ICL Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ICL Group Bundle

Understand how political shifts, economic volatility, and evolving social trends are impacting ICL Group's operations and market position. Our PESTLE analysis dives deep into these critical external factors, providing you with the foresight to anticipate challenges and capitalize on opportunities. Gain a competitive advantage by downloading the full, actionable insights today.

Political factors

ICL Group's substantial presence in Israel makes it inherently vulnerable to geopolitical shifts and localized conflicts. These situations can directly impede its supply chains, disrupt manufacturing sites, and alter the international flow of critical minerals such as potash and bromine, vital for agriculture and various industrial applications.

For instance, the ongoing security concerns in Israel present a notable challenge for ICL, as acknowledged in their reporting. The company is actively managing this risk by leveraging its geographically dispersed workforce and diversified operational footprint to maintain business continuity and mitigate potential impacts on its global market position.

Government policies globally significantly shape the demand for fertilizers and food additives, which are central to ICL's operations. For instance, the United States Department of Agriculture (USDA) projects that total farm sector income in 2024 will be $137.3 billion, a decrease from 2023, potentially impacting farmers' spending on inputs. Subsidies, food production regulations, and national food security programs directly influence how much farmers can afford for agricultural inputs and the required specifications for food ingredients, presenting both opportunities and challenges for ICL's Growing Solutions and Phosphate Solutions segments.

ICL Group, with over 90% of its sales originating internationally, is particularly exposed to shifts in global trade policies. For instance, the ongoing trade tensions between major economies in 2024 continue to create uncertainty around tariffs, directly impacting the cost of raw materials and finished goods for ICL.

New international agreements or the renegotiation of existing ones, such as those impacting agricultural inputs or specialty chemicals, could significantly alter market access and pricing for ICL's products. The company's reliance on key markets like China and India means that any changes in import duties or trade blocs in these regions, which saw combined trade volumes exceeding $10 billion for similar industries in 2024, could pose substantial challenges.

ICL's strategic response, focusing on a regional production model, aims to build resilience against these trade policy fluctuations. By diversifying its manufacturing footprint, the company seeks to mitigate the direct impact of tariffs and trade barriers on its cost structure and market reach, especially as global supply chains continue to reconfigure through 2025.

Mining and Resource Extraction Regulations

Governments worldwide, including those in key operational regions for ICL Group, impose stringent regulations on mining and resource extraction. These rules govern everything from initial licensing and land use to ongoing royalties and environmental operational standards. For instance, in 2024, many nations are reviewing or updating their mining codes to ensure greater resource value capture and environmental protection, which could directly affect ICL's cost structures and output.

Changes in these regulatory frameworks can significantly impact ICL's profitability. For example, increased royalty rates or new environmental compliance costs, which were a growing concern in 2024 discussions across several African and South American mining jurisdictions, can directly reduce margins. Similarly, shifts in resource ownership policies, such as nationalization or increased state participation in mining ventures, pose a risk to ICL's long-term operational stability and investment returns.

ICL Group's exposure to diverse political landscapes means it must navigate a complex web of national and international mining regulations.

- Licensing and Permitting: ICL secured key permits in 2024 for its Dead Sea operations, but ongoing renewals and new project approvals remain subject to evolving governmental policies.

- Royalties and Taxation: Royalty rates on extracted minerals can fluctuate; for example, potash royalty rates in some regions saw upward pressure in 2024, impacting production costs.

- Environmental Standards: Increasingly stringent environmental regulations, particularly concerning water usage and waste management in mining, require continuous investment in compliance technologies.

- Resource Nationalism: The trend of resource nationalism, where governments seek greater control over natural resources, could lead to policy changes affecting foreign mining companies like ICL.

Political Stability and Governance in Operating Countries

ICL Group's operations are significantly influenced by the political stability and quality of governance in the countries where it has mining and production facilities. For instance, in 2024, ongoing geopolitical tensions in regions where ICL has significant resource extraction, such as the Middle East, could introduce policy unpredictability. A World Bank Governance Indicator score of 75.2 for Israel in 2023, reflecting strong control of corruption and government effectiveness, provides a stable operational backdrop for a substantial portion of ICL's business.

Unstable political environments pose direct threats to ICL's assets and business continuity through potential policy shifts, civil unrest, or even nationalization risks. While ICL's diversified global footprint, with operations spanning across continents, helps to mitigate some of these risks by not being overly reliant on a single political landscape, the local political dynamics remain critically important. For example, changes in mining regulations or export policies in countries like Jordan, where ICL has potash operations, could directly impact profitability and supply chains.

- Political Stability: ICL operates in diverse political environments, requiring constant monitoring of governance quality and potential policy shifts.

- Risk Mitigation: A global operational footprint, while beneficial, necessitates understanding and managing country-specific political risks.

- Regulatory Impact: Changes in mining laws, environmental regulations, or trade policies in key operating countries can significantly affect ICL's financial performance.

- Geopolitical Sensitivity: The company's reliance on natural resources means it is susceptible to geopolitical events that could disrupt supply chains or alter market access.

Government policies significantly influence ICL's markets, with agricultural subsidies and food regulations directly impacting demand for fertilizers and food additives. For example, the USDA's 2024 projection of a $137.3 billion farm sector income highlights potential shifts in farmers' spending on inputs like those ICL provides.

Global trade policies and international agreements are critical due to ICL's extensive international sales, with over 90% of revenue generated outside Israel. Trade tensions in 2024, for instance, create uncertainty around tariffs, affecting raw material costs and finished product pricing for ICL.

Stringent mining and resource extraction regulations globally, including licensing, royalties, and environmental standards, directly impact ICL's operational costs and output. Many nations are updating mining codes in 2024 to enhance resource value and environmental protection, potentially increasing ICL's compliance expenses.

What is included in the product

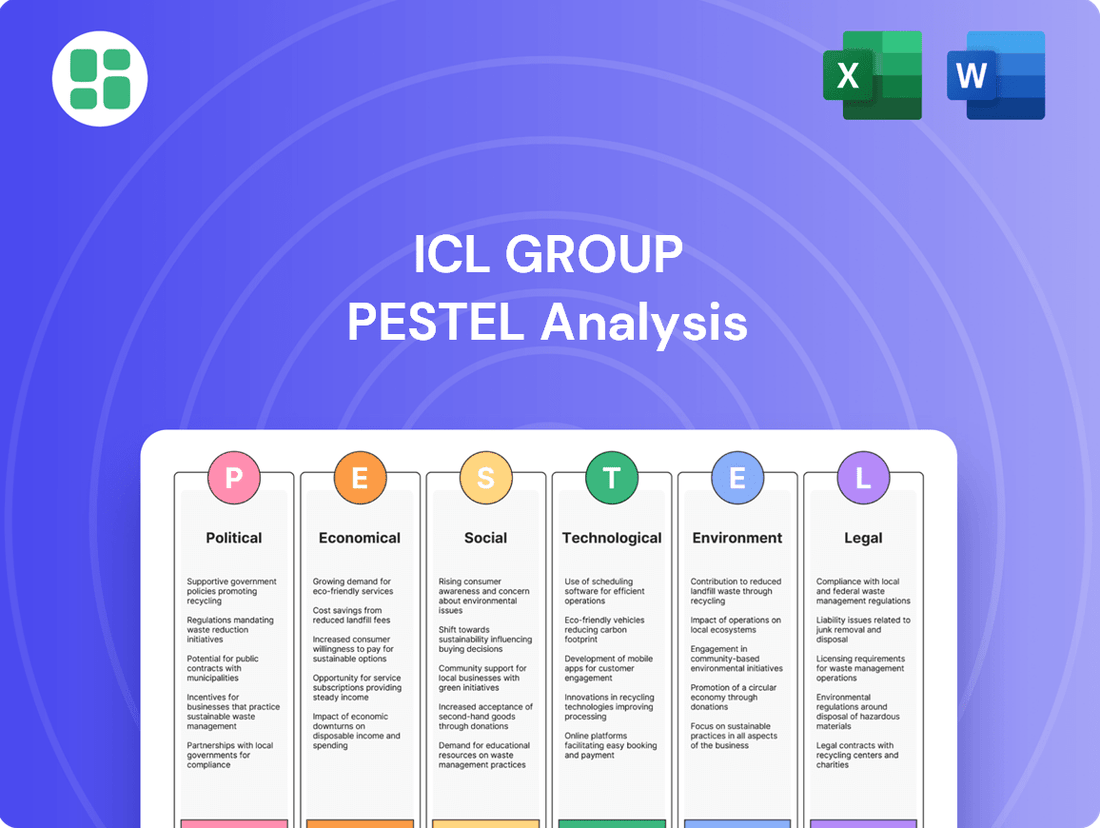

This PESTLE analysis examines the external macro-environmental factors impacting ICL Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions to inform strategic decision-making.

Provides a concise version of the ICL Group's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors.

Helps support discussions on external risks and market positioning for ICL Group by offering a clear, summarized view of the political, economic, social, technological, environmental, and legal landscape.

Economic factors

ICL Group's profitability is closely tied to the unpredictable global prices of essential minerals like potash, phosphate, and bromine. These price swings directly influence the company's earnings and profit margins. For instance, a dip in potash prices in Q1 2025, despite higher sales volumes, negatively impacted the Potash segment's revenue, highlighting this sensitivity.

The fertilizer market is particularly challenging due to the volatile nature of key input costs. For example, potash prices saw a notable decrease in early 2025, impacting ICL's financial performance in its Potash division. This underscores the significant risk associated with commodity price fluctuations for companies like ICL.

Global economic growth directly impacts ICL Group's core business, influencing demand for its industrial chemicals and food additives. A strong global economy generally means a more active industrial sector, leading to increased consumption of ICL's products. Conversely, economic slowdowns can dampen this demand.

In the first quarter of 2025, global industrial production saw a growth of 2.9%. Projections indicate this growth will stabilize at 3.1% for the remainder of the year, suggesting a steady but not explosive demand environment for industrial chemicals.

ICL Group, as a global entity with extensive international sales and operations, is inherently susceptible to the volatility of currency exchange rates. Fluctuations in the value of the US dollar relative to other key global currencies directly influence how ICL's international revenues and expenses are translated, thereby impacting its reported financial performance.

For instance, during 2024, ICL observed a tangible effect of these exchange rate shifts on its Growing Solutions segment, specifically noting an impact on sales within Brazil. This illustrates the direct, real-world consequences of currency movements on the company's operational and financial outcomes.

Inflationary Pressures and Input Costs

Rising inflation poses a significant challenge, directly impacting ICL Group's operational costs. We're seeing increases in expenses for essential raw materials, energy, transportation, and workforce wages. For instance, global commodity prices, a key input for ICL, experienced notable volatility in late 2024 and early 2025, driven by supply chain disruptions and geopolitical factors.

While ICL has been proactive with efficiency initiatives and cost-reduction programs, sustained inflation can still put pressure on profit margins. The ability to pass these increased costs onto customers through pricing adjustments is crucial, but market conditions and competitive landscapes will dictate the extent to which this is feasible. The company is closely observing the trajectory of global interest rates, as these influence borrowing costs and overall economic demand.

Key impacts include:

- Increased Cost of Goods Sold: Higher prices for fertilizers, minerals, and energy directly affect ICL's production expenses.

- Erosion of Profit Margins: If cost increases cannot be fully offset by price hikes, profitability will be negatively impacted.

- Impact on Consumer Spending: Rising inflation can reduce disposable income, potentially dampening demand for ICL's products, particularly in consumer-facing segments.

- Interest Rate Sensitivity: Changes in global interest rates affect ICL's financing costs and the overall economic environment in which it operates.

Agricultural Income and Farmer Purchasing Power

The financial well-being of farmers is a critical driver for ICL's fertilizer and crop nutrition sales. When commodity prices are low or input expenses rise, farmers tend to reduce spending on advanced fertilizers, directly impacting ICL's Growing Solutions segment.

For instance, in 2023, global grain prices experienced volatility, with wheat prices fluctuating significantly due to geopolitical events and supply chain disruptions. This directly influences farmer sentiment and their capacity to invest in crop inputs for the upcoming seasons.

- Farmer income directly correlates with demand for fertilizers.

- Lower commodity prices can reduce farmer purchasing power for advanced crop nutrition.

- Input cost inflation, such as for energy and raw materials, further squeezes farmer margins.

- Farmer sentiment, often tied to grain prices and yield expectations, is a key indicator for ICL's agricultural business outlook.

Economic factors significantly shape ICL Group's performance, primarily through commodity price volatility and global economic growth. For example, potash prices saw a notable decrease in early 2025, impacting ICL's Potash segment revenue despite increased sales volumes. Global industrial production grew by 2.9% in Q1 2025, with projections for 3.1% growth through the year, indicating a stable demand environment for ICL's industrial chemicals.

Currency exchange rate fluctuations also play a crucial role, as seen in 2024 when exchange rate shifts affected ICL's Growing Solutions segment sales in Brazil. Inflationary pressures are a persistent challenge, increasing operational costs for raw materials, energy, and transportation. While ICL implements cost-reduction measures, sustained inflation could pressure profit margins if cost increases cannot be fully passed on to consumers.

| Economic Factor | Impact on ICL | Data/Example |

|---|---|---|

| Potash Prices | Revenue and Profitability | Decreased in Q1 2025, impacting Potash segment revenue. |

| Global Industrial Production | Demand for Industrial Chemicals | Grew 2.9% in Q1 2025; projected to grow 3.1% for the remainder of 2025. |

| Currency Exchange Rates | International Revenue Translation | Affected Growing Solutions segment sales in Brazil during 2024. |

| Inflation | Operational Costs & Profit Margins | Increased costs for raw materials, energy, and transportation observed in late 2024/early 2025. |

Same Document Delivered

ICL Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of ICL Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed overview of the external forces shaping ICL Group's strategic landscape.

Sociological factors

The relentless rise in global population, projected to reach 10.4 billion by 2100, directly fuels an escalating demand for food. This demographic shift underscores the vital importance of companies like ICL Group, which are instrumental in bolstering food production through essential fertilizers and innovative food additives.

ICL's contribution to global food security is substantial; its products currently help feed an estimated 400 million people every single day. This highlights the company's foundational role in meeting the agricultural needs of a growing planet, ensuring a stable supply chain for a fundamental human necessity.

Consumers are increasingly prioritizing foods that are not only healthy but also produced sustainably. This shift directly impacts companies like ICL Group, which supplies essential ingredients for the food industry. For instance, a 2024 Nielsen report indicated that 73% of global consumers are willing to change their consumption habits to reduce their environmental impact, a significant driver for demand in ICL's specialty fertilizers and food additives that support cleaner production.

This heightened awareness fuels ICL's investment in innovative solutions. The company is focusing on areas like regenerative agriculture practices and technologies that enhance food quality and extend shelf life, directly responding to market desires for better, more responsibly sourced food. This aligns with ICL's strategic goal to provide solutions that contribute positively to global food security and environmental stewardship.

Public concern over the environmental and health effects of chemicals in agriculture and industry significantly shapes regulatory approaches and consumer choices. For instance, a 2024 survey indicated that 65% of consumers are more likely to purchase products from companies demonstrating strong environmental stewardship.

ICL, operating as a chemical producer, must actively cultivate a positive reputation. This involves highlighting product safety, adopting sustainable manufacturing processes, and showcasing responsible production methods, which are crucial for maintaining its social license to operate. In 2023, ICL reported a 10% increase in investments towards R&D focused on greener chemical alternatives.

Workforce Demographics and Labor Relations

ICL Group's operational success hinges on a skilled global workforce, exceeding 12,000 employees, particularly in mining, chemical processing, and research and development. Maintaining positive labor relations is paramount for ensuring consistent production and cost efficiency.

The availability of specialized talent in these core areas directly influences ICL's ability to innovate and maintain its competitive edge. For instance, a shortage of experienced chemical engineers or geologists could slow down new project development or impact existing operational output.

- Workforce Size: ICL Group employs over 12,000 individuals globally.

- Key Skill Areas: Focus on mining, chemical processing, and R&D talent.

- Impact of Labor Issues: Shortages or disputes can disrupt production and increase costs.

Corporate Social Responsibility (CSR) and Community Engagement

Societal expectations for corporate social responsibility, including ethical practices and community engagement, are increasingly vital for companies like ICL Group. In 2024, a significant majority of consumers and investors consider a company's social impact when making purchasing or investment decisions. ICL actively addresses these expectations by focusing on its contributions to local development and fostering strong stakeholder relationships, as highlighted in its comprehensive ESG reporting.

ICL's commitment to community engagement is evident in its various initiatives. For instance, in 2024, the company reported investing millions in local educational programs and environmental conservation efforts across its operational regions. These efforts aim to build trust and create shared value, aligning with the growing demand for businesses to be good corporate citizens.

- Societal Expectations: Growing consumer and investor demand for ethical business practices and positive community impact.

- ICL's Approach: Emphasis on stakeholder relationships and meaningful contributions to local development.

- ESG Reporting: Detailed disclosure of social and environmental performance, including community investment figures.

- Impact: Building trust and creating shared value through proactive corporate citizenship.

Societal expectations are increasingly shaping ICL Group's operations, with a strong emphasis on ethical practices and community engagement. In 2024, a substantial portion of consumers and investors factor a company's social impact into their decisions, making ICL's proactive approach to local development and stakeholder relationships crucial for its social license to operate.

ICL's commitment to corporate citizenship is demonstrated through significant investments in community initiatives. For example, in 2024, the company allocated millions towards local educational programs and environmental conservation projects in its operating regions, aiming to foster trust and shared value.

The demand for sustainable and healthy food products continues to rise, with 73% of global consumers in 2024 willing to alter consumption habits for environmental benefit. This trend directly benefits ICL, as its specialty fertilizers and food additives support cleaner production methods, aligning with consumer preferences for responsibly sourced goods.

| Societal Factor | 2024 Data/Trend | ICL's Response/Impact |

|---|---|---|

| Corporate Social Responsibility | Majority of consumers/investors consider social impact. | Focus on local development and stakeholder relationships; significant community investments reported in 2024. |

| Consumer Health & Sustainability Focus | 73% of global consumers willing to change habits for environmental benefit (Nielsen, 2024). | Demand for ICL's sustainable fertilizers and additives supporting cleaner production; investment in R&D for greener alternatives. |

| Workforce & Labor Relations | ICL employs over 12,000 globally; need for skilled mining, chemical processing, and R&D talent. | Positive labor relations are paramount for production consistency and cost efficiency; talent shortages can impact innovation. |

Technological factors

Technological advancements in fertilizer production, like controlled-release fertilizers and precision application, are reshaping the agricultural landscape and directly influencing ICL's Growing Solutions segment. These innovations aim to optimize nutrient delivery, minimizing waste and environmental impact.

ICL is heavily invested in research and development, focusing on creating novel products with superior nutrient release characteristics and enhanced efficiency for sustainable agriculture. For instance, their ongoing efforts in 2024 and into 2025 are geared towards developing next-generation fertilizers that respond dynamically to crop needs, potentially boosting yields by an estimated 5-10% in trials.

New technologies are revolutionizing mineral extraction and processing. Automation and digitalization are key, significantly boosting efficiency, cutting costs, and making mining safer. For ICL, this means improvements in their potash, phosphate, and bromine operations.

ICL is actively integrating smart technologies into its operations. For instance, they are investing in digital solutions to optimize their extraction processes. The company also focuses on generating sustainable energy to power its plants, which directly impacts the cost-effectiveness and environmental footprint of its mineral processing.

The development of alternative products and substitutes presents a potential long-term challenge for ICL Group. While potash, a core mineral for ICL, currently lacks direct synthetic substitutes, ongoing research into novel materials and production methods could eventually offer alternatives in other chemical segments. For instance, advancements in alternative proteins might reduce reliance on certain food additives derived from ICL's mineral base.

Digitalization and Automation in Operations

ICL Group is significantly enhancing its operations through digitalization and automation. The company is actively integrating digital agriculture solutions, which leverage data analytics and precision farming techniques to improve crop yields and resource efficiency. This focus is crucial as global food demand continues to rise, requiring more sustainable and productive agricultural practices.

The adoption of generative AI and advanced automation technologies is poised to revolutionize ICL's operational workflows. These tools can streamline processes, reduce manual labor, and improve decision-making across various functions, from R&D to logistics. For instance, AI can optimize fertilizer application, predict equipment maintenance needs, and enhance supply chain visibility, leading to substantial cost savings and operational improvements.

ICL's exploration into digital agriculture and AI is fundamentally reshaping its approach to building a more intelligent and sustainable food system. These advancements are not just about efficiency; they are about creating a more resilient and environmentally conscious food value chain.

- Digital Agriculture Adoption: ICL is investing in digital farming tools to optimize resource use, aiming for a 10-15% increase in resource efficiency in pilot programs by the end of 2025.

- AI Integration in R&D: The company is utilizing AI for faster development of new crop nutrition products, with a target to reduce R&D cycle times by up to 20% in the next two years.

- Automation in Manufacturing: ICL plans to automate key production lines, projecting a 5-10% reduction in operational costs through enhanced productivity and reduced waste by 2026.

- Supply Chain Optimization: Digital platforms are being implemented to provide real-time tracking and analytics, aiming to improve supply chain responsiveness by 25% by the close of 2025.

R&D in Sustainable and Precision Agriculture Solutions

ICL Group is significantly investing in research and development for sustainable and precision agriculture solutions, recognizing their critical role in future growth. This focus includes advancements in biostimulants and bio-inputs, which are essential for meeting the growing global demand for environmentally conscious farming methods.

These innovations are designed to provide ICL with a distinct competitive advantage in the agricultural sector. By developing cutting-edge products, the company is positioning itself at the forefront of sustainable agricultural practices.

A key strategic move to bolster these efforts was ICL's acquisition of a bio-inputs company in April 2025. This acquisition specifically aimed to broaden ICL's portfolio of specialty agricultural offerings, further solidifying its commitment to this high-growth area.

The company's R&D pipeline is robust, with a particular emphasis on solutions that enhance crop yield and resilience while minimizing environmental impact. For instance, their work on biostimulants aims to improve nutrient uptake and stress tolerance in plants, reducing the need for synthetic fertilizers and pesticides.

- R&D Investment: ICL's commitment to developing sustainable and precision agriculture solutions is a cornerstone of its long-term strategy.

- Market Alignment: Innovations in biostimulants and bio-inputs directly address global trends favoring eco-friendly farming.

- Strategic Acquisition: The April 2025 acquisition of a bio-inputs firm expanded ICL's specialty product range and market reach.

- Competitive Edge: These technological advancements are crucial for ICL to maintain and enhance its competitive position in the agricultural market.

ICL is actively integrating digital agriculture solutions, aiming for a 10-15% increase in resource efficiency by the end of 2025 through pilot programs. The company is also leveraging AI to accelerate the development of new crop nutrition products, targeting a 20% reduction in R&D cycle times in the next two years.

Automation in manufacturing is a key focus, with projected cost reductions of 5-10% by 2026 through enhanced productivity. Furthermore, digital platforms are being implemented to improve supply chain responsiveness by 25% by the close of 2025, offering real-time tracking and analytics.

| Technology Focus | Objective | Target Metric | Timeline |

|---|---|---|---|

| Digital Agriculture | Optimize resource use | 10-15% increase in resource efficiency | End of 2025 |

| AI in R&D | Faster product development | 20% reduction in R&D cycle times | Next two years |

| Automation in Manufacturing | Enhance productivity and reduce waste | 5-10% reduction in operational costs | By 2026 |

| Supply Chain Digitization | Improve responsiveness | 25% improvement | Close of 2025 |

Legal factors

ICL Group faces rigorous environmental mandates, particularly concerning emissions and waste management. In 2024, the company continued to invest in technologies to meet evolving standards, such as those under Israel's Clean Air Law, which governs industrial pollutant releases. These compliance efforts are crucial for maintaining operational licenses and avoiding penalties, directly influencing ICL's capital expenditures and operating expenses.

Regulations governing the safety and quality of food additives and industrial chemicals are paramount for ICL Group's operations. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation, which has been in effect for years and continues to evolve, impacts how ICL handles its chemical products. In 2024, companies like ICL are facing increased scrutiny on the environmental and health impacts of their chemical portfolios, necessitating robust compliance measures.

Adhering to international standards, such as those set by the Food and Agriculture Organization of the United Nations (FAO) and the World Health Organization (WHO) for food additives, and national laws like the U.S. Food, Drug, and Cosmetic Act for its American markets, ensures product integrity and consumer trust. This compliance is essential for maintaining market access and preventing disruptions. For example, in 2023, several food additive recalls occurred globally due to undeclared allergens or contaminants, highlighting the severe consequences of non-compliance.

Failure to meet these stringent safety and quality benchmarks can result in significant financial penalties, product recalls, and lasting damage to ICL's reputation. In 2024, the global regulatory landscape for chemicals and food ingredients is becoming more complex, with a growing emphasis on sustainability and transparency, making proactive compliance a critical business imperative for ICL.

ICL Group's extensive global presence means it must navigate a complex web of varying labor laws. These regulations cover crucial aspects like minimum wages, working hours, and collective bargaining rights across different jurisdictions. For instance, in 2024, many European countries continued to strengthen worker protections, impacting operational costs and employment practices.

Worker safety is paramount for ICL, underscored by its explicit Environment, Safety, Health and Security policy. This commitment aims to mitigate workplace accidents and ensure the well-being of its workforce. In 2023, the industrial sector globally saw a focus on reducing lost-time injury frequency rates, with many companies reporting rates below 1.0 per 200,000 hours worked, a benchmark ICL likely strives to meet or exceed.

Antitrust and Competition Laws

ICL Group, as a major global producer of specialty minerals and chemicals, operates under stringent antitrust and competition laws across its operating regions. These regulations are designed to prevent anti-competitive practices, such as price-fixing or market manipulation, and ensure a level playing field for all market participants. For instance, in 2024, regulatory bodies like the European Commission and the U.S. Federal Trade Commission continue to scrutinize large market share holders to maintain fair competition.

Compliance with these laws significantly influences ICL's strategic decisions, particularly regarding mergers, acquisitions, and its approach to market expansion. Any significant consolidation or partnership could face regulatory review to ensure it does not unduly stifle competition. ICL's established position and substantial market share in critical sectors, such as potash and phosphate-based fertilizers, represent a key competitive advantage but also draw regulatory attention.

- Market Share Scrutiny: ICL's significant global market share in potash and phosphate fertilizers, estimated to be a substantial percentage in key markets, necessitates careful navigation of competition laws to avoid accusations of monopolistic behavior.

- Merger & Acquisition Oversight: Potential acquisitions or mergers by ICL are subject to antitrust reviews in jurisdictions like the EU and the US, ensuring that such deals do not create dominant market positions that harm consumers or competitors.

- Pricing and Collusion Prevention: Antitrust laws prohibit practices like price-fixing and bid-rigging, requiring ICL to maintain transparent and independent pricing strategies across its product lines in 2024 and beyond.

- Regulatory Fines: Non-compliance can result in significant financial penalties; for example, competition authorities globally have imposed billions in fines on companies for antitrust violations in recent years, underscoring the importance of adherence.

Intellectual Property Rights and Patents

ICL Group's competitive edge hinges on robust protection of its intellectual property, particularly patents covering its innovative products and specialized processes. These legal safeguards are essential for ICL to capitalize on its significant research and development investments. By securing patents, ICL can prevent competitors from freely utilizing its proprietary technologies, thereby maintaining market exclusivity and profitability.

The legal frameworks governing intellectual property rights are paramount for ICL's sustained growth. These frameworks enable the company to secure its innovations, fostering an environment where R&D expenditures translate directly into tangible market advantages. For instance, in 2024, ICL continued to file new patents, reflecting its ongoing commitment to innovation in areas like specialty fertilizers and advanced materials.

ICL's strategic approach to patenting is critical in the global chemical and specialty minerals industry. The company actively monitors and defends its patent portfolio against potential infringements. This vigilance ensures that ICL can continue to benefit from its technological advancements, a key factor in its financial performance and market positioning.

- Patent Protection: ICL relies on patents to safeguard its unique product formulations and manufacturing processes.

- R&D Investment: Legal IP protection allows ICL to recoup investments made in developing new technologies.

- Competitive Advantage: Patents prevent unauthorized use of ICL's proprietary technologies, maintaining its market edge.

- Global Strategy: ICL's patent strategy is integral to its global operations and market access.

ICL Group operates within a complex legal framework that significantly shapes its business. Environmental regulations, such as those concerning emissions and waste, require continuous investment in compliance technologies, impacting operational costs. For example, adherence to Israel's Clean Air Law in 2024 necessitates ongoing technological upgrades.

The company must also navigate stringent product safety and chemical regulations globally, like the EU's REACH. This requires robust compliance measures for its chemical portfolio, with increased scrutiny in 2024 on environmental and health impacts. Failure to comply can lead to severe penalties and reputational damage.

Antitrust and competition laws are critical for ICL, given its substantial market share in key minerals. Regulatory bodies in the EU and US, for instance, continue to monitor market concentration in 2024 to prevent anti-competitive practices, influencing ICL's strategic decisions on mergers and acquisitions.

Intellectual property laws are vital for protecting ICL's innovations. The company actively secures patents for its specialized processes and products, enabling it to maintain market exclusivity and recoup significant R&D investments, as seen in its continued patent filings in 2024.

Environmental factors

ICL Group's operations, especially its mining activities around the Dead Sea, are deeply reliant on water. This dependency makes the company particularly vulnerable to water scarcity and evolving management regulations. For instance, in 2023, ICL reported investing in water efficiency projects as part of its sustainability strategy, aiming to reduce its freshwater consumption.

These environmental factors create significant operational hurdles, pushing ICL to invest heavily in advanced water-saving technologies and optimize water usage across its production sites. The company has publicly stated its commitment to achieving specific water reduction targets by 2030, reflecting the growing pressure to manage this vital resource more sustainably.

Large-scale mining operations, by their nature, present significant environmental challenges. These include the unavoidable destruction of natural habitats, leading to land degradation and posing a direct threat to local ecosystems and the biodiversity they support. For instance, mining activities can alter soil composition and water tables, impacting plant and animal life for extended periods.

ICL Group acknowledges these inherent risks and is actively committed to mitigating its environmental footprint. The company's strategy is increasingly aligned with global sustainability benchmarks, including the United Nations Sustainable Development Goals (SDGs). This commitment is demonstrated through investments in cleaner technologies and responsible resource management practices.

In 2023, ICL reported a 15% reduction in its Scope 1 and 2 greenhouse gas emissions compared to its 2019 baseline, showcasing progress in its environmental stewardship. The company also aims to achieve 100% renewable electricity sourcing for its operations by 2030, a move that will further lessen its impact on ecosystems.

As an industrial entity, ICL Group acknowledges its role in greenhouse gas (GHG) emissions. The company has committed to significant reductions, targeting a 30% decrease in Scope 1 and 2 emissions by 2030, using 2018 as a baseline. This aligns with their broader ambition to achieve carbon neutrality by 2050, a goal validated by the Science Based Targets initiative (SBTi).

Waste Management and Circular Economy Initiatives

ICL Group is actively engaged in enhancing its waste management practices and embracing circular economy principles to lessen its environmental impact. This involves a concerted effort to decrease waste at its source, boost recycling rates, and identify valuable applications for by-products, all while adhering to stringent environmental regulations.

The company has established specific targets for waste reduction. For instance, ICL aims to reduce waste intensity by 15% by 2025 compared to a 2020 baseline, with a particular focus on hazardous waste reduction.

- Waste Reduction Goals: ICL has committed to reducing its overall waste intensity by 15% by 2025, using 2020 as a benchmark year.

- Circular Economy Focus: The group is exploring innovative ways to reuse by-products from its mining and manufacturing processes, turning potential waste streams into valuable resources.

- Operational Efficiency: Initiatives include optimizing production processes to minimize material input and waste output, contributing to both environmental sustainability and cost savings.

- Regulatory Compliance: ICL's waste management strategies are designed to meet and exceed evolving environmental legislation in the regions where it operates.

Climate Change Impacts on Agriculture and Supply Chains

Climate change is fundamentally reshaping agriculture, with extreme weather events like prolonged droughts and intense floods becoming more frequent. These shifts directly affect crop yields and the stability of global food supply chains, underscoring the critical role companies like ICL play in ensuring food security. For instance, the World Meteorological Organization reported that 2023 was the warmest year on record, with significant impacts on agricultural productivity in various regions.

The increasing unpredictability of weather patterns necessitates more resilient food production systems. This growing need drives demand for advanced agricultural solutions that can help farmers adapt to changing conditions and maintain consistent output. ICL's focus on specialty fertilizers and crop nutrition solutions positions it to meet this escalating market requirement.

- Global average temperatures in 2023 were approximately 1.45°C above the pre-industrial average.

- Extreme weather events in 2024 have already led to crop damage and supply chain disruptions in key agricultural hubs.

- The UN projects that climate change could reduce global crop yields by up to 30% by 2050 without adaptation measures.

- ICL's investments in water-efficient fertilizer technologies are becoming increasingly vital for farmers facing water scarcity.

ICL Group faces significant environmental pressures, particularly concerning water usage due to its mining operations. The company is actively investing in water efficiency projects, aiming to reduce freshwater consumption and meet its 2030 water reduction targets. These efforts are crucial as climate change intensifies, leading to more frequent extreme weather events that impact agricultural productivity and global food security, a sector ICL heavily influences through its fertilizer business.

The company is also addressing its carbon footprint, having reduced Scope 1 and 2 greenhouse gas emissions by 15% in 2023 compared to a 2019 baseline. ICL's commitment extends to sourcing 100% renewable electricity by 2030 and a broader goal of carbon neutrality by 2050, validated by SBTi. Furthermore, ICL is prioritizing waste reduction, targeting a 15% decrease in waste intensity by 2025, with a focus on hazardous waste, and is integrating circular economy principles to transform by-products into valuable resources.

| Environmental Factor | ICL's Action/Commitment | Relevant Data/Target |

| Water Scarcity & Management | Investing in water efficiency projects | Aiming to reduce freshwater consumption; specific reduction targets by 2030 |

| Greenhouse Gas Emissions | Reducing Scope 1 & 2 emissions | 15% reduction achieved in 2023 (vs. 2019 baseline); target of 30% reduction by 2030 (vs. 2018 baseline) |

| Renewable Energy | Sourcing renewable electricity | Target of 100% renewable electricity sourcing by 2030 |

| Waste Management & Circularity | Reducing waste intensity, reusing by-products | Target of 15% waste intensity reduction by 2025 (vs. 2020 baseline) |

| Climate Change Impact on Agriculture | Developing advanced agricultural solutions | Addressing increased demand for resilient food production systems due to extreme weather |

PESTLE Analysis Data Sources

Our PESTLE analysis for ICL Group is meticulously constructed using a blend of official government publications, reputable financial institutions, and leading market research firms. This ensures that every aspect, from political stability to technological advancements, is grounded in current and verifiable data.