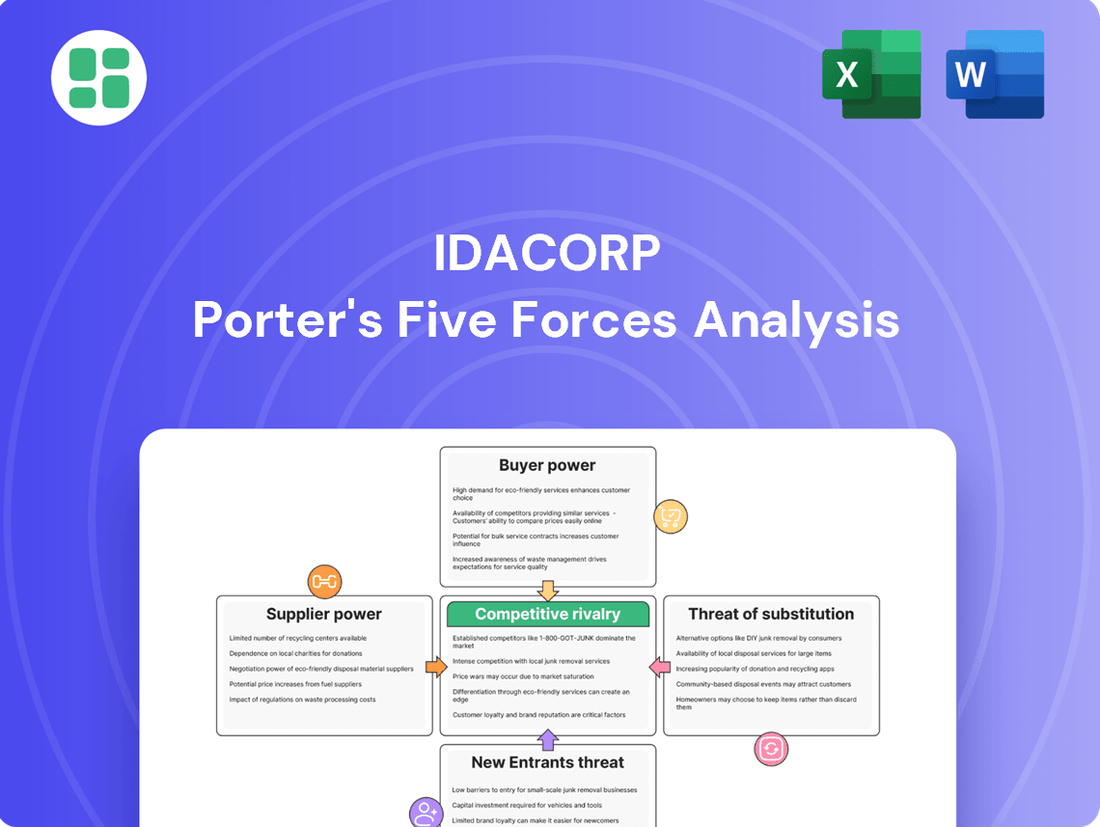

IdaCorp Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IdaCorp Bundle

IdaCorp faces a dynamic competitive landscape shaped by several key forces, including the bargaining power of buyers and the threat of new entrants. Understanding these pressures is crucial for strategic planning.

The complete report reveals the real forces shaping IdaCorp’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Idaho Power's reliance on a concentrated group of specialized suppliers for critical infrastructure, such as transmission components and generation equipment, significantly amplifies supplier bargaining power. For instance, in 2024, the lead times for certain high-voltage transformers extended to over 18 months, a direct reflection of limited manufacturing capacity among key suppliers. This scarcity allows these suppliers to dictate terms and pricing, impacting IdaCorp's operational costs and expansion plans.

IdaCorp faces significant challenges due to high switching costs when dealing with its suppliers. For instance, renegotiating or terminating long-term power purchase agreements for critical infrastructure projects could involve substantial penalties and necessitate lengthy legal processes. In 2024, the average cost for a utility to break a long-term power purchase agreement could range from millions to tens of millions of dollars, depending on the contract size and remaining term.

The capital-intensive nature of IdaCorp's operations further entrenches supplier relationships. Investing in new generation facilities or transmission lines requires immense upfront capital, and changing a primary supplier for these projects would likely mean re-engineering and re-certifying entire systems, a process that can easily add years and millions in costs. The lead time for procuring specialized components for new power plants, for example, can extend to 18-24 months, making abrupt supplier changes highly disruptive.

Furthermore, the complex and often lengthy regulatory approval processes associated with altering fundamental operational inputs, such as fuel sources or grid interconnections, act as a significant barrier to switching. Obtaining necessary permits and environmental clearances for a new fuel source, for example, can take 2-5 years and incur significant consulting and application fees, effectively locking IdaCorp into existing supplier arrangements and amplifying supplier leverage.

The threat of forward integration by suppliers, while less common for traditional utilities, could emerge if a key equipment manufacturer or fuel provider decided to enter energy generation or transmission. This would present a substantial risk, though the utility sector's high regulatory hurdles and capital demands do lessen this possibility.

IdaCorp's current generation assets do reduce its reliance on outside power producers, but any new resource additions might still originate from independent power producers, potentially increasing supplier leverage in those specific instances.

Impact of Regulatory Environment

The heavily regulated utility sector, where IdaCorp operates, significantly influences supplier bargaining power. While regulators often permit the pass-through of certain supplier costs to customers, this process isn't unfettered. Regulatory bodies meticulously review the prudence of all expenses, compelling utilities like IdaCorp to actively manage and negotiate supplier costs to demonstrate efficiency.

This regulatory oversight means that while IdaCorp might not have complete freedom to resist all supplier cost increases, there's a strong incentive to secure favorable terms. For instance, Idaho Power's 2025 rate case filing would have detailed the supplier costs it sought to recover, highlighting the direct link between these negotiations and customer rates.

- Regulatory Approval for Cost Pass-Through: While utilities can often pass supplier costs to customers, this requires explicit regulatory approval, limiting unilateral supplier leverage.

- Scrutiny of Expense Prudence: Regulators examine the reasonableness of all utility expenses, pushing for cost-effective supplier relationships.

- Rate Case Impact: Specific rate cases, such as Idaho Power's 2025 filing, directly incorporate and justify supplier costs, demonstrating the regulatory mechanism for cost control.

Fuel and Resource Availability

The availability and price volatility of primary energy sources, such as natural gas, significantly influence supplier power for IdaCorp. While IdaCorp heavily relies on hydropower, its use of natural gas and coal, alongside market purchases, exposes it to price fluctuations. For instance, in 2024, natural gas prices saw considerable swings due to factors like increased global demand and supply chain disruptions, directly impacting IdaCorp's generation costs and the bargaining power of its fuel suppliers.

Fluctuations in these energy markets, influenced by global supply chains and geopolitical events, directly impact the cost of generation and the bargaining power of fuel suppliers. This means that when fuel is scarce or in high demand, suppliers can often dictate higher prices, squeezing IdaCorp's profit margins. The company's reliance on a mix of energy sources means it must navigate these varying supplier dynamics across different fuel types.

- Natural Gas Price Volatility: In 2024, benchmark natural gas prices experienced significant fluctuations, impacting IdaCorp's fuel procurement costs.

- Global Supply Chain Impacts: Disruptions in global energy supply chains, exacerbated by geopolitical tensions, have amplified the bargaining power of fuel suppliers.

- IdaCorp's Energy Mix: While hydropower is a stable base, IdaCorp's dependence on natural gas and coal for a portion of its generation makes it susceptible to fuel supplier leverage.

- Market Purchases: The need for market purchases of energy and fuel means IdaCorp must contend with prevailing market prices, which are often influenced by supplier power.

IdaCorp's bargaining power with its suppliers is significantly constrained by the specialized nature of its equipment and the high costs associated with switching. For instance, in 2024, the average lead time for critical transmission components like high-voltage transformers exceeded 18 months, indicating limited supplier capacity and leverage. This reliance on a few key providers, coupled with substantial penalties for breaking long-term power purchase agreements, effectively locks IdaCorp into existing supplier relationships, amplifying supplier influence over pricing and terms.

| Factor | Impact on IdaCorp | 2024/2025 Data Point |

|---|---|---|

| Supplier Concentration | High; few specialized suppliers for critical infrastructure. | 18+ month lead times for high-voltage transformers in 2024. |

| Switching Costs | Very High; penalties for breaking long-term agreements, re-engineering needs. | Millions to tens of millions in potential penalties for breaking PPAs. |

| Capital Intensity | High; new projects require immense capital, making supplier changes disruptive. | 2-5 years and significant costs for regulatory approvals for new fuel sources. |

| Regulatory Environment | Moderate; costs can be passed through but require regulatory approval and scrutiny. | 2025 rate case filings detail and justify supplier costs for recovery. |

| Energy Source Volatility | Moderate; reliance on natural gas exposes IdaCorp to price swings. | Significant natural gas price fluctuations in 2024 due to global demand and supply. |

What is included in the product

IdaCorp's Porter's Five Forces analysis reveals the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market.

Effortlessly identify and mitigate competitive threats with a dynamic visualization of all five forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Idaho Power's position as a regulated monopoly in its service areas in southern Idaho and eastern Oregon significantly curtails customer bargaining power. Customers typically lack alternative electricity providers for transmission and distribution, leaving them with no choice but to rely on Idaho Power. This lack of options for residential and small commercial customers means they cannot easily switch utilities, thereby limiting their ability to negotiate better terms or pricing.

Customer bargaining power is significantly influenced by regulatory oversight on rates, as seen with entities like the Idaho Public Utilities Commission (IPUC) and the Oregon Public Utility Commission (OPUC). These bodies meticulously review and approve rate adjustments, ensuring they remain just and reasonable, which directly shields customers from potentially exorbitant charges.

For instance, Idaho Power's 2025 General Rate Case is a prime example of this regulatory mechanism. The proposed rate increases are undergoing rigorous public and regulatory examination, demonstrating how these commissions act as a crucial check on pricing power.

Customers, while limited in their choices for essential services like electricity, exhibit significant price sensitivity. This means that even without direct alternatives, they are keenly aware of and react to price changes. This sensitivity is amplified because electricity is a fundamental necessity for households and businesses alike.

The increasing cost of electricity, often a result of necessary infrastructure upgrades and growing demand, presents a considerable challenge. These rising costs are a focal point for both regulatory bodies and the general public, who are directly impacted by higher utility bills. For instance, in 2024, average residential electricity prices in the US saw an increase, reflecting these pressures.

IdaCorp recognizes this critical issue and actively works to maintain affordable pricing for its customers. A key strategy for IdaCorp is to keep its rates significantly lower than the national average, reportedly by 20-30%. This commitment aims to alleviate some of the burden on consumers, especially in the face of broader economic trends impacting household budgets.

Threat of Self-Generation and Distributed Energy Resources (DERs)

The bargaining power of customers is significantly influenced by the increasing viability of self-generation and distributed energy resources (DERs). Large industrial clients, and increasingly residential and commercial users, now have the practical option to produce their own electricity. This can be achieved through technologies like rooftop solar panels, small-scale wind turbines, or battery storage systems.

While widespread grid defection remains a future prospect, the declining costs of DERs are already granting some leverage to customers, especially those with substantial energy demands. For instance, in 2023, the average cost of solar photovoltaic (PV) systems for residential installations in the US continued its downward trend, making self-generation more economically attractive.

- Growing DER Adoption: By the end of 2023, cumulative installed solar capacity in the US surpassed 140 gigawatts (GW), with residential solar making a significant contribution.

- Cost Competitiveness: The levelized cost of energy (LCOE) for solar PV continued to fall, making it increasingly competitive with grid electricity prices in many regions.

- Customer Leverage: The availability of DERs provides customers with an alternative, empowering them to negotiate better terms or reduce their reliance on traditional utility providers.

- Utility Adaptation: Utilities are actively developing strategies to integrate DERs, such as offering net metering programs and exploring grid modernization initiatives to manage this evolving landscape.

Customer Growth and Diversification

IdaCorp's robust customer growth, reaching over 650,000 customers with a 2.6% increase in 2024, directly influences customer bargaining power. While this expansion fuels demand and necessitates strategic investments, it also diversifies the customer base. This diversification mitigates the risk of any single customer's unique demands disproportionately affecting IdaCorp's operations or pricing strategies.

- Customer Base Expansion: IdaCorp served over 650,000 customers in 2024.

- Growth Rate: The company experienced a 2.6% customer growth rate in 2024.

- Diversification Benefit: A larger, more diverse customer portfolio reduces the leverage of individual customers.

- Strategic Investment: IdaCorp manages growth through targeted investments to meet increased demand.

Despite being a regulated monopoly, customer bargaining power for Idaho Power is influenced by price sensitivity and the growing availability of distributed energy resources (DERs). Customers, particularly larger ones, can leverage self-generation options like solar or battery storage, especially as DER costs decline. For instance, residential solar installation costs in the US continued to decrease through 2023, making alternatives more feasible.

| Factor | Impact on Customer Bargaining Power | Supporting Data (2023-2024) |

|---|---|---|

| Lack of Direct Alternatives | Lowers bargaining power for essential transmission/distribution | Idaho Power serves a defined geographic area, limiting customer choice. |

| Regulatory Oversight | Protects customers from excessive pricing | IPUC/OPUC review all rate adjustments; Idaho Power’s 2025 Rate Case exemplifies this. |

| Price Sensitivity | Increases awareness and reaction to price changes | Electricity is a necessity; average US residential prices rose in 2024. |

| Distributed Energy Resources (DERs) | Increases bargaining power, especially for large users | US cumulative solar capacity exceeded 140 GW by end of 2023; solar LCOE is competitive. |

| Customer Base Size | Diversifies customer impact, reducing individual leverage | Idaho Power had over 650,000 customers in 2024, with 2.6% growth. |

Preview the Actual Deliverable

IdaCorp Porter's Five Forces Analysis

This preview showcases the complete IdaCorp Porter's Five Forces Analysis, offering a thorough examination of competitive forces within its industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no surprises. You can confidently use this detailed analysis for strategic decision-making the moment your transaction is complete.

Rivalry Among Competitors

Idaho Power's regulated monopoly status significantly curtails direct competitive rivalry for its core electricity transmission and distribution services. Within its designated service territory, there are no other utility companies directly competing for the same customer base for the essential delivery of power.

While direct competition for existing utility customers is relatively low, IdaCorp faces significant rivalry in securing new energy generation resources and developing essential infrastructure. This competition intensifies as the demand for electricity rises and the energy landscape shifts towards renewable sources.

Independent Power Producers (IPPs) and other energy developers actively compete for new generation projects and transmission line opportunities. For instance, in 2024, the U.S. saw significant investment in renewable energy projects, with solar and wind power leading the charge, creating a competitive bidding environment for land and interconnection rights.

This rivalry extends to securing the necessary infrastructure, such as transmission lines, to integrate new, often distributed, energy sources. The race to build out the grid to accommodate these changes means that companies like IdaCorp must be strategic and agile in their infrastructure development plans to remain competitive.

Inter-fuel competition for IdaCorp primarily manifests as indirect rivalry from alternative energy sources customers might choose for specific applications. For instance, natural gas remains a competitor for residential heating, and various fuels vie for dominance in the transportation sector. However, for general electricity needs, these are more substitutes than direct rivals to IdaCorp's core electric utility business.

IdaCorp's own strategic diversification into natural gas and renewable energy sources further illustrates this dynamic. By expanding its energy mix, the company is not only hedging against future market shifts but also actively participating in the broader energy landscape where different fuels compete for market share. This internal strategy reflects the external reality of inter-fuel competition impacting the utility sector.

Regulatory Framework Dictates Competition

IdaCorp operates within a highly regulated sector where state public utility commissions and federal bodies like the Federal Energy Regulatory Commission (FERC) significantly shape competitive dynamics. These agencies establish the rules for market entry, pricing, and operational standards, effectively defining the boundaries of competition. For instance, FERC’s Order No. 2023, implemented in 2023, aims to improve interconnection processes for large-scale renewable energy projects, potentially fostering more competition in wholesale electricity markets by streamlining access.

While regulations are designed to ensure grid reliability and consumer affordability, they also create a structured environment that can limit direct competition. Policies governing transmission access and wholesale market design, such as capacity markets or energy-only markets, introduce competitive elements but within a framework that prioritizes system stability. In 2024, the U.S. electricity sector saw continued investment in renewable energy, with the Energy Information Administration (EIA) projecting that renewables would account for approximately 24% of utility-scale generation in the U.S. for the year, a testament to how regulatory support for clean energy influences market participation.

- Regulatory Oversight: State public utility commissions and FERC are the primary architects of the competitive landscape for utilities like IdaCorp.

- Structured Competition: Policies on transmission, interconnection, and wholesale markets introduce competition, but within strict regulatory confines.

- Reliability and Affordability Focus: The regulatory framework prioritizes these aspects, influencing how competition can manifest.

- 2023/2024 Impact: FERC’s Order No. 2023 and the growing share of renewables (around 24% of U.S. utility-scale generation in 2024) illustrate regulatory influence on market structure and growth.

Growth in Demand and Investment Opportunities

The energy sector is experiencing a substantial increase in electricity demand, fueled by factors such as the proliferation of data centers, the ongoing trend of electrification across various industries, and a resurgence in manufacturing activities. This surge presents significant investment opportunities for all participants in the energy market, encouraging expansion and development.

While IdaCorp is making substantial capital investments in its own infrastructure to meet this growing demand, the attractive market conditions could also draw in new competitors. These new entrants may seek to develop their own generation or transmission assets, thereby intensifying the competitive rivalry for securing specific projects and market share.

- Rising Electricity Demand: Global electricity demand is projected to grow significantly. For instance, the International Energy Agency (IEA) reported in its 2024 outlook that global electricity demand is expected to increase by 3.4% in 2024, a notable acceleration from previous years, driven by economic growth and digitalization.

- Data Center Growth: The insatiable appetite for data processing and storage is a primary driver. In 2024, data centers are estimated to account for over 1.5% of global electricity consumption, with projections indicating this could rise to 5-10% by 2030 due to AI advancements.

- Electrification Trends: The shift towards electric vehicles (EVs) and the electrification of heating and industrial processes are adding further pressure on electricity grids. The global EV market, for example, saw sales exceed 10 million units in 2023, with continued strong growth anticipated in 2024.

- Increased Competition for Projects: The attractiveness of these growth areas means that IdaCorp faces heightened competition not only from established utilities but also from new investors, private equity firms, and technology companies looking to build or acquire energy assets, potentially driving up project costs and reducing margins.

IdaCorp's competitive rivalry is primarily shaped by its regulated monopoly status for core electricity delivery, limiting direct competition for existing customers. However, significant rivalry emerges in the pursuit of new generation resources and infrastructure development, particularly as the energy landscape evolves towards renewables.

Independent Power Producers and energy developers actively compete for new projects, with the U.S. renewable energy sector seeing robust investment in 2024, especially in solar and wind. This competition extends to securing land and interconnection rights, as well as building out transmission infrastructure to integrate new energy sources.

The overall competitive intensity for IdaCorp is moderate, mainly stemming from competition in acquiring new generation projects and navigating the evolving energy market, rather than direct customer poaching. This dynamic is further influenced by regulatory frameworks that structure market participation and prioritize grid stability.

The increasing demand for electricity, driven by data centers and electrification, is creating a more competitive environment for securing new energy assets and projects, potentially attracting new entrants and intensifying the race for market share.

SSubstitutes Threaten

The most significant substitute threat to IdaCorp's traditional utility model stems from Distributed Energy Resources (DERs). These include technologies like rooftop solar panels and on-site battery storage systems. As the costs associated with these solutions continue to fall, customers, especially larger commercial and industrial entities, are increasingly likely to generate their own power, thereby decreasing their dependence on IdaCorp's grid services.

For instance, the U.S. Energy Information Administration (EIA) reported that as of the end of 2023, residential solar capacity had grown significantly, and projections for 2024 indicated continued strong growth in distributed generation. This trend directly impacts IdaCorp by potentially reducing electricity sales volume and shifting the customer base towards self-generation, a critical consideration for the utility's long-term revenue stability.

The increasing adoption of energy-efficient appliances and smart home technologies by consumers acts as a significant substitute for traditional electricity demand. For instance, in 2024, the residential sector continued to see growth in smart thermostat installations, which can reduce heating and cooling energy consumption by up to 10-15%.

Furthermore, customer-driven conservation efforts directly substitute the need for grid-supplied power. Idaho Power itself encourages these practices through various programs, acknowledging that while this might reduce immediate sales, it aligns with broader regulatory mandates and environmental stewardship goals, a trend expected to persist and potentially accelerate through 2025.

Improvements in battery storage technology, both at the utility scale and behind-the-meter, are making intermittent renewable energy sources like solar and wind more reliable substitutes for traditional power. For instance, by mid-2024, global battery energy storage system (BESS) installations are projected to reach over 150 GW, a significant jump from previous years. This advancement empowers customers to store their own generated power or manage peak demand, reducing reliance on grid stability during crucial times.

Alternative Fuels for Specific End-Uses

While not a direct replacement for grid electricity, alternative fuels like natural gas and propane can still impact IdaCorp's demand if electrification efforts falter. For instance, in 2024, residential natural gas consumption for heating remained significant, with the U.S. Energy Information Administration reporting that approximately 49% of U.S. households used natural gas for heating in 2023. Similarly, gasoline and diesel continue to dominate the transportation sector, though electric vehicle adoption is growing.

However, the overarching trend favors electrification, which generally benefits utilities like IdaCorp. This shift means that while substitutes exist for specific applications, the broader energy landscape is moving towards greater electricity utilization.

- Natural Gas for Heating: In 2023, around 49% of U.S. homes relied on natural gas for heating, indicating a substantial market for this substitute fuel.

- Transportation Fuels: Gasoline and diesel remain dominant in transportation, though the market share of electric vehicles is steadily increasing year over year.

- Electrification Trend: The ongoing shift towards electrification in various sectors, including transportation and building heating, generally supports increased demand for electricity, mitigating the threat from substitutes.

Policy and Incentives for Substitutes

Government policies significantly influence the threat of substitutes by making alternative solutions more appealing. For instance, the U.S. Inflation Reduction Act of 2022 introduced substantial tax credits for renewable energy, such as a 30% credit for solar installations. This directly lowers the upfront cost for consumers considering self-generation, thereby increasing the attractiveness of substitutes for traditional energy providers.

These incentives can dramatically shift customer behavior. By reducing the financial burden of adopting substitute technologies, governments effectively accelerate their market penetration. This makes it easier for customers to switch away from existing products or services, intensifying the competitive pressure on incumbent firms.

- Government incentives like tax credits for solar panel installations (e.g., 30% in the U.S. Inflation Reduction Act) directly reduce the cost of substitute energy sources.

- Policy support for electric vehicles, including purchase rebates and charging infrastructure development, makes EVs a more viable substitute for gasoline-powered cars.

- Subsidies for energy efficiency upgrades in buildings can decrease demand for new energy connections, acting as a substitute for traditional utility services.

The threat of substitutes for IdaCorp is substantial, primarily driven by distributed energy resources (DERs) like rooftop solar and battery storage, which allow customers to generate their own power. For example, by mid-2024, global battery energy storage system installations are projected to exceed 150 GW, highlighting a significant shift towards energy independence.

Government incentives, such as the 30% U.S. federal tax credit for solar installations, further reduce the cost of these substitutes, making them more attractive to consumers and businesses alike. This policy support directly impacts IdaCorp's traditional utility model by potentially decreasing electricity sales volume and customer reliance on the grid.

| Substitute Technology | Impact on IdaCorp | Key Data Point (2023-2024) |

| Distributed Solar & Battery Storage | Reduced reliance on grid electricity, potential decrease in sales volume | Global BESS installations projected to exceed 150 GW by mid-2024 |

| Energy-Efficient Appliances | Lower overall electricity demand | Smart thermostat installations in homes can reduce energy use by 10-15% |

| Alternative Fuels (Natural Gas) | Competition for heating and industrial uses | ~49% of U.S. households used natural gas for heating in 2023 |

Entrants Threaten

The electric utility sector, especially for power generation and transmission, demands enormous upfront capital. Building new power plants, substations, and upgrading the grid requires billions of dollars. For instance, a new utility-scale solar farm can cost hundreds of millions, while a new nuclear plant can run into the tens of billions. These immense financial requirements create a formidable barrier, deterring many potential new entrants.

Stringent regulatory hurdles significantly deter new entrants in the utility sector. Companies like IdaCorp must navigate complex approval processes at state levels, such as those overseen by the Idaho Public Utilities Commission (IPUC) and the Oregon Public Utilities Commission (OPUC), as well as federal agencies like the Federal Energy Regulatory Commission (FERC). These involve obtaining environmental permits, securing siting approvals, and undergoing lengthy rate case proceedings.

These extensive regulatory requirements, designed to ensure reliability and public safety, act as substantial barriers to entry. For instance, the average time to obtain all necessary permits for a new major energy project can extend for several years, demanding significant upfront investment in legal and consulting expertise. This lengthy and costly process effectively limits the number of new players able to enter the market.

Idaho Power enjoys substantial economies of scale from its established, widespread transmission and distribution infrastructure, a result of decades of investment. A new competitor would face immense costs to build a comparable network, making it economically prohibitive.

Alternatively, any new entrant would need to secure access to Idaho Power's existing grid. This access is tightly controlled by regulations and typically comes with substantial fees, creating a significant barrier to entry for potential rivals.

Access to Distribution Channels and Customer Base

As a vertically integrated utility, Idaho Power's control over generation, transmission, and distribution presents a significant barrier for potential new entrants. This integration means new companies would face immense challenges in establishing direct customer access. For instance, in 2023, Idaho Power served over 620,000 customers, a base that would be incredibly costly and time-consuming for a newcomer to replicate.

Building parallel infrastructure or securing necessary interconnection agreements in Idaho's regulated utility landscape is exceptionally difficult. These hurdles require substantial capital investment and navigating complex regulatory approvals, making it impractical for most new market participants. The utility sector's inherent network effects further solidify this advantage for established players like Idaho Power.

- Control of Infrastructure: Idaho Power owns and operates its generation facilities, transmission lines, and distribution networks, creating a complete value chain.

- Customer Base Lock-in: The company's established customer base of over 620,000 in 2023 is a significant asset that new entrants would struggle to penetrate.

- Regulatory Hurdles: Gaining access to the grid and customer connections requires navigating stringent regulatory processes and obtaining difficult-to-secure interconnection agreements.

Brand Loyalty and Reliability Expectations

Brand loyalty and reliability expectations pose a significant barrier for potential new entrants into Idaho Power's service territory. While customers in a regulated monopoly don't actively 'choose' their provider, they have deeply ingrained expectations for consistent and affordable utility service, a reputation Idaho Power has cultivated over many years. Building this level of trust and a proven track record for dependability is a multi-decade endeavor, making it incredibly difficult for any new company to quickly establish credibility and meet the high standards consumers have come to expect.

For instance, Idaho Power reported a customer satisfaction score of 80% in their 2023 customer survey, indicating a strong base of satisfied users who are unlikely to switch without a compelling reason. A new entrant would not only need to offer competitive pricing but also demonstrate an equivalent or superior level of service reliability, which requires substantial investment in infrastructure and operational expertise. The sheer difficulty in overcoming this established trust and meeting the rigorous reliability benchmarks is a formidable deterrent.

- Customer Trust: Decades of reliable service have built strong customer loyalty for Idaho Power.

- Reliability Standards: Consumers expect consistent and dependable utility provision, a high bar for new entrants.

- Investment Barrier: Meeting these reliability expectations requires significant capital investment, deterring new competition.

The threat of new entrants for IdaCorp is notably low due to several significant barriers. The immense capital required to establish new generation and transmission infrastructure, coupled with stringent regulatory approvals at state and federal levels, deters most potential competitors. For example, building a new power plant can cost hundreds of millions or even tens of billions, a prohibitive sum for many. Furthermore, securing access to existing grid infrastructure involves substantial fees and complex regulatory navigation, effectively limiting market entry.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Building new power plants and transmission lines requires billions in upfront investment. | Extremely high, deterring most new players. |

| Regulatory Hurdles | Complex approval processes from agencies like FERC and state commissions are time-consuming and costly. | Significant deterrent, requiring extensive legal and consulting resources. |

| Infrastructure Control | IdaCorp's ownership of generation, transmission, and distribution networks creates a complete, hard-to-replicate value chain. | Makes it difficult for new entrants to establish direct customer access or competitive service offerings. |

| Customer Base & Trust | IdaCorp's established customer base of over 620,000 (2023) and decades of reliable service foster strong customer loyalty. | New entrants face a significant challenge in acquiring customers and building comparable trust and reliability. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for IdaCorp is built upon a robust foundation of industry-specific market research reports, financial statements from publicly traded competitors, and recent company press releases. We also incorporate data from reputable trade associations and government economic indicators to ensure a comprehensive view of the competitive landscape.