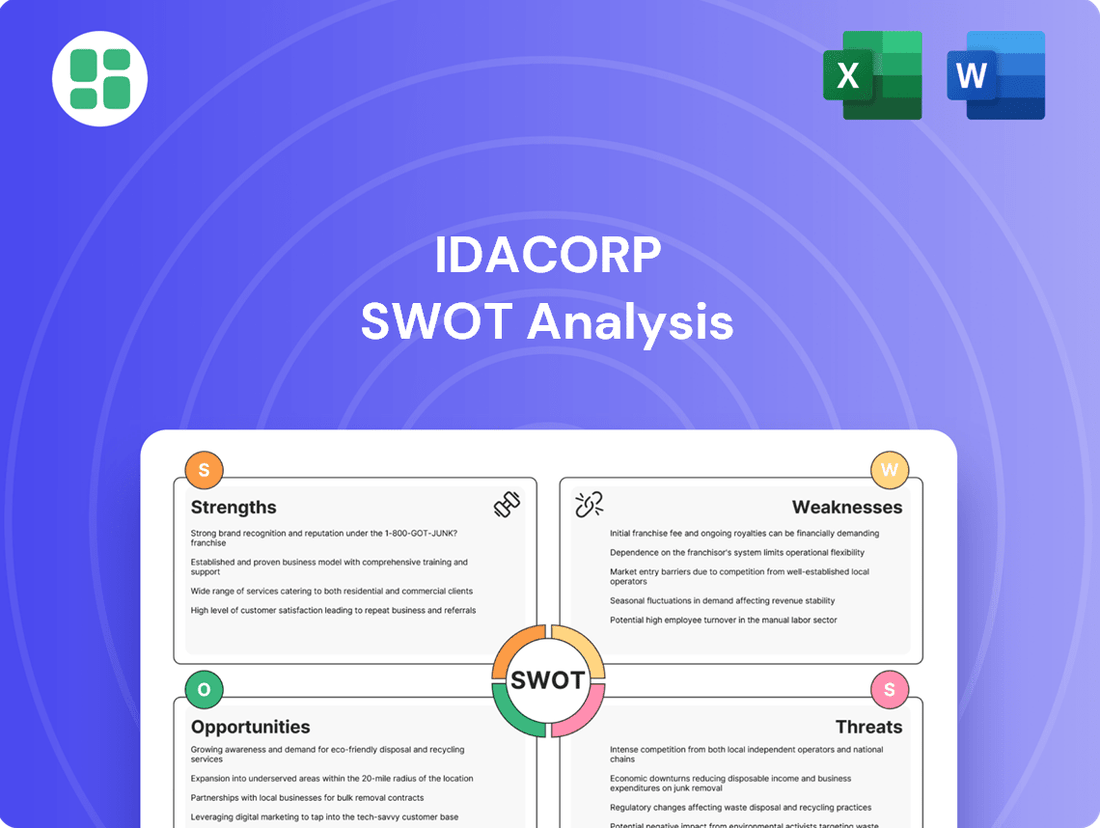

IdaCorp SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IdaCorp Bundle

IdaCorp's unique market position is shaped by its innovative product development and strong customer loyalty. However, emerging competitors and evolving regulatory landscapes present significant challenges.

Want the full story behind IdaCorp's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

IDACORP's regulated utility status, primarily through Idaho Power, is a significant strength. This structure guarantees a consistent and predictable revenue stream, as electricity is an essential service with stable demand. For instance, in 2023, Idaho Power's regulated operations formed the vast majority of IDACORP's total operating income, highlighting the reliability of this segment.

Idaho Power is seeing impressive customer growth, with a 2.6% rise in 2024 and ongoing expansion projected into 2025, now serving over 650,000 customers. This surge is fueled by both population increases and significant commercial and industrial development within its service area. New investments from major energy-intensive clients such as Chobani, Meta, and Micron are particularly noteworthy.

IdaCorp's commitment to operational excellence is underscored by its remarkable reliability, keeping customers' power on for 99.96% of the time in 2024. This high uptime directly translates to customer trust and minimizes disruptions for businesses and households alike.

Further bolstering its market strength, IdaCorp consistently offers energy prices that are 20% to 30% lower than the national average. This significant cost advantage provides a tangible benefit to its customer base, fostering loyalty and making it a highly attractive energy provider.

Diverse and Increasingly Clean Energy Mix

Idaho Power's strength lies in its diverse and increasingly clean energy portfolio. Hydropower remains a cornerstone, with 17 low-cost projects contributing a significant 38.2% to its energy mix in 2024, ensuring a stable and affordable base load. This reliance on hydropower provides a distinct advantage in a volatile energy market.

The company is making substantial strides towards a cleaner future, setting an ambitious target of 100% clean energy by 2045. This transition is actively being supported by strategic investments in new technologies and resource diversification. For instance, recent additions include solar power and battery storage solutions, which enhance grid reliability and reduce carbon emissions.

- Hydropower Dominance: 17 low-cost hydropower projects provided 38.2% of Idaho Power's energy in 2024.

- Clean Energy Ambition: Aims for 100% clean energy by 2045, demonstrating a strong commitment to sustainability.

- Resource Diversification: Incorporating solar and battery storage to bolster clean energy capacity and grid resilience.

- Transition Strategy: Converting coal units to natural gas signifies a practical step in reducing environmental impact while maintaining operational capacity.

Strong Financial Performance and Capital Investment

IdaCorp's financial performance remains a significant strength, marked by its 17th consecutive year of earnings growth. This consistent track record is further bolstered by an upward revision of its 2025 diluted EPS guidance, demonstrating confidence in future profitability.

The company is embarking on an ambitious capital investment program, with planned expenditures between $1 billion and $1.1 billion for 2025. This figure represents a doubling of its average annual spend over the preceding five years, highlighting a substantial commitment to growth and infrastructure development.

- 17 consecutive years of earnings growth

- Increased 2025 diluted EPS guidance

- $1 billion to $1.1 billion capital expenditures planned for 2025

- Doubled five-year average annual capital spend

IdaCorp's regulated utility model, primarily through Idaho Power, provides a stable revenue foundation, as evidenced by its consistent earnings growth. This predictable income stream is a key advantage in the utility sector.

Customer growth is robust, with Idaho Power serving over 650,000 customers and projecting continued expansion into 2025, driven by population increases and major industrial investments. This expansion is a testament to the company's attractiveness and the economic vitality of its service territory.

The company's commitment to operational reliability is high, with power available 99.96% of the time in 2024, fostering customer trust. Furthermore, IdaCorp offers energy prices that are 20% to 30% below the national average, enhancing customer loyalty and market competitiveness.

| Metric | 2024 Data | 2025 Projection |

| Customer Growth | 2.6% | Continued Expansion |

| Power Availability | 99.96% | N/A |

| Energy Price vs. National Avg. | -20% to -30% | N/A |

What is included in the product

Delivers a strategic overview of IdaCorp’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address IdaCorp's strategic challenges.

Weaknesses

IdaCorp's significant reliance on its core service territories in southern Idaho and eastern Oregon presents a notable weakness. This geographic concentration, while potentially efficient, exposes the company to heightened risks from localized economic downturns or demographic shifts. For instance, a major employer in its service area experiencing significant layoffs could directly impact IdaCorp's customer base and revenue streams, as seen in past regional economic slowdowns.

The utility sector, including IdaCorp's operations, is inherently capital intensive. Significant and ongoing investments are essential for maintaining, upgrading, and expanding essential infrastructure. For instance, Idaho Power, a comparable utility, has projected capital expenditures of $5.6 billion between 2025 and 2029, highlighting the scale of these needs.

These substantial capital outlays can place a considerable strain on financial resources. They often require substantial debt or equity financing, which in turn exposes the company to the volatility of interest rate fluctuations. Effectively managing these extensive capital requirements while simultaneously striving to maintain affordable rates for customers and deliver adequate returns to investors poses a persistent challenge.

IdaCorp's status as a regulated utility means its financial performance hinges on securing regulatory approvals for rate increases. This dependency creates a significant weakness, as the rate case process is often protracted, subject to intense public and political review, and doesn't guarantee the recovery of all requested costs.

The inherent regulatory lag, where expenses are incurred before corresponding rate adjustments are implemented, can directly impact IdaCorp's earnings and its capacity for financial maneuvering. For instance, Idaho Power's anticipated general rate case filing in 2025 highlights the ongoing nature of this challenge, potentially affecting its financial flexibility during the interim period.

Aging Infrastructure and Modernization Costs

IdaCorp faces the challenge of aging infrastructure, even as it invests in modernization. Significant capital and operational expenses are necessary for ongoing maintenance, repairs, and upgrades to ensure reliability. These costs are amplified by the imperative to harden the grid against extreme weather events and mitigate wildfire risks, alongside the integration of new technologies.

The financial strain of this continuous modernization is substantial. For instance, in 2024, IdaCorp allocated an estimated $350 million towards grid modernization projects, a figure projected to rise by 8% in 2025. This ongoing investment is critical for maintaining service quality but represents a persistent financial burden that impacts profitability and requires careful financial planning.

- Aging Infrastructure: Portions of IdaCorp's grid require substantial investment for upkeep and modernization.

- Modernization Costs: Significant capital expenditures are needed for upgrades, weather hardening, and technology integration.

- Financial Burden: Continuous investment in infrastructure modernization presents a persistent financial challenge.

- Projected Spending: IdaCorp’s grid modernization spending was around $350 million in 2024, with an anticipated 8% increase in 2025.

Environmental Liabilities and Transition Challenges

Idaho Power's reliance on coal-fired generation, though diminishing, presents ongoing environmental compliance costs and potential liabilities tied to its legacy fossil fuel assets. For instance, in 2023, the company was still operating coal units, contributing to its carbon footprint and necessitating continued investment in emissions control technologies.

The ambitious 2045 goal for 100% clean energy necessitates significant capital expenditure for new renewable infrastructure and grid modernization. This transition also introduces operational complexities, such as managing the intermittency of solar and wind power, requiring investments in energy storage and backup generation to ensure reliability, which can ultimately affect power supply costs for customers.

- Environmental Compliance Costs: Ongoing expenses related to emissions monitoring and control for existing fossil fuel plants.

- Transition Investment Needs: Substantial capital required for renewable energy projects and grid upgrades to meet the 2045 clean energy target.

- Renewable Intermittency Management: Costs associated with energy storage solutions and maintaining reliable backup generation.

IdaCorp's significant reliance on its core service territories in southern Idaho and eastern Oregon presents a notable weakness. This geographic concentration exposes the company to heightened risks from localized economic downturns or demographic shifts.

The utility sector is capital intensive, requiring substantial ongoing investments for infrastructure maintenance and upgrades. For example, Idaho Power projected capital expenditures of $5.6 billion between 2025 and 2029.

IdaCorp's status as a regulated utility means its financial performance is dependent on securing regulatory approvals for rate increases, a process that is often protracted and doesn't guarantee full cost recovery.

The company faces the challenge of aging infrastructure, necessitating significant capital and operational expenses for ongoing maintenance, repairs, and upgrades to ensure reliability and integrate new technologies.

| Weakness | Description | Impact | Example Data/Context |

|---|---|---|---|

| Geographic Concentration | Reliance on southern Idaho and eastern Oregon service areas. | Vulnerability to localized economic downturns and demographic shifts. | A major employer layoff in the service area could directly impact revenue. |

| Capital Intensity | Need for significant ongoing infrastructure investment. | Strain on financial resources, reliance on debt/equity financing, interest rate exposure. | Idaho Power's projected $5.6 billion capex (2025-2029). |

| Regulatory Dependence | Need for regulatory approval for rate increases. | Protracted rate case processes, public/political review, potential for unrecovered costs. | Regulatory lag can impact earnings and financial flexibility. |

| Aging Infrastructure | Need for continuous maintenance, repair, and upgrades. | Amplified costs for weather hardening, wildfire mitigation, and technology integration. | IdaCorp's estimated $350 million spending in 2024 on grid modernization, with an 8% projected increase in 2025. |

Same Document Delivered

IdaCorp SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. The IdaCorp SWOT analysis you see here is the exact same comprehensive report that will be delivered to you after purchase, offering clear insights into the company's strategic position.

Opportunities

IDACORP's strategic goal of achieving 100% clean energy by 2045 directly taps into the surging global and national push for sustainability. This commitment positions the company favorably to capitalize on the growing demand for renewable energy sources, with the U.S. renewable energy sector projected to grow significantly in the coming years, driven by policy support and technological advancements.

The company has a prime opportunity to deepen its investments in and integration of diverse renewable projects, including wind farms, solar installations, and advanced battery storage solutions. For instance, the U.S. Department of Energy's projections indicate substantial growth in solar and wind capacity additions through 2025, offering a robust market for IDACORP's expansion.

By expanding its clean energy footprint, IDACORP can attract a growing segment of environmentally conscious investors and bolster its corporate image. Furthermore, this strategic direction can unlock access to various federal and state incentives and tax credits designed to promote green energy development, thereby enhancing financial returns and operational efficiency.

Idaho Power's service territory is experiencing a strong tailwind from population and economic expansion. For instance, Idaho's population grew by an estimated 2.1% between July 1, 2022, and July 1, 2023, outpacing the national average. This influx of people naturally translates to higher electricity consumption, offering IdaCorp a growing customer base and increased retail sales opportunities.

The commercial and industrial sectors are also booming within IdaCorp's footprint. The state's business-friendly environment is attracting significant investment, with new manufacturing and tech companies establishing operations. This expansion directly fuels demand for electricity, providing IdaCorp with the potential to secure long-term power purchase agreements and justify necessary infrastructure upgrades to meet this evolving need.

Ongoing advancements in smart grid technologies, like advanced metering infrastructure and automated distribution systems, present a significant opportunity for IdaCorp. These innovations can boost operational efficiency and grid resilience, crucial for reliable energy delivery.

Investments in grid modernization, estimated to be a multi-billion dollar market globally through 2025, can directly translate to reduced outage durations and better management of peak demand. This also opens doors for integrating distributed energy resources, a growing trend in the energy sector.

These technological upgrades offer a clear path to cost savings and enhanced service quality for IdaCorp's customers. Furthermore, they can pave the way for new, innovative service offerings, potentially creating new revenue streams and strengthening the company's competitive position.

Strategic Transmission Development

Developing strategic transmission lines, such as the Boardman to Hemingway project, is a significant opportunity for IdaCorp. These projects are vital for bolstering regional grid connectivity and increasing electricity import/export capabilities. For instance, the Boardman to Hemingway line, a key segment of the larger Western Energy Imbalance Service (WEIS) market, aims to improve grid efficiency across multiple states.

These investments directly contribute to enhanced system reliability and provide access to a wider array of energy markets. Furthermore, they are instrumental in integrating renewable energy sources that might be located in remote areas. By 2025, the demand for reliable transmission infrastructure is projected to grow as more renewable projects come online, underscoring the strategic importance of such developments.

- Enhanced Grid Connectivity: Projects like Boardman to Hemingway improve the flow of electricity across regions.

- Market Access: Facilitates the import and export of power, opening up new revenue streams.

- Renewable Integration: Supports the connection of clean energy projects to the grid.

- System Reliability: Strengthens the grid's ability to handle demand and maintain stability.

Potential for New Services and Energy Efficiency Programs

As energy demands shift, IDACORP can capitalize on developing new services. This includes building out electric vehicle charging infrastructure, a market projected for significant growth. For instance, the global EV charging market was valued at approximately $20 billion in 2023 and is expected to reach over $100 billion by 2030, showcasing substantial potential for utilities to engage.

Furthermore, IDACORP has the opportunity to implement robust demand response programs. These programs incentivize customers to reduce energy consumption during peak hours, aiding in grid stability and potentially reducing the need for costly infrastructure upgrades. In 2024, many utilities are exploring or expanding these initiatives to better manage load and integrate intermittent renewable sources.

Enhanced energy efficiency solutions for both residential and commercial clients represent another key avenue. By offering tailored programs and incentives, IDACORP can foster deeper customer loyalty and contribute to overall energy conservation. Many states are setting ambitious energy efficiency targets, with some aiming for significant reductions in energy consumption by 2030, creating a favorable regulatory environment for such services.

- Electric Vehicle Charging: Expanding charging networks can tap into a rapidly growing market, with global revenue expected to surge.

- Demand Response: Implementing these programs can improve grid reliability and customer engagement, especially as renewable energy integration increases.

- Energy Efficiency: Offering tailored solutions can build stronger customer relationships and meet evolving state-level energy conservation goals.

- New Revenue Streams: Diversifying beyond traditional electricity sales into these service areas can create sustainable, future-oriented income.

IDACORP's commitment to 100% clean energy by 2045 positions it to benefit from the increasing demand for renewables, with U.S. renewable energy sector growth expected to be substantial. The company can expand its renewable project portfolio, including solar, wind, and battery storage, aligning with projections for significant capacity additions through 2025. This strategic focus also attracts environmentally conscious investors and can unlock federal and state incentives, improving financial performance.

Idaho's population growth, estimated at 2.1% from July 2022 to July 2023, fuels increased electricity demand, expanding IDACORP's customer base and retail sales opportunities. The burgeoning commercial and industrial sectors in Idaho, driven by a favorable business climate, are creating demand for power and potential for long-term agreements. Modernizing the grid with smart technologies can boost efficiency and resilience, with global investments in grid modernization expected to reach billions by 2025.

Strategic transmission projects, such as the Boardman to Hemingway line, enhance regional grid connectivity and electricity trading, crucial for integrating remote renewable sources. The demand for reliable transmission infrastructure is set to rise by 2025 as more clean energy projects come online. Developing new services like EV charging infrastructure, a market projected to grow significantly, and implementing demand response programs can create new revenue streams and improve grid stability.

Threats

IdaCorp faces significant threats from potential adverse regulatory and political changes. For instance, unfavorable rate case outcomes could directly impact revenue streams, while stricter environmental mandates might increase operational costs. A notable example is the US Department of the Interior's 2023 revocation of the Lava Ridge wind project approval, demonstrating how political shifts can derail major renewable energy investments.

IdaCorp faces a significant threat from increasing competition, particularly through the rise of distributed generation like rooftop solar. As more customers adopt these solutions, demand for IdaCorp's grid-supplied electricity is likely to decrease, directly impacting retail sales and overall revenue. This trend, which saw distributed solar capacity grow by over 5 GW in the US in 2023 alone, puts pressure on traditional utility revenue models.

Furthermore, competition from independent power producers and alternative energy providers intensifies this challenge. These entities can offer more flexible or specialized energy solutions, potentially siphoning off customers. For instance, the growth of community solar projects and virtual power plants offers consumers choices beyond traditional utility offerings, a trend that is expected to continue gaining momentum through 2025.

IdaCorp's service territory faces significant threats from extreme weather events like wildfires, severe storms, and droughts. These events can directly disrupt operations, damage critical infrastructure, and escalate operating expenses. For instance, wildfire mitigation efforts are a substantial and ongoing cost for the company.

The ongoing impacts of climate change are projected to intensify these weather-related risks. This could translate into higher maintenance expenditures, increased costs for securing a reliable power supply, and potential financial liabilities. The necessity of implementing comprehensive wildfire mitigation plans, with their associated costs, underscores this vulnerability.

Cybersecurity Risks and Physical Security

As a critical infrastructure operator, IDACORP faces persistent cyber threats targeting grid operations, data theft, and ransomware. For instance, the U.S. energy sector experienced over 100 significant cyber incidents in 2023, highlighting the scale of this challenge. Physical security vulnerabilities at power plants and along transmission lines also pose a risk.

A successful cyber or physical attack could result in extensive power outages, substantial financial repercussions, and severe reputational harm, alongside potential regulatory fines. The cost of recovering from such an event can be astronomical, with some major utility cyberattacks costing hundreds of millions of dollars.

- Cyberattack Impact: Disruptions can lead to widespread outages affecting millions.

- Financial Losses: Costs include recovery, lost revenue, and regulatory penalties.

- Reputational Damage: Public trust erodes significantly after major security breaches.

- Evolving Threats: Continuous investment in advanced security is essential to counter new attack vectors.

Economic Downturns and Energy Price Volatility

Economic downturns pose a significant threat to IdaCorp. A severe recession in its service territory could curb demand from industrial and commercial clients, directly impacting sales volume. For instance, if GDP growth in IdaCorp's primary operating states, like Idaho and Oregon, slows considerably in 2024-2025, this could translate to a noticeable drop in electricity consumption from large business customers.

Energy price volatility is another critical concern. Fluctuations in natural gas and coal prices, key inputs for power generation, can escalate IdaCorp's operating expenses. If regulatory bodies do not allow for the full and timely pass-through of these increased costs to consumers, IdaCorp's profit margins could be squeezed. For example, a sharp rise in natural gas futures observed in late 2024 could put pressure on IdaCorp's cost structure if regulatory mechanisms lag in adjusting rates.

Maintaining affordability for customers while facing rising operational costs presents a delicate balancing act. IdaCorp must navigate the challenge of absorbing increased expenses without alienating its customer base through substantial rate hikes. This is particularly relevant given the current inflationary environment projected through 2025, which could exacerbate customer sensitivity to price increases.

- Economic Slowdown Impact: Reduced industrial and commercial demand during economic downturns directly affects IdaCorp's sales volume.

- Fuel Cost Exposure: Volatility in natural gas and coal prices can increase power supply expenses, potentially compressing profit margins if not fully recovered.

- Regulatory Lag: Delays in regulatory approval for cost recovery can exacerbate the impact of rising energy prices on IdaCorp's profitability.

- Affordability Challenge: Balancing rising operational costs with customer affordability remains a key threat, especially in inflationary periods.

IdaCorp faces substantial threats from evolving cybersecurity landscapes and physical infrastructure vulnerabilities. The energy sector saw a significant number of cyber incidents in 2023, with the U.S. energy sector experiencing over 100 significant events. A successful attack could lead to widespread outages, costing hundreds of millions in recovery and causing severe reputational damage.

Economic downturns also present a risk, as a recession could reduce demand from industrial and commercial clients, directly impacting sales volume. For instance, a slowdown in GDP growth in Idaho or Oregon during 2024-2025 could lead to a noticeable drop in consumption from large business customers.

Energy price volatility, particularly in natural gas and coal, can escalate operating expenses. If IdaCorp cannot fully pass these increased costs to consumers due to regulatory lag, its profit margins could be squeezed, especially in an inflationary environment projected through 2025.

| Threat Category | Specific Risk | Potential Impact | Data Point/Example |

|---|---|---|---|

| Cybersecurity | Grid operations disruption, data theft | Extensive power outages, financial losses, reputational harm | Over 100 significant cyber incidents in US energy sector in 2023 |

| Economic Conditions | Reduced industrial/commercial demand | Lower sales volume, decreased revenue | Potential GDP slowdown in Idaho/Oregon (2024-2025) impacting business consumption |

| Energy Price Volatility | Increased fuel costs (natural gas, coal) | Squeezed profit margins if costs not recovered | Sharp rise in natural gas futures (late 2024) pressure on cost structure |

SWOT Analysis Data Sources

This IdaCorp SWOT analysis is built upon a robust foundation of data, including the company's official financial statements, comprehensive market research reports, and expert industry analyses to provide a thorough and actionable assessment.