Imagica Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Imagica Group Bundle

Imagica Group's SWOT analysis reveals a compelling blend of unique entertainment experiences and potential market expansion, balanced against operational challenges and evolving consumer preferences. Understanding these dynamics is crucial for anyone looking to invest, partner, or compete in the amusement and theme park sector.

Want to truly grasp Imagica Group's competitive edge and navigate its potential pitfalls? Purchase the complete SWOT analysis to unlock a detailed roadmap, actionable strategies, and expert insights essential for informed decision-making.

Strengths

Imagica Group boasts a remarkably diverse and comprehensive portfolio of visual solutions. This includes everything from intricate post-production work and efficient media asset management to full-scale content production for film, television, and digital platforms. The company also excels in advanced visual effects (VFX) and computer-generated imagery (CGI), offering a complete suite of services for the entertainment sector.

This extensive specialization translates into a robust and diversified revenue stream for Imagica Group. By not being tied to a single service, the company mitigates risks inherent in the often-volatile entertainment industry, ensuring greater financial stability and resilience in its operations.

Imagica Group's strength lies in its deep roots within the Japanese entertainment sector, demonstrated by its involvement in critically acclaimed projects like the Oscar-winning film 'Godzilla Minus One.' This domestic market leadership provides a robust foundation of recurring business and brand recognition.

The group's consistent participation in high-profile productions, including popular TV animation series, solidifies its reputation and ensures a steady flow of demand for its specialized visual effects and post-production services. This strong domestic engagement acts as a significant competitive advantage.

Imagica Group has strategically bolstered its capabilities by acquiring appci corporation in late 2024. This acquisition significantly enhances Imagica's game development services, a move that directly addresses the booming interactive entertainment market. By integrating appci, Imagica is now better positioned to offer comprehensive, end-to-end solutions within the gaming sector, diversifying its revenue streams and capitalizing on industry growth.

Expertise in Advanced Production Technologies

Imagica Group's strength lies in its profound expertise in advanced production technologies, particularly in high-demand areas such as Visual Effects (VFX), Computer-Generated Imagery (CGI), and 3D Computer Graphics (3DCG) for the gaming sector. This specialization is a significant competitive advantage, allowing them to cater to the increasing need for sophisticated visual content.

The company's technological proficiency is further underscored by strong order books in these specialized segments, indicating a robust demand for their services. For instance, the global VFX market was projected to reach approximately $63.3 billion by 2027, growing at a CAGR of over 10%, highlighting the lucrative nature of Imagica's core competencies. Their ability to deliver cutting-edge visual content ensures they remain competitive in an industry where visual fidelity is a key differentiator.

- Deep expertise in VFX, CGI, and 3DCG production for the gaming industry.

- Strong order pipeline in high-demand visual technology segments.

- Ability to deliver cutting-edge visual content, crucial for industry competitiveness.

Commitment to Media Education and Talent Development

Imagica Group's commitment to media education and talent development is a significant strength, acting as a vital pipeline for future industry professionals. This focus on nurturing talent ensures a continuous supply of skilled individuals, crucial for maintaining high standards in the specialized visual solutions sector.

This investment in human capital directly supports long-term innovation and service quality. For instance, Imagica's media education initiatives can cultivate a workforce adept at the latest visual effects technologies, a critical differentiator in a rapidly evolving market.

- Pipeline for Talent: Imagica's educational programs directly feed into its operational needs, creating a sustainable talent pool.

- Innovation Driver: Developing new talent fosters an environment ripe for innovation in visual effects and production techniques.

- Quality Assurance: A well-trained workforce is fundamental to delivering superior quality services, enhancing client satisfaction and project success rates.

Imagica Group's strength is its comprehensive visual solutions portfolio, spanning post-production, media asset management, content production, and advanced VFX/CGI for film, TV, and digital platforms. This diversification ensures robust revenue streams and resilience against industry volatility.

The company demonstrates deep expertise in high-demand areas like VFX, CGI, and 3DCG for gaming, evidenced by strong order books. The global VFX market's projected growth to $63.3 billion by 2027 underscores the lucrative nature of these specialized competencies.

Imagica's strategic acquisition of appci corporation in late 2024 significantly bolsters its game development services, capitalizing on the booming interactive entertainment market and diversifying revenue.

Furthermore, Imagica's commitment to media education cultivates a vital talent pipeline, ensuring a continuous supply of skilled professionals essential for innovation and maintaining high service quality in the visual solutions sector.

What is included in the product

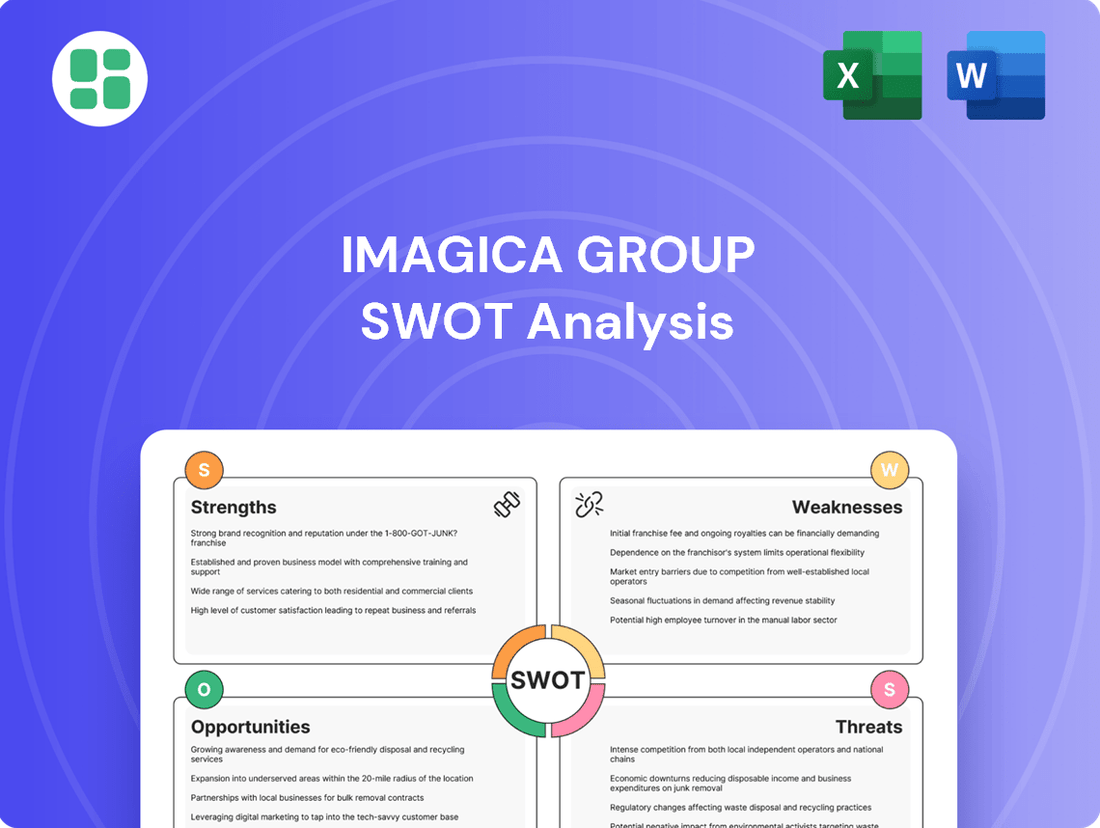

Delivers a strategic overview of Imagica Group’s internal and external business factors, highlighting its strengths in entertainment offerings and brand recognition, while also identifying weaknesses in financial performance and opportunities in expansion and diversification, alongside threats from competition and economic downturns.

Offers a clear, actionable framework to identify and address Imagica Group's core challenges, transforming potential weaknesses into strategic advantages.

Weaknesses

Imagica Group experienced a notable downturn in its consolidated financial performance for the fiscal year ending March 31, 2025. The company reported a net loss, alongside a reduction in both net sales and operating income.

While revenues surpassed market expectations, the earnings per share (EPS) significantly lagged behind projections. This performance highlights underlying issues in translating top-line growth into bottom-line profitability, even amidst robust demand in specific market areas.

Imagica Group's reliance on overseas markets, especially for its localization services, exposes it to significant risks from external industry disruptions. The 2023 Hollywood writers' and actors' strikes, for instance, directly impacted the company's international revenue streams, forcing workforce adjustments and highlighting the vulnerability of its business model to events beyond its control.

Imagica Group's international ventures have faced considerable headwinds, leading to a substantial operating loss. This financial strain prompted workforce reductions in June and October 2024, underscoring the persistent challenges in generating consistent profits and effectively scaling its business across foreign markets.

Dependence on Major Project Cycles for Revenue Stability

Imagica Group's revenue stability is significantly tied to the timing of major project releases. The absence of a blockbuster film, such as the impact felt from not having a major feature like 'Godzilla Minus One' in fiscal year 2024, directly affected revenue forecasts. This dependence on large, often sporadic projects creates inherent volatility in sales performance.

This reliance on episodic major projects means revenue can fluctuate considerably year-over-year.

- Revenue Volatility: Sales are subject to significant swings based on the presence or absence of major new film or entertainment projects.

- FY2024 Impact: The lack of a major film release in FY2024, unlike in previous periods, led to a downward revision of revenue expectations.

- Project Cycle Dependence: The business model is structured around the success and timing of large-scale, capital-intensive projects rather than consistent, recurring revenue streams.

High Capital Expenditure and Intense Competition in Core Markets

The post-production and VFX sectors, core to Imagica Group's operations, require substantial and ongoing capital investment in advanced technology to stay ahead. This continuous need for upgrades, such as high-performance rendering farms and sophisticated software, represents a significant financial commitment.

Imagica faces formidable competition within these markets. The landscape is populated by established post-production houses and nimble, emerging startups, all vying for market share. This intense rivalry puts downward pressure on pricing and demands a relentless pace of innovation to maintain profitability and attract clients.

- High Capital Expenditure: Significant ongoing investment is needed for cutting-edge technology in post-production and VFX.

- Intense Competition: Numerous established players and agile startups challenge market share and profit margins.

- Pressure on Margins: Fierce competition necessitates competitive pricing, impacting overall profitability.

- Need for Constant Innovation: Staying relevant requires continuous development of new techniques and service offerings.

Imagica Group's financial performance in the fiscal year ending March 31, 2025, was marked by a net loss and a decline in both sales and operating income, despite revenues exceeding expectations. This indicates a struggle to convert revenue into profit, a key weakness.

The company's reliance on overseas markets, particularly for localization services, makes it susceptible to external disruptions, as demonstrated by the impact of the 2023 Hollywood strikes on international revenue. This vulnerability was further highlighted by a significant operating loss from international ventures, leading to workforce reductions in June and October 2024.

Imagica's revenue stream is heavily dependent on the timing of major project releases, creating inherent volatility. The absence of a blockbuster film in fiscal year 2024, unlike in prior periods, led to a downward revision of revenue expectations, underscoring a weakness in its project-cycle dependent business model.

The post-production and VFX sectors demand continuous, substantial capital investment in advanced technology to remain competitive, posing a financial challenge. Furthermore, the company faces intense competition from both established players and agile startups, which pressures pricing and necessitates constant innovation to maintain profitability.

| Weakness Category | Specific Issue | Impact/Evidence | Financial Year |

| Profitability | Net loss and reduced operating income | FY2025 reported net loss, down from prior year | FY2025 |

| Revenue Generation | Dependence on major project releases | Lack of blockbuster in FY2024 impacted revenue forecasts | FY2024 |

| International Operations | Vulnerability to external disruptions and operating losses | Hollywood strikes impacted international revenue; operating loss led to layoffs | FY2023-FY2024 |

| Capital & Competition | High capital expenditure & intense competition | Need for constant tech upgrades; pricing pressure from rivals | Ongoing |

Preview the Actual Deliverable

Imagica Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual SWOT analysis for Imagica Group, detailing its strengths, weaknesses, opportunities, and threats.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain a comprehensive understanding of Imagica Group's strategic position.

Opportunities

The global streaming market is booming, with projections indicating continued strong growth through 2025 and beyond. This surge in demand for digital content, from blockbuster films to binge-worthy series, directly translates into a greater need for Imagica Group's core competencies in content creation, post-production, and visual effects. For instance, the global video streaming market size was valued at USD 232.20 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 14.2% from 2024 to 2030, according to Grand View Research. This presents a substantial opportunity for Imagica to capitalize on this expanding market by offering its specialized services to a wider range of content producers.

The integration of AI in content creation presents a significant opportunity for Imagica Group. Emerging technologies like AI-powered editing and generative AI are revolutionizing post-production and VFX. For instance, generative AI tools can accelerate asset creation and ideation, potentially reducing production timelines by up to 30% in certain areas, as observed in industry-wide trends during 2024.

Imagica can leverage these advancements to automate repetitive tasks, freeing up creative teams for more complex work. This automation, coupled with AI-driven enhancements, can lead to a notable improvement in output quality and efficiency. By adopting these tools, Imagica can streamline workflows, potentially cutting post-production costs by an estimated 15-20% as projected for the VFX industry in 2025.

Imagica Group is strategically tapping into the rapidly expanding gaming and interactive media sector. Recent acquisitions in game development, coupled with robust orders for 3DCG production services, position the company to leverage the significant growth in interactive entertainment.

This move into gaming represents a key diversification strategy, opening up new revenue streams and growth opportunities beyond Imagica's established film and television operations. The global gaming market was valued at over $200 billion in 2023 and is projected to continue its upward trajectory, presenting a substantial opportunity for Imagica.

Global Market Expansion and Strategic Partnerships

The global post-production services market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of over 7% through 2028, driven by increasing demand for high-quality visual content across various media platforms. The Asia-Pacific region, in particular, is a key growth engine, anticipated to see substantial expansion in its media and entertainment sectors. Imagica Group can capitalize on this trend by strategically expanding its international footprint.

This expansion could involve forging strategic alliances with local players in burgeoning markets or considering targeted acquisitions to gain immediate market access and operational capabilities. For instance, partnerships in countries with strong film industries, like India and South Korea, could unlock significant revenue streams. By leveraging its expertise, Imagica Group can tap into the growing demand for visual effects, animation, and digital restoration services worldwide.

Key opportunities for Imagica Group include:

- Expanding into high-growth regions: Targeting markets in Asia-Pacific, Latin America, and Eastern Europe where media consumption is rapidly increasing.

- Forming strategic partnerships: Collaborating with local production houses, broadcasters, and streaming services to offer integrated post-production solutions.

- Acquiring complementary businesses: Identifying and acquiring companies with specialized post-production technologies or established market presence in key international territories.

- Leveraging digital transformation: Investing in cloud-based workflows and remote collaboration tools to serve a global client base efficiently and cost-effectively.

Enhanced Value from Advanced Media Asset Management Solutions

The sheer amount of digital content being created today is staggering, making it harder for businesses to manage and utilize it effectively. Imagica Group's proficiency in advanced media asset management, particularly its AI-powered solutions for content organization and distribution, directly addresses this growing need. These capabilities allow clients to unlock greater value from their media libraries and improve operational efficiency.

Imagica Group's AI-driven MAM solutions can significantly streamline content workflows, reducing the time and resources spent on manual tagging and retrieval. This is crucial as the digital media landscape continues to expand, with the global digital asset management market projected to reach USD 5.4 billion by 2026, growing at a CAGR of 12.5%.

- AI-Powered Tagging: Automates the process of categorizing and describing media assets, improving searchability and discoverability.

- Efficient Distribution: Facilitates faster and more targeted delivery of content to various platforms and audiences.

- Content Monetization: Enables better organization and access to assets, potentially leading to new revenue streams.

- Workflow Optimization: Reduces manual effort in content management, freeing up resources for more strategic tasks.

Imagica Group is well-positioned to capitalize on the booming global streaming market, with projections indicating continued strong growth through 2025 and beyond. The increasing demand for digital content fuels the need for Imagica's core services in content creation and post-production. For instance, the global video streaming market was valued at USD 232.20 billion in 2023 and is expected to grow at a CAGR of 14.2% from 2024 to 2030, presenting a significant opportunity for Imagica.

The integration of AI in content creation offers substantial efficiency gains, with generative AI tools potentially reducing production timelines by up to 30% in certain areas during 2024. Imagica can leverage these advancements to automate tasks, improve output quality, and potentially cut post-production costs by an estimated 15-20% as projected for the VFX industry in 2025.

Imagica's strategic expansion into the rapidly growing gaming and interactive media sector, bolstered by acquisitions and robust 3DCG production orders, taps into a market valued at over $200 billion in 2023. Furthermore, the global post-production services market is projected to grow at a CAGR of over 7% through 2028, with the Asia-Pacific region being a key growth engine, offering Imagica opportunities for international expansion through partnerships and acquisitions.

Threats

The visual effects industry moves at lightning speed. For Imagica Group, this means their cutting-edge technology today could be outdated tomorrow, demanding constant, significant investment in research and development. This is a major threat, as falling behind technologically can quickly erode their competitive advantage in a fast-evolving market.

Staying ahead requires substantial R&D spending, which can strain financial resources. For instance, a significant portion of capital expenditure for companies in this sector is often allocated to upgrading hardware and software to meet the demands of increasingly complex visual effects. Failure to keep pace with these advancements, such as the growing use of AI in post-production, could render Imagica's current capabilities less attractive to clients.

The post-production and VFX sectors are experiencing fierce competition, with global giants and nimble startups vying for market share. This intense rivalry puts pressure on pricing and necessitates continuous innovation and service enhancement to secure and grow client relationships.

In 2024, the global VFX market was valued at approximately $16.5 billion, with projections indicating steady growth. However, this growth also attracts new entrants, intensifying the competitive landscape for companies like Imagica.

Global economic instability and industry-specific issues, like the potential for labor strikes impacting film and television production, directly threaten the demand for Imagica Group's visual solutions. A slowdown in consumer entertainment spending, a common occurrence during economic downturns, can significantly reduce revenue streams and profitability for the company.

Challenges in AI Integration and Infrastructure for Advanced VFX

The integration of AI into advanced VFX workflows for companies like Imagica faces significant hurdles. A major challenge is the substantial infrastructure investment required, particularly for large GPU farms, which are essential for training and running complex AI models. This high upfront cost can be a barrier to entry and widespread adoption.

Furthermore, the slow pace at which AI and machine learning capabilities are being integrated into primary VFX software tools hinders the seamless application of these technologies. This integration lag means that even with the hardware, the practical implementation and full realization of AI's benefits in day-to-day post-production tasks remain constrained. For instance, while AI-powered rotoscoping tools are emerging, their full integration into established pipelines is still in progress, impacting efficiency gains.

- Infrastructure Demands: High capital expenditure for GPU clusters and specialized hardware.

- Software Integration Lag: AI/ML features are not yet fully embedded in core VFX software suites.

- Talent Gap: Need for skilled professionals who can effectively implement and manage AI in creative pipelines.

- Data Requirements: AI models necessitate vast, high-quality datasets for training, which can be costly and time-consuming to acquire and curate.

Corporate Restructuring and Delisting from Public Market

The planned delisting from the Tokyo Stock Exchange, following Mikaduki, Inc.'s successful tender offer, marks a substantial shift for Imagica Group. This transition to private ownership introduces inherent uncertainties about the company's future strategic path and its operational transparency.

This move could limit Imagica Group's ability to raise capital through public markets, potentially impacting future growth initiatives or acquisitions. The company's financial reporting and governance structures may also change under private ownership, altering stakeholder perceptions.

- Delisting Impact: Imagica Group's shares are set to be delisted from the Tokyo Stock Exchange, transitioning from public to private ownership.

- Strategic Uncertainty: The change in ownership structure introduces questions about the future strategic direction and operational focus of the company.

- Capital Access: Private status may restrict access to public capital markets, potentially affecting funding for future expansion or investment.

- Transparency Concerns: The shift to private ownership could alter the level of transparency and public disclosure compared to its listed status.

The rapid advancement of visual effects technology presents a significant threat, demanding continuous and substantial investment in research and development to avoid obsolescence. Furthermore, the intensely competitive global VFX market, valued at approximately $16.5 billion in 2024, intensifies pressure on pricing and necessitates constant innovation. Economic instability and potential disruptions like labor strikes in the entertainment industry can directly impact demand for Imagica's services, while the high infrastructure and integration costs associated with AI adoption pose further challenges.

SWOT Analysis Data Sources

This Imagica Group SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and expert industry commentary to ensure a robust and actionable assessment.