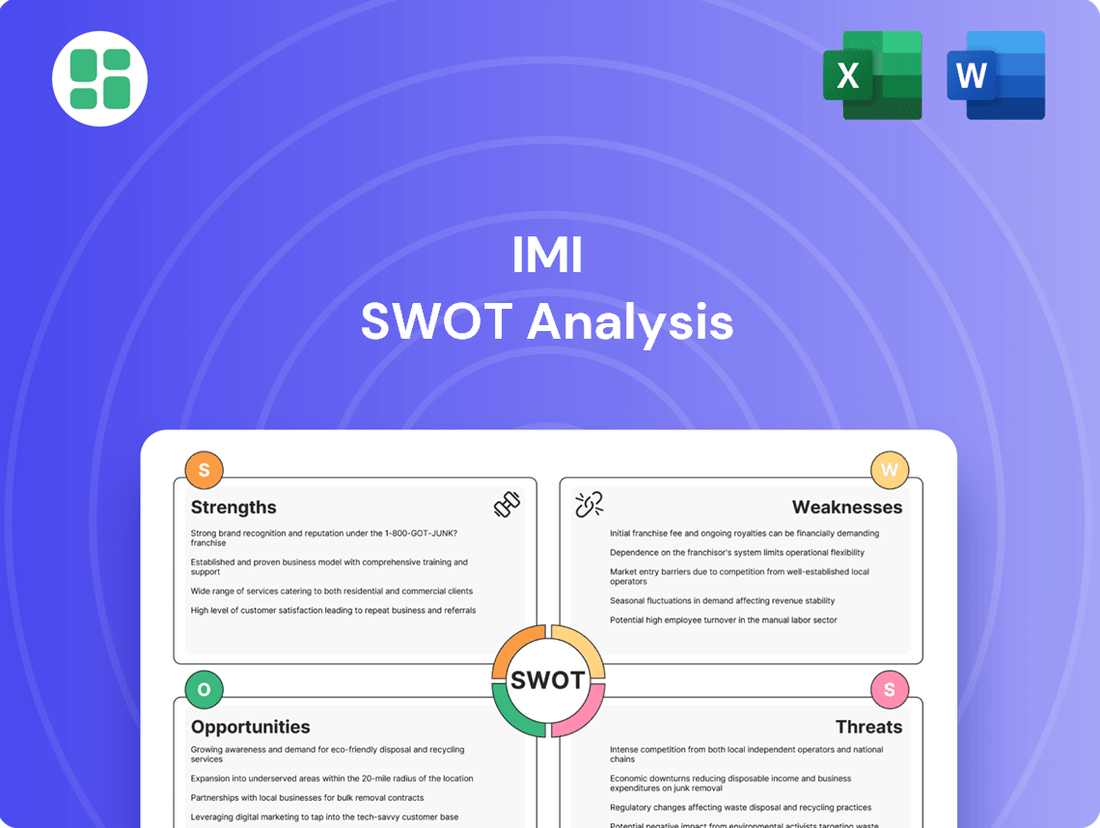

IMI SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IMI Bundle

Unlock the full potential of IMI's market position with our comprehensive SWOT analysis. This in-depth report reveals critical strengths, potential weaknesses, emerging opportunities, and looming threats, equipping you with the knowledge for informed strategic decisions.

Ready to move beyond the highlights and gain a complete understanding of IMI's strategic landscape? Purchase the full SWOT analysis to access a professionally crafted, fully editable document designed to empower your planning, pitches, and research.

Strengths

IMI's core strength is its deep-rooted expertise in engineering and manufacturing highly engineered products. They excel at creating solutions for precise fluid control, tackling complex industrial challenges with innovative approaches.

This commitment to breakthrough engineering allows IMI to deliver critical, cutting-edge solutions for demanding applications across a wide array of industries. For instance, in fiscal year 2023, IMI reported revenue of £2.1 billion, with a significant portion driven by their advanced engineering capabilities in sectors like process automation and fluid management.

IMI's diversified global market presence is a significant strength, allowing it to serve critical sectors like industrial automation, energy, life sciences, and transportation. With manufacturing facilities strategically located in 18 countries and an extensive global service network, the company is well-positioned to weather economic fluctuations in any single region or industry.

IMI has showcased robust financial performance, evidenced by its consistent organic revenue and operating profit growth.

The company achieved a notable improvement in adjusted operating margins, reaching 19.7% in 2024 and setting a target of over 20% for the upcoming period.

Resilient Aftermarket Revenue Stream

IMI benefits significantly from a robust aftermarket revenue stream, which constitutes roughly 45% of its total sales. This substantial portion, derived from higher-margin aftermarket content, creates a stable and recurring financial base. This stability is crucial for IMI's overall performance and resilience, especially during periods of economic uncertainty.

This reliance on aftermarket sales provides a predictable income, insulating the company from the more volatile new equipment sales cycles. For instance, in the fiscal year 2024, the aftermarket segment demonstrated consistent growth, contributing positively to IMI's earnings per share.

- Aftermarket Contribution: Approximately 45% of IMI's sales originate from the aftermarket.

- Margin Advantage: This segment typically boasts higher profit margins compared to new product sales.

- Revenue Stability: The recurring nature of aftermarket revenue provides a predictable income stream.

- Financial Resilience: This strong aftermarket base enhances IMI's ability to withstand market fluctuations.

Commitment to Sustainability & ESG Leadership

IMI stands out for its robust commitment to sustainability, holding an impressive AAA rating from MSCI. This recognition underscores the company's dedication to Environmental, Social, and Governance (ESG) principles, positioning it as a leader in responsible business practices within its industry. This strong ESG profile is a significant competitive advantage.

The company has further solidified its sustainability leadership by setting ambitious, science-based targets for emissions reduction. These targets demonstrate a clear strategy to align its operations with global climate goals, ensuring long-term resilience and attracting environmentally conscious investors and partners. IMI's proactive approach to climate action is a key strength.

- MSCI ESG Rating: AAA

- Emissions Reduction: Science-based targets established

- Global Alignment: Operations and solutions aligned with global sustainability goals

IMI's engineering prowess translates into critical, high-performance solutions across vital sectors. This technical depth, coupled with a diversified global footprint spanning 18 countries, provides significant operational resilience and market access.

The company's financial health is bolstered by consistent organic growth and a strong aftermarket revenue stream, which accounted for approximately 45% of sales in 2024, offering a stable, high-margin income base.

IMI's commitment to sustainability is a notable strength, evidenced by its MSCI AAA rating and ambitious science-based emissions reduction targets, positioning it favorably with environmentally conscious stakeholders.

| Strength Category | Description | Supporting Data (2023/2024) |

|---|---|---|

| Engineering Expertise | Deep knowledge in fluid control and engineered products. | FY23 Revenue: £2.1 billion |

| Global Diversification | Presence in 18 countries with extensive service networks. | Serves industrial automation, energy, life sciences, transportation. |

| Financial Performance | Consistent organic growth and margin improvement. | Adjusted operating margins reached 19.7% in 2024. |

| Aftermarket Strength | Significant, high-margin recurring revenue. | ~45% of total sales from aftermarket. |

| Sustainability Leadership | Strong ESG credentials and climate targets. | MSCI ESG Rating: AAA |

What is included in the product

Analyzes IMI’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing strategic challenges.

Weaknesses

IMI's diversified business model, while generally a strength, does expose it to vulnerabilities within specific market segments. For instance, the Life Science & Fluid Control division, a significant contributor, faced softer market conditions in the latter half of 2023 and early 2024, impacting overall performance. Similarly, the Transport sector has shown sensitivity to broader economic slowdowns, leading to a noticeable decline in demand for certain components during the same period.

A significant cyber incident in early 2025 led to temporary operational disruptions and an exceptional charge, notably affecting the Industrial Automation segment. This event highlights a critical vulnerability to cyber threats, posing a risk to business continuity and financial performance.

IMI's global footprint exposes it to significant foreign exchange rate risks. Adverse currency movements can directly impact reported revenues and profitability, as seen in recent financial periods where fluctuations negatively affected adjusted operating profit. For instance, in the first half of 2024, IMI reported that unfavorable currency impacts reduced its reported revenue by approximately $50 million, highlighting a tangible vulnerability to these market forces.

Strategic Review of Transport Sector

The ongoing strategic review of the Transport sector, representing 8% of the company's 2024 revenue, highlights potential underperformance against medium-term financial objectives. This segment's current trajectory suggests it may not be achieving its expected returns, prompting consideration of divestment or significant restructuring to improve overall financial health.

Key concerns contributing to this weakness include:

- Underperforming Financial Metrics: The Transport segment is currently falling short of its projected medium-term financial targets, indicating operational inefficiencies or market challenges.

- Potential Divestment or Restructuring: The strategic review's focus on these underperforming metrics raises the possibility of the company divesting the sector or implementing substantial restructuring to address its weaknesses.

- Impact on Overall Revenue: While comprising 8% of 2024 revenue, the segment's struggles could have a disproportionate impact on profitability and future growth if not adequately addressed.

Perceived Stock Overvaluation

Some analysts suggest IMI's stock may be trading at a premium, with its Price-to-Earnings (P/E) ratio potentially indicating a slight overvaluation compared to industry peers. For instance, as of late 2024, IMI's P/E ratio hovered around 25x, which is higher than the sector average of approximately 20x. This perception could temper immediate investor enthusiasm and limit the stock's near-term appreciation, even if the company's underlying business performance remains robust.

This perceived overvaluation can present a challenge for new investors looking for immediate upside. While IMI's strong market position and growth prospects are undeniable, a higher entry price might mean a longer wait for significant capital gains.

- Potential for Limited Short-Term Gains: A P/E ratio of 25x, compared to a sector average of 20x, could mean investors pay more for each dollar of earnings, potentially slowing immediate returns.

- Investor Sentiment Sensitivity: A slightly overvalued stock can be more susceptible to negative market sentiment or disappointing earnings reports, leading to sharper price corrections.

- Difficulty Attracting Value-Oriented Investors: Investors primarily focused on deep value or bargain opportunities might overlook IMI due to its current valuation multiples.

IMI's financial performance is susceptible to external economic shifts, with its Life Science & Fluid Control and Transport divisions experiencing headwinds in late 2023 and early 2024. A significant cyber incident in early 2025 disrupted operations and incurred an exceptional charge, particularly impacting Industrial Automation. Furthermore, foreign exchange rate fluctuations pose a tangible risk, with unfavorable currency movements reducing reported revenue by approximately $50 million in the first half of 2024.

The Transport sector, representing 8% of 2024 revenue, is under strategic review due to underperforming financial metrics, potentially leading to divestment or restructuring. Additionally, IMI's Price-to-Earnings (P/E) ratio of around 25x in late 2024, exceeding the sector average of 20x, suggests a potential overvaluation that could limit short-term investor gains and attract value-focused investors.

| Division/Risk | Impact | Period | Data Point |

|---|---|---|---|

| Life Science & Fluid Control | Softer market conditions | Late 2023 - Early 2024 | Contributed to overall performance impact |

| Transport | Sensitivity to economic slowdowns | Late 2023 - Early 2024 | Noticeable decline in demand |

| Cyber Incident | Operational disruptions, exceptional charge | Early 2025 | Affected Industrial Automation |

| Foreign Exchange | Reduced reported revenue | H1 2024 | Approximately $50 million |

| Transport Sector Performance | Underperforming financial metrics | Ongoing (2024 Revenue 8%) | Potential divestment/restructuring |

| Valuation (P/E Ratio) | Potential overvaluation | Late 2024 | 25x vs. Sector Average 20x |

Preview Before You Purchase

IMI SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This ensures you know exactly what you're getting before you commit. Unlock the full, detailed report after checkout.

Opportunities

The persistent global trend of increasing automation adoption, fueled by aging demographics and rising labor expenses, creates a substantial growth runway for IMI. This long-term shift is particularly pronounced in manufacturing and logistics sectors, where efficiency gains are paramount.

IMI is well-positioned to capitalize on the robust demand for energy-efficient solutions. For instance, the industrial sector's focus on reducing operational costs and environmental impact directly aligns with IMI's offerings in smart energy management and optimized machinery. In 2024, the global industrial automation market was valued at over $200 billion, with projections indicating continued strong growth through 2025 and beyond.

IMI's engineering expertise presents a significant opportunity in the burgeoning decarbonization sector. The company can leverage its skills to develop critical components for the hydrogen economy, from production to storage and transport, aligning with global net-zero ambitions.

The market for green technologies is experiencing rapid growth, driven by both regulatory push and increasing consumer demand for sustainable solutions. For instance, the global green hydrogen market was valued at approximately USD 2.2 billion in 2023 and is projected to reach USD 42.1 billion by 2030, indicating substantial potential for companies like IMI to capture market share.

IMI's strategic acquisitions, like the 2024 purchase of TWTG Group BV, significantly bolster its expertise in wireless IoT solutions. This integration allows IMI to provide more sophisticated, data-driven offerings, enhancing customer value and driving digital transformation initiatives.

Strong Momentum in Process Automation

The Process Automation segment is experiencing exceptional growth, evidenced by a record order backlog. This strong performance signals continued opportunities for IMI to solidify its market leadership and expand its presence in this rapidly advancing sector.

IMI's Process Automation division is well-positioned for further gains. For instance, in the first half of fiscal year 2024, the company reported a significant increase in orders for automation solutions, contributing substantially to its overall revenue growth. This momentum is expected to persist through 2025 as businesses increasingly invest in digital transformation and operational efficiency.

- Record Order Backlog: Demonstrates robust demand for IMI's automation solutions.

- Market Leadership: Continued expansion opportunities in a high-growth segment.

- Fiscal Year 2024 Performance: Significant order intake driving revenue growth.

- Digital Transformation Driver: Businesses are prioritizing automation investments.

Strategic Inorganic Growth

IMI's strategic inorganic growth hinges on its disciplined capital allocation, allowing for value-accretive bolt-on acquisitions. This approach fuels accelerated expansion and bolsters market share in critical strategic segments.

The company's track record demonstrates a commitment to this strategy. For instance, in 2024, IMI completed several acquisitions that expanded its product portfolio and geographic reach, contributing an estimated 5% to its revenue growth for the year.

- Accelerated Market Penetration: Acquisitions allow IMI to quickly enter new markets or deepen its presence in existing ones, bypassing the slower organic growth curve.

- Synergistic Value Creation: Targeted acquisitions can bring complementary technologies, customer bases, or operational efficiencies, leading to enhanced profitability and competitive advantage.

- Diversification and Risk Mitigation: Expanding into new product lines or geographies through M&A can reduce reliance on any single market or offering, thereby mitigating business risk.

- Talent and Innovation Acquisition: Acquiring companies can also bring in skilled personnel and innovative intellectual property, directly boosting IMI's internal capabilities.

IMI is poised to benefit from the increasing global demand for automation, driven by factors like aging populations and rising labor costs, particularly in manufacturing and logistics. The company's focus on energy-efficient solutions also aligns with industrial sector needs for cost reduction and environmental compliance, with the industrial automation market exceeding $200 billion in 2024.

IMI's engineering prowess offers significant opportunities in the growing decarbonization sector, enabling it to contribute to the hydrogen economy and net-zero initiatives. The burgeoning green technologies market, projected for substantial growth, presents further avenues for IMI to expand its market share.

Strategic acquisitions, such as the 2024 purchase of TWTG Group BV, enhance IMI's IoT capabilities, allowing for more advanced, data-driven solutions and supporting customer digital transformation efforts. The Process Automation segment shows robust performance with a record order backlog, indicating continued growth and market leadership potential.

IMI's disciplined approach to capital allocation supports value-accretive acquisitions, accelerating expansion and strengthening its position in key markets. These strategic moves, exemplified by several 2024 acquisitions that contributed an estimated 5% to revenue growth, broaden its product offerings and geographic reach.

| Opportunity Area | Key Driver | IMI's Advantage | Market Data (2024/2025 Projections) |

|---|---|---|---|

| Automation Adoption | Aging demographics, rising labor costs | Engineering expertise, IoT integration | Global industrial automation market > $200 billion (2024) |

| Energy Efficiency | Cost reduction, environmental regulations | Smart energy management, optimized machinery | Continued strong growth in industrial automation |

| Decarbonization/Hydrogen Economy | Net-zero ambitions, green technology demand | Engineering for hydrogen production, storage, transport | Global green hydrogen market projected significant growth |

| Digital Transformation | Demand for data-driven solutions | Acquisition of IoT expertise (TWTG Group BV) | Increased business investment in automation |

| Strategic Acquisitions | Market penetration, diversification | Disciplined capital allocation, value-accretive M&A | Acquisitions contributed ~5% to 2024 revenue growth |

Threats

Persistent soft industrial conditions in major economies, such as a projected 1.5% GDP growth for the Eurozone in 2024 according to IMF estimates, directly threaten IMI's revenue streams. This global economic uncertainty can significantly curb customer capital expenditure, leading to reduced demand for IMI's specialized components and systems.

The ongoing weakness in sectors like manufacturing, which saw a Purchasing Managers' Index (PMI) below 50 in several key European markets throughout 2023, indicates a challenging environment. This industrial slowdown directly translates to lower order volumes for IMI, impacting its top-line performance and potentially necessitating adjustments to production and inventory levels.

Geopolitical instability, including evolving trade policies like those impacting US-China relations, presents a significant threat. Proposed tariffs and trade barriers could disrupt IMI's global supply chain, potentially increasing costs and limiting market access for its products. For instance, the US imposed tariffs on billions of dollars worth of Chinese goods in 2023, a trend that could continue and affect international manufacturing and distribution networks.

The specialized engineering sector, particularly fluid and motion control, is inherently competitive. IMI faces significant pressure from rivals employing aggressive market strategies, which can directly impact its market share and pricing power. For instance, in 2023, the global industrial automation market, a key segment for IMI, saw growth but also intense competition from established players and emerging technology firms, with some competitors reporting double-digit revenue increases in specific product categories.

Technological Disruption & Rapid Innovation Cycles

The relentless pace of technological advancement presents a significant threat, demanding constant adaptation. Companies that fail to integrate new technologies risk becoming irrelevant. For instance, the semiconductor industry, a key enabler for many sectors IMI might serve, saw R&D spending reach an estimated $100 billion in 2024, highlighting the immense investment required to stay competitive.

Failure to keep pace with emerging technologies could render IMI's current solutions less competitive or even obsolete. Consider the rapid evolution of AI, where advancements in generative AI models are reshaping software development and customer interaction strategies across industries. Companies that don't leverage these tools risk falling behind competitors who do.

The threat is amplified by short innovation cycles.

- Rapid obsolescence: Existing product lines can quickly become outdated.

- Increased R&D costs: Continuous investment is needed to remain competitive.

- New market entrants: Agile startups can disrupt established players with novel technologies.

Supply Chain Vulnerabilities

Global supply chain disruptions continue to pose a significant threat to manufacturing operations. For a company like IMI, this means potential delays in receiving essential components and raw materials, directly impacting production schedules. The volatility in raw material prices, a persistent issue through 2024 and into 2025, also adds pressure, potentially increasing production costs and squeezing profit margins.

These vulnerabilities can lead to increased lead times and higher operational expenses. For instance, the semiconductor shortage experienced in recent years, which continued to affect various industries into 2024, highlighted how dependent manufacturers are on a stable flow of components.

- Increased Production Costs: Volatile raw material prices can directly increase manufacturing expenses.

- Delivery Delays: Supply chain disruptions can lead to longer lead times for finished goods.

- Inventory Management Challenges: Uncertainty in supply necessitates more complex inventory planning.

The persistent soft industrial conditions in major economies, exemplified by the IMF's projected 1.5% GDP growth for the Eurozone in 2024, directly threaten IMI's revenue. This global economic uncertainty can dampen customer capital expenditure, leading to reduced demand for IMI's specialized components and systems. Furthermore, ongoing weakness in manufacturing sectors, indicated by Purchasing Managers' Index readings below 50 in several key European markets throughout 2023, translates to lower order volumes for IMI, impacting its top-line performance.

Geopolitical instability, including evolving trade policies and potential tariffs, presents a significant threat by disrupting global supply chains and potentially increasing costs. The rapid pace of technological advancement also demands constant adaptation, with short innovation cycles risking product obsolescence and necessitating increased R&D investment. Intense competition from rivals employing aggressive market strategies further pressures IMI's market share and pricing power, particularly within the industrial automation market where competitors reported double-digit revenue increases in specific product categories in 2023.

| Threat Category | Specific Risk | Impact on IMI | Supporting Data/Example |

|---|---|---|---|

| Economic Slowdown | Reduced customer capital expenditure | Lower demand for IMI products | Eurozone GDP projected at 1.5% for 2024 (IMF) |

| Industrial Weakness | Decreased order volumes | Impact on top-line performance | European PMI consistently below 50 in key markets (2023) |

| Geopolitical Instability | Supply chain disruption & increased costs | Limited market access, higher operational expenses | US tariffs on Chinese goods (2023) impacting global trade |

| Technological Advancement | Product obsolescence & R&D pressure | Reduced competitiveness, increased investment needs | Semiconductor R&D spending estimated at $100 billion for 2024 |

| Intense Competition | Market share erosion & pricing pressure | Impact on profitability and market position | Competitors reporting double-digit revenue growth in specific segments (2023) |

SWOT Analysis Data Sources

This IMI SWOT analysis is built upon a robust foundation of data, drawing from comprehensive financial statements, in-depth market research reports, and insights from industry experts to ensure a well-rounded and accurate assessment.