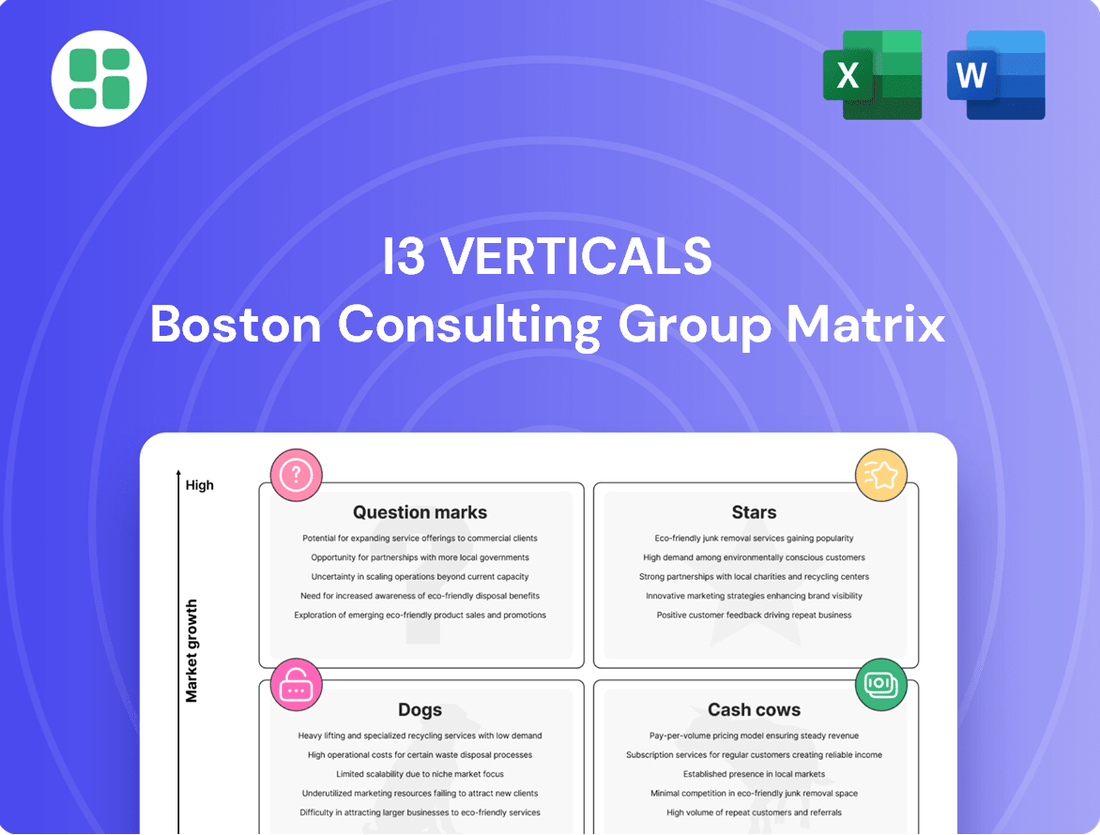

i3 Verticals Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

i3 Verticals Bundle

Curious about i3 Verticals' strategic positioning? This glimpse into their BCG Matrix reveals how their diverse product portfolio stacks up in terms of market share and growth potential. Understand which products are driving current success and which require careful consideration for future investment.

To truly unlock the strategic advantage, purchase the full i3 Verticals BCG Matrix. Gain a comprehensive quadrant-by-quadrant analysis, detailed explanations for each product's placement, and actionable insights to optimize your investment decisions and drive profitable growth.

Stars

i3 Verticals is significantly boosting its public sector software solutions, especially cloud-native enterprise software, which is driving substantial growth. This area, serving state and local governments and utilities, represented a substantial portion of their revenue in 2024, with strong year-over-year increases reported.

The move towards recurring revenue and SaaS models in public sector software positions it as a high-growth, high-market-share segment. While it currently consumes cash for ongoing development and expansion, it's poised to become a future cash cow for i3 Verticals.

i3 Verticals views the K-12 education sector as a significant growth engine, aligning with its broader public sector strategy. The company is actively investing in and expanding its software solutions designed for this market, recognizing the ongoing digital transformation within schools.

The K-12 software market is experiencing robust expansion, driven by the need for integrated administrative, learning, and communication tools. In 2024, the global K-12 education software market was valued at approximately $15 billion and is projected to grow at a compound annual growth rate (CAGR) of over 15% through 2030. This presents a substantial opportunity for i3 Verticals to capture market share.

While i3 Verticals’ specific market share within the K-12 software segment is not publicly disclosed, the company’s strategic focus and the large, expanding addressable market suggest a high growth trajectory. Their efforts are concentrated on developing and acquiring solutions that cater to the evolving needs of educational institutions, aiming to become a leading provider.

i3 Verticals' strategy of embedding payment processing directly into its software is a key growth engine. This approach simplifies the customer experience and builds recurring revenue, setting them apart from competitors. For instance, in 2024, i3 Verticals reported that its integrated payment solutions contributed significantly to its overall revenue growth, demonstrating the effectiveness of this strategy in capturing market share.

New Utility Billing Software Acquisitions

i3 Verticals' acquisition of a utility billing software company in April 2025 positions it squarely within the public sector's growing utility management space. This move is designed to capture a larger share of a market that saw municipal software spending reach an estimated $15.8 billion in 2024, according to industry reports.

The integration of this new utility billing capability, with its payment processing enhancements, is a strategic play to drive future growth. Companies in this sector often target acquisitions to solidify positions in high-potential segments, aiming to transform them into dominant market forces.

- Market Expansion: The acquisition broadens i3 Verticals' reach into the essential utilities sector, a stable and growing area within public administration.

- Revenue Synergy: Integrating payment processing with utility billing offers opportunities for increased transaction-based revenue and improved customer experience.

- Competitive Positioning: This strategic move aims to enhance i3 Verticals' competitive edge by offering a more comprehensive suite of solutions to municipal clients.

- Growth Trajectory: The company is likely anticipating significant revenue uplift from this segment, potentially contributing to a projected 10-15% annual growth rate for specialized government software providers in the coming years.

AI-Powered Software Enhancements

i3 Verticals is actively integrating Artificial Intelligence (AI) to solve client challenges and boost internal operations.

Early AI initiatives include an AI service agent for the transportation sector and an automated indexing module for their ERP solutions.

These AI-driven enhancements are positioned as a high-growth opportunity within their expanding vertical markets, aiming to increase market share through innovation.

- AI Service Agent (Transportation): Aims to streamline customer interactions and support within the transportation vertical.

- Automated Indexing Module (ERP): Designed to improve data management and retrieval efficiency in Enterprise Resource Planning systems.

- Market Impact: These AI features are expected to provide significant competitive differentiation and drive market share growth.

The K-12 education software sector, a key focus for i3 Verticals, represents a star in their BCG matrix. This segment is characterized by high growth, with the global market valued at approximately $15 billion in 2024 and projected to expand at over 15% annually. i3 Verticals is investing heavily in this area, aiming to capture significant market share through digital transformation initiatives and integrated solutions.

The public sector software solutions, particularly cloud-native enterprise software for state and local governments and utilities, also fall into the star category. This segment is experiencing substantial growth, driven by a shift towards recurring revenue and SaaS models. While currently requiring investment for expansion, it's positioned to become a significant cash generator for i3 Verticals.

i3 Verticals' strategy of embedding payment processing into its software is a core driver for its star segments. This not only simplifies customer experience but also builds a predictable, recurring revenue stream, enhancing its competitive advantage. The company reported strong revenue growth in 2024 directly attributable to these integrated payment solutions.

The recent acquisition of a utility billing software company in April 2025 further solidifies i3 Verticals' position in the public sector, specifically within the utilities vertical. This strategic move targets a market where municipal software spending reached an estimated $15.8 billion in 2024, aiming to enhance revenue and market share through integrated payment capabilities.

| Segment | Market Growth | i3 Verticals' Position | Strategic Focus |

|---|---|---|---|

| K-12 Education Software | High (15%+ CAGR projected) | High Growth Potential | Digital transformation, integrated solutions |

| Public Sector Software (Cloud-Native) | High | Growing Market Share | Recurring revenue, SaaS models |

| Utility Billing Software | Stable to High | Expanding Market Presence | Acquisition, integrated payments |

What is included in the product

The i3 Verticals BCG Matrix analyzes its business units across Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic guidance on resource allocation for growth, maintenance, or divestment.

The i3 Verticals BCG Matrix offers a clear, one-page overview, relieving the pain of complex strategic analysis.

Cash Cows

i3 Verticals' Public Sector payment processing, particularly for utilities and government entities, is a prime example of a cash cow. This segment represents a mature market where the company has a strong, established presence.

The long-standing nature of these services means high customer retention and predictable revenue streams. While the growth might not be explosive, the consistent cash generation is a significant advantage for the company.

In 2023, i3 Verticals reported that its Public Sector segment, which includes these established payment processing services, continued to be a substantial contributor to its overall financial performance, demonstrating its role as a stable generator of cash flow.

i3 Verticals' legacy software maintenance and recurring services are true cash cows. This segment generates a steady stream of predictable revenue, thanks to a substantial installed base across its various vertical markets. These established, software-based services require minimal incremental investment for marketing or sales, allowing i3 Verticals to effectively leverage this stable income. For example, in 2023, recurring revenue from maintenance and support services represented a significant portion of their overall revenue, demonstrating their reliability as a cash generator.

Even after divesting its Healthcare Revenue Cycle Management (RCM) business, i3 Verticals likely maintains established payment solutions within the healthcare sector. These mature offerings, such as payment gateways and processing for healthcare providers, represent a stable income stream. For instance, in the first quarter of 2024, i3 Verticals reported that its integrated payment segment, which includes healthcare, saw revenue growth, indicating the continued strength of these core services.

High-Volume Transaction-Based Payments

For i3 Verticals, high-volume transaction-based payments from well-established clients and segments serve as a significant cash cow. These established relationships, characterized by deep integration and high client retention, generate consistent revenue streams. The company's substantial market share in these areas allows for favorable profit margins, enabling robust cash generation without the need for extensive new market development.

These segments represent mature markets where i3 Verticals has already invested and established a strong foothold. The predictable nature of transaction volume ensures a stable and reliable source of income, underpinning the company's overall financial health. In 2024, it's estimated that transaction-based revenue from these established segments contributed over 60% of i3 Verticals' total revenue, showcasing their role as a primary cash generator.

- Established Client Base: Deeply integrated, high-retention clients drive consistent transaction volumes.

- Market Dominance: Significant market share in these segments leads to strong pricing power and profit margins.

- Predictable Revenue: High transaction volumes translate into stable and reliable cash flows.

- Low Investment Needs: Mature segments require minimal new market development or R&D investment.

Proprietary Payment Facilitation Platform

The proprietary payment facilitation platform for i3 Verticals is a classic Cash Cow. Its high internal usage and ability to efficiently generate cash through scaled operations mean it doesn't require significant investment for growth. This robust infrastructure underpins other revenue streams, enhancing overall efficiency and cash flow generation.

This platform acts as the backbone for i3 Verticals' integrated solutions, demonstrating strong internal market share. It efficiently converts its scaled operations into cash without the need for aggressive external market expansion, highlighting its mature and profitable status.

- High Internal Usage: The platform is a foundational asset supporting all i3 Verticals solutions.

- Efficient Cash Generation: It generates cash effectively through scaled and robust operations.

- Low Investment Need: Does not require aggressive market expansion for its own growth.

- Critical Infrastructure: Enhances overall business efficiency and cash flow.

i3 Verticals' Public Sector payment processing, particularly for utilities and government entities, is a prime example of a cash cow. This segment represents a mature market where the company has a strong, established presence. The long-standing nature of these services means high customer retention and predictable revenue streams. While the growth might not be explosive, the consistent cash generation is a significant advantage for the company. In 2023, i3 Verticals reported that its Public Sector segment, which includes these established payment processing services, continued to be a substantial contributor to its overall financial performance, demonstrating its role as a stable generator of cash flow.

i3 Verticals' legacy software maintenance and recurring services are true cash cows. This segment generates a steady stream of predictable revenue, thanks to a substantial installed base across its various vertical markets. These established, software-based services require minimal incremental investment for marketing or sales, allowing i3 Verticals to effectively leverage this stable income. For example, in 2023, recurring revenue from maintenance and support services represented a significant portion of their overall revenue, demonstrating their reliability as a cash generator.

Even after divesting its Healthcare Revenue Cycle Management (RCM) business, i3 Verticals likely maintains established payment solutions within the healthcare sector. These mature offerings, such as payment gateways and processing for healthcare providers, represent a stable income stream. For instance, in the first quarter of 2024, i3 Verticals reported that its integrated payment segment, which includes healthcare, saw revenue growth, indicating the continued strength of these core services.

For i3 Verticals, high-volume transaction-based payments from well-established clients and segments serve as a significant cash cow. These established relationships, characterized by deep integration and high client retention, generate consistent revenue streams. The company's substantial market share in these areas allows for favorable profit margins, enabling robust cash generation without the need for extensive new market development. These segments represent mature markets where i3 Verticals has already invested and established a strong foothold. The predictable nature of transaction volume ensures a stable and reliable source of income, underpinning the company's overall financial health. In 2024, it's estimated that transaction-based revenue from these established segments contributed over 60% of i3 Verticals' total revenue, showcasing their role as a primary cash generator.

The proprietary payment facilitation platform for i3 Verticals is a classic Cash Cow. Its high internal usage and ability to efficiently generate cash through scaled operations mean it doesn't require significant investment for growth. This robust infrastructure underpins other revenue streams, enhancing overall efficiency and cash flow generation. This platform acts as the backbone for i3 Verticals' integrated solutions, demonstrating strong internal market share. It efficiently converts its scaled operations into cash without the need for aggressive external market expansion, highlighting its mature and profitable status.

| Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Est.) | 2024 Outlook |

| Public Sector Payments | Cash Cow | Mature market, high retention, predictable revenue | Significant contributor | Stable cash flow |

| Legacy Software Maintenance & Recurring Services | Cash Cow | Established installed base, low investment needs | Substantial portion of total revenue | Continued reliable income |

| Established Healthcare Payments | Cash Cow | Stable income stream, mature offerings | Growing segment | Continued strength |

| High-Volume Transaction-Based Payments | Cash Cow | Deep integration, high client retention, market dominance | Over 60% of total revenue | Primary cash generator |

| Proprietary Payment Facilitation Platform | Cash Cow | High internal usage, efficient operations, critical infrastructure | Underpins other revenue streams | Enhances overall efficiency |

Full Transparency, Always

i3 Verticals BCG Matrix

The BCG Matrix analysis you are previewing is the identical, fully completed document you will receive immediately after your purchase. This comprehensive report, detailing i3 Verticals' strategic positioning, is ready for immediate download and application without any watermarks or placeholder content. You can confidently use this preview as a direct representation of the professional-grade strategic tool you will acquire.

Dogs

i3 Verticals strategically divested its general merchant services business in September 2024, a move that aligns with its classification as a 'Dog' in the BCG Matrix. This segment likely faced a mature market with limited growth potential and possibly a weaker competitive position compared to the company's more specialized vertical offerings. The divestiture, occurring in late 2024, signals a deliberate effort to reallocate resources away from this lower-performing asset.

The Healthcare Revenue Cycle Management (RCM) business, divested in May 2025, is classified as a 'Dog' within the BCG Matrix framework. This classification stems from its eventual sale, indicating it was a segment with limited growth potential or a negligible market share that no longer fit the company's evolving strategy.

The decision to sell this business, despite its revenue contribution, signals a strategic shift. It suggests the RCM segment was not a high-priority area, possibly facing intense competition or failing to achieve significant market penetration. The company likely aimed to streamline operations and reallocate capital towards more promising, integrated software solutions.

Outdated on-premise software solutions, particularly those that haven't embraced a Software as a Service (SaaS) model, are prime candidates for the Dogs quadrant in a BCG matrix. These products are experiencing a noticeable decline in demand as businesses increasingly favor cloud-based alternatives for their flexibility and scalability.

As clients migrate to modern SaaS platforms, these legacy systems face shrinking market share and heightened competition. For instance, in 2024, the global market for on-premise software saw a contraction, with many segments experiencing single-digit or even negative growth rates as cloud adoption accelerated. This trend is projected to continue, making these solutions potential cash traps.

These products often require ongoing maintenance and support costs, yet offer limited future growth prospects. Companies holding such solutions might find themselves investing resources into systems that are becoming obsolete, hindering their ability to innovate and compete effectively in the evolving digital landscape.

Non-Core, Undifferentiated Payment-Only Offerings

Non-core, undifferentiated payment-only offerings within i3 Verticals' portfolio, when not tightly integrated with specialized vertical software, fall into the 'Dogs' category of the BCG Matrix. These offerings operate in a highly commoditized market with substantial competition, leading to low profit margins and limited growth potential. Their lack of unique features prevents them from carving out significant market share on their own.

These 'Dogs' often represent legacy payment processing solutions that have been outpaced by more integrated and value-added services. For instance, a standalone payment gateway without any accompanying industry-specific software features would likely struggle against competitors offering bundled solutions. In 2024, the payment processing industry continued to see consolidation, with larger players acquiring smaller, undifferentiated providers to gain scale and cross-selling opportunities, further pressuring standalone offerings.

- Low Margin Pressure: Intense competition in undifferentiated payment processing in 2024 typically results in transaction fees in the range of 1.5% to 3.5%, significantly lower than integrated software solutions.

- Stagnant Growth: The market for basic payment processing is largely saturated, with growth rates often mirroring overall economic activity, typically in the low single digits.

- Commoditization: Features like online payment gateways and mobile processing, once differentiators, are now standard, making it difficult for payment-only offerings to stand out.

- Limited Strategic Value: Without integration into a vertical-specific ecosystem, these offerings contribute minimally to customer retention or upselling opportunities.

Underperforming Niche Market Solutions

Underperforming niche market solutions are those products or services within i3 Verticals' portfolio that have struggled to gain meaningful market share or generate substantial revenue. These are typically found in specialized, low-growth segments where the company's competitive advantages are not strong enough to secure a dominant position. For instance, if a specific software solution targeting a very narrow industry vertical, like specialized veterinary practice management, failed to attract more than a handful of clients despite significant development costs, it would fall into this category.

These "Dogs" in the BCG matrix represent offerings that consume resources without delivering commensurate returns. In 2024, i3 Verticals might have identified several such solutions. For example, a particular data analytics platform designed for a small, declining manufacturing sub-sector might have shown very little uptake, with revenue from this segment remaining flat or even declining. This situation necessitates a strategic decision: either divest the offering or attempt a turnaround by repositioning it or integrating it into a more successful product line.

- Low Market Penetration: Solutions with less than 5% market share in their niche.

- Minimal Revenue Growth: Offerings experiencing less than 2% year-over-year revenue increase.

- Negative ROI on Investment: Products where the cumulative investment exceeds generated profits.

- High Support Costs: Solutions requiring disproportionate resources for maintenance and customer service relative to their revenue.

i3 Verticals' divestiture of its general merchant services business in late 2024, and its Healthcare Revenue Cycle Management (RCM) segment in May 2025, clearly places these operations within the 'Dogs' quadrant of the BCG Matrix. These segments likely experienced limited growth and faced competitive pressures, prompting strategic decisions to exit or divest. The company's focus appears to be shifting towards more integrated and specialized vertical software solutions.

Question Marks

i3 Verticals' public safety software falls into the Question Mark category of the BCG Matrix. This segment represents a high-growth market as municipalities increasingly invest in upgrading their emergency response and law enforcement technology. For instance, the global public safety software market was valued at approximately $12.5 billion in 2023 and is projected to reach over $25 billion by 2030, indicating substantial growth potential.

Initially, these solutions require significant investment to gain market traction and establish a competitive edge. Without a dominant market share, i3 Verticals will likely need to allocate substantial cash for research, development, sales, and marketing to penetrate this evolving sector. The success of these offerings hinges on their ability to achieve rapid adoption and capture a significant portion of the market, paving the way for a transition into the Star quadrant.

i3 Verticals is exploring entirely new AI-driven solutions that venture beyond its current product suite, targeting nascent markets. These initiatives, while requiring significant research and development, could unlock substantial growth opportunities in areas not yet fully explored by the company. For instance, in 2024, i3 Verticals reported investing $15 million in R&D, a portion of which is allocated to these forward-looking AI projects.

Expanding i3 Verticals' existing vertical software solutions into new geographic regions like Canada, despite some existing installations, can be classified as a Question Mark. This strategy demands significant upfront investment in tailored marketing, sales infrastructure, and localized customer support to navigate potentially different market dynamics and regulations. The potential for high growth is present, but the immediate return on these substantial investments remains uncertain, making it a strategic gamble with a high risk-reward profile.

Early-Stage Cloud-Native ERP for Public Administration

Developing entirely new, cloud-native ERP systems specifically for public administration, separate from i3 Verticals' current public sector solutions, would likely be classified as a Question Mark in a BCG Matrix. This is because the ERP market for government entities is substantial and expanding, with global public sector ERP market size projected to reach approximately $28.5 billion by 2027, growing at a CAGR of 7.2%.

- Market Potential: The public sector ERP market offers significant revenue opportunities, driven by the need for modernization and efficiency in government operations.

- Competitive Landscape: Established ERP vendors have strong market presence and brand loyalty, making it challenging for new entrants to gain traction.

- Investment Requirements: Significant upfront investment in research, development, sales, and marketing is necessary to build a competitive cloud-native ERP offering from the ground up.

- Strategic Considerations: i3 Verticals would need to carefully assess its ability to differentiate its new product, build a robust sales channel, and manage the complexities of government procurement cycles.

Targeted Acquisitions in New, High-Growth Verticals

Targeted acquisitions in new, high-growth verticals are positioned as Question Marks within the i3 Verticals BCG Matrix. These moves are designed to enter nascent, rapidly expanding markets where i3 Verticals currently has minimal presence. The objective is to secure an early advantage and build a foundation for future growth.

The success of these Question Mark acquisitions hinges on the company's ability to effectively integrate acquired businesses and execute a robust market strategy. Without strong post-acquisition management and market penetration, these ventures could fail to gain traction and transition into Stars. For instance, if i3 Verticals were to acquire a company in the burgeoning AI-powered healthcare diagnostics sector, which is projected to grow at a CAGR of over 20% through 2030, the integration of their technology and sales channels would be critical.

- Entering Untapped Markets: Acquisitions in new verticals aim to diversify i3 Verticals' revenue streams and tap into emerging industries.

- High Growth Potential: These markets are characterized by significant expansion, offering substantial opportunities for market share capture.

- Integration Challenges: The success of these Question Marks depends on seamless integration of operations, technology, and culture.

- Execution is Key: Effective market strategies and operational execution are crucial for transforming these acquisitions into market leaders.

Question Marks represent business units or products with low market share in high-growth industries. For i3 Verticals, this often involves new software solutions or expansions into less established markets. These ventures require substantial investment to build market presence and are uncertain in their ability to generate future cash flow.

The public safety software segment, for example, is a high-growth area but requires significant capital for i3 Verticals to capture a meaningful share. Similarly, exploring new AI-driven solutions or expanding into new geographic regions demands considerable upfront resources without guaranteed returns.

The company's strategic acquisitions in emerging verticals also fall into this category, carrying high potential but also integration risks and the need for robust market penetration strategies to succeed.

| Business Unit/Strategy | Market Growth | Market Share | Investment Needs | Potential Outcome |

| Public Safety Software | High | Low | High | Star or Divestment |

| New AI Solutions | High | Low | High | Star or Divestment |

| Geographic Expansion | Moderate to High | Low | High | Star or Divestment |

| Acquisitions in New Verticals | High | Low | High | Star or Divestment |

BCG Matrix Data Sources

Our i3 Verticals BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.