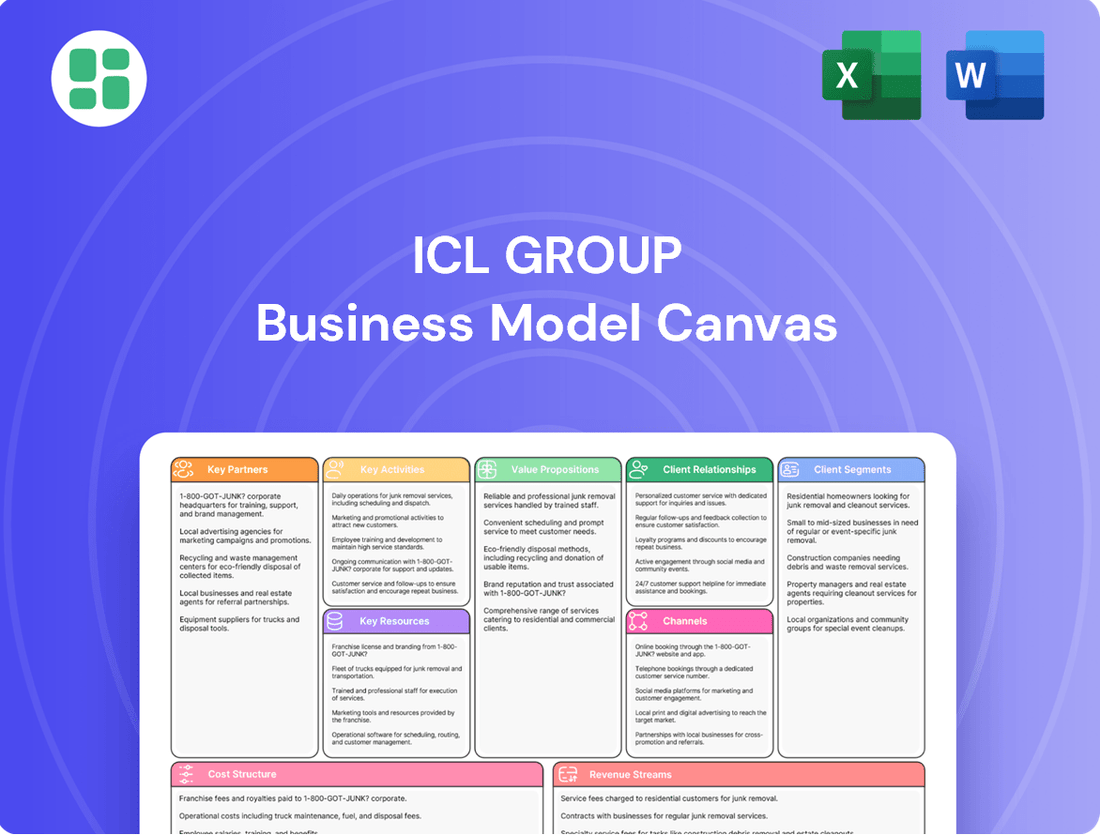

ICL Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ICL Group Bundle

Unlock the core of ICL Group's strategic genius with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance.

Dive into the intricate workings of ICL Group's business with our full Business Model Canvas. Discover their unique value propositions, cost structure, and channels, providing invaluable insights for your own strategic planning.

See how ICL Group builds and sustains its competitive edge. Our complete Business Model Canvas lays bare their customer segments, key activities, and revenue models, empowering you with actionable intelligence.

Want to truly understand ICL Group's success? The full Business Model Canvas provides an in-depth look at their partnerships, cost drivers, and value creation, perfect for analysts and strategists.

Partnerships

ICL Group strategically acquires companies to expand its product range and market presence, focusing on high-margin specialty areas. For instance, the 2023 acquisition of GreenBest in the UK and Custom Ag Formulators (CAF) in North America bolstered its local crop nutrition offerings.

Furthermore, ICL's acquisition of Lavie Bio in 2023 significantly strengthened its position in the growing agricultural biologicals sector, diversifying its overall portfolio.

ICL Group actively pursues joint ventures to accelerate the development and market entry of cutting-edge technologies. A prime example is their collaboration with Shenzhen Dynanonic to construct a Lithium Iron Phosphate (LFP) cathode material facility in Spain. This strategic alliance is vital for ICL's ambitious expansion into the rapidly growing energy storage and electric vehicle markets.

ICL solidifies its market standing through enduring supply pacts with crucial clients. For instance, framework agreements are in place with Chinese and Indian entities for potash supply, extending through 2027, demonstrating a commitment to long-term relationships and market stability.

Further strengthening its reach, ICL has a substantial distribution agreement with AMP Holdings Group Co. Ltd. in China. This partnership is instrumental in bolstering ICL's presence and sales within the competitive specialty fertilizer market in the region.

Collaborations with Academia and Startups

ICL Group actively cultivates innovation through strategic alliances with academic bodies and emerging companies, exemplified by its Planet Startup Hub. These collaborations are geared towards advancing regenerative agriculture, digital farming technologies, and the development of biological solutions, thereby uncovering novel avenues for growth across ICL's diverse business segments.

These partnerships are crucial for ICL's forward-looking strategy, enabling the company to tap into cutting-edge research and agile development cycles. For instance, in 2024, ICL continued to expand its network of startup collaborations, focusing on areas that directly address sustainability and efficiency in the agricultural sector. The Planet Startup Hub serves as a key platform for identifying and nurturing these promising ventures.

- Academic Linkages: ICL collaborates with universities on research projects exploring sustainable nutrient management and novel crop protection methods.

- Startup Ecosystem Engagement: The Planet Startup Hub actively scouts and partners with startups developing AI-driven agricultural platforms and advanced biological inputs.

- Focus Areas: Key areas of collaboration include regenerative farming practices, precision agriculture, and the creation of bio-based fertilizers and pesticides.

- Innovation Pipeline: These partnerships are designed to feed ICL's innovation pipeline, bringing new sustainable solutions to market.

Technology and Research Collaborations

ICL Group actively pursues technology and research collaborations to drive innovation and efficiency. These partnerships are crucial for accessing specialized knowledge in fields such as artificial intelligence, the Internet of Things, and biotechnology, enabling ICL to stay at the forefront of industry advancements.

These collaborations directly support ICL's substantial investment in research and development. For instance, in 2023, ICL reported R&D expenses of approximately $160 million, underscoring the importance of these external relationships in achieving their innovation goals and developing novel products and solutions.

- AI and Data Analytics: Partnering with tech firms to integrate AI for optimizing agricultural yields and improving resource management.

- Biotechnology Advancements: Collaborating with research institutions on developing advanced bio-fertilizers and crop protection solutions.

- IoT Integration: Working with technology providers to implement IoT sensors for real-time monitoring of soil conditions and crop health, enhancing precision agriculture.

ICL Group's key partnerships are foundational to its innovation and market expansion strategies, particularly in specialty minerals and agricultural solutions. These alliances span acquisitions, joint ventures, and distribution agreements, all designed to enhance its product portfolio and global reach.

Strategic acquisitions, like that of GreenBest and Custom Ag Formulators in 2023, bolster ICL's specialty product offerings and local market penetration. Joint ventures, such as the one with Shenzhen Dynanonic for LFP cathode material production, are critical for entering high-growth sectors like energy storage. Furthermore, enduring supply pacts and distribution agreements, like those with Chinese and Indian entities for potash and AMP Holdings Group in China, ensure market stability and expand sales channels.

| Partnership Type | Partner Example | Year | Strategic Benefit | Key Focus Area |

|---|---|---|---|---|

| Acquisition | GreenBest, Custom Ag Formulators (CAF) | 2023 | Expanded specialty product range, enhanced local presence | Crop nutrition |

| Joint Venture | Shenzhen Dynanonic | Ongoing | Accelerated market entry in energy storage | LFP cathode materials |

| Supply Pact | Chinese and Indian entities | Through 2027 | Market stability, long-term relationships | Potash supply |

| Distribution Agreement | AMP Holdings Group Co. Ltd. | Ongoing | Increased market share in specialty fertilizers | China specialty fertilizer market |

| Startup Collaboration | Planet Startup Hub network | Ongoing (expanded in 2024) | Access to cutting-edge research, agile development | Regenerative agriculture, biologicals |

What is included in the product

A comprehensive overview of the ICL Group's business model, detailing its key partners, activities, resources, and customer relationships to illustrate its integrated approach to specialty minerals and chemicals.

This model highlights ICL's value propositions, customer segments, and channels, emphasizing its focus on delivering innovative solutions across diverse end markets.

The ICL Group Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of their operations, allowing for quick identification of inefficiencies and areas for improvement.

It streamlines complex strategies into a single page, making it easier to address and resolve operational pain points effectively.

Activities

ICL Group's core operation revolves around extracting and producing vital minerals like potash, phosphate, and bromine. These minerals are sourced from unique geological deposits, notably the Dead Sea, which provides a significant portion of its raw material base.

In 2024, ICL continued to leverage its access to these resources, with potash production remaining a key driver. The company's strategic mining operations ensure a steady supply of these essential components for its downstream manufacturing processes, underpinning its integrated business model.

ICL Group's core activity involves transforming raw minerals, like potash and phosphate, into a wide array of specialized products. These include essential fertilizers that support global agriculture, vital food additives enhancing food quality and safety, and a variety of industrial chemicals crucial for numerous manufacturing processes.

This intricate manufacturing and product transformation is fundamental to ICL's business model, enabling them to serve critical global sectors. For instance, in 2024, ICL continued to focus on optimizing its production facilities to meet the growing demand for its specialized mineral-based solutions.

ICL's commitment to innovation is substantial, with a significant $64 million allocated to Research and Development in 2024. This investment fuels advancements across key areas like sustainable agriculture, industrial processes, and the creation of entirely new products.

The company actively integrates advanced technologies such as artificial intelligence, the Internet of Things (IoT), and biotechnology. These cutting-edge tools are crucial for enhancing ICL's existing product lines and developing novel solutions that meet evolving market demands.

Global Sales, Marketing, and Distribution

ICL Group actively manages its global sales, marketing, and distribution network, ensuring its diverse product range reaches customers across continents. This involves navigating intricate supply chains and tailoring strategies to distinct regional market demands.

In 2024, ICL Group continued to emphasize its global reach, with sales driven by its specialty minerals and chemicals. The company's strategy focuses on leveraging its established distribution channels to serve key agricultural, food, and industrial markets worldwide.

- Global Reach: ICL operates in over 100 countries, serving a broad customer base.

- Market Adaptation: Strategies are localized to address specific regional needs and regulatory environments.

- Supply Chain Efficiency: Continuous investment in logistics and warehousing ensures timely product delivery.

- Product Portfolio Diversification: Sales efforts span fertilizers, industrial products, and food ingredients, catering to varied market segments.

Strategic Acquisitions and Business Development

ICL Group actively engages in strategic acquisitions and mergers to broaden its product portfolio and access new geographical markets. This approach is crucial for enhancing its presence in lucrative specialty chemical segments.

In 2024, ICL continued its focus on inorganic growth, complementing its organic expansion strategies. The company aims to integrate businesses that offer synergistic benefits and contribute to higher profit margins.

- Market Expansion: Acquisitions allow ICL to enter and gain market share in regions where it has a limited presence.

- Product Diversification: The company targets businesses that expand its range of specialty products, moving towards higher-value offerings.

- Synergy Realization: ICL seeks M&A opportunities that provide operational efficiencies and cost savings through integration.

- Strengthening Core Businesses: Acquisitions can bolster ICL's existing strengths in areas like fertilizers and industrial chemicals.

ICL's key activities encompass the extraction of essential minerals like potash and phosphate, primarily from the Dead Sea, a crucial raw material source. In 2024, potash production remained a significant focus, ensuring a consistent supply for its integrated manufacturing processes.

The company transforms these raw minerals into specialized products, including agricultural fertilizers, food additives, and industrial chemicals, serving vital global sectors. In 2024, ICL continued to optimize production to meet demand for these mineral-based solutions.

Innovation is a cornerstone, with $64 million invested in R&D in 2024 to advance sustainable agriculture and develop new products, leveraging technologies like AI and IoT.

ICL manages a global sales and distribution network, adapting strategies to regional demands and ensuring efficient supply chains. In 2024, sales were driven by specialty minerals and chemicals, leveraging established channels to serve agricultural, food, and industrial markets.

Full Version Awaits

Business Model Canvas

The ICL Group Business Model Canvas you're previewing is the actual document you will receive upon purchase. This isn't a sample or mockup; it's a direct representation of the comprehensive analysis you'll gain access to. Upon completing your order, you'll download this exact file, ready for immediate use and strategic application.

Resources

ICL's access to unique and extensive natural mineral deposits, particularly potash and phosphate from the Dead Sea, forms a cornerstone of its business model. These reserves are not only vast but also possess high quality, giving ICL a significant cost advantage and supply chain security. For instance, in 2023, ICL's Dead Sea operations continued to be a primary source of its potash production, contributing substantially to its global market share.

These critical raw materials, including bromine also sourced from the Dead Sea, are fundamental to ICL's production capabilities across its diverse segments, from fertilizers to specialty chemicals. The strategic location and inherent quality of these deposits provide ICL with a durable competitive advantage, underpinning its ability to serve global markets reliably. ICL's phosphate rock reserves, primarily in Israel and Jordan, also represent a key asset, supporting its position in the phosphate market.

ICL Group operates a robust global network of advanced production and manufacturing facilities, complemented by extensive mining sites. These strategically located assets are fundamental to the company's integrated value chain, enabling efficient extraction and processing of essential minerals.

These facilities are critical for transforming raw minerals into a diverse portfolio of specialty products, serving various end markets. For instance, in 2024, ICL continued to invest in optimizing its production capabilities, aiming to enhance efficiency and sustainability across its operations, reflecting a commitment to operational excellence.

ICL Group's commitment to innovation is underscored by its substantial intellectual property portfolio, boasting 2192 patents worldwide and maintaining 749 active patents as of recent reporting. This extensive patent base is a testament to its robust research and development efforts.

This proprietary technology, combined with deep industrial know-how, serves as a critical engine for ICL's product development, allowing for continuous innovation and a distinct competitive edge in the market.

Skilled Global Workforce and Expertise

ICL Group's skilled global workforce, numbering over 12,000 employees as of early 2024, is a cornerstone of its operations. This diverse team brings essential expertise in areas critical to the company's success.

- Mineral Extraction and Processing: Deep knowledge in extracting and processing vital minerals like potash and phosphates ensures efficient resource utilization.

- Chemical Engineering and R&D: A strong foundation in chemical processing and ongoing research and development drives product innovation and process optimization.

- Market-Specific Solutions: The workforce possesses the expertise to tailor solutions for diverse agricultural, industrial, and specialty chemical markets worldwide.

- Operational Excellence: Their collective skills are fundamental to maintaining high operational efficiency and safety standards across ICL's global facilities.

Financial Capital and Investment Capacity

ICL Group's robust financial standing, evidenced by approximately $6.8 billion in sales revenue for 2024, directly fuels its investment capacity. This substantial revenue stream generates significant free cash flow, which is crucial for funding all aspects of the business.

This financial strength allows ICL Group to pursue strategic investments, including research and development for innovative products and potential acquisitions. The company's financial health underpins its ability to maintain operations and drive long-term growth initiatives.

- Financial Capital: Substantial sales revenue, projected around $6.8 billion in 2024, provides the bedrock.

- Investment Capacity: Strong free cash flow generation enables significant capital allocation.

- Strategic Funding: Capital is directed towards ongoing operations, R&D, and strategic investments.

- Growth Enablement: Financial stability supports and facilitates long-term expansion plans.

ICL's access to unique mineral deposits, particularly potash and phosphate from the Dead Sea, is a primary resource. These high-quality reserves offer a cost advantage and supply chain security, with Dead Sea operations being a major potash source in 2023. Bromine, also from the Dead Sea, is vital for its diverse product lines.

ICL's global network of advanced production facilities and mining sites are key resources. These assets efficiently transform raw minerals into specialty products for various markets. In 2024, ICL focused on optimizing these capabilities for enhanced efficiency and sustainability.

The company's intellectual property, with 2192 patents worldwide and 749 active patents, represents a significant resource. This proprietary technology, combined with industrial know-how, drives product development and provides a competitive edge.

ICL's skilled global workforce, exceeding 12,000 employees in early 2024, is crucial. Their expertise spans mineral extraction, chemical engineering, R&D, market-specific solutions, and operational excellence.

ICL Group's financial strength, demonstrated by approximately $6.8 billion in sales revenue for 2024, is a vital resource. This financial capacity fuels investments in R&D, operations, and strategic growth initiatives, supported by strong free cash flow generation.

Value Propositions

ICL Group delivers vital solutions tackling global sustainability issues across agriculture, food, and industrial markets. Their offerings are designed to bolster food security, promote eco-friendly farming methods, and support environmentally sound industrial operations.

In 2024, ICL's commitment to sustainability is evident in their advanced fertilizer solutions, which aim to increase crop yields while minimizing environmental impact. For instance, their controlled-release fertilizers are engineered to deliver nutrients precisely when plants need them, reducing nutrient runoff and enhancing water use efficiency, a critical factor in combating water scarcity.

ICL Group's agricultural solutions, encompassing advanced fertilizers, biostimulants, and precision agriculture tools, directly bolster food security. These innovations are designed to significantly boost crop yields and improve the nutritional content of food products.

For instance, ICL's specialized fertilizers are proven to increase nutrient uptake by plants, leading to healthier crops and more abundant harvests. In 2024, the global demand for efficient agricultural inputs continued to rise, with ICL positioned to meet this need through its science-backed product portfolio.

Furthermore, the company's focus on improving crop nutrition contributes to better quality food, making it more resilient and extending its shelf life. This is crucial for reducing post-harvest losses and ensuring more food reaches consumers, thereby enhancing global food availability and quality.

ICL Group's high-performance industrial chemicals and materials are critical components across numerous sectors. For instance, their flame retardants are essential for enhancing the safety of electronics, a market that saw significant growth in 2024 driven by increased consumer electronics demand and stricter safety regulations.

The company also provides clear brine fluids, crucial for efficient oil and gas extraction, a sector that experienced fluctuating but generally robust activity throughout 2024. Furthermore, ICL is a key player in supplying advanced battery materials, directly supporting the booming electric vehicle and renewable energy storage markets, which are projected to continue their rapid expansion.

Sustainable and Environmentally Responsible Products

ICL Group's commitment to sustainability is a core part of its offering, focusing on reducing its environmental impact. They actively work to lower their carbon footprint, evidenced by their investments in projects aimed at environmental improvement. In 2023, ICL reported a 12% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to their 2019 baseline.

The company designs products and manufacturing processes that prioritize resource efficiency, aiming to minimize waste and ecological harm. This includes developing solutions that help customers achieve their own sustainability goals, such as fertilizers that improve nutrient uptake and reduce runoff.

ICL's value proposition emphasizes environmentally responsible products and operations through several key initiatives:

- Reduced Carbon Footprint: ICL is actively working to decrease its greenhouse gas emissions, with a target to reduce absolute Scope 1 and 2 emissions by 30% by 2030 compared to 2019.

- Resource Efficiency: The development of products like controlled-release fertilizers and water treatment solutions helps customers use resources more effectively and minimize environmental discharge.

- Circular Economy Principles: ICL explores opportunities to incorporate circular economy principles, such as utilizing by-products and waste streams in their production processes.

- Investment in Green Technologies: The company invests in research and development for new technologies and processes that offer more sustainable alternatives in agriculture and industry.

Customized and Localized Solutions

ICL Group excels by crafting solutions specifically designed for the unique demands of different regions and customer groups. This means their products and services are fine-tuned for local agricultural needs and industrial applications.

Their strategy of regional production and strategic acquisitions allows ICL to adapt offerings effectively. For instance, in 2024, ICL continued to invest in its European operations, enhancing its ability to serve local agricultural markets with climate-specific fertilizer blends.

This localized approach ensures optimal performance for products, whether it’s for varied soil types in South America or specific industrial processes in Asia. ICL’s commitment to customization is a key driver of its value proposition.

- Tailored Products: ICL develops solutions that precisely match the requirements of diverse regional markets and customer segments.

- Regional Presence: Supported by regional production facilities and acquisitions, ICL ensures products are optimized for local conditions.

- Agricultural Adaptation: This localized strategy allows for the creation of fertilizers and crop nutrition solutions suited to specific climates and soil types.

- Industrial Relevance: ICL also customizes industrial products to meet the varying technical specifications and regulatory environments of different countries.

ICL Group's value proposition centers on providing essential solutions that address critical global challenges in agriculture, food, and industry. They offer advanced fertilizers, biostimulants, and precision agriculture tools to enhance food security and promote sustainable farming practices. In 2024, ICL's focus on controlled-release fertilizers, for example, directly supports efficient water use and minimizes nutrient runoff, crucial for addressing water scarcity.

Their industrial segment provides high-performance chemicals vital for safety and efficiency across various sectors, including flame retardants for electronics and clear brine fluids for oil and gas extraction. ICL is also a key supplier of advanced battery materials, powering the growth of electric vehicles and renewable energy storage markets.

A significant aspect of ICL's offering is its deep commitment to sustainability, actively reducing its environmental footprint. This is demonstrated through investments in green technologies and the development of resource-efficient products. ICL reported a 12% reduction in Scope 1 and 2 GHG emissions by the end of 2023 compared to a 2019 baseline, aligning with their target to reduce emissions by 30% by 2030.

ICL also differentiates itself through a highly localized approach, tailoring its products and services to meet specific regional agricultural needs and industrial requirements. This is supported by strategic regional production and acquisitions, ensuring optimal product performance and customer satisfaction across diverse global markets.

| Value Proposition Area | Description | Example (2024 Focus) | Impact |

|---|---|---|---|

| Sustainable Agriculture Solutions | Enhancing food security and promoting eco-friendly farming. | Controlled-release fertilizers for improved nutrient uptake and water efficiency. | Increased crop yields, reduced environmental impact. |

| Industrial Performance Chemicals | Providing essential components for safety and efficiency in various industries. | Flame retardants for electronics, clear brine fluids for oil and gas. | Enhanced product safety, optimized resource extraction. |

| Commitment to Sustainability | Reducing environmental impact through operational improvements and green technologies. | Investments in GHG emission reduction projects; 12% reduction in Scope 1 & 2 emissions by end of 2023 (vs. 2019 baseline). | Lower carbon footprint, resource efficiency. |

| Regional Customization | Tailoring products and services to local market needs and conditions. | Climate-specific fertilizer blends for European markets; adapted industrial solutions for Asian regulations. | Optimized product performance, enhanced customer satisfaction. |

Customer Relationships

ICL Group fosters deep customer connections by assigning dedicated account management teams to key industrial and agricultural clients. These teams provide crucial technical support, agronomic expertise, and tailored product recommendations, ensuring clients maximize the effectiveness of ICL's offerings.

In 2024, ICL continued to emphasize this direct engagement, with a significant portion of its customer base benefiting from personalized service. This approach is vital for industries relying on specialized chemical inputs, where precise application and performance are paramount for success and profitability.

ICL Group cultivates enduring strategic alliances with its principal clientele and distribution networks. This approach is designed to build a foundation of confidence and predictability, achieved through reliable product delivery and joint efforts to resolve challenges. For instance, in 2024, ICL continued to secure multi-year potash supply contracts with significant global purchasers, underscoring this commitment to long-term engagement.

ICL Group establishes Customer Innovation and Qualification Centers for specialized sectors like battery materials. These centers foster deep collaboration with clients, focusing on joint product development, rigorous testing, and tailored solutions to meet specific needs.

This collaborative approach significantly speeds up technological advancements and ensures ICL's offerings are precisely aligned with market demands. For example, in 2024, ICL announced a significant expansion of its battery materials R&D capabilities, reflecting the growing importance of these specialized centers.

Digital Engagement and AI-Driven Services

ICL is actively using digital tools, including AI, to connect better with customers. This approach helps them offer more tailored products and marketing, as seen in their efforts to understand customer needs more deeply.

These AI-driven platforms are crucial for improving how ICL delivers services and gathers insights. For instance, by analyzing customer interactions, ICL can refine its offerings to better meet specific demands.

- Enhanced Personalization: AI analyzes customer data to tailor product recommendations and marketing messages, leading to more relevant customer interactions.

- Improved Service Delivery: Digital platforms streamline customer support and information access, making it easier for clients to engage with ICL.

- Data-Driven Insights: By tracking digital engagement, ICL gains valuable feedback on product performance and customer preferences, informing future development.

Regionalized Customer Service and Adaptation

ICL Group tailors its customer service to specific regions, recognizing that local needs and market dynamics vary significantly. This regionalization ensures that their products and support are not just globally available but also locally relevant and effective.

This strategy is crucial for industries like agriculture and specialty minerals, where product application and regulatory environments differ greatly. For instance, in 2024, ICL's agricultural solutions were adapted for specific soil types and climate patterns prevalent in key markets like Brazil and Australia, demonstrating a commitment to localized performance.

- Regional Adaptation: ICL customizes its product formulations and service delivery models to align with regional agricultural practices and industrial demands.

- Local Market Responsiveness: By understanding local customer requirements, ICL enhances its ability to provide timely and relevant support, fostering stronger client relationships.

- Geographic Focus: In 2024, ICL reported significant growth in its specialty fertilizer segment in Europe, attributed in part to its localized sales and technical support teams addressing specific crop nutrition needs.

- Customer-Centric Approach: This focus on regionalized service reflects a broader commitment to understanding and meeting the unique challenges faced by customers across its diverse global operations.

ICL Group prioritizes direct client engagement through dedicated account management and technical support, particularly for industrial and agricultural sectors. This personalized approach, evident in 2024 with a substantial portion of clients receiving tailored service, ensures optimal product utilization and client success.

The company cultivates strategic alliances and long-term supply agreements, fostering trust and predictability, as demonstrated by multi-year potash contracts secured in 2024. Furthermore, ICL establishes Customer Innovation Centers for collaborative product development in specialized areas like battery materials, speeding up advancements and market alignment, with a notable R&D expansion announced in 2024.

Leveraging digital tools and AI, ICL enhances customer connections by offering personalized products and marketing, informed by deep customer need analysis. These platforms improve service delivery and provide data-driven insights, refining offerings based on digital engagement feedback.

ICL also regionalizes its customer service, adapting products and support to local market dynamics and agricultural practices, ensuring relevance and effectiveness. This localized strategy, exemplified by agricultural solutions tailored for Brazil and Australia in 2024, strengthens client relationships and drives growth, such as in the European specialty fertilizer segment.

Channels

ICL leverages a dedicated direct sales force to cultivate strong relationships with major industrial clients, large agricultural operations, and significant distribution partners worldwide. This approach facilitates direct negotiation, personalized service, and the effective transfer of in-depth product expertise.

In 2024, ICL's direct sales efforts were instrumental in securing key contracts, with a notable increase in engagement with emerging markets. The company reported that its direct sales channels contributed to a significant portion of its specialty minerals revenue, underscoring the channel's strategic importance.

ICL Group utilizes an extensive global distribution network, encompassing marketing companies, agents, and local distributors, to ensure broad market reach. This network is crucial for delivering its diverse product portfolio to customers worldwide.

Strategic partnerships are a cornerstone of ICL's distribution strategy. For instance, agreements with major agricultural distribution firms, such as AMP Holdings in China, significantly bolster market penetration and access to key agricultural regions.

In 2024, ICL reported that its Specialty Minerals segment, which heavily relies on this distribution network, continued to be a significant contributor to its revenue, demonstrating the effectiveness of its channel partners.

ICL Group's business model is significantly strengthened by its strategic acquisitions, which bring established channels and deep customer relationships. For instance, the 2024 acquisition of GreenBest, a leading European producer of organic fertilizers, and Custom Ag Formulators (CAF), a US-based crop nutrition company, are prime examples. These integrations allow ICL to leverage GreenBest's extensive European distribution network and CAF's strong ties with American growers, directly enhancing ICL's reach and market penetration.

By incorporating these acquired entities, ICL effectively broadens its distribution footprint and gains more direct access to end-users, particularly farmers and growers in crucial agricultural markets. This expansion not only diversifies ICL's customer base but also provides valuable local market intelligence, enabling more tailored product offerings and responsive customer service. The combined strength of ICL's global operations with the localized expertise of its acquired businesses positions the company for sustained growth in the specialty minerals and fertilizers sector.

Digital Platforms and Investor Relations

ICL Group leverages its corporate website and dedicated investor relations portal as primary digital channels for transparent communication. These platforms are vital for sharing essential information like financial reports, annual reviews, and sustainability updates, ensuring stakeholders have access to critical data.

Social media channels further amplify ICL's reach, facilitating direct engagement with investors and the broader financial community. This digital ecosystem is key to disseminating timely news, product developments, and strategic insights, fostering a connected stakeholder base.

- Digital Reach: ICL's investor relations portal provides comprehensive financial documents and company news.

- Stakeholder Engagement: Social media platforms are used to share press releases and engage in dialogue.

- Information Dissemination: The corporate website acts as a central hub for product information and corporate strategy.

Logistics and Supply Chain Operations

ICL Group's logistics and supply chain operations are crucial for its global reach, facilitating the timely and dependable delivery of essential raw materials and finished products. This network spans numerous regions, encompassing intricate management of shipping, warehousing, and inventory to meet diverse customer needs efficiently.

In 2024, ICL continued to invest in optimizing its supply chain. For instance, the company reported significant progress in its digital transformation initiatives aimed at enhancing visibility and reducing lead times across its global distribution channels. This focus on efficiency is paramount, especially given the fluctuating costs and availability of shipping services throughout the year.

- Global Reach: ICL operates a complex logistics network to serve customers across continents, ensuring product availability.

- Efficiency Focus: Continuous investment in supply chain technology and processes aims to improve delivery times and reduce operational costs.

- Inventory Management: Strategic warehousing and inventory control are key to meeting fluctuating market demands and ensuring product freshness.

- Risk Mitigation: Diversifying transportation routes and suppliers helps ICL navigate potential disruptions in the global logistics landscape.

ICL's channels are a blend of direct engagement and expansive partnerships, ensuring broad market access. The direct sales force focuses on key accounts, while a vast distribution network, bolstered by strategic acquisitions, reaches a wider customer base.

Digital platforms serve as vital communication tools, disseminating financial and strategic information, while robust logistics ensure product delivery. This multi-faceted channel strategy is critical for ICL's global operations and market penetration.

| Channel Type | Key Characteristics | 2024 Impact/Focus |

|---|---|---|

| Direct Sales Force | Cultivates relationships with major clients and large operations; enables direct negotiation and personalized service. | Secured key contracts, increased engagement in emerging markets; significant contributor to specialty minerals revenue. |

| Global Distribution Network | Extensive network of marketing companies, agents, and local distributors; ensures broad market reach for diverse products. | Crucial for Specialty Minerals segment revenue contribution; bolstered by partnerships like AMP Holdings in China. |

| Strategic Acquisitions | Integrates established channels and customer relationships from acquired companies. | Acquisitions like GreenBest and CAF expanded European and US distribution and grower access in 2024. |

| Digital Channels (Website, Investor Relations, Social Media) | Transparent communication for financial reports, news, and stakeholder engagement. | Disseminates timely news, product developments, and strategic insights to foster a connected stakeholder base. |

| Logistics & Supply Chain | Facilitates timely and dependable delivery of raw materials and finished products globally. | Investments in digital transformation enhanced visibility and reduced lead times; crucial for navigating fluctuating shipping costs in 2024. |

Customer Segments

ICL Group's agricultural sector serves a broad customer base including individual farmers, large-scale growers, agricultural cooperatives, and fertilizer distributors across the globe. This segment is crucial for ICL's operations, as it directly impacts food production worldwide.

The company offers a comprehensive suite of crop nutrition solutions, including specialty fertilizers and advanced biostimulants designed to significantly boost crop yields and encourage more sustainable farming methods. In 2024, ICL continued to emphasize its role in supporting global food security through these innovative agricultural inputs.

ICL Group is a key supplier to food manufacturers and processors, offering a range of food additives and functional ingredients. These essential components enhance the quality, extend the shelf life, and boost the nutritional profile of products across various categories.

The company's ingredients are vital for processed meats, dairy products, beverages, and baked goods. For instance, ICL's phosphates are widely used in processed meats to improve water retention and texture, a market segment that saw significant global growth in 2024. Their solutions also play a crucial role in dairy applications, contributing to the stability and mouthfeel of yogurts and cheeses.

ICL Group serves a diverse range of industrial chemical and materials customers, including those in electronics, energy storage, and automotive sectors. These industries rely on ICL's specialized products like flame retardants and advanced phosphate solutions to enhance performance and safety.

The oil and gas drilling and construction industries also represent key customer segments, utilizing ICL's clear brine fluids for efficient operations. In 2024, the global market for specialty chemicals, a core area for ICL, was projected to reach over $700 billion, indicating substantial demand for their offerings.

Specialty Product Buyers

Specialty Product Buyers are those who actively seek out high-value, tailored, and cutting-edge solutions designed for very particular uses. They are not looking for off-the-shelf items but rather products that solve specific, often complex, challenges.

ICL Group's business strategy increasingly focuses on expanding its presence within these specialty segments. This strategic pivot is driven by the understanding that these niche markets typically offer more robust profitability, often translating into higher profit margins compared to commodity products.

For instance, in 2024, ICL continued to highlight its specialty minerals and advanced additives as key growth drivers. The company reported that its specialty minerals segment, which includes products for food, agriculture, and industrial applications requiring precise formulations, contributed significantly to its overall revenue and profitability. This focus aligns with market trends where customization and performance are paramount, allowing ICL to capture premium pricing.

- Targeted Solutions: Customers in this segment require products that address unique application needs, demanding innovation and specific performance characteristics.

- Higher Margins: The specialized nature of these products allows ICL to achieve better profitability, reflecting the advanced technology and research investment involved.

- Innovation Driven: Specialty Product Buyers are often early adopters of new technologies and value suppliers who can co-develop solutions.

- Strategic Growth Area: ICL's emphasis on these segments underscores a commitment to moving up the value chain and capturing greater market share in high-growth, high-margin areas.

Geographically Diverse Markets

ICL Group’s customer base spans the globe, reaching key economic hubs across North America, Europe, and Asia. The company has a significant presence in rapidly developing Asian markets, with particular attention paid to China and India’s growing demand for specialty minerals and fertilizers.

Furthermore, ICL actively serves markets in South America, with Brazil being a notable focus area. This broad geographic reach allows ICL to tap into diverse agricultural and industrial needs, adapting its product offerings and strategies to comply with varying regional regulations and market dynamics.

- North America: A mature market with consistent demand for industrial minerals and specialty fertilizers.

- Europe: Strong focus on sustainable agriculture and advanced materials, with stringent regulatory environments.

- Asia (China & India): High-growth regions driven by expanding populations and increasing food security needs, alongside industrial development.

- South America (Brazil): Significant agricultural sector requiring advanced crop nutrition solutions to boost yields.

ICL Group's customer segments are diverse, encompassing agriculture, food, and industrial markets worldwide. This broad reach allows the company to cater to varied needs, from farmers seeking enhanced crop yields to food manufacturers requiring specialized ingredients and industrial clients needing performance-enhancing materials.

The company's agricultural segment serves individual farmers, large growers, and cooperatives, providing advanced crop nutrition solutions. In the food sector, ICL supplies essential additives and functional ingredients to processors for products like meats, dairy, and baked goods, supporting texture and shelf-life improvements. The industrial segment includes electronics, energy storage, and automotive industries, relying on ICL's specialty products such as flame retardants and phosphate solutions.

| Customer Segment | Key Needs | 2024 Focus/Data Point |

|---|---|---|

| Agriculture | Crop yield enhancement, sustainable farming | Global food security support through innovative inputs |

| Food | Quality, shelf-life, nutritional enhancement | Phosphates for processed meats (market growth in 2024) |

| Industrial Chemicals & Materials | Performance, safety, specialized applications | Specialty chemicals market projected over $700 billion in 2024 |

| Oil & Gas / Construction | Efficient operations | Clear brine fluids for operational efficiency |

Cost Structure

ICL Group's cost structure heavily relies on the extraction and processing of key minerals like potash, phosphate, and bromine. These upfront costs encompass extensive mining operations, significant energy consumption for processing, and the initial refining stages to prepare these materials for further use.

In 2023, ICL reported that its cost of goods sold, which includes these raw material expenses, was approximately $5.9 billion. This figure underscores the substantial investment required to bring their core products to market.

ICL Group dedicates significant resources to Research and Development, recognizing its importance for innovation and market leadership. In 2024, the company invested $64 million in R&D activities. This substantial outlay supports the creation of novel products, the enhancement of current offerings, and the investigation of cutting-edge technologies across its diverse business segments.

ICL Group's business model relies heavily on substantial capital expenditures. These investments are crucial for keeping their production facilities and mining operations in top shape, as well as for expanding their capacity. This includes everything from routine maintenance to major upgrades and the development of entirely new infrastructure.

In 2024, ICL Group demonstrated this commitment by earmarking $91 million specifically for facility upgrades. Looking ahead, the company has signaled its intent for significant investment in new ventures, notably the construction of a new Lithium Iron Phosphate (LFP) cathode material facility. This strategic investment underscores their focus on future growth and technological advancement.

Operational and Logistics Costs

ICL Group's operational and logistics costs are significant, encompassing everything from running its manufacturing plants to getting products to customers worldwide. These include expenses for labor, the energy needed to power facilities, and the complex network of transportation required to manage its global supply chain. In 2024, ICL continued its focus on improving efficiency to keep these costs in check.

The company actively pursues optimization programs to mitigate these substantial operational expenses. These efforts are crucial for maintaining profitability in a competitive market.

- Manufacturing Processes: Costs associated with raw material processing, chemical synthesis, and product finishing.

- Labor Expenses: Wages, benefits, and training for a global workforce involved in production and logistics.

- Energy Consumption: Significant expenditure on electricity and fuel to power manufacturing facilities and transportation fleets.

- Global Supply Chain Management: Costs related to warehousing, inventory, freight, and customs for international distribution.

Acquisition and Integration Costs

ICL Group's growth strategy heavily relies on acquiring and integrating other companies, which incurs substantial costs. These expenses cover the purchase price of businesses like GreenBest, Custom Ag Formulators, and Lavie Bio, as well as the significant investments needed to merge their operations, systems, and cultures into ICL's existing framework. For instance, the acquisition of GreenBest in 2023, a UK-based producer of sustainable fertilizers, likely involved substantial upfront capital and ongoing integration expenses to align its product lines and distribution channels with ICL's broader European strategy.

- Acquisition Outlay: Direct costs associated with purchasing target companies, including deal structuring and legal fees.

- Integration Expenses: Costs related to merging IT systems, consolidating operations, rebranding, and workforce alignment.

- Synergy Realization: Investments made to achieve cost savings and revenue enhancements post-acquisition, such as optimizing supply chains or cross-selling products.

- Due Diligence: Fees paid for financial, legal, and operational reviews of potential acquisition targets.

ICL Group's cost structure is anchored by the substantial expenses associated with extracting and processing its core minerals, potash and phosphate. These direct costs are complemented by significant investments in research and development, aiming to foster innovation and maintain competitive advantage. Furthermore, the company incurs considerable capital expenditures for facility maintenance and expansion, alongside operational and logistics costs that manage its global supply chain.

| Cost Category | 2023 (Approx.) | 2024 (Planned/Actual) | Notes |

|---|---|---|---|

| Cost of Goods Sold (Raw Materials & Processing) | $5.9 billion | N/A | Reflects direct costs of extraction and initial processing. |

| Research & Development | N/A | $64 million | Investment in innovation and new product development. |

| Capital Expenditures (Facility Upgrades) | N/A | $91 million | Focus on maintaining and expanding operational infrastructure. |

| Acquisition & Integration Costs | Varies | Varies | Costs associated with strategic acquisitions like GreenBest. |

Revenue Streams

ICL Group generates revenue from selling different types of potash, mainly for farming. This includes both long-term agreements with big buyers in places like China and India, and also sales on the open market. For example, in 2024, ICL's Potash segment reported significant sales volumes, driven by strong demand in key agricultural regions, contributing substantially to the group's overall financial performance.

The Industrial Products segment is a significant revenue generator for ICL Group, primarily driven by the sale of bromine and its derivatives. These products, including essential flame retardants, are crucial for safety in various manufacturing processes. In 2024, this segment saw continued demand, reflecting the ongoing need for specialized chemical solutions across multiple industries.

Beyond bromine, this segment also includes clear brine fluids, vital for the oil and gas sector, and a range of other specialty minerals. These materials find application in diverse industrial uses, from water treatment to agriculture. The strategic importance of these products underscores ICL's role as a key supplier in global industrial supply chains.

Sales from the Phosphate Solutions segment are generated through the provision of specialty phosphates. These are utilized in a variety of food and industrial applications, encompassing food additives, critical battery materials like Lithium Iron Phosphate (LFP), and phosphate-based fertilizers.

This segment is a significant contributor to ICL Group's profitability, often characterized by higher profit margins compared to other business areas. For instance, in the first quarter of 2024, ICL reported that its Phosphate Solutions segment generated $600 million in revenue, demonstrating its substantial market presence and value generation.

Sales from Growing Solutions Segment

Sales from the Growing Solutions segment are a key revenue driver, encompassing specialized fertilizers like controlled-release and water-soluble options, alongside biostimulants designed for diverse agricultural needs. This segment is further strengthened by strategic acquisitions, such as GreenBest and Custom Ag Formulators, which expand ICL's product portfolio and market reach.

- Specialty Fertilizers: This includes controlled-release fertilizers (CRF), water-soluble fertilizers (WSF), and biostimulants, catering to specific crop requirements and environmental conditions.

- Acquisition Impact: The integration of GreenBest and Custom Ag Formulators has broadened the product offerings and enhanced ICL's presence in key agricultural markets.

- Market Focus: These solutions are tailored for high-value crops and precision agriculture, addressing the growing demand for efficient nutrient management and yield enhancement.

New and Emerging Product Sales

ICL Group is seeing a growing portion of its revenue come from cutting-edge products introduced into new markets. This includes significant development in advanced battery materials, specifically lithium iron phosphate (LFP) cathode active materials, which are crucial for the booming electric vehicle and energy storage sectors. This strategic pivot highlights ICL's commitment to diversification and capturing growth opportunities in sustainable technologies.

For instance, ICL's investment in LFP technology is a direct response to the escalating demand for safer and more cost-effective battery solutions. By 2024, the global market for LFP batteries was projected to reach substantial figures, driven by automotive manufacturers seeking to expand their EV offerings. ICL's entry into this space positions them to benefit from this trend.

- Revenue from advanced battery materials, like LFP cathode active materials, is a key growth driver.

- This diversification strategy targets new sectors, particularly sustainable energy storage.

- ICL's innovation in these areas is designed to capture market share in rapidly expanding technological fields.

ICL Group's revenue streams are diversified across several key segments, including Potash, Industrial Products, Phosphate Solutions, and Growing Solutions. The company also leverages its expertise in advanced materials, particularly for the burgeoning battery sector. This multi-faceted approach allows ICL to cater to a wide array of global markets and industries.

| Segment | Primary Revenue Source | Key Products/Applications | 2024 Highlight |

|---|---|---|---|

| Potash | Potash sales (fertilizer) | Long-term agreements, open market sales | Strong demand in key agricultural regions |

| Industrial Products | Bromine and derivatives, clear brine fluids | Flame retardants, oil & gas sector, water treatment | Continued demand for specialized chemical solutions |

| Phosphate Solutions | Specialty phosphates | Food additives, battery materials (LFP), fertilizers | Q1 2024 revenue of $600 million |

| Growing Solutions | Specialty fertilizers, biostimulants | Controlled-release, water-soluble fertilizers, acquisitions (GreenBest) | Broadened product portfolio and market reach |

| Advanced Materials | Lithium Iron Phosphate (LFP) | Electric vehicles, energy storage | Targeting growth in sustainable technologies |

Business Model Canvas Data Sources

The ICL Group Business Model Canvas is informed by a robust blend of internal financial data, comprehensive market research, and strategic operational insights. This multi-faceted approach ensures each component of the canvas is grounded in accurate, actionable intelligence.