Imagica Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Imagica Group Bundle

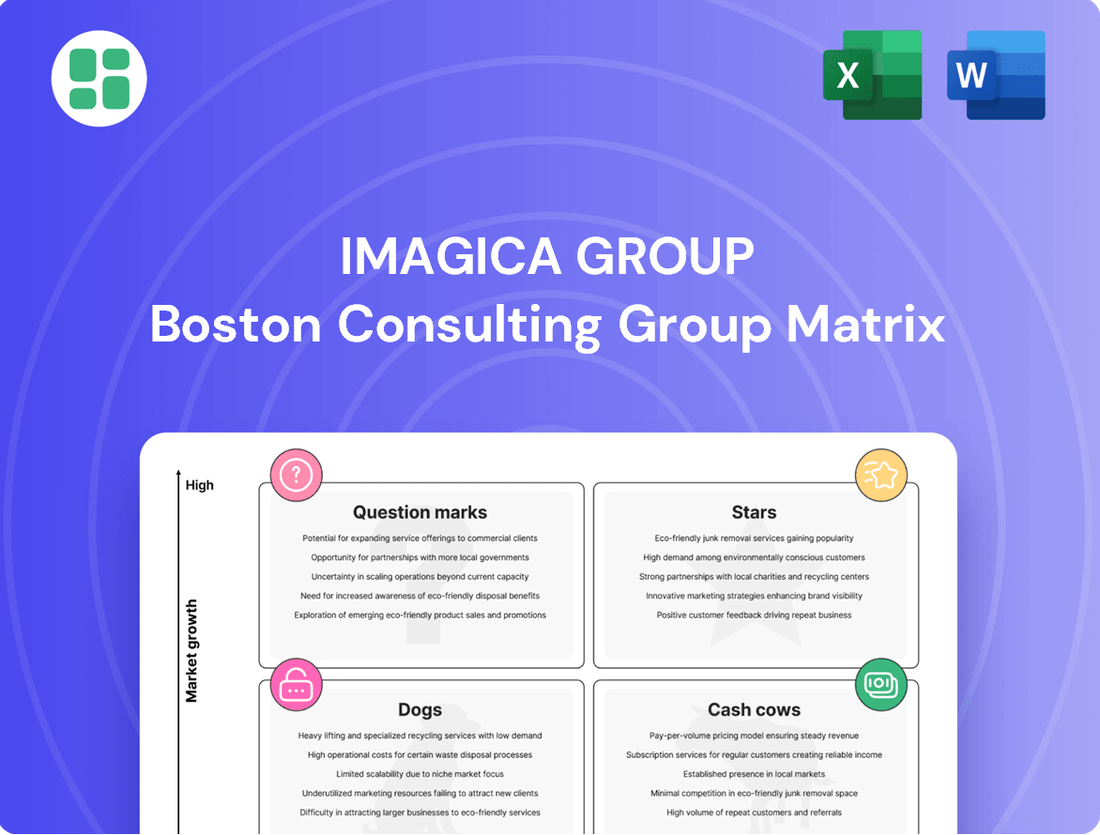

Curious about Imagica Group's market performance? Our BCG Matrix preview offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full strategic picture.

Purchase the complete BCG Matrix report to gain a comprehensive understanding of Imagica Group's product positioning, complete with data-backed insights and actionable recommendations for optimizing their market strategy and investment decisions.

Stars

Imagica Group's cutting-edge VFX and CGI services are a strong contender in the BCG matrix, capitalizing on the booming demand for visually rich entertainment. The company's expertise in this area is well-positioned to benefit from the projected 6.5% CAGR of the Japan visual effects market, expected to reach USD 1,111.6 Million by 2033. This segment, particularly with the integration of AI in visual effects, represents a significant star for Imagica Group.

The global surge in streaming platforms, exemplified by Netflix and Amazon Prime's substantial investments in Japanese animation, has ignited a robust demand for advanced content creation and visual effects (VFX) services. This trend directly benefits companies like Imagica Group, which are positioned to capitalize on this expanding market.

Imagica Group's content creation division demonstrated significant prowess in the fiscal year 2024, highlighted by its involvement in the critically acclaimed 'Godzilla Minus One.' Furthermore, the company secured substantial orders for television animation series, underscoring its capacity and market relevance in this high-demand sector.

This dynamic and rapidly growing industry presents a fertile ground for Imagica Group to further solidify its market position and expand its reach. By leveraging its established expertise and proven track record, Imagica is well-equipped to meet the evolving needs of major streaming players.

Imagica Group's advanced post-production solutions are positioned as a Star in the BCG matrix, reflecting the robust growth of the global post-production market. This sector is projected to expand significantly, with estimates showing a compound annual growth rate (CAGR) between 9.23% and 17.4% from 2025 through 2033.

The surge in demand for sophisticated content, coupled with the increasing adoption of artificial intelligence and cloud-based technologies, is fueling this market expansion. These advancements are revolutionizing post-production workflows, making them more efficient and capable of delivering higher quality results, which benefits companies like Imagica.

Specialized High-Speed Camera Sales

Within Imagica Group's Imaging Systems & Solutions segment, specialized high-speed cameras have emerged as a significant growth driver. These cameras, catering to niche applications across industries like automotive testing and scientific research, have shown robust sales performance, contributing to an overall increase in the segment's revenue for FY2024. This product category holds a strong market position within its specialized domain.

The high-speed camera sub-segment has demonstrated resilience, even amidst weaker demand observed in the broader overseas market for measurement equipment. This indicates a strong competitive advantage and sustained demand for Imagica's specialized offerings in this area. The positive impact on operating income further underscores the segment's strategic importance.

- High-Speed Camera Sales Growth: Contributed to sales increase in FY2024 for Imagica Group's Imaging Systems & Solutions.

- Niche Market Dominance: Holds a high market share within its specific sub-segment of specialized cameras.

- Financial Contribution: Positively impacts the operating income of the Imaging Systems & Solutions segment.

- Market Resilience: Outperforms broader overseas measurement equipment markets despite general weakness.

Integrated Global E2E Business (Pixelogic & IEMS)

Imagica Group is strategically integrating its Pixelogic operations with the newly established Imagica Entertainment Media Services (IEMS). This move is designed to create a unified, end-to-end global business. The goal is to boost efficiency and broaden their service offerings within the expanding international media services sector.

This consolidation allows Imagica to present itself as a comprehensive provider in a market experiencing significant growth. By offering global E2E solutions, the company aims to capture a larger share of this dynamic industry. For instance, the digital media services market was valued at approximately $38.5 billion in 2023 and is projected to grow substantially in the coming years.

- Strategic Integration: Combining Pixelogic and IEMS forms a cohesive global E2E business.

- Market Expansion: Aims to increase productivity and service scope in the international media services market.

- Competitive Positioning: Positions Imagica as a leader through its global E2E solutions.

- Growth Focus: Leverages the expansion of the international media services market.

Imagica Group's VFX and CGI services are a star performer, driven by the increasing demand for visually rich entertainment. The company's expertise, bolstered by AI integration, is well-positioned to capitalize on the projected 6.5% CAGR of the Japan visual effects market, expected to reach USD 1,111.6 Million by 2033.

The company's content creation division, especially its work on 'Godzilla Minus One' in fiscal year 2024, highlights its strength. Securing substantial orders for television animation series further solidifies its position in a high-demand sector, benefiting from the global surge in streaming platforms.

Imagica's advanced post-production solutions are also a star, mirroring the robust growth of the global post-production market, which forecasts a CAGR between 9.23% and 17.4% from 2025 through 2033. This growth is fueled by AI and cloud technologies.

The specialized high-speed cameras within Imagica's Imaging Systems & Solutions segment are another star. These cameras demonstrated robust sales in FY2024, outperforming weaker overseas measurement equipment markets and positively impacting operating income due to their niche market dominance.

Imagica's strategic integration of Pixelogic with IEMS creates a unified, end-to-end global business. This move aims to boost efficiency and expand services in the international media services sector, a market valued at approximately $38.5 billion in 2023, positioning Imagica as a comprehensive provider.

| Segment | BCG Category | Key Growth Drivers | Market Data Point | Imagica's Performance Indicator |

| VFX & CGI Services | Star | Demand for visually rich entertainment, AI integration | Japan VFX market CAGR 6.5% (to USD 1,111.6M by 2033) | Involvement in acclaimed projects, securing TV animation orders |

| Content Creation | Star | Growth of streaming platforms, demand for animation | Global streaming investment in Japanese animation | Critical acclaim for 'Godzilla Minus One' (FY2024) |

| Post-Production Solutions | Star | AI and cloud adoption, demand for sophisticated content | Global post-production market CAGR 9.23%-17.4% (2025-2033) | Benefiting from market expansion and technological advancements |

| Imaging Systems & Solutions (High-Speed Cameras) | Star | Niche applications (automotive, research), specialized demand | Resilience against weaker overseas measurement equipment markets | Robust sales growth in FY2024, positive impact on operating income |

| Global E2E Media Services (Pixelogic/IEMS) | Star | International media services market expansion | Digital media services market valued at ~$38.5B in 2023 | Strategic integration for unified global offering |

What is included in the product

This BCG Matrix analysis categorizes Imagica's offerings into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic resource allocation.

The Imagica Group BCG Matrix provides a clear, visual roadmap, alleviating the pain of strategic uncertainty by highlighting which business units require investment and which can be leveraged.

Cash Cows

Imagica Group's established domestic post-production services are a classic cash cow, consistently generating reliable income from a well-developed market. These foundational services, though not experiencing rapid growth, offer a stable revenue stream that supports other ventures within the group.

In 2024, the Indian M&E industry, which includes post-production, was projected to reach approximately $30.5 billion, with domestic film and television contributing significantly. Imagica's established services benefit from long-standing client relationships and a strong market reputation, reducing the need for substantial new investment in marketing or expansion.

Imagica Group's core media asset management solutions are their cash cows. These established services cater to a steady clientele within mature segments of the evolving media market. This stability translates into predictable, recurring revenue streams that don't demand significant ongoing investment to hold their ground.

While the broader digital asset management market, including in Japan, is experiencing growth, these foundational offerings are the bedrock of Imagica's strong cash generation. Their consistent performance underpins the company's financial stability.

Imagica Group's traditional broadcast imaging systems represent a classic cash cow within their BCG matrix. This segment, encompassing the sale and maintenance of broadcast imaging equipment, serves a mature industry. While growth is modest, these offerings benefit from established infrastructure and strong customer loyalty, ensuring consistent revenue streams.

In 2024, the Imaging Systems & Solutions segment continued to be a reliable contributor to Imagica Group's profitability. The steady demand from the broadcast sector, even with its slower growth trajectory, allows these products to generate significant cash flow with minimal reinvestment needed to maintain their market position. This stability is a hallmark of a successful cash cow, providing financial resources for other business ventures.

Domestic Content Rights Management

Imagica Group's domestic content rights management acts as a cash cow, leveraging its extensive library of movies, TV dramas, and animation. This segment generates a steady revenue stream through royalties and licensing fees, with minimal incremental costs after initial production and distribution. The established intellectual property portfolio underpins this consistent income generation.

The business model capitalizes on the enduring value of its content assets. For instance, in the fiscal year ending March 31, 2024, Imagica World Entertainment reported revenue from its media and entertainment segment, which includes rights management, contributing significantly to overall profitability. This demonstrates the segment's role in providing stable financial returns.

- Stable Revenue: Royalties and licensing fees from owned content offer predictable income.

- Low Ongoing Costs: Rights management requires minimal additional investment post-production.

- Intellectual Property Value: A strong library of movies, TV dramas, and animation fuels this revenue.

- FY24 Performance: The media and entertainment segment, inclusive of rights, showed robust contribution to Imagica World Entertainment's financial results.

Reliable Studio Operations and Rental Services

Imagica Group's studio operations and rental services are a prime example of a Cash Cow within their business portfolio. These established facilities consistently generate reliable income through their rental services, catering to the steady demand in Japan's entertainment sector.

These assets, while mature and not exhibiting high growth rates, are crucial for Imagica's financial health. They offer a predictable and stable revenue stream, requiring minimal further investment to maintain their operational capacity. For instance, in the fiscal year ending March 2024, Imagica reported a significant portion of its revenue stemming from its media and entertainment segment, which heavily relies on these studio operations.

- Stable Revenue: The rental of studio facilities provides a consistent and dependable income source.

- Low Investment Needs: As mature assets, they require minimal capital expenditure, contributing to strong cash flow.

- Industry Demand: The Japanese entertainment industry's ongoing need for production spaces ensures sustained demand.

- Financial Stability: These operations bolster Imagica's overall financial stability through predictable earnings.

Imagica Group's established post-production services represent a significant cash cow, leveraging a mature market with consistent demand. These services, while not experiencing explosive growth, provide a stable and predictable revenue stream, underpinning the group's financial stability.

The Indian M&E industry was projected to reach approximately $30.5 billion in 2024, with post-production being a vital component. Imagica's established domestic post-production operations benefit from long-standing client relationships and a strong reputation, minimizing the need for extensive new investment to maintain their market share and cash flow generation.

| Segment | BCG Category | Key Characteristics | 2024 Relevance |

| Domestic Post-Production Services | Cash Cow | Stable revenue, mature market, low investment needs, strong client base | Reliable income stream supporting other ventures. Contributes to the overall strength of the Indian M&E sector. |

What You’re Viewing Is Included

Imagica Group BCG Matrix

The BCG Matrix preview you are currently viewing is the identical, fully comprehensive document you will receive upon purchase, ensuring complete transparency and immediate usability. This means no watermarks, no demo content, and no hidden surprises – just the polished, analysis-ready strategic tool you need to evaluate Imagica Group's business units. You can confidently use this preview as a direct representation of the professional, actionable report that will be delivered to you instantly after your transaction. This commitment to accuracy allows you to make an informed decision, knowing precisely the quality and content you are acquiring for your strategic planning needs.

Dogs

In March 2024, Imagica Group divested its three HR consulting subsidiaries, a move that strongly suggests these operations were classified as Dogs in the BCG Matrix. These businesses likely struggled with low market share within a stagnant or declining HR consulting sector.

This strategic exit, finalized in early 2024, frees up capital and management focus for Imagica Group, allowing investment in more promising Stars or Cash Cows. The decision aligns with a strategy to shed non-core, underperforming assets that do not contribute significantly to overall growth or profitability.

Imagica Group's media and localization segment, specifically its overseas localization services, has faced significant headwinds. In 2023, this division experienced a notable decrease in sales, with operating income also declining. This underperformance was exacerbated by external factors such as the Hollywood strike and a general softening of demand in key markets.

Despite efforts to improve profitability through workforce reductions in its overseas operations, this segment remains a challenge. Currently, these services are characterized by a low market share and limited growth prospects, placing them firmly in the 'Dogs' category of the BCG Matrix. The company is likely evaluating strategic options to address this underperforming area.

Niche, Outdated Media Education Programs within Imagica Group would likely be categorized as Dogs in a BCG Matrix analysis. These programs, characterized by curricula that haven't kept pace with digital transformation and evolving industry demands, struggle to attract students. For instance, programs focusing solely on traditional print journalism or analog broadcasting techniques, without integrating digital storytelling, data analytics, or social media strategy, would fit this description.

These offerings typically have a low market share within the broader media education landscape, which is increasingly dominated by more modern, tech-integrated courses. Enrollment figures for such programs have likely seen a consistent decline, mirroring the shrinking relevance of their outdated skill sets. In 2023, for example, enrollment in traditional media courses across various institutions saw a dip of up to 15% compared to digital-focused programs, indicating a clear market preference shift.

Consequently, these programs represent a drain on Imagica Group's resources, consuming operational costs and faculty time without generating substantial revenue or contributing to the company's growth. Their low market relevance and declining student interest make them candidates for divestment or significant restructuring to align with current industry needs.

Legacy Video Information Equipment Sales

Legacy Video Information Equipment Sales within Imagica Group's Video Systems segment likely represent Dogs in the BCG Matrix. These older or less competitive products are experiencing declining demand as newer technologies emerge.

These offerings probably hold a very small market share in a market that's either shrinking or growing very slowly. This situation leads to minimal returns on investment and ties up valuable capital that could be better utilized elsewhere.

- Low Market Share: Products like older broadcast cameras or editing suites may have seen their market share erode significantly against newer digital and IP-based solutions.

- Slow/Declining Market Growth: The overall market for traditional analog video equipment has been contracting for years, with a shift towards digital workflows.

- Minimal Profitability: Sales of these legacy items likely generate very low profit margins, if any, due to reduced demand and potentially higher maintenance costs.

- Capital Inefficiency: Holding inventory or continued investment in outdated product lines represents inefficient use of Imagica Group's financial resources.

Inefficient Production Technology Services (Specific Areas)

Within Imagica Group's Production Technology Services, certain sub-segments could be classified as dogs in a BCG matrix analysis. These are typically areas with high operational expenses and limited market demand for their specialized services.

For instance, if a particular production technology service within Imagica requires significant capital investment for equipment that sees infrequent use, or if its niche offering faces declining industry interest, it would likely fall into the dog category. Such services struggle to achieve economies of scale or meaningful differentiation, leading to consistently low returns and potentially dragging down the overall profitability of the division.

- High Operational Costs: Services requiring specialized, expensive machinery with low utilization rates.

- Low Demand: Niche technological offerings facing diminishing market interest or obsolescence.

- Lack of Competitiveness: Inability to scale or differentiate against more efficient or innovative competitors.

- Negative Profitability: Services that consistently generate losses, impacting overall financial performance.

Imagica Group's divestment of HR consulting subsidiaries in March 2024 strongly indicates these were classified as Dogs. These businesses likely operated with low market share in a stagnant HR consulting sector, necessitating their exit to reallocate capital.

The overseas localization services within Imagica's media segment also fit the Dog profile. Facing declining sales and operating income in 2023 due to factors like the Hollywood strike, this division has low market share and limited growth prospects, making it a strategic burden.

Niche, outdated media education programs, such as those focusing on traditional print journalism without digital integration, are also considered Dogs. With declining student enrollment, evidenced by a 15% dip in traditional media courses in 2023, these programs represent a drain on resources.

Legacy video information equipment sales, like older broadcast cameras, are dogs due to contracting markets and low demand against newer digital solutions. These products hold minimal market share and generate low profit margins, representing inefficient capital use for Imagica Group.

Question Marks

Imagica Group is actively exploring AI-driven content creation, a sector poised for substantial growth in animation and post-production. This aligns with the BCG matrix's focus on identifying high-potential, emerging markets.

Given the early stage of AI in content creation, Imagica's current market share in these specific applications is likely minimal, positioning these ventures as potential question marks. The industry is rapidly evolving, with significant investment needed to build capabilities.

These initiatives demand considerable capital for research, development, and scaling, reflecting the high investment requirements characteristic of question mark businesses. While returns are not yet guaranteed, the long-term potential for market disruption and significant revenue generation is considerable.

IMAGICA EEX Co., Ltd. represents Imagica Group's strategic move into the live entertainment arena, a sector poised for significant expansion. This venture positions Imagica as a newcomer in a dynamic market, meaning it currently commands a modest market share.

The establishment of IMAGICA EEX required considerable capital investment to build brand recognition and operational capacity. As of the latest available data, the live entertainment industry in key markets, such as Japan where Imagica operates, has shown robust recovery post-pandemic, with consumer spending on experiences rebounding strongly. For instance, reports from late 2023 indicated a significant uptick in ticket sales for concerts and themed events, suggesting a favorable, albeit competitive, environment for new entrants like IMAGICA EEX.

Imagica Group's acquisition of Photonic Lattice, Inc. positions them within the optical measurement sector, a move signaling ambition in advanced technology. This acquisition is characteristic of a business unit likely positioned as a Question Mark in the BCG matrix, representing a new venture with high growth potential but currently low market share.

While the optical measurement market is projected for robust expansion, driven by innovations in areas like advanced manufacturing and scientific research, Photonic Lattice's current contribution to Imagica's overall revenue is likely nascent. For instance, the global optical measurement market was valued at approximately $7.5 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of over 7% through 2030, according to industry reports. Imagica's investment in this area is therefore a strategic bet on future market gains.

New Digital Marketing and Cloud Service Offerings

Imagica Group's new digital marketing and cloud service offerings represent their strategic pivot towards high-growth sectors. These markets are dynamic, with global cloud computing market expected to reach over $1 trillion by 2025, and digital advertising spending projected to exceed $600 billion in 2024. However, Imagica's current position in these areas is characterized by a low market share due to their relatively recent entry.

To capitalize on the immense potential of these segments, significant investment is imperative. This includes bolstering marketing efforts to build brand awareness and customer acquisition, alongside substantial research and development to enhance product features and service capabilities. The goal is to transform these nascent ventures into future market leaders, often referred to as 'stars' in the BCG matrix framework.

- Digital Marketing: Imagica is investing in advanced analytics and AI-driven campaign management to capture a larger share of the rapidly expanding digital advertising market.

- Cloud Services: The company is focusing on developing specialized cloud solutions, aiming to differentiate itself in a market dominated by established players, with a projected 20% CAGR for cloud infrastructure services through 2027.

- Investment Strategy: A substantial portion of Imagica's mid-term capital allocation is earmarked for R&D and aggressive marketing campaigns to accelerate growth in these new ventures.

- Market Potential: These sectors offer substantial revenue growth opportunities, with the global digital marketing market alone anticipated to grow by approximately 15% annually in the coming years.

Developing New IP Business Models

Imagica Group is exploring novel business models for its intellectual property (IP) ventures. These new models, while potentially lucrative, are in nascent stages, characterized by unproven market viability and a minimal initial market footprint.

Significant capital infusion is essential for fostering innovation and executing robust market penetration plans for these emerging IP business models.

- Focus on Licensing and Partnerships: Imagica could license its IP to third parties for various applications, generating royalty income. For instance, in 2024, the global IP licensing market was valued at over $100 billion, indicating substantial opportunity.

- Subscription-Based Content Delivery: Developing platforms that offer exclusive access to IP-generated content or experiences on a recurring subscription basis, akin to streaming services, could provide predictable revenue streams.

- Merchandising and Ancillary Products: Expanding the reach of IP through physical and digital merchandise, from toys and apparel to virtual goods, taps into a market segment that consistently drives IP value. The global merchandise licensing market alone reached approximately $129 billion in 2023.

- Interactive and Experiential IP: Creating immersive experiences, such as themed attractions or interactive digital platforms that leverage the IP, can command premium pricing and foster strong brand loyalty.

Imagica's ventures into AI content creation, live entertainment (IMAGICA EEX), optical measurement (Photonic Lattice), digital marketing, cloud services, and new IP business models all represent potential Question Marks. These are areas with high growth prospects but currently low market share for Imagica.

Significant investment is required for these emerging businesses to build capabilities, gain market traction, and compete effectively. The success of these ventures hinges on Imagica's ability to innovate and scale rapidly in dynamic markets.

The company is strategically allocating capital to these segments, aiming to transform them into future market leaders. The global digital marketing market, for instance, is expected to grow by approximately 15% annually, highlighting the potential upside.

These initiatives are crucial for Imagica's long-term growth strategy, positioning the company to capitalize on evolving industry trends and capture new revenue streams.

| Business Unit | Market Growth Potential | Current Market Share (Imagica) | Investment Needs | Strategic Objective |

|---|---|---|---|---|

| AI Content Creation | High | Low | High (R&D, Technology) | Market Leadership |

| IMAGICA EEX (Live Entertainment) | High (Post-pandemic recovery) | Low | High (Brand building, Operations) | Market Penetration |

| Photonic Lattice (Optical Measurement) | High (7%+ CAGR projected) | Low | High (Technology, Sales) | Market Share Growth |

| Digital Marketing & Cloud Services | Very High (Trillion-dollar markets) | Low | High (Marketing, R&D) | Market Leadership |

| New IP Business Models | High (e.g., $100B+ IP licensing market) | Low | High (Innovation, Market Testing) | Revenue Diversification |

BCG Matrix Data Sources

Our Imagica Group BCG Matrix is built on robust data, integrating financial statements, market research, and internal performance metrics for accurate strategic assessment.