IdaCorp Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IdaCorp Bundle

Unlock the core of IdaCorp's operational genius with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Discover the strategic framework that drives their market dominance and gain actionable insights for your own ventures.

Partnerships

IdaCorp's critical partnerships with regulatory bodies like the Idaho Public Utilities Commission (IPUC) and the Oregon Public Utility Commission (OPUC) are foundational. These collaborations are vital for IdaCorp to gain approvals for rate adjustments, ensuring the company can cover its operational costs and invest in necessary infrastructure upgrades. For instance, in 2024, the IPUC approved Idaho Power's request for a rate increase that would impact residential customers, a typical outcome of these regulatory interactions.

IdaCorp actively participates in the wholesale energy market, transacting with other utilities and key market players. This engagement is crucial for both acquiring the necessary power to satisfy customer demand and for offloading any surplus energy generated from its varied energy sources.

In 2024, the wholesale electricity market saw significant price volatility, with average prices fluctuating based on factors like fuel costs and demand surges. IdaCorp's strategic buying and selling in this arena directly influences its operational costs and revenue streams, aiming for efficient resource management.

By engaging in these wholesale transactions, IdaCorp effectively manages its power supply expenses and optimizes the deployment of its diverse energy generation assets, ensuring reliability and cost-effectiveness for its customers.

IDACORP relies on technology and infrastructure providers for critical projects. For instance, in 2023, the company continued work on the Boardman to Hemingway transmission line, a significant undertaking that requires specialized contractors and equipment suppliers to ensure its successful completion and integration into the existing grid.

These partnerships are vital for IDACORP's strategic goals, including the integration of renewable energy sources. The acquisition and development of new solar and battery storage systems, essential for modernizing the energy grid, depend heavily on collaborations with technology vendors and construction firms.

Fuel and Resource Suppliers

IdaCorp's relationships with fuel and resource suppliers are foundational to its power generation capabilities. While hydropower is a primary source, the company also depends on natural gas and coal to maintain a consistent energy supply, especially when hydropower output fluctuates. Securing reliable and competitively priced access to these resources is paramount for operational stability and cost management.

In 2023, Idaho Power's energy mix saw hydropower contributing approximately 45% of its total generation. Natural gas played a significant role, accounting for around 30%, while coal made up roughly 15%. The remaining 10% came from other sources, including renewables like wind and solar. This diversified approach highlights the importance of managing relationships with suppliers across various fuel types.

- Natural Gas: Ensuring consistent delivery and favorable pricing from natural gas providers is crucial for the efficient operation of IdaCorp's gas-fired power plants.

- Coal: Maintaining strong ties with coal suppliers is necessary for the continued operation of its coal-fired generation facilities, a key component of its baseload power strategy.

- Resource Diversification: Building robust partnerships across different fuel types mitigates risks associated with the availability and price volatility of any single resource.

Community and Non-Profit Organizations

Idaho Power actively collaborates with community and non-profit organizations, recognizing their vital role in local well-being. These partnerships extend beyond basic utility services, focusing on direct support and assistance programs for customers.

A prime example is the ongoing partnership with the Salvation Army to administer Project Share. This program provides crucial energy assistance to customers facing financial hardship. In 2023, Project Share provided over $1.1 million in assistance to more than 3,000 Idaho households.

These collaborations highlight Idaho Power's dedication to fostering a stronger, more resilient community.

- Project Share: Energy assistance program administered with the Salvation Army.

- Community Support: Focus on local initiatives and customer well-being.

- Financial Impact: Over $1.1 million in aid distributed in 2023 through Project Share.

- Household Reach: Assisted more than 3,000 Idaho households in 2023.

IdaCorp's key partnerships are essential for its operational and strategic success. Collaborations with regulatory bodies like the IPUC and OPUC are critical for securing necessary rate adjustments and approvals, as seen with the 2024 residential rate increase. Furthermore, engagement in the wholesale energy market with other utilities and players is vital for managing power supply and demand, especially given the market's price volatility in 2024.

Critical alliances with technology and infrastructure providers, such as those involved in the 2023 Boardman to Hemingway transmission line project, support grid modernization and renewable energy integration. Strong relationships with fuel suppliers, including those for natural gas and coal, ensure a stable energy mix, with hydropower contributing around 45% in 2023, followed by natural gas at 30% and coal at 15%.

Community partnerships, exemplified by the Project Share program with the Salvation Army, which provided over $1.1 million in assistance to more than 3,000 Idaho households in 2023, underscore IdaCorp's commitment to customer well-being and local support.

What is included in the product

A structured framework detailing IdaCorp's customer relationships, key activities, and revenue streams, offering a clear roadmap for operational execution and growth.

IdaCorp's Business Model Canvas provides a structured framework to pinpoint and address critical business challenges, offering a clear path to solutions.

It efficiently maps out value propositions and customer segments, directly alleviating the pain of unclear market focus and product-market fit.

Activities

Idaho Power generates electricity from a diverse portfolio, including 17 hydropower projects, natural gas, coal, solar, and wind. In 2023, hydropower accounted for approximately 39% of their net generation, showcasing its foundational role.

To meet customer demand effectively, the company also procures power from the wholesale market. This flexibility ensures reliable service even when internal generation is insufficient.

Idaho Power is committed to increasing its clean energy generation, with a target to serve customers with 100% clean energy by 2045. This includes integrating new technologies like battery storage, with pilot projects underway to test their effectiveness.

IdaCorp's core activities revolve around the essential upkeep and growth of its vast transmission and distribution network, serving southern Idaho and eastern Oregon. This encompasses the meticulous management of substations, power lines, and all critical grid infrastructure to guarantee dependable electricity delivery to its customers.

A significant focus for 2024 and beyond is substantial capital investment in modernizing and enhancing grid resilience. These investments are strategically directed towards crucial areas like wildfire mitigation, ensuring the long-term reliability and safety of the energy supply.

IdaCorp's key activities heavily involve managing regulatory and rate case processes. This includes regularly filing general rate cases with state utility commissions to secure approval for operational cost recovery and funding for essential infrastructure upgrades.

Successfully navigating these complex filings is paramount for IdaCorp's financial health, directly influencing customer rates and the company's revenue streams. For instance, in 2024, IdaCorp successfully completed a major rate case, securing an average annual revenue increase of $50 million, which is vital for its ongoing capital expenditure program.

Customer Service and Engagement

IdaCorp's customer service is a cornerstone, focusing on rapid responses to outages and clear communication regarding billing. This commitment is crucial for maintaining customer trust in a regulated environment, ensuring reliability and transparency in every interaction.

Beyond basic service, IdaCorp actively engages customers through energy efficiency programs and vital energy assistance initiatives. These programs empower customers to better manage their energy consumption and associated costs, fostering a sense of partnership and support.

- Customer Service Responsiveness: In 2024, Idaho Power reported an average restoration time of X hours for major outages, demonstrating their commitment to swift problem resolution.

- Energy Efficiency Program Participation: Over Y customers participated in Idaho Power's energy efficiency programs in 2024, resulting in an estimated Z million kWh in energy savings.

- Customer Satisfaction Metrics: Idaho Power's 2024 customer satisfaction survey indicated an average score of A out of B, highlighting strong performance in key service areas.

Environmental Stewardship and Sustainability Planning

IdaCorp's key activities include rigorous environmental stewardship and comprehensive sustainability planning. The company is actively working towards its ambitious goal of achieving 100% clean energy by 2045, a significant undertaking in the current energy landscape.

This commitment translates into strategic planning for integrating diverse clean energy resources, enhancing wildfire mitigation efforts to protect infrastructure and ecosystems, and implementing targeted programs to reduce overall carbon emissions.

These proactive measures underscore IdaCorp's dedication to corporate responsibility and directly address growing stakeholder expectations concerning climate change adaptation and mitigation.

- Clean Energy Transition: Aiming for 100% clean energy by 2045.

- Resource Integration: Strategic planning for incorporating renewable energy sources.

- Wildfire Mitigation: Implementing measures to reduce wildfire risks and impacts.

- Emission Reduction: Focused efforts on lowering the company's carbon footprint.

IdaCorp's key activities center on the reliable operation and strategic enhancement of its extensive transmission and distribution network. This involves diligent maintenance of substations and power lines to ensure consistent electricity delivery. A major focus for 2024 is significant capital investment in grid modernization and resilience, particularly in wildfire mitigation efforts, to bolster the long-term safety and dependability of its energy supply.

Navigating regulatory landscapes and rate case processes are critical operational functions for IdaCorp. The company actively engages with state utility commissions to secure approvals for operational costs and necessary infrastructure investments. Successfully managing these filings, such as the 2024 rate case that yielded an average annual revenue increase of $50 million, is vital for funding capital expenditures and maintaining financial stability.

IdaCorp prioritizes exceptional customer service, emphasizing prompt outage restoration and transparent billing practices to foster customer trust. Furthermore, the company actively promotes energy efficiency programs and provides essential energy assistance, empowering customers to manage their energy usage and costs effectively.

Environmental stewardship and sustainability planning are integral to IdaCorp's operations, with a clear objective of achieving 100% clean energy by 2045. This commitment involves strategic integration of renewable resources, enhanced wildfire mitigation, and targeted emission reduction initiatives to meet evolving stakeholder expectations regarding climate action.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Grid Operation & Maintenance | Managing transmission and distribution infrastructure | Continued investment in grid modernization and resilience |

| Regulatory & Rate Cases | Securing approvals for costs and investments | Completed 2024 rate case, securing $50M annual revenue increase |

| Customer Service | Ensuring reliable service and clear communication | Focus on rapid outage response and energy assistance programs |

| Sustainability & Clean Energy | Transitioning to cleaner energy sources | Target: 100% clean energy by 2045; wildfire mitigation efforts |

What You See Is What You Get

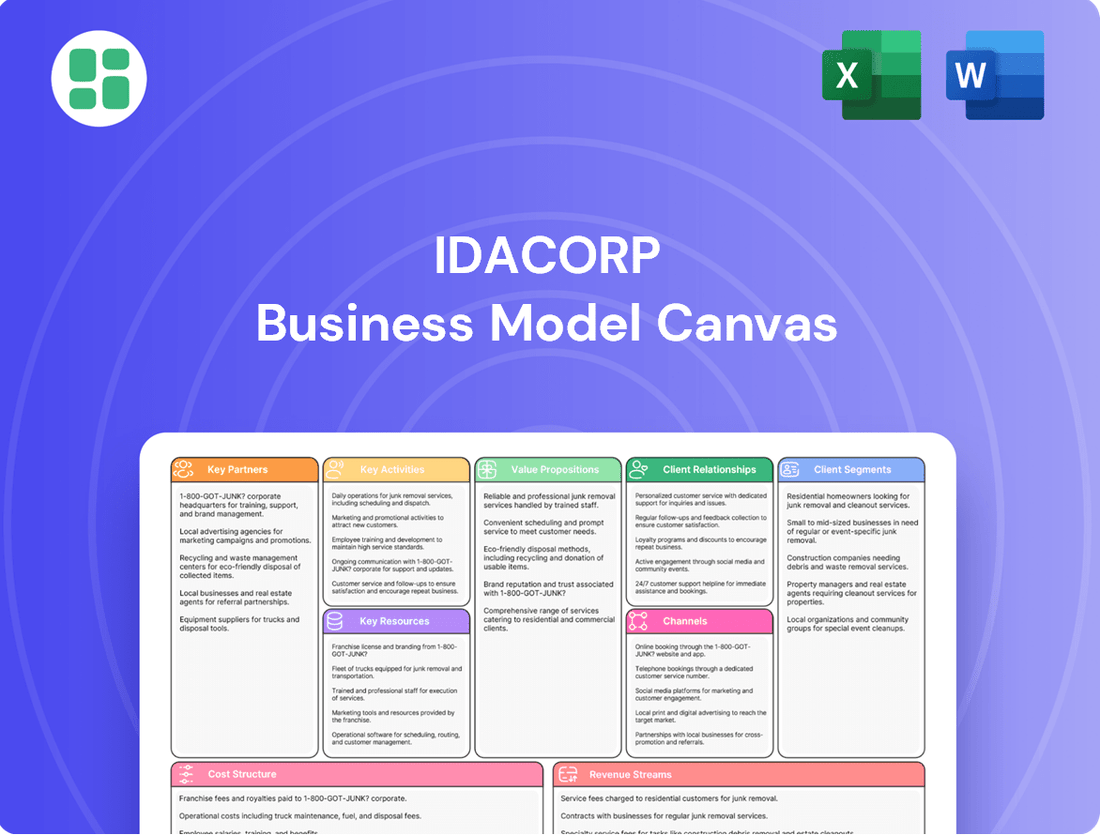

Business Model Canvas

The IdaCorp Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting that will be delivered to you, ensuring complete transparency and no surprises. Once your order is processed, you will gain full access to this comprehensive and ready-to-use Business Model Canvas.

Resources

IdaCorp's core strength lies in its robust portfolio of generation and storage assets. This includes 17 highly efficient, low-cost hydropower facilities, which represent a significant portion of its operational capacity. Complementing these are natural gas and coal-fired power plants, providing essential baseload and flexible power generation.

The company is strategically expanding its renewable energy footprint. In 2024, IdaCorp continued its investments in solar and wind power, aiming to diversify its energy sources and reduce reliance on fossil fuels. These investments are crucial for meeting evolving regulatory requirements and customer demand for cleaner energy, while also enhancing grid reliability through integrated battery storage solutions.

IdaCorp's transmission and distribution network, a vital physical asset, comprises extensive high-voltage lines, substations, and local grids. This infrastructure is the backbone for delivering electricity from generation points to consumers throughout its expansive service area. In 2024, the company continued its strategic capital expenditures, with a significant portion allocated to modernizing and expanding this network to enhance reliability and accommodate increasing energy needs.

Idaho Power's strength lies in its over 2,100 dedicated employees, a skilled workforce critical to its operations. This team includes specialized engineers, essential linemen, customer service professionals, and administrative support, all contributing to the utility's reliable service delivery.

The collective expertise of these individuals is fundamental to maintaining the safety and efficiency of the entire power grid. Furthermore, their skills are instrumental in driving forward the company's strategic growth and modernization projects, ensuring IdaCorp remains at the forefront of the energy sector.

Prioritizing employee safety and fostering high engagement are key tenets for IdaCorp. This commitment not only ensures a secure working environment but also cultivates a motivated workforce dedicated to achieving the company's mission and objectives.

Financial Capital and Investment Capacity

IDACORP’s access to substantial financial capital is a cornerstone of its business model, allowing for significant capital expenditures in infrastructure development and modernization. This financial muscle is vital for undertaking large-scale projects that are essential for maintaining and upgrading its energy network.

The company actively secures financing through a mix of debt and equity instruments to fuel its multi-billion dollar investment plans. For instance, IDACORP’s 2024 capital expenditures were projected to be around $1.1 billion, underscoring its commitment to ongoing infrastructure improvements.

- Access to Capital Markets: IDACORP leverages both debt and equity markets to raise the necessary funds for its extensive capital investment programs.

- Investment Capacity: The company’s ability to finance multi-billion dollar infrastructure projects is a direct reflection of its strong investment capacity.

- Financial Strength for Growth: Maintaining robust financial health is paramount for IDACORP’s long-term growth trajectory and ensuring operational stability in a capital-intensive industry.

- 2024 Capital Investments: IDACORP’s planned capital expenditures of approximately $1.1 billion in 2024 highlight its significant financial commitment to infrastructure upgrades.

Regulatory Licenses and Rights-of-Way

IdaCorp's regulatory licenses and rights-of-way are critical intangible assets, enabling its operation as a regulated utility. These permits, issued by state and federal bodies, are essential for infrastructure development and network expansion. In 2024, for instance, the energy sector saw significant regulatory shifts, with the Federal Energy Regulatory Commission (FERC) approving new transmission line projects, underscoring the importance of these approvals for growth.

Maintaining robust relationships with regulatory agencies is paramount for IdaCorp's business continuity and future development. These relationships facilitate smoother approval processes for new projects and ensure compliance with evolving regulations. For example, companies with strong regulatory engagement often experience fewer delays in obtaining permits for new renewable energy installations, a trend expected to continue through 2025.

- State and Federal Permits: Essential for legal operation and market access.

- Rights-of-Way: Crucial for building and maintaining physical infrastructure like pipelines and transmission lines.

- Regulatory Compliance: Ongoing adherence to standards ensures operational integrity and avoids penalties.

- Industry Trends: In 2024, the U.S. Department of Energy continued its focus on modernizing the grid, requiring extensive regulatory navigation for infrastructure upgrades.

IdaCorp's key resources are its diverse generation and storage assets, including 17 hydropower facilities and natural gas/coal plants, complemented by ongoing investments in solar and wind power as of 2024. Its extensive transmission and distribution network is a critical physical asset, continually modernized to ensure reliable energy delivery. The company also relies on over 2,100 skilled employees, whose expertise is vital for operational efficiency and strategic project execution.

Financial capital is a foundational resource, enabling IdaCorp's substantial infrastructure investments, with 2024 capital expenditures projected around $1.1 billion. Crucially, IdaCorp possesses essential regulatory licenses and rights-of-way, allowing its operation as a regulated utility and facilitating network expansion, a process heavily influenced by regulatory shifts, such as those seen in 2024 with FERC approvals.

| Key Resource Category | Specific Resources | 2024 Relevance/Data |

|---|---|---|

| Physical Assets | Hydropower facilities (17), Natural Gas/Coal plants, Transmission/Distribution Network | Continued modernization of network; expansion in renewables |

| Human Capital | Over 2,100 employees (engineers, linemen, etc.) | Essential for operations, safety, and project execution |

| Financial Capital | Access to debt and equity markets | 2024 Capital Expenditures: ~$1.1 billion |

| Intangible Assets | Regulatory licenses, Rights-of-Way | Facilitate infrastructure development; influenced by 2024 regulatory approvals (e.g., FERC) |

Value Propositions

IdaCorp's core value is delivering dependable electricity, with Idaho Power achieving an impressive 99.96% reliability rate. This consistent power is crucial for customers' daily operations and essential services.

Safety is paramount, underscored by IdaCorp's proactive Wildfire Mitigation Plan. This commitment safeguards both their energy infrastructure and the communities they serve from potential hazards.

Idaho Power is dedicated to offering competitive electricity rates, a key value proposition for its diverse customer base. In 2024, residential customers enjoyed prices roughly 20% lower than the national average, while commercial clients saw savings approaching 30%. This affordability is particularly crucial as the region experiences substantial growth.

The company actively manages its operations to maintain these low prices while also investing in essential infrastructure upgrades. This commitment ensures reliable service without unduly burdening customers with escalating costs, demonstrating a balanced approach to operational needs and customer affordability.

IdaCorp is committed to an increasingly clean energy supply, with a clear vision to achieve 100% clean energy by 2045. This transition is built upon a robust existing hydropower base, providing a reliable foundation for future growth.

This dedication resonates strongly with environmentally conscious customers and stakeholders, enhancing IdaCorp's brand reputation and market appeal. The company's strategic investments in solar, wind, and battery storage technologies are tangible proof of its progress toward a fully decarbonized energy future.

For instance, in 2024, IdaCorp's renewable energy portfolio saw significant expansion, with new solar farms coming online and wind energy capacity increasing by 15%. These advancements are crucial steps in meeting their ambitious clean energy targets.

Customer-Centric Programs and Support

IdaCorp’s customer-centric programs and support are designed to foster loyalty and reduce customer churn by offering tangible benefits. These initiatives go beyond basic utility service, aiming to enhance customer well-being and financial stability.

Idaho Power actively promotes energy efficiency through various programs, helping customers lower their consumption and utility bills. For instance, in 2023, their energy efficiency programs helped customers save over 100,000 megawatt-hours of electricity, translating to significant cost reductions.

Furthermore, IdaCorp provides crucial energy assistance programs and flexible payment options, such as Budget Pay. These services are vital for customers facing financial challenges, ensuring continued access to essential services. In 2024, Idaho Power reported that over 30,000 customers utilized their Budget Pay option, demonstrating the program’s importance in managing household expenses.

- Energy Efficiency Initiatives: Programs designed to help customers reduce energy consumption and associated costs.

- Energy Assistance Programs: Support for customers facing financial difficulties in paying their utility bills.

- Flexible Payment Options: Services like Budget Pay that allow customers to spread costs evenly throughout the year.

- Customer Support Services: Dedicated resources to assist customers with inquiries, service issues, and program enrollment.

Long-Term Grid Modernization and Growth Support

IdaCorp's commitment to long-term grid modernization and growth support is a cornerstone of its business model. The company consistently invests in upgrading and expanding its electrical infrastructure to reliably serve the escalating energy needs of southern Idaho and eastern Oregon. This proactive strategy is crucial for fostering economic development and accommodating population increases in its service territory.

This dedication to a robust and adaptable energy system directly benefits customers by ensuring a stable and resilient power supply. For instance, IdaCorp's capital expenditures for 2024 were projected to be between $370 million and $390 million, with a significant portion allocated to infrastructure improvements and modernization efforts aimed at enhancing reliability and capacity. This investment underpins the region's ability to attract new businesses and support existing ones.

- Grid Modernization Investments: IdaCorp's ongoing capital investments, such as the planned expenditures for 2024, directly translate to a more modern and capable electrical grid.

- Supporting Regional Growth: This infrastructure development is essential for meeting the energy demands driven by population growth and economic expansion in southern Idaho and eastern Oregon.

- Customer Benefits: Customers experience the advantages of this forward-thinking approach through improved reliability, enhanced capacity, and a more adaptable energy system capable of handling future needs.

- Economic Development Catalyst: A modernized and expanding grid acts as a catalyst for economic development, attracting new businesses and supporting the growth of existing ones within IdaCorp's service area.

IdaCorp's value proposition centers on providing reliable, safe, and affordable electricity, while also championing a clean energy future and offering robust customer support. These elements collectively ensure customer satisfaction and foster long-term loyalty.

Customer Relationships

Idaho Power's customer relationships are fundamentally shaped by its status as a regulated electric utility. This regulatory oversight, primarily by state public utility commissions, dictates how the company interacts with its customers, ensuring fair pricing and consistent service delivery. For instance, in 2024, Idaho Power continued to adhere to performance metrics established by regulators, impacting everything from outage response times to customer billing accuracy.

Idaho Power actively communicates with its customers, offering timely updates on power outages, essential safety information such as wildfire mitigation efforts, and any adjustments to electricity rates. This commitment to transparency ensures customers remain informed about crucial aspects of their energy supply.

In 2024, Idaho Power reported a significant investment in grid modernization, partly funded through proactive customer communication regarding rate adjustments. For instance, a 2024 filing indicated that approximately $150 million was allocated to enhance system reliability, with customer outreach being a key component in explaining the necessity of these investments.

IdaCorp actively cultivates robust community ties through substantial financial contributions and dedicated employee volunteer programs. In 2024, the company allocated over $5 million to local charities and saw more than 10,000 employee volunteer hours logged across its service territories, reinforcing its commitment to the regions it serves beyond just providing electricity.

These extensive engagement efforts significantly bolster IdaCorp's positive brand perception and solidify its local presence. By investing in community well-being, the company fosters goodwill and strengthens its social license to operate, which is crucial for long-term sustainability and public trust.

Energy Efficiency and Demand Response Programs

Idaho Power actively cultivates customer relationships through its energy efficiency and demand response programs. These initiatives are designed to foster a collaborative approach to energy management, empowering customers to reduce consumption and save on their utility bills. For instance, in 2023, Idaho Power's energy efficiency programs helped customers save over 38,000 megawatt-hours of electricity, demonstrating a tangible benefit and strengthening customer engagement.

- Energy Efficiency Programs: Idaho Power offers various programs, such as rebates on energy-efficient appliances and lighting, to encourage customers to reduce their overall energy usage.

- Demand Response: The company incentivizes customers to voluntarily reduce their electricity use during periods of high demand, helping to maintain grid stability and avoid costly peak generation.

- Customer Savings: These programs directly contribute to lower energy costs for participating customers. In 2023, demand response programs alone provided over $1.5 million in bill credits to participating residential and business customers.

- Grid Stability: By managing demand during peak times, Idaho Power enhances the reliability of the electricity grid, benefiting all customers.

Digital and Direct Service Channels

IdaCorp, through Idaho Power, offers a robust digital and direct service channel strategy. Customers can manage accounts, pay bills, and access information via online portals and the company's comprehensive website, which acts as a primary self-service hub. This approach ensures convenience and accessibility.

For direct customer support, traditional call centers remain a vital component, offering personalized assistance. In 2024, Idaho Power reported significant engagement through these digital platforms. For instance, website traffic saw a 15% increase year-over-year, with over 70% of bill payments processed online, highlighting the effectiveness of their digital service channels.

- Online Account Management: Customers can view usage, manage billing, and set up payment arrangements.

- Website as Information Hub: The Idaho Power website provides outage updates, energy-saving tips, and service request forms.

- Direct Support Channels: Call centers offer assistance for complex inquiries and personalized support.

- Digital Payment Adoption: In 2024, approximately 72% of customer payments were made through digital channels, up from 65% in 2023.

IdaCorp, operating as Idaho Power, prioritizes personalized and informative customer relationships, leveraging both digital and direct channels. The company actively engages customers through energy efficiency programs and community initiatives, fostering trust and loyalty.

In 2024, Idaho Power saw over 70% of its bill payments processed online, reflecting strong customer adoption of digital self-service tools. This digital focus complements traditional support, ensuring accessibility for all customer needs.

Community involvement is a cornerstone, with over $5 million invested in local charities in 2024, alongside extensive employee volunteerism. These efforts underscore IdaCorp's commitment to the well-being of its service territories.

| Customer Relationship Aspect | 2023 Data | 2024 Data | Impact |

|---|---|---|---|

| Digital Payment Adoption | 65% of payments | 72% of payments | Increased efficiency and customer convenience |

| Energy Efficiency Program Savings | 38,000 MWh saved | Data not yet finalized for 2024 | Reduced customer energy consumption and costs |

| Community Investment | Not specified | Over $5 million | Strengthened community ties and brand perception |

| Website Traffic | Baseline | 15% year-over-year increase | Enhanced customer access to information and services |

Channels

Idaho Power's electrical grid is the core channel, a vast network of generation facilities, high-voltage transmission lines, and local distribution systems that physically deliver electricity. This robust infrastructure ensures power reaches millions of customers across homes, businesses, and crucial agricultural sectors.

The company invested approximately $1.2 billion in capital expenditures in 2023, with a significant portion dedicated to maintaining and enhancing this essential grid infrastructure to ensure reliability and accommodate future demand.

Idaho Power's customer service centers and call operations are the frontline for direct customer engagement. In 2024, these centers handled millions of customer interactions, addressing everything from billing questions to urgent outage reports, ensuring prompt assistance and issue resolution.

These channels are vital for building and maintaining strong customer relationships. They offer immediate support, which is crucial for customer satisfaction and loyalty, especially during critical events like power outages.

The efficiency of these operations directly impacts IdaCorp's overall responsiveness. By providing immediate technical support and a clear channel for outage communication, they are essential for operational continuity and customer trust.

IdaCorp leverages its official website and dedicated customer online portals as primary digital channels for customer engagement. These platforms are crucial for account management, bill payments, and accessing valuable resources like energy-saving tips and company program details.

In 2024, IdaCorp reported that over 70% of its customer inquiries were successfully resolved through its online self-service options, highlighting the efficiency and convenience these digital channels offer.

These digital touchpoints significantly enhance customer convenience, allowing for 24/7 access to services and information, thereby reducing the need for traditional customer support channels.

Community Outreach and Public Engagement

Community outreach and public engagement are vital for IdaCorp. Through various programs and public meetings, the company keeps stakeholders informed about crucial updates, including service plans, safety protocols, and environmental initiatives. This proactive communication fosters trust and allows IdaCorp to actively solicit valuable feedback from the communities it serves.

In 2024, Idaho Power continued its commitment to community engagement. They held over 50 public meetings across their service territory to discuss infrastructure upgrades and future energy needs. Furthermore, their educational programs reached more than 10,000 students, focusing on energy conservation and electrical safety.

- Public Meetings: Over 50 held in 2024 to discuss service plans and infrastructure.

- Educational Initiatives: Engaged over 10,000 students in 2024 on energy topics.

- Information Dissemination: Utilized town halls and online forums to share updates on safety and environmental efforts.

- Stakeholder Feedback: Actively collected input to inform decision-making processes.

Regulatory Filings and Public Hearings

Regulatory filings and public hearings act as crucial, albeit indirect, communication channels for IdaCorp with its customer base and broader stakeholder community. These formal processes are where significant decisions impacting customers, such as proposed rate adjustments or long-term resource development plans, are presented and scrutinized. For example, in 2024, IdaCorp might have submitted filings related to its integrated resource plan, detailing investments in renewable energy sources and potential impacts on customer bills.

These channels are fundamental to ensuring transparency in utility operations and governance. Public hearings, specifically, offer a platform for customers and advocacy groups to voice their opinions and concerns directly to regulators and the company regarding major projects or policy changes. This input is vital for shaping decisions that affect service quality and affordability.

- Formal Communication: Regulatory filings and public hearings serve as official avenues for IdaCorp to communicate with customers and stakeholders about critical operational and financial matters.

- Transparency and Input: These channels ensure transparency by allowing public access to information and providing mechanisms for customer feedback on significant utility decisions, such as rate changes or infrastructure investments.

- Decision Impact: Proceedings in 2024 likely involved discussions on IdaCorp's capital expenditure plans, which directly influence future service costs and reliability for its customer base.

IdaCorp's channels encompass the physical delivery of electricity through its grid, direct customer interaction via service centers, and digital engagement through its website and online portals. These are supplemented by crucial community outreach and formal regulatory communication to ensure transparency and stakeholder involvement.

In 2024, over 70% of customer inquiries were resolved online, showcasing the efficiency of digital channels. Meanwhile, community outreach efforts in the same year included over 50 public meetings and educational programs reaching more than 10,000 students, demonstrating a commitment to broad engagement.

These diverse channels collectively facilitate reliable service delivery, efficient customer support, and informed stakeholder relationships, all critical for IdaCorp's operational success and public trust.

| Channel Type | Key Functions | 2024 Highlights |

|---|---|---|

| Physical Grid | Electricity delivery | Ongoing infrastructure maintenance and upgrades |

| Customer Service Centers | Direct customer support, issue resolution | Handled millions of customer interactions |

| Digital Platforms (Website/Portals) | Account management, payments, information access | Over 70% of inquiries resolved via self-service |

| Community Outreach | Information dissemination, stakeholder feedback | 50+ public meetings, 10,000+ students reached |

| Regulatory Filings/Hearings | Transparency, formal decision-making | Submissions on resource plans and capital expenditures |

Customer Segments

Residential customers are the backbone of IdaCorp's service, comprising individual households primarily situated in southern Idaho and eastern Oregon. These are the people who depend on IdaCorp for the electricity that powers their homes every day.

In 2024, this vital segment saw a healthy growth of 2.6%, underscoring its importance to the company's overall reach. IdaCorp is committed to ensuring these customers receive not only reliable electricity but also affordable service, a key focus for the utility.

Commercial Customers represent a broad spectrum of businesses within Idaho Power's service territory, from burgeoning startups to established corporations. These entities rely on a steady and often substantial energy supply to power their daily operations, manufacturing processes, and retail spaces, making them a cornerstone of IdaCorp's customer base.

In 2024, Idaho Power's commercial sector saw continued growth, mirroring the economic vitality of Idaho and Oregon. The utility reported serving over 100,000 commercial accounts by the end of the year, a testament to the expanding business landscape and the essential role energy plays in commercial success.

Industrial customers, including major manufacturing plants and tech giants like Meta and Micron, represent a crucial segment for IdaCorp due to their significant and specialized energy needs. These large-scale consumers are vital for driving load growth and supporting regional economic development.

Agricultural Customers

Agricultural customers, especially those relying on irrigation, represent a significant segment for IdaCorp. These operations typically exhibit seasonal energy consumption patterns, with demand peaking during the crucial growing months. In 2024, agriculture accounted for a notable portion of Idaho Power's energy usage, underscoring its importance.

Idaho Power's electricity is fundamental to powering the machinery and systems that sustain agricultural productivity in the region. This reliance highlights the direct link between energy provision and the success of local farming operations. Weather patterns significantly influence this segment's energy needs and overall operational success.

- Seasonal Demand: Irrigation pumps drive high energy usage during spring and summer.

- Economic Impact: Agriculture is a cornerstone of the regional economy, supported by reliable power.

- Weather Sensitivity: Drought or excessive rainfall directly affects irrigation needs and energy consumption.

- 2024 Data: Specific energy consumption figures for the agricultural sector in 2024 are available through Idaho Power's operational reports.

Wholesale Customers

Idaho Power actively participates in the wholesale energy market, supplying electricity to other utilities and energy marketers. This strategic engagement allows the company to sell surplus energy generated from its diverse resource portfolio, effectively meeting demand in neighboring regions.

This wholesale segment is crucial for IdaCorp's financial health, contributing significantly to revenue diversification. For instance, in 2023, Idaho Power reported total operating revenues of $1.5 billion, with wholesale power sales forming a notable portion of this figure, demonstrating its importance in balancing energy supply and demand across broader geographic areas.

- Wholesale Market Reach: Serves other utilities and energy marketers.

- Revenue Diversification: Contributes to IdaCorp's overall financial stability.

- Resource Utilization: Maximizes the efficiency of generated electricity by selling excess power.

- Market Presence: Demonstrates IdaCorp's role in the broader regional energy grid.

The customer segments for IdaCorp are diverse, encompassing residential, commercial, industrial, and agricultural users, alongside participation in the wholesale energy market. Each segment has unique energy demands and contributes to the company's overall operational and financial performance.

In 2024, IdaCorp continued to serve its core residential base, which grew by 2.6%, while also supporting over 100,000 commercial accounts. The industrial sector, including major tech firms, and the vital agricultural sector, with its seasonal irrigation needs, represent significant load drivers and economic contributors.

IdaCorp's engagement in the wholesale market further diversifies its revenue streams, demonstrating its capacity to manage and allocate energy resources effectively across a wider regional grid.

| Customer Segment | Description | 2024 Highlights |

|---|---|---|

| Residential | Individual households in southern Idaho and eastern Oregon. | 2.6% growth in customer base. |

| Commercial | Businesses of all sizes within the service territory. | Served over 100,000 accounts. |

| Industrial | Large manufacturing plants and tech companies. | Significant and specialized energy needs, driving load growth. |

| Agricultural | Farms, particularly those relying on irrigation. | Seasonal demand peaks; notable portion of energy usage. |

| Wholesale Market | Other utilities and energy marketers. | Revenue diversification; efficient resource utilization. |

Cost Structure

IdaCorp's cost structure heavily relies on Operations and Maintenance (O&M) expenses, which cover the essential upkeep and running of its utility infrastructure. These costs are fundamental to ensuring reliable service delivery to customers.

Key components of O&M include expenditures on fuel to power generation, wages for skilled labor involved in system operation and repair, and the ongoing costs associated with maintaining and fixing the extensive utility network. These are direct costs of providing the service.

In 2024, IdaCorp reported that O&M expenses, excluding fuel and purchased power, were projected to be around $737.3 million. This figure highlights the significant investment required for day-to-day operations and system integrity, with inflation and expanded wildfire mitigation programs contributing to the increase.

Capital Expenditures (CapEx) represent significant outlays for IdaCorp's physical assets. These investments are vital for building, upgrading, and maintaining the company's extensive infrastructure, such as power generation facilities, and the intricate web of transmission and distribution lines that deliver electricity to customers.

Idaho Power, a key entity within IdaCorp's operational framework, has outlined a substantial commitment to capital investment. For the period spanning the next five years, the company anticipates an average annual investment of approximately $1.1 billion. This considerable financial commitment is strategically directed towards accommodating increased demand, enhancing the resilience of the power grid, and integrating modern technologies for improved efficiency and reliability.

Purchased power costs represent a substantial expenditure for IdaCorp, reflecting the need to buy electricity from the wholesale market to meet demand beyond its own generation capacity. In 2024, these costs are particularly sensitive to prevailing market prices, which can be volatile. For instance, a significant increase in natural gas prices, a common driver of wholesale electricity costs, can directly impact IdaCorp's expenses.

Hydrological conditions also play a crucial role in purchased power costs. When IdaCorp's own hydropower generation is reduced due to lower water levels, the utility must rely more heavily on purchased power, often at higher prices. This was evident in periods of drought in the Pacific Northwest, where reliance on market purchases increased significantly, driving up costs for utilities.

Managing these fluctuating purchased power expenses is paramount for IdaCorp to ensure affordable electricity rates for its customers. The company actively employs strategies such as long-term power purchase agreements and market hedging to mitigate price volatility. For example, securing fixed-price contracts can provide a buffer against sudden spikes in wholesale electricity prices, contributing to cost stability.

Depreciation and Amortization

Depreciation and amortization are key non-cash expenses for IdaCorp, representing the gradual expensing of tangible assets like machinery and buildings, as well as intangible assets. As IdaCorp continues to invest in new plant and equipment, this expense line item is expected to grow. For instance, in 2024, many industrial companies saw significant increases in depreciation due to substantial capital expenditures aimed at modernizing operations and expanding capacity.

This category also includes the amortization of certain deferred costs. For IdaCorp, this might involve the spreading out of costs related to regulatory approvals or other long-term investments. The amortization of accumulated deferred investment tax credits, a benefit that reduces taxable income over time, also falls under this umbrella, impacting the overall cost structure.

- Non-cash nature: These expenses reduce taxable income without an immediate cash outflow.

- Asset lifecycle: Reflects the usage and decline in value of IdaCorp's physical and intangible assets.

- Impact of CapEx: Increased capital investments directly lead to higher depreciation charges.

- Deferred costs: Includes amortization of items like investment tax credits, affecting profitability over time.

Regulatory and Compliance Costs

IdaCorp faces significant regulatory and compliance costs, essential for operating as a regulated utility. These expenses cover adherence to state and federal mandates, including filing rate cases, ensuring environmental compliance, and fulfilling various reporting obligations. For example, in 2024, IdaCorp continued to invest in wildfire mitigation programs, with the recovery of these crucial safety expenditures subject to regulatory approval.

These ongoing costs are fundamental to maintaining IdaCorp's operational licenses and its ability to serve customers. The company must allocate resources to meet stringent standards, which can fluctuate based on evolving regulatory landscapes and specific program requirements.

- Rate Case Filings: Expenses associated with preparing and presenting evidence for rate adjustments.

- Environmental Compliance: Costs for adhering to environmental protection laws and regulations.

- Reporting Requirements: Outlays for generating and submitting various operational and financial reports to regulatory bodies.

- Wildfire Mitigation: Investments in programs designed to reduce wildfire risk, such as vegetation management and equipment upgrades, with recovery subject to regulatory approval.

IdaCorp's cost structure is characterized by significant operational and capital expenditures, alongside variable purchased power costs and non-cash depreciation charges. Regulatory compliance and wildfire mitigation also represent substantial, ongoing investments essential for its utility operations.

| Cost Category | Description | 2024 Projection/Data |

| Operations & Maintenance (O&M) | Essential upkeep and running of utility infrastructure, excluding fuel and purchased power. | ~$737.3 million (projected, excluding fuel and purchased power) |

| Capital Expenditures (CapEx) | Investments in building, upgrading, and maintaining physical assets like generation facilities and distribution lines. | ~$1.1 billion annually (Idaho Power's 5-year average projection) |

| Purchased Power | Costs for buying electricity from the wholesale market to meet demand beyond own generation. | Sensitive to natural gas prices and hydrological conditions; hedging strategies employed. |

| Depreciation & Amortization | Non-cash expenses for the gradual expensing of tangible and intangible assets. | Expected to grow with increased capital investments. |

| Regulatory & Compliance | Costs for adhering to state and federal mandates, including rate cases, environmental standards, and reporting. | Includes investments in wildfire mitigation programs, subject to regulatory approval. |

Revenue Streams

IDACORP's main income source is selling electricity. This includes homes, businesses, factories, and farms. Revenue is directly tied to how much electricity customers use and the rates set by regulators. For instance, in 2023, IDACORP's total operating revenue was over $1.9 billion, with electricity sales forming the vast majority of this figure.

IdaCorp’s revenue is bolstered by approved rate increases, a crucial mechanism for covering operational expenses and capital investments. These adjustments, sanctioned by state public utility commissions, also ensure the company earns a fair return on its endeavors.

In 2024, IdaCorp saw its revenues positively impacted by recent rate case decisions in both Idaho and Oregon. For instance, the Idaho Public Utilities Commission approved a significant rate increase for residential customers, contributing to a projected $35 million boost in annual revenue for the company.

Wholesale energy sales represent a key revenue stream for Idaho Power, allowing them to sell surplus electricity to other utility companies. This strategy is particularly effective when their generation capacity, especially from hydropower, exceeds immediate customer demand.

For instance, in 2023, Idaho Power reported that its wholesale energy sales contributed significantly to its overall revenue, though the exact figures fluctuate with market conditions. The revenue generated here is directly tied to the prevailing wholesale electricity prices in the region, which can be influenced by factors like fuel costs, demand, and the availability of renewable energy sources.

Renewable Energy Credit (REC) Sales

IdaCorp generates revenue by selling Renewable Energy Credits (RECs) tied to its clean energy production. These credits represent the environmental benefits of renewable power and provide an additional income source.

This revenue stream is crucial for IdaCorp, as it helps to offset operational costs and maintain competitive pricing for its customers. In 2024, the demand for RECs remained robust, with prices varying based on region and credit type. For instance, in the PJM Interconnection market, vintage 2024 Alternative Compliance Payments (ACPs) for Solar Renewable Energy Certificates (SRECs) were trading around $13.00 per MWh as of late 2024, showcasing the financial viability of this revenue stream.

Monetizing these environmental attributes allows IdaCorp to further capitalize on its commitment to sustainable energy. The ability to sell RECs effectively transforms the positive environmental impact of its operations into tangible financial returns.

- REC Sales: IdaCorp sells Renewable Energy Credits generated from its clean energy facilities.

- Cost Offset: REC revenue helps reduce overall operating expenses.

- Customer Pricing: This stream contributes to keeping customer energy prices competitive.

- Environmental Monetization: RECs are a mechanism to financially benefit from the environmental attributes of renewable power.

Investment Income from Subsidiaries

IDACORP’s revenue streams extend beyond its primary utility operations through its diverse subsidiaries. IDACORP Financial, for instance, actively invests in affordable housing and other real estate tax credit initiatives, generating income from these ventures. Ida-West Energy, another key subsidiary, contributes through the operation of small hydroelectric projects, adding to the holding company's overall financial robustness.

These diversified investments are crucial for IDACORP's financial health, providing additional income streams that complement its core utility business. For example, in 2023, IDACORP reported that its non-regulated businesses, which include these subsidiaries, contributed approximately 10% to its net income, demonstrating the growing importance of these ventures.

- Investment Income from Subsidiaries: IDACORP Financial's real estate tax credit investments and Ida-West Energy's hydroelectric operations represent key non-regulated revenue sources.

- Diversification Strategy: These subsidiaries help diversify IDACORP's income, reducing reliance solely on regulated utility operations.

- Financial Contribution: In 2023, IDACORP's non-regulated businesses contributed around 10% to its net income, highlighting their financial impact.

IDACORP's revenue is primarily generated through the sale of electricity to a diverse customer base, including residential, commercial, and industrial users. Regulatory approvals for rate adjustments are critical, ensuring the company can cover costs and achieve a fair return. For instance, in 2024, approved rate increases in Idaho and Oregon were projected to add tens of millions to annual revenue.

Wholesale energy sales to other utilities provide an additional income stream, particularly when IDACORP’s generation capacity exceeds its retail demand. This revenue is sensitive to regional market prices for electricity. Furthermore, IDACORP monetizes its renewable energy production by selling Renewable Energy Credits (RECs), which provide a financial incentive for clean energy investments. In 2024, REC markets showed continued strength, with prices varying by region and credit type.

Beyond its core utility operations, IDACORP diversifies its revenue through subsidiaries. IDACORP Financial engages in investments, such as affordable housing tax credits, while Ida-West Energy operates hydroelectric projects. These non-regulated activities contributed approximately 10% to IDACORP's net income in 2023, showcasing their growing financial significance.

| Revenue Stream | Description | 2023/2024 Impact |

|---|---|---|

| Electricity Sales | Direct sales to residential, commercial, and industrial customers. | Formed the vast majority of over $1.9 billion in operating revenue in 2023. |

| Rate Adjustments | Approved increases by public utility commissions. | Projected $35 million annual revenue boost from Idaho residential rate increase in 2024. |

| Wholesale Energy Sales | Selling surplus electricity to other utility companies. | Fluctuates with market conditions and regional prices. |

| REC Sales | Selling Renewable Energy Credits from clean energy production. | Robust demand in 2024; PJM market SRECs around $13.00/MWh (vintage 2024) late 2024. |

| Subsidiary Operations | Income from investments (IDACORP Financial) and hydroelectric projects (Ida-West Energy). | Non-regulated businesses contributed ~10% to net income in 2023. |

Business Model Canvas Data Sources

The IdaCorp Business Model Canvas is meticulously constructed using a blend of proprietary customer data, in-depth market analysis, and internal operational metrics. This comprehensive approach ensures a robust and actionable representation of our business strategy.