Inapa Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inapa Bundle

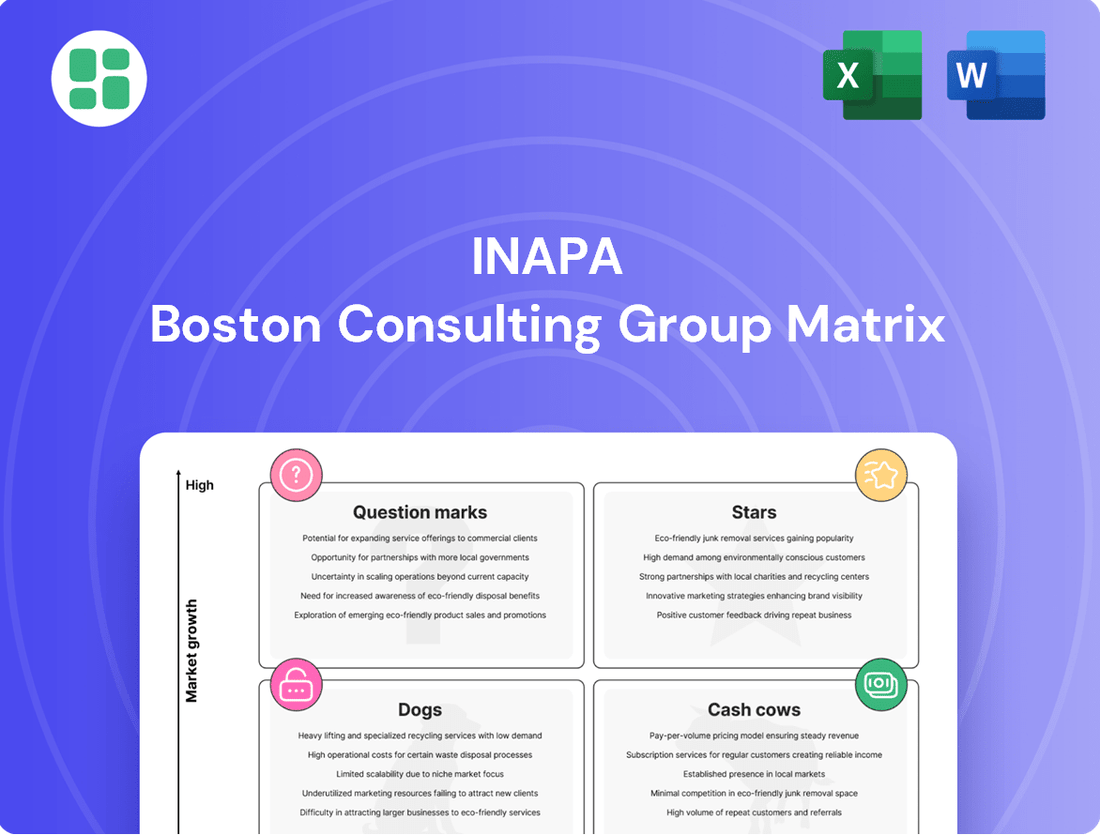

Unlock the strategic potential of Inapa's product portfolio with a glimpse into its BCG Matrix. Understand where your key offerings fit – are they burgeoning Stars, stable Cash Cows, underperforming Dogs, or promising Question Marks? This initial overview sets the stage for informed decision-making.

Don't let your strategic planning be based on incomplete data. Purchase the full Inapa BCG Matrix report to gain detailed quadrant placements, understand the underlying market share and growth rate dynamics, and receive actionable insights to optimize your resource allocation and drive future success.

Stars

Inapa's Digital Printing Media and Solutions segment offers a comprehensive range of materials, inks, and technical support for large-format digital printing. This sector is a significant player in the visual communication market, which has seen substantial expansion due to ongoing digital transformation and a growing need for captivating visual content.

The visual communication market is projected to reach approximately $300 billion globally by 2027, with digital printing media accounting for a substantial portion of this growth. If Inapa can solidify its position in key niches within this expanding market, this segment could emerge as a high-growth, high-share area for the company.

Sustainable packaging innovations represent a potential star for Inapa, especially as the European market for eco-friendly solutions is set to expand. Projections indicate the global sustainable packaging market could reach $435.7 billion by 2027, growing at a compound annual growth rate of 6.7%.

If Inapa can secure or grow its share in niche areas like compostable or advanced recyclable packaging, these could become strong performers. These segments often command higher margins and align with increasing regulatory pressure and consumer preference for greener options, offering a distinct advantage over conventional paper products.

While the broader paper market might be facing headwinds, Inapa's specialty papers for niche applications could be a shining star. If Inapa dominates segments like high-performance industrial papers or specialized packaging materials, these could be considered its Stars. The European paper industry saw a rebound in 2024, with packaging grades showing particular strength, indicating potential growth avenues for Inapa's specialized offerings.

E-commerce Focused Packaging Materials

The e-commerce sector's explosive growth is significantly boosting demand for specialized packaging. Inapa's focus on providing flexible and protective materials for online retail positions it well within this expanding market. If Inapa has secured a strong market share in this niche, it represents a Star in the BCG Matrix, benefiting from high growth and a dominant position.

The global e-commerce market size was valued at approximately $5.7 trillion in 2022 and is projected to reach $13.1 trillion by 2030, growing at a CAGR of 11.7%. This trend directly fuels the need for efficient and resilient packaging solutions. Inapa's strategic alignment with this trend, particularly if it has developed innovative or cost-effective packaging for online shipments, could translate into substantial revenue streams and market leadership.

- E-commerce Packaging Market Growth: The demand for packaging materials in e-commerce is projected to see continued robust growth, driven by increasing online sales volumes.

- Inapa's Market Position: If Inapa holds a significant market share in e-commerce-specific packaging, it indicates a strong competitive advantage in a high-demand segment.

- Industry Alignment: Inapa's offerings in this space are directly aligned with the broader economic trend of digital commerce expansion.

- Potential for Investment: As a Star, this business unit would likely warrant continued investment to maintain and grow its market leadership.

Advanced Visual Communication Services

Inapa's foray into advanced visual communication services, encompassing design support and specialized display solutions, positions it for growth. The visual communication design services market is projected to reach $75.2 billion globally by 2028, growing at a CAGR of 5.8% from 2023, driven by the increasing emphasis on strong brand identities and enhanced customer experiences.

These value-added services, if successfully integrated and marketed, could elevate Inapa's offering beyond traditional material supply. Such capabilities would allow Inapa to capture a larger share of the customer's budget by providing end-to-end solutions.

- Market Traction: Significant adoption of these advanced services would indicate strong market acceptance and revenue potential.

- Brand Identity Focus: Businesses are increasingly investing in visual communication to differentiate themselves in competitive markets.

- Customer Experience Enhancement: Innovative display solutions and design support directly contribute to improved customer engagement and satisfaction.

- Revenue Diversification: Expansion into services diversifies Inapa's revenue streams, reducing reliance on material sales alone.

Stars in Inapa's BCG matrix represent business segments with high market share in high-growth industries. These are areas where Inapa is performing exceptionally well and the overall market is expanding rapidly, suggesting strong future potential and a need for continued investment to maintain leadership. Identifying and nurturing these Star segments is crucial for Inapa's sustained growth and profitability.

| Segment | Market Growth | Inapa's Share | Potential |

|---|---|---|---|

| E-commerce Packaging | High (11.7% CAGR projected to 2030) | High (assuming strong market penetration) | Strong revenue growth, market leadership |

| Sustainable Packaging | High (6.7% CAGR projected to 2027) | High (if dominating niche eco-friendly solutions) | Higher margins, regulatory advantage |

| Digital Printing Media | High (part of $300B visual communication market by 2027) | High (if leading in key niches) | Significant player in expanding visual market |

What is included in the product

The Inapa BCG Matrix analyzes product portfolio performance using market share and growth, guiding investment decisions.

A clear visual of your portfolio's strengths and weaknesses, simplifying strategic decisions.

Cash Cows

Inapa's core paper distribution in Western Europe represents a classic Cash Cow. This segment has historically been a bedrock for the company, holding a substantial market share in a mature yet stable sector. Despite facing headwinds in 2023 with a noticeable dip in demand, the European paper industry began to show signs of recovery in 2024, with some reports indicating a modest uptick in consumption.

While this area might not boast high growth rates, it consistently delivers significant revenue streams and robust operational cash flow. For instance, the European paper and board market, though experiencing fluctuations, is projected to reach approximately €100 billion by 2025, underscoring the sheer scale and continued importance of this distribution channel for companies like Inapa.

The demand for recycled paper has been on the rise, with industrial paper grades like containerboard and cartonboard showing particular strength, fueling growth in the overall paper industry. Inapa benefits from its significant footprint in the wider paper market, using its considerable scale and existing partnerships to consistently generate revenue from these stable, albeit slow-growing, industrial segments.

Inapa's established logistics and warehousing services function as a classic Cash Cow within its BCG Matrix. These operations, boasting a significant European footprint with numerous warehouses and logistics platforms, are vital for Inapa's distribution network. While not a driver of rapid growth, they are crucial for the efficient functioning of the core business.

These integrated logistics capabilities generate consistent and stable cash flow. This stability is a direct result of optimized operations and the reliable service delivery that Inapa provides to its customers. In 2023, Inapa reported that its logistics segment played a key role in supporting its overall distribution efficiency, contributing to a steady operational performance.

Office Paper Distribution

Despite the ongoing digital transformation, office paper continues to be a staple, exhibiting steady, low-growth demand in a well-established market. Inapa’s deep roots and vast distribution infrastructure in this sector enable it to secure a significant market share, ensuring a reliable revenue stream and bolstering its overall financial health.

In 2024, the global office paper market, while mature, still represented substantial value, with demand underpinned by essential business functions that haven't been entirely replaced by digital alternatives. For instance, while e-invoicing is on the rise, physical documents for contracts, reports, and archival purposes continue to necessitate paper. Inapa's established logistics and supplier relationships in this segment allow for efficient operations, translating into consistent profitability.

- Market Stability: The office paper segment demonstrates resilience, with demand remaining consistent due to ongoing business needs for printing, copying, and document management.

- Inapa's Advantage: Inapa leverages its extensive distribution network and long-standing market presence to maintain a strong position, ensuring a stable revenue base.

- Profitability Contribution: This segment acts as a cash cow, generating predictable income that supports other business units and overall company financial stability.

- Digitalization Impact: While digitalization has influenced the market, essential uses for office paper persist, preventing a significant decline in demand.

Standard Packaging Material Distribution

Even after divesting some packaging operations, Inapa's continued distribution of standard packaging materials like basic films, tapes, and boxes would position these segments as cash cows within the BCG matrix. These products operate in markets with low growth but benefit from consistent, stable demand.

The established infrastructure and loyal customer relationships in this sector allow Inapa to generate predictable profits. For instance, in 2024, the global packaging market, while experiencing varied growth across segments, saw continued demand for essential materials, with the corrugated boxes segment alone projected to reach over $200 billion by 2025, indicating a mature but steady market.

- Stable Demand: Essential packaging materials have a consistent need across various industries, ensuring ongoing sales.

- Established Infrastructure: Inapa's existing supply chain and distribution networks support efficient and cost-effective delivery.

- Profit Generation: Despite low growth, the reliable demand allows these segments to generate significant, consistent profits for the company.

Cash Cows are business segments that hold a high market share in a low-growth industry. These units generate more cash than they consume, providing a stable and predictable revenue stream for the company. Inapa's established paper distribution in Western Europe and its integrated logistics services are prime examples of such segments.

These operations, while not experiencing rapid expansion, contribute significantly to Inapa's overall financial health. Their consistent cash generation allows for investment in other areas of the business or can be returned to shareholders. The resilience of these segments is a key factor in Inapa's sustained profitability.

For instance, the European paper and board market, despite its maturity, is a substantial economic contributor, projected to be around €100 billion by 2025. Similarly, Inapa's logistics, vital for efficient distribution, ensures steady operational performance, as noted in their 2023 reports.

The office paper segment, a consistent performer, benefits from Inapa's extensive network. Even with digitalization, essential paper needs persist, ensuring stable demand. In 2024, the global office paper market remained a significant sector, with physical documents still crucial for business operations.

| Inapa Segment | BCG Category | Market Growth | Market Share | Cash Flow Generation |

|---|---|---|---|---|

| Western European Paper Distribution | Cash Cow | Low | High | Strong & Stable |

| Integrated Logistics Services | Cash Cow | Low | High | Strong & Stable |

| Office Paper Distribution | Cash Cow | Low | High | Strong & Stable |

| Standard Packaging Materials | Cash Cow | Low | High | Strong & Stable |

What You’re Viewing Is Included

Inapa BCG Matrix

The Inapa BCG Matrix document you are currently previewing is the exact, unedited version you will receive upon purchase. This comprehensive analysis tool, designed for strategic decision-making, is delivered in its final, ready-to-use format, ensuring you gain immediate access to actionable insights.

Dogs

Traditional graphic paper for print media, like that used for newspapers and magazines, has seen a substantial drop in demand for years. This is largely because more and more people are consuming information digitally.

Inapa's products that depend heavily on these declining print markets, especially if they have a small slice of that shrinking pie, would likely fall into the Dogs category of the BCG Matrix.

These Dog products typically use up more company resources than they bring back in profits, making them a drain on overall performance. For instance, the global demand for printing and writing paper, which includes graphic paper, saw a decline of approximately 2% in 2023 compared to 2022, according to industry reports.

Underperforming regional operations within Inapa, such as those in Germany facing intense competition and declining demand, are categorized as Dogs in the BCG Matrix. These units may be a significant drain on resources, as evidenced by Inapa's 2023 restructuring and headcount reduction in Germany, a move directly linked to decreased market demand.

Outdated office consumables, beyond just paper, represent potential Dogs in Inapa's BCG Matrix. If these items are linked to practices being replaced by digital solutions and hold a small market share, they fall into this category. For instance, sales of physical fax paper or outdated stationery supplies might be declining significantly.

Undifferentiated Standard Envelopes

Undifferentiated standard envelopes, while essential, represent a mature market segment. Growth here is typically sluggish, and competition often centers on price, squeezing profit margins. For Inapa, if their market share in this commoditized area is small, these products would likely fall into the 'Dog' category of the BCG matrix.

This classification suggests that standard envelopes contribute little to Inapa's overall profits and offer limited potential for future expansion. In 2024, the global envelope market, while stable, is characterized by this low-growth, high-competition dynamic for standard products.

- Market Maturity: The demand for basic, undifferentiated envelopes has largely stabilized, with minimal anticipated growth in most developed economies.

- Price Sensitivity: Intense competition among manufacturers means that pricing is a primary differentiator, often leading to thin profit margins.

- Low Market Share: If Inapa's share of this specific market segment is minor, it signifies a weak competitive position.

- Limited Future Prospects: Products in the 'Dog' quadrant typically require significant investment to gain market share, with uncertain returns.

Legacy Visual Communication Hardware

Legacy visual communication hardware, such as older projector models or analog whiteboards, would be classified as Dogs in the Inapa BCG Matrix. These products typically possess a low market share within a rapidly evolving digital communication landscape. For instance, the global market for traditional projectors saw a decline, with shipments falling by approximately 8% in 2023 compared to 2022, as businesses increasingly adopt interactive flat panels and video conferencing solutions.

Products in the Dog quadrant often require significant support resources for diminishing returns. The cost of maintaining and servicing these older units can outweigh the revenue they generate. Companies often face challenges with spare parts availability and technical expertise for these legacy systems, further impacting profitability.

- Low Market Share: Legacy hardware struggles to compete with advanced digital alternatives.

- Declining Market Growth: The overall market for these older technologies is shrinking.

- High Support Costs: Maintaining and servicing outdated equipment is often inefficient.

- Low Profitability: These products contribute minimally to overall revenue and profits.

Products categorized as Dogs within Inapa's BCG Matrix are those with low market share in low-growth industries. These offerings often consume more resources than they generate in profit, representing a drain on the company. For example, Inapa's traditional printing paper segment, facing declining demand due to digitalization, fits this description. In 2023, the global printing paper market experienced a contraction, with reports indicating a roughly 2% decrease in demand year-over-year.

These Dog products are characterized by their inability to capture significant market share despite operating in mature or shrinking markets. They often require substantial investment for minimal return, making them a strategic concern. For instance, Inapa's underperforming German operations, impacted by reduced demand and increased competition, were restructured in 2023, highlighting the challenges associated with such market positions.

The key indicators for Inapa's products falling into the Dog category include low growth prospects and a weak competitive standing. These segments offer little potential for future expansion and may even require divestment or careful management to mitigate losses. The company's focus on modernizing its product portfolio often involves phasing out or reducing investment in these areas.

Inapa's legacy visual communication hardware, such as older projector models, also exemplifies Dog products. These items hold a small market share in a rapidly evolving digital landscape. The global market for traditional projectors saw a decline of approximately 8% in 2023, as businesses increasingly adopt advanced digital solutions.

| Product Category | Market Growth | Market Share | Profitability | Strategic Implication |

|---|---|---|---|---|

| Traditional Printing Paper | Declining | Low | Low | Resource drain, potential divestment |

| Underperforming Regional Operations (e.g., Germany) | Low/Declining | Low | Negative | Restructuring, cost reduction |

| Legacy Visual Hardware | Declining | Low | Low | Obsolescence, limited future |

Question Marks

Inapa's potential venture into advanced digital printing equipment and specialized software within the visual communication market positions them in a segment experiencing rapid technological adoption. This area, characterized by high growth potential, often requires substantial upfront investment to establish a competitive market share.

The broader visual communication market is increasingly shifting towards digital solutions, indicating a growing demand for advanced printing technologies. If Inapa were to enter this space with a low current market share, these offerings would likely be classified as Question Marks in the BCG Matrix, demanding strategic consideration for resource allocation and market penetration.

Smart packaging, including QR codes and NFC tags, is a significant growth area in the packaging sector, enhancing traceability and consumer engagement. Inapa's involvement in these innovative, high-growth but nascent solutions, where their current market share is minimal, positions them as a potential Star within the BCG matrix. These technologies demand considerable investment to establish and expand market presence, mirroring the characteristics of a Star requiring ongoing capital infusion to maintain its growth trajectory. The global smart packaging market was valued at approximately $34.5 billion in 2023 and is projected to reach $72.1 billion by 2030, indicating a robust compound annual growth rate of 11.1%.

AI-integrated logistics solutions represent a significant opportunity within the evolving supply chain landscape. Companies investing heavily in AI for logistics, like Inapa if they are developing such solutions, would likely be positioned as question marks in the BCG matrix. This is due to the substantial research and development costs associated with these cutting-edge technologies, coupled with a yet-to-be-fully-established market share for these specific AI applications.

The global AI in logistics market was valued at approximately $1.5 billion in 2023 and is projected to experience robust growth, reaching an estimated $10 billion by 2030, with a compound annual growth rate (CAGR) of over 30%. This rapid expansion indicates a high-growth sector, but for a company like Inapa, if its AI logistics offerings are nascent, they would still represent a low market share, thus fitting the question mark quadrant.

Expansion into Emerging European Markets (e.g., Eastern Europe)

Expanding into emerging European markets, particularly in Eastern Europe, presents a significant opportunity for Inapa within the packaging and paper sectors. These regions are anticipated to experience robust growth, making them attractive targets for market share expansion. For instance, the Central and Eastern European packaging market was valued at approximately $36.5 billion in 2023 and is projected to grow at a CAGR of 4.2% through 2028, according to Mordor Intelligence.

Given Inapa's current relatively small footprint in these high-growth areas, such ventures would represent new market entries. These strategic moves necessitate substantial investment in infrastructure, distribution networks, and local market understanding. The potential for increased market share in these rapidly developing economies positions these expansions as potential Stars or Question Marks in the BCG matrix, depending on the competitive landscape and Inapa's strategic commitment.

- Market Potential: Eastern European packaging markets are showing strong growth trajectories, with significant potential for increased demand.

- Strategic Investment: Expansion into these regions requires substantial capital outlay for establishing operations and building market presence.

- Competitive Landscape: Understanding the existing competition is crucial for successful market penetration and gaining market share.

- Growth Opportunity: These markets represent a chance for Inapa to diversify its revenue streams and tap into new customer bases.

Customized Packaging Concepts and Solutions

Inapa's customized packaging concepts and tailor-made solutions represent a potential area for strategic growth. If these offerings are in a high-growth market segment but Inapa has not yet achieved significant market penetration, they could be classified as 'Stars' or 'Question Marks' within the BCG matrix, depending on their current market share and the growth rate of the demand for such specialized packaging.

For instance, if the market for sustainable and smart packaging solutions, which often require customization, is experiencing a compound annual growth rate (CAGR) of over 10% and Inapa's share in this niche is still under 5%, these customized offerings would be considered 'Question Marks.' This would necessitate further investment to understand market needs, develop scalable solutions, and build brand recognition to capture a larger share.

Consider the global flexible packaging market, projected to reach USD 300 billion by 2028, with a significant portion driven by demand for innovative and customized solutions. Inapa's ability to tap into this segment with tailored concepts could position them for future success, but requires strategic resource allocation to overcome the initial uncertainty.

- High-Growth Demand Area: Customized packaging, especially for e-commerce and sustainable products, is a rapidly expanding market.

- Inapa's Current Position: If Inapa's market share in these customized segments is low, it indicates an opportunity for investment.

- Strategic Investment: Focused investment in R&D, production capacity, and marketing is crucial to elevate these offerings.

- Potential for Stars: Successful development and market penetration could transform these 'Question Marks' into 'Stars.'

Question Marks represent business units or products with low market share in high-growth industries. These ventures require significant investment to increase market share and could potentially become Stars or Dogs. Inapa's AI-integrated logistics solutions and expansion into emerging European packaging markets, where their current market share is minimal, exemplify this category. These areas demand careful strategic evaluation due to their high investment needs and uncertain future performance.

| Business Unit/Product | Market Growth | Market Share | BCG Classification | Strategic Consideration |

|---|---|---|---|---|

| AI-Integrated Logistics | High | Low | Question Mark | Invest for growth or divest if potential is low. |

| Eastern European Packaging Expansion | High | Low | Question Mark | Requires significant investment to gain traction. |

| Customized Packaging Solutions | High | Low (under 5%) | Question Mark | Focus R&D and marketing to capture market share. |

BCG Matrix Data Sources

Our Inapa BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.