Immunocore PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Immunocore Bundle

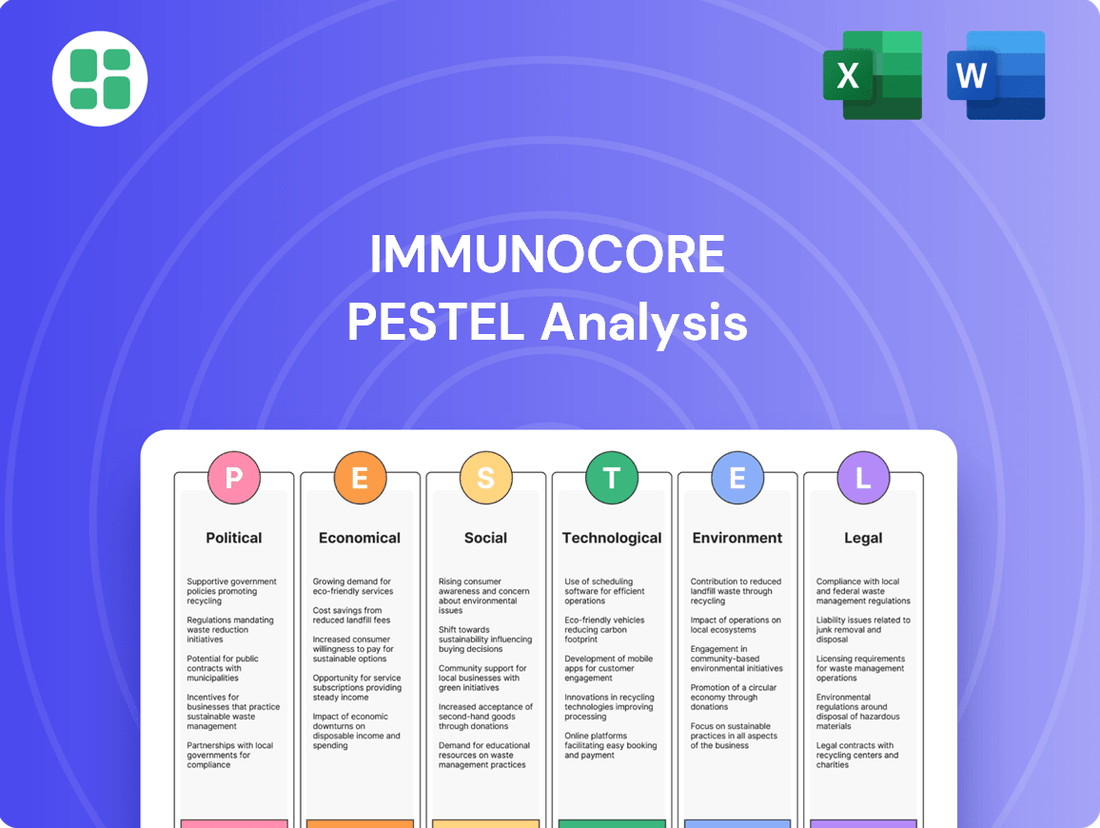

Unlock the strategic landscape surrounding Immunocore with our comprehensive PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors that are shaping its trajectory. Equip yourself with the foresight needed to navigate market complexities and identify emerging opportunities. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government healthcare policies, especially concerning oncology spending, are critical for Immunocore. For instance, the US Medicare Part B drug spending saw a significant increase, reaching an estimated $40.6 billion in 2023, highlighting a growing but competitive market. Changes in reimbursement rates or funding allocations for advanced cancer therapies directly affect KIMMTRAK's market access and revenue potential.

Immunocore's success hinges on navigating complex regulatory pathways, with bodies like the FDA and EMA scrutinizing new ImmTAC molecules. These processes are crucial for market entry, and any shifts in requirements can directly impact development schedules and go-to-market plans.

The company's ability to secure approvals for KIMMTRAK across various global markets, including the US and EU, demonstrates a proficiency in managing these demanding regulatory landscapes. This track record is vital for future product launches and market access.

International trade agreements are crucial for Immunocore's global reach, directly impacting how KIMMTRAK and its pipeline drugs can enter new markets. Favorable policies can streamline approvals and reduce tariffs, making it easier and more cost-effective to distribute treatments worldwide.

For instance, as of early 2024, the European Union continues to negotiate trade deals that could enhance market access for biopharmaceuticals. Immunocore's success in launching KIMMTRAK in countries like Japan, achieved through navigating specific market access requirements, highlights the importance of these agreements.

Geopolitical relationships and bilateral pacts significantly shape these negotiations. A stable international environment with cooperative trade policies generally benefits companies like Immunocore, facilitating smoother expansion and increasing the potential patient population for their innovative therapies.

Drug Pricing Regulations and Reimbursement Policies

Drug pricing regulations and reimbursement policies significantly impact Immunocore's financial health. For instance, the Inflation Reduction Act (IRA) in the US allows Medicare to negotiate prices for certain high-cost drugs, potentially affecting KIMMTRAK's revenue if it becomes subject to such negotiations. This landscape is evolving, with European countries increasingly engaging in national price negotiations, which could also influence global pricing strategies and market access for Immunocore's therapies.

Securing favorable pricing and broad reimbursement for KIMMTRAK is paramount for Immunocore's success. In 2024, the company's ability to navigate these complex reimbursement environments will directly correlate with its market penetration and overall profitability. For example, positive reimbursement decisions from key payers in major markets are critical for driving sales volume and ensuring patient access to treatment.

- US Inflation Reduction Act (IRA): Allows Medicare to negotiate prices for selected drugs, potentially impacting future revenue streams for companies like Immunocore.

- European Price Negotiations: National health systems in Europe often conduct their own price negotiations, creating a varied reimbursement landscape.

- KIMMTRAK Reimbursement: Securing broad and favorable reimbursement for KIMMTRAK is essential for its commercial success and patient access in key markets.

- Market Access Challenges: Navigating different pricing and reimbursement frameworks across various countries presents a significant political and operational challenge for pharmaceutical companies.

Biotechnology Research and Development Incentives

Government incentives play a crucial role in fueling Immunocore's ongoing investment in its ImmTAC platform. These can include grants, tax credits, and faster approval processes for novel treatments, which are vital for companies like Immunocore pushing the boundaries of biotechnology.

Supportive policies encourage continued research into new applications and disease areas, strengthening Immunocore's pipeline and its ability to bring innovative therapies to market. For instance, the U.S. government has historically provided significant funding for biomedical research through agencies like the National Institutes of Health (NIH), with biotechnology often a key beneficiary.

In 2024, the U.S. Congress continued to debate and implement legislation aimed at boosting domestic biomanufacturing and R&D. While specific figures for Immunocore are proprietary, broader industry trends show increased federal R&D spending. For example, the CHIPS and Science Act of 2022, while focused on semiconductors, also included provisions to bolster scientific research and development across various sectors, including life sciences.

Key aspects of these incentives include:

- Tax Credits: The R&D tax credit in the U.S. offers a direct reduction in tax liability for qualifying research expenses, encouraging companies to invest more in innovation.

- Grant Funding: Government grants, often from agencies like the NIH or the Biomedical Advanced Research and Development Authority (BARDA), provide non-dilutive capital essential for early-stage research and development.

- Expedited Review Pathways: Regulatory bodies like the FDA offer programs such as Fast Track, Breakthrough Therapy, and Priority Review, which can significantly shorten the time it takes for promising new therapies to reach patients, thereby reducing development costs and accelerating market entry.

Government healthcare policies, particularly those impacting oncology drug spending and reimbursement, directly influence Immunocore's revenue potential for KIMMTRAK. The US Medicare Part B drug spending, estimated at $40.6 billion in 2023, underscores the market's size and the importance of favorable reimbursement policies.

Navigating stringent regulatory approval processes from bodies like the FDA and EMA is paramount for Immunocore's pipeline development and market entry. The company's successful global approvals for KIMMTRAK highlight its ability to manage these complex requirements.

International trade agreements and geopolitical stability are crucial for expanding KIMMTRAK's global reach and streamlining market access. Favorable trade pacts can reduce tariffs and expedite regulatory processes, as seen in Immunocore's launch in Japan.

Drug pricing regulations, such as the US Inflation Reduction Act (IRA) allowing Medicare price negotiations, and varied European national price negotiations, present significant challenges. Successfully securing broad reimbursement for KIMMTRAK in 2024 is vital for its commercial success and patient access.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Immunocore across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for strategic decision-making.

Economic factors

Global healthcare spending is projected to reach $11.1 trillion by 2025, a significant increase driven by factors like aging populations and the adoption of advanced medical technologies. This upward trend, particularly in oncology, directly impacts the market viability for Immunocore's specialized cancer therapies. For instance, the US alone saw its national health expenditure climb to $4.5 trillion in 2023, highlighting the substantial financial commitments within healthcare systems.

The increasing allocation towards innovative treatments, including immunotherapy, presents a substantial opportunity for companies like Immunocore. However, this growth is tempered by the persistent pressure on pharmaceutical firms to prove the cost-effectiveness and overall value proposition of their therapies to healthcare providers and payers. This necessitates robust clinical data demonstrating improved patient outcomes and potential long-term savings for the healthcare system.

Global economic stability directly influences investor confidence and the capital available for biotechnology firms such as Immunocore. A robust economy generally translates to greater investment in the life sciences, supporting crucial research and development initiatives. For instance, in 2024, venture capital funding for biotech remained a significant, albeit cautious, area of investment, with deals often focusing on companies with clear clinical trial progress and strong market potential.

Economic downturns, however, can pose considerable challenges to fundraising efforts. During periods of economic uncertainty, investors may become more risk-averse, potentially impacting the pace of clinical trials and the expansion of companies like Immunocore. The International Monetary Fund (IMF) projected global growth to be around 3.2% for 2024, a figure that, while indicating expansion, also reflects underlying global economic fragilities that can affect capital markets.

Conversely, a stable and growing global economy can unlock increased investment opportunities within the life sciences sector. This environment allows companies to secure the necessary funding for late-stage clinical trials, manufacturing scale-up, and market penetration. The anticipated growth in global healthcare spending, projected to reach trillions by 2025, underscores the long-term potential, contingent on sustained economic health.

Pricing and reimbursement negotiations are critical for KIMMTRAK's market penetration, particularly in Europe where access can be complex. While the US market has demonstrated robust demand, European markets often require tailored strategies to secure favorable reimbursement and ensure widespread patient access, directly impacting revenue streams.

As of early 2024, the European landscape for advanced therapies remains varied; for instance, while Germany's G-BA has provided positive recommendations for certain oncology drugs, other nations may have longer assessment timelines or stricter budget impact thresholds, necessitating careful planning for Immunocore.

Competition from Other Cancer Therapies

Immunocore operates within a fiercely competitive oncology landscape. The market is saturated with existing treatments, including traditional chemotherapy, radiation, and surgery, alongside a growing number of targeted therapies and other immunotherapies. This intense competition necessitates a clear demonstration of clinical superiority for its ImmTAC molecules to capture and retain market share.

The success of Immunocore's therapies, such as KIMMTRAK (tebentafusp-gp100) for uveal melanoma, is directly challenged by advancements in competing treatment modalities. For instance, ongoing research into novel CAR-T cell therapies and bispecific antibodies targeting similar or overlapping patient populations presents a significant competitive threat. The market for uveal melanoma treatments alone, while niche, is seeing increased interest from numerous players, highlighting the crowded nature of the oncology space.

- Market Penetration: KIMMTRAK, approved in the US and EU, faces competition from established treatments and emerging therapies in the uveal melanoma market.

- Pipeline Competition: Immunocore's ongoing clinical trials for other ImmTACs will need to demonstrate significant advantages over existing and pipeline competitors in various cancer types.

- Therapeutic Advancements: The rapid pace of innovation in immunotherapy and targeted therapies means that competitors are constantly developing new treatment options that could impact Immunocore's market position.

Access to Capital for Pipeline Development

Immunocore's capacity to secure funding is crucial for advancing its diverse pipeline of ImmTAC candidates, extending beyond its current flagship therapy, KIMMTRAK. A robust financial standing, bolstered by consistent product sales and sustained investor trust, empowers the company to progress its clinical trials and investigate novel therapeutic avenues across oncology, infectious diseases, and autoimmune disorders.

As of late 2024, Immunocore reported a healthy cash and cash equivalents balance, enabling significant investment in its R&D programs. This financial strength is a direct result of the commercial success of KIMMTRAK and strategic partnerships, providing the necessary runway for pipeline expansion.

- Capital for Pipeline: Immunocore's ability to access capital directly fuels the development of its promising ImmTAC candidates.

- Financial Health: Strong cash reserves, driven by KIMMTRAK sales and investor confidence, are essential for clinical trial progression.

- Therapeutic Expansion: Access to capital allows exploration of new applications in oncology, infectious diseases, and autoimmune conditions.

- 2024 Financials: The company's financial position in late 2024 demonstrated a significant capacity for R&D investment, supported by commercial performance and strategic alliances.

Global economic stability directly impacts investor confidence and the capital available for biotechnology firms like Immunocore. A strong economy generally encourages investment in life sciences, supporting crucial research and development. For example, venture capital funding for biotech in 2024 remained a significant, albeit cautious, area, often prioritizing companies with clear clinical progress and strong market potential.

Economic downturns can hinder fundraising, making investors more risk-averse and potentially slowing clinical trials. The International Monetary Fund (IMF) projected global growth around 3.2% for 2024, indicating expansion but also highlighting global economic fragilities that can affect capital markets.

Conversely, a stable and growing global economy can boost investment in the life sciences sector, enabling companies to secure funding for late-stage trials, manufacturing, and market entry. The projected growth in global healthcare spending, expected to reach trillions by 2025, underscores long-term potential, contingent on sustained economic health.

Same Document Delivered

Immunocore PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Immunocore PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain valuable insights into the external forces shaping Immunocore's strategic landscape.

Sociological factors

The growing influence of patient advocacy groups for rare cancers like uveal melanoma is a key sociological factor. These organizations actively champion for quicker regulatory approvals and wider patient access to innovative treatments, such as KIMMTRAK. Their efforts can create a more favorable landscape for companies like Immunocore focused on rare disease therapies.

Public awareness campaigns are also playing a crucial role. Increased understanding of rare cancers can lead to greater demand for research and development funding. For instance, in 2024, patient advocacy groups globally raised over $50 million for rare cancer research, directly impacting the environment for companies developing novel treatments.

Public trust in cutting-edge treatments like Immunocore's T cell receptor (TCR) bispecific immunotherapies significantly shapes market penetration. Surveys from 2024 indicate that while a majority express optimism about gene and cell therapies, a substantial portion still harbor concerns about long-term safety and accessibility, impacting early adoption rates.

Addressing patient anxieties about the efficacy and ethical implications of novel biotechnologies is paramount for fostering confidence in companies like Immunocore. For instance, patient advocacy group reports in early 2025 highlight that clear communication about clinical trial outcomes and robust post-market surveillance are key drivers of public acceptance for advanced therapies.

The world's population is getting older. By 2050, it's projected that nearly 1 in 6 people globally will be 65 or older, a significant jump from 1 in 10 in 2020. This demographic shift directly correlates with increased cancer rates, as age is a primary risk factor for many types of cancer. For instance, the World Health Organization (WHO) estimates that cancer incidence is projected to rise by 55% between 2020 and 2040.

This growing patient pool presents a substantial and expanding market for innovative cancer treatments like those developed by Immunocore. The increasing prevalence of age-related cancers means a greater demand for therapies that can effectively target and treat these complex diseases. Immunocore's focus on developing first-in-class T cell receptor (TCR) therapies for various cancers, including those prevalent in older populations, positions it to capitalize on this enduring societal trend.

Healthcare Accessibility and Equity

Societal emphasis on healthcare accessibility and equity directly shapes Immunocore's global product distribution and pricing strategies. As of 2024, there's a growing demand for equitable access to advanced therapies, influencing commercial approaches.

The pressure to make life-saving treatments available to all, irrespective of economic background or location, is a significant driver for Immunocore's market access planning. For example, in 2023, the World Health Organization highlighted disparities in access to innovative medicines in low- and middle-income countries, a trend likely to continue influencing pharmaceutical companies.

- Global Health Initiatives: Increasing focus on global health equity by organizations like the WHO and Gavi, the Vaccine Alliance, puts pressure on biopharmaceutical companies to consider affordability and accessibility in emerging markets.

- Patient Advocacy Groups: The rising influence of patient advocacy groups worldwide in 2024 is pushing for fairer pricing and broader availability of novel treatments, impacting commercial strategies.

- Government Policies: Governments are increasingly implementing policies aimed at controlling healthcare costs and ensuring equitable access to pharmaceuticals, a trend expected to intensify.

- Emerging Market Focus: Biopharma companies are exploring strategies to improve access in emerging markets, with market growth in these regions projected to outpace developed markets in the coming years, according to industry reports from late 2023 and early 2024.

Ethical Considerations in Biotechnology

Societal discussions around advanced biotechnologies like gene editing and new immunotherapies are gaining significant traction. Immunocore faces the challenge of engaging with these conversations ethically, ensuring its R&D aligns with public values to foster trust and secure regulatory backing.

For instance, in 2024, public opinion polls indicated a growing concern regarding the long-term implications of CRISPR technology, with over 60% of respondents expressing a need for stricter ethical oversight. This highlights the importance for companies like Immunocore to proactively address public apprehension and demonstrate a commitment to responsible innovation.

- Public Scrutiny: Increased media attention on gene editing trials necessitates transparent communication from biotech firms.

- Societal Values: Aligning research with evolving ethical norms is crucial for maintaining a positive corporate image.

- Regulatory Landscape: Public ethical concerns directly influence the development and enforcement of future biotech regulations.

The increasing influence of patient advocacy groups is a significant sociological factor for Immunocore. These groups actively push for faster regulatory approvals and broader patient access to innovative treatments, creating a more favorable environment for companies focused on rare disease therapies. Public awareness campaigns also play a crucial role, with increased understanding of rare cancers driving demand for research and development funding; in 2024, these groups globally raised over $50 million for rare cancer research.

Public trust in cutting-edge treatments like Immunocore's TCR bispecific immunotherapies is vital for market penetration. While surveys from 2024 show optimism about cell therapies, concerns about long-term safety and accessibility still impact early adoption rates. Addressing these patient anxieties through clear communication about clinical trial outcomes and robust post-market surveillance, as highlighted in early 2025 patient advocacy group reports, is key to fostering public acceptance of advanced therapies.

Societal emphasis on healthcare accessibility and equity directly influences Immunocore's global product distribution and pricing strategies. The growing demand for equitable access to advanced therapies in 2024 is shaping commercial approaches, with organizations like the WHO highlighting disparities in access in emerging markets. This pressure for fair pricing and broader availability is expected to intensify.

Societal discussions around advanced biotechnologies like gene editing and new immunotherapies are gaining traction, requiring companies like Immunocore to engage ethically. Public opinion polls in 2024 indicated concerns about the long-term implications of gene editing technologies, with over 60% of respondents calling for stricter ethical oversight, underscoring the need for proactive communication and a commitment to responsible innovation.

Technological factors

Immunocore's business thrives on ongoing progress in T cell receptor (TCR) engineering and bispecific technologies. These advancements are crucial for developing next-generation therapies.

The company's ImmTAC molecules benefit from enhanced design, greater specificity, and increased potency, directly impacting their therapeutic effectiveness. This innovation is key to expanding their pipeline and exploring new treatment avenues.

For instance, by mid-2024, Immunocore reported significant progress in its ImmTAC platform, with several candidates in clinical trials, demonstrating the tangible impact of these technological leaps on their product development.

The development of companion diagnostics is crucial for Immunocore's personalized medicine approach, directly impacting the efficacy and accessibility of its therapies. For instance, KIMMTRAK's reliance on HLA-A*02:01 positivity underscores the necessity of robust diagnostic tools to identify eligible patients. This ensures treatment is administered to those most likely to benefit, a key factor in optimizing clinical trial success and patient outcomes.

Manufacturing complex biologics like KIMMTRAK requires significant technological advancements to scale efficiently. Immunocore's ability to ramp up production while maintaining stringent quality controls is paramount for meeting the growing global demand. For instance, in 2023, the company reported increased manufacturing capacity for KIMMTRAK, a key step in ensuring consistent supply.

Optimizing these production processes is not just about volume but also about cost-effectiveness and reliability. This technological focus directly impacts commercial success and the progression of Immunocore's pipeline. Improvements in cell culture, purification, and formulation technologies are vital for reducing per-unit costs and ensuring a dependable supply chain for their innovative therapies.

Emerging Gene Editing Technologies

Emerging gene editing technologies like CRISPR-Cas9 and its successors, while not directly integrated into Immunocore's current ImmTAC platform, are poised to reshape the broader immunotherapy arena. These tools offer unprecedented precision in modifying cellular genetics, which could lead to novel approaches for T cell engineering and cancer treatment. For instance, advancements in base editing and prime editing, which allow for more targeted DNA modifications without double-strand breaks, are gaining traction. The global gene editing market, valued at approximately $1.5 billion in 2023, is projected to grow significantly, indicating substantial investment and rapid innovation in this field.

Understanding these technological shifts is crucial for Immunocore's strategic planning. Future collaborations could leverage these gene editing capabilities to enhance the efficacy or broaden the applicability of T cell-based therapies, potentially creating synergistic effects with their existing ImmTAC technology. Furthermore, staying abreast of these developments is vital for maintaining competitive positioning, anticipating new therapeutic modalities, and identifying potential acquisition targets or partnership opportunities that could bolster their pipeline and market presence in the evolving landscape of immuno-oncology.

- CRISPR-Cas9 advancements: Continued refinement of CRISPR technology for enhanced specificity and reduced off-target effects.

- Base and Prime Editing: Development of precise single-nucleotide or small insertion/deletion editing without DNA breaks.

- Market Growth: The gene editing market is expected to exceed $4 billion by 2027, highlighting rapid technological progress and investment.

- Therapeutic Potential: These technologies could enable next-generation CAR-T therapies and other engineered cell treatments.

Data Analytics and AI in Drug Discovery

The integration of data analytics and artificial intelligence (AI) is revolutionizing drug discovery and development, presenting substantial technological avenues for Immunocore. By applying these advanced tools, companies can significantly speed up the research and development process, optimize clinical trial designs, and refine patient selection, thereby sharpening their competitive advantage. For instance, AI algorithms can analyze vast biological datasets to identify novel therapeutic targets and predict drug efficacy with greater accuracy, potentially reducing the time and cost associated with bringing new treatments to market.

The impact of AI on R&D efficiency is substantial. In 2024, the global AI in drug discovery market was valued at approximately $1.5 billion and is projected to grow at a compound annual growth rate (CAGR) of over 25% through 2030. This growth underscores the increasing reliance on AI for accelerating timelines and improving success rates in clinical trials. Immunocore can leverage these technologies to enhance its pipeline, potentially leading to faster regulatory approvals and improved patient outcomes.

- AI-driven target identification: AI platforms can sift through genomic, proteomic, and clinical data to pinpoint novel disease targets that might be missed by traditional methods.

- Predictive analytics in clinical trials: Machine learning models can forecast patient responses to therapies, optimize trial protocols, and identify patient subgroups most likely to benefit, improving trial success rates.

- Accelerated drug design: AI can rapidly design and screen potential drug candidates, predicting their properties and interactions, thereby shortening the preclinical phase.

- Enhanced data analysis: Advanced analytics can process complex biological data from clinical studies, providing deeper insights into drug mechanisms and patient stratification.

Immunocore's technological foundation rests on its advanced TCR engineering and bispecific technologies, driving the development of innovative therapies. The company's ImmTAC molecules are continuously refined for enhanced specificity and potency, directly impacting their therapeutic effectiveness and pipeline expansion. By mid-2024, Immunocore reported significant progress, with several ImmTAC candidates in clinical trials, showcasing the tangible benefits of these technological advancements.

Legal factors

Intellectual property rights, particularly patent protection for its ImmTAC molecules and platform technology, are absolutely critical for Immunocore's operations. This robust protection is the bedrock of their business, allowing them to maintain a significant competitive edge in the biopharmaceutical landscape.

Safeguarding their innovative discoveries through patents is essential for securing long-term revenue streams. For instance, the patent protection surrounding KIMMTRAK, their approved therapy for uveal melanoma, directly underpins its commercial success and future profitability.

Immunocore operates under stringent drug safety and efficacy regulations, a critical legal factor impacting its entire product lifecycle. These regulations mandate rigorous preclinical testing and multi-phase clinical trials, with significant investment required. For instance, the U.S. Food and Drug Administration (FDA) oversees these processes, demanding extensive data before approving new therapies.

Post-market surveillance is equally vital, requiring ongoing monitoring of approved drugs to detect any unforeseen adverse events. Failure to comply with these evolving regulatory standards, set by bodies like the FDA and the European Medicines Agency (EMA), can lead to significant delays in product launches, hefty fines, and even withdrawal of approved products from the market, directly affecting Immunocore's revenue streams and market access.

Immunocore’s operations are heavily influenced by data privacy laws like GDPR and HIPAA, particularly concerning its clinical trials and patient data handling. Failure to comply can result in substantial penalties; for instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher. Maintaining robust data protection is paramount for ethical conduct and stakeholder trust.

Antitrust Laws and Market Competition

Antitrust laws are a significant consideration for Immunocore, impacting how it operates and grows within the competitive biotechnology landscape. These regulations aim to prevent monopolistic practices and ensure a level playing field for all players, which directly affects Immunocore's commercial strategies and potential collaborations.

Compliance with antitrust regulations is crucial for Immunocore to avoid legal challenges and maintain its market access. The company must navigate these rules when forming partnerships, licensing agreements, or considering mergers and acquisitions to ensure fair competition.

- Regulatory Scrutiny: Antitrust authorities, such as the U.S. Federal Trade Commission (FTC) and the European Commission, actively monitor the biotechnology sector for anti-competitive behavior.

- Impact on M&A: For instance, in 2024, regulatory bodies worldwide have shown increased diligence in reviewing mergers and acquisitions within the pharmaceutical and biotech industries, often requiring divestitures or specific commitments to maintain competition.

- Partnership Agreements: Immunocore's licensing and co-development agreements must be structured to avoid exclusivity clauses that could stifle innovation or limit market entry for competitors.

- Market Share Considerations: While Immunocore is focused on niche areas like T-cell receptor (TCR) therapies, sustained market leadership in specific indications could attract regulatory attention if it appears to be limiting broader market access or innovation.

Clinical Trial Design and Ethical Guidelines

Immunocore's drug development hinges on strict adherence to legal and ethical frameworks governing clinical trials. These regulations, often dictated by bodies like the FDA in the US and the EMA in Europe, ensure patient safety and data reliability. For instance, the European Union's Clinical Trials Regulation (EU CTR) 536/2014, fully implemented in early 2023, harmonizes trial authorization and oversight across member states, impacting global trial strategies.

Navigating these guidelines is paramount for Immunocore's success. Key considerations include robust informed consent processes, transparent patient recruitment strategies, and rigorous data integrity protocols. Failure to comply can lead to trial invalidation, regulatory delays, and significant reputational damage. In 2024, the FDA continued to emphasize data transparency and patient privacy in its guidance updates, reflecting a global trend towards greater accountability in clinical research.

The evolving landscape of clinical trial design and ethical considerations presents both challenges and opportunities for Immunocore. Staying abreast of regulatory updates, such as the ongoing discussions around decentralized clinical trials and the use of real-world data, is crucial. For example, the ICH E6(R3) guideline, expected to be finalized in late 2024 or early 2025, will introduce further updates on Good Clinical Practice (GCP), influencing how trials are conducted globally.

- Regulatory Compliance: Immunocore must align with international standards like ICH GCP for all trial activities.

- Patient Safety and Rights: Ensuring informed consent and ethical patient treatment is non-negotiable.

- Data Integrity: Maintaining accurate and reliable data is critical for regulatory submissions and scientific validity.

- Evolving Guidelines: Adapting to new regulations like EU CTR and ICH E6(R3) impacts trial design and execution.

Intellectual property, especially patents for its ImmTAC technology and therapies like KIMMTRAK, forms the core of Immunocore's competitive advantage and revenue generation. The company's ability to secure and defend these patents is crucial for its long-term financial health and market exclusivity.

Stringent regulatory oversight from bodies like the FDA and EMA governs Immunocore's entire product lifecycle, from preclinical testing to post-market surveillance. Compliance with these evolving standards is vital to avoid delays, fines, and product withdrawal, directly impacting market access and profitability.

Data privacy laws, such as GDPR and HIPAA, significantly influence Immunocore's handling of patient data in clinical trials. Non-compliance can result in substantial penalties, underscoring the need for robust data protection measures to maintain ethical operations and stakeholder trust.

Antitrust regulations shape Immunocore's strategic maneuvers, including partnerships and acquisitions, ensuring fair competition within the biotech sector. Navigating these rules is essential to prevent legal challenges and maintain market access, with regulatory bodies in 2024 showing increased diligence in reviewing industry M&A.

Environmental factors

The biotechnology sector, including companies like Immunocore, faces significant environmental considerations regarding the management and disposal of biological materials and chemical byproducts. These specialized waste streams necessitate rigorous handling protocols to ensure safety and regulatory compliance.

In 2023, the global biotechnology market was valued at approximately $1.7 trillion, with waste management being a critical operational cost. Ensuring environmentally sound practices for biological waste, such as cell cultures and reagents, is paramount for maintaining a positive corporate image and avoiding substantial fines for non-compliance.

Failure to adhere to strict disposal regulations, which often include autoclaving or incineration for biohazardous materials, can lead to environmental contamination and public health risks. Companies are increasingly investing in advanced waste treatment technologies to meet evolving environmental standards and demonstrate their commitment to sustainability.

Immunocore's research and manufacturing operations, like many in the biopharmaceutical industry, are energy-intensive. For instance, the global biopharmaceutical sector's energy consumption is a significant factor in its environmental impact, with laboratories and production lines requiring substantial power for equipment, climate control, and specialized processes. While specific figures for Immunocore aren't publicly detailed for 2024/2025, the industry trend indicates a growing focus on reducing this footprint.

Implementing energy-efficient technologies in its facilities, such as advanced HVAC systems or LED lighting, can not only lower operational costs but also align with increasing investor and regulatory expectations for sustainability. The biopharma industry is increasingly exploring renewable energy procurement, with some companies setting targets to source a percentage of their energy from solar or wind power by 2025, a strategy that could offer Immunocore both environmental benefits and cost stability.

Supply chain sustainability is a growing concern for biotech firms like Immunocore, focusing on the ethical sourcing of raw materials. Companies are increasingly pressured to understand and mitigate the environmental impact of their suppliers, aiming for greener practices across their entire operational footprint.

For instance, the global pharmaceutical supply chain faces scrutiny over waste generation and energy consumption. In 2024, reports indicated that the healthcare sector contributes significantly to global carbon emissions, making sustainable sourcing a critical factor for companies like Immunocore to address.

Environmental Impact Assessments for New Facilities

Immunocore's potential expansion or construction of new research or manufacturing facilities would require comprehensive environmental impact assessments. These evaluations are crucial for adhering to stringent environmental regulations and mitigating any adverse effects on local ecosystems. For instance, in 2024, the UK government continued to emphasize net-zero targets, with significant investment planned for green infrastructure and sustainable manufacturing practices.

These assessments are not merely procedural; they are vital for long-term operational sustainability and corporate social responsibility. Failure to conduct thorough assessments can lead to project delays, fines, and reputational damage. For example, the European Union's Green Deal initiatives, which are increasingly influencing regulatory frameworks across member states, place a strong emphasis on minimizing industrial environmental footprints.

Key considerations in these assessments for Immunocore might include:

- Water Usage and Discharge: Evaluating the impact of water consumption and the quality of any discharged water on local aquatic environments.

- Energy Consumption and Emissions: Assessing the carbon footprint associated with facility operations and exploring renewable energy solutions.

- Waste Management: Developing robust plans for the disposal and recycling of chemical and biological waste generated during research and manufacturing.

- Biodiversity Impact: Analyzing the potential effects of construction and operation on local flora and fauna, and implementing mitigation strategies.

Bioremediation and Pollution Control

While Immunocore's primary focus remains on developing innovative therapies, the burgeoning field of green biotechnology, particularly bioremediation and pollution control, presents a landscape for potential future engagement. As a leader in biotechnology, the company could strategically align with environmental solutions, potentially through research partnerships or corporate social responsibility programs. The global bioremediation market was valued at approximately USD 2.9 billion in 2023 and is projected to grow significantly, indicating a robust sector for environmental innovation.

Exploring these avenues could allow Immunocore to contribute to sustainable practices and enhance its corporate image. For instance, advancements in using microbes or plants to clean up contaminated sites are gaining traction. The market for environmental biotechnology solutions, encompassing areas like waste management and pollution reduction, is expected to see continued expansion, driven by increasing regulatory pressures and public demand for cleaner environments.

- Bioremediation Market Growth: The global bioremediation market is anticipated to reach USD 4.5 billion by 2028, growing at a CAGR of 6.5% from 2023 to 2028.

- Corporate Responsibility: Companies in the biotech sector are increasingly scrutinized for their environmental impact, making proactive engagement in green initiatives beneficial.

- Potential Synergies: Future innovations in biotechnology could bridge therapeutic development with environmental stewardship, creating novel opportunities for companies like Immunocore.

Environmental factors significantly influence Immunocore's operations, particularly concerning waste management and energy consumption. The company, like others in the biotech sector, must adhere to strict protocols for handling biological and chemical byproducts, a critical aspect of operational cost and regulatory compliance.

The energy-intensive nature of biopharmaceutical research and manufacturing presents a challenge, with industry-wide efforts focusing on reducing carbon footprints through energy-efficient technologies and renewable energy procurement. Supply chain sustainability, including the ethical sourcing of raw materials, is also a growing concern, as the healthcare sector's contribution to global carbon emissions is substantial.

Furthermore, any expansion or new facility development for Immunocore necessitates thorough environmental impact assessments, addressing water usage, emissions, waste management, and biodiversity. The company also has opportunities to engage with the growing field of green biotechnology, such as bioremediation, which aligns with increasing regulatory pressures and public demand for environmental stewardship.

PESTLE Analysis Data Sources

Our PESTLE analysis for Immunocore is built on a robust foundation of data from leading scientific journals, regulatory bodies like the FDA and EMA, and market research firms specializing in the biotech sector. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting Immunocore's operations and strategic direction.