Immunocore Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Immunocore Bundle

Immunocore faces significant competitive pressures, with the threat of new entrants and the bargaining power of buyers shaping its strategic landscape. Understanding these dynamics is crucial for navigating the complex biopharmaceutical market.

The complete report reveals the real forces shaping Immunocore’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Immunocore's reliance on highly specialized raw materials and reagents for ImmTAC development places it in a vulnerable position regarding supplier bargaining power. The unique nature of these inputs often means a limited pool of qualified suppliers, allowing them to dictate pricing and supply terms.

For instance, in 2024, the biopharmaceutical industry continued to face supply chain challenges for critical reagents, with some specialized components seeing price increases of 10-15% due to high demand and limited production capacity. This directly impacts companies like Immunocore, as disruptions or cost hikes from these specialized vendors can significantly affect operational expenses and the ability to scale manufacturing.

Immunocore's reliance on Contract Manufacturing Organizations (CMOs) for producing its complex ImmTAC molecules significantly influences supplier bargaining power. The global biologics contract manufacturing market was valued at approximately $18.5 billion in 2023 and is projected to grow, indicating increasing demand for these specialized services.

However, the niche expertise required for advanced therapies like ImmTACs can lead to a concentration of capable CMOs. This limited pool of providers with the necessary technical skills and regulatory compliance can translate into considerable leverage for these suppliers, impacting pricing and production timelines for Immunocore.

Suppliers of advanced biotechnology equipment and proprietary technologies, such as specialized bioreactors and purification systems, wield significant influence. These critical components are often protected by patents and require specialized knowledge for operation and maintenance, making it difficult for Immunocore to switch providers. For instance, the cost of replacing highly specialized analytical instruments can run into hundreds of thousands of dollars, factoring into switching costs.

Intellectual Property (IP) of Input Components

Intellectual property held by suppliers can significantly bolster their bargaining power with Immunocore. For instance, if a key component, like a specialized viral vector used in their TCR therapy development, is protected by a supplier's patent, Immunocore faces limited options for alternative sourcing or in-house replication. This reliance on patented technology grants the supplier leverage in negotiations over pricing and terms.

Navigating these IP-protected inputs often necessitates complex licensing agreements. These agreements can be costly and may restrict Immunocore's operational flexibility. For example, in the biopharmaceutical sector, exclusive licensing of a patented cell line could mean higher upfront costs and ongoing royalty payments, directly impacting Immunocore's cost of goods and R&D expenses.

- Patented Inputs: Suppliers holding patents on critical components like cell lines or assay kits can restrict Immunocore's sourcing flexibility.

- Licensing Costs: The need for licensing agreements for IP-protected inputs increases operational expenses for Immunocore.

- Supplier Leverage: IP protection empowers suppliers to negotiate more favorable terms, potentially increasing costs for Immunocore.

Quality and Regulatory Compliance

Suppliers of pharmaceutical-grade materials and services are crucial for Immunocore, and their adherence to strict regulatory standards like Good Manufacturing Practices (GMP) significantly influences this dynamic. This means Immunocore faces limitations in readily switching to new, unproven suppliers, even if cost savings are apparent. The imperative for consistent, high-quality inputs and validated processes inherently bolsters the negotiating position of established, compliant vendors.

The reliance on suppliers who meet rigorous quality and regulatory benchmarks, such as those mandated by the FDA and EMA, limits Immunocore's flexibility. For instance, in 2024, the pharmaceutical industry continued to see increased scrutiny on supply chain integrity, making the validation of new suppliers a lengthy and costly process. This necessity for proven, compliant partners grants these suppliers considerable leverage.

- Regulatory Hurdles: Meeting GMP and other pharmaceutical quality standards is a significant barrier to entry for new suppliers, concentrating supply among a smaller group of qualified entities.

- Quality Assurance Costs: The expense and time involved in qualifying and auditing new suppliers for critical raw materials or manufacturing services reinforce the value of existing, trusted relationships.

- Supply Chain Stability: For a company like Immunocore, developing novel therapies, ensuring an uninterrupted supply of high-purity, compliant materials is paramount, making supplier reliability a key consideration that strengthens supplier power.

The bargaining power of suppliers for Immunocore is significant due to the specialized nature of its raw materials, reagents, and manufacturing services. Limited qualified suppliers for advanced biotechnology inputs, coupled with intellectual property held by vendors, allow them to dictate terms and pricing. For example, the biopharmaceutical industry in 2024 experienced continued supply chain challenges for critical reagents, with some specialized components seeing price increases of 10-15%.

| Factor | Impact on Immunocore | Supporting Data/Example (2023-2024) |

| Specialized Raw Materials | Limited supplier options, higher costs | Price increases of 10-15% for critical reagents in 2024 |

| Contract Manufacturing (CMOs) | Concentration of expertise, leverage for CMOs | Global biologics CMO market valued ~$18.5 billion in 2023 |

| Proprietary Technology/Equipment | High switching costs, supplier control | Cost of specialized analytical instruments can be hundreds of thousands of dollars |

| Intellectual Property (IP) | Restricted sourcing, licensing costs | Patented cell lines or viral vectors can necessitate costly licensing agreements |

| Regulatory Compliance (GMP) | Limited supplier pool, validated relationships | Increased scrutiny on supply chain integrity in 2024 |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Immunocore's unique position in the biopharmaceutical industry.

Instantly assess competitive intensity and identify strategic advantages with a dynamic Porter's Five Forces model tailored for Immunocore's unique biotech landscape.

Customers Bargaining Power

The high unmet medical need for uveal melanoma significantly curtails customer bargaining power. Immunocore's KIMMTRAK, a TCR therapy, is a first-in-class treatment for metastatic uveal melanoma, a rare cancer with historically limited effective systemic options. This scarcity of alternatives means patients and healthcare providers have little leverage to negotiate pricing or terms.

The bargaining power of customers for KIMMTRAK is significantly limited due to the highly specialized nature of its patient population and prescribers. Oncologists and specialized cancer centers are the primary customers, and their decisions are heavily influenced by treatment efficacy and patient survival rates for uveal melanoma, a severe disease.

These healthcare professionals prioritize clinical outcomes and significant survival benefits over price sensitivity. For instance, in 2024, therapies offering substantial improvements in progression-free survival or overall survival often command premium pricing, as seen with other advanced oncology treatments. This focus on life-saving results diminishes the collective bargaining power that a more general or price-conscious customer base might otherwise wield.

While individual patients and doctors may not hold much sway, large healthcare payers like private insurers and government programs wield considerable power. They influence market access and pricing through their decisions on drug formularies and reimbursement policies. This is particularly true for expensive oncology treatments, which face intense scrutiny.

Payers can negotiate for lower prices or implement restrictions on high-cost drugs, directly impacting their market penetration. For example, in 2024, many payers continued to implement stricter prior authorization requirements for specialty medications, including those in oncology, to manage their budgets.

However, for orphan drugs that address critical unmet medical needs, this bargaining power might be somewhat lessened. The urgency and lack of alternatives can give manufacturers of these specialized treatments more leverage when negotiating with payers.

Lack of Direct Substitutes for Approved Indication

The bargaining power of customers is significantly diminished for Immunocore due to the lack of direct substitutes for KIMMTRAK's approved indication. As the first-ever approved T cell receptor (TCR) therapy for uveal melanoma, KIMMTRAK offers a unique treatment modality. This lack of comparable alternatives means patients and their healthcare providers have limited options, thereby reducing their leverage in negotiating prices or demanding different terms.

This distinct market position, where KIMMTRAK stands alone in its therapeutic class for uveal melanoma, grants Immunocore considerable pricing power and a strong foothold in market penetration. The absence of viable, equally effective substitutes means patients are more likely to accept the established treatment, even at a premium, due to the unmet medical need it addresses.

- Unique Therapeutic Niche: KIMMTRAK's status as the world's first approved TCR therapy for uveal melanoma creates a significant barrier to entry for potential competitors offering similar direct substitutes.

- Reduced Patient Choice: The lack of alternative treatments with comparable efficacy means patients have fewer options, lessening their ability to bargain for lower prices or different treatment plans.

- Pricing Power Advantage: This lack of direct substitutes allows Immunocore to command premium pricing for KIMMTRAK, reflecting its innovative nature and the unmet medical need it fulfills.

Clinical Efficacy and Survival Data

The proven clinical efficacy of KIMMTRAK, demonstrated by its ability to significantly improve overall survival in metastatic uveal melanoma, directly impacts customer bargaining power. This strong value proposition means that healthcare providers and patients, facing a critical unmet need, are less likely to push back on pricing due to the drug's life-saving potential.

For instance, in the pivotal Phase 2 IMCgp100-202 trial, KIMMTRAK showed a median overall survival of 19.9 months compared to 17.5 months for the investigator's choice of therapy. This data, presented and discussed widely in medical forums, solidifies KIMMTRAK's position as a valuable treatment option.

- Demonstrated Survival Benefit: KIMMTRAK's median overall survival of 19.9 months in metastatic uveal melanoma patients provides a clear clinical advantage.

- Reduced Price Sensitivity: Patients and healthcare systems are more accepting of higher costs when a therapy offers substantial improvements in life-threatening conditions.

- Value-Based Proposition: The drug's efficacy creates a strong value proposition, diminishing the customers' ability to negotiate lower prices.

The bargaining power of customers for Immunocore's KIMMTRAK is significantly limited by the drug's unique position as the first-in-class therapy for metastatic uveal melanoma. This lack of direct substitutes, coupled with a high unmet medical need, means patients and healthcare providers have minimal leverage to negotiate pricing. While payers can exert some influence through formulary decisions and reimbursement policies, the critical nature of the treatment and its proven survival benefits, such as a median overall survival of 19.9 months in trials, often override price sensitivity.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Reasoning |

|---|---|---|

| Lack of Substitutes | Very Low | KIMMTRAK is the world's first approved TCR therapy for uveal melanoma, offering a unique modality with no direct competitors. |

| Unmet Medical Need | Very Low | Metastatic uveal melanoma has historically had limited effective systemic treatment options, creating high demand for effective therapies. |

| Customer (Healthcare Provider) Focus | Low | Oncologists prioritize efficacy and survival benefits over price, especially for life-threatening diseases. KIMMTRAK demonstrated a median overall survival of 19.9 months in trials. |

| Customer (Payer) Influence | Moderate | Payers can negotiate pricing and implement restrictions, but the drug's critical need and efficacy can limit their leverage. Many payers in 2024 implemented stricter prior authorization for specialty oncology drugs. |

Full Version Awaits

Immunocore Porter's Five Forces Analysis

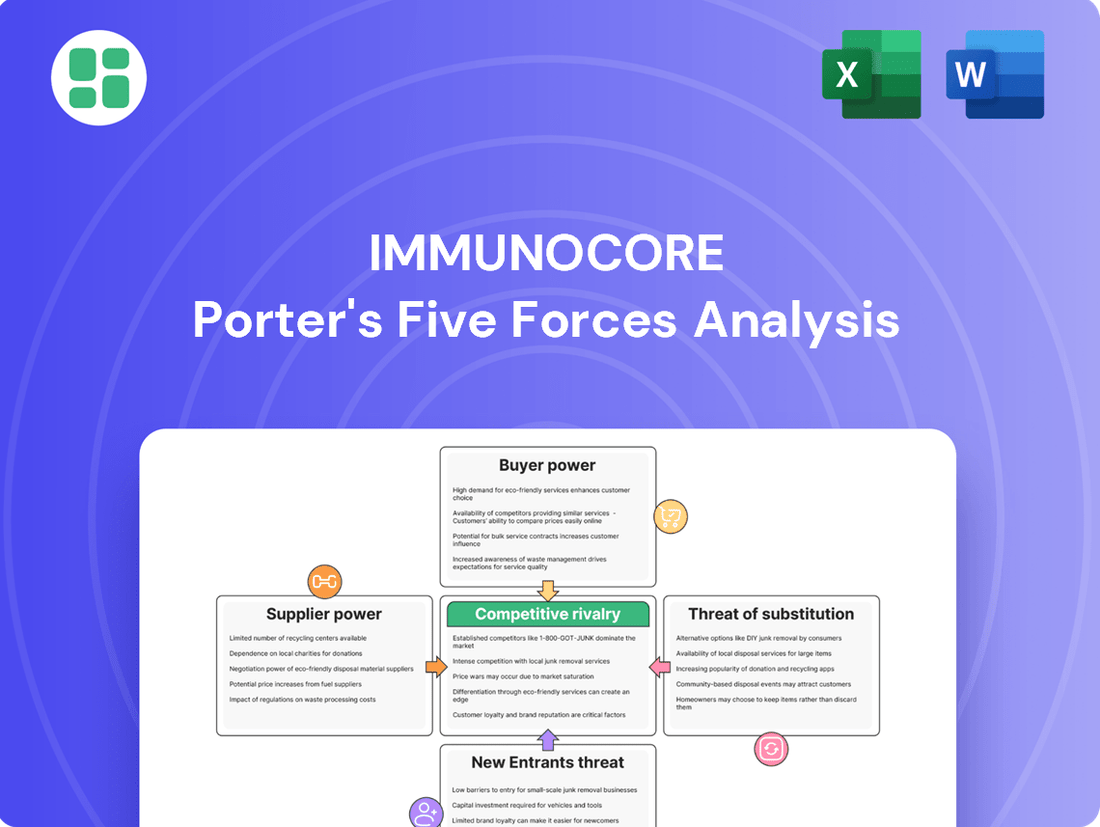

This preview showcases the complete Immunocore Porter's Five Forces Analysis, detailing the competitive landscape including threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors.

The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, providing a comprehensive understanding of Immunocore's strategic positioning.

Rest assured, the content and structure of this preview are identical to the final document you'll download, offering a clear and actionable assessment of Immunocore's competitive environment.

Rivalry Among Competitors

The T-cell receptor (TCR) therapy market, though experiencing rapid growth, remains nascent. Immunocore, with its first approved TCR therapy, is a trailblazer in this emerging field. This early stage implies a less saturated environment currently, but the influx of new entrants and innovative technologies signals escalating future rivalry.

Projections indicate substantial expansion for TCR therapies in the coming years. This forecast suggests a highly attractive market, albeit one that is poised to become increasingly competitive as more companies vie for market share and technological leadership.

While KIMMTRAK holds approval for uveal melanoma, the overall melanoma treatment market is intensely competitive. This includes established immunotherapies like checkpoint inhibitors, alongside targeted therapies and conventional treatments, all vying for market share and patient access.

Although not always direct substitutes for uveal melanoma, these alternative treatment modalities represent a constant competitive force. They possess the potential to evolve, be combined, or find new applications, thereby influencing treatment decisions and market dynamics.

Immunocore's strategic expansion into other melanoma indications, such as cutaneous melanoma, will inevitably heighten its rivalry with existing market leaders in those specific segments. This pipeline development signals a broader competitive engagement across the melanoma therapeutic landscape.

Immunocore's strategic expansion into new therapeutic areas beyond its initial success with KIMMTRAK intensifies competitive rivalry. By developing ImmTAC candidates for various solid tumors and infectious diseases, the company enters markets already populated by established giants. For instance, in the oncology space, companies like Bristol Myers Squibb and Merck have significant portfolios and market presence in many of the solid tumor indications Immunocore is targeting. This means Immunocore faces direct competition not just on therapeutic efficacy but also on market access, physician adoption, and commercialization capabilities.

High R&D Investment and Innovation Pace

The biotechnology sector, particularly immuno-oncology, is defined by substantial research and development expenditures and a swift innovation cycle. Companies are relentlessly pursuing the creation of advanced therapies, such as novel bispecific antibodies and cell-based treatments. This ongoing innovation and significant R&D investment across many players foster an intensely competitive landscape.

For instance, in 2023, the global biotechnology market size was valued at approximately USD 1.37 trillion, with a significant portion allocated to R&D, especially in oncology. Companies like Immunocore are deeply entrenched in this environment, where the pressure to innovate is constant.

- High R&D Investment: The immuno-oncology space demands substantial capital for drug discovery and clinical trials, often running into hundreds of millions of dollars per drug candidate.

- Rapid Innovation Pace: New therapeutic modalities and targets are frequently identified, requiring companies to adapt quickly or risk falling behind.

- Competitive Pressure: Numerous biotech firms are developing similar or complementary technologies, intensifying the race to market and clinical validation.

- Talent Acquisition: Fierce competition also extends to attracting and retaining top scientific and clinical talent, crucial for driving innovation.

Strategic Partnerships and M&A Activity

Strategic partnerships and mergers and acquisitions (M&A) significantly influence the competitive landscape for companies like Immunocore. Larger pharmaceutical giants are increasingly looking to acquire or collaborate with innovative biotechnology firms, particularly those with strong oncology and immunology portfolios, to bolster their own research and development pipelines.

These strategic moves can create formidable new competitors or strengthen existing ones, directly impacting Immunocore's market position and growth potential. For instance, in 2024, the biopharmaceutical sector continued to see substantial M&A activity, with major players investing heavily in targeted therapies and immune-oncology assets, reflecting a broader trend of consolidation aimed at acquiring cutting-edge technology and intellectual property.

- Increased Consolidation: The biopharma industry saw continued M&A in 2024, with large companies acquiring smaller, innovative biotech firms.

- Pipeline Expansion Focus: Acquisitions and partnerships are primarily driven by the need to expand oncology and immunology drug pipelines.

- Emergence of New Rivals: These strategic alliances can quickly introduce new, well-resourced competitors into the market.

- Impact on Market Standing: Such activities necessitate that companies like Immunocore remain agile and innovative to maintain their competitive edge.

The competitive rivalry within the TCR therapy market, while still developing, is intensifying. Immunocore, as an early leader with KIMMTRAK, faces competition not only from existing melanoma treatments like checkpoint inhibitors but also from a growing number of companies entering the TCR space. This includes established pharmaceutical giants and emerging biotechs investing heavily in R&D.

The broader immuno-oncology sector is characterized by rapid innovation and substantial R&D spending, with companies like Bristol Myers Squibb and Merck having significant market presence in areas Immunocore is targeting. This creates a dynamic where companies must constantly innovate and secure market access to thrive. For example, the global biotechnology market was valued at approximately USD 1.37 trillion in 2023, highlighting the immense investment and competition in the sector.

Strategic partnerships and M&A activity further shape the competitive landscape. In 2024, the biopharmaceutical industry continued to see major players acquiring or collaborating with innovative biotech firms to bolster their oncology and immunology pipelines. This trend means Immunocore must remain agile to maintain its competitive edge against well-resourced entities.

| Competitive Factor | Description | Impact on Immunocore |

|---|---|---|

| TCR Market Entry | Nascent but growing, attracting new entrants. | Increases future competition for market share. |

| Existing Melanoma Treatments | Checkpoint inhibitors, targeted therapies. | Direct competition for patient treatment in approved indications. |

| Broader Immuno-Oncology R&D | High investment, rapid innovation cycles. | Pressure to innovate and differentiate from established players. |

| Strategic Alliances & M&A | Consolidation and pipeline acquisition by large pharma. | Potential for new, well-funded competitors to emerge. |

SSubstitutes Threaten

While KIMMTRAK (tebentafusp) offers a novel TCR therapy for metastatic uveal melanoma, substitutes remain a significant threat. Existing treatments like surgery, radiation (brachytherapy, proton beam therapy), and liver-directed therapies are established options, particularly for localized disease. These alternatives, though not systemic, provide viable pathways for patients where KIMMTRAK might not be indicated or accessible.

The broader field of immuno-oncology presents several substitute modalities that could impact Immunocore, even if not directly targeting metastatic uveal melanoma. These include established therapies like PD-1/PD-L1 inhibitors, which saw significant market growth with approvals across various cancers. For instance, Keytruda (pembrolizumab) alone generated over $25 billion in revenue in 2023, showcasing the market penetration of checkpoint inhibitors.

Furthermore, CAR-T cell therapies and oncolytic viruses are rapidly evolving. While CAR-T therapies have primarily focused on hematological malignancies, ongoing research aims to expand their application to solid tumors. The global CAR-T therapy market was valued at approximately $2.4 billion in 2023 and is projected to grow substantially, indicating a competitive landscape for advanced cell-based treatments.

Other bispecific antibodies also represent potential substitutes. These therapies, designed to engage multiple targets, are gaining traction. The development of novel bispecifics, even if initially for different indications, could lead to repurposed or adapted versions that compete for patient populations or research investment, potentially diverting resources or attention from Immunocore's specific approaches.

The rise of targeted therapies, particularly those addressing specific genetic mutations like GNAQ/GNA11 in uveal melanoma, poses a significant threat. These therapies, if proven highly effective and widely adopted, could offer competitive treatment options.

For instance, advancements in precision medicine are leading to the development of small-molecule inhibitors and other novel agents. If these treatments gain regulatory approval and demonstrate superior outcomes or better tolerability compared to existing options, they could capture market share.

Non-pharmacological Interventions and Supportive Care

Non-pharmacological interventions and supportive care represent a significant threat of substitutes for advanced cancer therapies like those developed by Immunocore, especially when curative treatments are not feasible or desired by patients. These alternatives compete for patient attention and healthcare budgets, particularly in cases of advanced or treatment-resistant cancers where the focus shifts to quality of life and symptom management.

While not directly replacing the disease-eradicating potential of Immunocore's therapies, palliative and supportive care options can be seen as substitutes in the broader sense of addressing patient needs. For instance, the global palliative care market was valued at approximately USD 75 billion in 2023 and is projected to grow, indicating substantial resource allocation towards these supportive measures.

- Competition for Resources: Supportive care services, including pain management, nutritional support, and psychological counseling, consume significant healthcare resources that could otherwise be directed towards novel therapies.

- Patient Preference: Some patients, particularly those with advanced disease or significant treatment-related toxicities, may opt for less aggressive, supportive care approaches over potentially burdensome advanced therapies.

- Cost Considerations: The high cost associated with many advanced cancer treatments can make less expensive supportive care options more attractive, especially in healthcare systems with budget constraints.

- Limited Efficacy of Advanced Therapies: In situations where advanced therapies show limited efficacy or are associated with severe side effects, the perceived value of supportive care increases as a more tolerable alternative.

Pipeline of Competitors

The threat of substitutes for Immunocore's therapies, particularly in the uveal melanoma market, is a significant consideration. Competitors are actively developing novel treatment approaches, with some pipeline candidates already in advanced stages of clinical trials. These emerging therapies, upon regulatory approval, could present viable alternatives to Immunocore's existing offerings.

These potential substitutes might offer distinct mechanisms of action, potentially leading to improved efficacy or enhanced safety profiles compared to current treatments. For instance, advancements in cell therapies or novel small molecule inhibitors could directly challenge Immunocore's position. As of mid-2024, the oncology landscape is dynamic, with a robust pipeline across various cancer types.

The impact of these substitutes could be substantial, potentially fragmenting market share and pressuring pricing. For example, if a competitor demonstrates superior survival rates or a more convenient dosing regimen in clinical trials for a similar patient population, it could significantly alter the competitive landscape. The speed at which these pipelines advance and gain regulatory approval will be a key factor in assessing this threat.

- Pipeline Advancement: Companies like Kite Pharma (a Gilead company) and Novartis continue to invest heavily in CAR-T therapies, with ongoing research into solid tumor applications, which could eventually extend to indications targeted by Immunocore.

- Mechanism Diversity: Emerging therapies may leverage entirely different biological pathways, such as bispecific antibodies or novel immunomodulatory agents, offering distinct advantages over T-cell receptor engineered T-cell therapies.

- Clinical Trial Data: The efficacy and safety data emerging from competitor trials in 2024 and early 2025 will be crucial in evaluating the substitutability of their candidates.

The threat of substitutes for Immunocore's therapies, particularly KIMMTRAK, is multifaceted. Established treatments like surgery and radiation therapy remain viable alternatives, especially for localized uveal melanoma. Furthermore, the broader immuno-oncology field, including PD-1/PD-L1 inhibitors which generated over $25 billion in revenue in 2023, presents significant indirect competition.

Emerging cell therapies like CAR-T, valued at approximately $2.4 billion in 2023, and novel bispecific antibodies are rapidly evolving and could offer alternative treatment modalities. Advancements in targeted therapies and precision medicine, focusing on specific genetic mutations, also pose a competitive threat by offering potentially more effective or tolerable options.

Supportive and palliative care, representing a global market valued at around USD 75 billion in 2023, also acts as a substitute by addressing patient needs when curative options are limited or undesirable. Patient preference, cost considerations, and the perceived value of less aggressive approaches further bolster the threat of these substitutes.

The competitive landscape is dynamic, with ongoing research and pipeline advancements in 2024 and early 2025 by companies like Kite Pharma and Novartis in CAR-T therapies. Emerging therapies with diverse mechanisms of action and superior clinical trial data could significantly fragment market share and impact Immunocore's market position.

| Therapy Type | Market Status/Value (Approx.) | Relevance to Immunocore's Threat |

| Surgery/Radiation | Established, standard of care for localized disease | Direct substitutes for early-stage uveal melanoma |

| PD-1/PD-L1 Inhibitors | >$25 billion (2023 revenue for Keytruda alone) | Indirect competition within immuno-oncology |

| CAR-T Therapies | ~$2.4 billion (2023 global market) | Evolving threat, potential for solid tumor applications |

| Bispecific Antibodies | Growing market, diverse applications | Emerging competitors with novel mechanisms |

| Targeted Therapies/Precision Medicine | Rapidly advancing, focus on genetic mutations | Potential for superior efficacy/tolerability |

| Supportive/Palliative Care | ~$75 billion (2023 global market) | Addresses patient needs when advanced therapies are not pursued |

Entrants Threaten

The biotechnology sector, especially for innovative treatments like those developed by Immunocore, presents formidable regulatory challenges. Securing approval requires extensive, multi-phase clinical trials, a process that can span many years and cost hundreds of millions of dollars. For instance, the average cost for developing a new drug from discovery to market approval was estimated to be over $2.6 billion as of 2023, with many biotech products facing even higher development expenses.

These stringent requirements, overseen by bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), demand significant scientific expertise and a deep understanding of complex compliance frameworks. This high barrier to entry, both in terms of time and financial investment, effectively discourages many potential new competitors from entering the market, thereby protecting established companies like Immunocore.

Developing and commercializing novel biologic therapies, such as Immuno-Oncology's ImmTAC molecules, requires substantial capital. This includes the significant costs associated with extensive research, rigorous clinical trials, and the establishment of specialized manufacturing capabilities.

The financial commitment to build a competitive presence in this advanced biotechnology sector is exceptionally high, effectively deterring most potential new entrants. For instance, the total R&D spending for biopharmaceutical companies can easily run into hundreds of millions, if not billions, of dollars annually, as seen with major players in the oncology space.

Immunocore's strong intellectual property portfolio, particularly for its ImmTAC platform and the approved drug KIMMTRAK, acts as a significant deterrent to new entrants. These patents, covering core technologies and applications, necessitate substantial investment in research and development and legal navigation for any competitor seeking to enter the market.

Specialized Scientific Expertise and Talent

The development of TCR bispecific immunotherapies demands a deep well of specialized knowledge in areas like immunology, oncology, and protein engineering. Assembling a team with this level of expertise is a significant hurdle for any new player entering the field.

Attracting and keeping top-tier scientific and clinical talent is both difficult and expensive. This talent scarcity acts as a substantial barrier, making it tough for emerging companies to build the capable teams needed to compete with established firms like Immunocore.

- High Demand for Specialized Skills: The oncology and immunology sectors are experiencing intense competition for talent.

- Cost of Talent Acquisition: Companies may spend upwards of $200,000-$500,000 to recruit top-tier scientists and clinicians.

- Limited Talent Pool: The number of individuals with proven experience in TCR bispecific development is relatively small globally.

Established Commercial Infrastructure and Market Access

Immunocore’s status as a commercial-stage biopharmaceutical company with an approved product, Kimmtrak, presents a significant hurdle for potential new entrants. This established commercial infrastructure, including manufacturing capabilities and market access channels in key regions like the United States and Europe, requires immense capital investment and time to replicate.

For instance, building out a global sales force and securing reimbursement agreements for a novel therapy can take years and hundreds of millions of dollars. In 2023, Immunocore reported Kimmtrak net product revenue of $140.6 million, demonstrating the tangible results of its existing infrastructure.

- Established Commercial Infrastructure: Immunocore has already built a sales and marketing network, crucial for reaching physicians and patients.

- Manufacturing Capabilities: The company possesses the necessary facilities and expertise to produce its therapies at scale.

- Market Access Channels: Immunocore has navigated complex regulatory and payer landscapes to gain market access in multiple countries.

- High Barrier to Entry: New entrants face substantial challenges in replicating this established commercial foundation, requiring significant time, capital, and strategic partnerships.

The threat of new entrants in the advanced biopharmaceutical space, particularly for innovative therapies like Immunocore's ImmTACs, is significantly mitigated by extremely high barriers. These include the vast capital required for research, development, and clinical trials, which can easily exceed billions of dollars. For instance, by the end of 2023, Immunocore had invested over $1.3 billion in R&D since its inception, highlighting the immense financial commitment needed.

The complex regulatory landscape, demanding extensive and costly clinical validation processes overseen by agencies like the FDA and EMA, further deters new players. Furthermore, Immunocore's robust intellectual property portfolio, covering its core technology and specific applications, necessitates significant legal and research investment for any potential competitor. The scarcity of specialized talent in fields like immunology and protein engineering, coupled with the high cost of recruitment, estimated at $200,000-$500,000 per top scientist, also presents a formidable challenge.

Immunocore's established commercial infrastructure, including manufacturing, sales, and market access channels, built over years and substantial investment, represents another significant hurdle. Replicating this requires immense capital and time, making it difficult for new entrants to compete effectively.

| Barrier Type | Description | Estimated Cost/Impact |

| Capital Requirements | R&D, clinical trials, manufacturing | Billions of dollars (e.g., Immunocore's cumulative R&D > $1.3B by end of 2023) |

| Regulatory Hurdles | Extensive clinical validation, FDA/EMA approval | Years of development, hundreds of millions in costs |

| Intellectual Property | Patents on core technology and applications | Requires significant R&D and legal investment to circumvent |

| Talent Scarcity | Specialized skills in immunology, oncology | High recruitment costs ($200k-$500k per top scientist), limited global pool |

| Commercial Infrastructure | Manufacturing, sales, market access | Years to build, hundreds of millions in investment |

Porter's Five Forces Analysis Data Sources

Our Immunocore Porter's Five Forces analysis is built upon a foundation of comprehensive data, including company annual reports, SEC filings, and industry-specific market research from sources like Fierce Biotech and Evaluate Pharma.

We leverage a blend of primary and secondary data, drawing from clinical trial databases, patent filings, and financial analyst reports to accurately assess competitive pressures within the immunotherapy landscape.