ICL Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ICL Group Bundle

ICL Group's strengths lie in its diversified product portfolio and global reach, but it faces challenges from fluctuating commodity prices and intense competition. Understanding these dynamics is crucial for any investor or strategist looking to navigate this complex market.

Want the full story behind ICL Group's competitive advantages, potential threats, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

ICL Group boasts a diverse product portfolio spanning fertilizers, food ingredients, and industrial chemicals, catering to essential global needs in agriculture, food processing, and manufacturing. This broad offering, which includes key products like potash and phosphate fertilizers, positions ICL to benefit from consistent demand across multiple vital industries. For instance, in 2023, ICL's specialty fertilizers segment demonstrated strong performance, contributing significantly to its overall revenue.

ICL Group's ownership of unique natural resources like potash, phosphate, and bromine is a cornerstone of its competitive strength. This proprietary access to essential raw materials is critical for their specialty mineral businesses, ensuring a stable supply chain and better cost management.

This control over vital resources translates into a significant competitive moat, making it difficult for new players to enter the market. For instance, in 2024, ICL continued to leverage its Dead Sea concessions, a primary source of potash and bromine, highlighting the enduring strategic value of these assets.

ICL Group boasts a truly global operational footprint, serving customers in over 100 countries across agriculture, food, and industrial sectors. This extensive reach, as highlighted by their 2023 annual report which detailed significant sales in North America, Europe, and Asia Pacific, allows for robust market diversification. It effectively cushions the company against localized economic downturns and opens doors to capitalize on growth opportunities in rapidly developing economies.

Integrated Value Chain and Operational Efficiency

ICL Group's integrated value chain, spanning from mineral extraction to the creation of advanced products, is a significant strength. This end-to-end control is crucial for optimizing production, ensuring consistent quality, and driving cost efficiencies throughout their operations. For instance, in 2023, ICL reported a significant portion of its revenue derived from its specialty minerals and advanced additives segments, demonstrating the success of transforming basic minerals into higher-margin products.

This vertical integration allows ICL to capture value at multiple stages, directly impacting profitability. By managing the entire process, they can better respond to market demands and maintain a competitive edge. The company's focus on transforming potash and phosphate into specialized fertilizers and industrial products exemplifies this strategy, contributing to their robust market position.

- Integrated Value Chain: Manages operations from raw material extraction to finished product manufacturing.

- Operational Efficiency: End-to-end control optimizes production processes and reduces costs.

- Quality Assurance: Direct oversight ensures high standards across all product lines.

- Margin Maximization: Transformation of basic minerals into specialty products enhances profitability.

Commitment to Innovation and Sustainable Solutions

ICL Group's dedication to innovation and sustainability is a significant strength. The company's mission to create essential solutions for humanity underscores a continuous investment in research and development. This focus allows them to pioneer new products that address global challenges.

Their commitment translates into tangible advancements, such as developing enhanced agricultural inputs that boost crop yields while minimizing environmental impact. For instance, ICL has been actively developing controlled-release fertilizers, which reduce nutrient runoff. In 2024, ICL reported a strong pipeline of sustainable product innovations, with a significant portion of their R&D budget allocated to these areas, aiming to capture a growing market share in green chemistry and advanced agriculture.

- Focus on R&D: ICL consistently invests in developing innovative and sustainable products, aligning with global trends.

- New Revenue Streams: Investments in areas like enhanced agricultural inputs and eco-friendly industrial chemicals are designed to create new market opportunities.

- Investor Appeal: The company's commitment to sustainability resonates with environmentally conscious investors and customers, enhancing its market position.

- Market Alignment: ICL's innovative solutions are positioned to meet the increasing demand for sustainable products across various industries.

ICL Group's proprietary access to unique mineral resources, including potash, phosphate, and bromine, forms a significant competitive advantage. This control over essential raw materials ensures supply chain stability and cost efficiencies for its specialty mineral businesses.

The company's extensive global operational footprint, serving customers in over 100 countries, provides robust market diversification and resilience against regional economic fluctuations. This broad reach allows ICL to capitalize on growth opportunities worldwide.

ICL's integrated value chain, from extraction to advanced product manufacturing, enables optimized production, consistent quality, and enhanced profitability. This end-to-end control allows for greater responsiveness to market demands and a sustained competitive edge.

A strong commitment to innovation and sustainability drives ICL's research and development efforts, leading to the creation of advanced solutions for agriculture and industry. This focus positions the company to meet growing global demand for eco-friendly products and capture new market opportunities.

What is included in the product

Delivers a strategic overview of ICL Group’s internal and external business factors, highlighting its strengths in specialized minerals and market opportunities in sustainable solutions, while also addressing weaknesses in operational efficiency and threats from global competition.

The ICL Group SWOT analysis offers a clear, actionable framework to identify and leverage strengths, mitigate weaknesses, capitalize on opportunities, and address threats, thereby alleviating strategic uncertainty and guiding focused decision-making.

Weaknesses

ICL Group's reliance on potash and phosphate makes it highly susceptible to fluctuations in global commodity prices. For instance, potash prices saw significant volatility in 2023, with benchmark prices for granular potash in the second half of 2023 averaging around $130-$150 per tonne, a notable decrease from earlier periods, directly impacting ICL's revenue streams.

This inherent price sensitivity can lead to unpredictable earnings, even with diversification efforts. While ICL aims to broaden its portfolio, the core mineral segments still represent a substantial portion of its business, meaning downturns in these markets can disproportionately affect overall financial health.

Consequently, effective risk management is crucial for ICL. Strategies to mitigate the impact of commodity price swings, such as hedging or long-term supply agreements, are vital to maintain stable financial performance and investor confidence in the face of market volatility.

ICL Group's operations are characterized by high capital intensity. The extraction and processing of minerals necessitate substantial upfront investments in mining infrastructure, sophisticated processing plants, and continuous maintenance. For instance, ICL has historically invested billions in developing new mining sites and upgrading existing facilities, reflecting this demanding capital requirement.

This significant capital expenditure translates into high fixed costs for the company. These substantial fixed costs can constrain financial flexibility, potentially limiting the company's ability to pursue other strategic growth opportunities or to distribute dividends to shareholders. Maintaining this infrastructure is an ongoing commitment, requiring consistent capital allocation.

Consequently, ICL Group's financial health is closely tied to its ability to generate consistent and robust cash flows. These cash flows are crucial not only for supporting day-to-day operations but also for funding necessary expansions and technological upgrades. In 2023, for example, while revenue remained strong, the company's capital expenditure program remained a key focus, underscoring the ongoing need for significant cash generation.

ICL Group's extensive global operations, especially in regions rich with natural resources, inherently expose it to significant geopolitical and regulatory risks. Changes in trade policies, like potential tariffs on fertilizers or minerals, could directly impact ICL's cost structure and market access. For instance, evolving environmental regulations in Europe or North America might necessitate costly operational adjustments.

Political instability in countries where ICL sources raw materials or has significant production facilities can lead to supply chain disruptions and increased operational expenses. The company must constantly navigate a complex web of diverse international regulations, from chemical safety standards to labor laws, which adds a layer of compliance burden and potential for unforeseen costs.

Environmental and Social Governance (ESG) Scrutiny

ICL Group, like others in the mining and chemical sectors, faces growing pressure concerning its environmental footprint. This includes significant attention on water consumption, waste disposal practices, and greenhouse gas emissions, areas where operational transparency and performance are increasingly critical.

The company must navigate rigorous Environmental and Social Governance (ESG) standards, which are heavily influenced by public opinion and investor expectations. For instance, in 2023, the global mining sector saw increased investor focus on water stewardship, with companies reporting on water intensity and recycling efforts becoming more common.

- Reputational Risk: Failure to meet evolving sustainability targets or manage environmental incidents could damage ICL's brand image and public trust.

- Regulatory Fines: Non-compliance with environmental regulations can result in substantial financial penalties, impacting profitability.

- Increased Costs: Adhering to stricter ESG mandates may necessitate higher capital expenditures for pollution control and sustainable practices, potentially raising operational costs.

Dependence on Specific Natural Resource Locations

ICL Group's reliance on specific geographic locations for its key mineral resources, such as potash in Israel and bromine from the Dead Sea, creates a significant weakness due to geographic concentration risk. This limited sourcing base makes the company vulnerable to localized disruptions. For instance, a natural disaster, a labor strike, or even specific regional regulatory shifts in these concentrated areas could severely hamper ICL's production capabilities and disrupt its global supply chain. This concentration inherently reduces the company's flexibility in navigating regional challenges and ensuring consistent output.

The company's operational footprint, heavily weighted towards its Dead Sea operations for bromine and potash, highlights this vulnerability. In 2023, ICL continued to derive a substantial portion of its revenue from these core mineral extraction activities. Any unforeseen event impacting these specific sites, like extreme weather events or geopolitical instability in the region, poses a direct threat to ICL's ability to meet market demand and maintain its competitive edge. This geographic dependency limits its ability to quickly pivot or supplement production from alternative, geographically diverse sources.

- Geographic Concentration: ICL's primary mining operations are concentrated in a few key locations, notably Israel for potash and bromine.

- Vulnerability to Localized Events: Disruptions at these specific sites, whether due to natural disasters, political instability, or labor issues, can have a disproportionate impact on overall production.

- Reduced Agility: The dependence on these limited resource locations restricts ICL's ability to quickly adapt to regional challenges or source materials from alternative, geographically dispersed sites.

ICL Group's significant reliance on specific mineral resources, particularly potash and bromine from its Dead Sea operations, creates a pronounced weakness due to geographic concentration. This limited sourcing base makes the company highly susceptible to localized disruptions, such as natural disasters, labor disputes, or regional regulatory changes, which could severely impact production and supply chains. For instance, ICL's 2023 financial reports consistently highlighted the importance of its Israeli operations for revenue generation, underscoring this concentration risk.

This geographic dependency restricts ICL's agility in responding to market shifts or sourcing materials from alternative, more diverse locations. Any unforeseen event impacting these core sites, like extreme weather or political instability in the region, poses a direct threat to the company's ability to meet global demand and maintain its competitive position. The lack of broad geographic diversification in its primary resource extraction limits its resilience against regional challenges.

The company's operational structure, heavily weighted towards its Dead Sea facilities, amplifies this vulnerability. In 2023, ICL continued to derive a substantial portion of its revenue from these core mineral extraction activities, making it difficult to quickly pivot or supplement production from alternative, geographically dispersed sources. This inherent concentration limits its flexibility in navigating regional challenges and ensuring consistent output.

What You See Is What You Get

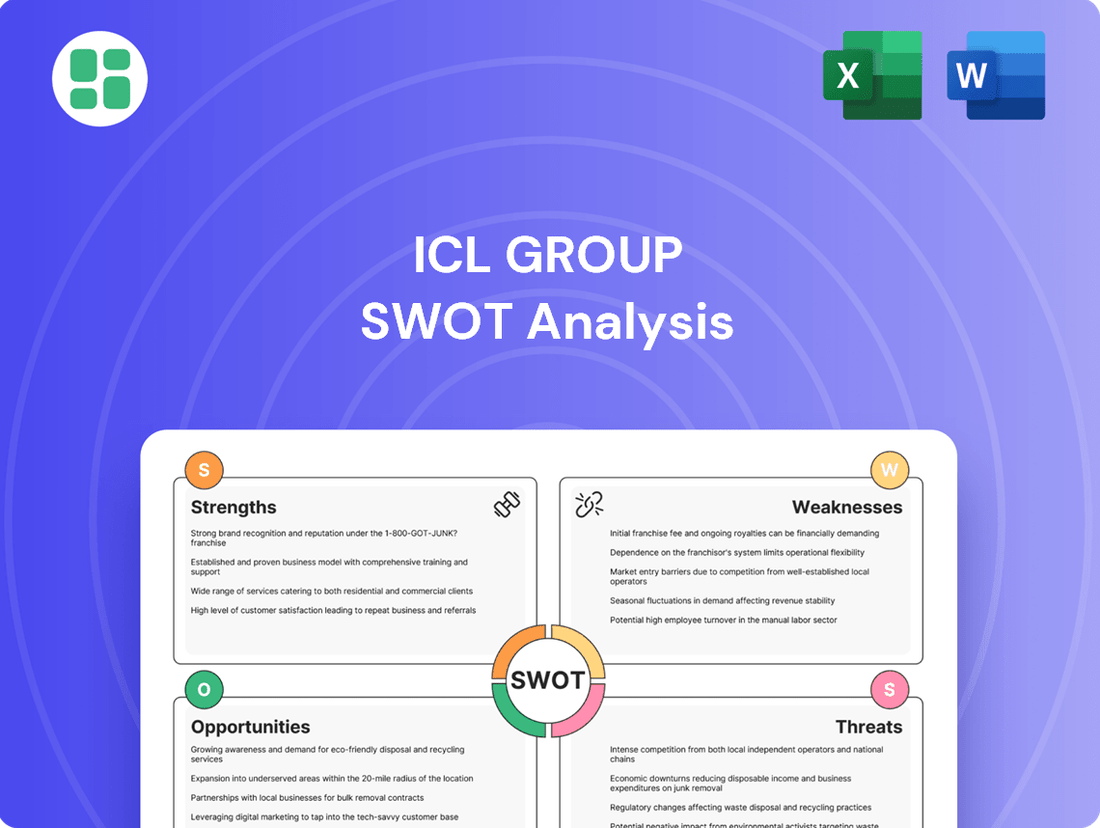

ICL Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of ICL Group's internal Strengths and Weaknesses, alongside external Opportunities and Threats. This detailed breakdown is designed to equip you with actionable insights for strategic planning.

Opportunities

The world's population is projected to reach nearly 10 billion by 2050, fueling a robust and ongoing demand for food. This demographic shift, combined with improving global incomes, directly translates into a greater need for fertilizers and other essential agricultural inputs, creating a significant opportunity for ICL Group.

ICL is well-positioned to benefit from this trend by increasing its production of fertilizers and developing advanced, specialized nutrient solutions. These innovations are crucial for enhancing crop yields and promoting sustainable agriculture, aligning with global food security goals. For instance, ICL's specialty phosphate products are key to improving crop efficiency.

ICL Group is well-positioned to capitalize on the growing demand for specialty chemicals, particularly those essential for high-tech industries like electronics and advanced battery production. These niche markets offer significantly higher margins compared to traditional bulk chemicals.

The company's existing proficiency in mineral processing provides a strong foundation for developing innovative, high-value products for these specialized sectors. This strategic shift promises to diversify ICL's revenue streams and enhance profitability by moving into less commoditized areas of the chemical industry.

For instance, the global specialty chemicals market was projected to reach over $800 billion by 2024, with segments like battery materials experiencing even faster growth. ICL's expansion into these areas, potentially through targeted acquisitions or strategic alliances, could significantly boost its market share and financial performance in the coming years.

ICL Group has a significant opportunity to expand its investments in sustainable and green technologies across its operations. This focus on eco-friendly mineral extraction, processing, and product innovation aligns with the growing global demand for environmentally responsible solutions. For instance, by developing advanced water recycling systems in its Dead Sea operations, ICL could significantly reduce its water footprint, a critical metric for sustainability reporting.

This strategic pivot can bolster ICL's brand image, making it more attractive to a rising tide of ESG (Environmental, Social, and Governance) focused investors. Companies prioritizing sustainability often see improved access to capital and lower borrowing costs. For example, in 2024, green bonds issued by companies with strong sustainability credentials saw an average yield that was 0.25% lower than conventional bonds, according to industry reports.

Furthermore, by innovating in bio-based fertilizers and biodegradable crop protection solutions, ICL can tap into new, high-growth markets. The global market for bio-fertilizers alone was projected to reach $10.5 billion by 2025, indicating substantial potential for ICL to capture market share with its sustainable product offerings.

Strategic Acquisitions and Partnerships

ICL Group can significantly bolster its market position through strategic acquisitions and partnerships. By integrating complementary businesses or technologies, ICL can broaden its resource base and enter new geographical markets, as demonstrated by its past acquisition of Allana Potash in 2019 to expand its potash assets in Ethiopia. Such moves can also unlock access to cutting-edge technologies, enhancing its competitive edge.

Pursuing mergers, acquisitions, or joint ventures offers a pathway to expand ICL's resource base and gain access to new technologies or markets. For instance, acquiring innovative companies in related sectors or partnering with technology developers could sharpen ICL’s competitive advantage and optimize its operational scale. This strategic M&A activity is projected to contribute to synergistic cost savings, improving overall financial performance.

- Expand resource base: Acquisitions can grant access to new mineral deposits or production facilities.

- Access new technologies: Partnerships can bring in advanced processing or product development capabilities.

- Enter new geographic markets: Mergers can provide immediate market entry and distribution networks.

- Achieve cost synergies: Combining operations can lead to efficiencies in procurement, logistics, and R&D.

Digital Transformation and Operational Optimization

ICL Group can leverage digital transformation to significantly boost its operational efficiency. By integrating advanced technologies like AI and IoT into its mining and manufacturing processes, the company can achieve substantial cost savings and productivity improvements. For instance, predictive maintenance powered by AI can minimize downtime, a critical factor in resource-intensive industries.

The implementation of digital solutions offers a clear path toward optimizing resource allocation and supply chain management. This translates to more efficient use of raw materials and better logistics, potentially reducing waste and delivery times. ICL's focus on digital transformation aligns with industry trends; by mid-2024, global manufacturing investment in AI was projected to reach over $100 billion, highlighting the significant potential for companies like ICL to benefit.

- Enhanced Efficiency: AI and IoT can optimize mining extraction and chemical production processes, leading to higher yields and reduced waste.

- Cost Reduction: Predictive maintenance and streamlined logistics through digital platforms can lower operational expenditures.

- Improved Safety: IoT sensors and AI-driven analytics can monitor hazardous environments, enhancing worker safety and compliance.

- Agile Operations: Digital transformation fosters a more responsive operational framework, allowing ICL to adapt quickly to market changes and demand fluctuations.

ICL has a significant opportunity to expand its presence in high-growth specialty chemical markets, particularly those serving the electronics and advanced battery sectors. The company's expertise in mineral processing provides a solid foundation for developing high-value products that command higher margins than traditional bulk chemicals.

By focusing on sustainable and green technologies, ICL can enhance its brand image and attract ESG-focused investors, potentially leading to lower capital costs. Innovations in bio-based fertilizers and biodegradable crop protection solutions also open new, lucrative market segments.

Strategic acquisitions and partnerships present a clear avenue for ICL to broaden its resource base, access new technologies, and enter new geographic markets, thereby strengthening its competitive position and operational scale.

Digital transformation, including the adoption of AI and IoT, offers substantial opportunities for ICL to improve operational efficiency, reduce costs, and enhance safety across its mining and manufacturing operations.

Threats

The ongoing volatility in the global geopolitical landscape presents a substantial threat to ICL Group. Escalating trade tensions and regional conflicts, such as those impacting key shipping lanes in 2024, can directly disrupt ICL's international supply chains. For instance, increased tariffs or sanctions imposed on critical raw material suppliers or export markets could significantly elevate operational costs and restrict market access, as seen with the impact of trade disputes on global fertilizer markets.

The specialty minerals and chemicals sector is a crowded arena. ICL Group faces formidable competition from established global giants and agile, regional players all striving to capture market share. This intense rivalry, especially in well-developed markets, often translates into significant pricing pressures, potentially squeezing profit margins and demanding constant innovation to stay ahead.

In 2024, the global specialty chemicals market is projected to grow, but this growth is accompanied by heightened competition. For instance, the potash market, a key area for ICL, has seen increased production from new entrants, contributing to oversupply concerns in certain segments. This oversupply can depress prices for commodity-grade products, directly impacting revenue streams.

Governments globally are tightening environmental rules, with many introducing or increasing carbon taxes and emission caps. For instance, the European Union's Emissions Trading System (EU ETS) saw carbon prices fluctuate, with allowances trading around €90-€100 per tonne in early 2024, a significant increase from previous years.

These stricter regulations directly impact ICL Group by raising compliance costs. Investments in new technologies to meet emission standards, like advanced scrubbers or carbon capture systems, become essential, potentially diverting capital from other growth initiatives. For example, a facility needing to upgrade to meet a new particulate matter limit could face millions in capital expenditure.

Failure to adapt to these evolving frameworks poses substantial risks. Non-compliance can lead to hefty fines, operational disruptions, or even temporary shutdowns, as seen with other industrial players facing penalties for exceeding emission limits. Furthermore, a poor environmental record can damage ICL's reputation, affecting investor confidence and market access.

Technological Disruption and Substitute Products

Technological shifts and the rise of substitute products represent a significant long-term threat to ICL Group. Emerging innovations in areas like advanced agricultural inputs or novel industrial materials could diminish the market need for ICL's established mineral-based offerings. For example, the development of highly efficient, lab-grown nutrient solutions or bio-based industrial chemicals could directly compete with traditional fertilizers and specialty minerals. Staying ahead requires constant investment in research and development to adapt and innovate.

The competitive landscape is evolving rapidly, with potential disruptions on the horizon. For instance, advancements in precision agriculture technologies that optimize nutrient delivery might reduce overall fertilizer demand, impacting ICL's core fertilizer business. Similarly, breakthroughs in material science could lead to the creation of substitutes for industrial minerals ICL supplies, such as new flame retardants or water treatment chemicals. ICL's ability to anticipate and respond to these technological waves is critical for sustained market position.

- Fertilizer Market Dynamics: Global fertilizer demand is projected to grow, but the *type* of fertilizer demanded could shift. Innovations in slow-release or enhanced-efficiency fertilizers, which reduce nutrient runoff, could outpace demand for conventional products. For instance, the global fertilizer market was valued at approximately USD 250 billion in 2023 and is expected to see continued growth, but the *composition* of that growth is key.

- Specialty Minerals Competition: The industrial specialties segment faces threats from material science advancements. For example, in the flame retardant market, there's ongoing research into halogen-free alternatives, which could impact demand for certain bromine-based products ICL offers.

- R&D Investment: ICL Group's commitment to innovation is paramount. In 2023, the company invested significantly in R&D to develop next-generation products and processes, aiming to preemptively address potential technological disruptions and the emergence of substitute solutions.

Economic Downturns and Reduced Industrial Demand

Economic downturns pose a significant threat to ICL Group. Global or regional slowdowns can drastically cut demand for industrial chemicals and even agricultural products as companies reduce output and consumers curb spending. For instance, a broad economic contraction could see ICL's sales volumes shrink and face intense pricing pressure, directly impacting profitability and its ability to fund future growth initiatives.

The vulnerability is particularly acute for non-essential industrial chemicals. During a recession, businesses prioritize essential operations, leading to a sharp decline in demand for products used in less critical manufacturing processes. This could translate to lower revenue streams for ICL, potentially affecting its financial stability and investment capacity. For example, in 2023, while ICL reported strong results in some segments, the broader chemical industry experienced headwinds due to slowing global growth.

The impact of an economic slowdown on ICL Group can be multifaceted:

- Reduced Sales Volumes: Lower industrial activity and consumer spending directly translate to fewer orders for ICL's products.

- Pricing Pressures: In a weaker demand environment, ICL may be forced to lower prices to remain competitive, squeezing profit margins.

- Decreased Profitability: The combination of lower sales and pricing pressures would inevitably lead to reduced earnings.

- Impact on Investment: Financial constraints resulting from a downturn could hinder ICL's plans for capital expenditures and strategic investments.

Intensifying global competition, particularly in key markets like potash where new entrants are increasing supply, poses a significant threat by potentially depressing prices and squeezing profit margins for ICL Group. Furthermore, evolving consumer preferences and technological advancements, such as the development of bio-based industrial chemicals or precision agriculture solutions, could diminish demand for ICL's established mineral-based products, necessitating continuous innovation and adaptation to maintain market relevance.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from ICL Group's official financial filings, comprehensive market research reports, and expert industry analyses to ensure a thorough and accurate assessment.