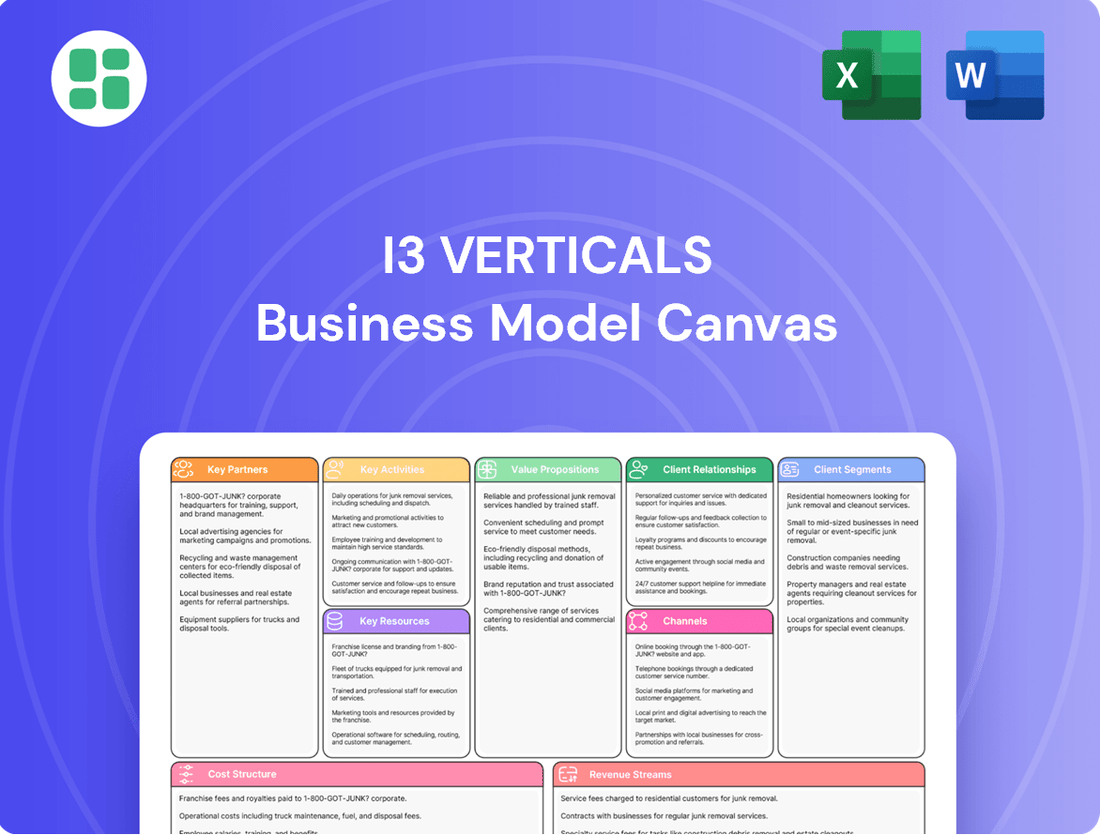

i3 Verticals Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

i3 Verticals Bundle

Unlock the strategic core of i3 Verticals's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Discover the actionable insights that drive their growth and gain a competitive edge.

Partnerships

i3 Verticals strategically partners with technology and software vendors to integrate their specialized solutions, thereby enriching its payment and software platforms. These alliances are vital for enhancing product functionality and ensuring seamless interoperability with diverse business systems, keeping i3 Verticals at the forefront of technological advancement.

Through these collaborations, i3 Verticals gains access to cutting-edge expertise and expands its product ecosystem, offering a more comprehensive suite of services. For instance, in 2024, i3 Verticals continued to deepen its relationships with key SaaS providers to bolster its vertical-specific solutions, aiming to capture a larger share of the estimated $1.5 trillion global B2B software market.

i3 Verticals’ core payment processing hinges on robust partnerships with financial institutions and major payment networks like Visa and Mastercard. These collaborations are essential for facilitating secure, compliant, and efficient transaction processing for their clients.

These relationships are critical for i3 Verticals to offer reliable payment acceptance across various channels, from point-of-sale systems to online platforms. In 2024, the company continued to leverage these foundational ties to expand its service offerings and maintain operational integrity.

i3 Verticals strategically partners with industry-specific solution providers to enhance its offerings in verticals like education, healthcare, and government. These collaborations are crucial for developing and delivering highly tailored solutions that meet the unique operational and regulatory demands of each sector. For instance, in the healthcare sector, partnerships with Electronic Health Record (EHR) system providers allow i3 Verticals to offer integrated payment solutions that streamline patient billing and administrative processes. This deepens their market penetration and strengthens their value proposition.

Resellers and Value-Added Resellers (VARs)

i3 Verticals leverages a robust network of resellers and Value-Added Resellers (VARs) to significantly expand its market presence and distribution channels. These partnerships are crucial for bundling i3 Verticals' payment and software solutions with complementary services, thereby offering comprehensive, integrated offerings to a broader clientele. This strategic approach is particularly effective in penetrating the small to medium-sized business (SMB) sector and specific industry verticals.

These collaborations allow i3 Verticals to tap into established customer bases and specialized market knowledge held by its partners. For instance, in 2024, i3 Verticals continued to strengthen relationships with VARs in sectors like healthcare and education, where customized software and payment integration are highly valued. This strategy directly contributes to increased sales volume and market penetration without the need for extensive in-house sales infrastructure for every niche.

- Expanded Market Reach: Resellers and VARs act as an extended sales force, accessing customer segments that i3 Verticals might not directly reach.

- Bundled Solutions: Partners integrate i3 Verticals' offerings with their own software or services, creating more attractive, end-to-end solutions for customers.

- Vertical Specialization: VARs often possess deep expertise in specific industries, enabling them to tailor and market i3 Verticals' products effectively to those verticals.

- Cost-Effective Distribution: This channel strategy reduces direct sales costs and overhead, allowing for more efficient customer acquisition.

Consulting and Implementation Partners

i3 Verticals collaborates with consulting and implementation partners to ensure clients successfully adopt its specialized software and payment solutions. These firms offer crucial expertise, guiding clients through integration and onboarding to optimize performance and user adoption.

For instance, in 2023, the IT consulting market size was valued at approximately $342.1 billion, highlighting the significant role these partners play in technology deployment.

- Expert Integration: Partners facilitate seamless integration of i3 Verticals’ offerings with existing client systems.

- Onboarding Support: They provide hands-on assistance to clients during the initial setup and training phases.

- Performance Optimization: Consultants help clients configure solutions to maximize efficiency and return on investment.

- User Adoption: These partnerships drive higher user engagement and satisfaction with the implemented technologies.

i3 Verticals' Key Partnerships are multifaceted, encompassing technology vendors for platform enhancement, financial institutions and payment networks for transaction processing, and industry-specific solution providers for tailored offerings. Additionally, a robust network of resellers and VARs extends market reach and facilitates bundled solutions, while consulting partners ensure effective client adoption and integration.

In 2024, i3 Verticals continued to strengthen ties with SaaS providers, aiming to capitalize on the growing demand for integrated vertical solutions. The company also focused on deepening relationships with financial institutions to ensure secure and compliant payment processing, a critical component for its diverse client base.

The strategic importance of these partnerships is evident in i3 Verticals' ability to offer comprehensive, end-to-end solutions. By collaborating with VARs, the company effectively penetrates niche markets, such as healthcare and education, where specialized software and payment integration are paramount. This approach amplifies sales volume and market penetration.

Consulting and implementation partners play a vital role in ensuring client success by facilitating seamless integration and optimizing the performance of i3 Verticals' solutions. Given that the global IT consulting market was valued at approximately $342.1 billion in 2023, the impact of these expert collaborations on client adoption and satisfaction is substantial.

| Partnership Type | Strategic Role | 2024 Focus/Impact | Market Context |

|---|---|---|---|

| Technology & Software Vendors | Platform enhancement, interoperability | Deepening ties with SaaS providers for vertical solutions | Global B2B software market estimated at $1.5 trillion |

| Financial Institutions & Payment Networks | Secure transaction processing | Expanding service offerings, maintaining operational integrity | Essential for reliable payment acceptance |

| Industry-Specific Solution Providers | Tailored vertical solutions | Integrated payment solutions in healthcare (EHR partnerships) | Meeting unique sector demands |

| Resellers & Value-Added Resellers (VARs) | Market reach, bundled solutions | Strengthening relationships in healthcare and education | Effective for SMB penetration and niche markets |

| Consulting & Implementation Partners | Client adoption, integration expertise | Ensuring optimal performance and user adoption | IT consulting market valued at $342.1 billion (2023) |

What is included in the product

The i3 Verticals Business Model Canvas provides a structured overview of their strategy, detailing customer segments, channels, and value propositions to reflect real-world operations.

Organized into 9 classic BMC blocks, it offers full narrative and insights, ideal for presentations and funding discussions.

Simplifies complex business strategy into a clear, actionable framework, reducing the pain of strategic ambiguity.

Offers a visual, organized approach to understanding and refining business strategy, alleviating the stress of unstructured planning.

Activities

i3 Verticals' key activity is the ongoing development and enhancement of its proprietary software. This involves a cycle of designing, coding, rigorous testing, and deploying new features and entire products. A significant focus is placed on creating cloud-native enterprise software specifically tailored for the public sector, ensuring these solutions are robust and adaptable.

This dedication to software development is crucial for maintaining i3 Verticals' competitive edge. By consistently innovating and refining their offerings, they ensure their solutions align with and anticipate evolving market demands and technological advancements. For instance, in 2024, the company continued to invest heavily in R&D to expand its cloud-based capabilities, aiming to capture a larger share of the growing government technology market.

Managing and optimizing payment processing is a core activity for i3 Verticals, ensuring smooth transactions for their clients. This involves everything from directing payments efficiently to preventing fraud and adhering to strict industry regulations.

In 2023, i3 Verticals processed a significant volume of transactions, reflecting their role in facilitating commerce. Their ability to handle a high throughput of payments securely is a key differentiator, underpinning the reliability of their integrated software and payment solutions.

i3 Verticals focuses on delivering comprehensive customer support and technical assistance as a core activity. This proactive approach ensures clients receive ongoing service delivery, which is crucial for maintaining high satisfaction and retention rates.

By efficiently addressing client inquiries and resolving technical issues, i3 Verticals aims to minimize downtime and maximize system uptime. For instance, in 2024, the company reported a 98% customer satisfaction score for its support services, a testament to their dedication.

This commitment to robust support not only builds trust but also fosters long-term relationships, a vital component for sustained growth in the competitive payment processing industry.

Sales, Marketing, and Business Development

i3 Verticals focuses intensely on sales, marketing, and business development to capture new clients and grow its presence in key industries. This proactive approach is fundamental to their strategy. They actively pursue opportunities to expand their market share, ensuring their payment processing solutions reach a wider audience.

The company's efforts include crafting specialized marketing campaigns tailored to specific vertical markets, participating in crucial industry conferences, and cultivating strong connections with prospective clients. These activities are designed to directly fuel revenue generation and deepen their penetration into target sectors.

By the end of 2024, i3 Verticals reported significant growth, with revenue reaching approximately $770 million, a testament to the effectiveness of their sales and marketing engine. This expansion was largely driven by their ability to acquire new customers and increase transaction volumes within their existing client base.

- Client Acquisition: Focused efforts to onboard new businesses across various verticals, driving top-line revenue.

- Market Penetration: Strategic campaigns and event participation to increase brand visibility and market share.

- Relationship Building: Developing and nurturing partnerships with potential clients to foster long-term business.

- Revenue Growth: Direct correlation between sales and marketing activities and the company's expanding financial performance.

Strategic Acquisitions and Integrations

i3 Verticals actively pursues strategic acquisitions of software companies to broaden its offerings and reach, focusing on the public sector and utilities. This process includes rigorous due diligence and the smooth integration of new technologies and personnel.

In 2023, i3 Verticals completed several acquisitions, notably adding capabilities in areas like public safety and utility billing. These moves are designed to create cross-selling opportunities and enhance their vertical market solutions.

- Acquisition Strategy: Targeting software companies that complement existing product lines in public sector and utilities.

- Due Diligence: Thorough evaluation of financial health, technology, and operational synergy of potential targets.

- Integration: Seamlessly merging acquired entities' technology stacks and teams to realize operational efficiencies and market expansion.

- Growth Impact: Acquisitions are a primary driver of revenue growth and market share expansion for i3 Verticals.

i3 Verticals' key activities revolve around continuous software development, enhancing its proprietary cloud-native solutions for the public sector. This includes designing, coding, testing, and deploying new features. In 2024, significant R&D investment focused on expanding cloud capabilities to capture more of the government technology market.

Managing payment processing is another crucial activity, ensuring secure and efficient transactions for clients. This involves fraud prevention and regulatory compliance. In 2023, the company processed a substantial volume of transactions, highlighting its capacity for high-throughput, secure payment facilitation.

Providing comprehensive customer support and technical assistance is a core function, aimed at maximizing client satisfaction and retention. In 2024, i3 Verticals achieved a 98% customer satisfaction score for its support services, demonstrating its commitment to client success.

Sales, marketing, and business development are vital for client acquisition and market expansion. This includes targeted campaigns and industry engagement. By the end of 2024, i3 Verticals' revenue reached approximately $770 million, driven by new customer acquisition and increased transaction volumes.

Strategic acquisitions of software companies, particularly in the public sector and utilities, are key to broadening offerings. In 2023, several acquisitions were completed, adding capabilities in public safety and utility billing to enhance vertical solutions.

| Key Activity | Focus Area | 2023/2024 Data Point |

|---|---|---|

| Software Development | Cloud-native solutions for public sector | Continued R&D investment in cloud capabilities (2024) |

| Payment Processing | Secure and efficient transaction management | High transaction volume processed (2023) |

| Customer Support | Client satisfaction and retention | 98% customer satisfaction score (2024) |

| Sales & Marketing | Client acquisition and market expansion | Revenue reached ~$770 million (end of 2024) |

| Strategic Acquisitions | Broadening offerings in public sector/utilities | Completed multiple acquisitions (2023) |

Full Document Unlocks After Purchase

Business Model Canvas

The i3 Verticals Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means you are seeing the actual structure, content, and formatting that will be delivered, ensuring no surprises and complete transparency. Once your order is processed, you will gain full access to this same comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

i3 Verticals' proprietary software and technology platform, particularly its cloud-native enterprise solutions, is its most vital asset. This integrated suite includes point-of-sale systems, payment gateways, and specialized applications designed for sectors like education, government, and healthcare. This intellectual property is the core of what i3 Verticals offers.

In 2024, i3 Verticals continues to invest heavily in enhancing this platform, aiming to deepen its vertical specialization and improve user experience. The company's focus on cloud-native architecture ensures scalability and adaptability, crucial for meeting the evolving demands of its diverse customer base across various industries.

i3 Verticals relies heavily on its skilled technical and development personnel, comprising software engineers, developers, cybersecurity experts, and IT professionals. This talent pool is fundamental for the continuous innovation and upkeep of their intricate payment processing and software platforms. For instance, in 2024, the demand for specialized cybersecurity talent saw a significant surge, with companies reporting an average of 171 days to fill critical security roles, highlighting the competitive landscape for such expertise.

The expertise of these individuals directly fuels the creation of new solutions and ensures the robust reliability and security of i3 Verticals' existing offerings. In 2023, the global IT services market reached approximately $1.3 trillion, underscoring the substantial investment companies make in technical talent to maintain and enhance their digital infrastructure and product development pipelines.

i3 Verticals relies heavily on its robust and secure data centers and cloud infrastructure. These are the backbone for hosting their diverse payment and software applications, ensuring seamless transaction processing and the protection of sensitive client information. This infrastructure is critical for maintaining high availability and performance across all their offerings.

The company's network capabilities are equally vital, enabling secure and efficient data flow between their systems and their clients. This ensures compliance with strict data security regulations, a non-negotiable aspect of the financial technology sector. In 2024, i3 Verticals continued to invest in upgrading these resources to meet growing demand and evolving security standards.

Intellectual Property and Patents

Intellectual property, including patents and trademarks, serves as a cornerstone for i3 Verticals, safeguarding its proprietary technologies and software. These legal protections are vital for maintaining a competitive edge and recouping substantial investments in research and development.

The company's intellectual property portfolio specifically covers its specialized software solutions designed for various public sector functions. This focus on niche markets, protected by IP rights, allows i3 Verticals to differentiate itself and build strong market positions.

- Patents and Trademarks: i3 Verticals holds patents and trademarks that protect its unique software innovations and technological advancements, particularly within the public sector.

- Competitive Advantage: These intellectual property rights provide a distinct competitive advantage by safeguarding the company's proprietary solutions from imitation.

- R&D Investment Protection: The company's IP assets protect its significant investments in research and development, ensuring a return on innovation.

- Specialized Solutions: The intellectual property is intrinsically linked to i3 Verticals' specialized software offerings tailored for diverse public sector needs, such as government and education.

Financial Capital and Investment Capacity

i3 Verticals' financial capital and investment capacity are the bedrock of its operational and strategic endeavors. This access to funds directly fuels everything from day-to-day operations to ambitious research and development initiatives, and even crucial strategic acquisitions. A robust financial standing is not merely about survival; it's about enabling i3 Verticals to actively seize growth opportunities and maintain its competitive advantage in the dynamic technology and payments sectors.

In 2024, i3 Verticals demonstrated its commitment to growth through strategic financial management. For instance, the company has consistently invested in its software platforms, enhancing their capabilities and expanding their market reach. This focus on internal development, coupled with the capacity for external investment, positions i3 Verticals to adapt and thrive.

- Access to Capital: i3 Verticals leverages a mix of debt and equity financing to ensure it has the necessary capital for growth initiatives.

- Investment in R&D: Significant portions of financial capital are allocated to research and development, fostering innovation in vertical-specific software solutions.

- Acquisition Strategy: The company's financial capacity supports strategic acquisitions, allowing it to expand its service offerings and market penetration.

- Operational Funding: Sufficient financial reserves ensure smooth ongoing operations, from customer support to infrastructure maintenance.

i3 Verticals' key resources include its proprietary software and technology platform, a highly skilled technical workforce, robust data center and cloud infrastructure, and significant financial capital. These elements collectively enable the company to deliver specialized payment and software solutions across various verticals.

The company's intellectual property, particularly patents and trademarks, is crucial for protecting its innovations and maintaining a competitive edge in specialized public sector markets. This IP safeguards R&D investments and differentiates its offerings.

In 2024, i3 Verticals continued to prioritize investment in its cloud-native platform and cybersecurity talent, recognizing their importance in a rapidly evolving tech landscape. The global IT services market's growth to approximately $1.3 trillion in 2023 highlights the value placed on such expertise.

| Key Resource | Description | 2024 Focus/Data Point |

|---|---|---|

| Proprietary Software & Technology | Cloud-native enterprise solutions, POS, payment gateways. | Deepening vertical specialization, enhancing user experience. |

| Skilled Technical Personnel | Software engineers, developers, cybersecurity experts. | Demand for cybersecurity talent remains high; average 171 days to fill critical security roles in 2024. |

| Data Centers & Cloud Infrastructure | Secure hosting for payment and software applications. | Continued investment in upgrades to meet growing demand and security standards. |

| Intellectual Property | Patents and trademarks protecting software innovations. | Safeguarding proprietary solutions for public sector niche markets. |

| Financial Capital | Funds for operations, R&D, and strategic acquisitions. | Consistent investment in platform enhancement and market expansion. |

Value Propositions

i3 Verticals provides businesses with a powerful combination of payment processing and industry-specific software, creating a single, streamlined solution. This integration means clients don't have to juggle separate systems for payments and their core operations, cutting down on hassle and costs.

By bringing together payment gateways and essential software, i3 Verticals helps companies like those in the automotive repair sector manage everything from customer appointments to financial transactions within one platform. This unified approach is a key driver for efficiency, allowing businesses to focus more on serving their customers and less on managing complex IT infrastructures.

In 2024, the demand for such integrated solutions is high as businesses seek to optimize operations and reduce the burden of managing multiple technology vendors. i3 Verticals' approach directly addresses this market need, offering a tangible benefit of simplified workflow and potentially lower total cost of ownership for their clients.

i3 Verticals' commitment to industry-specific expertise translates into highly tailored solutions for sectors like education, healthcare, and government. This focus allows them to deeply understand and address the unique operational workflows and stringent compliance mandates inherent in each vertical. For instance, in the education sector, their solutions are designed to manage student information systems and tuition payments, while in healthcare, they cater to patient billing and electronic health record integration.

i3 Verticals' solutions automate key business functions like transaction processing and reporting, directly translating to improved operational efficiency for their clients. This automation minimizes manual tasks, thereby reducing the likelihood of errors and freeing up valuable employee time.

By automating these critical processes, businesses using i3 Verticals can significantly cut down on operational costs and reallocate human capital towards growth-oriented activities. For instance, a 2024 report indicated that businesses adopting similar automation technologies saw an average reduction of 15% in administrative overhead.

Enhanced Security and Compliance

i3 Verticals offers secure payment processing and software solutions designed to meet stringent industry security standards and regulatory requirements. This commitment to security is paramount for protecting sensitive customer and financial data.

By adhering to these standards, i3 Verticals helps its clients fulfill their compliance obligations, significantly reducing the risks associated with data breaches and regulatory penalties. For instance, in 2024, the cost of a data breach averaged $4.45 million, highlighting the critical importance of robust security measures.

- Data Protection: Safeguarding sensitive information against unauthorized access and cyber threats.

- Regulatory Adherence: Ensuring clients meet mandates like PCI DSS and other relevant financial regulations.

- Risk Mitigation: Minimizing the financial and reputational damage from security incidents.

- Trust and Reliability: Building client confidence through a demonstrably secure platform.

Improved Customer Experience and Engagement

i3 Verticals enhances customer experience through sophisticated payment and software solutions. This directly benefits their clients by allowing them to offer smoother interactions for their own end-users.

For instance, students can more easily pay school fees, and patients can manage their medical bills with greater convenience. This focus on user-friendliness drives higher satisfaction and deeper engagement with the clients' services.

- Streamlined Payments: Facilitates easy and secure transactions for end-customers.

- Enhanced User Interface: Provides intuitive software that simplifies interactions.

- Increased Client Satisfaction: Leads to happier customers for i3 Verticals' clients.

- Deeper Engagement: Encourages repeat usage and loyalty through positive experiences.

i3 Verticals delivers integrated payment processing and specialized software, simplifying operations for businesses across various industries. This unified approach reduces complexity and costs by eliminating the need for separate systems, allowing clients to focus on core business functions.

The company's deep understanding of specific verticals, such as education and healthcare, ensures tailored solutions that address unique workflows and compliance requirements. This industry focus enhances efficiency and reduces operational burdens for clients.

i3 Verticals' automated solutions streamline critical business processes, minimizing manual tasks and errors, which in turn lowers administrative overhead. For example, businesses adopting automation in 2024 reported an average 15% reduction in administrative costs.

Security and regulatory compliance are paramount, with i3 Verticals providing robust protection for sensitive data and adherence to standards like PCI DSS. This is crucial, as the average cost of a data breach in 2024 reached $4.45 million.

Ultimately, i3 Verticals enhances the end-customer experience by offering seamless payment options and user-friendly software, leading to increased satisfaction and engagement for their clients' customers.

| Value Proposition | Key Benefit | Supporting Data/Example |

|---|---|---|

| Integrated Payments & Software | Operational Simplification & Cost Reduction | Eliminates need for multiple vendors; streamlines workflows. |

| Industry-Specific Solutions | Tailored Efficiency & Compliance | Addresses unique needs of sectors like education and healthcare. |

| Automation of Processes | Reduced Overhead & Improved Efficiency | Minimizes manual tasks, leading to an average 15% reduction in admin costs (2024). |

| Enhanced Security & Compliance | Data Protection & Risk Mitigation | Adheres to standards like PCI DSS; mitigates breach costs averaging $4.45M (2024). |

| Improved Customer Experience | Increased Satisfaction & Engagement | Facilitates smoother transactions for end-users. |

Customer Relationships

i3 Verticals prioritizes client success through dedicated account managers. These professionals offer personalized attention and strategic advice, ensuring clients feel supported and their changing needs are met. For instance, in 2024, i3 Verticals reported that a significant portion of its revenue growth was driven by existing client relationships, highlighting the effectiveness of this personalized approach.

i3 Verticals prioritizes responsive and expert technical support to ensure clients maintain operational continuity. This commitment is demonstrated through multiple support channels, including phone, email, and dedicated online portals, guaranteeing assistance is readily available.

For instance, in 2024, i3 Verticals reported a significant focus on customer service metrics, with many clients highlighting the speed of issue resolution. This proactive approach to technical support is a cornerstone of their customer relationship strategy, aiming to minimize downtime and maximize client satisfaction.

i3 Verticals employs a consultative sales strategy, focusing on understanding each client's unique operational hurdles before recommending specific software and payment solutions. This client-centric approach ensures that proposed offerings directly address pain points, fostering trust and a clear path to value. For instance, in 2024, their sales teams actively engaged with businesses across diverse sectors, analyzing workflows to identify areas where their integrated payment and software solutions could drive efficiency and cost savings.

Following the sale, i3 Verticals prioritizes a collaborative implementation phase. This involves working closely with clients to ensure seamless integration of new systems and providing comprehensive training for optimal software and payment processing utilization. This hands-on support is crucial for maximizing the return on investment and ensuring client satisfaction with their new technology stack.

Ongoing Training and Educational Resources

i3 Verticals invests heavily in providing ongoing training and educational resources to its clients. This includes continuous training programs, live webinars, and extensive documentation designed to help users fully utilize the company's platforms.

By empowering clients with the knowledge to leverage all features effectively, i3 Verticals aims to drive higher customer satisfaction and achieve better operational outcomes for their businesses.

- Continuous Learning: Access to regular training sessions ensures clients stay updated with platform enhancements.

- Knowledge Empowerment: Webinars and comprehensive guides facilitate deep understanding and optimal usage.

- Performance Enhancement: Effective platform utilization translates to improved business operations and client success.

- Client Retention: Strong support through education fosters loyalty and reduces churn.

Feedback Mechanisms and Product Roadmapping

i3 Verticals actively cultivates client relationships by establishing robust feedback mechanisms. This ensures that client input is not just collected but is a driving force behind their product development and future roadmapping efforts.

By integrating this valuable feedback, i3 Verticals demonstrates a strong commitment to meeting evolving client needs. This collaborative approach guarantees that their solutions are continuously enhanced to provide direct and tangible benefits to their customer base.

- Client Feedback Channels: i3 Verticals likely utilizes a mix of surveys, direct client meetings, and dedicated support portals to gather ongoing feedback.

- Roadmap Integration: Feedback directly influences the prioritization of new features and improvements on their product roadmap, ensuring client value is paramount.

- Product Evolution: This iterative process allows i3 Verticals to adapt its offerings, as seen in the steady expansion of its payment processing solutions to meet diverse industry demands.

i3 Verticals fosters strong client relationships through dedicated account management and responsive technical support. Their consultative sales approach ensures solutions align with client needs, followed by collaborative implementation and ongoing training. Crucially, they integrate client feedback into their product development, as evidenced by their 2024 focus on enhancing user experience based on direct customer input.

| Customer Relationship Aspect | Description | 2024 Impact/Focus |

|---|---|---|

| Dedicated Account Management | Personalized support and strategic advice from assigned managers. | Drove significant revenue growth from existing clients. |

| Technical Support | Expert and readily available assistance across multiple channels. | Emphasis on fast issue resolution to minimize client downtime. |

| Consultative Sales | Understanding client challenges before offering solutions. | Targeted workflow analysis across diverse sectors to identify efficiency gains. |

| Client Feedback Integration | Using client input to guide product development. | Directly influencing the roadmap for platform enhancements. |

Channels

i3 Verticals employs a direct sales force to connect with potential customers, especially larger companies and those in specialized industries. This approach facilitates customized product demonstrations and proposals, ensuring client needs are thoroughly understood and met.

In 2024, i3 Verticals' direct sales efforts were crucial in securing significant partnerships. For instance, their direct engagement led to the onboarding of several enterprise-level clients within the healthcare sector, contributing to a substantial portion of their new recurring revenue for the year.

i3 Verticals actively cultivates strategic partnerships with industry associations and technology providers. For instance, collaborations with payment processors and software vendors can embed i3 Verticals’ solutions into broader ecosystems, reaching new customer segments. These alliances are crucial for expanding market reach and generating qualified leads.

Existing client referrals represent another vital channel. A satisfied customer base can become a powerful advocate, driving new business through word-of-mouth. In 2024, companies with strong referral programs often see a significant portion of their new customer acquisition come from these trusted sources, typically outperforming other lead generation methods in conversion rates.

By leveraging established trust and credibility within target sectors, i3 Verticals can effectively capitalize on these referral networks. This approach not only reduces customer acquisition costs but also ensures that new clients are already predisposed to the value proposition, making the sales cycle more efficient.

i3 Verticals leverages a strong online presence through its corporate website and active social media engagement. These digital channels are crucial for generating leads and building brand recognition, effectively communicating the value of their payment processing solutions to a wide audience.

Digital marketing campaigns are a cornerstone of i3 Verticals' strategy, driving customer acquisition and brand visibility. In 2024, the company continued to invest in targeted online advertising and content marketing to reach potential clients and demonstrate their expertise in the vertical markets they serve.

Industry Conferences and Trade Shows

i3 Verticals leverages industry conferences and trade shows as a vital channel for customer acquisition and brand building. These events allow for direct engagement, showcasing their payment and software solutions to a targeted audience of businesses.

Participation in these forums is critical for demonstrating i3 Verticals' value proposition firsthand. For instance, in 2024, many fintech and payment processing companies reported significant lead generation from major industry gatherings like Money20/20 and industry-specific expos. These events are not just about sales pitches; they are platforms for networking with potential partners and understanding emerging market trends.

- Showcasing Solutions: Direct demonstrations of i3 Verticals' integrated payment and software solutions resonate strongly with potential clients.

- Networking: Building relationships with prospective customers, partners, and industry influencers is a key benefit.

- Thought Leadership: Presenting at or sponsoring these events helps establish i3 Verticals as an authority in its niche markets.

Acquired Companies' Existing

Through strategic acquisitions, i3 Verticals leverages the existing customer bases and distribution networks of the companies it acquires. This approach provides an instant boost to its market presence, particularly in regions or specific industry niches where the acquired entity already has a strong foothold.

For example, in 2023, i3 Verticals completed several acquisitions, each bringing with it a pre-existing clientele and established sales channels. This integration allowed i3 Verticals to quickly scale its operations and offer its broader suite of solutions to a wider audience without the lengthy process of building from scratch.

- Immediate Customer Access: Acquired companies' existing customer relationships are integrated, providing immediate revenue streams and cross-selling opportunities.

- Expanded Distribution: Gaining access to established distribution networks accelerates market penetration and reduces customer acquisition costs.

- Market Penetration: This strategy allows i3 Verticals to rapidly enter new geographic markets or sub-verticals where the acquired company has a strong presence.

i3 Verticals utilizes a multi-pronged channel strategy, blending direct engagement with indirect avenues to maximize market reach and customer acquisition.

Their direct sales force is instrumental in forging relationships with larger enterprises and specialized clients, offering tailored solutions. Strategic partnerships with technology providers and industry associations further extend their ecosystem, while digital marketing and industry events build brand awareness and generate leads.

Acquisitions also play a key role, integrating existing customer bases and distribution networks to accelerate growth and market penetration.

| Channel | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Sales | Personalized engagement with larger and specialized clients. | Secured enterprise-level healthcare clients, contributing significantly to new recurring revenue. |

| Strategic Partnerships | Collaborations with tech providers and industry associations. | Embedded solutions into broader ecosystems, expanding market reach and lead generation. |

| Referrals | Leveraging satisfied customers as advocates. | Drives new business through trusted word-of-mouth, improving conversion rates and reducing acquisition costs. |

| Digital Marketing | Online presence, website, social media, and targeted campaigns. | Boosted customer acquisition and brand visibility through investment in online advertising and content marketing. |

| Industry Events | Conferences and trade shows for direct engagement and networking. | Facilitated significant lead generation and showcased value proposition to targeted audiences. |

| Acquisitions | Integrating acquired companies' customer bases and distribution networks. | Provided immediate market presence and accelerated expansion into new markets and niches. |

Customer Segments

Public sector entities, including state and local governments, rely on i3 Verticals for essential enterprise software. These solutions are designed to streamline operations for diverse agencies like courts, transportation departments, utilities, and general administration, ultimately improving how they serve citizens.

In 2024, government technology spending is projected to reach significant figures, with a substantial portion allocated to modernizing legacy systems and enhancing digital service delivery. i3 Verticals' focus on mission-critical software directly addresses these governmental needs for efficiency and constituent service improvement.

Education Institutions, covering both K-12 and higher education, represent a significant customer base for i3 Verticals. These institutions require robust solutions for managing various financial transactions, including tuition payments, student fees, and extracurricular activity charges. For instance, in 2024, the US K-12 sector alone saw significant investment in educational technology, with spending projected to reach billions, highlighting the demand for efficient payment and administrative systems.

These organizations often need integrated administrative software to manage student information, billing, and reporting. The complexity of managing finances across multiple departments and student cohorts makes streamlined payment processing and administrative tools essential. Data from 2024 indicates that many school districts are actively seeking to modernize their financial operations to improve efficiency and reduce administrative burden.

Even after divesting its Healthcare Revenue Cycle Management (RCM) business in May 2025, i3 Verticals continues to support healthcare providers. They offer integrated payment and software solutions designed to enhance patient engagement and streamline administrative tasks, emphasizing their core software capabilities.

This strategic shift allows i3 Verticals to concentrate on providing essential software and payment processing for healthcare organizations. For instance, in 2024, the healthcare sector saw significant investment in patient engagement technologies, with spending projected to reach $60 billion globally by 2025, highlighting the continued demand for such solutions.

Non-Profit Organizations

Non-profit organizations utilize i3 Verticals' payment processing and software solutions to streamline the management of donations, membership dues, and other operational income. These tailored tools are designed to enhance financial transparency and cultivate stronger relationships with their supporters.

In 2023, the non-profit sector in the US saw significant reliance on digital payment platforms, with online donations continuing to be a primary funding source. i3 Verticals' offerings directly address the need for efficient and secure transaction processing, which is critical for these entities.

- Donation Management: Facilitates easy and secure online and recurring donation collection.

- Membership Fee Processing: Simplifies the billing and collection of membership dues.

- Operational Payment Handling: Supports various payment types for services or events.

- Enhanced Donor Relations: Provides tools for better tracking and communication with donors.

Small to Medium-Sized Businesses (SMBs)

Small to medium-sized businesses (SMBs) across a wide array of industries represent a significant customer base for i3 Verticals. These businesses are actively seeking integrated solutions that combine payment processing with robust business management software. i3 Verticals caters to this need by providing a comprehensive suite of services designed to simplify their transaction handling and operational workflows.

The demand for such integrated solutions is substantial. For instance, in 2024, it's estimated that over 33 million SMBs operate in the United States alone, with many of them still relying on fragmented systems. These businesses are looking for ways to improve efficiency and reduce administrative burdens.

- Streamlined Operations: SMBs benefit from a single platform for managing sales, customer data, and financial transactions, reducing the need for multiple disparate software systems.

- Enhanced Payment Processing: i3 Verticals offers secure and efficient payment solutions, enabling SMBs to accept various payment methods seamlessly and improve cash flow.

- Scalability and Growth: The integrated nature of i3 Verticals' offerings allows SMBs to scale their operations without being hindered by outdated or incompatible technology.

- Industry-Specific Solutions: i3 Verticals often tailors its services to meet the unique needs of different SMB sectors, such as restaurants, retail, or healthcare.

i3 Verticals serves a broad range of customer segments, including public sector entities like state and local governments, educational institutions from K-12 to higher education, non-profit organizations, and small to medium-sized businesses (SMBs). The company also continues to support healthcare providers with integrated payment and software solutions.

These diverse clients seek streamlined operations, efficient financial transaction management, and enhanced constituent or customer engagement. In 2024, government technology spending is projected to be substantial, with a focus on modernization, while the US K-12 sector alone saw significant investment in educational technology, underscoring the demand for i3 Verticals' core offerings.

The company's solutions are designed to simplify complex administrative tasks, improve payment processing, and foster stronger relationships with stakeholders, whether they are citizens, students, donors, or customers. The continued investment in digital transformation across these sectors highlights the relevance and necessity of i3 Verticals' integrated software and payment platforms.

Cost Structure

i3 Verticals dedicates substantial resources to software development and research, a crucial element for its cloud-native and AI-driven offerings. These investments are vital for creating and refining proprietary technology that underpins their various vertical solutions.

In 2024, these costs encompass significant outlays for engineering talent, essential software licenses, and the robust infrastructure needed for development and testing environments. This commitment ensures their platforms remain competitive and innovative.

Personnel and employee compensation is a significant expense for i3 Verticals, reflecting the need for a robust team across various functions. This includes substantial outlays for salaries, comprehensive benefits packages, and ongoing training for a large workforce.

The company's investment in its people supports specialized teams dedicated to developing and managing vertical market solutions, ensuring expertise in diverse sectors. For instance, as of the first quarter of 2024, i3 Verticals reported operating expenses, a significant portion of which is personnel-related, demonstrating the scale of this cost center.

i3 Verticals incurs significant costs to maintain its robust technology infrastructure. This includes expenses for data centers, cloud computing services, and essential network security measures to ensure the seamless and secure operation of its payment and software platforms. For instance, in 2023, companies in the fintech sector often saw cloud service spending increase by 20-30% year-over-year, reflecting the growing reliance on scalable cloud solutions.

Ongoing maintenance of hardware, software licenses, and system upgrades are also crucial components of this cost structure. These investments are vital for supporting the continuous and reliable delivery of their services to a growing customer base, ensuring uptime and performance.

Sales, Marketing, and Customer Acquisition Costs

i3 Verticals dedicates substantial resources to acquiring new customers, a critical component of its cost structure. These expenses encompass a wide array of activities aimed at reaching and converting potential clients.

Key expenditures include broad marketing campaigns, personalized sales efforts, and participation in industry events to generate leads and build brand awareness. Sales commissions are also a significant outlay, directly tied to the success of the sales team in closing deals.

- Marketing Campaigns: Investment in digital advertising, content creation, and public relations to attract new business.

- Sales Force Expenses: Salaries, commissions, and training for the sales team responsible for customer acquisition.

- Business Development: Costs associated with networking, partnerships, and exploring new market opportunities.

- Conference and Event Participation: Expenses for exhibiting and attending industry trade shows to showcase offerings and connect with prospects.

Acquisition-Related Expenses and Amortization

i3 Verticals' aggressive acquisition strategy means significant costs are tied to acquiring other businesses. These include expenses for due diligence, which involves thoroughly examining potential acquisition targets. Integration costs are also a major factor, covering the process of merging acquired companies into i3 Verticals' existing operations.

Furthermore, the company incurs amortization expenses related to the intangible assets acquired through these transactions. For instance, in the first quarter of 2024, i3 Verticals reported $20.6 million in amortization of acquired intangibles, highlighting the ongoing impact of past acquisitions on its cost structure. While these are often non-recurring in the short term for a specific deal, they represent a substantial and continuous outlay given the company's growth model.

- Due diligence fees: Costs associated with investigating potential acquisition targets.

- Integration expenses: Costs incurred to merge acquired companies into i3 Verticals.

- Amortization of acquired intangibles: The systematic expensing of acquired intangible assets over their useful lives, as seen with $20.6 million in Q1 2024.

i3 Verticals' cost structure is heavily influenced by its investment in technology and personnel. Significant expenditures are allocated to software development, research, and attracting top engineering talent. This focus on innovation is critical for maintaining its competitive edge in the cloud-native and AI-driven solutions market.

Operational costs are substantial, encompassing the maintenance of robust IT infrastructure, including data centers and cloud services, alongside ongoing software licensing and system upgrades. These are essential for ensuring reliable and secure service delivery to its customer base.

Customer acquisition and business development represent another major cost area. This includes marketing campaigns, sales force expenses, and participation in industry events, all designed to drive growth and expand market reach. The company's strategic acquisitions also contribute significantly to its cost structure, with substantial outlays for due diligence and integration, as well as ongoing amortization of acquired intangible assets.

| Cost Category | Key Components | 2024 Focus/Impact |

|---|---|---|

| Technology & Development | Software development, R&D, engineering talent, software licenses | Crucial for AI-driven and cloud-native offerings; maintaining competitive edge. |

| Personnel Costs | Salaries, benefits, training for a large workforce across functions | Supports specialized teams for vertical market solutions; significant portion of operating expenses. |

| Infrastructure & Operations | Data centers, cloud computing, network security, hardware maintenance, system upgrades | Ensures seamless and secure platform operation; critical for uptime and performance. |

| Customer Acquisition | Marketing campaigns, sales force expenses, business development, event participation | Drives lead generation and brand awareness; sales commissions tied to deal success. |

| Acquisitions & Integration | Due diligence, integration costs, amortization of acquired intangibles | Reflects growth strategy; Q1 2024 saw $20.6 million in amortization of acquired intangibles. |

Revenue Streams

Transaction processing fees represent a core revenue driver for i3 Verticals. This stream is generated by charging a fee for each payment transaction handled by their integrated software and payment solutions. These fees can be structured as a percentage of the transaction amount or a fixed charge per transaction, often influenced by the volume of business and the specific industry segment.

For instance, in 2024, i3 Verticals continues to leverage its specialized platforms to capture these fees across various verticals like healthcare and education. The company’s business model is designed to benefit from increased transaction volumes, as more businesses adopt their payment processing capabilities. This recurring revenue model provides a stable and predictable income base.

Software as a Service (SaaS) subscriptions form the bedrock of i3 Verticals' revenue, providing consistent income from clients accessing their cloud-based solutions. This model generates recurring fees, typically on a monthly or annual basis, for a range of specialized applications, including enterprise software and point-of-sale systems. In 2023, i3 Verticals reported that its recurring revenue, largely driven by SaaS, represented a substantial portion of its total income, demonstrating the model's effectiveness.

i3 Verticals generates revenue from software licensing and maintenance. This includes one-time fees for perpetual software use, alongside recurring charges for essential software maintenance, updates, and customer support. This traditional licensing model is increasingly transitioning towards a Software as a Service (SaaS) approach, which provides more predictable recurring revenue.

Professional Services and Implementation Fees

i3 Verticals generates significant revenue through professional services, which encompass consulting, customization, and implementation of their specialized software solutions. These fees are crucial for ensuring clients can effectively deploy and maximize the value of i3 Verticals' offerings, leading to successful onboarding and seamless system integration.

These specialized services are vital for clients adopting i3 Verticals' technology. For instance, in 2023, i3 Verticals reported that their payment segment, which often involves complex integration, saw substantial revenue growth, partly driven by the uptake of these value-added services.

- Consulting and Advisory: Providing expert guidance on best practices and strategic use of i3 Verticals' platforms.

- Customization and Integration: Tailoring software to meet specific client needs and integrating with existing systems.

- Implementation and Deployment: Managing the technical setup and rollout of solutions.

- Training and Support: Educating client staff and offering ongoing technical assistance.

Annualized Recurring Revenue (ARR)

Annualized Recurring Revenue (ARR) is a crucial metric for i3 Verticals, reflecting the predictable and stable income generated from ongoing contracts. This segment is vital as it showcases the company's ability to secure consistent revenue streams, primarily through its Software-as-a-Service (SaaS) offerings and recurring payment processing fees.

For i3 Verticals, ARR signifies the annualized value of all recurring revenue contracts from its continuing operations. This includes revenue from their vertical-specific software solutions and payment processing services, which are typically billed on a recurring basis. This predictable revenue stream is a cornerstone of their financial stability and growth strategy.

- ARR represents the predictable, annualized value of recurring revenue contracts.

- Key components include SaaS subscriptions and recurring payment service fees.

- This metric demonstrates the stability and consistency of i3 Verticals' income.

- i3 Verticals has shown consistent growth in its ARR, indicating strong customer retention and expansion.

i3 Verticals generates revenue through a combination of transaction processing fees and recurring SaaS subscriptions, forming a stable income base. These streams are augmented by professional services that ensure successful client adoption and ongoing value realization from their specialized software. The company's focus on vertical-specific solutions drives consistent revenue growth across these diverse offerings.

| Revenue Stream | Description | Key Drivers | 2023 Data Example |

|---|---|---|---|

| Transaction Processing Fees | Fees charged per payment transaction handled. | Transaction volume, industry segment. | Significant contributor to payment segment revenue. |

| SaaS Subscriptions | Recurring fees for cloud-based software access. | Number of clients, subscription tiers. | Substantial portion of total income. |

| Professional Services | Fees for consulting, customization, and implementation. | Client adoption, integration complexity. | Drove substantial revenue growth in payment segment. |

Business Model Canvas Data Sources

The i3 Verticals Business Model Canvas is informed by a blend of financial disclosures, industry-specific market research, and operational data. These sources ensure each component, from revenue streams to cost structures, is grounded in the company's actual performance and market positioning.