i3 Verticals Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

i3 Verticals Bundle

Our analysis of i3 Verticals reveals a competitive landscape shaped by moderate buyer power and intense rivalry, particularly within its niche software markets. Understanding the threat of substitutes and the bargaining power of suppliers is crucial for navigating this dynamic environment.

The complete report reveals the real forces shaping i3 Verticals’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

i3 Verticals depends on specialized technology providers for critical functions like payment network access, cloud infrastructure, and proprietary software. The bargaining power of these suppliers can be substantial when their solutions are unique or when i3 Verticals faces high costs to switch to alternatives, potentially impacting i3 Verticals' operational efficiency and cost structure.

Payment network operators, such as Visa and Mastercard, are critical suppliers for companies like i3 Verticals. These networks wield significant power because they provide the essential infrastructure for processing transactions and boast near-universal merchant acceptance. In 2024, interchange fees, largely set by these networks, represent a substantial cost for payment processors. Their leverage stems from their indispensable role in the payment ecosystem, influencing terms and conditions for all participants.

The availability of skilled software developers, cybersecurity experts, and data scientists is paramount for a technology and payments company like i3 Verticals. In 2024, the demand for these specialized roles continues to outstrip supply, a trend that has been intensifying. This scarcity directly translates to increased bargaining power for employees in these fields.

A tight labor market for tech talent means that companies face higher wage demands and escalating recruitment costs. For instance, average salaries for senior software engineers in the US saw an approximate 8-10% increase in 2024 compared to the previous year, according to various industry reports. This puts significant pressure on i3 Verticals to attract and retain top performers.

To effectively mitigate this supplier bargaining power, i3 Verticals must prioritize robust talent acquisition and retention strategies. This includes offering competitive compensation packages, investing in professional development, and fostering a positive work environment to ensure they can secure the essential expertise needed to drive innovation and maintain operational excellence.

Hardware Manufacturers

Hardware manufacturers, particularly those supplying point-of-sale (POS) terminals and payment processing equipment, exert moderate bargaining power over companies like i3 Verticals. This power stems from the specialized nature of their products and the need for compatibility with existing payment infrastructures. While the market for hardware has several players, specific integration needs or proprietary technologies can narrow i3 Verticals' options, potentially increasing supplier leverage.

The bargaining power of these hardware suppliers is influenced by several factors:

- Supplier Concentration: While there are multiple hardware manufacturers, a few key players may dominate the market for specific, certified POS devices essential for payment processing compliance.

- Switching Costs: The cost and complexity of integrating new hardware or switching to alternative suppliers can be significant, making it less feasible for i3 Verticals to change providers frequently.

- Differentiation: Suppliers offering unique features, robust security, or superior technical support can command higher prices or more favorable terms.

- Input Costs: Fluctuations in the cost of raw materials or components used in hardware manufacturing can impact pricing and supplier willingness to negotiate.

In 2024, the global POS terminal market was valued at approximately $25 billion, with growth driven by the increasing adoption of cashless payments. This large market size indicates a degree of competition among suppliers, which can temper their bargaining power. However, for i3 Verticals, securing hardware that meets stringent Payment Card Industry Data Security Standard (PCI DSS) certifications and integrates seamlessly with their software solutions remains a critical consideration, potentially giving specialized suppliers an edge in negotiations.

Regulatory Compliance Service Providers

The bargaining power of regulatory compliance service providers for i3 Verticals is considerable. Given the stringent regulations in the payment and financial software sectors, the need for specialized legal, compliance, and cybersecurity expertise is paramount. Failure to adhere to these regulations can result in substantial fines and reputational damage, making these services indispensable.

These specialized providers hold significant sway because their services are critical and highly niche. For instance, companies in the financial sector often face complex compliance requirements related to data privacy (like GDPR or CCPA), anti-money laundering (AML), and Know Your Customer (KYC) regulations. The cost of non-compliance can be staggering; in 2023, fines for data breaches alone for financial institutions reached billions globally, underscoring the value of expert compliance services.

- Criticality of Services: Compliance providers offer essential services that directly impact i3 Verticals' ability to operate legally and avoid severe penalties.

- Specialized Expertise: The knowledge required for regulatory compliance is highly specialized, limiting the number of qualified providers.

- High Switching Costs: Transitioning to a new compliance provider can be complex and time-consuming, involving significant data migration and retraining.

- Reputational Risk: Non-compliance carries severe reputational damage, increasing the perceived value and power of reliable compliance partners.

Suppliers of specialized technology, such as payment networks and software providers, hold considerable leverage over i3 Verticals. Their critical role in transaction processing and the high costs associated with switching providers amplify their bargaining power. This is evident in the 2024 continued reliance on payment networks like Visa and Mastercard, where interchange fees remain a significant operational expense, directly influenced by these network operators' market dominance.

The scarcity of specialized tech talent in 2024 also empowers employees, leading to increased wage demands and recruitment costs for companies like i3 Verticals. With average senior software engineer salaries seeing an approximate 8-10% rise in 2024, retaining top talent becomes a strategic imperative, highlighting the significant bargaining power of skilled individuals.

| Supplier Type | Key Considerations for i3 Verticals | Supplier Bargaining Power Factor | 2024 Impact/Data Point |

|---|---|---|---|

| Payment Networks (e.g., Visa, Mastercard) | Essential for transaction processing, universal acceptance | High due to indispensability and network effects | Interchange fees represent a substantial cost |

| Specialized Software Providers | Proprietary solutions, integration complexity | Moderate to High depending on uniqueness and switching costs | Reliance on specialized cloud and payment gateway software |

| Skilled Tech Talent | Software developers, cybersecurity experts | High due to demand outstripping supply | Approx. 8-10% salary increase for senior engineers |

| POS Hardware Manufacturers | Certified devices, compatibility needs | Moderate, influenced by concentration and switching costs | Global POS market valued at ~$25 billion in 2024 |

| Regulatory Compliance Services | Legal, compliance, cybersecurity expertise | High due to criticality and specialized knowledge | Billions in fines for data breaches in 2023 |

What is included in the product

This analysis of i3 Verticals' competitive landscape examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces in a clear, actionable format.

Customers Bargaining Power

Customers of i3 Verticals, especially those in sectors like education and government, are often locked into integrated payment and software solutions. The complexity of migrating extensive data, the need for comprehensive staff retraining, and the intricate process of integrating entirely new systems create significant hurdles for them to switch to a competitor. This difficulty in changing providers directly diminishes their bargaining power.

While i3 Verticals operates in niche sectors like education and healthcare, the customers within these areas, such as individual schools or local government agencies, are typically numerous and dispersed. This fragmentation means that no single customer or small group of customers holds significant sway over i3 Verticals' pricing or terms. For instance, in the K-12 education market, i3 Verticals serves thousands of school districts, each with its own budget and decision-making process, diluting any individual customer's ability to negotiate substantial concessions.

Customers in sectors like education, healthcare, and government frequently demand highly specialized software and payment systems. These are designed to fit their specific operational procedures and compliance requirements. This need for bespoke solutions can amplify customer leverage, compelling i3 Verticals to modify its products to keep clients engaged.

Price Sensitivity in Certain Segments

Certain customer segments within i3 Verticals' market, particularly smaller businesses and non-profit organizations, exhibit a notable price sensitivity. This means they are more likely to shop around and compare offerings based on cost, putting pressure on i3 Verticals to offer competitive pricing. For instance, in 2024, the average transaction fee for payment processing across various industries hovered around 2.9%, a benchmark that price-sensitive clients would closely scrutinize.

This price sensitivity is most pronounced for more standardized or commoditized aspects of i3 Verticals' services, such as basic payment gateway functionalities. While the company’s specialized solutions provide significant value, the core processing elements can be seen as interchangeable by some buyers. This dynamic can lead to customers demanding lower prices or seeking alternative providers if i3 Verticals’ pricing is perceived as too high for these essential services.

- Price Sensitivity Drivers: Smaller organizations and non-profits often operate with tighter budgets, making cost a primary decision factor.

- Impact on Pricing Strategy: i3 Verticals must balance the value of its specialized offerings with the need for competitive pricing on commoditized services to retain price-sensitive customers.

- Market Benchmarks: In 2024, the average interchange fee, a significant component of transaction costs, varied by card type but generally represented a substantial portion of processing expenses, influencing customer price expectations.

Access to Alternative Payment Solutions

Customers increasingly have access to a wider array of payment solutions beyond specialized providers. This includes general-purpose payment processors and, for larger organizations, the capability to develop their own in-house payment systems. For instance, the global digital payments market was valued at approximately $7.7 trillion in 2023 and is projected to grow significantly, indicating a robust competitive landscape for payment processing services.

While i3 Verticals provides integrated solutions, the growing availability of these alternatives grants customers greater negotiation leverage. This is particularly true for businesses that can choose between i3 Verticals and other payment processing options, or even build their own infrastructure. The ability to switch or develop alternatives means customers are not entirely reliant on a single provider, influencing pricing and service terms.

- Increased Payment Options: Customers can leverage general-purpose payment processors or in-house development.

- Customer Negotiation Leverage: The availability of alternatives empowers customers in discussions with integrated solution providers like i3 Verticals.

- Market Growth: The digital payments market's projected growth signifies a dynamic environment with numerous competing solutions.

- Reduced Switching Costs: For some customers, the ease of adopting alternative payment solutions can lower the perceived cost of switching providers.

The bargaining power of i3 Verticals' customers is moderated by several factors, including customer concentration and switching costs. While customers in niche sectors like education and healthcare often require specialized, integrated solutions, making switching complex and costly, the dispersed nature of these customers, particularly in markets like K-12 education with thousands of school districts, limits the leverage of any single entity.

Price sensitivity is a notable driver for smaller organizations and non-profits, especially for more commoditized services like basic payment gateway functions. For instance, in 2024, average transaction fees for payment processing were around 2.9%, a benchmark that price-sensitive clients closely monitor. This necessitates that i3 Verticals balances specialized value with competitive pricing on core services.

The increasing availability of alternative payment solutions, from general-purpose processors to in-house development capabilities, also grants customers greater negotiation leverage. The global digital payments market, valued at approximately $7.7 trillion in 2023, reflects this competitive landscape, empowering customers who are not entirely reliant on a single provider.

| Factor | Impact on Bargaining Power | Supporting Data/Observation |

|---|---|---|

| Customer Concentration | Low | Thousands of dispersed customers in sectors like K-12 education. |

| Switching Costs | High (for integrated solutions) | Data migration, retraining, and system integration complexity. |

| Price Sensitivity | Moderate (for commoditized services) | Focus on average transaction fees (e.g., ~2.9% in 2024) for smaller clients. |

| Availability of Alternatives | Moderate to High | Growth in digital payments market ($7.7T in 2023) and availability of general processors. |

Preview the Actual Deliverable

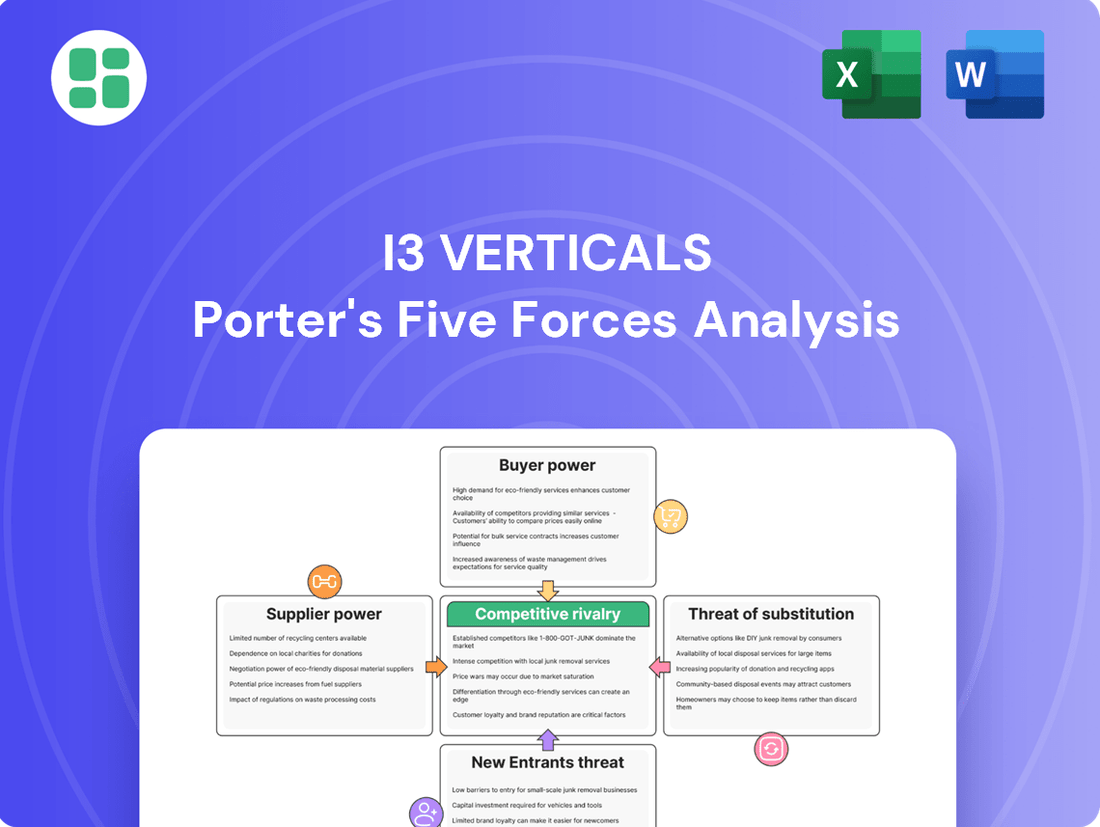

i3 Verticals Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details i3 Verticals' position within its industry by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products, providing a comprehensive strategic overview.

Rivalry Among Competitors

The fintech and payment processing landscape is a crowded arena, featuring a vast array of competitors from established financial institutions to nimble, emerging startups. This fierce competition compels companies like i3 Verticals to constantly innovate and differentiate their offerings.

The intensity of this rivalry directly translates into significant pricing pressure, as providers vie for market share by offering more attractive terms. For instance, in 2024, the global fintech market was valued at over $2.4 trillion, a testament to its growth and the sheer number of entities operating within it.

Consequently, a relentless focus on customer acquisition and retention becomes paramount. Companies must invest heavily in user experience, security, and value-added services to stand out amidst the noise and maintain a loyal customer base.

i3 Verticals carves out its competitive edge through deep vertical specialization, focusing on integrated software and payment solutions tailored for specific industries like the public sector and healthcare. This strategic approach aims to sidestep direct clashes with broader, horizontal payment processors.

While this vertical focus minimizes competition from generalized players, i3 Verticals still encounters robust rivalry from other companies that also concentrate on these niche markets. For instance, in the public sector vertical, competitors might offer specialized software for government agencies, creating a competitive landscape within that specific segment.

The company's commitment to these specialized verticals means it must contend with established players who possess deep industry knowledge and existing client relationships. This intense rivalry within niche markets necessitates continuous innovation and superior service delivery to maintain market share and attract new customers.

The payment and vertical software sectors are seeing a flurry of mergers and acquisitions, driving significant consolidation. This trend means fewer, larger players are emerging as they snap up specialized companies to broaden their offerings and capture more of the market. For instance, in 2024, the software M&A market saw continued robust activity, with deal volumes remaining high, particularly in niche vertical software segments.

Focus on Recurring Revenue Models

The increasing prevalence of recurring revenue models, such as Software-as-a-Service (SaaS), intensifies competitive rivalry. Companies like i3 Verticals prioritize customer retention and product stickiness, leading to more aggressive competition for new clients. This shift means that once a customer is acquired, businesses must work harder to keep them, often through continuous product improvement and superior customer service.

This focus on recurring revenue means that acquiring new customers is a significant battleground.

- Customer Acquisition Cost (CAC): As competition for recurring revenue clients heats up, the cost to acquire each new customer is likely to rise.

- Churn Rate: Companies must actively work to minimize customer churn, as losing a recurring revenue customer is more impactful than in a one-time sale model.

- Product Differentiation: To stand out, businesses need to offer unique value propositions and continuously innovate their offerings to maintain customer loyalty.

- Market Saturation: In sectors with many SaaS providers, differentiation becomes even more critical to avoid being lost in a crowded marketplace.

Innovation in Digital and Embedded Payments

The digital payments landscape is a hotbed of competition, with companies constantly pushing the boundaries of innovation. This intense rivalry is fueled by the rapid evolution of digital, real-time, and embedded finance solutions. For instance, the global digital payments market was valued at approximately $8.7 trillion in 2023 and is projected to reach over $17 trillion by 2030, indicating significant growth and, by extension, fierce competition.

To stay ahead, businesses like i3 Verticals must continuously innovate their payment offerings. This means focusing on speed, enhancing security measures, and improving overall efficiency to meet ever-changing customer expectations. The demand for seamless, integrated payment experiences is driving this innovation cycle. Companies that fail to adapt risk falling behind in this dynamic market.

- The global digital payments market size was valued at USD 8.7 trillion in 2023.

- The market is projected to grow at a compound annual growth rate (CAGR) of 10.0% from 2024 to 2030.

- Key areas of innovation include real-time payment processing and the integration of financial services directly into non-financial platforms (embedded finance).

- Customer expectations for speed, security, and convenience are primary drivers of this competitive innovation.

Competitive rivalry within the fintech and payment processing sectors is intense, with numerous players vying for market share. This dynamic environment forces companies like i3 Verticals to constantly innovate and differentiate their specialized offerings to remain competitive. The sheer volume of participants, including both established financial giants and agile startups, creates significant pricing pressure and a strong emphasis on customer acquisition and retention.

i3 Verticals navigates this rivalry by focusing on deep vertical specialization, offering integrated software and payment solutions tailored to specific industries. While this strategy reduces direct competition from broad-based providers, it intensifies rivalry within these niche markets. Companies must leverage their industry knowledge and customer relationships to stand out, as evidenced by the continued high volume of M&A activity in vertical software segments during 2024, indicating consolidation driven by competitive pressures.

The shift towards recurring revenue models, particularly Software-as-a-Service (SaaS), further amplifies competitive rivalry. This trend elevates the importance of customer retention and product stickiness, making customer acquisition a critical battleground with rising Customer Acquisition Costs (CAC). Companies must continuously enhance their offerings and customer service to minimize churn and maintain a competitive edge in a market characterized by rapid innovation in digital and embedded finance solutions.

| Metric | 2024 Data/Trend | Impact on i3 Verticals |

| Fintech Market Value | Over $2.4 trillion globally in 2024 | High competition and pressure to innovate |

| Digital Payments Market Value | Approx. $8.7 trillion in 2023, projected 10% CAGR (2024-2030) | Intensified competition in payment solutions |

| Software M&A Activity | Continued robust activity in 2024, especially in niche verticals | Consolidation may lead to fewer, larger competitors in target verticals |

| SaaS Adoption | Increasing prevalence of recurring revenue models | Focus on customer retention, higher CAC, need for product differentiation |

SSubstitutes Threaten

Traditional, non-integrated payment processing presents a viable substitute for i3 Verticals' solutions. Companies can choose to bundle separate payment gateways with generic accounting or CRM software, bypassing the need for a fully integrated, vertical-specific platform. This option can be particularly attractive for businesses prioritizing cost savings over deep customization, as standalone solutions may offer lower upfront investment.

Large government entities or major healthcare systems often possess the financial clout and technical talent to engineer their own proprietary payment and operational software. This in-house development acts as a potent substitute, allowing these organizations to sidestep external providers altogether, though it demands substantial upfront investment and ongoing upkeep.

For instance, a large hospital network might dedicate millions to building a custom patient billing system, thereby eliminating the need for i3 Verticals' services. While this approach offers tailored functionality, the total cost of ownership, including development, maintenance, and updates, can exceed that of utilizing a specialized vendor, especially when considering the rapid pace of technological change in the fintech sector.

For less complex requirements, readily available generic ERP or CRM software with basic payment processing capabilities can act as substitutes for i3 Verticals' specialized solutions. These alternatives may not possess the granular, industry-specific functionalities that i3 Verticals provides, but they often come with a lower price tag, making them an attractive option for budget-conscious businesses.

Manual or Legacy Systems

The threat of substitutes for i3 Verticals' payment processing solutions includes the continued use of manual or legacy systems in certain market segments. While these methods are less efficient, they represent a direct alternative for businesses not yet fully embracing digital transactions.

For instance, a significant portion of small businesses still rely on paper checks or cash for transactions, bypassing the need for modern payment gateways. This reliance on older methods, though declining, presents an indirect competitive pressure.

- Prevalence of Manual Payments: In 2024, an estimated 15% of small business transactions in the US still involved manual payment methods like checks or cash, according to industry reports.

- Legacy System Adoption: While specific data for legacy payment system adoption is scarce, a significant number of smaller, older businesses may still operate with outdated, non-integrated financial software.

- Cost of Transition: The perceived cost and complexity of migrating from manual or legacy systems can deter some businesses from adopting newer, integrated solutions offered by companies like i3 Verticals.

Emergence of New Payment Technologies

The threat of substitutes for i3 Verticals is amplified by the rapid emergence of new payment technologies. Innovations like blockchain-based transactions or advanced digital wallets offer alternative ways to process payments, potentially bypassing traditional software integrations. For example, the global digital payment market was valued at approximately $7.7 trillion in 2023 and is projected to grow significantly, indicating a strong shift towards alternative payment methods.

These new technologies represent a significant substitute threat if they achieve broad consumer and business adoption independently of i3 Verticals' core offerings. Such widespread adoption could reduce the reliance on integrated payment solutions provided by i3 Verticals, particularly in sectors where these new technologies offer greater efficiency or lower costs.

- Increased competition from fintech companies offering specialized payment solutions.

- Potential for disintermediation if new payment rails bypass existing software providers.

- Consumer preference shifts towards more convenient or secure digital payment methods.

- Regulatory changes that could favor or accelerate the adoption of alternative payment systems.

The threat of substitutes for i3 Verticals encompasses a range of alternatives, from basic manual processes to sophisticated new technologies. Businesses can opt for less integrated solutions, such as bundling separate payment gateways with generic software, which may appeal to those prioritizing cost savings. However, these substitutes often lack the deep vertical specialization that i3 Verticals offers.

For larger organizations, developing proprietary in-house payment systems presents a significant substitute, though this requires substantial investment and ongoing maintenance. Even generic ERP or CRM software with basic payment features can serve as a substitute for businesses with less complex needs, offering a lower price point despite limited functionality.

The prevalence of manual payments, particularly among small businesses, and the continued use of legacy systems also contribute to the threat of substitutes. In 2024, an estimated 15% of US small business transactions still involved manual methods like checks or cash, highlighting a segment less reliant on integrated solutions.

Emerging payment technologies, such as blockchain and advanced digital wallets, represent a growing substitute threat as they gain wider adoption. The global digital payment market, valued at approximately $7.7 trillion in 2023, demonstrates a strong trend towards alternative payment methods that could bypass traditional software providers.

| Substitute Type | Description | Key Considerations for Businesses | Potential Impact on i3 Verticals |

|---|---|---|---|

| Manual/Legacy Systems | Use of checks, cash, or outdated non-integrated software. | Lower upfront cost, but less efficient and secure. | Limited impact on businesses already digitized; potential for small businesses to remain in this segment. |

| Bundled Generic Software | Combining separate payment gateways with standard accounting/CRM. | Cost-effective for basic needs, but lacks vertical specialization and seamless integration. | Direct competition for businesses seeking cost-efficiency over deep functionality. |

| In-house Development | Large entities building their own payment and operational software. | High upfront investment and ongoing maintenance, but offers complete control and customization. | Significant threat to large enterprise clients who can afford custom solutions. |

| New Payment Technologies | Blockchain, digital wallets, and other emerging digital payment methods. | Potential for increased efficiency, lower transaction fees, and new user experiences. | Disintermediation risk if these technologies gain broad adoption independently of integrated platforms. |

Entrants Threaten

Entering the integrated payment and vertical software market demands considerable capital. Companies need to invest heavily in developing sophisticated software, building robust payment processing infrastructure, and establishing strong sales and marketing channels. For instance, a new entrant might need to spend tens of millions of dollars just to build a competitive platform and acquire initial customers.

The payment and healthcare/government software sectors are laden with stringent regulations, demanding rigorous adherence to data security standards like PCI DSS and HIPAA, alongside various financial compliance mandates. These intricate regulatory landscapes present a significant obstacle for potential new entrants seeking to establish a foothold.

The threat of new entrants for i3 Verticals is significantly tempered by the substantial need for deep vertical expertise and established relationships. i3 Verticals focuses on specialized sectors such as the public sector and healthcare, areas that require intricate knowledge of regulations, unique operational workflows, and highly specific software functionalities. New companies entering these markets face a steep learning curve and the considerable challenge of building the trust and rapport that i3 Verticals already possesses with its client base, a process that is both time-consuming and resource-intensive.

Brand Reputation and Trust

In sectors where i3 Verticals operates, such as government and healthcare, brand reputation and established trust are paramount. Securing contracts often hinges on a proven track record, making it difficult for newcomers to penetrate the market. New entrants face a significant hurdle in building the credibility that i3 Verticals already possesses, which directly impacts their ability to gain market share.

For instance, in 2024, government technology procurement cycles often favor vendors with extensive experience and established security certifications. A new entrant would need substantial investment and time to demonstrate the same level of reliability and compliance that i3 Verticals has cultivated. This inherent advantage of established trust acts as a substantial barrier.

- Established Trust: i3 Verticals benefits from years of successful service delivery in sensitive government and healthcare environments.

- Contractual Hurdles: New entrants must overcome rigorous vetting processes that prioritize proven performance and security.

- Market Credibility: Building a reputation comparable to i3 Verticals requires significant time and demonstrated success, which is a major deterrent.

Integration Complexity and Ecosystem Development

The intricate nature of integrating payment and software solutions creates a substantial hurdle for potential new entrants. Companies must ensure their offerings work flawlessly with a multitude of third-party systems, payment processors, and established customer workflows, a process that demands significant technical expertise and ongoing investment.

Building and sustaining a robust ecosystem, which is crucial for comprehensive service delivery in this sector, represents a considerable technical and operational challenge. This complexity acts as a significant barrier, deterring new companies from easily entering the market and competing with established players like i3 Verticals.

- Integration Complexity: Seamlessly connecting with diverse third-party systems and payment networks is a major technical undertaking.

- Ecosystem Development: Creating and maintaining a comprehensive suite of interconnected solutions requires substantial ongoing investment.

- Operational Barriers: The sheer scale of managing these integrations and ecosystem components presents significant operational challenges for newcomers.

The threat of new entrants for i3 Verticals is relatively low due to high capital requirements and significant regulatory hurdles. Developing sophisticated vertical software and secure payment processing infrastructure demands substantial upfront investment, potentially in the tens of millions of dollars. Furthermore, adherence to stringent data security and financial compliance standards like PCI DSS and HIPAA creates a complex and costly barrier for newcomers.

Deep vertical expertise and established customer relationships are critical deterrents for new entrants in i3 Verticals' target markets, such as government and healthcare. These sectors require intricate knowledge of regulations and operational workflows, alongside a proven track record and trust. For instance, in 2024, government technology procurement heavily favors vendors with extensive experience and security certifications, making it difficult for new companies to gain traction without significant time and investment to build comparable credibility.

The complexity of integrating payment and software solutions, along with building a robust ecosystem, presents a substantial technical and operational challenge. New entrants must ensure seamless compatibility with numerous third-party systems and payment processors, a demanding task that requires ongoing investment and expertise. This intricate web of integrations and ecosystem components acts as a significant barrier, limiting the ease with which new companies can enter and compete.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Developing specialized software and payment infrastructure costs tens of millions. | High barrier; requires significant funding. |

| Regulatory Compliance | Adherence to PCI DSS, HIPAA, and financial mandates. | High barrier; demands expertise and investment. |

| Vertical Expertise & Relationships | Intricate knowledge of government/healthcare workflows and established trust. | High barrier; requires time and proven success. |

| Integration Complexity | Seamlessly connecting diverse systems and payment networks. | High barrier; technically demanding and costly. |

Porter's Five Forces Analysis Data Sources

Our i3 Verticals Porter's Five Forces analysis is built upon a robust foundation of data, incorporating financial reports, industry-specific market research from firms like IBISWorld, and publicly available SEC filings. This blend ensures a comprehensive understanding of the competitive landscape.