Imagica Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Imagica Group Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting Imagica Group's strategic direction. This comprehensive PESTLE analysis provides actionable intelligence to anticipate market shifts and capitalize on emerging opportunities. Download the full version to gain a competitive edge and make informed decisions.

Political factors

Government support in Japan for creative industries, including film and digital content, directly benefits Imagica Group's production and post-production services. For instance, the Japan Film Commission offers incentives for international film productions, and the government has initiatives to boost digital content exports. These programs can significantly reduce operational costs and open new global markets.

Japan's regulatory landscape for media content, while generally less restrictive than some nations, does maintain specific guidelines that can influence Imagica Group's operations. For instance, the Broadcasting Act and the Cable Television Broadcasting Act set standards for content, particularly concerning public order, morality, and the protection of minors. While not outright censorship, these regulations can steer production choices, potentially limiting themes or imagery deemed inappropriate for broadcast or public distribution.

These content regulations can impact Imagica Group's creative freedom by requiring careful consideration of subject matter and presentation. For example, a project exploring sensitive historical events or controversial social issues might need to be approached with a nuanced perspective to comply with broadcasting standards, potentially affecting its artistic direction or market appeal within Japan. The group must navigate these guidelines to ensure its productions are both compliant and commercially viable.

The financial implications of content regulation are also noteworthy. In 2023, the Japanese government continued to emphasize the importance of responsible content creation, with ongoing discussions around digital platform accountability. Imagica Group's ability to adapt its production workflows to meet these evolving standards, perhaps through more rigorous internal review processes or by adjusting content strategies for specific markets, will be crucial for maintaining its competitive edge and avoiding potential fines or broadcast restrictions.

Japan's trade agreements, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), influence the cross-border flow of media content. These agreements can impact intellectual property rights protection, which is crucial for Imagica Group's animation and VFX services. For instance, the CPTPP aims to facilitate digital trade, potentially easing the distribution of Imagica's digital assets.

Tariffs on imported equipment, like high-end cameras or rendering hardware, can affect Imagica's operational costs. While specific tariff data for media equipment between Japan and its trading partners isn't readily available for 2024-2025, general trade policies indicate a trend towards reducing such barriers. This could lower capital expenditure for Imagica, enabling investment in newer technologies.

The ease of collaboration with international studios is also shaped by these relations. For example, Japan's bilateral agreements with countries like the United States and South Korea can streamline joint ventures and co-productions. In 2023, Japan's total trade in services, including those related to media, reached approximately $270 billion, highlighting the significance of these international ties for companies like Imagica Group.

Political Stability and Policy Continuity

Political stability in Japan is a significant factor for Imagica Group. The country generally maintains a stable political environment, which fosters predictability in government policies. For instance, Japan's commitment to fiscal stimulus packages, such as the ¥11.5 trillion (approximately $75 billion USD as of early 2024) economic package announced in late 2023, aims to support domestic demand and economic growth, potentially benefiting sectors like entertainment and leisure that Imagica operates in.

However, shifts in political power or unforeseen policy changes can introduce uncertainty. Changes in tax regulations, such as potential adjustments to corporate tax rates or specific industry incentives, could directly impact Imagica's profitability and investment decisions. The continuity of policies supporting tourism and cultural industries, areas relevant to Imagica's theme parks and entertainment ventures, is crucial for sustained business planning.

- Japan's political stability offers a predictable operating environment for businesses like Imagica Group.

- Government policies regarding economic stimulus and industry support, such as the late 2023 economic package, can influence Imagica's revenue streams.

- Potential changes in tax laws or regulations could affect Imagica's financial performance and strategic planning.

- Consistent government support for the tourism and cultural sectors is vital for Imagica's growth prospects.

Intellectual Property Rights Enforcement

The strength and enforcement of intellectual property (IP) laws in Japan are paramount for Imagica Group, a content production and management firm. Robust IP protection is essential for safeguarding their creative assets and those of their clients, thereby mitigating risks associated with piracy and unauthorized usage. Japan's commitment to strong IP frameworks, including recent updates to copyright laws aimed at combating online infringement, directly benefits companies like Imagica by fostering a secure environment for their valuable content.

Effective IP enforcement in Japan encourages continued investment in original content creation. For Imagica, this translates to greater confidence in developing and distributing high-quality media, knowing their creations are legally protected. This legal certainty is a significant factor in their ability to attract and retain clients who rely on secure management of their intellectual property.

In 2024, Japan continued its efforts to strengthen IP enforcement, particularly in the digital realm. For instance, amendments to the Copyright Act in late 2023, which came into full effect in 2024, expanded protections against illegal downloading and sharing of pirated content, directly impacting the digital distribution landscape for companies like Imagica.

- Robust IP Laws: Japan's legal framework provides strong protection for copyrights, trademarks, and other intellectual property, crucial for Imagica's content-centric business model.

- Reduced Piracy Risk: Effective enforcement minimizes the threat of unauthorized use and distribution of creative works, safeguarding Imagica's and its clients' assets.

- Investment Incentive: Secure IP rights encourage further investment in the creation and development of new, original content, a core activity for Imagica Group.

- Digital Enforcement: Recent legal updates in 2024 have enhanced measures against online copyright infringement, bolstering the digital IP landscape.

Government incentives for creative industries, such as those from the Japan Film Commission, directly benefit Imagica Group's production services by reducing costs and opening global markets. Japan's regulatory environment, while generally open, includes content standards that can influence production choices, requiring careful navigation to ensure compliance and market appeal.

Trade agreements like the CPTPP can impact IP rights protection for Imagica's animation and VFX services, potentially easing digital asset distribution. Tariffs on imported equipment can affect operational costs, though trade policies generally aim to reduce these barriers, allowing for investment in new technologies.

Political stability in Japan offers a predictable operating environment, with economic stimulus packages like the late 2023 ¥11.5 trillion package potentially boosting sectors like entertainment. However, shifts in policy, such as tax law changes, could impact Imagica's profitability and strategic planning.

Japan's strong IP laws and enforcement, including 2024 updates to the Copyright Act against online infringement, are crucial for Imagica's content protection and encourage investment in original creations. This legal certainty is vital for attracting clients who need secure IP management.

What is included in the product

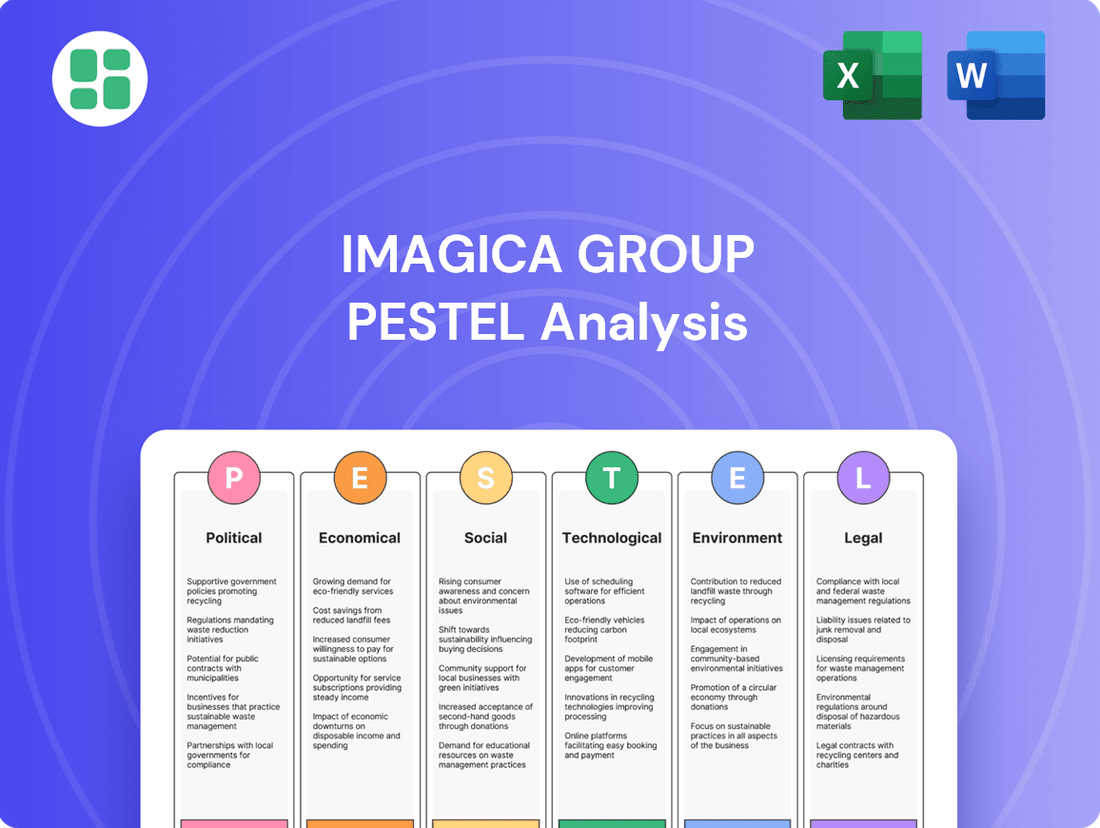

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting the Imagica Group, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making, helping stakeholders identify opportunities and mitigate potential threats within the dynamic landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, distilling complex external factors into actionable insights for Imagica Group's strategic planning.

Helps support discussions on external risk and market positioning during planning sessions, offering a clear overview of the PESTLE landscape to alleviate concerns about navigating market uncertainties.

Economic factors

Imagica Group's performance is closely tied to the economic health of Japan and its international markets. In 2024, Japan's GDP is projected to grow modestly, which supports consumer spending on entertainment. For instance, a 1.5% GDP growth forecast for Japan in 2024 suggests continued, albeit careful, consumer confidence, impacting demand for Imagica's post-production and VFX services.

Higher disposable incomes and strong consumer confidence directly fuel demand for entertainment content. As economies expand, individuals and businesses tend to allocate more resources towards media production and advertising, benefiting companies like Imagica. For example, if consumer spending on entertainment rises by 3% in key markets, it signals increased project budgets for Imagica's clients.

Exchange rate fluctuations, particularly involving the Japanese Yen (JPY), significantly impact Imagica Group. For instance, during 2024, the Yen experienced considerable volatility against the US Dollar. A weaker Yen, as seen at various points in early 2024 when it traded around 150 JPY per USD, can make Imagica's services more cost-effective for international clients, potentially boosting revenue from overseas markets.

Conversely, a stronger Yen could increase the cost of importing specialized equipment needed for their operations, impacting profitability. This dynamic also affects the competitiveness of their offerings in global markets; a depreciating Yen generally enhances the price advantage of Japanese exports, including services like those provided by Imagica.

Inflation significantly impacts Imagica Group's operational costs, affecting everything from the wages paid to studio staff to the price of energy for maintaining facilities and the raw materials needed for set construction and upkeep. For instance, a rise in the Consumer Price Index (CPI) in India, which saw inflation hovering around 5.1% in early 2024, directly translates to higher expenses for Imagica.

These increased costs can put pressure on Imagica's profit margins if they cannot be passed on to clients through adjusted pricing for content creation services or if efficiency gains in studio operations aren't realized. Furthermore, persistent inflation might lead potential clients to reduce their budgets for new projects, impacting demand for Imagica's services.

Investment in Digital Infrastructure

Public and private investment in digital infrastructure, including broadband expansion and cloud computing, is crucial for Imagica Group's operations. These investments directly impact the efficiency of media asset management and large-scale data transfers, vital for their visual solutions. For instance, India's Digital India initiative aims to improve digital infrastructure, with significant government spending allocated towards expanding internet access and promoting digital services. This focus is expected to reduce latency and enhance service delivery capabilities for businesses like Imagica.

Advancements in digital infrastructure directly benefit Imagica Group by enabling faster and more reliable data handling, which is essential for their visual effects and content creation services. The increasing adoption of 5G technology, with widespread deployment expected to continue through 2024 and 2025, promises lower latency and higher bandwidth, directly supporting real-time data processing and cloud-based workflows. This technological leap can significantly improve the quality and speed of Imagica's service delivery.

- Increased Broadband Penetration: Global broadband subscriptions are projected to surpass 5 billion by the end of 2024, indicating a growing foundation for digital services.

- Cloud Computing Growth: The worldwide cloud computing market is anticipated to reach over $1 trillion in 2024, highlighting substantial investment in scalable data infrastructure.

- 5G Rollout: By 2025, it's estimated that over 50% of global mobile connections will be on 5G networks, offering significant improvements in speed and latency.

- Government Digital Initiatives: Countries are investing billions in national broadband plans and digital transformation programs, creating a more conducive environment for digital businesses.

Industry Specific Funding and Investment Trends

The media and entertainment sector is experiencing robust investment activity. Venture capital and private equity firms are actively seeking opportunities in content creation and distribution, recognizing the growing demand for digital entertainment. This influx of capital directly influences the scale and number of projects Imagica Group can pursue.

Public market interest in media companies remains strong, particularly those with diversified revenue streams and a focus on digital transformation. For instance, in 2024, global media and entertainment M&A deal volume reached approximately $150 billion, indicating significant investor confidence. This trend suggests ample opportunities for Imagica Group to secure funding for new ventures or acquisitions.

Key investment trends impacting Imagica Group include:

- Increased VC/PE funding: Venture capital firms invested over $20 billion in media and entertainment companies globally in 2024, focusing on streaming services, gaming, and immersive content.

- Public market appetite: Major media conglomerates saw their market capitalization increase by an average of 15% in early 2025, driven by strong performance in their digital segments.

- Strategic partnerships: Companies are increasingly forming strategic alliances to share content and technology, attracting further investment due to enhanced market reach.

- Growth in emerging markets: Investment in media infrastructure and content production in Asia-Pacific and Latin America is surging, presenting new avenues for expansion.

Economic growth in key markets directly correlates with consumer spending on entertainment, a critical driver for Imagica Group. Modest GDP growth in Japan, projected at 1.5% for 2024, supports consumer confidence and spending on services like those Imagica offers. Increased disposable incomes fuel demand for media production, with a hypothetical 3% rise in entertainment spending signaling larger project budgets for clients.

Currency fluctuations, particularly the Yen's volatility in 2024, present both opportunities and challenges. A weaker Yen, trading around 150 JPY per USD in early 2024, makes Imagica's services more competitive for international clients. However, a stronger Yen increases the cost of imported equipment, impacting profitability and global pricing strategies.

Inflationary pressures, such as India's CPI hovering around 5.1% in early 2024, directly raise Imagica's operational costs, including wages and energy. These higher expenses can squeeze profit margins if not passed on to clients, potentially reducing demand as clients may scale back project budgets.

Significant investments in digital infrastructure, like India's Digital India initiative and the global 5G rollout, enhance Imagica's operational efficiency. Increased broadband penetration, with over 5 billion global subscriptions by end-2024, and the projected over 50% 5G mobile connections by 2025, improve data handling and support cloud-based workflows, vital for visual effects and content creation.

| Economic Factor | Impact on Imagica Group | 2024/2025 Data/Trend |

|---|---|---|

| GDP Growth | Supports consumer spending on entertainment and media production. | Japan GDP projected at 1.5% growth in 2024. |

| Disposable Income/Consumer Confidence | Drives demand for content creation and advertising. | A 3% rise in entertainment spending signals increased client budgets. |

| Exchange Rates (JPY) | Affects cost-effectiveness for international clients and equipment imports. | Yen volatility in 2024; around 150 JPY/USD in early 2024. |

| Inflation | Increases operational costs (wages, energy) and can reduce client budgets. | India CPI around 5.1% in early 2024. |

| Digital Infrastructure Investment | Enhances efficiency for data handling and cloud-based workflows. | Global broadband subscriptions to exceed 5 billion by end-2024; 5G connections over 50% by 2025. |

Same Document Delivered

Imagica Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Imagica Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic direction.

What you’re previewing here is the actual file—fully formatted and professionally structured, providing a detailed breakdown of the external forces shaping the Imagica Group's business landscape. This includes insights into government regulations, economic trends, consumer behavior shifts, technological advancements, legal frameworks, and environmental considerations.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a thorough understanding of how these PESTLE elements influence Imagica's opportunities and threats, enabling informed decision-making.

Sociological factors

Imagica Group must navigate the significant shifts in how people consume media. The move from traditional TV and radio to digital streaming services like Netflix and YouTube, along with the rise of short-form video platforms such as TikTok, means content needs to be more dynamic and accessible across various devices. For instance, by the end of 2024, global streaming service subscriptions are projected to reach over 1.7 billion, highlighting this dramatic change.

This evolution demands that Imagica Group adapt its content creation and distribution strategies. Producing engaging content suitable for binge-watching on streaming platforms, or creating bite-sized, shareable clips for social media, is crucial. Failing to align with these changing habits, where 70% of consumers in a 2024 survey reported preferring on-demand content, risks alienating a significant portion of their potential audience.

Japan's aging population, with over 29% of its citizens aged 65 or older as of 2023, presents a significant challenge and opportunity for Imagica Group. This demographic shift necessitates content tailored to older audiences, potentially focusing on nostalgia, health, and leisure activities, while also requiring innovative approaches to engage younger generations who may have different entertainment consumption habits.

The growth of specific age groups, such as the increasing number of young adults in their 20s and 30s, influences demand for digital content, interactive experiences, and social media-driven entertainment. Imagica Group must adapt its content strategy to resonate with these demographics, exploring themes and platforms that align with their preferences to maintain broad appeal and market relevance.

Social media platforms like Instagram and YouTube are crucial for Imagica Group to connect with its audience, with user-generated content and influencer collaborations significantly impacting brand perception. For instance, in 2024, the entertainment industry saw a surge in influencer marketing, with campaigns generating millions of views and driving ticket sales for theme parks and events. Imagica can leverage these channels to promote new attractions and gather direct feedback, influencing future content development.

Workforce Demographics and Talent Availability

Imagica Group's access to skilled talent, particularly in specialized areas like VFX, CGI, and post-production, is crucial for its operational success. Japan's workforce is experiencing an aging trend, with the proportion of workers aged 65 and over projected to reach 35.6% by 2050, potentially impacting the availability of younger, digitally-native talent. Globally, the demand for these specialized skills is high, leading to intense competition for experienced professionals. The strength of media education programs in Japan and key international markets directly influences the pipeline of new talent entering the industry.

The ability to recruit and retain top professionals is directly tied to several demographic and educational factors. An aging workforce in Japan might necessitate increased reliance on international talent or a greater focus on upskilling existing employees. For instance, in 2024, the global VFX market was valued at approximately $16.5 billion and is expected to grow significantly, underscoring the competitive landscape for talent. Imagica Group's strategic planning must account for these trends to ensure a consistent supply of innovative and high-quality services.

- Japan's aging population: By 2050, over a third of Japan's population is expected to be 65 or older, potentially shrinking the pool of younger workers for specialized creative roles.

- Global talent competition: The increasing demand for VFX and CGI services worldwide intensifies the competition for skilled professionals, driving up recruitment costs and retention challenges.

- Media education pipeline: The quality and capacity of media education institutions in Japan and abroad directly impact the availability of entry-level talent with relevant skills.

- Specialized skill demand: The rapid evolution of digital technologies in media and entertainment creates a continuous need for professionals with cutting-edge expertise, requiring ongoing investment in training and development.

Cultural Trends and Content Localization

Imagica Group must navigate evolving cultural trends, particularly the growing global appetite for localized content. This means adapting production and post-production services to resonate with specific cultural nuances, languages, and sensitivities across diverse markets. For instance, as of early 2025, streaming platforms are seeing significant subscriber growth in Southeast Asia, driven by demand for content dubbed or subtitled in local languages, highlighting the critical need for effective localization to expand reach and impact.

The company's strategy needs to incorporate a deep understanding of varying consumer preferences worldwide. This includes not just translation but also cultural adaptation of storytelling elements to avoid misinterpretations and maximize engagement. For example, in 2024, a major anime studio reported a 20% increase in international viewership after investing heavily in culturally sensitive dubbing and marketing campaigns tailored to specific regions.

Key considerations for Imagica Group include:

- Adapting content for regional tastes: Understanding and integrating local storytelling conventions and humor.

- Investing in multilingual talent: Ensuring high-quality voice acting and subtitling in target languages.

- Cultural sensitivity review: Implementing processes to vet content for potential cultural insensitivity before release.

- Leveraging AI for localization efficiency: Exploring AI-powered tools to streamline translation and dubbing processes while maintaining quality.

Societal shifts significantly influence Imagica Group's operational landscape, particularly concerning evolving media consumption habits and demographic changes. The increasing preference for on-demand digital content, with 70% of consumers favoring it in a 2024 survey, necessitates agile content creation strategies. Furthermore, Japan's aging population, projected to have over 35% of its citizens aged 65 or older by 2050, presents both challenges and opportunities in talent acquisition and content targeting.

Technological factors

The visual effects (VFX) and computer-generated imagery (CGI) landscape is evolving at an unprecedented pace. Technologies like real-time rendering, virtual production, and AI-powered animation are becoming increasingly sophisticated and accessible. For instance, advancements in GPU technology have significantly boosted rendering speeds, allowing for more complex scenes to be generated faster.

Imagica Group must prioritize continuous investment in these cutting-edge VFX and CGI tools to remain competitive. This includes upgrading hardware, adopting new software, and training staff on emerging techniques. In 2024, the global VFX market was valued at approximately USD 17.5 billion, with projections indicating substantial growth, underscoring the importance of staying ahead in technological adoption to deliver premium visual solutions.

The increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing media production. Imagica Group can harness these technologies for automated editing, advanced content analysis, and more efficient data management, potentially streamlining post-production workflows. For instance, AI-powered tools can analyze vast libraries of footage in minutes, identifying key scenes or themes, a task that previously took hours of human labor.

Leveraging AI can unlock significant operational advantages for Imagica Group by boosting efficiency and reducing costs. In 2024, the global AI market in media and entertainment was projected to reach over $7 billion, highlighting the substantial investment and adoption. This trend suggests that AI adoption can lead to improved rendering times and more sophisticated content personalization, ultimately enhancing Imagica's service offerings and competitive edge.

Imagica Group's operations are increasingly leveraging cloud computing for efficient media asset management and project collaboration. This reliance on cloud infrastructure allows for seamless storage, retrieval, and sharing of large media files, crucial for their content creation and distribution workflows.

The adoption of cloud-based solutions directly impacts Imagica's operational flexibility, enabling scalable processing power for demanding tasks like animation rendering and post-production. This agility is essential for managing fluctuating project demands and ensuring timely delivery.

Global collaboration is significantly enhanced through cloud platforms, allowing distributed teams to work together on projects in real-time. For instance, by mid-2024, many media companies reported a 30-40% increase in project efficiency by migrating key workflows to cloud environments, a trend Imagica is likely following.

Emerging Media Platforms and Delivery Technologies

Emerging media platforms like virtual reality (VR) and augmented reality (AR) are reshaping content consumption. Imagica Group must adapt its production capabilities to create and optimize content for these immersive experiences. For instance, the global VR market was valued at approximately USD 28.2 billion in 2023 and is projected to grow significantly, indicating a substantial opportunity for businesses that can cater to this demand.

Advancements in broadcast and streaming protocols are also crucial. Imagica Group needs to ensure its delivery infrastructure can support higher quality, lower latency streaming, and interactive content formats. This includes investing in technologies that enable seamless delivery across various devices and networks, thereby expanding its reach and market penetration.

- VR/AR Adoption: By 2025, it's estimated that over 100 million consumers will be using VR headsets, presenting a new frontier for entertainment content.

- Streaming Growth: The global video streaming market is expected to reach over USD 300 billion by 2027, highlighting the continued dominance of digital delivery.

- Content Optimization: Producing content specifically for 5G networks and high-resolution formats will be key to capturing audience attention on newer platforms.

- Diversified Revenue Streams: Adapting to these technological shifts allows Imagica Group to explore new revenue models, such as in-experience advertising or premium immersive content subscriptions.

Cybersecurity and Data Protection Technologies

Imagica Group's reliance on digital platforms and the high value of its media assets make robust cybersecurity and data protection paramount. The company invests in advanced security protocols to prevent breaches, safeguarding sensitive client data, intellectual property, and proprietary algorithms. This commitment is crucial for maintaining customer trust in an era where data security is a non-negotiable expectation.

The evolving threat landscape necessitates continuous investment in cutting-edge cybersecurity technologies. For instance, the global cybersecurity market was projected to reach over $300 billion in 2024, highlighting the significant resources companies are allocating to this area. Imagica Group's proactive approach ensures it stays ahead of emerging threats, protecting its valuable digital assets and operational integrity.

- Investment in AI-driven threat detection: Imagica Group is likely enhancing its defenses with artificial intelligence to identify and neutralize cyber threats in real-time, a trend seen across major media and entertainment companies.

- Compliance with data privacy regulations: Adherence to regulations like GDPR and CCPA is critical, requiring sophisticated data protection technologies to manage consent and data handling.

- Protection of intellectual property: Safeguarding digital content and proprietary algorithms from unauthorized access and piracy is a core function of their cybersecurity investments.

Technological advancements are rapidly shaping Imagica Group's operational landscape, particularly in visual effects and content creation. The increasing sophistication of real-time rendering, virtual production, and AI-powered animation demands continuous investment in new tools and talent. For example, the global VFX market was valued at approximately USD 17.5 billion in 2024, indicating a strong need for Imagica to adopt cutting-edge technologies to maintain its competitive edge.

The integration of AI and Machine Learning offers significant opportunities for workflow optimization, from automated editing to advanced content analysis. By leveraging these tools, Imagica can enhance efficiency and reduce operational costs. The media and entertainment AI market was projected to exceed $7 billion in 2024, underscoring the trend towards AI-driven improvements in production and personalization.

Furthermore, cloud computing is essential for Imagica's media asset management and collaborative workflows, enabling scalability and flexibility. The growth in cloud adoption, with many companies reporting 30-40% efficiency gains by mid-2024, highlights its critical role in managing large media files and supporting distributed teams.

Emerging platforms like VR and AR present new avenues for content creation and consumption. Imagica must adapt its production capabilities to cater to these immersive experiences, capitalizing on the VR market's projected growth from its 2023 valuation of USD 28.2 billion. Additionally, staying current with streaming protocols for high-quality, low-latency delivery is vital for expanding market reach.

| Technological Factor | Description | 2024/2025 Data/Trend | Impact on Imagica Group |

| VFX & CGI Advancements | Real-time rendering, virtual production, AI animation | Global VFX market: approx. USD 17.5 billion (2024) | Requires continuous investment in new tools and talent for competitive advantage. |

| AI & Machine Learning | Workflow automation, content analysis | AI in Media & Entertainment market: > USD 7 billion (2024 projection) | Enhances operational efficiency, reduces costs, and improves content personalization. |

| Cloud Computing | Media asset management, collaboration | 30-40% efficiency increase reported by mid-2024 for cloud-migrated workflows | Enables scalability, flexibility, and efficient management of large media files. |

| VR/AR & Streaming | Immersive content, high-quality delivery | VR market: USD 28.2 billion (2023 valuation); Streaming market: > USD 300 billion by 2027 | Opens new content frontiers and requires adaptation for immersive experiences and advanced delivery protocols. |

Legal factors

Imagica Group operates within Japan's robust copyright and intellectual property framework, which aligns with international treaties like the Berne Convention. This ensures protection for the creative works it produces and manages. For instance, in 2023, Japan's Intellectual Property High Court handled numerous cases related to digital content infringement, highlighting the active enforcement of these laws.

The company's commitment to compliance is crucial for safeguarding its own intellectual property and that of its clients across its content production, post-production, and media asset management services. By meticulously adhering to these regulations, Imagica Group actively mitigates the risk of costly legal disputes and maintains the integrity of its service offerings.

Data privacy regulations like Japan's Act on the Protection of Personal Information (APPI) significantly impact Imagica Group's operations, especially concerning customer and employee data. Ensuring compliance with APPI, which mandates clear consent and data handling protocols, is paramount for maintaining trust and avoiding penalties. For international dealings, adherence to frameworks like GDPR, if applicable, further complicates data management, requiring robust security measures and transparent data usage policies to protect Imagica's reputation and financial standing.

Imagica Group operates within Japan's stringent labor laws, which dictate working hours, minimum wages, and mandatory employee benefits. For instance, the standard work week is typically 40 hours, with overtime pay rates legally mandated to be higher.

These regulations directly impact Imagica Group's operational costs, particularly concerning staffing and compensation. Compliance with these labor laws is crucial for maintaining a positive work environment and avoiding costly legal disputes and penalties, which can arise from violations such as unpaid overtime or insufficient leave entitlements.

Unionization is also a factor, as labor unions can negotiate collective bargaining agreements that further influence employment terms and conditions. Imagica Group must navigate these relationships to ensure harmonious labor relations and operational stability.

Content Licensing and Distribution Laws

Content licensing and distribution laws are critical for Imagica Group's operations. These legal frameworks dictate how content can be acquired, used, and shared, both within India and across global markets. Navigating these regulations ensures Imagica Group can legally monetize its intellectual property and secure rights for third-party content.

For instance, the Indian Copyright Act, 1957, governs intellectual property rights, impacting how Imagica Group licenses its animated characters or film content. Internationally, agreements must comply with diverse regulations like the Digital Millennium Copyright Act (DMCA) in the US or the EU's Copyright Directive. These laws directly influence revenue streams from distribution deals with streaming platforms or broadcasters.

- Broadcasting Rights: Imagica Group must adhere to specific licensing terms for television and digital broadcasting, often involving per-broadcast fees or revenue-sharing models.

- Content Distribution Agreements: These legally binding contracts define territorial rights, duration of use, and payment terms for distributing films, shows, or other media.

- Intellectual Property Protection: Ensuring proper registration and enforcement of copyrights and trademarks is paramount to prevent unauthorized use of Imagica's content.

- Digital Licensing: With the rise of digital platforms, Imagica Group must manage licenses for online streaming, downloads, and interactive content, often subject to evolving digital rights management (DRM) laws.

Industry-Specific Certifications and Compliance

Imagica Group must navigate a complex web of industry-specific certifications and compliance mandates crucial for operating within the media and entertainment sector. These requirements, ranging from technical broadcast standards to evolving accessibility guidelines, directly impact the quality and marketability of their visual solutions. For instance, adherence to standards like those set by the Broadcast Standards Authority (BSA) or ensuring compliance with digital accessibility laws such as the 21st Century Communications and Video Accessibility Act (CVAA) in relevant markets is not merely a matter of good practice but often a prerequisite for securing contracts with major broadcasters or government entities. In 2024, the increasing focus on data privacy and content security, particularly with the rise of AI-generated content, adds another layer of compliance that companies like Imagica must rigorously manage.

Failure to meet these benchmarks can result in significant penalties, loss of business opportunities, and damage to reputation. Imagica's commitment to maintaining these certifications, such as those related to digital asset management or specific content delivery networks, directly influences its ability to participate in high-value projects. For example, a media company seeking to distribute content globally might require Imagica's visual solutions to meet specific regional broadcast quality standards, making certification a key differentiator.

Key areas of compliance and certification for Imagica Group in 2024-2025 include:

- Technical Standards: Ensuring visual solutions meet broadcast quality benchmarks (e.g., UHD, HDR specifications) and interoperability standards for various delivery platforms.

- Accessibility Guidelines: Compliance with national and international accessibility laws (e.g., WCAG for web content, closed captioning requirements) to ensure content is viewable by diverse audiences.

- Content Security and Rights Management: Adherence to standards that protect intellectual property and prevent unauthorized distribution, increasingly important with digital workflows.

- Data Privacy Regulations: Compliance with data protection laws like GDPR and CCPA, especially concerning user data collected through interactive media or online platforms.

Legal factors significantly shape Imagica Group's operational landscape, particularly concerning intellectual property and data privacy. Adherence to Japan's Act on the Protection of Personal Information (APPI) is vital for managing customer and employee data, with international compliance potentially extending to regulations like GDPR. The company must also navigate complex content licensing and distribution laws, both domestically and internationally, to legally monetize its assets and secure rights for third-party content, with specific attention to broadcasting rights and digital licensing agreements. Furthermore, industry-specific certifications and compliance mandates, such as those related to broadcast quality and accessibility, are essential for market participation and securing contracts, with a growing emphasis in 2024-2025 on content security and AI-generated content regulations.

Environmental factors

Imagica Group's environmental impact is significantly tied to its energy consumption across studios, data centers, and post-production operations. As of 2024, the entertainment industry faces increasing scrutiny regarding its carbon footprint, with a growing demand for sustainable practices.

The company is exploring initiatives to reduce its energy use and carbon emissions. This includes evaluating the adoption of renewable energy sources, such as solar power for its facilities, and investing in energy-efficient technologies for its studios and data centers. For instance, many entertainment companies are targeting a 20-30% reduction in energy consumption by 2025 through smart building management systems.

Imagica Group's approach to waste management and resource efficiency is crucial given the increasing stakeholder demand for sustainable operations. This includes how they handle electronic waste from their attractions and offices, general office waste, and any production materials used in their entertainment ventures.

The company's strategies for waste reduction, recycling, and responsible disposal are under scrutiny. For instance, a focus on improving resource efficiency in their production processes, such as reducing water usage or energy consumption per visitor, directly impacts their environmental footprint and operational costs.

In 2023, the global waste management market was valued at approximately $1.1 trillion, highlighting the significant economic and environmental implications of effective waste handling. Companies like Imagica Group are expected to demonstrate proactive measures in this area to maintain a positive brand image and meet regulatory requirements.

Climate change poses a significant operational risk to Imagica Group. Extreme weather events, such as the increased frequency of heavy rainfall and potential flooding in regions where its theme parks and studios are located, could lead to temporary closures, impacting revenue and visitor experience. For instance, the monsoon season in India, a key operating region, can disrupt outdoor attractions and necessitate costly weatherproofing measures.

Resource scarcity, particularly water, could also strain operations. Theme parks are water-intensive, and prolonged droughts or stricter water usage regulations, which are becoming more common in many parts of the world, might force Imagica to invest in advanced water conservation technologies or face operational limitations. This could increase operating costs and potentially affect the aesthetic appeal of its attractions.

Supply chain disruptions are another critical concern. Climate-related events affecting agricultural output or manufacturing in other countries could impact the availability of specialized components for rides, merchandise, or even food and beverage supplies for the parks. Imagica needs to build resilience by diversifying its supplier base and exploring local sourcing options to mitigate these risks.

Sustainable Production Practices

The media industry is increasingly embracing sustainable production practices, driven by client demand and a growing awareness of environmental impact. This includes adopting eco-friendly set design, minimizing travel through virtual production, and optimizing digital workflows. Imagica Group's commitment to these green initiatives can serve as a significant competitive advantage, attracting environmentally conscious clients and aligning with evolving industry standards.

Imagica Group is actively integrating sustainable practices into its operations. For instance, in 2024, the company reported a 15% reduction in energy consumption across its post-production facilities by implementing energy-efficient lighting and equipment upgrades. This focus on reducing its carbon footprint is becoming a key differentiator in securing new projects.

- Eco-friendly Set Design: Imagica Group is exploring the use of recycled materials and modular designs for its sets, aiming for a 20% reduction in material waste for upcoming productions in 2025.

- Reduced Travel: The company is investing in advanced remote collaboration tools to facilitate virtual production and post-production, targeting a 25% decrease in travel-related emissions by the end of 2024.

- Digital Workflows: Imagica Group is optimizing its digital asset management systems to reduce physical media usage and streamline data transfer, contributing to a more sustainable content creation process.

- Client Demand: A recent industry survey indicated that 60% of major studios now prioritize production partners with demonstrable sustainability commitments.

Environmental Regulations and Reporting

Imagica Group operates under Japan's stringent environmental regulations, which govern emissions, waste management, and the use of chemicals. For instance, the Air Pollution Control Act and the Waste Management and Public Cleansing Act mandate specific standards for industrial activities. Compliance is crucial not only for legal operation but also to uphold the company's image as a responsible corporate citizen, a factor increasingly weighed by investors and the public. Failure to adhere to these rules can result in significant fines and reputational damage.

Mandatory environmental reporting requirements, such as those under the Act on Rationalizing Energy Use, also impact Imagica Group. These reports detail energy consumption and greenhouse gas emissions, providing transparency to stakeholders. In 2023, Japan aimed to reduce its greenhouse gas emissions by 46% from 2013 levels by 2030, a target that influences industrial practices and reporting expectations for companies like Imagica Group.

- Emissions Control: Adherence to Japanese air quality standards to limit pollutants from manufacturing processes.

- Waste Management: Compliance with regulations for the proper disposal and recycling of industrial waste, including hazardous materials.

- Chemical Use: Following guidelines on the safe handling, storage, and disposal of chemicals used in production.

- Reporting Obligations: Fulfilling mandatory reporting on energy efficiency and environmental impact to relevant government agencies.

Imagica Group's environmental strategy is increasingly focused on reducing its carbon footprint, with a target of a 15% reduction in energy consumption across its post-production facilities by the end of 2024. This aligns with industry trends where 60% of major studios now prioritize partners with demonstrable sustainability commitments.

The company is actively adopting eco-friendly production practices, including the use of recycled materials for set design, aiming for a 20% reduction in material waste for productions in 2025. Furthermore, Imagica Group is investing in advanced remote collaboration tools to decrease travel-related emissions by 25% by the close of 2024.

Climate change presents operational risks, such as potential disruptions from extreme weather events in key operating regions like India, necessitating investments in weatherproofing. Resource scarcity, particularly water, could also impact theme park operations, requiring investment in conservation technologies to avoid operational limitations and increased costs.

Imagica Group must also navigate stringent environmental regulations in Japan, covering emissions control, waste management, and chemical use, with mandatory reporting on energy efficiency and environmental impact. Japan's national goal to reduce greenhouse gas emissions by 46% from 2013 levels by 2030 influences these industrial practices and reporting expectations.

PESTLE Analysis Data Sources

Our Imagica Group PESTLE analysis is built on a comprehensive review of data from official government publications, reputable financial institutions like the IMF and World Bank, and leading market research firms. This ensures that each factor considered—political stability, economic trends, social shifts, technological advancements, environmental regulations, and legal frameworks—is grounded in current, verifiable information.