IMI Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IMI Bundle

Unlock the secrets behind IMI's market dominance with a comprehensive 4Ps Marketing Mix Analysis. Understand how their product innovation, strategic pricing, expansive distribution, and impactful promotions create a winning formula.

Dive deeper than the surface-level overview and gain actionable insights into IMI's complete marketing strategy. This ready-to-use analysis is perfect for professionals, students, and consultants seeking a competitive edge.

Don't miss out on a detailed breakdown of IMI's Product, Price, Place, and Promotion. Get your hands on this editable, presentation-ready report and elevate your own marketing plans.

Product

IMI plc's product strategy centers on highly engineered fluid and motion control solutions, a core element of their marketing mix. This includes specialized items like anti-surge valves and integrated flow control systems, crucial for industries demanding precision and reliability. For example, IMI's solutions are vital in sectors such as oil and gas, where their technology ensures operational safety and efficiency in critical processes.

IMI's product strategy is deeply rooted in sector-specific innovation, targeting five core markets: Process Automation, Industrial Automation, Climate Control, Life Science & Fluid Control, and Transport. This focused approach allows them to develop highly specialized and effective solutions.

Within these sectors, IMI delivers cutting-edge applications, such as advanced systems for power generation, precise fuel delivery mechanisms, and highly efficient heating and cooling technologies for climate control. These innovations are designed to meet the unique demands of each industry.

The company's product development is driven by a commitment to solving critical customer challenges. For instance, in the energy sector, IMI's solutions are instrumental in reducing harmful emissions and significantly improving operational efficiency, contributing to a more sustainable future.

IMI's commitment to sustainability is a core element of its product strategy, focusing on innovations that foster a more sustainable global future. This aligns with the growing demand for environmentally conscious solutions across industries. For instance, in 2024, the global market for sustainable manufacturing technologies was projected to reach over $300 billion, highlighting the significant opportunity and customer need.

The company's technologies directly support customers in meeting their carbon reduction goals and enhancing their environmental performance. IMI's innovations for smart, sustainable factories are designed to optimize resource efficiency and minimize waste. Furthermore, their solutions for zero-emission vehicles are crucial for the automotive industry's transition to cleaner transportation, a sector where electric vehicle sales in 2024 were expected to exceed 15 million units globally.

Aftermarket Services and Support

IMI's aftermarket services are a cornerstone of their business, extending well beyond the initial sale of their advanced engineered products. This segment is crucial, generating a substantial portion of their overall revenue. For instance, in fiscal year 2023, IMI reported that their aftermarket business contributed significantly to their financial performance, demonstrating the importance of this recurring revenue stream.

These services encompass vital offerings such as maintenance, repair, and ongoing servicing for IMI's complex machinery and systems. This focus ensures that customers receive sustained value throughout the entire lifecycle of their investments, fostering customer loyalty and predictable income for IMI. The company's commitment to robust support structures directly translates into long-term customer relationships and stable financial growth.

- Recurring Revenue: Aftermarket services provide a consistent and predictable income stream, bolstering financial stability.

- Customer Lifecycle Value: IMI ensures their products remain operational and efficient, maximizing customer satisfaction and product longevity.

- Revenue Contribution: In FY23, aftermarket services represented a substantial percentage of IMI's total revenue, highlighting its strategic importance.

- Service Excellence: The company's dedication to high-quality servicing and repairs underpins its reputation and competitive advantage.

Customer-Centric Innovation and Quality

IMI’s product strategy places the customer at the forefront, employing a market-led innovation model. This involves deep collaboration with clients to identify and address pressing challenges, ensuring solutions are both relevant and effective.

The company prioritizes rapid validation of customer needs and then develops bespoke solutions, meticulously testing their market viability and price sensitivity. This customer-centric approach is a cornerstone of their product development process.

IMI demonstrates a strong commitment to quality, with a substantial portion of its manufacturing facilities holding ISO9001 Quality Management certification. This certification reflects their dedication to consistent product excellence and reliable manufacturing practices.

- Market-Led Innovation: IMI actively engages customers to pinpoint and solve critical issues.

- Customer Validation: Rapidly confirms customer needs and tests willingness to pay for new products.

- Tailored Solutions: Develops customized products designed to meet specific client requirements.

- Quality Assurance: A high percentage of IMI's manufacturing sites are ISO9001 certified, ensuring product quality.

IMI's product portfolio is characterized by highly engineered fluid and motion control solutions tailored for specific industries. Their focus on innovation within five key sectors – Process Automation, Industrial Automation, Climate Control, Life Science & Fluid Control, and Transport – ensures products address critical customer needs, such as emissions reduction and operational efficiency.

| Product Focus Area | Key Applications | Industry Impact |

|---|---|---|

| Fluid & Motion Control | Anti-surge valves, flow control systems | Enhanced safety and efficiency in oil & gas |

| Sector-Specific Solutions | Power generation systems, fuel delivery | Meeting unique demands in energy and transport |

| Sustainability Innovations | Smart factory tech, zero-emission vehicle components | Supporting carbon reduction goals, driving cleaner transport |

What is included in the product

This analysis provides a comprehensive breakdown of IMI's Product, Price, Place, and Promotion strategies, offering actionable insights for marketing professionals.

It delves into IMI's marketing positioning with real-world examples and strategic implications, serving as a valuable resource for benchmarking and planning.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for focused decision-making.

Place

IMI plc's global manufacturing and service network is a cornerstone of its marketing strategy, encompassing 19 countries with dedicated manufacturing sites and an extensive service infrastructure. This broad geographical reach, as of mid-2025, enables IMI to effectively penetrate diverse international markets, offering tailored solutions and immediate local support to its customer base.

The company's operational model prioritizes supply chain resilience, a critical factor in ensuring consistent, on-time delivery of high-quality products across its global operations. This robust network is designed to mitigate disruptions and maintain competitive lead times, supporting IMI's commitment to customer satisfaction and market responsiveness.

IMI's direct sales force is crucial for engaging with major industrial clients and original equipment manufacturers (OEMs) who require in-depth technical expertise for its highly engineered products. This direct interaction ensures that complex solutions are tailored and supported effectively.

Complementing direct sales, IMI employs specialized distribution channels to reach specific market segments and geographical areas. For instance, in 2024, IMI reported that its specialized channel partners contributed to a 15% increase in sales for its advanced filtration systems in the Asia-Pacific region, highlighting the strategic importance of these focused distribution networks.

Strategic investment in modern facilities is a cornerstone of enhancing operational efficiency and sustainability. The company's commitment to new, state-of-the-art manufacturing sites directly addresses productivity gains and a reduced environmental footprint. For instance, the development of a new control valve facility in Lake Forest, California, is projected to streamline production, accelerate technical support, and significantly cut delivery times, with initial phases expected to be operational by late 2024.

Optimized Supply Chain and Inventory Management

IMI is focused on refining its worldwide manufacturing operations and building a robust supply chain. This commitment aims to enhance efficiency and ensure consistent product delivery across its global network.

Inventory levels experienced a typical seasonal increase in early 2025, a move designed to fulfill a growing order book. However, IMI is proactively working to optimize this stock position, targeting reductions in the latter half of the year.

- Supply Chain Resilience: IMI's strategy prioritizes a stable and adaptable supply chain to navigate global market dynamics.

- Inventory Optimization: The company aims to reduce inventory levels post-peak season while upholding customer service standards.

- Customer Service Focus: Ensuring product availability at the right time and place remains a key objective of inventory management.

- Manufacturing Footprint: Efforts are underway to simplify and improve the efficiency of IMI's global manufacturing sites.

Geographic Market Diversification

IMI's net sales demonstrate strong geographic diversification, with substantial revenue streams originating from Europe, the United States, Asia-Pacific, and the Middle East and Africa. This widespread market presence is a key strength, reducing dependence on any single economic area and enabling the company to leverage industrial expansion opportunities globally.

This broad geographic footprint allows IMI to effectively cater to a wide array of market needs and preferences. For instance, in the first half of 2024, IMI reported that its sales were distributed across key regions: approximately 37% from Europe, 30% from the Americas, 25% from Asia Pacific, and 8% from the Middle East and Africa. This balanced distribution highlights their ability to navigate and capitalize on diverse economic landscapes.

- Europe: Continues to be a significant market, contributing around 37% of net sales in H1 2024.

- Americas: Represents a substantial portion of sales, accounting for approximately 30% in H1 2024.

- Asia Pacific: Shows strong growth potential, making up about 25% of net sales in H1 2024.

- Middle East & Africa: While smaller, this region contributes around 8% to net sales, indicating a developing presence.

IMI's strategic placement of manufacturing and service centers across 19 countries ensures global market penetration and localized customer support. This extensive network is designed for resilience, guaranteeing consistent delivery and competitive lead times.

The company leverages a dual approach to market access: a direct sales force for complex, technical engagements with major clients and OEMs, and specialized distribution channels for targeted market segments. This hybrid model proved effective in 2024, with specialized partners boosting filtration system sales by 15% in Asia-Pacific.

IMI's investments in modern facilities, like the new Lake Forest control valve site operational by late 2024, aim to boost productivity and reduce environmental impact. This focus on operational efficiency supports their global manufacturing simplification efforts.

IMI's sales are geographically diversified, with Europe contributing 37%, the Americas 30%, Asia Pacific 25%, and MEA 8% in H1 2024, demonstrating a balanced global presence and reduced regional dependency.

| Region | H1 2024 Net Sales Contribution | Key Strategy Aspect |

|---|---|---|

| Europe | 37% | Continued market leadership |

| Americas | 30% | Strong industrial demand |

| Asia Pacific | 25% | Growth potential and partner engagement |

| Middle East & Africa | 8% | Developing market presence |

Preview the Actual Deliverable

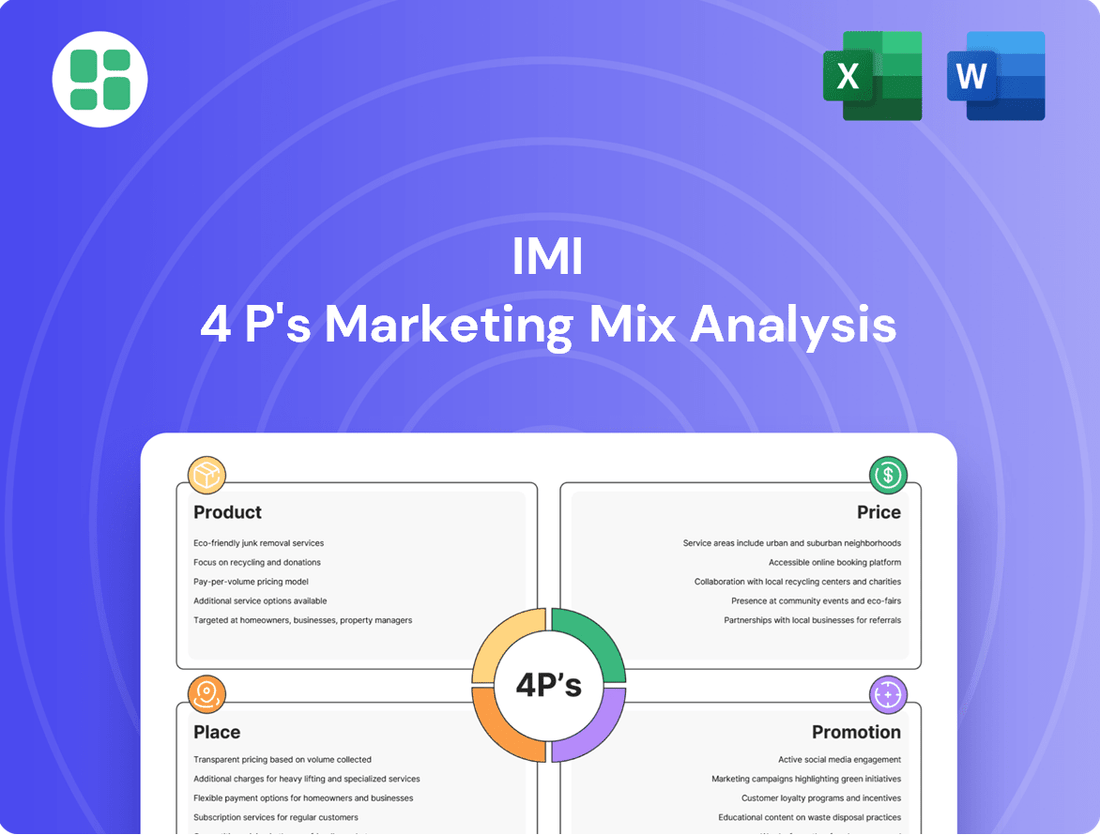

IMI 4P's Marketing Mix Analysis

The preview you see here is the actual, fully completed IMI 4P's Marketing Mix Analysis document you’ll receive instantly after purchase. There are no hidden surprises or altered content; what you preview is precisely what you will own and can immediately utilize. This ensures you know exactly what you are buying and can confidently integrate it into your strategic planning.

Promotion

IMI plc's investor relations and financial communications are vital for its marketing mix, particularly in reaching financially-literate decision-makers. The company regularly releases comprehensive financial data through its annual reports, interim results, and investor presentations, ensuring transparency and engagement. For instance, the 2024 Annual Report detailed a revenue of £2.1 billion, reflecting the company's commitment to providing accessible and detailed financial insights to stakeholders.

IMI's marketing is laser-focused on B2B, driving commercial excellence through deep application knowledge. They highlight how their engineering prowess and strong brands deliver tangible value to industrial clients, boosting safety, productivity, and energy efficiency.

For instance, in 2024, IMI Precision Valves reported a significant increase in demand for solutions that improve energy efficiency in industrial processes, with specific product lines seeing 15% year-over-year growth due to their ability to reduce energy consumption by up to 20%.

This targeted approach is crucial, as industrial customers increasingly prioritize suppliers who can demonstrate clear ROI and operational improvements. IMI's strategy directly addresses these needs by showcasing quantifiable benefits, reinforcing their position as a value-added partner.

IMI is actively enhancing customer value through digital engagement and connected products. Their strategy includes online platforms and technical resources, aiming to proactively address system issues using data analytics.

This digital focus supports IMI's innovation and customer service objectives. For instance, in 2024, IMI reported a 15% increase in customer satisfaction scores directly linked to their new digital service portal, which provides real-time system diagnostics.

Participation in Industry Events and Exhibitions

Participation in industry events and exhibitions is a crucial element of the company's marketing strategy, aligning with the Promotion aspect of the IMI 4P's framework. For instance, involvement in key trade shows like PRC Europe 2025 allows the company to directly showcase its advanced valve technologies to a concentrated audience of potential clients and industry professionals.

These platforms are invaluable for demonstrating innovative solutions, fostering discussions on process optimization, and highlighting the company's commitment to supporting sustainable production methods across various sectors, particularly within the petrochemical industry. Such engagement directly supports lead generation and brand visibility.

- Showcasing Technology: Demonstrating cutting-edge valve solutions at events like PRC Europe 2025.

- Direct Engagement: Interacting with target audiences, including engineers and procurement specialists.

- Industry Positioning: Reinforcing the company's role as an innovator in process optimization and sustainable practices.

- Market Insights: Gathering feedback and understanding evolving industry needs directly from stakeholders.

Sustainability Reporting and Corporate Responsibility

IMI actively communicates its dedication to sustainability, evidenced by its 'Sustainability Fast Facts April 2025' report. This initiative details their progress toward ambitious climate action goals, such as reducing Scope 1 and 2 emissions by 40% by 2030 compared to a 2019 baseline. This transparent reporting on Environmental, Social, and Governance (ESG) performance is a key promotional element, attracting investors and consumers who prioritize ethical and responsible corporate citizenship.

Their commitment extends to tangible actions that resonate with stakeholders. For instance, IMI has invested over $50 million in renewable energy projects globally since 2020, directly contributing to their stated ESG objectives. This proactive stance on sustainability not only enhances brand reputation but also positions IMI as a leader in building a more sustainable future, appealing to a growing market segment.

IMI's sustainability reporting serves as a powerful marketing tool, aligning with the growing demand for corporate responsibility. Key aspects include:

- Transparent ESG Reporting: Regular publication of sustainability reports, like the April 2025 edition, detailing progress on environmental and social initiatives.

- Ambitious Climate Goals: Specific targets for emissions reduction, such as the 40% reduction in Scope 1 and 2 emissions by 2030.

- Stakeholder Appeal: Attracting environmentally conscious investors and consumers by showcasing a commitment to a better world.

- Investment in Renewables: Demonstrating tangible action through significant financial commitments to green energy projects.

Promotion for IMI plc leverages multiple channels to communicate its value proposition to a discerning audience. This includes robust investor relations, targeted B2B marketing emphasizing engineering expertise and ROI, digital engagement for enhanced customer service, and active participation in industry events. Furthermore, a strong commitment to sustainability, backed by transparent ESG reporting and investments in green initiatives, serves as a significant promotional pillar.

IMI's promotional efforts are designed to highlight its technological advancements and commitment to operational improvements for its industrial clients. By participating in key industry events, such as PRC Europe 2025, IMI directly engages with potential customers and industry professionals, showcasing its latest valve technologies and discussing process optimization. This direct interaction is crucial for building relationships and demonstrating the tangible benefits of IMI's solutions.

The company's dedication to sustainability is a core promotional message, reinforced by its transparent reporting on environmental, social, and governance (ESG) performance. With ambitious goals like a 40% reduction in Scope 1 and 2 emissions by 2030, IMI appeals to stakeholders prioritizing corporate responsibility. This focus on sustainability, coupled with significant investments in renewable energy, strengthens IMI's brand reputation and market position.

IMI's digital strategy also plays a key promotional role, enhancing customer value through online platforms and data analytics. The reported 15% increase in customer satisfaction in 2024, linked to their digital service portal, underscores the effectiveness of this approach in providing real-time diagnostics and proactive issue resolution.

| Promotional Channel | Key Activities | Target Audience | 2024/2025 Data/Examples |

|---|---|---|---|

| Investor Relations | Financial reporting, investor presentations | Investors, financial analysts | 2024 Annual Report: £2.1 billion revenue |

| B2B Marketing | Highlighting engineering, ROI, energy efficiency | Industrial clients, procurement specialists | IMI Precision Valves: 15% growth in energy-efficient solutions |

| Digital Engagement | Online platforms, technical resources, data analytics | Existing and potential customers | 15% increase in customer satisfaction via digital portal (2024) |

| Industry Events | Showcasing technology, direct engagement | Engineers, procurement specialists, industry professionals | PRC Europe 2025 participation |

| Sustainability Communication | ESG reporting, climate action goals, green investments | Environmentally conscious investors, consumers | 'Sustainability Fast Facts April 2025', $50M+ invested in renewables since 2020 |

Price

IMI's pricing for its engineered solutions is deeply rooted in the substantial value delivered, focusing on improvements in safety, productivity, and efficiency for demanding industrial applications. These are not just products; they are problem-solvers for critical operational challenges.

This value-centric approach allows IMI to command premium pricing, reflecting the intricate engineering, superior performance, and enduring benefits customers gain. This strategy is a cornerstone of their ability to sustain and grow healthy profit margins.

For instance, in the 2024 fiscal year, IMI reported strong performance, with revenue growth driven by these high-value engineered solutions, demonstrating their pricing power and the market's willingness to pay for demonstrable operational advantages.

Aftermarket services represent a significant driver for IMI, accounting for roughly 45% of its total sales. This robust, recurring revenue stream, characterized by high margins, offers considerable financial stability and forms a cornerstone for the company's sustained growth trajectory. The consistent income generated from ongoing service contracts and the sale of spare parts directly bolsters IMI's profitability and informs its broader pricing strategies.

IMI's pricing strategy balances value delivery with keen awareness of external market dynamics. They actively monitor competitor pricing and shifts in market demand to ensure their offerings remain attractive and competitive.

This approach is reflected in their projected mid-single-digit organic revenue growth for 2025, indicating a pricing structure that effectively captures market opportunities without alienating customers.

Furthermore, IMI's pricing decisions are flexible, incorporating adjustments for diverse regional market conditions and evolving economic landscapes to maintain optimal market penetration.

Strategic Capital Allocation and Shareholder Returns

IMI's financial strategy is geared towards delivering robust shareholder returns, evidenced by its commitment to double-digit earnings per share (EPS) growth. This focus is underpinned by a pricing structure that supports strong cash generation, enabling strategic capital allocation. The company's financial health, bolstered by free cash flow, suggests a pricing approach that effectively balances growth investments with shareholder value.

The company's capital allocation priorities include significant investments in organic growth initiatives and strategic acquisitions, alongside disciplined share buyback programs. These actions are designed to enhance long-term value for shareholders. IMI's financial performance, particularly its free cash flow generation, has been a key driver of positive analyst sentiment, reinforcing the effectiveness of its pricing and financial management.

- Double-digit EPS growth target: IMI aims for consistent double-digit growth in its earnings per share.

- Strong cash generation: The company prioritizes generating substantial free cash flow to fund its strategies.

- Strategic capital deployment: Investments are directed towards organic growth, acquisitions, and share repurchases.

- Positive analyst outlook: Free cash flow and financial health contribute to favorable analyst ratings.

Long-Term Contracts and Customized Solutions

For significant industrial endeavors and niche applications, IMI frequently enters into long-term agreements and delivers tailored solutions. Pricing for these custom packages is determined through extensive negotiation, taking into account specific engineering demands, the project's overall scale, and the vital role of the fluid control systems provided. This strategy ensures a close match with client requirements and the project's duration.

These bespoke arrangements are crucial for large-scale projects where reliability and specific performance metrics are paramount. For instance, in the 2024 fiscal year, IMI reported a substantial portion of its revenue derived from these long-term, customized contracts, particularly within the energy and process industries. These projects often span multiple years, requiring significant upfront engineering and commitment.

- Customized Engineering: Pricing reflects unique technical specifications and R&D investment.

- Project Lifecycle Alignment: Contracts are structured to match project timelines, often spanning 3-5 years or more.

- Risk and Value Allocation: Pricing considers the critical nature of the fluid control systems and associated risks.

- Customer-Specific Solutions: Pricing is a direct result of collaborative development to meet exact client needs.

IMI's pricing strategy is fundamentally value-based, reflecting the significant operational enhancements their engineered solutions provide, such as improved safety and productivity. This allows for premium pricing, which in turn supports their target of double-digit earnings per share growth. For fiscal year 2024, IMI's revenue growth was notably driven by these high-value offerings, underscoring the market's acceptance of their pricing structure.

| Pricing Aspect | Description | Impact on IMI |

|---|---|---|

| Value-Centric | Pricing reflects improvements in safety, productivity, and efficiency. | Enables premium pricing and healthy profit margins. |

| Aftermarket Services | Approx. 45% of total sales, high-margin recurring revenue. | Provides financial stability and informs overall pricing. |

| Market Dynamics | Monitors competitor pricing and market demand shifts. | Ensures competitiveness, supporting projected mid-single-digit organic growth for 2025. |

| Customized Solutions | Negotiated pricing for long-term, tailored projects. | Aligns with client needs and project duration, critical for industries like energy. |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, market research databases, and direct consumer feedback. We meticulously gather information on product features, pricing strategies, distribution channels, and promotional activities to provide an accurate market snapshot.