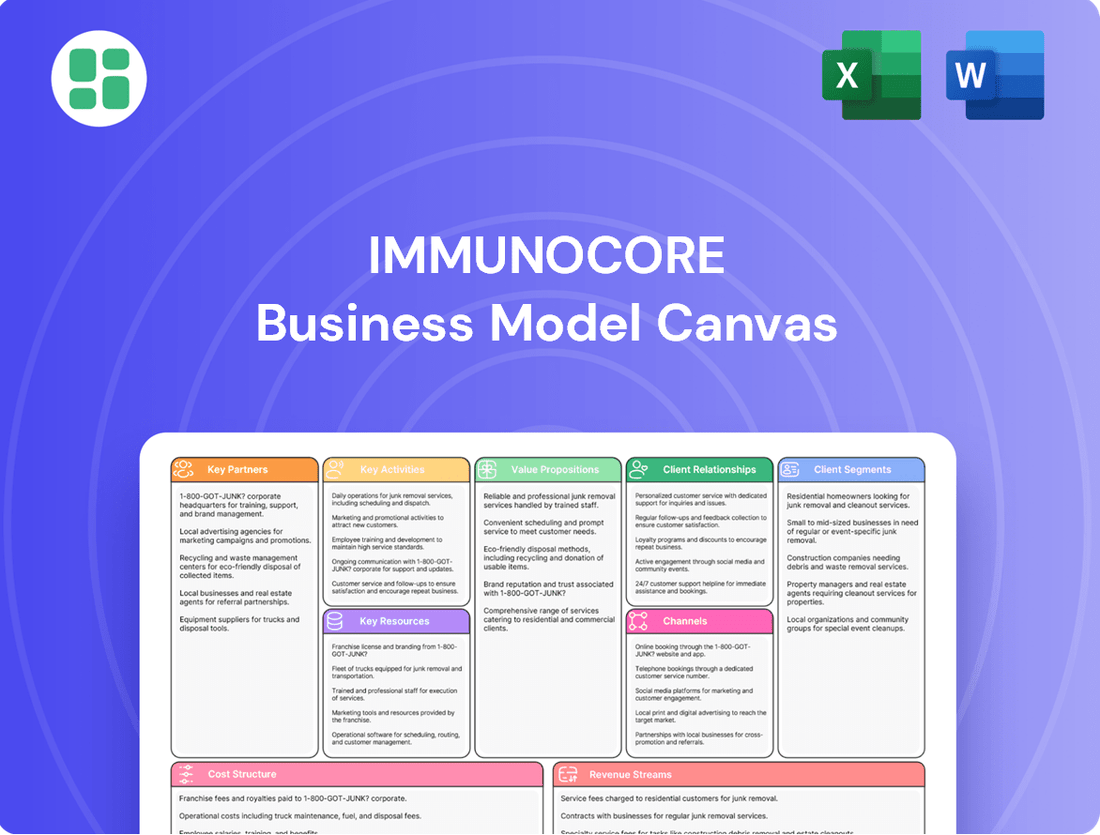

Immunocore Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Immunocore Bundle

Discover the strategic core of Immunocore's innovative approach to biopharmaceuticals with our comprehensive Business Model Canvas. This detailed breakdown illuminates how they leverage cutting-edge science to address unmet medical needs and create significant value for patients and stakeholders.

Unlock the full strategic blueprint behind Immunocore's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Immunocore actively engages in research collaborations with leading academic institutions and specialized research organizations. These partnerships are vital for deepening the company's foundational understanding of T cell receptor (TCR) biology and for identifying novel therapeutic targets. For instance, in 2024, collaborations continued to focus on advancing the preclinical validation of new ImmTAC molecules, building upon a strong scientific knowledge base.

Clinical Research Organizations (CROs) are crucial partners for Immunocore, enabling the effective execution and management of their broad clinical trial programs. These collaborations are vital for efficient patient recruitment, meticulous data gathering, and adherence to regulatory standards, thereby speeding up the development of ImmTAC candidates through various trial stages.

The considerable scale of Immunocore's ongoing Phase 3 trials, such as the SAVANNAH and PIONEER studies for tebentafusp in uveal melanoma and non-small cell lung cancer respectively, absolutely demands comprehensive CRO support. For instance, in 2023, Immunocore reported significant progress with tebentafusp, underscoring the reliance on CROs to manage these complex, multi-site, global studies.

Immunocore collaborates with specialized contract manufacturing organizations (CMOs) for the complex production of its ImmTAC molecules, such as KIMMTRAK. These partnerships are crucial for ensuring consistent quality and the scalability needed for global supply of both approved products and pipeline candidates.

In 2024, the demand for biologics manufacturing capacity continued to be robust, with CMOs playing an increasingly vital role in the pharmaceutical industry's supply chain. Maintaining these strategic alliances is paramount for Immunocore's commercial viability and the advancement of its clinical programs, directly impacting its ability to meet market demand and patient needs.

Distribution and Commercialization Partners

Immunocore strategically partners with regional pharmaceutical companies and distributors to extend KIMMTRAK's global reach and for the commercialization of future products. These collaborations are crucial for navigating diverse regulatory landscapes and leveraging established local sales networks. For instance, in 2024, Immunocore continued to build out its commercial infrastructure, with a focus on expanding access in key European markets through such partnerships.

These alliances are designed to access local market expertise, established sales channels, and crucial regulatory knowledge, thereby facilitating market access in territories beyond Immunocore's direct operational footprint. This approach is vital for ensuring broader patient access to their therapies and driving revenue growth. The company's strategy in 2024 aimed to solidify these relationships to maximize KIMMTRAK's commercial potential.

Key aspects of these partnerships include:

- Market Access: Leveraging partners' established relationships with healthcare providers and payers.

- Sales Force Expansion: Utilizing existing sales teams to promote KIMMTRAK and future pipeline assets.

- Regulatory Navigation: Benefiting from partners' in-depth understanding of local regulatory requirements and submission processes.

- Logistics and Distribution: Ensuring efficient supply chain management and product delivery within specific regions.

Diagnostic Test Developers

Immunocore’s reliance on specific HLA alleles, such as HLA-A*02:01 for KIMMTRAK, underscores the critical need for diagnostic test developers. These partnerships are essential for creating and distributing companion diagnostics. This ensures that patients who are most likely to benefit from Immunocore's targeted therapies are accurately identified.

Collaborations with diagnostic companies are vital for Immunocore to ensure the effective and safe deployment of its therapies. By working with these partners, Immunocore can establish robust diagnostic frameworks. This allows for precise patient stratification, maximizing the potential of their innovative treatments.

- Companion Diagnostics: Partnerships with diagnostic test developers are fundamental for creating the companion diagnostics necessary to identify patients with specific HLA types, like HLA-A*02:01 for KIMMTRAK.

- Patient Identification: These collaborations are crucial for ensuring that eligible patients are accurately identified, which is a prerequisite for the effective and safe administration of Immunocore's targeted therapies.

- Therapeutic Efficacy: By enabling precise patient selection, these diagnostic partnerships directly contribute to optimizing therapeutic outcomes and ensuring that the right treatment reaches the right patient.

Immunocore's key partnerships are vital for advancing its scientific understanding and therapeutic development. Collaborations with academic institutions and research organizations in 2024 focused on deepening knowledge of TCR biology and identifying new targets, supporting preclinical validation of ImmTAC molecules.

Clinical Research Organizations (CROs) are essential for managing Immunocore's extensive clinical trials, ensuring efficient patient recruitment and data integrity for candidates like tebentafusp, as evidenced by progress in 2023 studies.

Specialized contract manufacturing organizations (CMOs) are critical for producing ImmTAC molecules, including KIMMTRAK, ensuring quality and scalability for global supply, a role that grew in importance in 2024 due to robust demand for biologics.

Strategic alliances with regional pharmaceutical companies and distributors in 2024 were crucial for expanding KIMMTRAK's global reach and commercialization, leveraging local expertise and sales networks to enhance market access.

Partnerships with diagnostic test developers are fundamental for creating companion diagnostics, like those for KIMMTRAK's HLA-A*02:01 requirement, ensuring precise patient identification and optimizing therapeutic efficacy.

What is included in the product

A detailed breakdown of Immunocore's strategy, outlining its focus on pioneering T-cell receptor (TCR) therapies for cancer and autoimmune diseases.

This model highlights key partnerships, its proprietary ImmTAC platform, and the clinical development pipeline as core value drivers.

Immunocore's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their innovative approach to developing T-cell therapies, simplifying complex scientific and commercial strategies for stakeholders.

Activities

Immunocore's key activity is the continuous research and development of its ImmTAC platform. This involves discovering and advancing new bispecific molecules designed to target a range of diseases, including various cancers, infectious diseases, and autoimmune conditions.

The R&D process encompasses critical stages such as identifying disease targets, optimizing lead compounds, and conducting rigorous preclinical testing. This methodical approach is fundamental to building and sustaining a strong pipeline of potential therapies.

In 2023, Immunocore reported R&D expenses of $287.8 million, underscoring the substantial financial commitment required to fuel innovation and maintain its competitive edge in the biopharmaceutical sector.

Clinical trials management is a cornerstone of Immunocore's operations. This involves meticulously overseeing multiple trials, including their ongoing Phase 3 studies for melanoma. In 2024, the company continued to advance its ImmTAC technology through these crucial stages.

Key activities include designing effective trial protocols, successfully recruiting eligible patients, managing the performance of clinical sites, and conducting rigorous data analysis. Ensuring strict adherence to all regulatory requirements throughout these processes is also paramount.

The successful completion of these trials is vital for Immunocore. It directly impacts their ability to gain further regulatory approvals and expand the approved indications for their innovative therapies, ultimately driving future revenue growth.

Manufacturing and quality control are central to producing ImmTAC molecules like KIMMTRAK. This involves intricate processes to ensure each batch is safe, effective, and consistent, adhering to strict global regulatory requirements. For instance, in 2024, Immunocore continued to refine its manufacturing capabilities to meet the growing demand for KIMMTRAK, a therapy approved in major markets like the US and EU.

Maintaining high standards in manufacturing directly impacts product reliability and patient outcomes. The company's commitment to quality control is paramount, ensuring that the complex biological nature of ImmTACs is managed meticulously throughout production. This rigorous approach is essential for commercial supply and for providing necessary drug product for ongoing clinical trials.

Regulatory Affairs and Market Access

Navigating the intricate global regulatory pathways is a cornerstone activity for Immunocore. This involves diligently securing and maintaining product approvals from key health authorities like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). For instance, in 2024, ongoing engagement with these bodies is crucial for their lead asset, KIMMTRAK (tebentafusp-tebn), and any pipeline advancements.

Beyond initial approval, a critical function is ensuring patient access through reimbursement and favorable pricing negotiations with payers worldwide. This process is vital for commercial viability and widespread patient benefit. In 2024, Immunocore's market access teams are actively working to secure these agreements in numerous territories, understanding that successful outcomes directly impact revenue and market penetration.

- Global Regulatory Navigation: Continuously managing product approvals with agencies such as the FDA and EMA.

- Market Access and Reimbursement: Securing favorable pricing and reimbursement from payers to ensure patient access.

- Commercial Viability: Linking successful regulatory and market access strategies directly to commercial success.

- 2024 Focus: Ongoing efforts to expand access for KIMMTRAK and prepare for future product launches.

Commercialization and Sales

Immunocore’s commercialization of KIMMTRAK involves a direct sales force focused on engaging oncologists and healthcare providers in approved regions. Marketing efforts and market penetration strategies are crucial for driving adoption and ensuring patient access through hospitals and specialty pharmacies.

Key activities include expanding sales within existing markets and strategically launching KIMMTRAK in new territories. For instance, in 2024, the company continued its focus on broadening access and uptake in the United States and Europe, building on the initial launches.

- Direct Sales Force Engagement: Building relationships with oncologists to educate them on KIMMTRAK's profile and patient benefits.

- Marketing and Market Penetration: Implementing targeted campaigns to raise awareness and drive prescribing habits.

- Channel Access: Collaborating with hospitals and specialty pharmacies to streamline patient access and reimbursement.

- Geographic Expansion: Prioritizing launches and sales growth in key markets like the US and Europe, with ongoing plans for further global penetration.

Immunocore's key activities are centered on advancing its proprietary ImmTAC technology. This involves the ongoing research and development of novel bispecific molecules targeting a spectrum of diseases, with a strong emphasis on oncology. The company's commitment to innovation is reflected in its substantial R&D investments, with $287.8 million spent in 2023 alone, demonstrating a clear focus on building a robust pipeline.

Managing clinical trials is paramount, including the progression of its lead asset, KIMMTRAK, through critical phases. This encompasses meticulous trial design, patient recruitment, site management, and data analysis, all while adhering to stringent regulatory standards. The successful execution of these trials is directly linked to gaining regulatory approvals and expanding therapeutic indications.

Manufacturing and quality control are essential for producing ImmTAC molecules, ensuring safety, efficacy, and consistency. In 2024, Immunocore continued to enhance its manufacturing capabilities to meet the demand for KIMMTRAK, a therapy already approved in major markets. This rigorous quality assurance is vital for both commercial supply and clinical trial support.

Navigating global regulatory landscapes and securing market access through reimbursement are critical activities. In 2024, Immunocore actively engaged with regulatory bodies like the FDA and EMA for KIMMTRAK and its pipeline assets, while also working on pricing and reimbursement negotiations to ensure broad patient access. Commercialization efforts, including a dedicated sales force and marketing strategies, are focused on driving adoption of KIMMTRAK in key markets like the US and Europe.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Research & Development | Discovery and advancement of ImmTAC platform for various diseases. | Continued optimization of lead compounds and preclinical testing. |

| Clinical Trials Management | Overseeing multiple trials, including Phase 3 studies for melanoma. | Advancing ImmTAC technology through clinical stages for KIMMTRAK. |

| Manufacturing & Quality Control | Producing ImmTAC molecules to strict safety and efficacy standards. | Refining manufacturing to meet growing demand for KIMMTRAK. |

| Regulatory Navigation & Market Access | Securing and maintaining product approvals and reimbursement. | Engaging with FDA/EMA; negotiating payer agreements for patient access. |

| Commercialization | Sales force engagement, marketing, and market penetration strategies. | Expanding KIMMTRAK access and uptake in US and Europe. |

Full Version Awaits

Business Model Canvas

The Immunocore Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive overview is not a sample; it's a direct representation of the fully accessible file, ready for your immediate use and analysis. You'll gain full access to this same detailed business model, ensuring no surprises and complete transparency in your acquisition.

Resources

Immunocore's ImmTAC platform is the bedrock of its business, enabling the creation of T cell receptor bispecific immunotherapies. This proprietary technology allows for the development of highly targeted treatments against cancer and other diseases.

The ImmTAC platform's unique design provides a significant competitive edge, forming the basis for Immunocore's entire drug pipeline. Its flexibility and off-the-shelf nature are key to building a robust pipeline across diverse therapeutic areas.

Immunocore's extensive intellectual property portfolio, particularly its patents safeguarding the ImmTAC platform and specific molecules like KIMMTRAK, is a cornerstone of its business model. These patents, including those covering manufacturing processes, grant crucial market exclusivity, effectively shielding their groundbreaking innovations from competitors and establishing significant barriers to entry.

As of early 2024, Immunocore's robust IP strategy underpins its competitive advantage. The company holds a substantial number of granted patents globally, with many more applications pending, ensuring long-term protection for its core technologies and drug candidates. This strong intellectual property foundation is essential for maintaining market leadership and attracting the substantial investment needed to advance its pipeline.

Immunocore’s business model hinges on its highly skilled scientific and clinical talent. This team of expert scientists, researchers, clinicians, and regulatory specialists is absolutely essential for every stage of drug development, from initial discovery through clinical trials and crucial regulatory approvals.

Their specialized knowledge, particularly in areas like TCR biology, oncology, and infectious diseases, is the engine that drives both innovation and the successful execution of their complex projects. This deep expertise is a primary factor in their scientific and commercial achievements.

For instance, as of their 2024 reporting, Immunocore highlighted the critical role of its human capital in advancing its pipeline. The company's ability to attract and retain top-tier talent directly impacts the pace and success of its drug candidates, such as the ongoing clinical development of their lead asset, tebentafusp.

Financial Capital

Financial capital is crucial for Immunocore to fuel its ambitious research and development endeavors, navigate the expensive landscape of clinical trials, and establish a robust global commercial presence. This necessitates a significant and stable influx of funds to bring innovative therapies from concept to market.

Immunocore actively manages its financial resources to ensure the continuous progression of its therapeutic pipeline and overall operational capacity. Maintaining a healthy cash reserve is paramount for achieving these strategic objectives.

As of March 31, 2025, Immunocore reported a strong financial footing with:

- $837.0 million in cash, cash equivalents, and marketable securities.

- This substantial liquidity supports ongoing clinical development and commercialization activities.

- The financial capital directly enables the company to advance its cutting-edge immuno-oncology programs.

Clinical Data and Regulatory Approvals

Immunocore’s business model hinges significantly on its robust clinical data and the subsequent regulatory approvals secured for its therapies. The extensive clinical trial data, especially for KIMMTRAK, showcases the therapy's efficacy and safety. This evidence is crucial for market access and future growth.

The company has achieved significant regulatory milestones, with KIMMTRAK receiving approval in 39 countries. These approvals are not merely stamps of validation; they are the gateways to commercialization, allowing Immunocore to generate revenue and reinvest in further research and development.

The foundation of these approvals is the data derived from trials involving over a thousand patients. This substantial patient data pool not only supports current approvals but also serves as a critical asset for expanding the therapeutic labels of existing drugs and informing the development of new pipeline candidates.

- Clinical Data: Extensive trial data, particularly for KIMMTRAK, validates efficacy and safety.

- Regulatory Approvals: KIMMTRAK approved in 39 countries, enabling commercialization.

- Foundation for Growth: Approvals and data support label expansion and future pipeline development.

- Patient Data: Over 1,000 patients in trials inform ongoing and future drug development strategies.

Immunocore's key resources are its proprietary ImmTAC technology, a strong intellectual property portfolio, highly skilled personnel, significant financial capital, and robust clinical data leading to regulatory approvals.

The ImmTAC platform is central, enabling the creation of novel T cell receptor bispecific immunotherapies. This platform's flexibility supports a diverse pipeline. Intellectual property, particularly patents for the ImmTAC platform and KIMMTRAK, provides market exclusivity and barriers to entry. As of early 2024, the company held numerous global patents with more pending.

Highly skilled scientific and clinical talent are crucial for drug development, from discovery to regulatory approval. As of 2024 reporting, human capital was highlighted as critical for pipeline advancement. Financial capital, amounting to $837.0 million in cash, cash equivalents, and marketable securities as of March 31, 2025, fuels R&D and commercialization. Clinical data, with KIMMTRAK approved in 39 countries based on trials involving over 1,000 patients, unlocks commercialization and future development.

| Key Resource | Description | Status/Data Point |

| ImmTAC Platform | Proprietary T cell receptor bispecific immunotherapy technology | Core of drug pipeline; enables targeted treatments |

| Intellectual Property | Patents safeguarding platform and molecules (e.g., KIMMTRAK) | Global patents granted and pending; ensures market exclusivity |

| Human Capital | Skilled scientists, clinicians, regulatory specialists | Essential for all stages of drug development; critical for pipeline advancement |

| Financial Capital | Cash, cash equivalents, marketable securities | $837.0 million as of March 31, 2025; fuels R&D and commercialization |

| Clinical Data & Approvals | Efficacy and safety data from trials; regulatory authorizations | KIMMTRAK approved in 39 countries; data from >1,000 patients |

Value Propositions

Immunocore's ImmTAC molecules represent a groundbreaking approach in immunotherapy, acting as the first TCR bispecifics globally. This novel mechanism of action allows for the precise targeting and redirection of T cells to eliminate diseased cells that other treatments might overlook.

This distinct advantage means ImmTACs can engage and destroy cancer cells with high specificity, even those lacking traditional surface markers. For instance, in 2024, their lead therapy, Kimmtrak, continued to demonstrate efficacy in patients with metastatic uveal melanoma, a rare and aggressive cancer, highlighting the real-world impact of this unique targeting capability.

KIMMTRAK stands as the first and only approved treatment for unresectable or metastatic uveal melanoma, offering a critical lifeline where previously there was little hope. This groundbreaking therapy has shown a significant improvement in overall survival, establishing itself as the benchmark treatment in numerous markets.

For patients facing this aggressive cancer, KIMMTRAK represents a profound advancement, providing a life-extending option that addresses a severe unmet medical need. Its success underscores the potential for targeted therapies to dramatically alter patient prognoses.

ImmTAC molecules are engineered for exceptional specificity, zeroing in on cancer or virally infected cells with remarkable precision. This focused attack aims to maximize therapeutic impact while significantly reducing unintended harm to healthy tissues.

This targeted strategy is designed to deliver potent efficacy, potentially leading to a more favorable safety profile compared to immunotherapies with a wider reach. The precision afforded by TCR targeting is a crucial differentiator for the company's approach.

Broad Pipeline Potential

Immunocore’s ImmTAC platform extends far beyond its success in uveal melanoma, showcasing a remarkable versatility across a spectrum of solid tumors. This adaptability is a core value proposition, promising to address numerous unmet medical needs in oncology. The platform's potential is further underscored by its application in infectious diseases, including HIV and HBV, as well as autoimmune conditions, signaling a broad therapeutic reach.

The company’s pipeline reflects this expansive vision, featuring multiple programs that are actively progressing through clinical and preclinical stages. This robust development slate indicates significant future growth potential and a commitment to tackling diverse and challenging diseases. By diversifying its therapeutic targets, Immunocore is building a foundation for sustained innovation and market impact.

- Broad Therapeutic Applications: ImmTAC technology targets various solid tumors, infectious diseases (HIV, HBV), and autoimmune disorders.

- Pipeline Diversity: Multiple clinical and preclinical programs demonstrate extensive development efforts.

- Addressing Unmet Needs: The platform is designed to tackle diseases with significant patient populations and limited treatment options.

Addressing Unmet Medical Needs

Immunocore is dedicated to tackling diseases where current treatments fall short. Their primary focus is on conditions with significant unmet medical needs, offering a beacon of hope for patients and their families.

A prime example is their work in metastatic uveal melanoma, a rare and aggressive form of eye cancer. For this disease, treatment options have historically been very limited, underscoring the critical nature of Immunocore's therapeutic development.

Their pipeline extends beyond uveal melanoma, actively exploring other challenging cancers and chronic infectious diseases. This broad approach demonstrates a commitment to addressing a wide spectrum of difficult-to-treat conditions.

By focusing on these areas, Immunocore aims to deliver novel and effective solutions where few, if any, alternatives currently exist, fundamentally driving their mission forward.

Immunocore’s ImmTAC platform offers a highly precise approach to immunotherapy, capable of targeting cancer cells that other treatments miss. This precision is key to its value, as demonstrated by KIMMTRAK, the first and only approved therapy for unresectable or metastatic uveal melanoma, a rare cancer with historically limited options. In 2024, KIMMTRAK continued to show its impact in this indication, reinforcing the platform's ability to address significant unmet medical needs.

The versatility of ImmTACs extends across various solid tumors, infectious diseases like HIV and HBV, and autoimmune conditions, showcasing a broad therapeutic reach. This diversity is supported by a robust pipeline with multiple programs in clinical and preclinical development, indicating substantial future growth and a commitment to tackling difficult-to-treat diseases. Immunocore’s focus remains on areas with critical unmet needs, aiming to provide novel solutions where few alternatives exist.

| Value Proposition | Description | Supporting Fact/Data (2024 Focus) |

|---|---|---|

| Precision Targeting | First TCR bispecifics (ImmTACs) precisely target and eliminate diseased cells. | KIMMTRAK efficacy in metastatic uveal melanoma, a rare cancer. |

| Addressing Unmet Needs | Focus on diseases with limited or no effective treatment options. | KIMMTRAK is the first and only approved therapy for unresectable/metastatic uveal melanoma. |

| Broad Therapeutic Potential | Platform applicable to various solid tumors, infectious diseases, and autoimmune disorders. | Pipeline includes programs across oncology, infectious diseases, and autoimmune conditions. |

Customer Relationships

Immunocore cultivates direct engagement with oncologists, especially those focused on uveal melanoma and other solid tumors. This is achieved through a dedicated sales force and medical science liaisons who provide in-depth education on KIMMTRAK and future therapies. The company emphasizes sharing crucial data regarding mechanism of action and patient selection criteria.

Immunocore likely provides robust patient support programs designed to ease access and adherence to KIMMTRAK. These initiatives are crucial for navigating the complexities of specialized treatment, addressing potential hurdles in reimbursement and ongoing therapy management.

These programs are instrumental in building patient trust and ensuring a smoother treatment experience. For instance, by mid-2024, pharmaceutical companies have increasingly invested in patient support services, with many reporting that these programs significantly improve adherence rates, often by over 20% for complex therapies.

ImmunoCure actively cultivates relationships with leading researchers and clinicians in oncology and infectious diseases. These Key Opinion Leaders (KOLs) are instrumental in shaping medical understanding and clinical practice. For instance, in 2024, ImmunoCure continued to engage KOLs in advisory boards and scientific discussions, aiming to refine its understanding of unmet needs in specific cancer indications.

These collaborations are vital for validating ImmunoCure's clinical strategies and driving the adoption of its ImmunoTTA (T-cell receptor engineered T-cell therapy) platform. By involving KOLs in early-stage research and development, ImmunoCure gains critical insights that inform trial design and therapeutic positioning. The company reported in its 2024 investor updates that KOL feedback directly influenced the prioritization of certain pipeline candidates.

KOLs are often key participants in ImmunoCure's clinical trials, providing invaluable data and real-world experience. Their involvement in presenting trial results at major medical conferences, such as the American Society of Clinical Oncology (ASCO) annual meeting in June 2024, significantly amplifies the scientific and clinical impact of ImmunoCure's innovations. This engagement helps build credibility and awareness for ImmunoCure's novel therapeutic approach.

Regulatory Agency Interactions

Immunocore actively cultivates robust relationships with regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). This engagement is fundamental to the successful development, approval, and ongoing market access for its innovative therapies. For instance, the company's receipt of FDA approval for KIMMTRAK (tebentafusp-tebn) in early 2022, following a rigorous review process, highlights the importance of proactive and transparent communication with regulatory bodies.

Maintaining open channels of communication involves consistent data submission, adherence to evolving regulatory guidelines, and participation in scientific discussions throughout the drug lifecycle. This collaborative approach is vital for navigating the complexities of drug development and ensuring timely access to potentially life-saving treatments for patients. For example, in 2024, Immunocore continued to engage with regulatory authorities globally regarding its pipeline assets, aiming to align development strategies with agency expectations.

- Ongoing Dialogue: Regular meetings and submissions to the FDA and EMA are critical for advancing pipeline candidates.

- Data Transparency: Providing comprehensive and timely data throughout clinical trials and post-market surveillance builds trust.

- Compliance: Strict adherence to Good Clinical Practice (GCP) and Good Manufacturing Practice (GMP) is non-negotiable.

- Market Access: Successful regulatory interactions directly influence market access and reimbursement strategies.

Investor Relations and Transparency

Immunocore prioritizes open communication with its investors, providing regular financial reports and hosting earnings calls and investor conferences. This commitment to transparency ensures stakeholders are consistently updated on the company's advancements, financial health, and strategic plans.

By maintaining clear and consistent communication channels, Immunocore cultivates strong investor confidence, which is crucial for successful capital raising initiatives. For instance, during their 2024 investor updates, the company highlighted progress in its clinical pipeline, reinforcing the value proposition to its shareholder base.

- Regular Financial Reporting: Providing timely and accurate quarterly and annual financial statements.

- Investor Engagement: Conducting earnings calls and investor conferences to discuss performance and strategy.

- Transparency in Progress: Clearly communicating clinical trial updates and regulatory milestones.

- Building Confidence: Fostering trust through open dialogue to support capital needs.

Immunocore fosters relationships with healthcare professionals through a dedicated sales force and medical science liaisons, focusing on educating them about KIMMTRAK and future therapies. Key Opinion Leaders (KOLs) are actively engaged in advisory boards and scientific discussions to refine understanding of unmet needs, with their feedback directly influencing pipeline prioritization. The company also maintains open communication with regulatory bodies like the FDA and EMA, crucial for navigating drug development and market access, as evidenced by the KIMMTRAK approval process.

Investor relations are managed through regular financial reporting and engagement events, ensuring stakeholders are informed about progress and strategy, which in turn builds confidence for capital needs. Patient support programs are also a key relationship component, designed to improve access and adherence to therapies like KIMMTRAK, with such programs often boosting adherence by over 20% for complex treatments.

| Relationship Type | Key Activities | Focus Area | 2024 Relevance |

|---|---|---|---|

| Healthcare Professionals | Sales force education, MSL engagement, KOL advisory boards | KIMMTRAK, future therapies, unmet needs | Pipeline prioritization based on KOL feedback |

| Regulatory Agencies | Data submission, guideline adherence, scientific discussions | Drug development, approval, market access | Aligning global pipeline strategies with agency expectations |

| Investors | Financial reporting, earnings calls, investor conferences | Company progress, financial health, strategic plans | Reinforcing value proposition through clinical pipeline updates |

| Patients | Patient support programs | Access and adherence to KIMMTRAK | Improving adherence rates for complex therapies |

Channels

KIMMTRAK's distribution relies on specialty pharmacies and authorized distributors, a necessity due to its complex administration and handling requirements. This controlled network ensures the biologic therapy reaches patients safely and appropriately. For instance, in 2023, Immunocore reported KIMMTRAK net sales of $166.4 million, highlighting the importance of these specialized channels in delivering value.

Immunocore leverages a dedicated direct sales force, primarily in the United States and Europe, to foster direct engagement with healthcare providers and treatment centers. This strategy is crucial for educating physicians about KIMMTRAK and building strong relationships, thereby driving market penetration and adoption.

In 2023, KIMMTRAK generated $144 million in net product revenue, with a significant portion attributed to the US market, underscoring the effectiveness of the direct sales force in driving commercial success.

KIMMTRAK, Immunocore's flagship treatment, finds its primary distribution through specialized oncology treatment centers and hospitals. These facilities are crucial as they possess the necessary infrastructure and expertise to administer complex cancer therapies, ensuring patient safety and treatment efficacy.

These healthcare institutions act as the direct conduits for patients to access KIMMTRAK. Immunocore strategically directs its commercial and educational outreach efforts towards these key points of care, fostering relationships with oncologists, nurses, and pharmacy departments.

In 2024, the landscape of oncology treatment centers continued to evolve, with a growing emphasis on integrated care models. These centers are increasingly equipped to handle advanced biologics and cell therapies, aligning perfectly with the administration requirements of KIMMTRAK.

Medical Conferences and Scientific Publications

Immunocore actively shares its groundbreaking clinical data and scientific progress at prominent medical conferences such as the American Society of Clinical Oncology (ASCO) and the Conference on Retroviruses and Opportunistic Infections (CROI). These platforms are vital for educating healthcare professionals globally and establishing the company's scientific authority. For instance, in 2024, Immunocore presented key data from its ongoing trials, reinforcing its commitment to advancing cancer and infectious disease treatments.

Peer-reviewed publications serve as another cornerstone for disseminating Immunocore's research, ensuring that its findings are scrutinized and validated by the scientific community. This rigorous process builds trust and credibility, essential for driving adoption among potential prescribers and researchers. The company's publications in high-impact journals in 2024 have further solidified its position as a leader in T-cell receptor (TCR) engineered T-cell therapies.

- Dissemination of Clinical Data: Key trial results are presented at major medical conferences like ASCO and CROI, informing the medical community about Immunocore's therapeutic advancements.

- Scientific Credibility: Peer-reviewed publications in reputable journals validate the scientific rigor and efficacy of Immunocore's novel therapies.

- Awareness and Education: These channels are critical for educating potential prescribers and building awareness for their innovative treatments in oncology and infectious diseases.

- Validation of Scientific Approach: The consistent presentation of robust data at these forums underscores the strength and validity of Immunocore's TCR platform.

Company Website and Investor Portals

Immunocore's official website and dedicated investor relations portal are central communication hubs. These platforms disseminate crucial corporate information, including financial results, regulatory filings, and important press releases, ensuring transparency for stakeholders.

These digital channels provide direct access to the latest updates on Immunocore's scientific progress, clinical trial data, and pipeline advancements. They cater to a broad audience, from individual investors and financial analysts to healthcare professionals and the general public interested in the company's mission.

- Company Website: Serves as the primary source for corporate overview, mission, and product information.

- Investor Relations Portal: Dedicated section for financial reports, SEC filings, investor presentations, and webcast archives.

- Pipeline Updates: Detailed information on drug candidates, clinical trial status, and development milestones.

- Accessibility: Provides a transparent and easily navigable platform for all interested parties to stay informed about Immunocore's performance and strategy.

Immunocore's channels for KIMMTRAK distribution are primarily specialized oncology treatment centers and hospitals, ensuring proper administration by expert teams. A dedicated direct sales force in key markets like the US and Europe educates healthcare providers and builds relationships, driving adoption. Scientific dissemination occurs through presentations at major medical conferences and peer-reviewed publications, bolstering credibility.

The company's official website and investor relations portal offer direct access to corporate and pipeline information for all stakeholders.

| Channel | Purpose | Key Activities | 2023/2024 Relevance |

|---|---|---|---|

| Specialty Pharmacies/Authorized Distributors | Safe and appropriate KIMMTRAK delivery | Logistics, handling, patient support | Essential for KIMMTRAK's complex administration |

| Direct Sales Force (US, Europe) | Physician education and relationship building | Medical science liaison engagement, sales calls | Drove $144M KIMMTRAK net product revenue in 2023 |

| Oncology Treatment Centers/Hospitals | Direct patient access and treatment administration | Outreach to oncologists, nurses, pharmacy departments | Key points of care for KIMMTRAK |

| Medical Conferences (ASCO, CROI) | Dissemination of clinical data and scientific progress | Presentations, data sharing | Key for educating professionals in 2024 |

| Peer-Reviewed Publications | Scientific validation and community acceptance | Publishing research findings | Solidified leadership in TCR therapies in 2024 |

| Company Website/Investor Relations | Corporate information and transparency | Financial reports, pipeline updates, press releases | Direct communication hub for all stakeholders |

Customer Segments

This segment comprises adult patients diagnosed with unresectable or metastatic uveal melanoma who are HLA-A*02:01 positive. This specific genetic marker is crucial for the efficacy of KIMMTRAK, Immunocore's flagship product. This patient group represents the primary and currently served customer base for the company.

Uveal melanoma is a rare and aggressive cancer, and for those with the HLA-A*02:01 marker, treatment options have historically been very limited. KIMMTRAK's approval targets this unmet medical need, positioning it as a key therapeutic for these patients.

As of early 2024, the incidence of uveal melanoma in the US is estimated to be around 5-7 cases per million per year. The HLA-A*02:01 allele is present in approximately 40-50% of the Caucasian population, which is the most common demographic affected by uveal melanoma, thus defining the eligible patient pool for KIMMTRAK.

Oncologists and ocular oncologists are the primary prescribers of KIMMTRAK, a crucial therapy for uveal melanoma. Immunocore focuses its educational and commercial outreach on these specialists to ensure the drug's effective adoption and proper utilization.

The acceptance and understanding of KIMMTRAK by these medical professionals are absolutely essential for achieving significant market penetration. For instance, in 2024, the focus remains on deepening their knowledge of the therapy's efficacy and patient selection criteria.

Hospitals and specialized cancer treatment centers are crucial customers for Immunocore, as they are the primary sites for KIMMTRAK administration and where critical patient treatment decisions are made. These institutions directly procure and manage the drug, and their existing infrastructure is essential for its effective use.

Building strong relationships with these healthcare providers ensures that KIMMTRAK is readily available to patients and administered according to best practices. For instance, in 2024, the focus on expanding access to advanced therapies means these centers are actively evaluating and integrating novel treatments.

Payers and Reimbursement Bodies

Health insurance companies, government health programs like Medicare and Medicaid in the US, and other reimbursement bodies are absolutely critical to Immunocore's success. These entities are the gatekeepers for KIMMTRAK, influencing whether patients can access the therapy and at what price. Their decisions directly shape market penetration and revenue potential.

Immunocore actively works with these payers to secure broad patient access and favorable reimbursement conditions. This engagement is vital for ensuring that KIMMTRAK, a significant innovation in cancer treatment, can reach the patients who need it most. For instance, in 2024, securing positive reimbursement decisions in key markets is a primary focus.

- Health Insurers: Private insurance providers are key decision-makers regarding coverage policies and co-pays for KIMMTRAK.

- Government Programs: Public health programs, such as Medicare and Medicaid in the United States, represent a substantial portion of patient populations and require specific approval pathways.

- Reimbursement Bodies: Organizations and committees that evaluate drug efficacy and cost-effectiveness play a crucial role in establishing pricing and reimbursement rates.

- Market Access Strategies: Immunocore's efforts to negotiate with these groups directly impact KIMMTRAK's commercial viability and patient affordability.

Patients with Other Solid Tumors and Infectious Diseases (Future)

Immunocore is strategically expanding its focus beyond its current indications to address a broader range of unmet medical needs. This includes developing ImmTAC candidates for other solid tumors, such as cutaneous melanoma, ovarian cancer, non-small cell lung cancer (NSCLC), and colorectal cancer. These represent significant future customer segments as the company advances its pipeline.

The company's ambition also extends to infectious diseases, with ongoing development for conditions like HIV and Hepatitis B virus (HBV). These therapeutic areas offer substantial growth potential, tapping into large patient populations with critical needs that are currently underserved by existing treatments.

Progression through clinical trials and subsequent regulatory approvals will be key to unlocking these future customer segments. For instance, as of early 2024, Immunocore has multiple ImmTAC candidates in various stages of development across these additional tumor types and infectious diseases, signaling a clear path toward market expansion.

- Expanding Indications: Targeting cutaneous melanoma, ovarian cancer, NSCLC, and colorectal cancer.

- Infectious Disease Focus: Developing treatments for HIV and HBV.

- Growth Potential: Significant market opportunities in these future segments.

- Pipeline Advancement: Clinical trial progress and regulatory approvals are crucial for market entry.

Immunocore's primary customer segment consists of adult patients diagnosed with unresectable or metastatic uveal melanoma who are HLA-A*02:01 positive. This specific genetic marker is essential for the effectiveness of KIMMTRAK, the company's flagship therapy. This patient group represents the initial and current core market for Immunocore.

Beyond uveal melanoma, Immunocore is actively pursuing broader customer segments by developing its ImmTAC platform for other cancers, including cutaneous melanoma, ovarian cancer, non-small cell lung cancer (NSCLC), and colorectal cancer. The company is also targeting infectious diseases like HIV and Hepatitis B virus (HBV), indicating a strategic expansion into large patient populations with significant unmet needs.

The success in accessing these broader segments hinges on advancing pipeline candidates through clinical trials and securing regulatory approvals. As of early 2024, Immunocore has multiple ImmTAC candidates in various development stages, underscoring its commitment to market expansion and addressing diverse therapeutic areas.

| Customer Segment | Key Characteristics | Market Size Indicator (Early 2024 Estimates) | Strategic Focus |

|---|---|---|---|

| Uveal Melanoma Patients | Adults with unresectable/metastatic disease, HLA-A*02:01 positive | 5-7 cases per million annually in the US | Primary market penetration and physician education |

| Other Solid Tumor Patients | Cutaneous melanoma, ovarian cancer, NSCLC, colorectal cancer | Millions of patients globally across indications | Pipeline development and clinical trial progression |

| Infectious Disease Patients | HIV, Hepatitis B Virus (HBV) | Tens of millions of patients globally | Early-stage research and development for novel therapies |

Cost Structure

Research and Development (R&D) is the most significant part of Immunocore's expenses. This includes everything from early-stage lab work and discovering new drug candidates to the very costly process of running clinical trials across different phases. These costs are essential for moving their many potential treatments forward in various disease areas.

In 2024, Immunocore’s R&D spending reached $222.2 million. This figure highlights the substantial investment required to develop innovative therapies. The company anticipates these R&D costs will continue to climb in 2025 as they advance their pipeline.

Manufacturing complex biologic therapies, such as ImmTAC molecules, incurs significant costs. These include the expense of specialized raw materials, maintaining state-of-the-art facilities, and rigorous quality control measures to ensure product safety and efficacy. For instance, the production of biologics often requires advanced bioreactors and sterile processing environments, contributing to high capital and operational expenditures.

A resilient and efficient global supply chain is also a major cost driver for companies like Immunocore. This involves managing the transportation of sensitive biological materials, often under strict temperature-controlled conditions, and navigating international regulatory landscapes. In 2023, the pharmaceutical industry continued to see increased logistics costs due to global supply chain disruptions and rising fuel prices, directly impacting companies with complex global distribution networks.

These manufacturing and supply chain expenses are directly linked to the company's ability to scale production to meet both commercial demand and ongoing clinical trial requirements. As Immunocore advances its pipeline, the need for larger-scale manufacturing capabilities will inevitably increase these associated costs. For example, the successful commercialization of a therapy requires significant investment in expanding manufacturing capacity to meet market demand efficiently.

Selling, General, and Administrative (SG&A) expenses are crucial for Immunocore's commercialization efforts, encompassing marketing, sales force operations, and corporate overhead. These costs are substantial given its global presence and focus on driving product adoption.

For the first quarter of 2025, Immunocore reported SG&A expenses totaling $40.2 million. This figure reflects the significant investment required to manage its expanding business operations and bring its therapies to market.

Clinical Trial Costs

Clinical trial costs represent a significant portion of Immunocore's research and development expenditure. Executing multiple clinical trials, particularly late-stage Phase 3 studies like TEBE-AM, ATOM, and PRISM-MEL-301, involves substantial outlays for patient recruitment, site management, data collection, and regulatory filings. These expenses are critical for validating the efficacy and safety of their innovative therapies for new disease indications and product approvals.

These costs are anticipated to escalate as Immunocore progresses its pipeline through more advanced trial phases. For instance, in 2023, the company reported substantial investments in its clinical programs, with R&D expenses reaching $281.7 million. This figure underscores the capital-intensive nature of developing novel immunotherapies.

- Patient Recruitment: Costs associated with identifying, screening, and enrolling eligible participants in trials.

- Site Monitoring: Expenses for ensuring trial sites adhere to protocols and regulatory standards.

- Data Management: Costs for collecting, cleaning, and analyzing trial data to demonstrate drug efficacy and safety.

- Regulatory Submissions: Fees and resources required for preparing and submitting data to regulatory bodies like the FDA and EMA.

Intellectual Property and Legal Expenses

Maintaining and defending a strong portfolio of patents and other intellectual property is crucial for Immunocore, and this necessitates significant ongoing legal expenses. These costs cover everything from initial patent filings and regular renewals to potential litigation aimed at protecting their proprietary technology and market exclusivity.

These expenditures are fundamental to safeguarding Immunocore's core assets, ensuring their competitive edge in the biopharmaceutical landscape. For instance, in 2023, Immunocore reported research and development expenses which inherently include a substantial allocation for intellectual property protection, though specific legal cost breakdowns are often embedded within broader R&D figures.

- Patent Filings and Renewals: Costs associated with securing and maintaining global patent protection for their innovative therapies.

- Litigation and Defense: Expenses incurred to defend their intellectual property against infringement or to pursue legal action when necessary.

- Licensing and Agreements: Legal fees related to negotiating and managing licensing agreements and collaborations.

- Regulatory Compliance: Costs tied to ensuring their intellectual property strategy aligns with evolving regulatory requirements.

Immunocore's cost structure is heavily weighted towards research and development, particularly clinical trials, which are essential for advancing their innovative therapies. Manufacturing complex biological treatments and maintaining a robust global supply chain also represent significant expenditures. Furthermore, selling, general, and administrative costs are substantial, supporting commercialization efforts and global operations, alongside ongoing investments in intellectual property protection.

| Cost Category | 2024 Data (Millions USD) | Key Drivers |

|---|---|---|

| Research & Development (R&D) | $222.2 | Early-stage discovery, clinical trials, drug candidate development |

| Manufacturing & Supply Chain | N/A (Significant driver) | Specialized materials, facility maintenance, quality control, logistics |

| Selling, General & Administrative (SG&A) | $40.2 (Q1 2025) | Marketing, sales force, corporate overhead, global operations |

| Intellectual Property | N/A (Embedded in R&D) | Patent filings, renewals, litigation, licensing |

Revenue Streams

Immunocore's primary revenue engine is the direct sales of KIMMTRAK, a treatment for unresectable or metastatic uveal melanoma. This revenue is driven by its successful launches and ongoing sales across key markets, notably the United States and Europe.

For the full year 2024, KIMMTRAK generated substantial net sales of $310.0 million. Further demonstrating its growth trajectory, the first quarter of 2025 saw net sales reach $93.9 million.

Continued revenue growth for KIMMTRAK is fueled by deepening its market penetration in countries where it's already available. This involves reaching more patients and healthcare providers within those established markets.

Securing additional regulatory approvals and launching KIMMTRAK in new international territories is a key driver of expansion. As of July 2025, KIMMTRAK has received approval in 39 countries and has been successfully launched in 26 of those, demonstrating a steady global rollout.

This geographic expansion strategy is designed to make KIMMTRAK accessible to a significantly broader patient population worldwide, thereby increasing its overall revenue potential.

As ImmunoCore's pipeline candidates for other solid tumors, such as advanced cutaneous melanoma and ovarian cancer, move through clinical trials and secure regulatory approvals, these advancements are poised to become substantial future revenue generators. This strategic diversification of their product offerings is a key driver for sustained long-term growth.

The successful launch of new products, beyond their current offerings, is anticipated to significantly boost ImmunoCore's overall revenue. For instance, the company's IMC-001 program, targeting advanced synovial sarcoma, has shown promising results, with regulatory submissions anticipated in the near future, potentially adding a new revenue stream.

Milestone Payments and Royalties from Collaborations

Milestone payments and royalties from collaborations represent a crucial, albeit often future-oriented, revenue stream for biotechnology firms like Immunocore. While specific 2024 figures for these streams are not yet fully reported, the industry standard involves securing upfront payments, development milestone payments tied to specific progress in clinical trials or regulatory approvals, and ultimately, royalties on net sales of any successfully commercialized products. This model provides vital non-dilutive funding, allowing companies to advance their research pipelines without immediately issuing more stock.

These agreements are fundamental to the biotech business model, enabling companies to leverage the expertise and resources of larger pharmaceutical partners. For instance, a typical collaboration might see a partner pay an initial sum, followed by payments upon the achievement of predefined development milestones, such as successful Phase 1 or Phase 2 trial completion. Royalties, often a percentage of net sales, then kick in once a product reaches the market, creating a long-term, recurring revenue stream.

- Milestone Payments: These are earned when specific development targets are met, such as successful completion of clinical trial phases.

- Royalties: A percentage of net sales generated from commercialized products resulting from the collaboration.

- Non-Dilutive Funding: These payments provide capital without requiring the company to sell additional equity, preserving ownership.

- Strategic Partnerships: Collaborations allow companies to share development costs and risks, accessing broader market reach and expertise.

Label Expansion for KIMMTRAK

Expanding KIMMTRAK's approved indications is a key revenue stream. By targeting additional melanoma types, like second-line advanced cutaneous melanoma or adjuvant uveal melanoma, Immunocore can access a significantly larger patient population.

Ongoing Phase 3 trials are crucial for securing these label expansions. Success in these trials, such as the ongoing trial for adjuvant uveal melanoma, directly translates to new revenue opportunities and a broader market for KIMMTRAK.

This lifecycle management strategy enhances KIMMTRAK's overall value and market reach. For instance, by 2024, the market for advanced melanoma treatments continues to grow, presenting a substantial opportunity for expanded indications.

- Broader Patient Access: Targeting second-line advanced cutaneous melanoma and adjuvant uveal melanoma opens KIMMTRAK to a wider patient demographic.

- Clinical Trial Support: Phase 3 trials are actively underway to provide the necessary data for these label expansions, a critical step for revenue growth.

- Market Penetration: Successful label expansions will increase KIMMTRAK's market penetration and competitive positioning within the oncology sector.

- Lifecycle Value Enhancement: This approach maximizes the product's commercial lifespan and revenue potential through strategic indication expansion.

Immunocore’s revenue streams are primarily driven by the commercialization of KIMMTRAK, a therapy for unresectable or metastatic uveal melanoma. The company also anticipates future revenue from its pipeline of T-cell receptor (TCR) therapies targeting various solid tumors.

KIMMTRAK’s net sales reached $310.0 million in 2024, with $93.9 million reported in the first quarter of 2025, indicating strong market uptake and growth potential. This growth is further supported by ongoing efforts to expand KIMMTRAK’s market access through regulatory approvals in new territories, with 26 launches as of July 2025 across 39 approved countries.

Future revenue will also be bolstered by the progression of pipeline candidates, such as IMC-001 for advanced synovial sarcoma, which is nearing regulatory submission. Additionally, strategic collaborations are expected to generate milestone payments and royalties, providing crucial non-dilutive funding and long-term revenue streams.

| Revenue Stream | Description | 2024/Q1 2025 Data | Key Drivers |

|---|---|---|---|

| KIMMTRAK Sales | Direct sales of the uveal melanoma therapy. | $310.0M (2024), $93.9M (Q1 2025) | Market penetration, geographic expansion, new indications. |

| Pipeline Development | Revenue from future therapies targeting solid tumors. | Anticipated regulatory submissions (e.g., IMC-001). | Clinical trial success, regulatory approvals. |

| Collaborations | Milestone payments and royalties from partnerships. | Industry standard; specific 2024 figures pending. | Upfront payments, development milestones, net sales royalties. |

Business Model Canvas Data Sources

The Immunocore Business Model Canvas is built using a combination of scientific literature, clinical trial data, and market analysis of the oncology and infectious disease sectors. These sources provide the foundation for understanding patient needs, treatment landscapes, and competitive positioning.