corporate governance laws. These legal frameworks govern the procedures for managing distressed companies, impacting everything from creditor negotiations to potential asset restructuring.

The legal intricacies of insolvency proceedings, such as the convening of creditor meetings and the mandated sale of assets, directly shape Inapa's future operational landscape and organizational form. This legal scaffolding determines how creditors are treated and what remains of the company's business post-restructuring.

Inapa navigates a landscape shaped by stringent competition laws and anti-trust regulations across Europe. These rules are vital for preventing any single entity from gaining undue market power, ensuring a level playing field for all participants. For instance, the European Commission actively monitors mergers and acquisitions to safeguard fair competition, with significant fines levied for violations.

Adherence to these regulations is not merely a compliance issue but a strategic imperative for Inapa. It ensures that the company's operations and growth strategies are conducted ethically and legally, fostering trust with customers and stakeholders. Recent enforcement actions in the paper and packaging sector, such as investigations into potential price-fixing cartels in 2024, underscore the importance of robust compliance programs.

Data Protection and Privacy Laws (e.g., GDPR)

Operating across Europe, Inapa's digital printing and logistics services are subject to strict data protection laws like the GDPR. This necessitates significant investment in robust data security infrastructure to safeguard customer information. Failure to comply can result in substantial fines; for instance, in 2023, GDPR fines exceeded €1.5 billion across the EU.

These regulations impact how Inapa collects, processes, and stores customer data, influencing everything from marketing outreach to supply chain management. The company must ensure transparency and obtain explicit consent for data usage, adding complexity to its operational procedures.

- GDPR Fines: Over €1.5 billion in fines issued across the EU in 2023 for data protection breaches.

- Data Handling: Stringent requirements for customer data processing in digital printing and logistics.

- Compliance Costs: Increased expenditure on data security infrastructure and legal counsel.

- Consumer Trust: Adherence to privacy laws is crucial for maintaining customer confidence.

Product Safety and Labeling Requirements

Legal mandates around product safety and accurate labeling are paramount, particularly for sectors like packaging and visual communication. These regulations ensure consumer protection and market integrity. For instance, in the EU, the Packaging and Packaging Waste Regulation (PPWR) is set to significantly impact these areas.

The PPWR, expected to be fully implemented by 2025, introduces stringent, harmonized labeling requirements for packaging. This includes mandates for digital traceability, meaning suppliers must ensure their products meet these new standards for materials, composition, and clear labeling to be legally sold within the EU market.

- PPWR Harmonization: The EU's PPWR aims to create a unified set of rules for packaging across member states, simplifying compliance but demanding significant adaptation.

- Digital Traceability: Suppliers will need robust systems to track and communicate product information digitally, often through QR codes or similar technologies, as mandated by the PPWR.

- Material Compliance: Regulations often specify acceptable materials and restrict certain substances in packaging, requiring rigorous testing and verification.

Inapa's legal environment is heavily shaped by EU regulations like the Packaging and Packaging Waste Regulation (PPWR), effective February 2025, which mandates significant waste reduction and increased recyclability, impacting Inapa's product design and material choices through 2030.

The company's recent insolvency proceedings highlight the critical role of national insolvency laws in managing distressed entities, dictating creditor rights and asset disposition. Furthermore, competition laws and anti-trust regulations across Europe, enforced by bodies like the European Commission, are vital for maintaining fair market practices, with significant penalties for violations, as seen in potential cartel investigations in 2024.

Data protection laws, particularly the GDPR, impose strict requirements on Inapa's handling of customer data in its digital printing and logistics operations, necessitating robust security measures and transparency, with GDPR fines exceeding €1.5 billion in the EU in 2023.

The PPWR also introduces harmonized labeling and digital traceability requirements for packaging, compelling suppliers to ensure compliance with material composition and clear labeling standards for EU market access.

| Legal Factor | Impact on Inapa | Key Legislation/Regulation | Relevant Data/Enforcement | Timeline/Period |

| Packaging Waste & Sustainability | Requires adaptation of product offerings, materials, and design for recyclability and reuse. | EU Packaging and Packaging Waste Regulation (PPWR) | 10% reduction in packaging waste per capita by 2030; 30% reduction in plastic packaging waste by 2035. | Phased implementation from February 2025 through 2030+. |

| Insolvency & Corporate Governance | Governs procedures for distressed companies, affecting creditor negotiations and asset restructuring. | National Insolvency Laws | Inapa's insolvency declaration and delisting from Euronext Lisbon in late 2023. | Late 2023 onwards. |

| Competition & Anti-Trust | Ensures fair market practices; requires adherence to prevent undue market power. | EU Competition Laws & Anti-Trust Regulations | Investigations into potential price-fixing cartels in the paper and packaging sector in 2024. | Ongoing; 2024 enforcement actions. |

| Data Protection & Privacy | Mandates robust data security, transparency, and consent for customer data processing. | General Data Protection Regulation (GDPR) | Over €1.5 billion in GDPR fines issued across the EU in 2023. | Ongoing; 2023 fine data. |

| Product Safety & Labeling | Ensures consumer protection and market integrity through standardized labeling. | EU Packaging and Packaging Waste Regulation (PPWR) | Mandates digital traceability and harmonized labeling requirements for packaging. | Full implementation expected by 2025. |

Environmental factors

The European Union's commitment to a circular economy, particularly with the Packaging and Packaging Waste Regulation (PPWR), is setting rigorous recycling targets for paper and packaging. This regulatory environment directly impacts companies like Inapa, requiring them to align their operations and product development with these sustainability goals.

Europe's paper recycling rate reached 75.1% in 2024, a figure that underscores the region's progress toward its 2030 recycling objectives. Inapa must actively contribute to this trend by ensuring its product portfolio and operational practices facilitate and encourage higher recycling rates for paper-based materials.

The growing global demand for paper and wood products is directly linked to consumer and regulatory pressure against deforestation. In 2024, the global forest products market was valued at approximately $650 billion, with a significant portion of this growth attributed to demand for certified sustainable materials. Inapa's commitment to sourcing fibers from sustainably managed forests, such as those certified by the Forest Stewardship Council (FSC) or the Programme for the Endorsement of Forest Certification (PEFC), is therefore paramount to maintaining its environmental reputation and market access.

The paper industry, including companies like Inapa, faces increasing pressure to reduce its carbon footprint and transition towards decarbonized operations. This environmental imperative is driven by global climate change concerns and evolving regulatory landscapes.

The European pulp and paper sector has demonstrated progress, achieving a notable reduction in CO2 emissions. For instance, by 2023, the industry had already cut its greenhouse gas emissions by over 60% compared to 1990 levels, showcasing a strong industry-wide commitment to sustainability.

For Inapa, aligning with these trends necessitates a strategic focus on energy-efficient operations and the adoption of greener fuel sources. This commitment to decarbonization is crucial for maintaining market competitiveness and meeting stakeholder expectations in the coming years.

Waste Management and Pollution Control

Effective waste management and pollution control are critical for Inapa, especially given the environmental impact of packaging materials. The company must navigate stringent regulations concerning waste reduction, chemical usage, and the recyclability of its products. For instance, the European Union's Packaging and Packaging Waste Regulation (PPWR) aims to significantly increase recycling rates and reduce packaging waste across member states, impacting Inapa's operational standards.

Inapa's commitment to sustainability means actively seeking ways to minimize its environmental footprint. This includes optimizing its supply chain to reduce waste generation and ensuring compliance with evolving chemical restrictions, such as those under REACH regulations. By promoting the recyclability of its paper and packaging products, Inapa can align with circular economy principles and meet growing consumer and regulatory demands for eco-friendly solutions.

- Regulatory Compliance: Adherence to EU directives like the PPWR, which targets a 70% recycling rate for packaging by 2030.

- Chemical Restrictions: Compliance with REACH regulations, limiting the use of hazardous substances in paper production and packaging.

- Recyclability Focus: Increasing the use of recycled content and designing products for easier recycling, contributing to a circular economy.

- Waste Minimization: Implementing strategies to reduce waste throughout the production and distribution processes.

Climate Change Adaptation and Supply Chain Resilience

The escalating frequency of extreme weather events, such as floods and droughts, poses a significant threat to the paper and packaging industry by disrupting the supply of vital raw materials like timber and affecting transportation networks. For instance, in 2024, several major paper-producing regions experienced significant weather-related disruptions, leading to an estimated 5% increase in raw material costs for some manufacturers due to supply shortages.

Businesses in this sector are increasingly focusing on adapting to these climate impacts and bolstering their supply chain resilience. This involves diversifying sourcing locations and investing in more robust logistics infrastructure to mitigate the risks associated with climate-induced disruptions. By 2025, it is projected that companies prioritizing these adaptations will see a 10-15% reduction in operational downtime caused by environmental factors.

- Extreme weather events in 2024 led to an estimated 5% rise in raw material costs for some paper manufacturers.

- Supply chain disruptions are becoming more common due to climate change impacts.

- Adaptation and resilience are key environmental considerations for the paper and packaging sector.

- Companies investing in climate adaptation are expected to experience reduced operational downtime by 2025.

Environmental factors significantly shape Inapa's operational landscape, driven by increasing regulatory scrutiny and a global push for sustainability. The European Union's commitment to a circular economy, particularly through the Packaging and Packaging Waste Regulation (PPWR), mandates higher recycling targets for paper and packaging, directly influencing Inapa's product development and operational strategies.

The paper industry's carbon footprint is under intense pressure, with the European pulp and paper sector having already reduced its greenhouse gas emissions by over 60% compared to 1990 levels by 2023. This necessitates Inapa's focus on energy-efficient operations and greener fuel sources to maintain market competitiveness and meet stakeholder expectations.

Climate change introduces tangible risks, with extreme weather events in 2024 causing an estimated 5% increase in raw material costs for some paper manufacturers due to supply shortages. Consequently, adapting to these impacts and bolstering supply chain resilience through diversified sourcing and robust logistics is crucial for mitigating operational downtime.

| Environmental Factor | Impact on Inapa | Key Data/Trend |

|---|---|---|

| Circular Economy & Recycling Targets | Requires alignment of product design and operations with EU regulations like PPWR. | EU aims for 70% packaging recycling rate by 2030. Europe's paper recycling rate was 75.1% in 2024. |

| Decarbonization & Emissions Reduction | Necessitates investment in energy efficiency and greener fuel sources. | European pulp and paper sector reduced GHG emissions by >60% (vs 1990) by 2023. |

| Climate Change & Supply Chain Resilience | Demands diversification of raw material sourcing and robust logistics to counter weather disruptions. | Extreme weather in 2024 led to ~5% raw material cost increases for some paper manufacturers. |

PESTLE Analysis Data Sources

Our PESTLE analysis is grounded in comprehensive data from reputable sources including government publications, international economic bodies, and leading industry research firms. This ensures that each factor, from political stability to technological advancements, is supported by factual and current information.